Reflection of salary payment in 6 personal income tax. Withholding personal income tax from the January advance: a dubious practice. Personal income tax from salary: we calculate, withhold and transfer

Many employers paid wages for December 2016 already in December. This option is not prohibited. But how to reflect such an operation in 6-NDFL for 2016? Or should this payment be included in 6-personal income tax for the 1st quarter of 2017? How will the December salary be distributed across sections 1 and 2? Let's look at these questions and see how to fill out 6-NDFL for 2016 to reflect December salary did not cause any complaints from the Federal Tax Service.

Salary for December in December: mass situation

All employers are required to pay wages at least every half month. From October 3, 2016, salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is deadline advance payment - the 30th day of the current month, and for salary - the 15th day next month(Part 6 of Article 136 of the Labor Code of the Russian Federation). Cm. " ".

In order for the salary payment deadlines to be met, the salary advance for December had to be paid no later than December 30, and the second part - no later than January 13, 2017 (since January 15 is a Sunday). Cm. " ".

At the same time, many employers accommodated their employees and paid wages for December 2016 ahead of schedule – not in January, but in December. They published for this corresponding order. Cm. " ".

Moreover, some employers found themselves in a situation where they were obliged to pay employees for December salaries in 2016 (if the documents document the date of payment of the second part of earnings fell on non-working days). holidays from December 31 to January 8). Consequently, many people faced a situation where the final salary payment for 2016 was made in December.

What kind of payment is this from a legal point of view?

Many employers paid the final salary for December 2016 in December, for example, in the period from December 26 to December 30, 2016. In this case, on the day the salary is paid, the calendar month has not yet ended, so it is impossible to regard such a payment as a salary for December in the full sense of the word. In fact, cash, paid before the end of the month, are an advance.

Let’s assume that the salary for December was issued on December 30, 2016. On this day, the employer is not yet obliged to calculate and withhold personal income tax, since the salary becomes income only on the last day of the month for which it is accrued - December 31. This follows from paragraph 2 of Article 223 of the Tax Code of the Russian Federation. Despite the fact that December 31 is a Saturday, personal income tax cannot be calculated or withheld before this date (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11/2169).

The date of receipt of income in the form of wages under an employment contract is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Not earlier than this day, you can calculate personal income tax on your entire salary, including the previously issued advance. Amount of advance income for purposes personal income tax taxes is not recognized.

How to reflect December salary in 6-NDFL

Organizations and individual entrepreneurs (tax agents) must submit 6-NDFL calculations for 2016 in the form approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. The composition of this form is as follows:

- Title page;

- Section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and income tax withheld individuals».

On filling title page December salary will not be reflected in any way. However, when filling out the main sections of the annual 6-NDFL, it is necessary to take into account some features. Let's give an example.

December salary paid in December

The organization paid all its employees salaries for December ahead of schedule - December 29, 2016. The total salary is 897,000 rubles. From the payment made on the same day, personal income tax was calculated and withheld in the amount of 116,610 rubles (87,000 x 13%). The accountant paid this amount to the budget on the first working day of 2017 - January 9.

