How to find a company's gross profit. What is gross profit and how is it calculated

Each commercial enterprise strives to maximize income. When developing a strategy to improve performance, an organization should consider financial indicators. One of the most important characteristics in this area is gross profit.

What is gross profit and what does it characterize?

The indicator characterizes the financial result from the perspective of taking into account exclusively production costs.

A feature of this type of profit is the inclusion in the amount of managerial and business expenses.

In other words, gross profit, among other things, contains wages of the AUP, costs of concluding agreements and contracts and other institutional costs.

The indicator is found as the difference between revenue and technological cost, which, in turn, consists of the costs of materials, wages of workers and shop expenses.

Each group of indicators is divided into narrower ones. It is necessary to understand that the income of managers directly related to the manufacturing process is taken into account in the technological cost.

Formula for calculating gross profit

The indicator is based on enterprise data for the period. Typically, gross profit is calculated once a year.

The calculation uses two indicators - revenue and technological cost for the entire volume of production (excluding commercial and administrative expenses).

General calculation formula

IN general view gross profit can be found using the following formula:

GP = TR – TC tech, Where

GP (gross profit) – gross profit, rub.;

TR (total revenue) – revenue, rub.;

TC tech (total cost) – technological cost, rub.

Balance calculation formula

Data for calculating gross profit are located in the form financial statements entitled "Report on financial results" In accordance with the provisions of the report, the formula looks like this:

Page 2100 = page 2110 – page 2120, Where

line 2100 – gross profit, rub.;

line 2110 – revenue, rub.;

line 2120 – technological cost, rub.

Calculation example

The company Ekran LLC is engaged in the production of drills for milling machines. Financial statements for the last 2 years contains the following data:

Then the gross profit for 2013 and 2014, respectively, is:

GP 2013 = TR – TC tech = 120,000 – 40,000 = 80,000 rubles

GP 2014 = TR – TC tech = 180,000 – 60,000 = 120,000 rubles

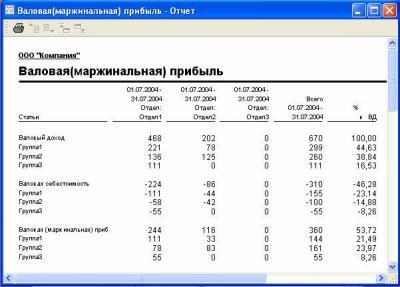

Video - “gross profit” report in the 1C: Trade Management program:

The direct dependence of the indicator on the amount of revenue and technological cost is obvious. The higher the sales volumes will be when constant costs per unit, the greater the gross profit will be.

Where is the indicator used?

Calculation of gross profit is especially relevant when the share of administrative and commercial expenses is relatively small. If they are no more than 5% of full cost, then it is advisable to use the indicator in question for short- and medium-term planning.

In the case of long-term planning, it is rational to calculate other types of profit. For example, margin.

The indicator can also be used when drawing up budgets and flows Money for the next period.

It's worth remembering that this type profit is close to production and does not reflect, for example, advertising costs. Therefore, for the final budget, analyzing gross profit alone will not be enough.

What is the difference between gross and contribution margin

In some sources you can see that these two types of profits are identical. This doesn't always happen.

The fundamental difference is that gross profit represents the difference between revenue and the total set of variables, as well as part of the fixed costs.

Contribution margin is revenue minus only variable costs.

Often the enterprise bears fixed costs, therefore the gross profit will be less than the marginal profit. TO fixed costs include rent and utility bills.

Gross profit is important to manufacturing enterprise, because it allows you to evaluate the magnitude and significance of the technological cost. The indicator must be taken into account when planning for a period of 1-3 years.

