Re-registration of cash register in offline mode. Who will change the fiscal drive? What it is

Menu:

If you have any difficulties with the choice, you can shift this task onto the shoulders of our specialists.

Obtaining an electronic signature

To work with the websites of the Federal Tax Service and the Federal Tax Service, you will need an electronic digital signature (EDS).

Electronic digital signature You can receive either upon concluding an agreement with the OFD, or at a national certification center, or order production EDS key from our organization (which is more convenient and faster for you).

Purchase and installation of a fiscal storage device

To transmit fiscal data online, a fiscal storage unit (FN) is installed in cash registers. Some devices go on sale with fiscal drives already installed, and some require separate installation of the fiscal drive. In many devices, installing the FN is a very simple process, but in some it is not so much.

Unfortunately, on this moment There are some difficulties with purchasing fiscal drives separately from cash registers. Let's hope that by the summer of 2017 there will be no more problems with purchasing fiscal drives.

Attention: it is not possible to register a cash register without the serial number of the fiscal drive.

Setting up access to the taxpayer’s personal account

For full access to the entrepreneur’s personal account on the Federal Tax Service website, you will need the following:

- operating system Windows XP (or higher) or Mac OS X 10.9 (or higher);

Unfortunately, the Federal Tax Service web programmers have linked the taxpayer’s personal account specifically to the browser Internet Explorer. However, there are several versions of browsers that support encryption of secure connections in accordance with GOST 34.10-2001, 28147-89. For example, these are RedFox and (tested for full functionality) browsers. In order for access to the Federal Tax Service account to be checked through these browsers, it is enough to install any browser extension that allows you to change the User Agent, and set the User Agent parameter to Internet Explorer (from version 8 to 11, depending on the section of the site tax). In this case, access to the Federal Tax Service account will only be via direct links.

You can access the entrepreneur’s personal account on the Federal Tax Service website using a direct link:

Adding a cash register to the Federal Tax Service account and obtaining a cash register registration number

To obtain a registration number (RN) of a cash register, which will later be required during registration, you need to go to the taxpayer’s personal account and follow the steps:

1. Select the item "Cash Accounting".

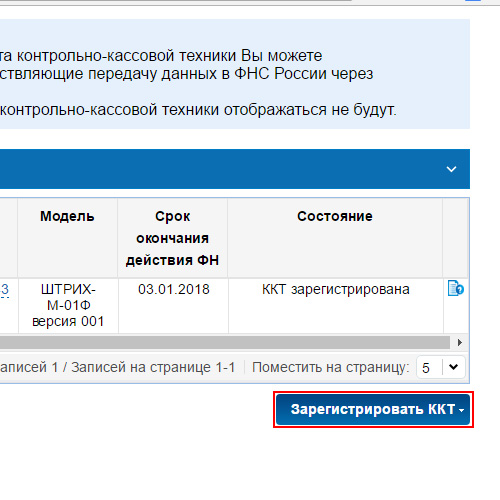

2. Click the “Register cash register” button.

And we choose how we want to load the data.

4. After entering the data, the “Sign and Send” button will light up blue. You press it.

4. After entering the data, the “Sign and Send” button will light up blue. You press it.

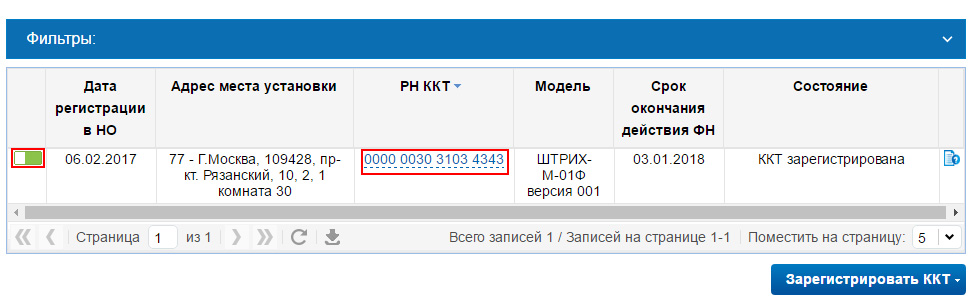

5. The CCP model will appear in the list. If all data is entered correctly, the cash register will receive a RN, and the registration status icon will be half-filled with green.

