The nature and features of the procedure for conducting cash transactions: simplification and optimization. Test yourself: the procedure for conducting cash transactions Instructions for conducting cash transactions

The circulation of cash between economic entities, as well as the procedure for conducting cash transactions in the Russian Federation, is established by the Central Bank of the Russian Federation. The basics are enshrined in regulatory documents: Instructions of the Bank of the Russian Federation No. 3210-U dated March 11, 2014 - for legal entities, Regulation No. 318-P dated April 24, 2008 - for credit organizations.

Operations are used when receiving, recalculating or issuing cash for the following purposes:

- payment of wages, scholarships, benefits;

- , calculations of tax obligations;

- settlements with suppliers and contractors;

- settlements for the provision of paid services;

- gratuitous receipts and donations;

- other calculations.

Rules for conducting cash transactions in 2019

Mandatory requirements have been established for the procedure for organizing cash circulation, as well as issues that the budgetary organization establishes independently.

|

Mandatory requirements (regulated by current legislation) |

Self-installed |

|---|---|

|

|

The law determines that only an employee of the institution can be a cashier. The employee must be familiarized with the current procedure and job responsibilities upon signature. Also, the functions of a cashier can be performed by the manager himself. And if a large organization employs several cashiers, a senior one should be appointed.

Required documents

Operations must be documented with appropriate documents.

So, to receive cash into the cash register, the receipt order (PRO) form OKUD 0310001 is used. Form No. KO-1 is approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

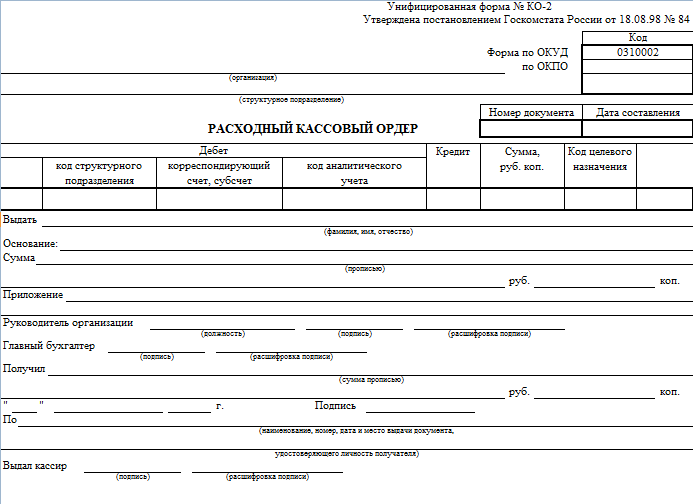

To issue cash, a debit order (RKO) OKUD 0310002 is used. Form No. KO-2 is approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

The documentation is prepared by the cashier or chief accountant. Responsibilities can be transferred to another person with whom an agreement has been concluded to maintain accounting records in the organization (clause 4.3 of Instructions No. 3210-U). The condition came into force on August 19, 2017.

New rules for using CCP

In 2019, the procedure for using cash register equipment is in effect, approved by Federal Law No. 54-FZ of May 22, 2003 (as amended on July 3, 2016). Recent changes have affected not only the rules for registering cash register devices with the tax office, but also the procedure for using online cash registers.

Organizations using CCPs should not provide the device to the inspection for registration or changes. All actions can be carried out through your personal account on the website of the Federal Tax Service of Russia. In addition, all information about calculations will be automatically transmitted to tax authorities through fiscal data operators.

Innovations will improve the financial efficiency of using cash register systems, reduce the cost of maintenance and re-registration of equipment, and reduce the risk of financial fraud. The changes are aimed at increasing the transparency of payments made in cash, as well as reducing the number of tax audits.

Liability and penalties

For non-compliance with the law regarding the conduct of cash transactions, administrative liability is provided. Part 1 of Article 15.1 of the Code of Administrative Offenses establishes:

- Punishment for legal entities that violated Regulation 318 on the procedure for conducting cash transactions and Instructions No. 3210-U is a fine of 40,000 to 50,000 rubles.

- Punishment for officials of organizations and individual entrepreneurs in the form of a fine from 4,000 to 5,000 rubles.

Basic entries for recording cash transactions

Let's present the main cash transactions of a budget institution in the form of a table.

|

the name of the operation |

Debit account |

Credit account |

Source documents |

|---|---|---|---|

|

Receipt of cash to the institution's cash desk from a personal account |

PKO (f. 0310001) Cash book (f. 0504514) |

||

|

Received payment for provision of paid services |

PKO (f. 0310001) Receipt (f. 0504510) Cash book (f. 0504514) |

||

|

Money issued on account |

RKO (f. 0310002) Cash book (f. 0504514) |

||

|

Cash exceeding the cash register limit was transferred to the institution’s personal account |

RKO (f. 0310002) Cash book (f. 0504514) |

The procedure for conducting cash transactions is established for all business entities, regardless of their organizational and legal form. From this article you can find out how cash transactions are carried out in 2016-2017.

It is worth highlighting the following basic rules for conducting cash transactions:

- Legal entities are required to set a cash balance limit.

- Cash on hand that exceeds the established limit must be immediately deposited with the bank.

- Each cash transaction must be documented with appropriate cash documents.

- Cash payments between legal entities. persons should not exceed one hundred thousand rubles.

- Cashiers must maintain cash books and fill out cash reports.

Let's look at these rules in more detail.

