Competently filling out the application for registration of individual entrepreneurs

Application for state registration legal entity when created, it is submitted according to form P11001. Please note 8 non-obvious nuances of filling out an application for registering an LLC in 2017, this will protect you from tax refusal and save your time and money.

You can download the application form for form P11001 for free using the link below:

The basic rules for filling out form P11001 are set out here:

Let us dwell in more detail on some aspects of completing an application for registration of an LLC in 2017, which may become reasons for refusal of state registration of a legal entity:

- Filling out Form 11001 manually is highly discouraged.

Yes, the law does not prohibit filling out form P11001 by hand and in black ink, but in most tax process The verification of an application for state registration of a legal entity upon creation is already automated, which means that if the system cannot recognize at least one letter in the application P11001, you will be denied registration. If you fill out on a computer, you must use only capital letters, Courier New font and font size 18. We recommend that you use some online document preparation service for LLC registration to fill out form P11001 online and for free. Since, when filling out form P11001, you indicate information about the founders of a legal entity, which contains personal data, choose services from well-known companies and with a secure connection (lock in the address bar). All examples of filling out on our website were prepared using the free online service for preparing form P11001.Free online service preparation of documents for LLC registration

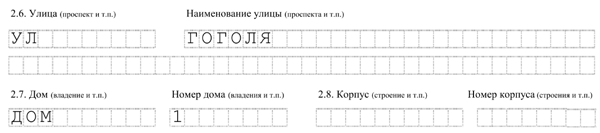

- All addresses in the application for LLC registration in 2017 must strictly comply.

If you decide to fill out the application form in form P11001 yourself and on your computer, please note that when filling out the address in form 11001, discrepancies are not allowed. For example, if instead of “street”, as in the picture above, you wrote “street”, you will be rejected. When filling out in the online service, these points are usually already taken into account.

If you decide to fill out the application form in form P11001 yourself and on your computer, please note that when filling out the address in form 11001, discrepancies are not allowed. For example, if instead of “street”, as in the picture above, you wrote “street”, you will be rejected. When filling out in the online service, these points are usually already taken into account. - Blank application sheets in form P11001 are not attached.

The application form in form P11001 has 24 sheets, but you only need to fill out those that correspond to the legal form of the legal entity you have chosen and the composition of the founders. No corrections or notes are allowed. Sheets or pages that are not completed and do not contain any information are not included in the application for state registration of a legal entity upon creation. A blank sheet may be a reason for refusal of registration. - The application for registering an LLC in 2017 must be printed on one side of A4 sheet.

Double-sided printing is not allowed, black ink only.

Double-sided printing is not allowed, black ink only. - Sheet N of form P11001 is filled out for each of the founders.

The most popular question regarding filling out an application for registration of an LLC is how to fill out sheet H of form P11001, containing information about the applicant. The problem is that many people mistakenly consider the applicant to be the person who will take the documents to the tax office. This is wrong. The applicants are all founders of the company with limited liability. Accordingly, each of them fills out their own sheet N. - You need to sign the application in form P11001 at the tax office.

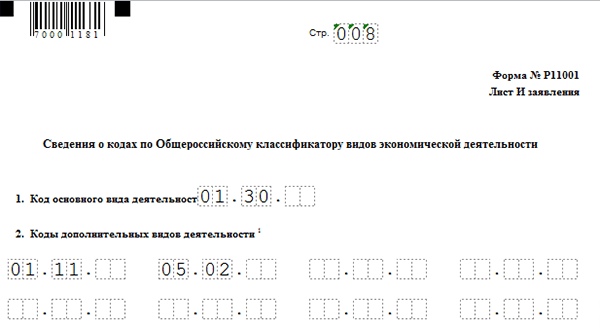

If you sign an application at home, then even if you submit it yourself and with the full complement of founders, there is a high probability that tax officials will demand notarization your signatures. Sign the application when personal visit You need to go to the registration authority only in the presence of a person authorized to accept your application. In this case, you won’t have to have anything certified by a notary; we wrote more about this in the note: - OKVED codes in the application for opening an LLC must be at least four digits.