Registering a cash register

After receiving the registration number, all that remains is to enter the required data in cash machine. Each cash register manufacturer has its own methods for registering and re-registering online cash registers. You can find instructions for your cash register using the following links, or on the description pages of a specific cash register:

Be careful when registering a cash register. The data in the cash register must be entered carefully, otherwise you can “screw up” the FN.

Selecting CCP operating modes

When registering a cash register, you may need to select the operating mode of the cash register. The operating mode must correspond to the selected item when adding a cash register to the taxpayer’s personal account (see screenshot 3). When entering data into a cash register, the names of operating modes may differ from the names of points on the Federal Tax Service website. Usually available the following items:

- Encryption - additional SSL encryption of transmitted data. Changing this parameter will require changing the FN.

- Autonomous mode - mode of operation of the cash register without transferring data to the OFD. For cash registers installed in hard-to-reach locations populated areas without access to the Internet.

- Automatic mode - for using CCP in automatic systems calculations.

- Application in the service sector - if the cash register will be used for settlements when providing services to the population.

- BSO mode - for strict reporting forms.

- Application by payment agents/subagents.

- Application by banking agents/subagents.

Changing the cash register operating mode (except for the "Encryption" mode) requires re-registration of the cash register without changing the fiscal drive. Changing the "Encryption" mode requires changing the FN.

Completion of registration of cash registers in the Federal Tax Service LC

Upon completion of registration, the cash register will print a receipt with the numbers of the fiscal document, fiscal attribute, date and time of registration.

To complete the CCP registration:

- Go to the entrepreneur’s personal account;

- Double-click on the PNM KKT;

- Enter the time, date, FD number and FP number.

If all the data was entered correctly and everything was entered correctly during registration, the registration indicator will be completely filled green. This means that the cash register is registered with the Federal Tax Service.

1. Should the cash register have its own Internet connection or is it possible through the PC to which the cash register is connected?

The cash register must comply with the requirements of 54-FZ and must be entered in the Federal Tax Service register. The KKT user is obliged to ensure that the KKT is connected to the Internet and transmits fiscal documents OFD. Recommendations for connecting to the Internet of the cash register must be requested from the manufacturer of the specific model of the cash register.

2. Maintenance of cash register systems in separate divisions in other regions

For questions about the conditions for obtaining an ASC certificate, which allows an organization to service specific CCP models, you must contact the accreditation centers of CCP manufacturers.

3. If you specified the “offline” flag when registering a cash register, is it possible to re-register it after it goes online?

To do this, you need to go to the taxpayer’s account and re-register the cash register.

4. Do I understand correctly: in order to modernize a client’s cash register, it is possible not to be an ASC, but to enter into an agreement with any ASC? From whom do you purchase components for modernization?

To switch to an online cash register, an organization (entrepreneur) can either purchase a new cash register or upgrade an old one that is already working (letter of the Ministry of Finance of Russia dated September 1, 2016 No. 03-01-12/VN-38831). CCP manufacturers regulate: if the modernization is carried out by an organization without an ASC certificate for the right to service the CCP or the organization has not signed a service agreement with the ASC, then the CCP is removed from the manufacturer’s warranty.

5. Is it possible to register a cash register at the Federal Tax Service branch, and not through www.nalog.ru?

By general rule CCP registration is carried out with the tax authority. From July 15, 2016, organizations and individual entrepreneurs may, at their discretion, submit an application for registration of a cash register:

- to any territorial inspection in in paper form;

- V electronic form through the CCT office. In this case, the date of submission of the application in electronic form is the date of its placement in the cash register office;

- through the fiscal data operator. The filing date is considered to be the date the application is submitted to the fiscal data operator.

6. How can the Federal Tax Service transfer cash registers from offline mode?

Write an application for re-registration of the cash register, removing the sign of cash register autonomy.