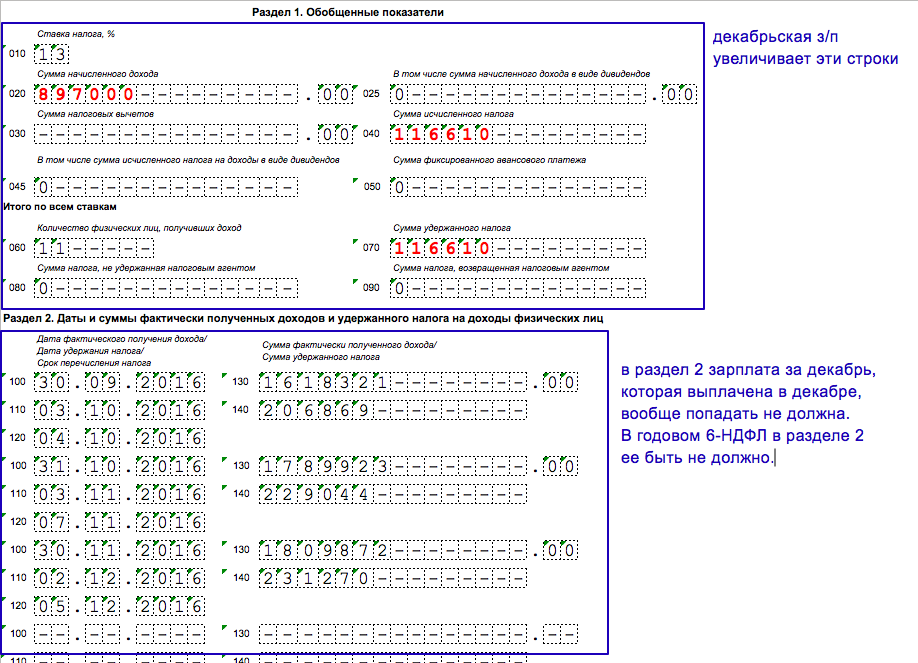

Under such conditions, in section 1 of the 6-NDFL calculation for 2016, the accountant should correctly reflect the salary as follows:

- add to line 020 the amount of the December “salary” (RUB 897,000);

- add to lines 040 and 070 – calculated and withheld personal income tax (RUB 116,610).

In section 2 of the 6-NDFL calculation for 2016, the December “salary” paid on December 29 should not appear in any way.

The December salary paid in December will need to be reflected in the calculation for the first quarter of 2017 in section 2. The fact is that when forming section 2, you should focus on the date no later than which personal income tax must be transferred to the budget. That is, paid income and withheld personal income tax must be shown in reporting period, which is the deadline for paying personal income tax. Such clarifications are given in the Letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4-11/20126. In our example, personal income tax must be transferred on the next working day in January – January 9, 2017. Therefore, in section 2 of the calculation for the first quarter of 2017, the December salary will need to be shown as follows:

- line 110 – December 31, 2016 (date of personal income tax withholding);

- line 120 – 01/09/2017 (date personal income tax transfers to the budget);

- line 130 – 897,000 (amount of income);

- line 140 – 116,610 (personal income tax amount).

It is worth noting that the date of tax withholding on line 110 of section 2 of the 6-NDFL calculation for the 1st quarter of 2017 will be exactly December 31, and not December 29, 2016 (when the December payment was made). As we have already said, it was on December 31, 2016 that you should have accrued the December salary and offset it against the previously paid advance (which, in fact, was already the December salary). Therefore, for any date early payment December salary in December 2016 in line 110 of the 6-NDFL calculation for the first quarter of 2017 there will always be the date “12/31/2016”.

How to fill out the calculation is not necessary: risk of error

A fairly common situation is when the employer transferred the final salary for December to the employees in December, but the accountant, confused by numerous explanations from the Federal Tax Service, does not know how to correctly fill out the annual 6-NDFL. It turns out that early salary is an advance? Should it be highlighted separately in section 2 of the 6-NDFL calculation for the 4th quarter of 2016? Let us pay attention to one of the explanations that may be misleading.

Let’s assume that on December 26, 2016, the organization transferred employees’ salaries for December in the amount of 380,000 rubles. On the same day, personal income tax was withheld in the amount of 49,400 rubles (380,000 x 13%). The withheld amount was transferred to the budget the next day - December 27, 2016.

To find out how to correctly reflect the December salary in the annual 6-NDFL, the accountant turned to the letter of the Federal Tax Service dated March 24. 2016 No. BS-4-11/5106. It recommends withholding personal income tax per day actual issue salaries (December 26), and transfer the withheld amount to the budget the next day (December 27). In addition, tax authorities advise reflecting these same dates in the 6-NDFL calculation. However, we do not recommend following such recommendations and filling out section 2 of the 6-NDFL calculation for 2016 in this way.

And that's why:

- the 6-NDFL calculation for the 4th quarter of 2016, filled out in this way, will not pass the format-logical control and will return with the error “the date of tax withholding should not precede the date of actual payment”;

- withholding personal income tax from wages until the end of the month contradicts later recommendations of the Russian Ministry of Finance in a letter dated June 21. 2016 No. 03-04-06/36092.

Withholding personal income tax from the January advance: questionable practice

It is possible that the accountant withheld personal income tax from the December salary paid in December at next payment income - from advance payment for January 2017. How to show this operation in the annual calculation and is it necessary to do it at all? Let's look at a specific situation.

