Practical task in the form of km 3 form. The procedure for drawing up an act on the return of funds

Form of the act of return of funds according to the KM-3 form used to process a return to the buyer, as well as in the case when the cash receipt. Usually it is filled out by the cashier and certified by CEO, the organization's seal is placed on the document. Thus, the completed act of returning funds to the buyer is the basis for reducing the cash balance in the cash register within one cash register shift.

Cloud service for trade management MoySklad offers convenient tools for design and printing necessary documents. You can download the KM-3 act, its form and sample, as well as other documents used in trade. Most of them can be filled out and printed online at automatic mode. But that's not all! MyWarehouse will help you automate the cashier's workplace at minimal cost and establish effective accounting in your store.

Act KM-3. Sample filling

We will tell you in more detail how to fill out this document correctly. Sample of filling out the KM-3 act You can download and print from the link below.

According to the sample of filling out the KM-3 act in it in mandatory numbers and amounts of unused cash receipts. Based on returned checks, the company's cash desk reduces revenue. This fact entered into the Cashier's Journal.

Form KM-3 is filled out and signed by members of the commission, including the cashier himself and the head of the enterprise, in a single copy. After this, the completed form is submitted to the accounting department along with canceled checks, which must be stuck on separate sheet paper, and other applications, if any.

In case of a return from the client, there may be the following attachments to the KM-3 form:

- cash receipt - the buyer must keep it and provide it;

- sales receipt or form strict reporting, if your outlet does not use a cash register;

- refund receipt, if it appears at your checkout;

- buyer's statement about returning the goods to free form– ask the buyer to write a statement explaining the reason for returning the goods.

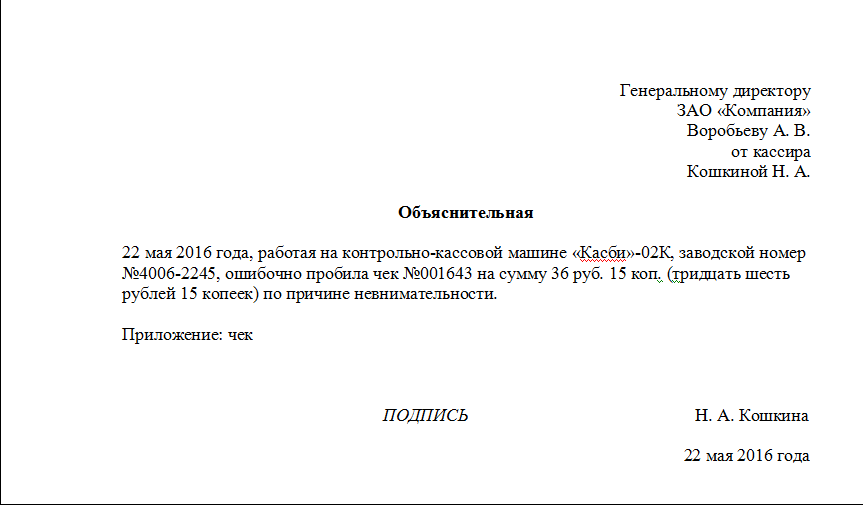

If the return certificate sums of money is issued due to an incorrectly punched check, ask the cashier to write explanatory note and attach it to the KM-3 form. This is not necessary, but it will protect you from unnecessary questions from inspection authorities.

The completed act in form KM-3 with attachments must be stored in the organization’s cash documents for five years. IN tax office it is available upon request only.

The letter of the law implies the ability of each buyer to return goods that do not meet the established characteristics. In order to reflect this situation in accounting and notify the Federal Tax Service inspection that the sale has been cancelled, the cashier should return the goods from customers. In the article we will tell you how to fill out form KM-3 (Act on the return of money to buyers (clients) for unused cash receipts), in what cases it is used.

What is the KM-3 act and who fills it out

In cases where the buyer returns goods purchased for cash on the same day, the cashier must refer to the KM-3 act. This document is unified and approved by a resolution of the State Statistics Committee in 1998. In addition to carrying out the return of goods by the buyer, the KM-3 act must certainly be filled out in a situation where, during the sale, the cashier made an error, as a result of which he was forced to carry out the “Return” operation.

Instructions for filling out the KM-3 act

This document must be drawn up in one copy by an established commission consisting of:

- The head of a company or structural unit (for example, a store);

- Head of department (manager);

- Senior shift cashier;

- Cashier.