7. Is a service center agreement required to service cash register equipment under 54-FZ?

No, not needed.

8. Where to buy a fiscal drive?

9. Who will change the fiscal drive?

The draft law does not establish specialized organizations to replace the fiscal drive.

10. How to register a cash register and obtain a Federal Tax Service registration number?

It is necessary to submit an application for registration of a cash register in tax authority. Submission methods provided for by the draft law “On the Application of CCP”:

- personally to the tax authority;

- innings electronic application through your personal account on the website nalog.ru;

- submission of an electronic application through the website of the fiscal data operator (at the First OFD given service under development).

11. What will happen to the central heating center?

12. Is it necessary to enter into a service agreement with the central service center after implementing the CRF?

Maintenance at a central service center will no longer be mandatory.

13. Must the fiscal drive be purchased from cash register suppliers or from you?

From the manufacturer of fiscal drives or from a person who has the right to such sale.

Information about issued fiscal drives can be obtained from the register of fiscal drives on the Federal Tax Service website.

14. A taxpayer who does not currently use a cash register. The need for connection depends on the type of activity and location.

The list of types of activities for which the use of CCP is not mandatory is established by the Federal Law “On the Use of CCP”.

15. Difference between FN and ECLZ. Is it possible to convert EKLZ into FN?

When moving from an ECLZ to a fiscal storage device, not only a replacement is made, but also an update of the software (firmware) of the cash register is carried out; it is not possible to upgrade an existing ECLZ in the FN.

16. Is it possible to purchase FN separately from cash register?

Yes, it can be purchased separately or as part of a cash register (it should be understood that the FN should be purchased separately only to replace the FN that was previously used in the cash register. B otherwise A CCP modernization kit is required).

You can purchase FN from the manufacturer of fiscal drives or from a person who has the right to such a sale.

Information about issued fiscal drives can be obtained from the register of fiscal drives on the Federal Tax Service website.

17. How long does the FN work? Issues of re-registration of cash registers with a new FN.

The service life of fiscal drives is at least 13 months.

The maximum period is not limited by law and will be set by the manufacturer depending on the validity period of the fiscal attribute key.

18. Is it possible to damage the FN or CCP by connecting it incorrectly (including when connecting to the OFD)?

Work to modernize the CCP must be carried out qualified specialists. It is not necessary to enter into an agreement with the central service center. The FN can be replaced on your own, but the client bears responsibility for possible damage to the CCP.

19. If the requirements for CCP or FN have changed, is it possible to work according to the old requirements?

If it is established additional requirements to cash register equipment and (or) fiscal storage cash register equipment and fiscal storage included in the register cash register equipment and into the register of fiscal drives, can be used by users and are not subject to exclusion from the register of cash register equipment and the register of fiscal drives due to their non-compliance with accepted regulations legal acts within one year from the date of entry into force of the regulatory legal act. If within one year cash register equipment and fiscal storage devices are not brought into compliance with the newly adopted regulatory legal acts, such cash register equipment and such fiscal storage devices are subject to exclusion from the registers.

20. Do I need to bring the cash register after 02/01/2017 to the Federal Tax Service in order to register it?

An application for registering a cash register with the Federal Tax Service can be submitted through Personal Area taxpayer on the website nalog.ru. The 1C-OFD service includes consulting services upon registration of cash register with the Federal Tax Service.

21. If a client’s ECLZ expires, can he be transferred to a new cash register and registered with the Federal Tax Service?

Registration of a new type of cash register is already possible with the Federal Tax Service, including through the taxpayer’s account on nalog.ru. From February 1, 2017, only a new type of cash register can be registered.

22. Is there support for BSOs in electronic form and sending them to the client?

According to the new law, the seller is obliged to transfer the BSO to in electronic format.

23. Who bears the costs if the CCP and FN fail?

The cost of any breakdown is borne by the KKT user. FN needs to be changed every 13 months. If the CCP goes out of service, then the client should have a spare CCP with which he can work on this point of sale. If there is no cash register, he has no right to trade. If the shift is not closed within 72 hours, the FN will be automatically blocked, i.e. repairs must be made during this period of time. For this purpose, there are agreements with ASCs, which undertake to carry out such work within the time limits specified in the agreement.

