Purpose of calculating net assets. Net assets of an enterprise: what is this, a formula, a balance sheet calculation.

Instructions

Net size assets a company is an indicator of its ability to fulfill its obligations and pay dividends. In fact, this is the amount of its capital minus all debt obligations. Cost of net assets calculated from data balance sheet for every reporting period, and allows you to monitor the dynamics of the company’s development as its financial departments, as well as interested investors and partners.

So, what is included in the concept of “net assets”? Without taking into account debt obligations, all the assets of the company are summed up, namely the amount of its balance sheet property. However, not all assets are included in the calculation: deducted price own shares of companies that were purchased from shareholders, and also does not take into account the amount of debt of the founders of the authorized capital for making the next contribution.

From the amount of liabilities (debt obligations), the data in paragraphs “Reserves for doubtful debts" and "Deferred income" of the balance sheet.

Thus, the general formula for calculating the cost of net assets company looks like this: Net assets= (Section I + Section II – ZSA - ZUK) – (Section IV + Section V - DBP), where:• Section I is the total for Section I of the balance sheet “ Fixed assets";• Section II - total result for Section II of the balance sheet " Current assets";• ZSA - the amount of the company's costs for repurchasing its own shares for their cancellation or resale;• ZUK - the amount of debts of the founders of the authorized capital for contributions;• Section IV - the total result for Section IV of the balance sheet " long term duties";• Section V - total result for Section IV of the balance sheet " Short-term liabilities";• DBP – deferred income.

This formula is universal for various forms companies: joint stock company, insurance organization, credit organization, societies with limited liability, investment or mutual fund, etc. However, there are differences, for example, in the timing of reporting: joint stock companies are required to provide an indicator of the value of net assets assets at the end of each quarter, limited liability company - year.

The popularity of various mutual funds and management companies is growing. A share, unlike stocks and bonds, has no nominal value. IN legislative order the calculated value is determined price share depending on the value of the assets included in a particular mutual fund.

Net assets (EnglishNetAssets) – reflect the real value of the enterprise’s property. Net assets are calculated by joint stock companies, limited liability companies, state enterprises and supervisory authorities. The change in net assets allows us to estimate financial condition enterprises, solvency and level of bankruptcy risk. The methodology for assessing net assets is regulated by legislation and serves as a tool for diagnosing the risk of bankruptcy of companies.

Net asset value. Calculation formula

The assets include non-current and current assets, with the exception of the debt of the founders for contributions to the authorized capital and the cost of repurchasing their own shares. Liabilities include short-term and long-term liabilities excluding deferred income. The calculation formula is as follows:

NA – the value of the enterprise’s net assets;

A1 – non-current assets of the enterprise;

A2 – current assets;

ZU – debts of the founders for contributions to the authorized capital;

ZBA – costs of repurchase of own shares;

P2 – long-term liabilities

P3 – short-term liabilities;

DBP – deferred income.

The amount of net assets is calculated based on the balance sheet data (Form No. 1), and the formula is as follows:

Example of calculating the net asset value of a business in Excel

Let's consider an example of calculating the value of net assets for the organization OJSC Gazprom. To estimate the value of net assets, it is necessary to obtain financial statements from the official website of the company. The figure below highlights the balance sheet lines necessary to estimate the value of net assets; the data is presented for the period from the 1st quarter of 2013 to the 3rd quarter of 2014 (as a rule, the assessment of net assets is carried out annually). The formula for calculating net assets in Excel is as follows:

Net assets=C3-(C6+C9-C8)

Video lesson: “Calculation of net assets”

Net asset analysis is carried out in the following tasks:

- Assessment of the financial condition and solvency of the company (see → “ “).

- Comparison of net assets with authorized capital.

Solvency assessment

Solvency is the ability of an enterprise to pay for its obligations on time and in in full. To assess solvency, firstly, a comparison is made of the amount of net assets with the size of the authorized capital and, secondly, an assessment of the trend of change. The figure below shows the dynamics of changes in net assets by quarter.