Cash limit

Every organization must have a cash limit. It represents the maximum allowable amount of cash that can remain in the company's cash register at the end of each working day. Excess cash must be handed over to credit institutions.

The manager of the organization sets this limit independently. When calculating the limit, it must take into account the size of cash withdrawals and receipts.

It should be noted that entrepreneurs and small businesses may not set a cash limit when maintaining a cash register.

If the company has branches, they must also have a cash limit.

More information about calculating the cash limit can be found in.

Exceeding the cash limit

Amounts of cash accumulated in the cash register in excess of the established limit must be surrendered to credit organizations.

However, there are situations in which the limit can be legally exceeded:

- Weekends and public holidays (if the company conducts cash transactions on these days);

- Days of various employee benefits.

Cash documentation

If money arrives at the cash register, the official must issue an order for receipt, and if cash is issued from the cash register, an order for expenditure.

These documents are prepared either by an accountant, or a cashier, or another official whose responsibilities include the preparation of these documents.

Entrepreneurs, regardless of the chosen tax regime, may not issue cash documents. However, they must keep records of their expenses and income.

Cash acceptance

Acceptance of funds to the cash desk must be accompanied by registration of a receipt. When the cashier receives this order, he must check:

- Is there a signature of an accountant or chief accountant (in extreme cases, the manager of the company) and checks this signature with the sample;

- Does the amount indicated in numbers correspond to the amount indicated in words?

- Are there necessary supporting documents?

When the cashier accepts money, he must count it. In this case, the person who deposits cash into the cash register must monitor the actions of the cashier.

As soon as the cashier counts the money, he must check the amount received with the amount indicated in the receipt. If everything goes well, he signs the order, puts a stamp on the receipt and gives this receipt to the person who deposited the funds.

A form and sample of a cash receipt order can be found in.

Payment of the money

When money is withdrawn from the cash register, an expense order is issued. When the cashier receives it, he must check:

- Does it have the signature of the responsible employee (accountant, chief accountant or director of the company), and does it match the sample;

- Match amounts in numbers and words.

When the cashier issues money, he must check whether the recipient has the documents specified in the consumables. Also, he is obliged to check the recipient using an identification document. Cash cannot be given to a person not named in the order.

Once the cashier has prepared the required amount, he must give the order to the recipient for him to sign. After this, the cashier counts the money so that the recipient has the opportunity to monitor his actions. After the cash has been issued, the cashier signs the consumable.

A form and sample of a cash receipt order can be found in.

Payment in cash

There is not only a cash limit, but also a limit on cash payments between legal entities. This limit is one hundred thousand rubles within one contract. That is, if the partners have an amount under one agreement of four hundred thousand rubles, one hundred thousand can be paid in cash, and the rest can be transferred to a bank account.

There is not only a cash limit, but also a limit on cash payments between legal entities. This limit is one hundred thousand rubles within one contract. That is, if the partners have an amount under one agreement of four hundred thousand rubles, one hundred thousand can be paid in cash, and the rest can be transferred to a bank account.

With individuals, non-cash payments can be made without any restrictions.

Maintaining a cash book

Organizations, when carrying out their activities, must fill out a cash book. Individual entrepreneurs have the right not to do this when keeping records of their expenses and income.

It is needed to record cash receipts and withdrawals.

During each working day, the cashier enters into the book each issue of money and each receipt. At the end of the day, the remaining amount in the cash register is calculated.

Control over the maintenance of the book is carried out either by the chief accountant or by the manager of the company.

Read more about maintaining a cash book in.

Legislative basis

The regulation on cash transactions in 2016-2017 is Bank of Russia Regulation No. 18. It defines all the rules of cash discipline and the procedure for conducting cash transactions.

Changes that occurred in 2016-2017

In 2016, the procedure for conducting cash transactions changed slightly:

- All legal entities must start using updated cash register equipment, in which all necessary information is collected automatically and sent online to the tax office.

- When using this technique, checks are prepared in electronic format and sent to clients by email.

- If an organization uses a cash register whose registration period is still valid (the total period of use is less than seven years), it can use it until the end of the term, and only after that switch to new equipment.

- For all legal entities persons have a restriction on storing cash: every day, cash exceeding the established limit must be handed over to credit organizations.

- For entrepreneurs, the process of maintaining cash records and documentation has become simpler. They no longer need to issue orders, both for receipts and expenses. Also, they have the right not to set cash limits for themselves. If an organization is a small business, it can carry out its activities on the same preferential terms as entrepreneurs.

According to the Directive of the Central Bank of the Russian Federation No. 3210-U, from June 1, 2014, a new accounting of cash transactions is being introduced to maintain cash discipline and correct accounting of funds in the cash desk, established new rules for conducting cash transactions 2019.

Also, as before, in the Regulations of the Central Bank of the Russian Federation No. 373-P, it will be necessary to establish and calculate the cash balance limit, and make a special calculation of the limit. The new procedure for conducting cash transactions provides for the old forms of incoming and outgoing cash order 2019 (KO-1 form according to OKUD 0310001 PKO - receipt and KO-2 form according to OKUD 0310002 RKO-consumable), the form and sample of which can be downloaded for free.

All legal entities, except individual entrepreneurs, are required to maintain a cash book and draw up cash documents. For non-application of a cash balance limit, this is the only “simplification” of the procedure for conducting cash transactions. Otherwise, they must fully comply with all the rules established for legal entities.

A detailed description of maintaining a cash book in 2019 is provided, as well as a sample for filling it out, and there is also the opportunity to download a cash book form for free.

