Explanation tax 2 personal income tax and actually listed. Explanations for personal income tax (sample)

Tax authorities often require clarification when there is a suspicion of a violation tax legislation, identification of errors and inconsistencies in the submitted documents and information. Explanations to the tax on personal income tax (a sample is given below) prepared for typical situations, examples of which you will also find below.

When can tax authorities ask for clarification?

According to approved form requirements for the direction of explanations (the form was adopted by order of the Federal Tax Service No. ММВ-7-2 / [email protected] of 05/08/2015) cases when clarifications are requested are provided in following articles Code: Art. 88 - conducting tax audit (office), Art. 105.29 - tax monitoring, art. 25.14 - with participation in foreign companies.

However, in practice, demands come to submit an explanation to the tax on personal income tax (we will give a sample of such explanations for different cases below) for many other reasons. In such cases, it is not the responsibility of the taxpayer to provide explanations. However, it is recommended to send them. After all, without having received satisfactory explanations, the tax authorities will come with.

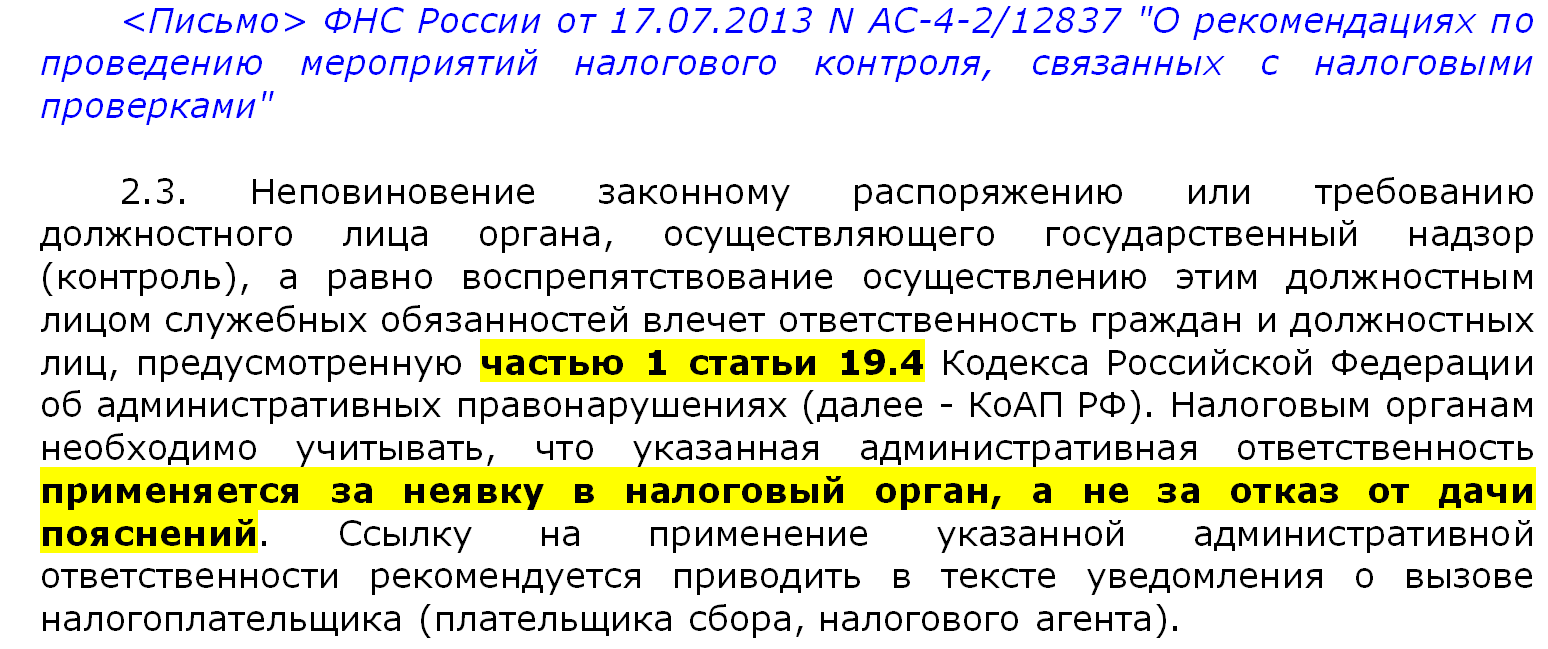

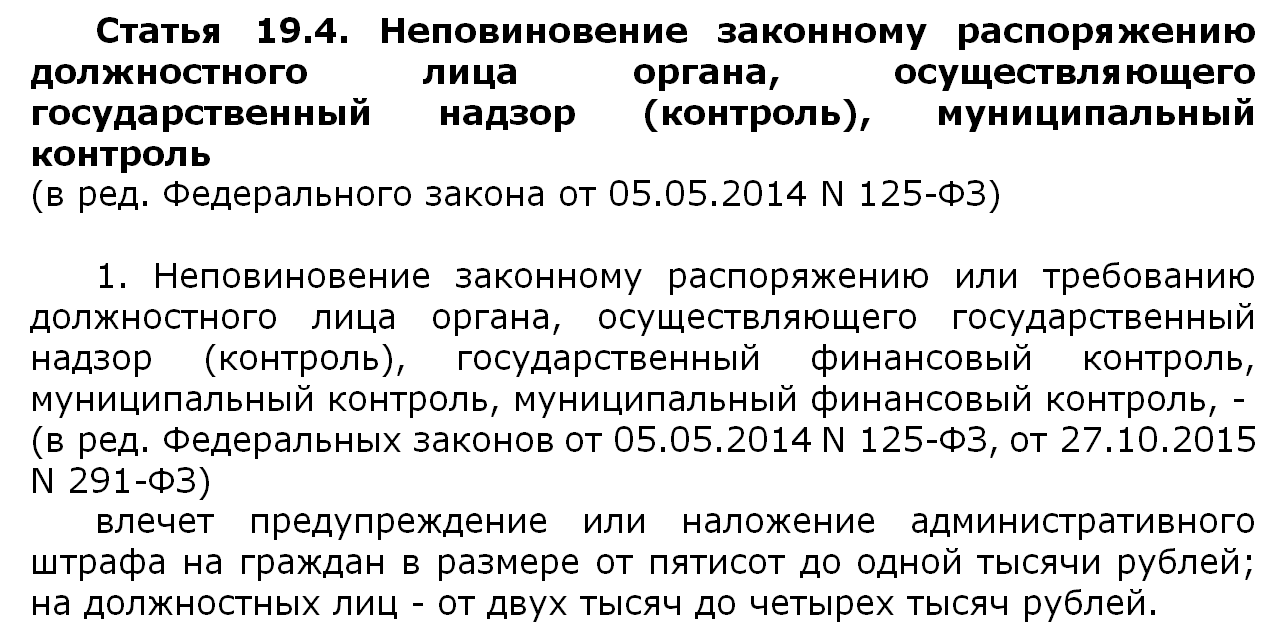

If, nevertheless, explanations are not provided, then it should be borne in mind that the grounds for administrative responsibility in that case, no. In support of this, explanations of the Federal Tax Service of Russia are given, according to which they can start a case under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation, but not for refusal to provide explanations, but for failure to comply with another requirement - failure to appear to provide explanations. That is, it is imperative to appear, but not to give explanations.

A technical error.

The reasons for such demands may be reasons of a very different nature. Often this happens after submission to the tax office, after studying which inspectors establish discrepancies in the amount of income received by employees and income taxes transferred to the treasury.