In accordance with the order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/25@, which entered into force on July 4, 2013, OKVED codes in the application for registration of an LLC must contain at least 4 characters. If you indicate a two- or three-digit code, you will be denied registration of an LLC. - If you have a TIN, you must indicate it.

The TIN field is not required to be filled out, but it is important to understand that you can leave it blank only if the person has never received it. In all other cases, you will be refused due to incomplete data.

When using specialized online services to prepare an application for LLC registration, most of the problems described above will be resolved automatically. But nevertheless, before submitting to the tax office, carefully double-check all addresses, information about the founders of the legal entity and other personal data. Please note that the state fee for registering an LLC, which in 2017 is 4,000 rubles, is not refundable if registration is refused. This means that the slightest mistake will cost you both money and time. Therefore, if you still have any questions, be sure to write to us in the comments.

In addition, we have prepared samples for filling out Form 11001 in 2017.

For reference commercial activities IP must pass official registration– registration. The person submits a package of papers, which includes an application, the form of which is approved for legislative level. Form P21001 has certain order filling, failure to do so may result in refusal to open and issue a certificate.

General requirements for completing an application

An application for opening an individual entrepreneur is submitted to current form, established by the wording of the legislation in force at the time of submission to the Federal Tax Service. The document can be submitted manually or typewritten.

At manual filling you need to fulfill the requirements:

- When designing, only dark ink is used.

- Entries are made in block letters.

- Empty cells are not crossed out.

- If necessary, transfer text to next line no hyphenation sign is placed. A new word begins after a space if the end of the previous one falls on the last cell of the line.

- After specifying a period, for example, in an address, there is always an empty cell (space).

- It is not allowed to make blots or erasures on the paper. Forms with corrections are not accepted and are sent for revision.

- In indicating cities, streets and other data, only established by law abbreviations.

You can learn how to correctly fill out and use abbreviations from the Instructions for filling out the form. The form must have text on only one side of the sheet. Two-way recording is not possible. For typewritten views printed on a printer, sheets with single-sided printing are used.

If documents are submitted by an individual in person, the application is not signed in advance. The document is signed at the time of acceptance by the registering inspector. The signed form is only submitted if papers are submitted. confidant or by post.

Completing the application is simple. If the form is filled out correctly, the Federal Tax Service will have no reason to refuse registration. Any inaccuracy leads to refusal to open an individual entrepreneur. The package of papers for registration of an individual entrepreneur will have to be submitted again.

Attention! At resubmission documents for registration of individual entrepreneurs, you need to pay the state fee again.

Information used to fill out the form

The form consists of 3 sheets - title, pages “A” and “B”. The essence of filling out the application is to correctly enter data about the individual in accordance with the passport information.

The information includes:

- Last name, first name, patronymic in full. The data is indicated in Russian. Foreign nationals must write personal information in accordance with the data indicated on the residence permit.

- Gender, date and place of birth.

- Identification number, evidence of which must be available at the time of submitting the forms (a copy of the document must be submitted as part of the papers).

- Citizenship or status. Foreigners need to additionally fill in the country code.

- Passport information. When filling out, it is necessary to observe the spaces of the number and series of the document and the registration address.

The information in the application must exactly match the person’s documents.

Entering data on types of activities

Codes of types of planned activities are indicated on sheet “B”. When drawing up a document, you need to correctly enter information about the types of activities planned by the individual entrepreneur for use.

When filling out the sheet, you must consider:

- Species are entered according to the codes of the OKVED directory, taking into account the relevance of the edition.

- Four-digit writing numbers are used.

- The data required for the activity code corresponds to the type of taxation.

Attention! For systems that have restrictions on types of activities, codes that exactly correspond to the selected mode are used.