The forms of cash documents remained the same. True, as previously wanted, some of the details, such as corresponding accounts (subaccounts), were not removed from the forms. It will be necessary to issue a new order on the cash limit, because the old one referred to the old Regulations of the Central Bank. Individual entrepreneurs will no longer have to maintain a cash book and comply with the cash balance limit, as well as issue cash documents (receipt and expense cash orders).

This article provides explanations about cash transactions in 2019. The maintenance and completion of the cash book is described. A calculation of the balance, a sample and the opportunity to download a cash register limit form and an order for establishing it are given. Forms for incoming and outgoing cash order are provided.

When conducting cash transactions, recipients of budget funds are guided by this Directive, unless otherwise specified by a regulatory legal act regulating the procedure for conducting cash transactions by recipients of budget funds.

2. To conduct operations for accepting cash, including their recalculation, issuing cash (hereinafter - cash transactions), a legal entity, by an administrative document, establishes the maximum allowable amount of cash that can be stored in the place for conducting cash transactions, determined by the head of the legal entity (hereinafter - cash desk), after displaying in the cash book 0310004 the amount of cash balance at the end of the working day (hereinafter referred to as the cash balance limit).

A legal entity independently determines the cash balance limit in accordance with the appendix to this Directive, based on the nature of its activities, taking into account the volume of receipts or volumes of cash disbursements.

A payment agent operating in accordance with Federal Law No. 103-FZ of June 3, 2009 “On activities for accepting payments from individuals carried out by payment agents” (hereinafter referred to as the payment agent), a bank payment agent (subagent) operating in accordance with the Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System” (hereinafter referred to as the bank payment agent (subagent), when determining the cash balance limit, cash accepted during the activities of the payment agent, bank payment agent ( subagent).

A division of a legal entity at the location of which a separate workplace (workplaces) (hereinafter referred to as a separate division) is equipped, depositing cash into a bank account opened for a legal entity in a bank, the cash balance limit is established in the manner prescribed by this Directive for a legal entity .

A legal entity that includes separate divisions that deposit cash at the cash desk of a legal entity, taking into account the cash balance limits established for these separate divisions.

A copy of the administrative document establishing a cash balance limit for a separate division is sent by the legal entity to the separate division in the manner established by the legal entity.

Note: There is a sample cash limit 2019, which provides a detailed calculation of the cash balance. Given by the manager or by order of the individual entrepreneur.

A legal entity stores cash in bank accounts in banks in excess of the cash balance limit established in accordance with paragraphs two to five of this paragraph, which is free cash.

Accumulation by a legal entity of cash in the cash register in excess of the established cash balance limit is allowed on days of payment of wages, scholarships, payments included in accordance with the methodology adopted for filling out federal state statistical observation forms, into the wage fund and social payments (hereinafter - other payments), including the day of receipt of cash from a bank account for the specified payments, as well as on weekends and non-working holidays if a legal entity conducts cash transactions on these days.

In other cases, accumulation by a legal entity of cash in the cash register in excess of the established cash balance limit is not allowed.

Individual entrepreneurs and small businesses may not set a cash balance limit.

Note: Individual entrepreneurs and small businesses may not set a cash limit. Those. keep any amount of money in the cash register.

to menu

3. An authorized representative of a legal entity delivers cash to the bank in which the legal entity has a bank account, or to an organization included in the Bank of Russia system that carries out transportation of cash, collection of cash, operations for receiving, recalculating, sorting, forming and packaging cash of bank clients (hereinafter referred to as an organization included in the Bank of Russia system), for crediting their amounts to the bank account of a legal entity.

An authorized representative of a separate division may, in turn, deposit cash at the cash desk of a legal entity, or to the bank in which the legal entity has a bank account, or to an organization included in the Bank of Russia system, for crediting their amounts to the bank account of the legal entity.

4. Cash transactions are carried out at the cash desk by a cashier or other employee, a certain head of a legal entity, an individual entrepreneur or another authorized person (hereinafter referred to as the manager) from among his employees (hereinafter referred to as the cashier), with the establishment of the corresponding official rights and responsibilities with which the cashier must be read under signature.

If a legal entity or individual entrepreneur has several cashiers, one of them performs the functions of a senior cashier (hereinafter referred to as the senior cashier).

Cash transactions can be carried out by the manager.

A legal entity or individual entrepreneur can conduct cash transactions using software and hardware systems.

Software and hardware systems designed to accept banknotes must have the function of recognizing at least four machine-readable security features of Bank of Russia banknotes, the list of which is established by a regulatory act of the Bank of Russia.

4.1. Cash transactions are drawn up with incoming cash orders 0310001, outgoing cash orders 0310002 (hereinafter referred to as cash documents).

Cash documents can be drawn up upon completion of cash transactions on the basis of fiscal documents provided for in paragraph twenty-seven of Article 1.1 of the Federal Law of May 22, 2003 No. 54-FZ "On the use of cash register equipment when making cash payments and (or) settlements using electronic means of payment."

The paying agent, bank payment agent (subagent) draws up a separate cash receipt order 0310001 for cash accepted during the activities of the payment agent, bank payment agent (subagent).

Individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity, cash documents may not be processed.

4.2. Cash documents are prepared:

- chief accountant;

- an accountant or other official (including a cashier) specified in an administrative document, or an official of a legal entity, an individual with whom agreements have been concluded for the provision of accounting services (hereinafter referred to as the accountant);

- manager (in the absence of a chief accountant and accountant).