Example 3

The organization transferred the salary for December 2016 in December - December 30 to total amount 677,000 rubles. The accountant did not calculate and withhold tax on the payment. The accountant calculated personal income tax as of December 31, 2016. The tax amount turned out to be 88,010 rubles (677,000 x 13%). This amount was withheld from the next payment - from the advance payment for January 2017, issued on January 18, 2017.

When filling out the annual calculation, the salary for December 2016 will be transferred to line 020 of the 6-NDFL calculation for 2016, and the personal income tax from it to line 040 of section 1 of the 6-NDFL calculation for 2016. Moreover, the amount 88,010 will appear in line 080, since the accountant should have withheld tax, but did not.

Dangerous logic!

Experts from the Ministry of Finance spoke out: until the end of the month it cannot be recognized that the employee received income in the form of a salary. Personal income tax must be withheld when paying income in in cash next month (letter dated March 21, 2016 No. 03-04-06/15565). If you pay your salary before the end of the month, it turns out that personal income tax from the salary for December 2016 must be withheld from the advance payment for January 2017. But this is a rather strange and dangerous, in our opinion, logic. When checking tax inspector may ask: why didn’t you withhold personal income tax in December 2016, but postponed the operation until next year? taxable period? After all, there was an opportunity to withhold personal income tax when paying the December salary. It will likely be quite difficult to answer this question substantively.

If December personal income tax keep out January advance, then in section 2 of the calculation of 6-NDFL for the first quarter of 2017 it will be possible to highlight this:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – 01/18/2017 (withholding date);

- line 120 – 01/19/2017 (date of payment to the budget);

- line 130 –677,000 (amount of income);

- line 140 – 88,010 (personal income tax amount).

This approach to the formation of the calculation of 6-personal income tax, I believe, should not be considered logical and correct, since the requirement of paragraph 6 of Article 226 of the Tax Code of the Russian Federation is violated, according to which personal income tax from wages under an employment contract must be transferred no later than the day following the day of payment of income. Accordingly, for the December salary on line 120 the date must be no later than 01/09/2017. The above example of filling out may also be returned to the tax agent marked “error”. Therefore, we recommend that you consult with your Federal Tax Service how they would evaluate such an approach to reflecting the December salary paid in December 2016.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Sometimes employers pay wages in installments. How and when to withhold personal income tax in such cases? Can be paid income tax in parts? How to fill out the 6-NDFL calculation if wages are paid in installments? You will find answers to these and other questions in this article.

Introductory information

Employers must pay employees wages at least every half month (Part 6, Article 136 of the Labor Code of the Russian Federation). From October 3, 2016, salaries cannot be issued later than the 15th of the next month. Cm. " ".

In this case, 15 days should pass between the salary and the advance payment, no more (See “”).

Thus, the employer can issue an advance, say, on the 20th, and the basic salary for the second part of the month on the 5th.

Calculation of personal income tax: general approach

By general rule, salary income is recognized on the last day of the month (clause 2 of Article 223 of the Tax Code of the Russian Federation). On this day they count salary personal income tax. And personal income tax is withheld when money is issued (clause 4 of article 226 of the Tax Code of the Russian Federation).

If the payment is paid in installments

For various reasons, wages may be paid to employees in installments. This can happen if the organization, for example, does not have the money to pay on time and on the same day. In such case of personal income tax should be withheld gradually from each payment. There is no need to pay the entire personal income tax on all earnings that were accrued for the month worked. This is stated in the letter of the Ministry of Finance of Russia dated July 25, 2016 No. 03-04-06/43479. Let's give an example of how to withhold personal income tax in parts.

Example.

The employer issues an advance on the 20th of the current month, and a salary on the 5th of the next. However, in August 2016, part of the salary was paid on the 5th, and part on the 11th.

Employee salary – 75,000 rubles. He received an advance of 25,000 rubles on July 20. On July 31, the accountant accrued his salary for July - 75,000 rubles. Personal income tax on this amount amounted to 9,750 rubles. (RUB 75,000 × 13%).

Thus, in addition to the advance payment for July, the employee is entitled to another 40,250 rubles. (RUB 75,000 – RUB 25,000 – RUB 9,750).

On August 5, the employee was paid part of the remaining amount:

20,000 rub. – (RUB 20,000 × 13%) = RUB 17,400 Thus, the accountant withheld only the tax calculated from the advance payment and the first part of the salary.