We present the completion of the act in the form of a table:

| p/p | Intelligence | A comment |

| 1 | Company or division registration details | They are indicated in the header of the act and consist of the name in accordance with registration documents, TIN, contact details |

| 2 | Information about CCP used in the organization | Make, model, numbers (registration and factory) |

| 3 | Filling period | Indicate the date of drawing up the act |

| 4 | Serial number | Indicated depending on the number of check grounds |

| 5 | Check number and amount | The cashier learns this information from the cash receipt |

| 6 | Person who authorized the return | You must indicate your position and full name |

If the company has drawn up a KM-3 act, it is necessary to document this situation. The basis for drawing up the act is the sales receipt. Read also the article: → "". The cashier must stick the receipt on a piece of paper and attach it to the return statement.

Important! The manager must put his signature on the check, and the cashier must put a stamp confirming that the check has been redeemed.

However, a receipt is not always available. What should you do if you don’t have a cash receipt? According to the requirements of the law, the seller must return the goods even if the buyer does not have a sales receipt. Accordingly, in this situation, the package of documents that must be transferred to the accounting service will consist of:

- Act in the form KM-3;

- Buyer's return requests;

- Statements from the buyer about the loss of the cash receipt;

- A sales receipt printed from the program in which accounting is kept.

All documents related to a return from a buyer during a cash register shift or a cashier’s check being entered erroneously by a cashier must be attached to a Z-report and a certificate from the cashier-operator, and transferred to the company’s accounting department within the time limits approved by internal standards.

Errors when filling out the KM-3 form

Due to this act is an extremely important document for the Federal Tax Service inspection, allowing the company to prove that there was no non-receipt of revenue in the company, Special attention You should pay attention to errors that occur when preparing this document.

The most common errors that occur when filling out are:

- There are no signatures on the document responsible persons. Due to this document confirms the issuance of funds; this is unacceptable.

- The “document number” field remains blank. The cashier prints the document from the accounting program. In this case, the date in most cases is entered automatically, and the act number must be entered manually.

- One person signs for all members of the commission. The law established that the issuance of funds under the KM-3 act must be confirmed by a commission consisting of managers structural divisions, as well as a cashier. As a result, the document must contain the signatures of the above persons.

Responsibility for errors in filling out

In what programs can the KM-3 act be formed?

The following programs can be used:

| Software for generating the KM-3 act | |||

| p/p | Program | Maybe | Impossible |

| Paid programs | |||

| 1 | 1c accounting | Yes | |

| 2 | Circuit | Yes | |

| 3 | Class365 | Yes | |

| 4 | SAP | Yes | |

| Free programs | |||

| 5 | Taxpayer legal entity | No | |

| 6 | Business Pack | No | |

Rating of the most asked questions

Question No. 1 Is it necessary to fill out KM-3 due to the return of a purchase after the cash register shift is closed?

No, the act is filled out only when returning during a cash register shift, since in this case cash are issued from the cash register, and not from the operating cash desk.

Question No. 2 What check number should be displayed in the act: a sales receipt or a return receipt?

The document must reflect the number of the check that was issued fiscal registrar when returning the goods or, if the cashier made a mistake, the number of this receipt.

Question #3 What are the consequences for a company if there is no cash receipt when drawing up the KM-3 act?

The law establishes that a cash receipt must be attached to this document (for a refund or indicating a cashier’s error). In cases where it is missing, it is necessary to supplement the package of documents with an explanatory note from the buyer, if we're talking about O product return, or the cashier, if there is a mistake by a company employee.

Competent management of cash discipline is a necessity that, in the course of tax audits can save the enterprise from many troubles. That is why, when funds arrive, you should not only correctly record revenue, but also document returns and errors.

If the organization returned money to the consumer using an unused or erroneous cash receipt, then this operation must be confirmed. The document that allows you to certify the fact of transfer of money in this case is the cash return act. A properly prepared document will allow you to justify the fact of a decrease in the organization’s revenue.

To understand what an act of return of funds is, you should consider in what situations it is necessary to issue it, what type of document it is, and how to fill it out correctly.

When and in what form is it needed?

The requirements of cash discipline regulate the cases in which an act should be drawn up, as well as its form.

Information on the standards for drawing up an act, the need for drawing up, as well as the consequences of its absence, can be found:

- in the Instructions for use and filling out primary forms accounting documentation on accounting of cash settlements with the population during the implementation of trading operations using cash registers(approved by Resolution of the State Statistics Committee of Russia No. 132, December 25, 1998);

- V Model rules operation of cash registers when making cash payments to the population (approved by the Ministry of Finance of Russia No. 104 08/30/93);

- in the Central Bank Instructions No. 3073-U “On making cash payments” (07.10.13) and No. 1843U “On spending cash from the cash desk” (06.20.07);

- in Letters of the Federal Tax Service No. 22-12/97729 (03.11.06), No. 34-25/072141 (30.07.07), No. 18-11/3/092847 (01.10.07), No. 22-12/118181 (18.12. 08); No.AS-4-2/6710 (11.04.13);

- in the Administrative Code.