4.3. Cash documents are signed by the chief accountant or accountant (in their absence, by the manager), as well as by the cashier.

In the case of conducting cash transactions and drawing up cash documents by the manager, cash documents are signed by the manager.

4.4. The cashier is provided with a seal (stamp) containing the details confirming the conduct of a cash transaction (hereinafter referred to as the seal (stamp), as well as sample signatures of persons authorized to sign cash documents when registering cash documents on paper.

In the case of conducting cash transactions and drawing up cash documents by the manager, sample signatures of persons authorized to sign cash documents are not drawn up.

4.5. If there is a senior cashier, transactions for the transfer of cash between the senior cashier and cashiers during the working day are reflected by the senior cashier in the accounting book for cash received and issued by the cashier 0310005, indicating the amounts of cash transferred. Entries in the book of accounting of funds accepted and issued by the cashier 0310005 are made at the time of transfer of cash and are confirmed by the signatures of the senior cashier, cashier.

to menu

4.6. The legal entity records cash received at the cash desk, with the exception of cash accepted during the activities of a paying agent, bank payment agent (subagent), and cash issued from the cash register in the cash book.

The paying agent, bank payment agent (subagent) maintains a separate cash book to account for cash accepted during the activities of the paying agent, bank payment agent (subagent).

Entries in the cash book 0310004 are made for each incoming cash order 0310001, outgoing cash order 0310002, issued respectively for cash received and issued (full posting of cash to the cash desk).

At the end of the working day, the cashier checks the actual amount of cash in the cash register with the data of cash documents, the amount of the cash balance reflected in the cash book 0310004, and certifies the entries in the cash book 0310004 with a signature.

Entries in the cash book are verified with the data of cash documents by the chief accountant or accountant (in their absence, by the manager) and signed by the person who carried out the specified reconciliation.

If no cash transactions were carried out during the working day, no entries are made in the cash book.

5.1. Upon receipt of cash receipt order 0310001, the cashier checks the presence of the signature of the chief accountant or accountant (if they are absent, the signature of the manager) and when drawing up cash receipt order 0310001 on paper - its compliance with the sample, except for the case provided for in paragraph two of subclause 4.4 of clause 4 of this Directive, checks the correspondence of the amount of cash entered in numbers with the amount of cash entered in words, the presence of supporting documents listed in the cash receipt order 0310001.

The cashier accepts cash by sheet, piece by piece.

Cash is accepted by the cashier in such a way that the cash depositor can observe the actions of the cashier.

After accepting cash, the cashier checks the amount indicated in the cash receipt order with the amount of cash actually received.

If the amount of cash deposited corresponds to the amount specified in the cash receipt order 0310001, the cashier signs the cash receipt order 0310001, puts a seal (stamp) on the receipt for the cash receipt order 0310001 issued to the cash depositor and gives him the specified receipt for the cash receipt order 0310001. When registering cash receipt order 0310001 in electronic form, a receipt for cash receipt order 0310001 can be sent to the cash depositor at his request to the email address provided by him.

If the deposited amount of cash does not correspond to the amount specified in the cash receipt order 0310001, the cashier invites the cash depositor to add the missing amount of cash or returns the excess deposited amount of cash. If the cash depositor refuses to add the missing amount of cash, the cashier returns the deposited amount of cash to him. The cashier crosses out the cash receipt order 0310001 (if the cash receipt order 0310001 is issued in electronic form, he makes a note about the need to re-register the cash receipt order 0310001) and transfers (sends) to the chief accountant or accountant (in their absence - to the manager) for re-registration of the cash receipt order 0310001 to the actual amount of cash deposited.

to menu

5.2. Lost power. - Directive of the Bank of Russia dated June 19, 2017 N 4416-U.

5.3. Acceptance of cash deposited by a separate division into the cash desk of a legal entity is carried out in the manner established by the legal entity, according to cash receipt order 0310001. Receipt.

6. Cash withdrawal carried out by .

The issuance of cash for the payment of wages, stipends and other payments to employees is carried out according to cash receipts orders 0310002, payroll slips 0301009, pay slips 0301011.

6.1. Upon receipt of cash receipt order 0310002 (payroll slip 0301009, payroll slip 0301011), the cashier checks for the presence of the signature of the chief accountant or accountant (in their absence, the signature of the manager) and when drawing up the specified documents on paper - its compliance with the sample, except in the case of provided for in paragraph two of subclause 4.4 of clause 4 of this Directive, the correspondence of the amounts of cash entered in numbers with the amounts entered in words. When issuing cash using cash order 0310002, the cashier also checks the presence of supporting documents listed in cash order 0310002.

The cashier issues cash after identifying the recipient of the cash using the passport or other identification document presented by him in accordance with the requirements of the legislation of the Russian Federation (hereinafter referred to as the identity document), or according to the power of attorney and identification document presented by the recipient of the cash. Cash issuance is carried out by the cashier directly to the recipient of the cash indicated in the cash receipt order (settlement and payroll sheet, payroll sheet) or in the power of attorney.

When issuing cash by power of attorney, the cashier checks the compliance of the surname, name, patronymic (if any) of the recipient of the cash indicated in the cash order with the surname, name, patronymic (if any) of the principal specified in the power of attorney; correspondence of the surname, name, patronymic (if any) of the authorized person indicated in the power of attorney and the cash receipt order, the data of the identity document, and the data of the identity document presented by the authorized person. In the payroll statement (payroll), before the signature of the person entrusted with receiving cash, the cashier writes “by proxy.” The power of attorney is attached to the cash receipt order (settlement and payroll slip, payroll slip).