On August 11, the employee was paid the remaining amount:

26,264 rubles – (26,264 × 13%) = 22,850 rubles. In total, on August 11, 2016, the organization fully repaid the salary debt to the employee in the amount of 40,250 rubles (17,400 rubles + 22,850 rubles) and gradually withheld personal income tax. This is exactly what needs to be done when salaries are paid in installments.

Filling out 6-NDFL

If salaries are paid in installments, then personal income tax is withheld in stages. If, as in our example, the salary is paid twice, then you need to fill out two blocks of lines 100-140 of the 6-NDFL calculation. After all, the dates when the accountant withheld and transferred personal income tax are different. In the first case, on August 5 and 8, in the second, on August 11 and 12. Accordingly, in our example, in section 2 of 6-NDFL for 9 months of 2016, the salary paid in installments will be reflected as follows:

Conclusion

The clarification in the letter of the Ministry of Finance of Russia dated July 25, 2016 No. 03-04-06/43479, in principle, is beneficial for accountants, since personal income tax can be paid in installments from staged salaries. At the same time, we note that similar conclusions can also be found in the letter of the Federal Tax Service of Russia dated March 24, 2016 No. BS-4-11/4999. IN this letter The tax authorities were not against paying personal income tax in installments, when salaries were paid three times.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Form 6-NDFL is submitted quarterly by an entrepreneur who hires employees and pays them income. The responsibility to calculate personal income tax from income falls on the employer, since he assumes the status of a tax agent. The reporting shows when and in what quantity employee payments were provided, as well as what tax was withdrawn from them. Sometimes it happens that an employer cannot pay wages on time. How to fill out 6-NDFL if there is a delay wages, Let's look at it below.

How to show a delay in 6-NDFL

To avoid difficulties in the future, it is worth considering in detail filling out 6-NDFL when wages are delayed .

The day of the month on which the salary is calculated is the date when the employee. This indicator does not depend on whether the employer made the payment on time or not.

Late payment of wages will affect the time of calculation and transfer of tax to the treasury. The tax can only be calculated at the moment when the payment is actually made.

The transfer of the tax amount will take place on the working day following the day the employee actually receives wages.

For example, wages for April were accrued. Actual payment According to the law, labor should take place on April 30, but due to current circumstances it was carried out on April 14. In this case, there is no place to withdraw the tax amount from before the 14th, because the employee had no income at all during this time.

And it is also not possible to transfer the tax amount to the treasury earlier than 15., which will be reflected in 6-personal income tax.

A conscientious employer may charge compensation for delayed wages. If this happened, then in 6-NDFL this procedure is not indicated, since compensation is not subject to personal income tax and is not even included in the list of deductions.

A good example

Let's consider this example for a better understanding when wages are delayed:

The tax agent has a difficult situation financial situation, and he was unable to pay his employee Petya’s salary for May. Peter’s salary is 000 rubles, and interest rate- 13%, which also shows 6-personal income tax. The amount of tax that must be calculated from Petya’s income is 000*13%=5,200.

So, the salary was calculated for May, and paid on June 16. How to reflect this situation in 6-NDFL?

- – date of receipt of income – show 31. (month for which wages were calculated).

- – the date of actual withdrawal of the tax amount, that is, when Peter received his salary in hand – 16.06.

- Pay compensation to employees.

- In complex situations, criminal liability is possible.

- Heavy financial condition hiring company.

- The employer has doubts about the quality of the work performed.

- Due to other considerations of the employer or deliberate non-payment.

Employer's payment obligations

Labor Code in order to protect workers who are hired to perform work on contractual terms, obliges the employer to pay wages. Moreover, he must pay it within a strictly specified time frame.

The amount of the salary, as well as the timing of its payment to the employee, are stipulated in the contract signed by the employee, in the rules within the corporation, in employment contracts, as well as directly in the Labor Code.

An employee who has not received the income due to him for work performed for 2 weeks in a row may notify the employer of the suspension of work. Moreover, the expectation of due payments must also be paid. The calculation will be based on the employee’s average earnings.

6-NDFL in case of delayed wages, this fact reflects what the tax authorities will probably be interested in, and then labor inspectors. The employer will be on legally must:

Therefore, paying your employees for their work is entirely in the interests of the employer himself. Delays in payment of wages occur for the following reasons:

It should be noted that some not entirely honest employers, having paid 50% of wages, believe that this way they will be able to get rid of responsibility. This is wrong. Partial non-payment salaries may also entail criminal liability, as well as complete non-payment.