You will have to draw up an act when funds are issued from the cash register, the check for which has already been punched, as well as in case of errors made by cashiers.

Typical examples of such cases are:

- an inflated amount of the check, mistakenly typed by the cashier when it was punched;

- a check issued by the cashier by mistake, the money for which was not received at the cash register;

- refund to the consumer of the overpayment if any of the goods are mistakenly punched several times;

- return by the buyer of the purchased goods and compensation of its cost from the cash register;

- consumer refusal to purchase after a cash receipt has been punched, etc.

Any return of funds from the cash desk requires the execution of an act.

It is important to remember that the act that reflects the return to the buyer must be based on the latter's statement.

Application requirements:

- the consumer’s application must be made in writing, the form of presentation is arbitrary;

- in addition to describing the claims or reasons for returning the goods, the text of the application must necessarily include the date of application, the amount of return and the signature of the consumer;

- In order for the cashier to make a refund, the application must have permission from the head of the organization or from a person authorized to do so.

If there is no executive visa, a return is not allowed, and a KM-3 act will not be required.

The need to draw up an act is influenced by:

- the presence of the above-described reasons and grounds;

- the fact that the date the check was punched coincides with the date of the return;

- method of payment for the purchase.

If the return date is later than the receipt date, or the buyer purchased the goods without paying in cash (for example, by bank card), then the KM-3 return certificate is not issued. This is due to the fact that in these cases the organization does not have the right to return cash from the cash desk.

Refunds are made from the funds of the organization (main cash desk), based on the consumer’s application and a check attached to it, confirming the fact of transfer of funds cash receipt order(KO-2). A record of the completed transaction is entered into the cash book on the day the funds are issued. In this case, it is allowed to make a refund using proceeds not deposited into the current account.

Thus, an act in form KM-3 is drawn up only if a refund or correction of a cashier’s error is made on the day the check was punched. It is important to remember that the act is a document attached to a specific cash register. Therefore, if there are several cash registers, then the return must be made exactly on the machine on which the returned check was punched.

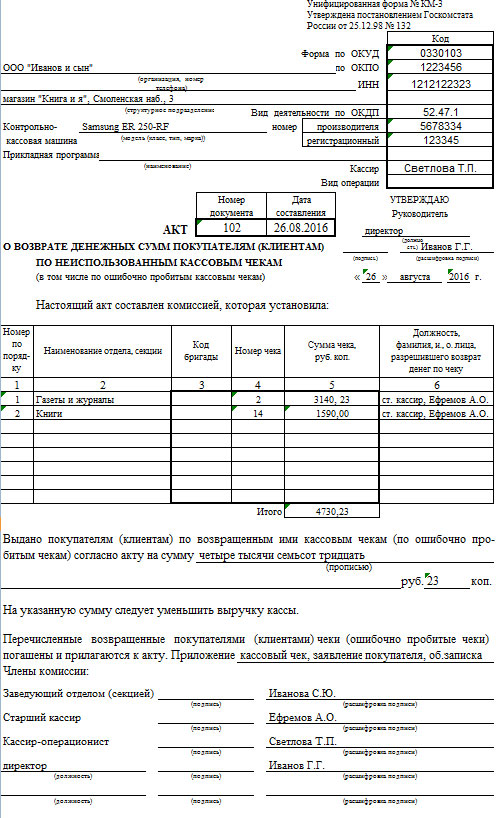

For returns, a unified form of the act has been established - KM-3, which has a code according to OKUD - 0330103. The form of the KM-3 form has the following appearance.

An example of an act on the return of funds

The procedure for registering acts is carried out at the end of the cash register shift, after the Z-report is taken (a report on cash register revenue for the day). The document is drawn up in one copy. The cashier is obliged to take into account everything in it bad checks, as well as all amounts that were returned to consumers during the shift.

The form can be filled out manually or generated on a computer. Some programs that support the operation of the cash register, for example 1C, Kontur, SAP, have a function that allows you to generate a KM-3 act.

A commission, which includes employees who have given the cashier the right to make a refund, takes part in drawing up the act.

Depending on their powers, they may be:

- head of division/department/section;

- senior shift cashier;

- Chief Accountant;

- Head of the organization.

The act is certified by a seal and handwritten signatures members of the commission.

In addition to filling out the form, you will need to support the preparation of the act with additional documents.