24. What happens if the Internet is turned off? What is the deadline for sending accumulated sales?

Data on a punched check must be transferred to the OFD within 30 calendar days. If this does not happen, the cash register will stop and it will be impossible to continue sales.

25. What to do if the cash register was blocked after a long time offline?

Connect it to the Internet. FN sent the data to the OFD and will unblock the cash register.

26. Can acquiring terminals comply with 54-FZ without installing additional equipment?

Cash register equipment as part of a payment terminal

An automatic settlement device is a device for making settlements with the buyer (client) in automatic mode using CCT without participation authorized person organization or individual entrepreneur. Such a device is payment terminal.

At the same time, organizations and entrepreneurs using a payment terminal are required to use a cash register as part of it.

From July 1, 2017, organizations and entrepreneurs (with some exceptions) are required to use online cash registers, which must comply with the new requirements of Law No. 54-FZ and transmit fiscal data to the inspectorate. Until this moment, you can use the “old” sample cash registers registered before 02/01/2017.

27. I have an error with the ATOL KKT driver with data transfer (Retail 2.2). What to do?

For all errors with the ATOL KKT driver with data transfer (Retail 2.2.) the following is required:

- FN registration report (photo or scan), as well as a description of how FN was fiscalized - through 1C or through ATOL software.

- The KKT firmware version on which the error occurs. It is best to take a photo or scan of a printout of “Information about CCP” (more details in the documentation for CCP).

- KKT driver logs FprnM1C and FprnMSM (default path C:\Users\user\AppData\Roaming\ATOL\DRIVERS).

- And, if possible, data from register 48 of the cash register (via the Register Manager, more details in the documentation for the cash register).

- Send information to [email protected].

28. What needs to be changed in the OFD Personal Account when changing the FN in the cash register? Is re-registration with the Federal Tax Service necessary?

If the FN changes, then the cash register must be re-registered in the Federal Tax Service and a new activation in the OFD.

29. If the user independently upgrades the cash register, how to prove that the result of the upgrade meets the requirements of 54-FZ?

In this case, the user himself is responsible for compliance of the cash register with the requirements of 54-FZ.

30. How does the return procedure work at the checkout counters in accordance with the new procedure, as well as other standard procedures?

The protocol used in the interaction between CCP and OFD supports all standard set ECLZ protocol, including returns. Procedures such as discounts, markups, etc. are also supported.

31. What happens to the system when there is no connection?

If OFD does not return fiscal sign within 1-1.5 seconds, the cash register begins to function in “offline mode”, and when a connection appears, it sends checks to the OFD. Moreover, the fiscal sign in this case is formed locally on board the cash register itself.

The duration of possible stay in this mode will be studied as part of an experiment based on statistical information.

32. Is the consumer of cash register equipment obliged to contact the manufacturer of cash register equipment to upgrade it to a data transfer function and will an examination of the model of cash register equipment be carried out?

The user of cash register equipment has the right to contact the manufacturers of cash register equipment to clarify information about the possibility of modernizing the model of cash register equipment.

Please note that cash register equipment registered in accordance with the procedure in force before the entry into force Federal Law No. 54 Federal Law "On the use of cash register equipment when making cash payments and (or) settlements using electronic means payment", is removed from registration accounting with the tax authorities in accordance with the procedure in force before the entry into force of Federal Law No. 54-FZ.

Thus, the user of cash register equipment must deregister the cash register. cash register equipment, working according to the old order, and then provide your cash register equipment to the manufacturer of cash register equipment or authorized representative manufacturer for its modernization, who will add this instance of cash register equipment to the copy-by-instance register of cash register equipment.

33. Not all cash desks currently operating will be able to transmit data to the Federal Tax Service. Where can I see the list of online cash registers that can be used after February 1, 2017? How to start working with them - register with the Federal Tax Service or are there any new rules?