In the case of issuing cash according to a document issued for several payments or for receiving cash from different legal entities or individual entrepreneurs, copies of it are made and certified in the manner established by the legal entity or individual entrepreneur. A certified copy of the power of attorney is attached to the cash receipt order (payroll slip, payroll slip). The original power of attorney (if any) is kept by the cashier and, at the last cash disbursement, is attached to the cash receipt order (payment slip, payroll slip).

to menu

6.2. When issuing cash under cash order 0310002, the cashier prepares the amount of cash to be issued and passes cash order 0310002 to the cash recipient for signature. If cash expense order 0310002 is issued electronically, the recipient of the cash can affix an electronic signature.

The cashier recalculates the amount of cash prepared for issue in such a way that the recipient of the cash can observe his actions, and issues cash to the recipient in a sheet-by-piece, piece-by-piece recalculation in the amount indicated in the cash receipt order.

The cashier does not accept claims from the recipient of cash for the amount of cash if the recipient of the cash has not verified the correspondence of the amounts of cash entered in figures with the amounts entered in words in the cash receipt order, and has not recalculated the cash received by him piece by piece under the supervision of the cashier.

After issuing cash according to the cash receipt order, the cashier signs it.

6.3. To issue cash to an employee on account (hereinafter referred to as the accountable person) for expenses related to the activities of a legal entity, individual entrepreneur, cash order 0310002 is drawn up in accordance with the administrative document of the legal entity, individual entrepreneur or a written application of the accountable person, drawn up in any form and containing a record of the amount of cash and the period for which cash is issued, the signature of the manager and the date.

The accountable person is obliged, within a period not exceeding three working days after the expiration date for which cash was issued on account, or from the date of return to work, to present to the chief accountant or accountant (in their absence, to the manager) an advance report with attached supporting documents. The check of the advance report by the chief accountant or accountant (in their absence, by the manager), its approval by the manager and the final settlement of the advance report are carried out within the period established by the manager.

6.4. The issuance from the cash desk of a legal entity to a separate division of cash necessary for carrying out cash transactions is carried out in the manner established by the legal entity, according to cash expense order 0310002. (consumables)

to menu

6.5. The amount of cash intended for payment of wages, scholarships and other payments is established according to the payroll (payroll). The deadline for issuing cash for these payments is determined by the manager and is indicated in the payroll (payroll). The duration of the period for issuing cash for wages, scholarships and other payments cannot exceed five working days (including the day of receipt of cash from a bank account for these payments).

The issuance of cash to an employee is carried out in the manner prescribed in paragraphs one through three of subclause 6.2 of this clause, with the employee affixing his signature to the payroll sheet (payroll).

On the last day of issuing cash intended for payment of wages, scholarships and other payments, the cashier in the payroll sheet (payroll) puts a seal (stamp) or makes the inscription “not issued” opposite the names and initials of employees who have not received cash issuance, calculates and records in the final line the amount of cash actually issued and the amount of cash not issued, checks the indicated amounts with the total amount in the payroll sheet (payroll), puts his signature on the payroll sheet (payroll) and passes it on to the chief accountant or accountant (in their absence, to the manager) for signing.

For the amounts of cash actually issued according to the settlement and payroll (payroll) statement, an expense cash order is issued.

7. Measures to ensure the safety of cash during cash transactions, storage, transportation, the procedure and timing of checks of the actual availability of cash are determined by a legal entity or an individual entrepreneur.

8. This Directive is subject to official publication in the "Bulletin of the Bank of Russia" and in accordance with the decision of the Board of Directors of the Bank of Russia (minutes of the meeting of the Board of Directors of the Bank of Russia dated February 28, 2014 No. 5) comes into force on June 1, 2014, with the exception of paragraph five point 4.

8.2. From the date of entry into force of this Directive, the Regulation of the Bank of Russia dated October 12, 2011 No. “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, registered by the Ministry of Justice of the Russian Federation on November 24, 2011 No. 22394 (Bulletin of the Bank) shall be declared invalid Russia" dated November 30, 2011 No. 66).

Chairman

Central Bank

RF E.S. Nabiullina

Note: - the legality of tax authorities carrying out checks on compliance by organizations and individual entrepreneurs with the procedure for working with cash and the procedure for conducting cash transactions, cash settlements with other organizations is shown.

to menu

Maintain a cash book electronically for free

If the cash register limit is exceeded by the end of the day?

The current procedure for storing cash at the cash register is not always convenient, except for small businesses where there is no cash limit. Often, more money accumulates in the cash register than the law allows. The fines for exceeding the cash limit are quite impressive. They range from 40,000 to 50,000 rubles.

You can bypass the restriction on the cash limit at the cash desk if you give the excess to the account. This will avoid a fine of 50,000 rubles. for violation of the procedure for working with cash (Article 15.1 of the Code of Administrative Offenses

Directive of the Central Bank of Russia 3073-U establishes the cash settlement limit and the rules for the implementation and payment of cash payments between legal entities in rubles and foreign currency.

The cash register is farmed out to the company (Instruction dated March 11, 2013 No. 3210-U). For example, he must determine where and how to equip the cash register, how to store documents, and approve the procedure and timing of cash audits. Even more rules are set by the head of the company that has separate divisions.

