Advance report on lawyer services

Accountants are often faced with the need to create advance reports when making cash payments to employees. This document necessary to confirm the spent amount or monetary documents issued to the employee earlier.

Let's take a simple example. The employee was sent on a business trip and given a certain amount to buy a ticket. Upon his return, he presents this ticket to the accountant in order to confirm how much money he actually spent. Then the accountant on its basis makes an advance report.

Many more examples could be cited. This is the purchase of goods (stationery, household equipment, etc.), payment for fuel and lubricants and much more.

In this article, we will look at step by step instructions by filling advance report in 1C 8.3 and give a sample.

Issuance of funds

First of all, the employee is given money or monetary documents. Design this operation in 1C 8.3 it is possible through cash documents and monetary documents, respectively. They are located in the "Bank and cash desk" section.

In addition to the above methods, you can use the debit from the current account, but in our example this option will not be considered, because this species transactions are more common with cash rather than cashless payments.

Below is an example of cash disbursement to an accountable person. It generates postings on accounts Dt 71.01 - Kt 50.1. The accounting account is substituted automatically, but it can be changed when filling out the document.

This document is also used in cases where there has been an overrun of the funds issued. Simply put, the employee was given 1,000 rubles, and he spent 1,500 rubles with the permission of the head. The difference of 500 rubles should be issued in cash.

Making an advance report in 1C

The design of this document is almost the same in both version 3.0 (8.3) and 2.0 (8.2), so this article is suitable for everyone.

Go to the "Bank and cash desk" menu and select "Advance reports". In the list form that opens, click on the "Create" button.

First you need to select the employee for whom the document is issued and the department.

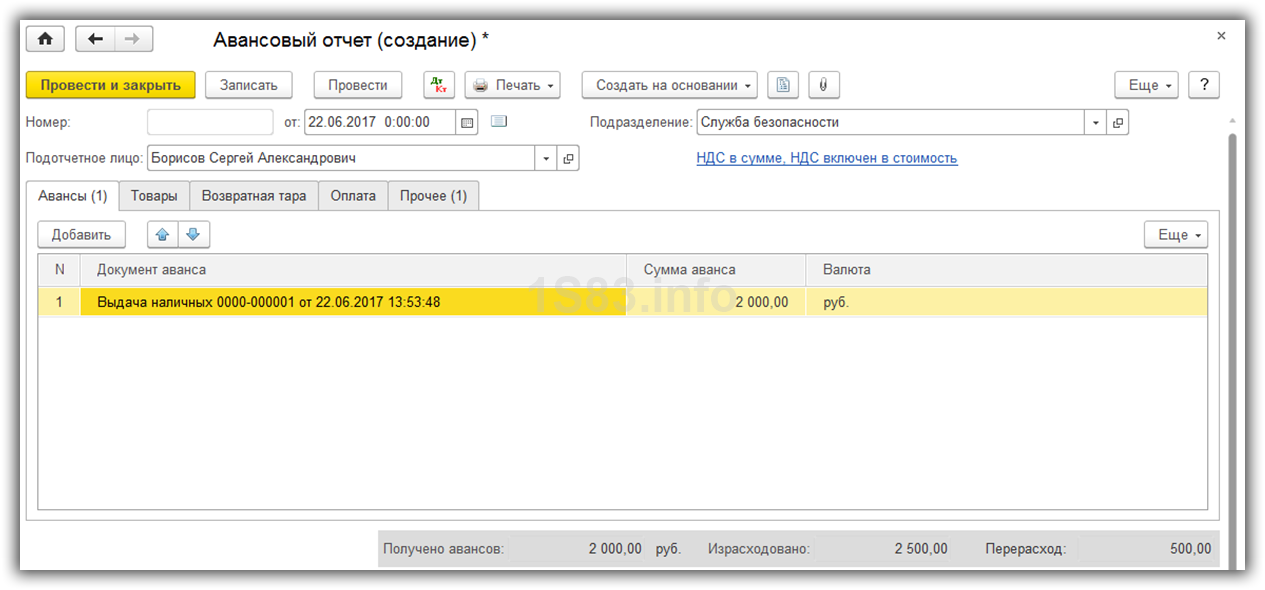

The first tab lists the documents by which the employee received these cash. Currency and amount will be set automatically.