Particular attention must be paid to codes when planning applications licensed species activities, compliance of codes with requirements is reviewed by the licensing committee. Data on species prohibited for individual entrepreneurs is not provided.

The procedure for creating a document

Sheet “B” of the document must be submitted to the registration authority. The text states:

- The procedure for obtaining completed certificates.

- Contact phone number.

The sheet is submitted in 2 copies, one of which should not be stitched. The inspection returns a copy to the applicant as confirmation of the submission of the package of forms.

The question often arises about the need to submit an application for registration of an individual entrepreneur. In some cases, the inspector allows you to immediately replace the sheet with the error in his presence. In the event of a minor error being detected when submitting the form, you may not have to staple the document in advance and have a spare blank form with you.

The option to quickly replace a sheet is available when submitting a package of forms in person and only in a limited number of Inspections. Legal requirements oblige you to staple the document, to which you must attach a second copy of sheet “B”.

Still have questions?

Dear readers! Our articles talk about standard methods solutions legal issues, but every case wears individual character.

If you want to find out how to solve your particular problem, please use the form just below ↓ or use the online consultant at the bottom right! →

The application form for registering an individual entrepreneur and examples of how to fill it out can be downloaded online. Future individual entrepreneurs must use form P21001. When selecting a sample, make sure that it meets current requirements.

What happens if the application for state registration of individual entrepreneurs is filled out incorrectly?

Form P21001 consists of several pages and is easier to fill out than the LLC registration form. You will not have any major difficulties when completing your application. However, mistakes are still made. More often we're talking about about incorrectly selected font when filling out using a text editor, blots and errors, typos, empty fields and columns.

In all these cases, the documents may be returned to you at the stage of submitting them to the tax office. If the inspector finds errors when filling out the application for registration as an individual entrepreneur, he will give you all the documents, pointing out your mistakes. All you have to do is prepare a new application.

Tax officers are not required to check the document thoroughly upon acceptance. This is done after, within five working days. If errors or inconsistencies are discovered at this time, you will receive official refusal and lose the money transferred as state duty. On at the moment this is 800 rubles - not such a large amount.

If, when filling out the registration application individual entrepreneur you not only made a mistake, but deliberately distorted the data, and you were able to prove this to the tax office, you may be brought to justice administrative responsibility. If it is proven that you planned to conduct a criminal and, even more so, terrorist activities, the matter may lead to criminal liability.

In order not to risk your time, money, or your own freedom, first find out how to fill out an application for registration of an individual entrepreneur, and only then proceed with its registration.

How should I fill out an application for registration of an individual entrepreneur?

There are only three options:

- By hand

Please note: when filling out an application by hand, you can make a lot of mistakes and mistakes, so if possible, it is better to use a computer.

- In a text editor

- Using a special service

It is best to fill out an application for registration as an individual entrepreneur on the Federal Tax Service website or law firm, where you plan to contact (for example, Rigby). Services, as a rule, do not differ from each other. Their main advantage is automation. You don't need to choose a font and ensure the correctness of the design. It is enough to enter the data correctly.

You can use the Federal Tax Service service if you plan to submit documents directly using the site. The application can also be printed.

The procedure for filling out an application for registration of an individual entrepreneur

And now - about how to fill out an application for registration of an individual entrepreneur. There is nothing complicated about this - form P21001 consists of only four pages, each of which is filled out according to its own rules.

Page 1

The first page contains basic information about the future entrepreneur. The data is indicated in large block letters (when filling out an application for state registration of an individual entrepreneur by hand), or in capital letters (when filling out on a computer).

In the first part, indicate the last name, first name and patronymic. All citizens Russian Federation fill out clause 1.1. Clause 1.2 is intended for foreign citizens. It is filled in with Latin characters. If you have Russian citizenship, these fields must be left blank.