All cash registers that will operate under the new rules must ensure the transmission of payment information. Federal Law No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using electronic means of payment” also has exceptions. Thus, it will be necessary to modernize the existing fleet of cash register equipment. To implement registration actions in the new order (unlike the current one) you will not need to contact the inspectorate and physically provide the cash register for inspection. In the new procedure, it will be possible to register, re-register or deregister a cash register remotely - via the Internet - in the cash register account on the official website of the Federal Tax Service of Russia. A list of models and specific instances of cash registers that comply with the requirements of the law and, accordingly, are available for registration, will be posted on the official website of the Federal Tax Service of Russia.

34. Is the physical participation of a tax inspector provided for when generating a cash register registration card and sending it to the taxpayer? Or will this happen automatically?

The registration card will be generated and sent to the taxpayer automatically.

35. Will there still be a need to provide the tax authorities with the set of documents required by the Federal Tax Service at present during registration? Will journal keeping (form KM-4) be maintained after the procedure for using cash registers has been improved? Is it necessary to have cash documents at the facility, such as a form, a version passport?

When registering a cash register, submit documents for on paper the tax authority is not required. You only need to submit the application electronically. Moreover, after the adoption of the relevant bill, there will be no need to store the form and version passport at the facility.

36. Where can I find a list of areas remote from communication networks?

37. Will the new law solve the problem of the impossibility of issuing a check when making payments on the Internet?

In accordance with current regulation cash registers should be used (including) when paying payment card via the Internet with delivery to the buyer paper check, which is an objective problem. The new regulation solves this problem, namely: it frees the seller from the obligation to print and issue it to the buyer at the time of settlement. cash receipt- a cash receipt can be sent to the buyer electronically without printing it.

38. What should the seller do if the buyer does not have an email or telephone?

If the buyer does not provide the seller with his subscriber number or address Email, the seller must print and give him a paper cash receipt or strict reporting form.

39. Does an organization (individual entrepreneur) have the right to use a cash register, the model of which was excluded from the State Register during its seven-year period of operation?

No, you have no right.

In case of exclusion of a cash register from the State Register of its further exploitation carried out before expiration regulatory period depreciation*.

Cash register equipment belongs to the fourth depreciation group- property with a term beneficial use over 5 years up to 7 years inclusive**.

Thus, in case of exclusion of the cash register model from the State Register deadline her further use should not exceed 7 years inclusive (regardless of the initial cost of such equipment).

At the end of 7 years of operation, there are no grounds to use a cash register excluded from the State Register.

40. How can I find out if the cash register is transmitting data to the operator?

Information about transferred checks can be viewed in the personal account of the cash register owner with the fiscal data operator.

41. What needs to be done to unblock a cash register that has worked for 30 days without an Internet connection?

Connect it to the Internet.

42. How is the fiscal drive replaced?

In accordance with legal requirements, the fiscal drive (FN) must be located in the cash register housing. The method for replacing the FN is indicated in the manufacturer's instructions and may differ depending on the model of cash register equipment. When replacing a fiscal drive, you must take into account that violation of the operating instructions may lead to loss of the manufacturer's warranty. Also, after replacing the FN, you will need to make changes to the CCP registration card. Changes can be made remotely through the KKT Personal Account on the website nalog.ru or in person at the Federal Tax Service.

43. Who is responsible for the reliability and uninterrupted transmission of data?

Before the data is transferred to the OFD, the owner of the cash register is responsible for the accuracy and uninterrupted operation. After receiving confirmation from the OFD, responsibility for the safety, completeness and further transfer of data shifts to the operator.

44. If the cash register does not send checks, we advise the client to take actions that in some cases really help:

Here are the current settings of the OFD Platform.

For combat FN

ip: ofdp.platformaofd.ru

Port: 21101

INN: 9715260691

For test FN

ip: ofdt.platformaofd.ru

Port: 19081

Society with limited liability"Evotor OFD"

NN: 9715260691

Here are the current settings of the First OFD.