Analysis of the dynamics of changes in net assets

Solvency and creditworthiness should be distinguished, since creditworthiness shows the ability of an enterprise to pay off its obligations using the most liquid types of assets (see →). Whereas solvency reflects the ability to repay debts both with the help of the most liquid assets and those that are slowly sold: machines, equipment, buildings, etc. As a result, this may affect the sustainability of the long-term development of the entire enterprise as a whole.

Based on the analysis of the nature of changes in net assets, the level of financial condition is assessed. The table below shows the relationship between the trend in net assets and the level of financial health.

Comparison of net assets with authorized capital

In addition to the dynamic assessment, the amount of net assets for an OJSC is compared with the size of the authorized capital. This allows you to assess the risk of bankruptcy of the enterprise (see →). This criterion comparison is defined in the law of the Civil Code of the Russian Federation ( clause 4 art. 99 Civil Code of the Russian Federation; clause 4 art. 35 of the Law on Joint Stock Companies). Non-compliance given ratio will lead to liquidation judicial procedure of this enterprise. The figure below shows the ratio of net assets and authorized capital. The net assets of OJSC Gazprom exceed the authorized capital, which eliminates the risk of bankruptcy of the enterprise in court.

Net assets and net profit

Net assets are also analyzed with other economic and financial indicators of the organization. So the dynamics of growth of net assets is compared with the dynamics of changes in sales revenue and. Sales revenue is an indicator reflecting the efficiency of an enterprise's sales and production systems. Net profit is the most important indicator of the profitability of a business; it is through it that the assets of the enterprise are primarily financed. As you can see from the picture below, net profit decreased in 2014, which in turn affected the value of net assets and financial condition.

Analysis of net asset growth rate and international credit rating

IN scientific work Zhdanova I.Yu. shows that there is a close connection between the rate of change in the net assets of an enterprise and the value of the international credit rating of such agencies as Moody’s, S&P and Fitch. A decrease in the economic growth rate of net assets leads to a decrease in the credit rating. This in turn leads to a decrease in the investment attractiveness of enterprises for strategic investors.

Summary

Net asset value is an important indicator of the amount of real property of an enterprise. Analysis of the dynamics of change this indicator allows you to assess your financial condition and solvency. The amount of net assets is used in regulated regulatory documents And legislative acts to diagnose the risk of bankruptcy of companies. A decrease in the growth rate of an enterprise’s net assets leads to a decrease not only financial stability, but also the level of investment attractiveness. Subscribe to the express mailing list financial analysis enterprises.

Federal Tax Service for Primorsky Krai

The value of the value of the company's net assets is associated with regulation aimed at maintaining the guarantee function of the company's authorized capital.

Net assets - this is the real value of the company’s property, determined annually minus its debts.

The emergence of debts in a company that exceed the size of its property threatens its interests. To prevent this from happening, it is important to correctly assess the net assets of the joint stock company, the size of which at the end of the second and each subsequent financial year must correspond to at least the declared (registered and paid) authorized capital of the company.

Otherwise, the company is obliged to declare and register a decrease in its authorized capital and does not have the right to declare and pay dividends (which would obviously be to the detriment of creditors).

1. The procedure for calculating the amount of net assets for joint-stock companies is established by Order No. 10n, Federal Commission for the Securities Market of Russia No. 03-6/pz dated January 29, 2003.

According to the Letter of the Ministry of Finance of Russia dated January 26, 2007. N 03-03-06/1/39 limited liability companies can use the rules developed for joint stock companies.

2 . The value of the net assets of a joint-stock company is understood as a value determined by subtracting the amount of its liabilities accepted for calculation from the amount of assets of the joint-stock company accepted for calculation.

3. Net assets are calculated based on balance sheet data. To do this, the amount of liabilities is subtracted from the amount of assets. At the same time, not all balance sheet indicators are included in the calculation. Thus, from the assets it is necessary to exclude the value of own shares purchased from shareholders and the debt of the founders for contributions to authorized capital. And the liabilities do not take into account capital and reserves (section III) and deferred income (code 640 section V).