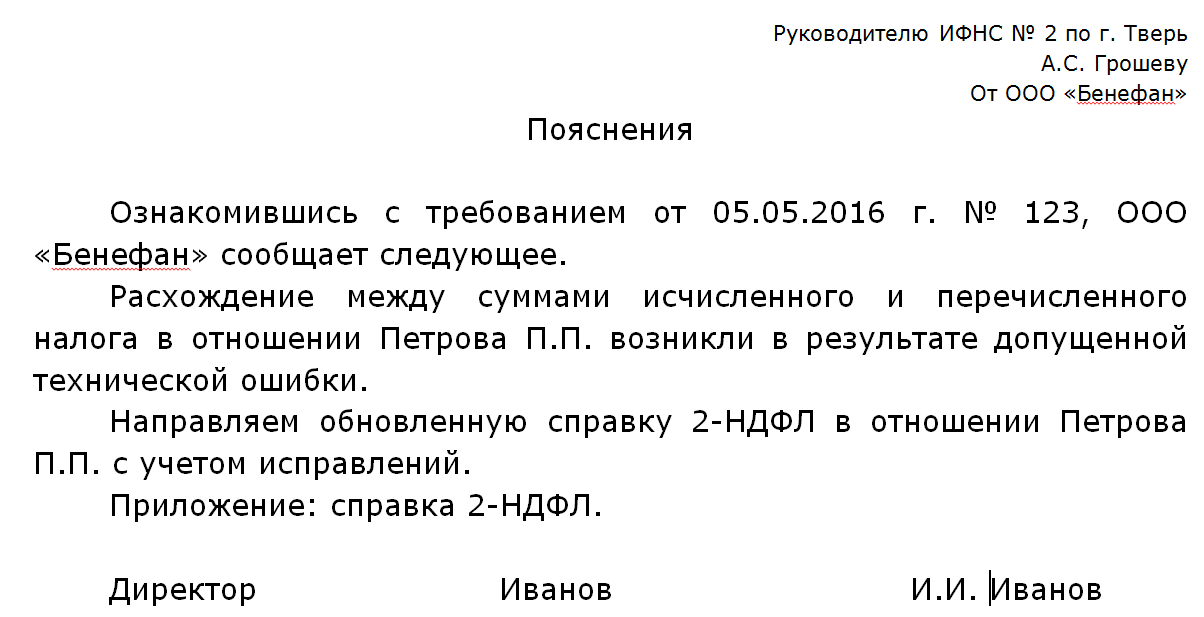

If such inconsistencies have occurred as a result of technical error, then the following explanations can be provided.

The discrepancy between the 3-NDFL declaration and the 2-NDFL certificate.