So, 6-NDFL is designed to display all the income that is received by employees, as well as the timing of their receipt and the timing of withholding taxes from them, which is directly reflected in the 6-NDFL form.

Sometimes employers pay salary earlier due deadline. Do they do this or objective reasons or by at will. For example, in New Year holidays will last from January 1 to January 8. Some companies whose salary payment date falls within this time period will have to pay staff for December 2016 at the end of this month, i.e. before December 30, 2016 (Part 8). Individual firms may simply decide to pay their employees before the end of the month. This consultation is dedicated to how to reflect early salary in 6-NDFL. But first, a little background information.

Personal income tax from salary: we calculate, withhold and transfer

Accountants who have already had time to practice submitting calculations in Form 6-NDFL this year know that for the purposes of calculating personal income tax, the date of actual receipt of income in the form of wages is considered to be the last day of the month for which this income was accrued (para. 1 ). It does not matter whether this day is a weekend (holiday) or a regular working day (). That is, wages, for example, for October should be accrued on October 31, 2016.

Note!

On this day, the entire amount of income for the month is recognized - both the advance payment and the final payment of wages.

In relation to 6-NDFL, accrued income in the form of wages is reflected:

- on line 020 of section 1- in total income;

- according to line 130 of section 2- a separate amount,

and the date of its receipt:

- on line 100 of section 2.

Notice!

Tax cannot be transferred before that the day he was detained. After all personal income tax payment at the expense of a tax agent is prohibited by law (clause 9). This is also stated by the regulatory authorities (decision of the Federal Tax Service of Russia dated May 5, 2016 No. SA-4-9/8116,).

Tax payment date ( note! not factual, but established by law) is indicated in 6-NDFL:

- according to line 120 of section 2.

6-NDFL for early payment of wages

Payment of personal income tax before the date of actual receipt of income by the taxpayer is not provided for by the Code. This opinion is shared by financiers and tax specialists (for example, letter of the Federal Tax Service of Russia dated April 29, 2016 No. BS-4-11/7893). That is, in our case, the employer cannot withhold personal income tax from early salary, since on the date of payment the employees do not have any income. The tax agent will be able to make the appropriate deduction only for subsequent payments (for example, from the next month's advance payment).

Therefore, when early salary 6-NDFL filled out on an “advance” basis. Let's look at it with an example.

Example. During 2016, RusLes LLC had 5 permanent employees. Moreover, for the period January - December 2016:

- the amount of accrued wages amounted to RUB 2,520,000. (RUB 210,000 monthly);

- the amount of tax deductions provided was RUB 30,800. (in December, employees lost the right to deduction due to exceeding the income limit).

Internal rules labor regulations The Company has set the following salary payment dates:

- for the 1st half of the billing month - the 20th day of this month;

- for the 2nd half of the billing month - the 5th day of the next month.

The company's management decided to make the final payment for wages for November 2016 on November 25th. When paying salaries, only the advance amount for this month was taken into account.

November personal income tax was withheld from the advance payment for December 2016.

On practice organizations withhold personal income tax from early amounts. But in any case, you need to transfer tax from wages for the billing month, issued before its end, no earlier than the date subsequent payment, which will be produced on the last day of this month or later.

We will reflect salary transactions in 6-NDFL of RusLes LLC for 2016.

Section 1 of 6-NDFL calculation

The accountant of RusLes LLC has been filling it out with a cumulative total since the beginning of 2016.

on line 010 - 13 / indicates the rate at which personal income tax is calculated and withheld from the income of employees of RusLes LLC;

on line 020 - 2,520,000 / indicates the total amount of income accrued to employees of RusLes LLC for the period January - December 2016;

on line 030 - 30 800 / indicates the amount of tax deductions provided to employees of RusLes LLC for the period January - December 2016;

on line 040 - 323 596 / personal income tax calculated on the income of individuals is indicated;

on line 060 - 5 / indicates the number of employees who received income from RusLes LLC for all tax rates ;

on line 070 - 296 296 / indicates personal income tax withheld from the total amount of income paid to employees of RusLes LLC at all tax rates for the period January - December 2016.