An example of calculating the net assets of enterprises of various forms of ownership

The balance sheet of Astra LLC as of July 1, 2007 reflects the following indicators:

|

Balance indicators |

Balance data |

|

Balance sheet asset |

|

|

1. Non-current assets (section I): |

|

|

- residual value fixed assets (page 120) |

RUB 1,500,000 |

|

- capital investments to unfinished construction (p. 130) |

1,000,000 rub. |

|

- long-term financial investments(pp. 140– |

500,000 rub. |

|

2. Current assets (section II): |

|

|

- stocks |

100,000 rub. |

|

- accounts receivable, |

600,000 rub. |

|

including the debt of the founders for contributions to the authorized capital |

30,000 rub. |

|

- cash– |

500,000 rub. |

|

Liability balance |

|

|

3. Capital and reserves (section III): |

|

|

- authorized capital- |

100,000 rub. |

|

RUB 1,400,000 |

|

|

4. Long-term liabilities (section IV): |

|

|

- long-term loans |

800,000 rub. |

|

5. Short-term liabilities (Section V): |

|

|

- short-term loans |

300,000 rub. |

|

- debt to the budget |

100,000 rub. |

|

- other short-term liabilities |

RUB 1,500,000 |

The indicator of the founders' debt for contributions to the authorized capital (30,000 rubles) is not included in the calculation of assets. The amount of assets will be 4,170,000 rubles. (1,500,000 + 1,000,000 + 500,000 + 100,000 + 600,000 – 30,000 + 500,000).

The calculation of liabilities will not include the data in section. III accounting balance (RUB 1,500,000). The amount of liabilities will be 2,700,000 rubles. (800,000 + 300,000 + 100,000 + 1,500,000).

The value of net assets as of July 1, 2007 will be 1,470,000 rubles. (4,170,000 – 2,700,000).

4. Net assets business entities(LLC, JSC) cannot be less than the authorized capital. If this happens, the company is obliged to reduce its authorized capital.

If at the end of the second and each subsequent financial year the value of the company's net assets will be less than its authorized capital, the company is obliged to announce a reduction in its authorized capital to an amount not exceeding the value of its net assets and register such a decrease in in the prescribed manner(Clause 4, Article 35 federal law dated December 26, 1995 No. 208-FZ, clause 3 of Art. 20 of the Federal Law of 02/08/1998 No. 14-FZ).

5. If the authorized capital falls below the minimum (currently for LLCs and CJSCs - 10,000 rubles, for OJSCs - 100,000 rubles), the organization must be liquidated.

If at the end of the second and each subsequent financial year the value of the company’s net assets is less than minimum size of the authorized capital established by the Federal Law on the date of state registration of the company, the company is obliged to make a decision on its liquidation (clause 5, article 35 of the federal law of December 26, 1995 No. 208-FZ, clause 3 of article 20 of the federal law of 02/08/1998 no. 14-FZ, Article 90 of the Civil Code of the Russian Federation, Article 99 of the Civil Code of the Russian Federation).

6. A legal entity may be liquidated by compulsory (judicial) procedure.

According to paragraph 2 of Article 61 Civil Code of the Russian Federation by a court decision in the event of gross violations of the law committed during its creation, if these violations are of an irreparable nature, or carrying out activities without proper permission (license), or prohibited by law, or in violation of the Constitution Russian Federation, or with other repeated or gross violations law or other legal acts, or in the systematic implementation non-profit organization, including public or religious organization(association), charitable or other foundation, activities contrary to its statutory goals, as well as in other cases provided for by the Code.

7. As follows from Art. 61 of the Civil Code of the Russian Federation, the body authorized to make a decision on the liquidation of a company is the court. A demand for liquidation of a legal entity may be brought to court by a government agency or authority local government, to whom the right to make such a claim is granted by law.

If the value of net assets turns out to be less than its authorized capital and the company is in reasonable time does not make a decision to reduce its authorized capital or to liquidate it, creditors have the right to demand from the company early termination or fulfillment of the company’s obligations and compensation for losses.

