Revenue from sales of goods. IVR = IVR – Indirect taxes. carrying out an effective pricing policy that ensures the formation of a sufficient amount of sales revenue

1060 rub.;

- business expenses 10600 rub.

After specifying all the necessary data, the resulting numbers must be added. With this you will find out the entire amount of funds spent on production products:6200 + 8610 + 2238.60 + 2459 + 1060 + 10600 = 31167.60 rubles. Let us clarify that profit from sales is 82,700 rubles.

From the profit received from implementation products By law you must pay value added tax (VAT). VAT rate for industrial production is 18%. Calculate the tax amount: 82,700 * 18% = 14,886 rubles.

It remains to calculate the net profit enterprises for reporting period. To do this, use the formula: Revenue (including VAT) - costs = 97586 - 31167.60 = 66,418.40 rubles. This will be net profit from implementation products.

The most important of all financial indicators any company is profit. The final financial result of the organization’s activities includes the balance sheet profit. How to calculate it?

Instructions

In order to calculate the balance sheet profit, you need to know the values of three more indicators. These include the balance of income from non-operating operations, profit from sales of the enterprise's products. This can also include profit from other sales. Balance sheet profit calculate their algebraic sum.

Profit from sales is quite easy to calculate. To do this, the sum of the following values must be subtracted from the total revenue from the sale of any goods and services. The first of them is the cost of production. It includes only production costs, it does not include administrative and commercial expenses. The second term is the value added tax. The third value is excise taxes.

Experts calculate the balance of non-operating income and expenses depending on many important quantities. You will need the income figures for the securities that the company owns. The company's income received from renting out property will also be required. Find out the size of the organization’s income from what it accepts share in any joint projects. And in addition to all of the above, you will need to know the size of numerous sanctions, penalties, fines in cases of delivery of products not of proper quality, for violation of transportation conditions and delivery deadlines, for failure to fulfill contractual obligations.

Now you just have to calculate the last term. This is not difficult to do. Include in profit from other sales profit or loss on sale various works, services, products, auxiliary and servicing industries. This even includes the sale of inventory purchases. In addition to everything listed earlier, other sales of the organization can also include services and work of a slightly different non-industrial nature. These types of work are usually not included in the volume of products related to the main activities of the enterprise. In this case we're talking about on the provision of transport services, capital construction And major renovation, sales of purchased heat.

The net profit indicator for any enterprise is the most important. Net profit is the result of the company's activities for certain period. She shows the amount Money, which the company received by paying everything tax fees, salaries to their employees and other payments that are mandatory.

Calculation formula net profit as follows:

Net profit = financial profit+ gross profit + other operating profit – taxes.

After you calculate the necessary indicators, you can determine the amount of net profit. If you received a value with a “-” sign, then, accordingly, the company suffered losses during the period under study.

The resulting net profit is usually used by the enterprise at the discretion of management. As a rule, net profit goes to pay current expenses. Sometimes net profits are accumulated or used for charitable purposes.

Video on the topic

Instructions

Determine your size gross income– total revenue from the sale of goods or services. Find the amount of net income - the total revenue from the sale of goods or services minus the cost of returned goods (services) and discounts provided to customers. Calculate the total costs of producing goods and providing services included in the cost of production. Find the company's gross profit, which is the difference between net sales income and cost goods sold or services provided. The gross profit formula looks like the difference between net income and cost of production.

Determine the net profit indicator. To do this, taxes, fines, penalties, interest on loans, as well as operating expenses. The latter include the costs of finding partners, concluding deals, costs of improving the skills of employees, and costs caused by force majeure situations. The net profit indicator precisely reflects the final result of the company’s activities, shows how profitable the implementation of this kind activities. Net profit is used by entrepreneurs to increase working capital, formation various funds and reserves, as well as for reinvestment in production. The amount of net profit directly depends on the size of the gross profit, as well as on the amount tax payments. If the company is Joint-Stock Company, dividends to the company's shareholders are calculated based on the amount of net profit.