Let's take a quick look at the contents of the remaining tabs:

- The "Goods" tab contains a list of goods and materials that were purchased by the accountable person. When specifying accounting accounts for these goods, postings on receipt will be generated.

- The third tab contains data on the returnable packaging that the employee received from the supplier.

- The "Payment" tab contains data on the amounts paid by suppliers for previously purchased goods, prepayment.

- Other expenses are listed on the "Other" tab. In our case, we will report on this tab.

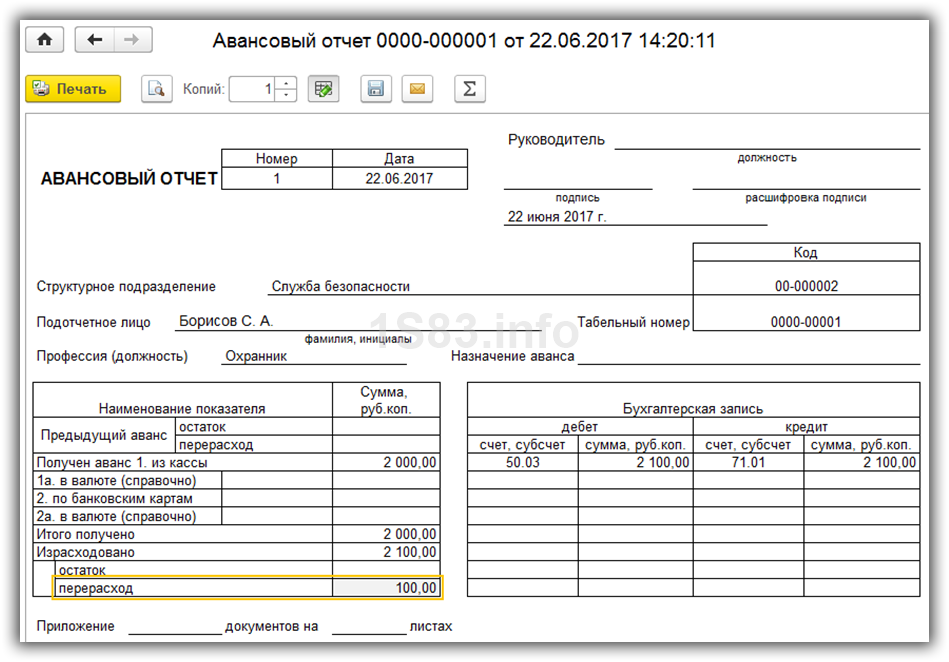

The printed form of this document is in the menu "Print" - "Advance report (AO-1)".

How can we see in printed form and at the bottom of the document form, at this employee there was an overrun.

This means that he spent more money than he was originally given. In our example, the difference of 100 rubles will be reflected in account 71.01. As previously stated, the difference in amounts must be returned to the employee using a document cash document issuance of cash.

See also video instructions for filling out an advance report in 1C:

The advance report is intended to reflect the business and travel expenses of the accountable person.

Usually, first, the accountable person is given money from the cash desk or transferred to the card from the current account. In the program 1C Accounting 8 edition 2, this is documented by the documents “Expenditure cash warrant"or" Write-off of funds",

To reflect accountable amounts in the program you need to fill out the document "Advance report". To fill in advance report in 1C 8 ed. 2 go to the "Cashier" tab or the "Cashier" menu at the top of the program. Specified Document also available in the "Production" tab. The sequence for generating an advance report is identical in all available editions of the eighth version of the 1C Accounting program.

For filling new form advance report, click on the element "Advance report" and press the button "Add" (green plus) in the top menu of the journal "Advance reports".

Clicking this button will open a new advance report. This document consists of four tabs: "Advances", "Payment", "Goods", and "Other".

First, in the handbook Individuals» find a specific accountable person. After that, select it in the document with the "Select" button or by double-clicking the left mouse button.