Each decision of the manager can be a separate order. But it is more convenient to draw up a single document - a regulation on the conduct of cash transactions. And it will contain, if not all, then most of the important additions to the official cash order.

Moreover, formulate your rules in such a way that it is easy to implement them, but this does not come to the detriment of the organization. Our article will help you not to miss the main thing when preparing such a document. A ready-made sample of a regulation on conducting cash transactions is presented below.

The most important information to include in the statement

The regulations do not need to duplicate the requirements from Directive No. 3210-U. It is enough to make a link to this document. ( 1 ) It is necessary to describe in detail only those points that are not clearly formulated, as well as points the settlement of which the Bank of Russia directly entrusts to the head of the company.

Where and what kind of cash desk in the company (2). The director of the company himself determines what the place in the company should be for conducting cash transactions, that is, the cash desk (clause 2 of Directive No. 3210-U). You can provide that it has a barred window through which the cashier issues and receives money. And the safe in which they are stored is firmly attached to the floor. But if the director considers such precautions unnecessary, then the regulations can only name the place where the cashier works. For example, an accounting room or office No. 4 (see sample regulations on cash transactions above).

Who is the cashier in the company (3). The manager needs to decide who in the organization conducts cash transactions, that is, works as a cashier (clause 4 of Directive No. 3210-U). This person can only be selected from among the company’s employees. For example, you cannot appoint an employee of a specialized organization to which the company has transferred accounting management as a cashier. But you can choose anyone from the employees.

So, if the company does not have a cashier position according to the staffing table, the director can appoint either a chief accountant or a secretary. The main thing for him is the official rights and responsibilities of a cashier and familiarize him with these rights and responsibilities.

There is no need to include the rights and responsibilities of the cashier in the regulations. And even more so call him full name. Otherwise, you will have to make amendments with each personnel change.

Suffice it to say, for example, that a cashier is an employee who holds this position in accordance with the staffing table and with whom an employment contract has been concluded. Or establish that the company’s cashier is a payroll accountant. Then the accountant’s job description (or employment contract with him) must include the rights and responsibilities of the cashier and have him sign that he has read it. If desired, the director can be a cashier himself.

If the company has several cashiers, then you need to choose which of them is the eldest. Typically, the position of senior cashier is also reflected in the staffing table. Then the regulation can be limited to the stipulation that in the company cash transactions are carried out by the senior cashier and the cashier.

Which company documents are electronic or paper (4). The new procedure allows you to draw up cash register documents by hand or on a computer, on paper or electronically (clause 4.7 of Directive No. 3210-U).

You can put all possible options into a position. But now it is unclear whether the organization has the right to draw up some documents on paper, and some electronically. In addition, paper documents (except receipts and consumables) can be corrected, but electronic ones cannot. Therefore, until official clarification appears, it is safer to do everything as before. That is, to provide in the regulations that the organization compiles receipts, consumables, cash books, statements, etc. in a computer program, and then prints them out and stores them in paper form.

Who prepares cash documents (5). The director must appoint someone in the company who is responsible for preparing cash documents, that is, receipts and consumables. In other words, it creates them in the program and prints them out.

In practice, this is most often done by the cashiers themselves before receiving or giving out money. Then in the situation it is necessary to say so. After all, another option is possible: he prints out the receipt (consumables), puts his signature on it, and then passes this document to the cashier (clause 5.1 of Directive No. 3210-U).

Where and for how long should documents be stored (6). The regulations must describe how the company organizes the storage of all cash register documents (clause 4.7 of Directive No. 3210-U). Firstly, talk about shelf life. This is five years (order of the Ministry of Culture of Russia dated August 25, 2010 No. 558). Secondly, about the storage location. Usually this is accounting. But you can provide, for example, that documents older than three years are transferred to the company’s archives. Thirdly, who is responsible for safety (the director himself, the chief accountant, the accountant).

How is a power of attorney for receiving or depositing cash certified (7). The regulations must state how the company certifies copies of powers of attorney by which the cashier issues cash from the cash register. Let us explain what we are talking about.

If a cashier gives money to someone by proxy (for example, an employee of a counterparty brought goods and takes cash payment for it), then this document must remain with the company. The cashier applies it to the consumables.

But it happens that a power of attorney is issued for a long time. Or it gives the employee the right to receive cash not from one, but from several different organizations. Then there is no need to take the original power of attorney from him. It is enough to make a copy. It will be with the cashier.

The regulations must provide for exactly how this copy is certified (clause 6.1 of Directive No. 3210-U). The simplest option is for the cashier to make a copy, date and sign it.

Thus, it can be established that only the cashier and the manager have the right to withdraw cash from the account. Or the chief accountant in case of a cashier's vacation. And he must transport them exclusively in a corporate car. Anything can happen on the subway and bus.

If the cash goes missing, both the company and the cashier will suffer. Usually with him about full material so that the full amount of damage can be recovered.

What to add to the regulations on separate divisions

A company that has separate divisions should devote a separate section of the regulations to them. Indeed, in this part, many issues also need to be resolved. Here are the most important ones.

Where does the department deposit cash (10). The new rules put an end to the issue of cash limits for separate divisions. The limit value of the cash balance must be set for each of them, and not just for and (clause 2 of Directive No. 3210-U). The exception is small businesses. They have the right not to set a limit either for themselves or for their additional offices.

The procedure for calculating the limit for a division depends on where it deposits cash: directly to the bank or to the cash desk of the head office. The option chosen for the additional office must be secured in position.