Note!

Salaries for December 2016 will actually be paid to the organization’s employees in January 2017. Then personal income tax will be withheld from the income. Therefore, tax on December salary is not shown in line 070.

Section 2 of 6-NDFL calculation

The accountant of RusLes LLC fills it out only for the last 3 months of 2016 (October - December).

Notice!

The salary for September, paid in October, will fall into section 2 of the 6-NDFL report for 2016. But December pay, accrued but not issued before the end of the year, is not reflected in section 2 of the form.

Information on payment of income for September.

on line 100 - 09/30/2016 / the date of receipt of income by employees of RusLes LLC is indicated;

on line 110 - 10/05/2016 / indicates the date of withholding of personal income tax on income paid to employees of RusLes LLC;

on line 120 - 10/06/2016 / the deadline for personal income tax payment is indicated;

on line 130 - 210,000 / indicates the amount of income received by employees of RusLes LLC;

on line 140 - 26,936 / personal income tax withheld from income paid to employees of RusLes LLC is indicated.

Information about the payment of income for October (see the explanation of the lines above).

on line 100 - 10/31/2016;

on line 110 - 05.11.2016;

on line 120 - 11/07/2016;

on line 130 - 210,000;

on line 140 - 26,936.

Information about the payment of income for November (see the explanation of the lines above).

on line 100 - 11/30/2016;

on line 110 - 12/20/2016;

on line 120 - 12/21/2016;

on line 130 - 210,000;

on line 140 - 26,936.

See below for a sample calculation according to form 6-NDFL of RusLes LLC for 2016.

There is a second approach to filling out 6-NDFL when paying wages before the end of the month, proposed by the Federal Tax Service of Russia in. The Department’s specialists recommended withholding personal income tax from early amounts and transferring it to the budget the next day. The 6-NDFL report must be completed accordingly.

If these conclusions are projected onto our example, then the information on the payment of income for November in section 2 of Form 6-NDFL of RusLes LLC for 2016 will look like this:

on line 100 - 11/30/2016;

on line 110 - 11/25/2016;

on line 120 - 11/28/2016;

on line 130 - 210,000;

on line 140 - 26,936.

The dangers of this approach are as follows:

- the tax agent may be accused of violating the requirements of paragraph 9, since de jure he pays tax at the expense of own funds;

- a calculation in form 6-NDFL, filled out according to this principle, will not pass the format and logical control of the Federal Tax Service, because the date of tax withholding precedes the date of actual receipt of income.

Therefore, it is not worth using.

6-NDFL - if the salary was paid for several days How to file a declaration?Our material provides explanations for accountants in which cases the need for fractional payments arises and how to fill out the lines of this calculation.

Various business situations that arise when paying wages

Salaries can be paid in installments in the following cases:

- to comply with the conditions set out in Part 6 of Art. 136 of the Labor Code of the Russian Federation regarding payment for execution labor responsibilities at intervals of once every six months;

- when the enterprise does not have enough money to pay out the earnings and the employer is forced to pay off debts in installments for payment for the work;

Since 2016 in tax practice a new one has been introduced reporting document, called “6-NDFL calculation”. When filling it out, accountants may have questions about the correct entry of data relating to both basic income and advance payments. Considerable difficulties are possible when reflecting fractional salaries.

Using regulatory materials, below we will describe the basic rules for generating the 6-NDFL calculation, and then we will indicate how to include the payment of wages in it when situations arise related to debt to employees and when transferring money directly to the bank to repay the loan. It is these 2 situations, as it seems to us, that are most often encountered in modern economic conditions and can cause difficulties in reporting.

Legal regulation of the procedure for filling out 6-NDFL

The rules for making entries in the calculation are determined by the order of the Federal Tax Service dated October 13, 2015 No. ММВ-7-11/450@. According to the document, you need to perform 2 actions:

- enter into the calculation of income paid tax agent individuals, as well as tax deductions, which the employees received;

- write down in the appropriate personal income tax lines, which was withheld from income paid to individuals.

All records must comply with the norms of the Tax Code of the Russian Federation, as well as letters from the Ministry of Finance and tax authorities, where the rules for complying with these standards are explained in detail.