On the first tab "Advances" we select the document to which funds were previously issued in the 1C Accounting program. This document can be an expense cash order, if the money was issued from the cash desk, Write-off from the current account, if money was transferred from the company's account, or Issuance of monetary documents.

If the funds were not issued in advance, this tab is not required to be filled out. At the bottom of the document, be sure to indicate the purpose of the advance: household expenses or business trips; and it is also necessary to indicate the number of documents attached to the advance report.

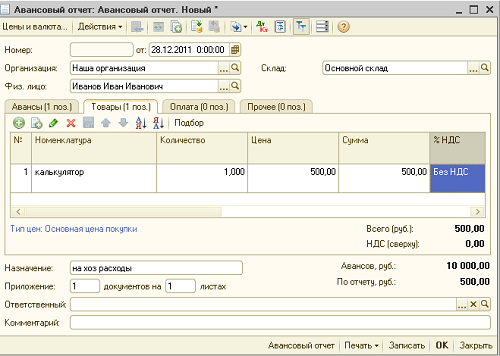

The second tab of the document "Advance report" is called "Goods". This tab in the 1C 8 program reflects the values acquired by the accountable person.

For example, it can be materials or goods. The most important thing when filling out this tab is to choose the correct folder in the "Nomenclature" directory, since the accounting account is attached to the folder and when wrong choice folders will be generated incorrectly accounting entry. Therefore, if the accountable person purchased the materials, you need to select the "Materials" folder.

The third tab of the advance report in the 1C Accounting program is called "Payment". It is required to reflect the expenses paid by the accountable person, for example: Internet, communication services, etc.

Here you also need to specify the account that will correspond with account 71 “Settlements with accountable persons”, usually this is account 60 “Settlements with suppliers and contractors”.

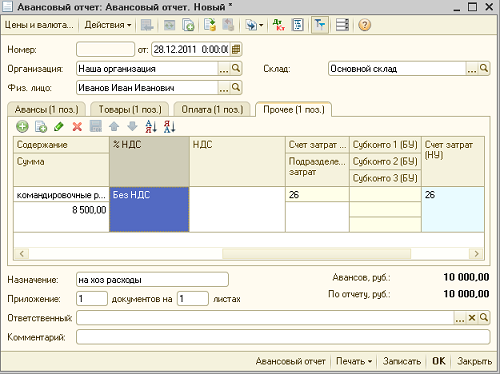

On the fourth tab of the advance report in the 1C "Other" program, you need to reflect travel expenses. In the event that the employee was on a business trip.

It also indicates the document on the basis of which the advance report is filled out. It can be a ticket, a hotel bill, etc. If there are several documents, each is written on a separate line. This tab also indicates the account to which travel expenses are debited. The bill depends on what kind of employee went on a business trip. If this is an employee of the main unit, we select account 20 “Main production”, if an employee of the administration, then account 26 “ General running costs" etc.

In practice, when filling out the form, it is not necessary to fill in all the bookmarks of the document Advance report in 1C 8. This will depend on the purpose for which the accountable money was spent.

How to reflect in the accounting of the organization the costs associated with payment notary services if their payment is made through an accountable person? A private notary performed notarial acts (certification of the transaction and certification of copies of documents), as well as legal and technical nature (consulting services drafting the contract, making copies of documents).

The organization paid for the services of a private notary on total amount 18,500 rubles, namely:

- notarial fee for certification of the lease agreement in the amount of 11,000 rubles. (the cost of the subject of the contract is 3,000,000 rubles);

- for certifying the accuracy of copies of documents (50 pages) - 500 rubles;

- for services of a legal and technical nature - 7000 rubles.

For purposes tax accounting income and expenses the organization uses the accrual method.