The data of the cash register registered in the UI must match the data of the cash register that is planned to be connected to the Main site:

Server address and connection port: DNS name: k-server.1-ofd.ru

Connection port: 7777.

The data of the cash register registered in the UI must match the data of the cash register where testing is planned (Test site).

TIN, Reg. Federal Tax Service number, Serial number FN,

The server runs on protocol version 1.1 (as of 2016-06-24)

Server address and connection port: DNS name: kkm-server-test.1-ofd.ru

Connection port: 7777 (with FP check)

Here are the current OFD-Y settings.

For combat FN

ip: 91.107.67.212

Port: 7779

For test FN

ip: 91.107.67.212

port: 7790

If all this does not help, then ask the following information according to CCP:

1) CCP model

2) FN number

3) KKT firmware number

4) New cash desk or after modernization

5) Phone number of the client’s personal account where this cash register was added

6) Phone number of the contact person

7) Send information to technical support

- Check that the data entered into the cash register is completely identical to the data indicated in the Federal Tax Service (including that the OFD TIN is entered everywhere as 9715260691, and not 009715260691)

- Re-enter the OFD settings into the cash register.

- Reconnect the CCP to the Internet again, it is advisable to check another connection network

45. When registering a cash register system, does the operator allow you to encrypt customer data?

One of the main functions of the Fiscal Storage is encryption.

46. Recommendations for troubleshooting errors when connecting cash register devices to 1C software products

- Check that the installed 1C configuration supports changes to 54-FZ on the use of cash register devices.

- Check that the platform version is not lower than 8.3.8.2197. If 8.3.9 is used, then the PC architecture must be 32-bit.

- If the user has an ATOL cash register and AFTER fiscalization of the FN he has the error “2001.0.0 0:20:0.0" is not a valid date and time", then the user needs to update the ATOL cash register firmware to version 2282 and higher. Flashing the cash register is performed by an authorized service center (STO).

- If the user has a cash register terminal Shtrikh-M (as well as Retail-01F or RR-electro) and has an error in calculating discounts and markups, then the user must check the mode of discounts and markups in the cash register system (Table 17, Field 3, the value should be 0). If the user cannot do this on his own, he must contact an authorized service center(TsTO).

- If you can’t figure out the error yourself, you need to prepare next package data to investigate the error:

- The order of user actions leading to the error.

- Description of the error from the Log.

- FN registration report (photo or scan), and also how was the FN fiscalized: through the 1C software interface or through the software of the cash register manufacturer?

- Find out the firmware version of the KKT.

For KKT ATOL:

Option 1:- Open KKM driver test: Start - All programs - ATOL - Drivers commercial equipment v.8 - Tests - KKM driver.

- Setting properties - Configure connection parameters to the cash register.

- Click test connection and take a screenshot.

- Turn off the CCP.

- Press the receipt tape rewind button.

- Turn on the cash register while holding the receipt tape rewind button.

- After the first or second sound signal(depending on the CCP model) release the tape rewind button.

- Scan or photograph the printed report “Information on CCP”.

- Open KKM Driver Test: Start - All Programs - Shtrikh-M - FR Driver 4.13 - FR Driver Test.

- Setting up properties - Configure the connection parameters of the cash register - Click OK.

- Status - Long request and take a screenshot.

- Provide KKT driver logs:

For KKT ATOL:- FprnM1C.log and FprnMSM.log files (default path C:\Users\_user_\AppData\Roaming\ATOL\DRIVERS)

- Specify the location of the log files: Start - All programs - ATOL - Retail equipment drivers v.8 - Driver management and open the "Logs" tab

- Enable logging in driver settings:

Open KKM Driver Test: Start - All Programs - Shtrikh-M - FR Driver 4.13 - FR Driver Test. - Setting properties - Additional parameters - Logs.

- Screenshots of settings KKM cash registers in 1C.

- Screenshot of KKT driver settings in 1C.

- Screenshot of CCP registration parameters in 1C.

47. OFD is not available. What to do?

Check common causes:

- Invalid OFD address in cash register parameters.