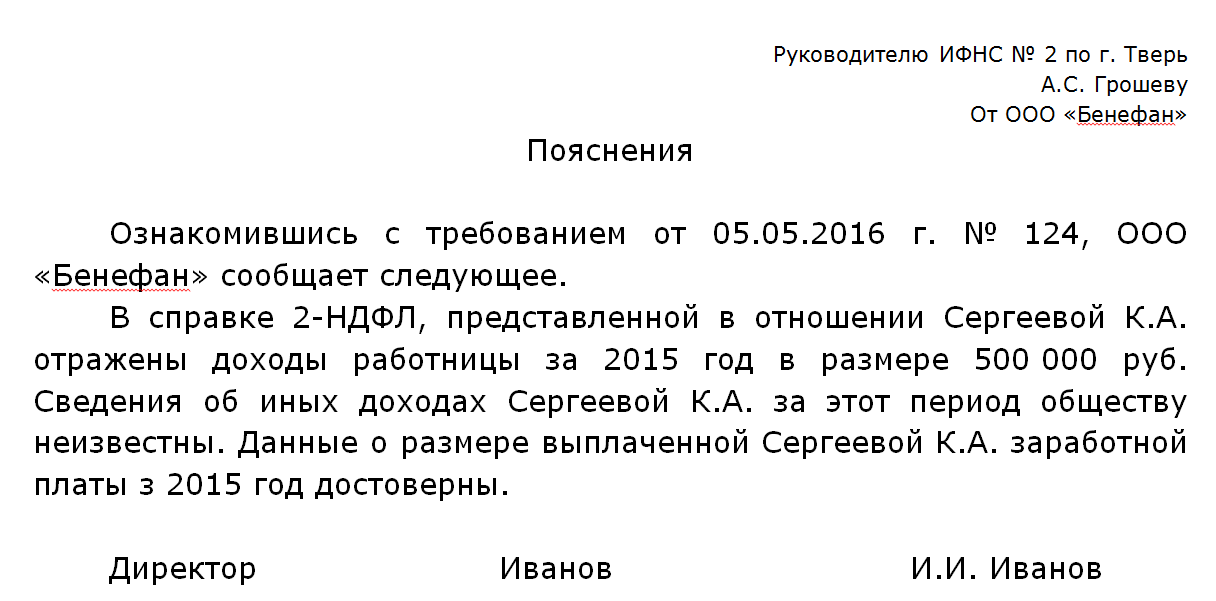

Inconsistency may also arise due to discrepancies between the income statement and the 3-NDFL declaration drawn up and submitted by the employee himself. workers are filing in order to take advantage of the deduction. Having received a declaration from an employee with a different amount of income for the same period as in the certificate, the tax authorities will certainly be interested in the reasons for the discrepancies. After all, if the company reports that the employee has such and such an income, it is withheld from this income income tax, and the employee in the declaration submits information about a different amount of income, then the question arises, where does this discrepancy come from. Does the employee of the company receive " gray salary», Taxes from which are not withheld and paid.

If this is not the reason, and the information provided by the company is true, then it has nothing to worry about. It is enough to prepare explanations and indicate that the information submitted is reliable, and the reasons for the employee's indication of other income of the organization in the declaration are not known.

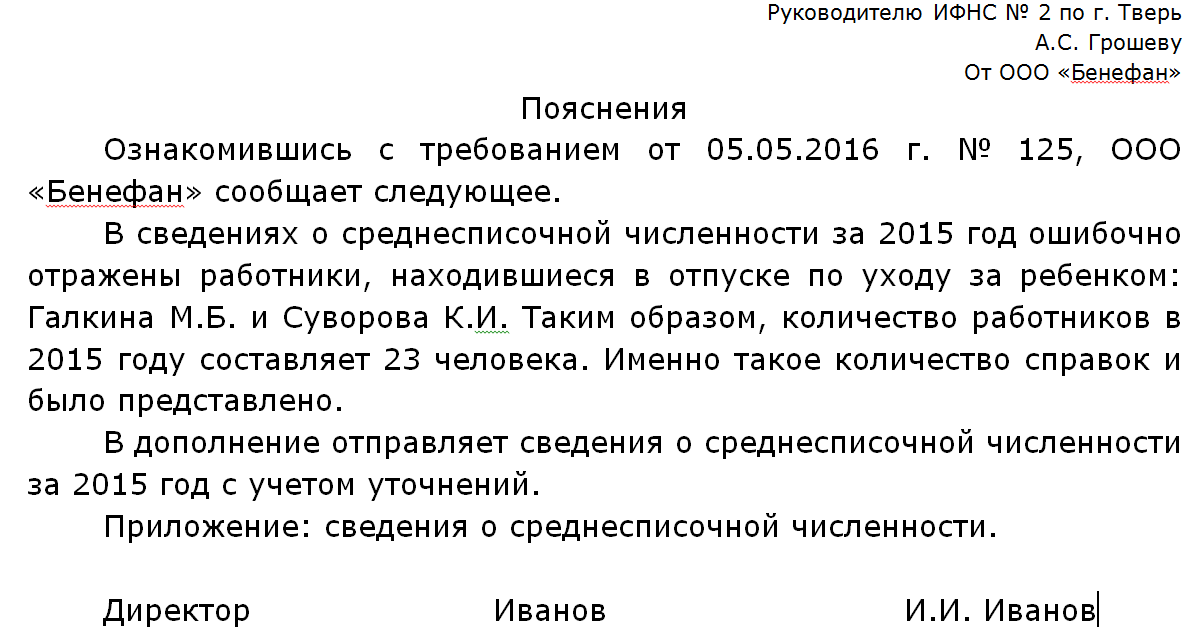

Inconsistency of the submitted certificates with the average number of employees.

Companies annually submit information to the SSC (). If, when checking the 2-NDFL certificates from the tax authorities, the number of certificates submitted differs from the number of the company's personnel according to the CSC, then they will require explanations. Depending on the reason for this discrepancy, the explanations in the tax office may be different.

If there is an error in the SSC, an explanation of this should be sent to the tax office, attaching the updated information about the SSC.

If the information about the SSH was submitted correctly, but certificates about some employees were not sent by mistake, then they must be submitted.