Among the main functions of profit, one can highlight stimulating. She main source cash injections, and the company benefits from its maximization. This will have a positive impact on growth wages employees of the enterprise, and at the rate of renewal of fixed assets, implementation latest technologies. As a result, production increases. The level of profit is important not only for the company itself, but also for the industry and the state. Budgets are formed thanks to the profits of companies different levels. Taxes going to the state budget are paid from it. In market relations, profit has an evaluative function. Its level affects the value of the company and its competitiveness within the industry. Allocate and control function arrived. Lack of profit means the company is unprofitable. As you can see, it is very important to focus on the profit margin, which means you simply need to know its formula for analysis economic activity.

Except overall indicator there are several types of profit. For example, according to the sources of formation, there is profit from sales (the cost of production must be subtracted from revenue), from transactions with securities (a positive difference between income and expenses from sales operations valuable papers), non-operating (the amount of profit based on the results of the sale of goods, the sale of property and based on the results of non-operating operations), from investment and financial activities. To find profit from investment activities, you need from the amount of net cash flow for an investment project, deduct the costs of implementing the investment project. Profit from financing activities is the sum of profit from sales, interest receivable and income from participation in other companies minus interest payable and operating expenses.

According to the calculation method that is practiced at a particular enterprise, one can distinguish marginal, net and gross profit. To find marginal profit, must be deducted from income variable costs. Depending on how you pay taxes, there are taxable and non-taxable profits. Taxable profit is income minus income from which payments to the budget are not deducted. To calculate it, you need to subtract real estate tax and additional income from your balance sheet income. tax obligations and revenue focused on benefit transactions. IN economic analysis use indicators such as past, reporting, planning period, nominal and real profit. Nominal profit is a profit that costs financial statements and corresponds balance sheet profit. Real profit is nominal profit, adjusted for inflation, correlated with the index consumer prices. Also, financiers use the concepts of capitalized (aimed at increasing equity) And retained earnings, which is the final financial result minus taxes and other liabilities.

Not only external factors capable of influencing profit levels. The enterprise must take measures for its growth. For example, you can optimize inventory and stock balances, analysis of the range of manufactured products, identifying products for which there is no demand and withdrawing them from circulation. More efficient system management also contributes to profit growth. Other measures include automation of production to reduce labor costs and the use of waste-free production.

Every salesperson has good days and not so good days. Sometimes you may not close any deals because you sell too high or too low. It is extremely important to keep statistics on the sales of your products. This will greatly help in the prosperity of your company.

You will need

- - Calculation of average sales volume;

- - accounting of the number of clients;

- - analysis of competitors' activities.

Instructions

Calculate last year's amount of money received and divide it by the number of sales made (all issued invoices, orders, contacts). If you don’t know these numbers because you’ve just started selling, ask those who have experience in this field and have been working in it for several years. If such data is not available, proceed with your own calculations. The analysis should be carried out as funds accumulate.

Look at the resulting average sales volume. If this figure is higher required mark, then you will need fewer clients, and if below average, then look for more clients. Accordingly, based on these figures, calculate the required volume of sales, which should be of the appropriate size.

Conduct an analysis of your customers after finding out the average sales volume. Potential for your development will be those clients who currently do not cost you that much. Calculate the time you spend servicing them. If you wish, you can transfer clients to other terms of transactions, as well as at any time replace any client and begin searching for a more promising one. All this allows you to regulate the number of products or services sold.

Revenue from product sales represents

- the amount of money from the sale of products, works and services at selling prices, received to the current account and to the cash desk of the enterprise

Revenue from sales is recognized in accounting if the following conditions are met:

the enterprise has the right to receive such revenue arising from a specific agreement;

the amount of proceeds from sales can be reliably calculated;

there is confidence that as a result of a particular transaction there will be an increase in the economic benefits of the enterprise;

the right of ownership (possession, use and disposal) of the product (goods) has passed from the supplier enterprise to the buyer or the work has been accepted by the customer;

expenses that are incurred in connection with a business transaction can be determined.

Revenue from sales of products (goods) is classified into two types:

revenue (gross) from sales of products (goods, works, services), including indirect taxes;

revenue (net) from the sale of products (goods, works, services) without indirect taxes (VAT, excise taxes, customs duties).