Point 2 must be completed only if you have a TIN. You do NOT need to register with the tax office as individual for registration of individual entrepreneurs. You will do this automatically - 5 days after submitting the documents you will be given both a TIN and a registration certificate.

Clause 4.2 (“Place of birth”) is filled out as in the passport, including the designation of the locality. For example, if “hor. Volgograd”, exactly the same should be written in the application. The dot is placed in a separate cell. All letters must be capitalized.

Page 2

The second page is devoted to passport details and location permanent registration. Please note that abbreviations (names) settlements etc.) are done in accordance with the regulations. How to fill out the application for state registration of individual entrepreneurs correctly can be read in Appendix No. 20 to the order of the Federal Tax Service of Russia No. MMB-7-6/25 dated January 25, 2012.

If you are registered in a city, you do not need to fill out the “District” column; if in a village (town, etc.), fill out both this column and field 6.5. Similarly, you do not need to fill out the “Apartment” field if you live in a private house.

Point 7 is devoted to passport data. Here you need to indicate the type of document (in numerical designation), number and series, date and place of issue, as well as department code.

When filling out an application for state When registering an individual entrepreneur, you can indicate the address of temporary registration if you do not have a permanent one. Since no marks about such a place of residence are made in the passport, you need to attach a document confirming temporary registration.

Page 3

This most important page in the application for registration of an individual as an entrepreneur, before filling out which you will have to open the OK 029-2001 classifier. Activity codes are constantly updated, so before selecting, make sure the classifier is up to date.

Before filling out an application for state registration as an entrepreneur, select the codes you are interested in, write them down on a piece of paper or save them in separate file. It will be easier to fill out the document later.

Pay attention to the layout of the page. The first point is the main type of activity. Next - additional ones. You have the right to choose only one main OKVED code. There can be as many additional ones as you like. There are 56 additional codes on one page. If this is not enough, you can make a second page with activities.

Theoretically, when filling out an application for registration of an individual entrepreneur, you can include the entire classifier. In practice, 5-10 codes are enough. When choosing them, consider the prospects. It is quite possible that in the future you will decide to change your activity or open a new direction. If the corresponding code is not in the application and, accordingly, in the Unified State Register of Individual Entrepreneurs, you will have to make changes to the register and pay a fee.

Page 4

When filling out an application for registration of individuals. persons as individual entrepreneurs special attention You should focus on the last page. Be careful: you do not need to check all the boxes here.

According to the rules for filling out an individual entrepreneur registration application, you have the right in advance to:

- indicate last name, first name, patronymic in the first line;

- choose the method of issuing the registration certificate (personally to the applicant, the applicant or an authorized representative, sending by mail);

- indicate telephone number and e-mail.

+7(ХХХ)ХХХХХХХ

Each character, including brackets and "+", is placed in a separate cell. The address is indicated in the same way. email, if it exists. You can do without e-mail.

There is no need to make any other marks before submitting an application for registration of an individual entrepreneur with the Federal Tax Service - you will find out how to fill out the remaining columns either from a notary or from the tax inspector who accepts your documents.

Please pay special attention: you do not need to sign it yourself. IN otherwise the document will be invalid. You can sign a document only after completing an application for registration of an individual entrepreneur. They do this in two ways:

- At a notary, if you want to transfer documents to the Federal Tax Service through a proxy (here you will also need to issue the power of attorney);

- In the presence of a tax inspector, at the stage of transferring documents (if you do this in person).

All other fields are filled in by the employee accepting the documents, as well as (if necessary) by the notary.

Additional requirements for completing an application for registration of individual entrepreneurs

You can find complete instructions for filling out an application for registration of an individual entrepreneur by opening Appendix No. 20 to the order of the Federal Tax Service of Russia No. MMB-7-6/25 dated January 25, 2012. This document provides the basic rules for preparing documents submitted to tax office. They will be useful to both future entrepreneurs and founders of legal entities.