You can do this:

- the cash receipt itself;

- a sales receipt (if the cash register is not used during operation);

- refund check.

The check on the basis of which the act is drawn up must be signed by the manager or other person authorized to authorize the withdrawal of cash from the cash register. There is also a stamp on the check indicating that it has been cancelled.

The checks recorded in the act must be pasted on a sheet of paper. They are an annex to the act and must be kept with it for 5 years.

If the act is drawn up due to the return of funds, then the consumer’s application with a visa of the head of the organization, as the basis for the return, is also attached to the act.

After completing the act, the document details are entered into the cashier’s journal. The act itself and the annexes are transferred to the organization’s accounting department. Based on it, the accountant reduces the amount of cash receipts for the day.

Non-standard situations

Despite established order registration, there are situations in which its implementation may be difficult.

Error

If the basis of the act is a cashier’s error, then it is not always possible to confirm it with a check. The cashier may make a mistake, but without noticing it right away, give the wrong receipt to the consumer. Also, the check may be lost by the cashier (damaged or lost).

In this case, the manager has the right to punish the employee for negligence, according to Article 244 of the Labor Code of Russia. However, this does not eliminate the need to draw up an act and record the cashier’s mistake in it. When drawing up an act, it is customary to use as a basis the explanatory note of the employee who allowed it.

The explanatory form is free.

It states:

- date of the cash error;

- Full name of the responsible employee;

- KKM number;

- reasons for the error;

- reasons for the absence of a check.

This requirement is not established by law. But the preparation of such a document will be additional evidence that the organization did not commit any violations in recording revenue receipts. You can also attach a sales report to the act.

Return

The difficulties associated with processing refunds to consumers are due to the fact that the processing rules are prescribed for ideal conditions.

Difficulties for cashiers arise in the following cases:

- if the consumer who returned the goods does not have a receipt;

- if necessary, return the money not for the entire check, but only for part of it;

- with a printed receipt for the return.

In cases where an organization has an obligation to return money to clients, the law “On the Protection of Consumer Rights” stipulates the return of funds even without presenting a receipt. It is enough for the consumer to write a return application and prove that the product was purchased at this point of sale. Therefore attach cash document not always possible.

If there is no receipt available, this is regarded by tax specialists as a violation of the requirements for registering revenue receipts and may result in a fine being imposed on the organization. To prevent such an outcome of the case, you can replace the receipt with a statement from the consumer who returned the goods that the receipt was lost.

There is a receipt available, but the return is made only for one of the list of goods; a document should be drawn up only for the amount of the return. In this case, the check will have to be collected from the buyer for reporting. In return, the law allows the consumer to be issued a copy of the receipt, certified by the organization’s seal and the signature of management.

Difficulties that arise when printing a refund receipt often add additional confusion to the work of cashiers:

- depending on brand/model cash register, the refund amount can be reflected in the cash register as revenue, and not as a write-off (this introduces additional difficulties into the work of the accounting department);

- a refund check may not always be issued (for example, if at the time of return there is not enough money in the cash register to compensate the consumer for the purchase amount);

- no refund check fiscal document and is only an appendix to the KM-3 act.

That is why it is more convenient to use the scheme for drawing up the KM-3 act with attachments, bypassing the punching of a refund check.

Completion Instructions

When filling out the form, you must fill in the required fields.

These include:

| "Cap" of the act | It states:

|

| "Body" of the document | This section consists of a list of checks for which refunds are made. For each check, the following is recorded in the section:

|

| "Total" | This line indicates total amount of all refunds made, and under it this amount is indicated in words. Here you should also indicate the details of the appendices to the act: cash and sales receipts, statements, explanatory notes, etc. |

The end of the document contains information about the persons who were included in the commission for drawing up the act. The act must bear the signatures of all persons who took part in the return of funds (authorized and implemented it).

Other nuances

It is important to fill out all documents correctly to prove that there was no intent to conceal part of the proceeds.

The act will be invalid if it does not contain:

- signatures of the persons who authorized or carried out the return;

- all signatures are made by one person;

- document number.

It is also important that the document is recorded on the date of execution in all accompanying documents- cashier's journal, cash book etc.

If you do not take these nuances into account, then basis of the Code of Administrative Offenses, the tax service may fine the organization. The possible fine is 50,000 rubles.

You should be aware that the statute of limitations for violations related to cash discipline equal to two months. Claims made by Federal Tax Service specialists on this basis after this period are unlawful.

The final set of documents proving the return must include:

- the act of return of funds;

- canceled check;

- reasons for return (consumer statement);

- additional documents (cashier's explanatory note, sales receipt, sales report).