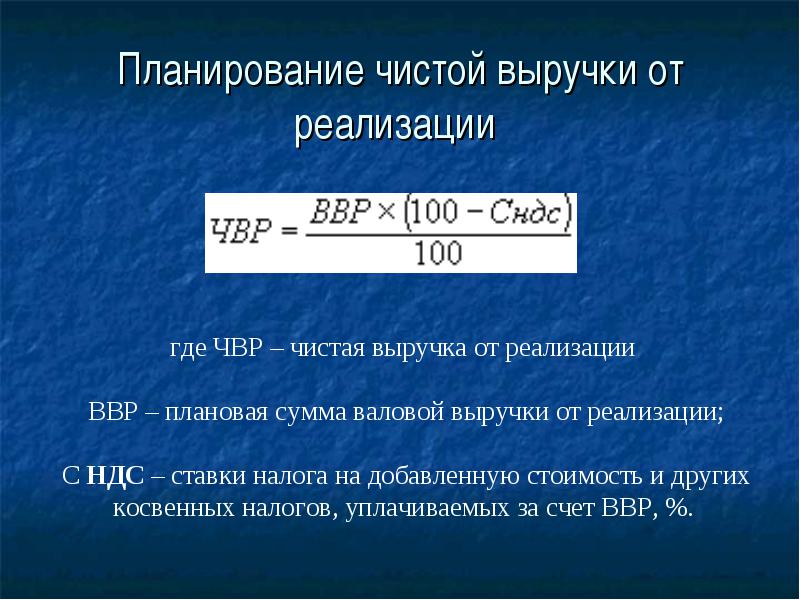

CHVR = VVR – Indirect taxes,

where NVR is net sales revenue;

GVR – gross sales revenue.

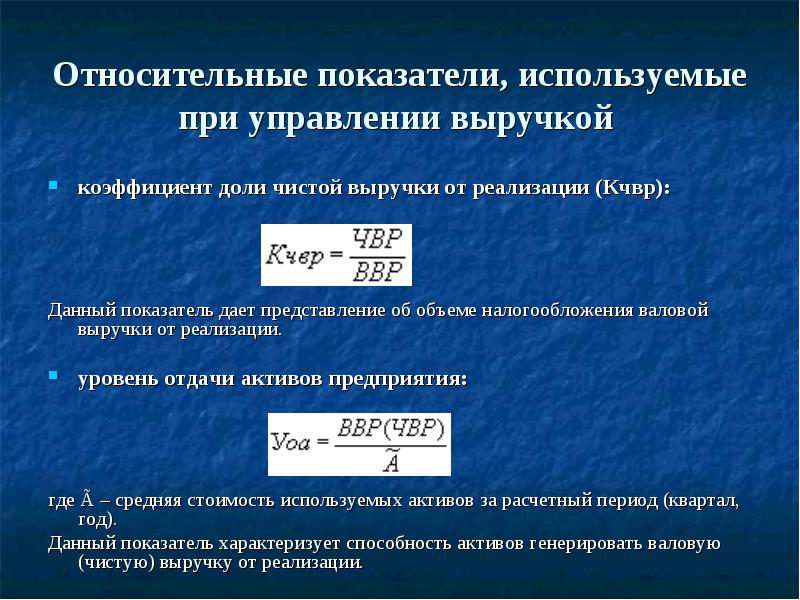

Relative indicators used in revenue management

coefficient of share of net sales revenue (Kchvr):

This indicator gives an idea of the amount of taxation of gross sales proceeds.

level of return on enterprise assets:

where à is the average cost of assets used for the billing period (quarter, year).

This indicator characterizes the ability of assets to generate gross (net) sales revenue.

The volume of revenue from product sales depends on a number of factors:

level of selling prices;

volume of sales of manufactured products;

VVR taxation level.

Planning (forecasting) revenue from product sales.

- Planning of sales revenue is necessary to determine profit, draw up operational financial plans(balance of payments, consolidated and functional budgets).