Among the basic rules for filling out an application for state registration of an individual entrepreneur, we will highlight:

- The form can be filled out using software or manually. You will find information on fonts just above. When filling out manually, you should refer to the sample in the application. Applications must be completed in black ink. The font color when printed on a printer should also be black. One cell is allocated for each symbol, although there are exceptions.

- OKVED codes must consist of at least four digits. There is no need to put dots between parts of the code. You need to start from the leftmost cell. This applies to almost all numbers that are indicated in the application.

- On the second page, when indicating passport data, you must leave one empty cell between the series and passport number. If there is a space between the digits of a series or number in the passport, it is also indicated as an empty cell. The same applies to any other spaces.

- If there is not enough space left for a word or digital designation on a line, it is transferred to the next one in its entirety. The remaining empty cells are defined as one space.

- When filling out an application to the tax office when registering an individual entrepreneur or LLC, you must not make any blots, errors, or corrections. If the need for correction arises when filling it out manually, it is better to take new form. You cannot use a corrector. Postscripts are also not allowed. The print should be good enough. You cannot print the form or the application itself on a faulty printer.

- The application for registration of an individual entrepreneur must be numbered in the same way as the application for opening an LLC: used continuous numbering. The page number is entered in the appropriate field and contains three digits (for example, 001, 002, 014).

- Blank pages that do not require filling do not need to be printed.

- Double-sided printing is not permitted. Each new page is issued on separate sheet paper

How to properly fill out an application for registration of an individual entrepreneur and avoid problems?

We list the basic rules that every future entrepreneur should remember:

- Before filling out, contact your local Federal Tax Service and check the requirements again. Each department has its own nuances of working with documents. So, before filling out an application for registration of an individual entrepreneur in Moscow, you need to clarify what information must be provided without fail.

- Under no circumstances should mistakes, omissions, additions, corrections, etc. be made. If you are preparing a document directly with the tax office before filing, take several forms with you. The slightest mistake - and the inspector will have the right not to accept your application.

- Make sure you have all the documents required to complete the individual entrepreneur registration application. Usually a passport is enough. But if, for example, you do not have permanent registration, you may need documents confirming temporary registration. They are attached to the application.

- Sign the registration application entrepreneurial activity during its registration it is impossible. This is done only in the presence of a tax inspector or in notary office. Going to a notary makes sense if you are sending documents by mail or with an authorized representative. In other cases, it is easier to sign the application directly at the tax office. If the signature is already there when submitted, and there are no notary marks in the document, you will be refused.

To avoid refusals and problems in the future, pay maximum attention to your application. If you have any doubts, it is better to contact a lawyer (for example, the Rigby company) who will help you fill out or advise on your issue.

- What are the benefits of linoleic acid and how to use it?

- Fat content of cottage cheese: what is it and which is healthier?

- Program for psychological preparation of children for school Program of additional education for psychological readiness for school

- Hymn to Buddha, Who Transcended the World

- German New Medicine

- Separate VAT accounting - what is it and when to implement it?

- Romanov Konstantin Konstantinovich - biography

- Twice Hero of the Soviet Union Grechko Andrey Antonovich

- Stages and course of the Battle of Borodino briefly

- How to conduct a master class “Painting gingerbread cookies” for children: big secrets and little tips

- New Year's gingerbread: recipes, design ideas

- You can also calculate the cost of insurance on your computer.

- Cheese or cheese product. What's the difference? How to choose the right cheese and what is important to know when buying Which cheese is the most natural

- How to make a talisman from a red thread prayer How to make a talisman from a red thread

- How to enter a cash receipt order 1s 8

- Explanations of the Ministry of Finance on the preparation of financial reporting forms Deadline for submission of form 737

- Enterprise accounting basic: pros and cons 1C accounting basic version

- 1c accounting chart of accounts

- Modern Chinese naval forces Chinese Navy

- Soviet Press Day May 5