- Lack of Internet.

- If the network connection is for sending CCP data, the cable may be damaged.

- Incorrect setting of the data transfer service (for KKT ATOL).

Both enterprises and individual entrepreneurs should purchase cash registers. How to use it, what types are there, is it necessary to register and what are the nuances of use?

Basic information

In order for the state to control cash flow, cash register equipment is used. The main task is to record the receipt and control the timely delivery of revenue by the organization.

When choosing a device, it is necessary to take into account which equipment is most suitable for the organization in terms of parameters - installation location, load intensity, number of sellers, type of tape, whether the device can be connected to a computer.

If cash register equipment is faulty, you cannot use it. It is also not allowed to use an unregistered device. After choosing, you need to go to the technical service center, where cash register equipment is purchased.

A service agreement is also drawn up there. Without this, registration of the device will be denied. To register, you must visit the tax office in person. You can also entrust this to a technical service center. In this case you will need.

When calculating plastic card there are some peculiarities. Cash register equipment also records payment by card. The amount of cash (which the cashier will hand over at the end of the work shift) will not match the amount indicated on the counter.

This is due to the fact that when paying by bank card cash does not go to the cash register. This year, online cash registers began to be introduced into operations.

- will put into circulation a new electronic storage device;

- there will be no more fiscal funds;

- the cash register will have a function for transferring information to tax service;

- All enterprises will apply CCP, regardless of the type of activity;

- the receipt will contain the name of the product.

The essence of such a cash register is that information about the check is transmitted to the tax authorities via the Internet. The tax service can come with an audit at any time and check the receipt.

They pay attention to the data it contains. The check is also checked for authenticity. If it is discovered that it is counterfeit, then an accusation will be made of improper use of the cash register.

Such a violation means that the device is not operating in fiscal mode. The organization will be fined. The State Register of Cash Registers puts forward the following requirements for equipment:

- the device must have a housing, fiscal memory and storage for it, tape and a device that prints a receipt;

- ensuring printing of checks from the cash register;

- record data in the device’s memory;

- providing the ability to input and output information;

- have a watch;

- be in good condition;

- have a passport;

- The device must have “State Register” and “Service” signs.

The device is deregistered in the following cases:

- the organization ceases operations;

- the installation location of the cash register has changed;

- replaced legal address enterprises;

- malfunctions appeared;

- the device was excluded from the register;

- the owner has changed;

- The depreciation period has expired (7 years).

If an organization operates without a cash register, it faces a fine. If it is the first violation, a warning may be issued.

Penalties will also arise if an unregistered cash register is used or if the cashier punched the receipt and did not give it to the buyer.

For individual entrepreneurs, the amount ranges from 3 thousand to 4 thousand rubles, for organizations - 30,000-40,000 rubles. When using a cash register, there are positive sides and negative.

Benefits include:

The disadvantages are:

What it is

Cash register equipment is a machine that is equipped with memory; a device for calculating and issuing receipts to customers.

To regulate the engine rotation speed, a KKT controller is used. There are many device models, you need to select best option for a cash register.

Fiscal memory is a set of tools that provide registration and storage of data necessary for financial accounting or payment using a payment card.

Purpose of the object

Cash registers are used for the following purposes:

- maintaining accurate revenue records;

- increasing employee productivity;

- reduction of errors when paying for purchases;

- improvement sanitary conditions and hygiene during sales;

- reduction of time for calculating amounts.

The cash register performs the following functions:

- accounting of revenue in automatic mode - by waiters, sections, cash register;

- storage of revenue information;

- printing checks;

- recording the weight and cost of goods;

- registration of products that are returned.

The main purpose is to control the turnover of products and goods. Also used for financial settlements with people during the provision of services or sales.

Current regulatory framework

The operating rules are contained in, which was developed by the Department of Finance on August 30, 1993.

reads:

- when using a cash register, it is necessary to register it with the tax office;

- ensure the serviceability of the device, use it when making calculations;

- issue a receipt to the buyer when paying for the purchase;

- maintain and store documentation related to CCP.