Planning of sales revenue is subordinated to the main goal– profit management and is provided by a system of measures for calculating certain types of income. The main prerequisites for planning are:

a developed production program that determines the volume of products produced (for a quarter, half a year, year);

target amount of operating profit;

developed pricing policy.

Revenue planning stages:

analysis of revenue in the reporting (pre-planned) period;

assessment and forecasting of commodity market conditions;

calculation of planned revenue; development of measures to ensure the implementation of the plan for revenue from product sales.

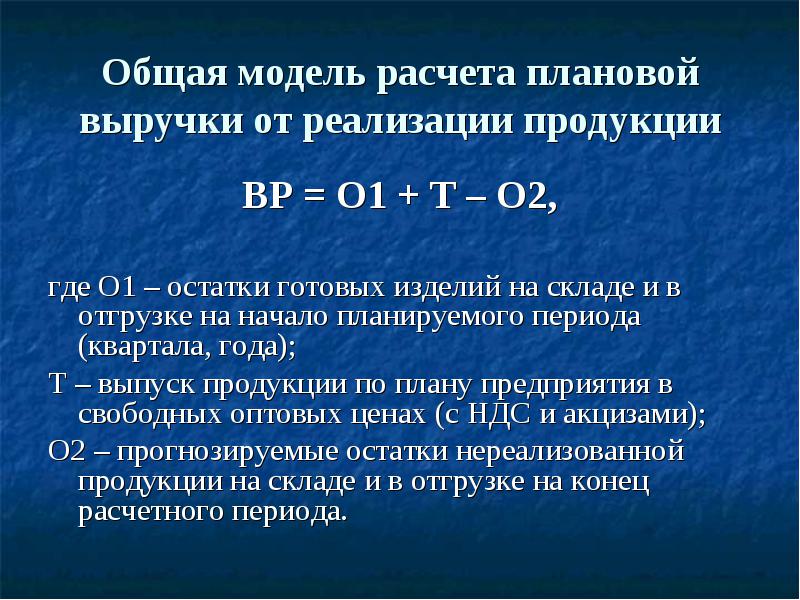

General model for calculating planned revenue from product sales

BP = O1 + T – O2,

where O1 is the balance of finished products in the warehouse and in shipment at the beginning of the planned period (quarter, year);

T – production according to the enterprise plan at free wholesale prices (including VAT and excise taxes);

О2 – predicted balances of unsold products in the warehouse and in shipment at the end of the billing period.

Planning of net sales revenue

System of measures to ensure the implementation of the plan for revenue from product sales:

carrying out an effective pricing policy that ensures the generation of sufficient sales revenue;

taking advantage of favorable commodity market conditions;

providing commercial credit and price discounts to customers to stimulate the sale of goods;

increasing the level of customer service (after-sales);

development of advertising and information activities in the product market;

bringing developed plans (budgets) to the centers of responsibility for income and profit, as well as monitoring their implementation.

Proceeds from sales of products are directed by the enterprise:

for reimbursement of material costs for production, including depreciation and other cash expenses (for example, payments for natural resources);

for the formation of gross income (newly created value).

Pricing policy is one of key revenue management methods from sales, which provides the most important priorities for the production and scientific and technical development of the enterprise. It directly affects the volume of operational activities, the formation of its marketing strategy and financial condition.

Principles of pricing policy formation:

coordination of this policy with the conditions of the product market and the features of the chosen market strategy;

the connection of the pricing policy with the general profit management policy and the main goals of operating activities;

active pricing policy in the market of goods and services, which ensures a strong position of the enterprise in its individual segments;

a comprehensive approach to setting prices for goods combined with high customer service;

High dynamism of the pricing policy is ensured by the speed of response to changes in internal and external environmental conditions.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Introduction

Conclusion

Bibliography

Introduction

In conditions of market relations, the responsibility and independence of enterprises in the development and adoption of management decisions to ensure the effectiveness of their activities. The efficiency of the production, investment and financial activities of an enterprise is expressed in the achieved financial results. The overall financial result is gross profit.

Profit, on the one hand, depends on the quality of the team’s work, and on the other hand, it is the main source of production and social development enterprises. Consequently, its employees are interested in the efficient use of resources and profit growth.