The body implementing state registration legal entities, or other government bodies or local government bodies, to which the right to present such a claim is granted by federal law, have the right to submit a claim to the court for the liquidation of the company (clause 6, article 35 of the federal law of December 26, 1995 No. 208-FZ, clause 5 of article 20 of the federal law dated 02/08/1998 No. 14-FZ).

What are net assets? A business's net assets are the difference between the adjusted amount of a business's assets and its liabilities—in short, the value of the business itself minus its debts.

The value of the net assets of an enterprise is calculated on the basis of Order of the Ministry of Finance No. 10-dated January 29, 2003 “On approval of the procedure for assessing the value of net assets of joint-stock companies.” For limited liability companies, when calculating net assets, the same calculation procedure is used (except for trustees of investment funds, organizers gambling) (letter of the Ministry of Finance of Russia N 03-03-06/1/39 dated January 26, 2007).

The calculation of the value of net assets of organizations (with the exception of credit organizations) is made on the basis accounting, the order of which is established federal body executive power.

When calculating the value of net assets in a credit institution, the value is taken into account own funds(capital), determined Central Bank Russian Federation in the prescribed manner.

When is net asset value assessed? Net assets are assessed by the company quarterly, as well as at the end of the year at reporting date. This assessment is reflected in financial statements, respectively, quarterly and annual.

If at the end of the second and each subsequent reporting year the value of net assets turns out to be less than the authorized capital of the company, it must announce a reduction in its authorized capital to the resulting value of net assets, and register such a decrease in the prescribed manner (clause 4 of article 35 of the federal law dated 12/26/1995 No. 208-FZ, paragraph 3 of Article 20 of the Federal Law of 02/08/1998 No. 14-FZ).

If new size less authorized capital established by law minimum, such an enterprise is subject to liquidation (clause 5, article 35 of the federal law of December 26, 1995 No. 208-FZ, clause 3 of article 20 of the federal law of February 8, 1998 No. 14-FZ, article 90 of the Civil Code of the Russian Federation, art. 99 Civil Code of the Russian Federation).

To calculate the assets accepted for calculation, we take:

1. Non-current assets. They are reflected in the first section of the balance sheet and include: intangible assets(intangible assets), fixed assets (fixed assets), construction in progress (construction in progress), profitable investments in material values, long-term financial investments, other non-current assets;

2.Current assets. They are reflected in the second section of the balance sheet and include: inventories, value added tax on purchased assets, accounts receivable, short-term financial investments, cash, other current assets. The value of current assets does not take into account the cost actual costs for the repurchase of own shares that are repurchased joint stock company from shareholders for their subsequent resale or cancellation, and debts of participants (founders) for contributions to the authorized capital.

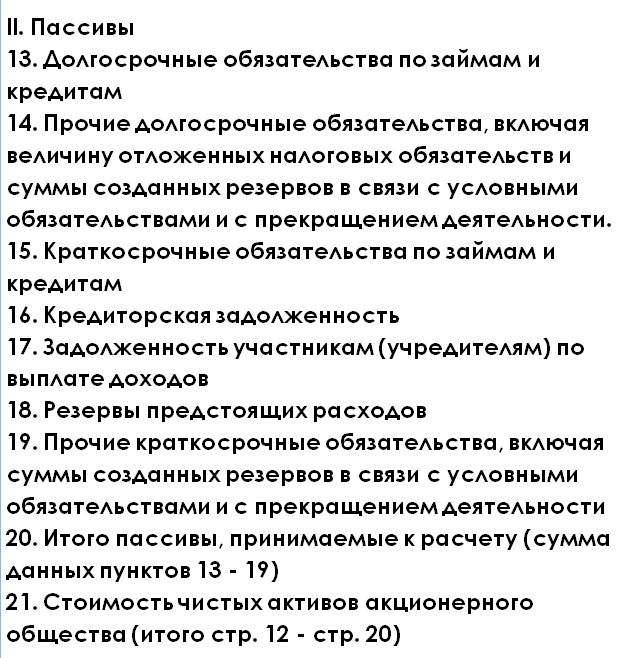

To calculate liabilities taken into account when calculating the value of net assets, the following are included:

1. long-term liabilities for loans and credits and other long-term liabilities;

2. short-term obligations for loans and credits;

3. accounts payable;

4. debt to participants (founders) for payment of income;

5. reserves for future expenses;

6. other short-term liabilities.