Video - what is the difference between profit and gross income:

Enterprise management depends on many factors - technical, financial, legal and social processes and phenomena, entrepreneurial intuition, experience of doing business in modern conditions market economy. At the core, any commercial activities lies the desire to obtain the maximum possible profit without loss of quality of products and with minimal risks for the enterprise. It is profit that is the final, final indicator of the efficiency of an enterprise, and it is profit that allows this enterprise to develop and optimize its industrial potential. In order to correctly and purposefully direct and regulate financial flows both within the enterprise and outside, you need to have a certain competence in the types of profit, its sources, classification and optimal ways of its further use. One of these types is gross profit, which will be discussed in this material.

Gross profit (GP) and cost

If the concept of profit includes the difference between expenses and income from the sale of goods or services, then gross is a characteristic of the efficiency of production and financial policy enterprises. So, gross profit is the difference between revenue from a product or service sold and its cost. It is important to note that, unlike net profit, VP does not exclude variable and operating costs and income tax deductions. In formal expression, gross profit is obtained in this way: VP = B-C, where B is revenue for sold goods, and C is the cost of the product or service produced. Gross profit is the profit from the sale of a product or service minus its cost.

In order to correctly and objectively obtain the volume of gross profit of an enterprise, you must first determine all the cost items that include the cost of goods, including variables that were not determined and calculated in advance. So, according to the most common definition, cost is the entire volume of resources expressed in monetary equivalent, which was spent on the production and sale of a product or service. Thus, only having full picture about all the costs incurred by production for the production and sale of goods or services, you can objectively calculate the amount of gross profit for certain period time.

Factors Affecting Gross Profit

Like any other financial category,VP is influenced by a number of factors. Conventionally, they can be divided into factors that depend on the activities of the entrepreneur and independent factors. The first category includes the dynamics of growth in production volumes and product sales, expansion of the range, work to improve the quality and competitiveness of products, cost reduction, optimization  labor productivity and coefficient useful action each unit of human resources, maximum use of production assets and capacities, regular analysis and, if necessary, revision of the company’s marketing strategy. The second category includes factors that cannot be influenced by subjects economic activity: geographical, natural, environmental or territorial conditions, legislative regulation, changes in government strategy in supporting business, international and global changes regarding resource and transport support enterprises.

labor productivity and coefficient useful action each unit of human resources, maximum use of production assets and capacities, regular analysis and, if necessary, revision of the company’s marketing strategy. The second category includes factors that cannot be influenced by subjects economic activity: geographical, natural, environmental or territorial conditions, legislative regulation, changes in government strategy in supporting business, international and global changes regarding resource and transport support enterprises.

If the second category of factors obliges you to choose a flexible and rapidly changing management strategy that would ensure the continued functioning of the enterprise without, or with minimal losses and costs, then the management of factors of the first category is quite within the capabilities of experienced and competent enterprise management.

By increasing the volume of production and sales of products, and thereby increasing trade turnover, the company contributes to the growth of its gross income, applies directly here proportional dependence. Because great importance it is necessary to maintain the pace and volume of production at a stable level, avoiding a decrease, since it will inevitably entail a negative impact on gross income. It is important to note that unsold product balances, which could generate income, but for one reason or another become unnecessary ballast for the enterprise, have an extremely negative role. Some managers sometimes use a discount strategy additional goods at a reduced cost or barter exchange of balances, with the aim of maximizing their sale and returning the expended capital to revolving fund. Most often, such marketing steps do not bring gross income, but if positive result and there is, then minimal.

It is very important to influence the cost of production - the use of innovative technologies in production, the search for the lowest possible methods of delivering products to the buyer, the introduction and use of alternative and economical energy resources ultimately helps to reduce costs and significantly affects the gross profit of the enterprise.

One of the most important factors it is worth noting pricing policy enterprises - high competition in a modern market economy constantly stimulates the manufacturer to revise pricing. Two categories of factors intersect here, because the state antimonopoly policy interferes with the pricing policy of an enterprise, on the one hand, promoting healthy competition in the market for goods and services, and on the other hand, preventing the free setting of prices for a particular product. But you should not strive to constantly reduce prices to increase the company’s turnover - a stable and confident exchange rate will help you stay afloat, and this will in any case be better than a feverish increase in volumes in order to maintain a stable income.