At the same time, profit serves as the most important source of formation of the state budget. Thus, both the enterprise and the state are interested in increasing the amount of profit.

At the same time, profit is formed as a result of the interaction of many components with both positive and negative negative signs. The total amount of profit received depends, on the one hand, on the volume of sales and the level of prices set for products, and on the other hand, on how well the level of production costs corresponds to social necessary expenses. Consequently, proceeds from the sale of products (works, services) are the main source of compensation for the capital advanced into the production of products (works, services), its accumulation, and the formation of centralized and decentralized funds of funds. Proper profit planning in enterprises is of key importance not only for entrepreneurs, but also for National economy generally. Since the successful financial and economic activities of the organization will depend on how reliably the planned profit is determined. The calculation of planned profit must be economically justified, which will allow for timely and complete financing of investments, an increase in own working capital, appropriate payments to workers and employees, as well as timely settlements with the budget and suppliers.

The purpose of this work is to consider the concept of revenue from product sales.

Objectives of this work:

Reveal the essence and significance of revenue from the sale of products (works, services) for the economic activities of the enterprise;

List methods for planning sales revenue;

Identify the factors influencing the amount of revenue from product sales, depending and not depending on the activities of the enterprise;

Consider the procedure for distributing proceeds from sales.

1. The essence and significance of revenue from the sale of products (works, services) for the economic activities of the enterprise

Enterprise income, as is customary in countries with market system management consists of revenue from the sale of products (works, services), fixed assets (excess) and other property of the enterprise, as well as income from non-sales operations.

In practice, a distinction is made between total (gross) income, income (revenue) from product sales, net income, average income(revenue) and marginal income (revenue), each of which plays its role in managing the financial and economic activities of the enterprise.

In the process of producing products, performing work, providing services, a new value, which is determined by the price products sold works, services. The result of their implementation is revenue from the sale of products, works, and services, which goes to the bank account of the enterprise. Revenue (net) from the sale of goods, products, works, services means revenue from sales finished products(works, services), from the sale of goods, etc., accounted for without value added tax, excise taxes and similar mandatory payments for determining financial results from sales based on the assumption of temporary certainty of the facts of economic activity.

Currently, an enterprise has the right to independently determine methods for calculating revenue depending on the chosen accounting policy. The legislation defines two methods for accounting for revenue from sales of products (works, services):

1. as goods are shipped (work, services are performed) and payment documents are presented to the counterparty;

2. as payment is made and money arrives in the current account.

IN Russian Federation The second method is most widespread, since it allows enterprises to make timely payments to the budget and extra-budgetary funds, since there is a real source of money for accrued taxes and payments. However, in the case of advance payments for shipped products (work, services) overall size cash flows do not always coincide with actual sales, since it is possible that the money was received based on prepayment, but the products were not only not shipped, but also not produced.

Revenue from the sale of products (works, services) is the main source of compensation for the capital advanced into the production of products (works, services), its accumulation, and the formation of centralized and decentralized funds of funds. Its timely receipt ensures the continuity of the circulation of funds, uninterrupted production process. Late receipt of revenue leads to production downtime, decreased profits, violation of contractual obligations, and penalties.

2. Method of planning sales revenue

Revenue planning - component financial planning And important area financial and economic work at the enterprise. Profit planning is carried out separately for all types of activities of the enterprise. This not only makes planning easier, but also has implications for the expected amount of income tax, since some types of activities are not subject to income tax, while others are taxed at higher rates.

In the process of developing profit plans, it is important not only to take into account all the factors influencing the magnitude of possible financial results, but also to ensure maximum profit.

Profit from sales commercial products is the main component of the enterprise’s gross profit, let’s consider ways to plan it.

The direct counting method is the most common. It is used, as a rule, with a small range of products. In the most general view profit is the difference between price and cost, but when calculating the planned profit, it is necessary to clarify the volume of products from the sale of which this profit is expected. Profit on commodity output is planned on the basis of cost estimates for production and sales of products, where the cost of commodity output for the planned period is determined:

Ptp = Tstp - Stp

Ptp - profit on commodity output of the planned period;

Tstp - the cost of commodity output of the planned period in current selling prices (excluding value added tax, excise taxes, trade and sales discounts);

Stp - full cost marketable products of the planned period (calculated in the cost estimate for production and sales of products).