A new procedure for submitting explanations and documents from 02.06.2016.

From 01/01/2017, for not providing explanations claimed under Article 88 of the Tax Code (part 3) for errors identified during, they may be fined 5 thousand rubles, and for repeated violation - by 20 thousand rubles.

The tax authorities carefully monitor the implementation of the legislation by taxpayers. In particular, this is manifested in the fact that if they discover any inaccuracies, you will have to provide a written explanation to the tax office. For personal income tax, you can see a sample of such a statement in this article.

Situations when it is necessary to provide an explanation of the tax

Tax authorities may request clarification in different cases... So, for example, a situation may arise when the amount of accrued, withheld and paid tax will differ. Or, also, a scenario is possible in which the deductions will be applied incorrectly. The amount of tax may also be less than the amount paid in previous year more than ten percent. All this attracts the attention of the tax authorities. Some examples are discussed in more detail below.

A technical error

The difference in the amount of taxes may well not be intentional, it can happen as a result of an error. In this case, you should not worry, you just need to indicate this in the explanation and indicate the correct amount (see example below).

The difference in the information provided in the forms 3-NDFL and 2-NDFL

Another annoying case that may be a reason for asking for clarification. To obtain a deduction, use the 3-NDFL form, and for income - 2-NDFL. Naturally, there should be no difference between the numbers indicated in them, this may push tax authorities the thought that the employee receives an informal wages... Again, however, you don't have to worry if this was not done on purpose, you just need to indicate it in the explanation.

Average headcount: discrepancy in numbers

It is necessary that the number of 2-NDFL certificates correspond to average headcount workers. Otherwise, the tax office will have doubts about the fact that all employees are properly registered.

What happens if no explanation is provided?

From 01.01.2018, amendments to the Tax Code will come into force, according to which separate accounting of VAT on goods (works, services) used both in taxable VAT and in non-taxable / tax-exempt operations will be required, even if the rule is observed five percent.

Written explanation to the tax on personal income tax (sample)

Tax officers cannot conduct office checks in respect of the 2-NDFL Certificates provided by the tax agent, since these certificates are not tax return or by calculation (Art. 80, Clause 1, Art. 88 of the Tax Code of the Russian Federation). However, this does not mean that inspectors do not study the received certificates at all. Moreover, if they reveal any inaccuracies in them, they will ask tax agent imagine written explanations on personal income tax (Article 31 of the Tax Code of the Russian Federation). And it is better not to ignore such requests. Otherwise officials organizations or individual entrepreneurs can be fined in the amount of 2,000 rubles. up to 4000 rubles (part 1 of article 19.4 of the Code of Administrative Offenses of the Russian Federation).

Reasons why the Federal Tax Service Inspectorate asks for clarification

In fact, there are many reasons for requesting clarifications on personal income tax from a tax agent. For example, an agent may be asked to explain why the amounts of calculated, withheld and paid personal income tax from income differ. specific employee or why the deductions were incorrectly applied. Or, for example, inspectors may ask about the reasons for the decline personal income taxpaid in the current year, compared to the listed last year, if such a decrease exceeds 10% (Letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2 / \u200b\u200b12722).

How to write an explanation to the tax on personal income tax

- How to correctly draw up a vehicle sales contract form (sample) and download it in different formats

- Registration of coursework according to GOST

- How to staple documents correctly

- Examples of general form design

- Orders in the organization: types and design features

- How to draw up an act correctly: registration, samples Act of an event

- The procedure for the preparation and execution of acts

- Layout of requisites on documents Rules for placement of requisites in documents

- Organizational and administrative documents: Types, Functions, Drafting

- Sighting a document How to properly endorse documents sample

- Prosecutor in criminal proceedings

- My Arbitrator: Arbitration Cases File

- Success fee in legal practice review of controversial litigation by bulls a

- Peculiarities of drawing up a testamentary assignment Non-property testamentary assignment

- Form of the certificate of completion - sample

- Waybills for a rented vehicle without a crew

- We fill in the employee's personal card

- Employee's personal card

- Features of the annual power of attorney for obtaining goods and materials and a sample document for download

- What if the employer does not accept the letter of resignation?