Analysis of product profitability makes it possible to determine which product is worth making the maximum bet on, and the need to produce which products should be reduced or even limited. After all, it is obvious that the turnover of profitable products gives maximum gross income, thereby increasing the net profit of the enterprise.

During the operation of any production, over time, problems arise. inventories, which are no longer used or their use is inappropriate. This may arise due to illiterate management, or due to objective factors. In such a case, in order to avoid losses that may arise due to the fact that the ownership of these assets and their further implementation will be much lower than the cost of their acquisition, it is worth taking measures to implement them. The money received from the sale of fixed assets will also be part of the gross profit of the enterprise.

Another source for increasing gross profit may be a non-operating income item - incoming rent, interest and dividends on shares or deposits, fines and sanctions in favor of the enterprise and other sources.

Optimal distribution of gross profit

So, having sold products and received a certain amount of money, you need to use it correctly and constructively, without forgetting any of the expense items. Imagine a pyramid, at the top of which is the total gross profit, followed by various sources of expenses: rent for construction or production facilities, payment of interest on existing loans, various charitable contributions and funds, all kinds of taxes, and most importantly - net profit. Further, the net profit is also distributed into several groups - environmental funds and payments, selection, preparation and training of human resources, social funds to create social infrastructure for both the enterprise and the state as a whole, personal income owners of the enterprise, and reserve cash savings.

A strategy for paying wages to staff has a good effect when they receive not only a fixed fee for their work, but, like the owner of the enterprise, a part of the income from the final gross income of the enterprise. Such payments are of a bonus nature and, as a rule, are made irregularly, most often at the end of the year or reporting period.

A strategy for paying wages to staff has a good effect when they receive not only a fixed fee for their work, but, like the owner of the enterprise, a part of the income from the final gross income of the enterprise. Such payments are of a bonus nature and, as a rule, are made irregularly, most often at the end of the year or reporting period.

It is worth noting that all types of payments are divided into two categories - those minimum amount which is fixed, and those whose distribution depends on the managers and owners of production. The first include different kinds payments for rent, interest, loans. The second category is more specific, since the volume of payments in charities or on social needs depends on the decision of the management apparatus, and therefore may not always be objective and useful. Part increase own profit on the part of the businessman, and therefore a decrease in expenses on other items may further negatively affect the growth dynamics of the enterprise. This is primarily due to human factor who plays vital role in production - complete social package for personnel, developed social support and infrastructure significantly influence the level of labor productivity.

Thus, an objective and comprehensive approach to the distribution of gross income of any enterprise makes it possible not only for its subsequent development, expansion of production capacity and strengthening of personnel capabilities, but also contributes to a further increase in the net income of the enterprise.

- Homemade caramel syrup

- What is a spelling chart for schoolchildren

- How to soak meat in vinegar

- How to bake a meat pie - step-by-step recipes for preparing dough and filling with photos

- Pike cutlets "Original"

- What color were the insects you saw?

- Delicious snacks with a spicy touch: preparing salads with Korean carrots

- What is binge drinking: symptoms Alcoholic during binge drinking

- Psychosomatic factors of thyroid diseases Psychological causes of thyroiditis

- Tower coastal batteries of Sevastopol 30th coastal battery

- Liberation of Belarus - Operation Bagration

- Lunar calendar for December dream book

- Marshmallow recipe with sweetener: what to add to homemade dessert

- Puff pastries with cottage cheese, from ready-made puff pastry

- Sterlet recipes

- Why does a woman dream about a baby kangaroo?

- Runic inscription to attract customers for your business

- What do the numbers mean in fortune telling on coffee grounds?

- Fortune telling on paper with a ronglis pen

- Orange peels: uses, features and best recipes