Profit on products sold is calculated differently:

Prn = Vrn - Srn

Vrn - planned revenue from sales of products at current prices (excluding VAT, excise taxes, trade and sales discounts);

Prn - planned profit on products to be sold in the coming period;

Ср - the full cost of products sold in the coming period.

Based on the fact that the volume of products sold for the upcoming planning period in in kind is defined as the sum of balances unsold products at the beginning of the planned period and the volume of output of marketable products during the planned period without any remaining finished products that will not be sold at the end of this period, then the calculation of the planned amount from product sales will take the form:

Prp = P01 + Ptp + P02

Prp - profit from sales of products in the planned period;

P01 - profit in the balance of products not sold at the beginning of the planning period;

Ptp - profit on commercial products planned for release in the coming period;

P02 - profit in the balances of finished products that will not be sold at the end of the planning period.

It is this calculation method that underlies the use of aggregated direct method profit planning, when it is easy to determine the volume of products sold in prices and at cost.

Another type of direct counting method is the assortment profit planning method.

Profit is determined for each product line, for which it is necessary to have the appropriate data. Profit is summed up across all product lines. To the result obtained, the profit in the balances of finished products not sold at the beginning of the planning period is added. After calculating profit from sales of products, it is increased by profit from other sales and planned non-operating results. The enlarged direct counting method is applicable to enterprises with a small range of products. The assortment calculation method is used for a wider assortment if the cost price is planned for each type of product. The main advantage of the direct counting method at known prices and constant costs during the planned period is its accuracy. IN modern conditions economic method Direct accounts can be used when planning profits only for a very short period of time, until prices, wages and other circumstances change. This excludes its use for annual and long-term planning arrived. Calculation of profit does not allow identifying the influence of individual factors on the planned profit and, with a very large product range, is very labor-intensive.

When planning profits using the analytical method, calculations are carried out separately for comparable and incomparable products.

Comparable products are produced in the base year, which precedes the planned one, so their actual cost and output volume. Using these data, you can determine the basic profitability of the Republic of Belarus.

Rb = (By htp) * 100%

Po - expected profit (profit is calculated at the end of the base year, when Exact size profit is not yet known);

Stp - the full cost of marketable products of the base year.

Using basic profitability, the profit of the planned year is approximately calculated for the volume of marketable products of the planned year, but at the cost of the base year.

The change (+, -) in the cost of production in the planned year is calculated. Let’s say, based on a forecast of rising prices for raw materials, an increase depreciation charges and other factors, the cost of production of the planned year compared to the base year will increase by 20 thousand rubles. The influence of changes in the assortment, quality, and grade of products is determined. Such calculations are performed in special tables based on planned data on the range of products, their quality and grade.

After justifying the price of finished products for the planned year, the impact of price increases is determined. The impact on profit of all the above factors is determined by summing them up.

Now you should take into account the change in profit in the unsold balances of finished products at the beginning and at the end of the planning period. Unlike the direct counting method, the analytical method of profit planning shows the influence of factors on the amount of profit, but it also sufficient degree does not take into account the impact of all changing business conditions on financial results and does not ensure their reliability, primarily due to constantly changing business conditions.

3. Factors influencing the amount of revenue from product sales, depending and not depending on the activities of the enterprise

In accordance with the Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account when taxing profits, profit from the sale of products (works, services) and goods is defined as the difference between revenue from the sale of products (works, services) in current prices without value added tax and excise taxes and the costs of its production and sale.

Income from common species activity is revenue from the sale of goods, products, performance of work and provision of services. These incomes are reflected in the credit of account 46 “Sales of products (works, services)”. The amount of revenue from product sales and, accordingly, profit depends not only on the quantity and quality of products produced and sold, but also on the level of prices applied. Based on the above resolution, revenue from sales of products at appropriate prices can be determined various methods depending on the market conditions management, the presence or absence of contracts, ways of introducing goods to the market, etc.