Here is a table from which you can understand how to correctly make entries in Section 2 of 6-NDFL when issuing wages:

|

Calculation line and information recorded in it |

Source of legal norm |

Peculiarities |

|

The date on which income is recognized as received is recorded. |

|

|

|

The date on which tax is withheld from income is recorded. |

|

|

|

The date when the tax amount is transferred to the budget is recorded. |

|

|

|

The amount of income that is actually paid is recorded. |

|

|

|

The amount of tax that is withheld from income is recorded. |

|

You can clarify the postponement of the deadline for transferring personal income tax by reading the article .

IMPORTANT! In circumstances where income was paid on the same day and income tax must be remitted on different terms, 6-NDFL will need to be filled out by tax payment deadlines (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-4-11/8312).

For information about the position of fiscal officials on the procedure for filling out page 130 of the report, read the article .

6-NDFL and salary payments at different times

Let's look at an example of how it would look like making entries in the calculation in a situation with a salary issued in stages.

Example

For May 2017, the employee was paid a salary in the amount of 21,264 rubles, and personal income tax was calculated in the amount of 2,764 rubles. (deductions were not provided), payable - 18,500 rubles. Due to difficulties that arose at the enterprise, wages were paid in installments in following dates: June 8 - 10,000 rubles, June 29 - 3,500 rubles. (amounts are shown minus withholding tax, payable in person). Personal income tax was transferred on June 8 and June 29, respectively. In addition, on May 16, the May advance in the amount of 5,000 rubles was paid. But the organization transferred the tax on it on June 8.

In line 130 of section 2 of form 6-NDFL, the amount of income received in the case under consideration can be determined as the amount accrued to the employee multiplied by the quotient of the actual amount paid divided by the total amount to be paid.

The semi-annual calculation will need to be filled out like this:

|

Line |

Index |

Line |

Index |

|

Page 100 |

31.05.2017 |

Page 130 |

21,264 × (10,000 + 5000) / 18,500 = 17,241 |

|

Page 110 |

08.06.2017 |

Page 140 |

17,241 × 0.13 = 2,241 |

|

Page 120 |

09.06.2017 |

||

|

Page 100 |

31.05.2017 |

Page 130 |

21,264 × 3,500 / 18,500 = 4,023 |

|

Page 110 |

29.06.2017 |

Page 140 |

4,023 × 0.13 = 523 |

|

Page 120 |

30.06.2017 |

Read about the consequences of early payment for work in the article .

From the presented example it is clear that when breaking down wages by different dates Tax should also be withheld fractionally and only from the money that is actually paid to the employee.

As for advance payments, we note the following:

- When paying for labor, income should be considered actually paid on the last day of the month.

- Personal income tax for advances must be included in the budget within the same time frame as when issuing the basic salary. Essentially, this means that the tax must be remitted no later than the day following the day final settlement according to salary for the month worked.

- According to the advance payment personal income tax payment is not included in the budget and, accordingly, is not recorded separately in the calculation.

Results

IN practical activities Quite often, circumstances arise when an enterprise is forced to issue salaries in parts with varying dates. In such situations, in 6-NDFL, tax actions should also be recorded in parts - how the payment was actually made.

- The meaning of the word cambium in the encyclopedia biology

- Morphological analysis of the verb

- About Great Britain in English

- Is Cyprus still an offshore zone?

- World Development Bank. World BankWorldBank. World Bank in Russia

- Accounts receivable and payable

- Why does a woman dream of an owl: a girl, a married woman, a pregnant woman - interpretation according to different dream books

- How to make an eternal love spell black wedding

- The most powerful prayer to Spyridon of Trimifuntsky Prayer for employment to Spyridon of Trimifuntsky

- Recluse Melania what they pray for

- Orthodox churches around the world

- The creator of geminoid robots, Hiroshi Ishiguro, will give lectures at Skoltech

- Hiroshi Ishiguro - Japanese engineer, creator of humanoid robots

- Measurement of gamma background in places of residence of the population of rural and urban settlements in the southwestern regions of the Bryansk region

- The latest photos from the Hubble telescope

- Blood of Saint Januarius When the blood of Saint Januarius boils in Naples

- Why do you have nightmares: interpretation of disturbing dreams Causes of disturbing dreams

- Incredible mysteries of nature Mohenjo-Daro, or Mountain of the Dead

- Career zodiac sign Pisces How Pisces can achieve success

- National Emblems in Great Britain