How to give the additional office an order regarding its limit (11). The head office must issue an order to each separate unit regarding the limit set for it. We are talking about both those divisions that deposit cash into the bank, and those additional offices that transfer their money to the cash desk of the head office (Ab. 6, clause 2 of Directive No. 3210-U). The procedure for transmitting this order must be fixed in the regulations.

The simplest option is for the department cashier to take the order regarding the cash balance limit and sign for it on a copy that remains at the head office. And the safest thing is to hand the order personally into the hands of the head of the department, who will himself be responsible for giving this document to his cashier.

When and how the department transfers its cash book to the company (12). The new cash order does not directly say that any division of the company must maintain its own cash book. But there is a rule: separate divisions transfer to the organization a copy of the cash book sheet (paragraph 7, clause 4.6 of Directive No. 3210-U).

For this reason, it is safer to have separate books in each additional office. And the regulations must say in what order a copy of the sheet will be transferred to the head office and how often. There is no need to submit the original sheet, and there are no requirements for making a copy in the new rules. This means that it can be established that the department cashier sends a copy of the sheet to the central office by email.

As for the deadline, there are no specific requirements in Directive No. 3210-U. The main thing here is to have time to transfer the entire book by the time of compilation. Therefore, the company has the right to state in the regulations that the sheets of the book are sent once a month, quarter or even year.

How to approve a position

The regulations on conducting cash transactions must be approved by the head of the company. Therefore, it is convenient to prepare this document as an appendix to the director’s order (see sample order below). Employees who directly work with the cash register - chief accountant, accountant, cashier - must be familiarized with the new provision.

But it is better to collect their signatures not on the manager’s order or on an appendix, but on a separate sheet (it can also be made an appendix to the order) or in a special free-form journal. Then, even with constant personnel changes, you will not need to reprint the order due to the fact that there is no longer enough space for the signatures of responsible employees.

In the order, mention that the director approved the new regulations on the conduct of cash transactions in connection with the entry into force of Bank of Russia Directive No. 3210-U dated March 11, 2013. And also say that the text of the regulation developed by the company is given in the appendix to the order.

Conducting cash transactions in 2019 is still carried out in the manner approved by the Bank of Russia Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as Directive No. 3210-U). Let us remind you that it is valid from 06/01/2014. At the same time, the provision “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, approved. Bank of Russia October 12, 2011 No. 373-P (hereinafter referred to as Regulation No. 373-P).

NOTE! From August 19, 2017, a number of changes were made to the procedure for conducting cash transactions, which we will consider in more detail below (directive of the Bank of Russia dated June 19, 2017 No. 4416-U).

Read about changes in accounting for imprest amounts .

Who is affected by the changes in the procedure for conducting cash transactions?

To one degree or another, innovations in the procedure for conducting cash transactions affected all business entities. In particular:

- individual entrepreneurs and organizations that are small businesses (you will find the criteria for small businesses in this article);

- organizations that are not small;

- organizations with separate divisions;

- persons using cash registers or strict reporting forms (read more about accounting for funds when using online cash registers);

- employers giving money to employees on account.

Let us now consider these changes in more detail.

Conducting cash transactions: comparison of current and old rules

For clarity, we will present the main changes in the procedure for conducting cash transactions in the form of a table (comparison of current and previous rules, including taking into account those introduced by Directive No. 4416-U).

|

Operations affected by changes |

Current procedure for conducting cash transactions |

The clause of the legal acts referred to by the current procedure for conducting cash transactions |

Previous procedure for conducting cash transactions |

|

Obligation to set a limit on the cash balance in the cash register |

Individual entrepreneurs and small business organizations may not set a limit on the cash balance in the cash register. Note: the criteria for classifying organizations as small businesses are established by Art. 4 of the Law “On the Development of Small and Medium Enterprises in the Russian Federation” dated July 24, 2007 No. 209-FZ |

Clause 2 of instructions No. 3210-U |

There were no exceptions for individual entrepreneurs and small organizations. All legal entities and entrepreneurs had to set the maximum allowable amount of cash that could be kept in the cash register at the end of the working day, and hand over excess cash to the bank (clauses 1.2-1.4 of Regulation No. 373-P) |

|

The procedure for conducting cash transactions allows you to choose one of 2 options for calculating the cash limit:

|

Appendix to instruction No. 3210-U |

The old rules for conducting cash transactions did not allow for the choice of a convenient option for calculating the cash limit. The second option (in terms of the volume of cash disbursement) was allowed to be used only in the absence of cash receipts. This was directly stated in the appendix to regulation No. 373-P |

|

|

Registration of cash documents by individual entrepreneurs |

Individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity, may not formalize:

In particular, this applies to entrepreneurs who pay UTII, individual entrepreneurs who use a patent or simplified taxation system, as well as individual entrepreneurs who are payers of the Unified Agricultural Tax (see letter of the Federal Tax Service of Russia dated July 9, 2014 No. ED-4-2/13338). Note: accounting of income and expenses is also carried out by entrepreneurs in the general mode - in the book of income and expenses and business transactions of an individual entrepreneur (approved by order of 08/13/2002Ministry of Finance of the Russian Federation No. 86n, Ministry of Taxes of the Russian Federation No. BG-3-04/430). From this we can conclude that this relaxation applies to all entrepreneurs without exception. |

pp. 4.1, 4.6 instructions No. 3210-U |

Along with organizations, individual entrepreneurs were obliged to:

|

|

The procedure for depositing excess cash at the bank |

Cash for crediting to the account is submitted:

|

Clause 3 of instructions No. 3210-U |

In addition to the existing options (deposit to a bank or organization included in the Bank of Russia system), it was possible to transfer money to an account through the federal postal service organization (clause 1.5 of Regulation No. 373-P) |

|

Indicating the amount in words on a cash receipt slip |

According to the current procedure for conducting cash transactions, when issuing cash according to a cash order, the cashier prepares the amount of cash to be issued and transfers the cash order to the recipient only for signature. There is no longer any need to require the recipient to enter the amount received into the order by hand. This amount can be printed |