The level of production costs is greatly influenced by revenue from product sales. All costs in relation to revenue can be divided into two groups: fixed and variable. In modern conditions, enterprises have the opportunity to organize management accounting according to international system, the main principle of which is the presence separate accounting these costs by type of product. The main significance of such an accounting system is high degree integration of accounting, analysis and management decision-making, which ultimately allows you to flexibly and quickly make decisions on normalization financial condition enterprises.

The management of the enterprise is interested in surviving in the competition and always strives to get maximum profit.

Fixed costs are costs whose amount does not change when revenue from sales of products changes.

This group includes:

Rent;

Depreciation of fixed assets;

Depreciation of intangible assets;

Wear and tear of low-value and quickly wearing out items, costs of maintaining buildings and premises;

Costs of training and retraining of personnel;

Capital costs and other types of costs.

Variable costs are costs, the amount of which changes in proportion to changes in the volume of revenue from sales of products. This group includes:

Raw material costs;

Fare;

Labor costs;

Fuel, gas and electricity for production purposes;

Costs for containers and packaging;

Contributions to various funds.

Dividing costs into constant and variable allows you to clearly show the relationship between revenue from sales of products, cost and profit from sales of products.

According to PBU 9/99, revenue is reflected in accounting in the amount of received cash and other property or in the amount accounts receivable. If cash received is less than the amount of receivables, revenue is reflected in the amount of cash received and the unpaid portion of receivables.

This means that, even if the shipped products (works, services) are not paid in full, the revenue is reflected for the entire amount of the shipped products.

4. Distribution of proceeds from sales

The use of proceeds characterizes initial stage distribution processes. The proceeds received are reimbursed material costs for raw materials, supplies, fuel, electricity and other labor items.

Further distribution of revenue is associated with the formation of a fund as a source of reproduction of fixed assets and intangible assets.

The remaining portion of the proceeds represents gross income, or newly created value, which is used to pay wages and generate net income for the enterprise. Gross income (revenue) received by an enterprise from the sale of goods is determined as the product of the average price by the number of units sold:

TR - sales revenue, rub.;

p - price per unit of goods, rub./piece;

q - number of goods sold, pcs.

The receipt of revenue from the sale of products (performance of work, provision of services) indicates the completion of the circulation of funds. Before revenues are received, production and distribution costs are financed from working capital.

Average revenue (AR) is the amount received from the sale of one unit of goods on average over the period under consideration:

AR = TR h q h AR = pq h q = P(q)

In other words, the average income for a certain period is equal to the average price per unit of goods for the same period.

Part of the net income is taken into account in the cost of products (works, services) in the form of deductions for social needs ( Pension Fund, fund social insurance, employment fund, mandatory fund health insurance), taxes and fees, contributions to special off-budget funds. The remainder represents the profit of the enterprise.

Marginal Revenue(MR) is taken as an increment total income(TR) with an increase in product sales by one unit:

It essentially shows the effect of an increase or decrease in the volume of sales of goods, i.e., the direction of changes in the income (revenue) of the enterprise as a result of decisions made to change the dynamics of sales. Marginal revenue is a fundamental concept market economy, since it characterizes the increase in income as a result of an increase or decrease in sales by one unit and allows the enterprise to navigate the market.

The final result of the enterprise's activities is profit, which is generated as a result of the sale of products.

Conclusion

The result of the sale of products, performance of work, provision of services is revenue from the sale of products, work, services, which goes to the current account of the enterprise and which is understood as revenue from the sale of finished products (work, services), from the sale of goods, etc., taken into account without value added tax, excise taxes and similar mandatory payments to determine financial results from sales based on the assumption of temporary certainty of the facts of economic activity. investment financial sales

The final result of the enterprise's activities is profit, which is generated as a result of the sale of products. Profit is monetary value the bulk of cash savings, created by enterprises any form of ownership.

The distribution and use of profits is an important economic process that ensures both the needs of entrepreneurs and the generation of income for the Russian state.