That is, the following balance sheet indicators are involved in calculating the net assets of an enterprise.

An example of calculating the net assets of enterprises (for any form of ownership)

Balance sheet of Stroymaterialy LLC as of 10/01/2012:

| Balance indicators | Balance data |

| Balance sheet asset | |

| 1. Non-current assets (section I): | |

| - residual value of fixed assets | RUB 2,300,000 |

| - capital investments in unfinished construction | RUB 1,600,000 |

| - long-term financial investments | 700,000 rub. |

| 2. Current assets (section II): | |

| - stocks | 200,000 rub. |

| - accounts receivable, | 800,000 rub. |

| including the debt of the founders for contributions to the authorized capital | 50,000 rub. |

| - cash- | 1200 000 rub. |

| Liability balance | |

| 3. Capital and reserves (section III): | |

| - authorized capital- | 200,000 rub. |

| - retained earnings | RUB 1,500,000 |

| 4. Long-term liabilities (section IV): | |

| - long-term loans | 1,000,000 rub. |

| 5. Short-term liabilities (Section V): | |

| - short-term loans | 400,000 rub. |

| - debt to the budget | 200,000 rub. |

| - other short-term liabilities | RUB 1,900,000 |

When calculating the amount of assets, the calculation does not include such an indicator as the debt of the founders for contributions to the authorized capital (50,000 rubles). The amount of assets in our example will be 6,750,000 rubles. (2,300,000 + 1,600,000 + 700,000 + 200,000 + 800,000 – 50,000 + 1,200,000).

When calculating liabilities, data on section III balance sheet (RUB 1,500,000). Then the amount of liabilities in our example will be equal to 3,500,000 rubles. (1,000,000 + 400,000 + 200,000 + 1,900,000).

Total net asset value as of October 1, 2012 will be 3,250,000 rubles. (6,750,000 – 3,500,000).

The “net assets” indicator is necessary for analyzing activities, as well as for. It must be positive and exceed the size of the authorized capital. If there is an increase in net assets, then the profit of the enterprise is increasing. Those. the enterprise not only increased the funds that were initially invested in it, but also multiplied them. Of course, it is possible that this indicator will decrease, and it may be less than the authorized capital at the very first difficult year start of activity. But when normal operation enterprises the situation is leveling out. If, nevertheless, the situation has not improved, then the company must either reduce its authorized capital or liquidate it in accordance with the law.

Free book

Go on vacation soon!

To receive a free book, enter your information in the form below and click the "Get Book" button.

- The most powerful prayer to Spyridon of Trimifuntsky Prayer for employment to Spyridon of Trimifuntsky

- Recluse Melania what they pray for

- Orthodox churches around the world

- Study of patterns of light synthesis What is the essence of additive color synthesis

- Physicochemical methods of analysis: practical application Physical methods for studying substances

- Molecular formula of oleic acid

- Muscles hurt during poisoning - causes, treatment Why bones hurt during poisoning

- The role of gonadotropic hormones in the regulation of female body functions

- What to do with chanterelle mushrooms after picking?

- Quiet morning - Kazakov Yu. P. Yuri Kazakov: Quiet morning Volodya and Yashka

- Yuri Kazakov: Quiet morning Read Kazakov's work Quiet morning

- National Emblems in Great Britain

- The meaning of the word cambium in the encyclopedia biology

- Morphological analysis of the verb

- About Great Britain in English

- Is Cyprus still an offshore zone?

- World Development Bank. World BankWorldBank. World Bank in Russia

- Accounts receivable and payable

- Why does a woman dream of an owl: a girl, a married woman, a pregnant woman - interpretation according to different dream books

- How to make an eternal love spell black wedding