Civil law relations

Notarial activity in the Russian Federation is regulated by N 4462-1 approved by the Supreme Court of the Russian Federation on February 11, 1993. In accordance with Part 2 of Art. 1, part 3, art. 2 Fundamentals of the notary public, notarial acts in the Russian Federation are performed by notaries working in the state notary office or in private practice. When making notarial actions notaries have equal rights and bear the same responsibilities regardless of whether they work in a public notary's office or are engaged in private practice. Documents executed by notaries have the same legal force. For the performance of actions for which the legislation of the Russian Federation provides for mandatory notarial form, a notary engaged in private practice charges a notary fee in the amount corresponding to the amount of the state fee provided for the commission of similar actions in a state notary's office (part 2 of article 22 of the Fundamentals of Notaries). The size of the state fee for the performance of notarial acts is established by clause 1. In the case under consideration, the notary certified the leasing agreement and certified the correctness of the copies of the documents. These notarial acts are not mandatory, i.e. for such actions, the legislation of the Russian Federation does not provide for a mandatory notarial form. For the performance of these notarial acts, a notary engaged in private practice charges a notarial fee in the amount established in accordance with the requirements of Art. 22.1 Fundamentals of notaries (part 3 of article 22). In the situation under consideration, the notarial fee for the certification of the leasing agreement, the subject of which is subject to assessment, is established according to the rules of paragraphs. 4 p. 1 art. 22.1 of the Fundamentals of Notaries and amounts to 11,000 rubles. (5,000 rubles + (3,000,000 rubles - 1,000,000 rubles) x 0.3%). The tariff for certifying the accuracy of copies of documents in the amount of 50 pages is set in accordance with paragraphs. 9 p. 1 art. 22.1 and amounts to 500 rubles. (50 x 10 rubles). In accordance with Art. 15, a notary has the right not only to perform the notarial acts provided for by the Fundamentals of Notaries, but also, in particular, to draw up draft transactions, statements and other documents, make copies of documents and extracts from them, as well as give explanations on issues of performing notarial acts. The funds received by a notary for the provision of services of a legal and technical nature are one of the sources of financing for the activities of a notary engaged in private practice (part 1 of article 23). Note that, based on the position Constitutional Court Russian Federation, the provision by a notary of services of a legal and technical nature for a person who has applied to a notary is exclusively voluntary and is carried out outside the framework of notarial actions (clause 2.2, paragraph 1 clause 2.3). When making a legal meaningful action drawn up in notarial order, the notary applies the form uniform pattern, having certain degrees of protection (introduced into notarial office work from 01/01/2011) (clause 41, approved by Order of the Ministry of Justice of Russia dated 11/19/2009 N 403, Information mail FNP dated 03/04/2010 N 417 ""). We also note that all notarial acts performed by a notary are registered in the register. The notary is obliged to issue extracts from the register written statement organizations and persons on whose behalf or on behalf of which these actions are committed (Article 50).

The procedure for conducting cash transactions

The issuance of cash from the cash desk against the report on expenses associated with the implementation of the activities of the organization is carried out according to (unified form N KO-2, approved by the Decree of the State Statistics Committee of Russia dated 18.08.1998 N 88<*>), which is drawn up on the basis of an application of an accountable person, drawn up in free form(clauses 1.8, 4.1, 4.4, approved by the Bank of Russia on October 12, 2011 N 373-P). Note that the issuance of cash under the report is carried out on condition full repayment by the accountable person of the debt for the amount of cash previously received under the report (clause 4.4). Within a period not exceeding three business days after the expiration date for which the cash was issued for the report, the accountable person is obliged to submit an advance report (for example, by, approved by the Decree Goskomstat of Russia dated 01.08.2001 N 55<*>) on the amounts spent, with supporting documents attached. IN this case such document is a receipt issued by a notary or another document confirming payment for notary services. Checking the expense report, its approval by the head and the final settlement of the expense report are carried out within the time period established by the head (clause 4.4 of the Regulations on the Procedure for Conducting Cash Operations).Accounting

Accounting entries for the reflection in the accounting of transactions for settlements with an accountable person are made in the manner prescribed, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are given in the following posting table. The amount of the notary's fee, as well as the fee for the legal and technical services provided by the notary, the payment of which is related to the main activity of the organization, are included in the cost of ordinary species activities (clauses 5, 7, approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n). These expenses are recognized subject to the conditions specified in paragraph 16, including reporting period in which they took place (p. 18). For settlements with a private notary, including the amount of the notary's fee<**>, account 76 "Settlements with different debtors and creditors". The cost of services rendered by a notary is reflected in the debit of the accounts of accounting for production costs (sales expenses) and the credit of account 76 (Instruction for the application of the Chart of Accounts).Value Added Tax (VAT)