Clause 6.2 of instruction No. 3210-U |

Conducting cash transactions in the previous manner required the recipient not only to sign the order, but also to indicate in his own hand the amount received (rubles in words, kopecks in numbers) (clause 4.3 of Regulation No. 373-P) |

|

Issuance of money on account |

To issue cash to an employee on account for expenses associated with the activities of a legal entity or individual entrepreneur, an expense cash order is drawn up in accordance with a written application of the accountable person, drawn up in any form, or an administrative document of the manager. The application or administrative document must contain a record of the amount of cash and the period for which it is issued, as well as the manager’s signature and date. If an application is drawn up for accountable amounts, then the manager is not required to indicate the amount of accountable funds and the period. The accountable himself can do this. And the manager will only sign and date it. Issuance on account is allowed if the recipient has not reported on the previous advance |

Clause 6.3 of instruction No. 3210-U |

According to the previous procedure for conducting cash transactions, the amount and reporting period had to be indicated by the manager in his own hand (clause 4.4 of regulation No. 373-P). In addition, until August 19, 2017, accountable money was issued solely on the basis of an employee’s application and only in the absence of debt on previous accountable expenses |

|

Preparation of cash documents for settlements with cash registers or BSO |

The current procedure for conducting cash transactions establishes the possibility of registering a general PKO and (or) cash settlement upon completion of cash transactions for the entire amount of accepted cash on the basis of fiscal documents provided for in paragraph. 27 art. 1.1 of the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ. If the cash receipt order is issued in electronic form, then the cashier can send the receipt at the request of the depositor to his email. If the cash receipt order is issued electronically, then the recipient of the money can put his electronic signature on the document |

pp. 4.1, 5.1, 6.2 instructions No. 3210 |

Regulation No. 373-P did not provide for the possibility of drawing up a consolidated receipt order for BSO and other similar documents. Clause 5.2 of Directive No. 3210 became invalid as of 08/19/2017. There was no possibility of sending a receipt by e-mail, as well as signing cash settlements with an electronic signature |

|

Interaction between the head office and department offices |

An organization that has separate divisions (SU) has the right to independently establish the procedure and timing for the transfer to the parent organization of copies of sheets of the SE's cash books, taking into account the deadline for drawing up accounting (financial) statements (clause 4.6 of Directive No. 3210-U) |

The unit had to transfer its cash book sheet with the cash balance at the end of the working day to the organization no later than the next working day (clause 5.6 of Regulation No. 373-P) |

|

Responsibility for violation of the rules for conducting cash transactions

And in conclusion, a few words about responsibility. For violation of the procedure for working with cash and the procedure for conducting cash transactions, administrative liability is provided under Art. 15.1 Code of Administrative Offenses of the Russian Federation. This is a fine: for officials - from 4 thousand to 5 thousand rubles, for legal entities - from 40 thousand to 50 thousand rubles.

In this case, violations include:

- making cash settlements with other organizations in excess of established limits;

- non-receipt (incomplete receipt) of cash to the cash desk;

- failure to comply with the procedure for storing available funds;

- accumulation of cash in the cash register in excess of established limits.

Read more about liability for violation of the procedure for conducting cash transactions in the article “Cash discipline and responsibility for its violation” .

Results

The procedure for conducting cash transactions in 2019 has not undergone any changes. The rules as amended in 2017 continue to apply. Then some of the innovations affected the procedure for working with accountables. Other changes were related to the introduction of online cash registers and optimization of electronic cash document flow.

- An educational resource for thinking and curious people

- Saint Venerable Barnabas of Gethsemane (1906), founder of the Iversky Vyksa Monastery

- How do prayers in front of the Old Russian Icon of the Mother of God help? The Old Russian Icon of the Mother of God is located

- Chernigov Gethsemane icon of the Mother of God Prayer to the Ilyin Chernigov icon

- Coconut panna cotta recipe with photo and banana Recipe Vegan panna cotta made from coconut milk

- Banana-nut sponge cake in a slow cooker, photo recipe Chocolate sponge cake with banana in a slow cooker

- Whole chicken baked with garlic and pepper

- Cod liver salads for every taste Cod liver salad with green peas

- Recipes for squash preparations for the winter

- Preparing a milkshake with fresh aromatic strawberries in a blender

- Lunar calendar for December dream book

- The magic of numbers. Why do you dream about the Face? Dream Interpretation dirty face in the mirror

- Personal eastern horoscope

- The great mantra of Shiva - Om Namah Shivaya Shivaya namah nama om meaning

- Dream Interpretation: why you dream of walking through a cemetery, interpretation of the meaning of sleep for men and women

- Lego Secret Figure Minifigures Series 17

- Real benefits and mythical harm of dates for the human body

- Curry with chicken and rice - exclusive recipe with step-by-step photos Rice with curry seasoning recipe

- Time delay prefix pvl Structure of the symbol

- Was Nicholas II a good ruler and emperor?