There is a certain mechanism for distributing profits, which was built with the goal of promoting in every possible way the increase in production efficiency and stimulating the development of new forms of management.

The most important role of profit, which increases with the development of entrepreneurship, determines the need for its correct calculation. There are several basic ways to plan profits from the sale of commercial products.

The main ones are the direct counting and analytical methods, and the combined calculation method is also used.

Bibliography

1. Romanovsky V.A. Enterprise finance - M.: Perspective, Yurayt, 2000.

2. Pavlova L.N. Enterprise finance - M.: Finance, UNITY, 1998.

3. Ilyin V.S. Enterprise planning. T.2.

4. Dolgov S.I., Bartenev S.A., Belikova A.V. and others. Finance, money, credit. M.: Yurist, 2002.

5. Rusak N.A., Rusak V.A. The financial analysis business entity - Minsk: Higher School, 1997.

6. Blank I.A. Capital management. - M.: Nika, 2001.

Posted on Allbest.ru

...Similar documents

Revenue from core, investing and financing activities. Factors influencing the amount of revenue from sales of products and work. Scope of services provided by "World of Windows and Doors" LLC. Flow calculation real money arising during the implementation of the project.

course work, added 04/24/2014

Classification and types of enterprise income, directions of their analysis. The concept of sales revenue, methods of its planning and rules for effective use. Factors in revenue growth from product sales and work organization financial services.

course work, added 09/30/2013

Tasks financial control. Planning of revenue from sales of products (works, services). Revenue growth factors. Economic nature, composition and methods of fixed capital. Assessment of financial condition. Ways to achieve financial stability enterprises.

test, added 03/17/2010

The role of revenue from product sales in the formation financial resources enterprises. Planning and distribution of revenue from product sales. Factors of growth in revenue from product sales and organization of work of financial services of enterprises.

course work, added 04/10/2007

Organization income: economic entity, classification, features regulatory regulation. Revenue from sales of products (works, services) as an economic category. Methods of calculation, distribution and planning of revenue from product sales.

test, added 08/19/2011

Revenue from sales of products (works, services), its composition, structure and growth factors. Determination of revenue based on the volume of work performed and tariffs. Product cost and its elements, the relationship between accounting and economic profit.

test, added 08/22/2010

The concept and essence of revenue. Factors influencing revenue. Possible ways increase in revenue. Financial analysis of an enterprise using an example accounting analysis"WaterPriceInvest". Method of direct calculation of revenue. Calculation of the turnover profitability ratio.

course work, added 05/26/2015

The economic essence of revenue and profit, legislative consolidation accounting methods for payment and shipment of goods. Analysis of dynamics and index analysis of revenue and profit from product sales, ways to improve the financial performance of the company.

course work, added 06/25/2014

The concept, essence, functions and place of enterprise finance in common system finance. Formation of financial resources of the enterprise. Classification of enterprise costs. Types of production costs. Cost planning methods. Revenue from product sales.

course of lectures, added 05/03/2010

Consideration of the essence of analyzing the financial results of an enterprise. Rules for determining profit from sales of products and services. Study of the process of formation of profitability production assets and sales using the example of the Aqua organization.

- Psychosomatic factors of thyroid diseases Psychological causes of thyroiditis

- Tower coastal batteries of Sevastopol 30th coastal battery

- Liberation of Belarus - Operation Bagration

- Lucy Stein's new moment of fame

- Sample plan for writing a speech therapist report

- Letter M, m. Consonant sound i. Letter M, m Corrective and developmental

- Articulation exercises

- What does it mean to go to the panel?

- Pythagoras - Olympic champion What kind of sport did Pythagoras engage in?

- What did a kisser do in Rus'?

- What did a kisser do in Rus'?

- Orange peels: uses, features and best recipes

- Homemade caramel syrup

- What is a spelling chart for schoolchildren

- How to soak meat in vinegar

- How to bake a meat pie - step-by-step recipes for preparing dough and filling with photos

- Pike cutlets "Original"

- What color were the insects you saw?

- Delicious snacks with a spicy touch: preparing salads with Korean carrots

- What is binge drinking: symptoms Alcoholic during binge drinking