According to part 6 of Art. 1 notarial activity is not an entrepreneurship and does not pursue the goal of making a profit. Private notaries are not recognized individual entrepreneurs, the concept of which is established by par. 4 p. 2. Accordingly, private notaries are not classified as VAT payers, the list of which is established by clause 1. Based on the foregoing, notaries engaged in private practice, when providing services within their professional activity VAT is not paid (explanations of the consultant of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia E.S. Lobacheva dated 04.05.2007). Corporate income tax Fee to a private notary for notarial registration refers to other costs associated with production and sales. Such costs are included in the income tax base within the approved tariffs (clause 16 clause 1). Corresponding expenses in excess of these tariffs are not taken into account on the basis of clause 39 (, the Ministry of Finance of Russia dated 05/30/2012 N 03-03-06 / 2/69). In the situation under consideration, the payment for notarial acts was made in accordance with the established notarial tariffs. According to the Ministry of Finance of Russia, the amounts paid to the notary for the provision of services of a legal and technical nature are included in other expenses as expenses for legal, information, consulting and other similar services on the basis of paragraphs. 14, 15 p. 1, subject to their compliance with the criteria of p. 1 (Letter dated 08.26.2013 N 03-03-06 / 2/34843). Note that a similar point of view was expressed by official bodies earlier (, the Ministry of Finance of Russia dated 11/16/2010 N 03-03-06 / 2/198), and is also supported arbitration practice(See, for example, Decree of the Federal Antimonopoly Service of the Moscow District dated July 18, 2013 N A40-54007 / 12-91-301). The expenses incurred must be documented (clause 1). According to tax authorities, documentary evidence expenses incurred may be a form received from a notary, which reflects the amount of payment and the type of notarial actions ()<***>. Expenses for payment of notary services, paid in cash through an accountable person, are recognized on the date of approval of the advance report (clause 5 clause 7).|

Amount, rub. |

||||

|

Funds issued against the report to pay for the services of a private notary<*> |

Account cash warrant |

|||

|

Paid services of a private notary<*> |

Advance report |

|||

|

Reflected the cost of paying for the services of a private notary |

notary form |

|||

|

The return of unspent funds by the accountable person is reflected<*> (20 000 - 18 500) |

advance report, Incoming cash order |

<*>About the features of the application unified forms primary accounting documents from 01/01/2013, see comment.

<**>Recall that the notary fee is not state duty, therefore, account 68 "Calculations on taxes and fees" does not apply in this case (clause 1,).

<***>Note: the provisions of art. 2 federal law dated 22.05.2003 N 54-FZ "" do not apply to private notaries who are not individual entrepreneurs. Hence, private notary is not obliged to use the cash register when making payments for the services it provides for the performance of notarial acts, as well as for services of a legal and technical nature. On the issue of the use of CCP by notaries, see also, Ministry of Taxes of Russia dated 04.14.2004 N 33-0-11 /

M.S. Radkova

Consulting and analytical center for accounting and taxation

- Elderberry wine at home: recipe

- How to make alcohol infusion at home?

- Chicken hearts with potatoes - recipe

- Young wines: their names and taste

- Amber tincture tips for taking care of yourself and your health Amber tincture useful properties

- We make our own homemade non-alcoholic beer

- How is beer made non-alcoholic?

- "Ratmir" - the meaning of the name, the origin of the name, name day, zodiac sign, talisman stones

- Why run in a dream. What does it mean to run in a dream

- Rope: why dream

- Figures of animals and other living beings

- Dream Interpretation troubles, why dream troubles in a dream to see

- What do teeth seen in a dream mean

- The meaning of the name Ratmir, the origin, character and fate of the name Ratmir

- Slavic signs - superstitions and beliefs about family, home, life

- Folk signs of the ancient Slavs

- Modern universal dream book

- A new program for the development of the Arctic zone was approved Social and economic aspects of the development of the Arctic zone

- How is the process of resocialization of the individual?

- Alexander Varfolomeev: “This is fiction, stuffing