Such a kit will be enough so that in case of claims from employees tax service, defend your position in court.

Strokova E.

When tax authorities check the work of organizations and entrepreneurs with cash and their management cash transactions, then if an act on the return of money to buyers (clients) using unused cash receipts is discovered unified form N KM-3<1>(hereinafter referred to as act KM-3) study it and the documents attached to it especially carefully. After all, they must make sure that the posting is correct. cash proceeds. Therefore, let's consider when to compose this primary document and how to complete the accompanying papers.

When to draw up an act

Act KM-3 must be drawn up if:

<или>the cashier made a mistake and entered an incorrect cash receipt (for example, a check for a large amount that was not cleared during the shift);

<или>the buyer returns the goods on the day of purchase and the money is returned to him from the operating cash desk;

<или>the check has been knocked out, but the buyer has changed his mind about purchasing it (for example, when the check is first knocked out in general cash register, and then the department releases the goods).

We are writing an act

This act is drawn up in one copy at the end of the working day (shift) when submitting revenue for the day (when making a Z-report).<2>:

That is, on the same day that the erroneous or unnecessary check is issued. The act is signed by a commission, which consists

From the head of the organization (entrepreneur);

Head of department (section);

Senior cashier;

Cashier-operator.<1>.

The cashier reflects the total amount of the act for all checks canceled during the day in column 15 of the cashier-operator’s journal in Form N KM-4

What to attach to the act<3>.

The KM-3 act must be accompanied by an incorrect check pasted on a piece of paper (this is more convenient so as not to lose it). The check must be signed by the head of the organization (head of department or section) or the entrepreneur himself and must be stamped “Canceled”<4>However, the check that must be attached to the act is not always available. And then tax authorities may interpret this as non-compliance with the requirements for processing refunds to customers or erroneously entered amounts on cash registers. And, accordingly, equate to non-receipt of part of the proceeds

. This means you need to insure yourself, but how depends on the situation.

SITUATION 1. The buyer returning the goods did not return the check.<5>. Therefore, if the buyer was able to prove to you that he purchased the goods from you, and you returned the money to him, then the buyer’s application for a refund can be attached to the KM-3 act, indicating that the cash receipt was lost. On this application, the head of the organization (entrepreneur) must put a mark that he agrees with the return of money to the buyer. Moreover, if the cash register program allows you to print out information about the purchase, then it can also be attached to the act.

SITUATION 2. The cashier does not have the erroneously punched check.

This is possible, for example, when:

<или>the check was mistakenly issued for a larger amount, but the buyer took it, although the money for the goods was received in the required amount;

<или>The cashier lost the unsold incorrect receipt.

At first glance, there is a shortage of money in the cash register, for which the cashier is responsible<6>.

However, if the documents show that money is available for all the goods sold and the head of the organization (entrepreneur) considers it possible not to punish the cashier, then you can take an explanatory note from him. And then this note and a commodity report can be attached to the KM-3 act (for example, according to form N TORG-29<7>).

Please note that in this situation, tax authorities, of course, may try to fine you for not posting revenue, but the courts will most likely support you<8>.

So, correct design Act KM-3 will allow you to avoid fines for non-receipt of revenue. And they are rather big<9>.

And keep an eye on the deadlines: if more than 2 months have passed since the document was incorrectly executed, then they will no longer be able to punish you - the statute of limitations for bringing to justice will have passed<10>.

- Measurement of gamma background in places of residence of the population of rural and urban settlements in the southwestern regions of the Bryansk region

- The latest photos from the Hubble telescope

- Blood of Saint Januarius When the blood of Saint Januarius boils in Naples

- Why do you have nightmares: interpretation of disturbing dreams Causes of disturbing dreams

- Incredible mysteries of nature Mohenjo-Daro, or Mountain of the Dead

- Career zodiac sign Pisces How Pisces can achieve success

- National Emblems in Great Britain

- The meaning of the word cambium in the encyclopedia biology

- Morphological analysis of the verb

- About Great Britain in English

- Is Cyprus still an offshore zone?

- Sample plan for writing a speech therapist report

- Letter M, m. Consonant sound i. Letter M, m Corrective and developmental

- Articulation exercises

- How are these sounds similar?

- Pythagoras - Olympic champion What kind of sport did Pythagoras engage in?

- What did a kisser do in Rus'?

- Tselovalnik - a mysterious profession of ancient Rus'

- The creator of geminoid robots, Hiroshi Ishiguro, will give lectures at Skoltech

- Hiroshi Ishiguro - Japanese engineer, creator of humanoid robots