Articles of Federal Law No. 54:

According to Order No. VG-3-14/36 of the State Tax Service, issued on June 22, 1995, the cash register must be registered with the tax service.

The use of cash registers is subject to the following laws and regulations:

- Federal Law No. 54 “On the Application of CCP”.

- “On the procedure for making cash financial payments.”

- Typical operating instructions.

- Technical requirements.

Emerging nuances

Exist certain nuances when using CCT. They apply to individual entrepreneurs. If he does not pay, then it is mandatory to use a cash register.

In the case of taxation, there is no need to establish a cash register. To keep records, it will be enough to use a check machine.

There is no need to register or register it. The only drawback is that in some cases the machine receipt does not have legal force.

Almost all cash registers have a warranty sticker, so you don’t have to buy a separate one.

Any KKM model subject to fiscalization - actions aimed at setting up the device, its startup and operation. Without this procedure, you will not be able to start using the device.

After fiscalization, you can issue checks containing the following information:

- name of the enterprise or individual entrepreneur;

- organization code;

- serial number of the cash register;

- date and time of purchase;

- check number.

The check must be cleared at the time the goods are released. To do this, you can put a stamp on it or tear it in a specially designated place.

Types of cash registers

The classification of types of cash registers depends on the design and scope of their application. Based on the type of functioning, devices are divided into autonomous and fiscal.

The first type works offline. In order for the device to function, it needs to be charged from time to time. Serves both for information input and output. Keyboard included.

The only negative is that there is no list of purchased goods in the receipt. The advantage of the device is that the device does not need to be tied to a trading software. This type ideal for those who work on the road.

The next type is fiscal registrar. Works as an output device. It is not intended for input, since there are no buttons on it. According to the area of application, CCP is divided into machines for trade, provision of services, hotels and restaurants, and sale of petroleum products.

By design there are:

According to the number of keys – one-, two-, four-key. According to the number of registers - with two, three, etc. Types of cash register equipment differ from each other in the following parameters:

- number of operations performed;

- number of cashiers and sections;

- the capacity of the amounts that are entered;

- number of prices;

- types of documents that are generated.

Registration in the state register

Registration of a cash register is carried out at the tax office. After passing mandatory procedures the inspector issues an identification card.

It must be stored at the address that will be indicated. Keep the card while using the cash register. After receiving the card, its owner becomes a tax payer.

During your first visit to the service, you must prepare the following documents:

- agreement technical support;

- cash register;

- statement.

If the organization's address, name or owner changes, it is necessary to re-register. It is carried out at the address where the card was first issued.

As soon as the documents are submitted, the inspector will conduct an inspection within 10 days, after which the re-registration process will begin. Upon completion, a new card will be issued.

You will need the following documents: a device registration card, an operating agreement, an application. Before applying for re-registration, you must find out the inspection requirements.

- documents were not provided in full or contain incorrect information;

- if the type of cash register is excluded from the register;

- the device is wanted;

- there is no agreement with technical service;

- reporting tapes are not reliable or were printed by another cash register.

During registration in State Register the following data is entered - brand and name of the manufacturer, software version of the program, type of activity and tax regime (of the enterprise that services the cash register), registration period.

Step-by-step instructions for registering the device:

- Buying a cash register. When choosing a model, you need to pay attention to the fact that the equipment has a “State Register” sticker.

- Conclusion of an agreement on maintenance. Do this in the city where the cash register was purchased.

- Registration. Individual entrepreneurs register at the place of their registration, enterprises - at the place where the device is installed.

- Visit to tax office with documents.

- Fiscalization.

- Entering data into .

- Receiving a registration card.

It will not be possible to register a cash register without an electronic control tape. This is a device that records the operations performed by the device.

The service life is a year and a month, after which control - the cash register is blocked. Any CCP model must be included in the register at certain period. After expiration, it can be extended.

Preparing for work

Operating cash registers is permitted to those who have studied standard rules and completed training. It is necessary to install the cash register in such a place that buyers can see the purchase amount. Preparation for work must be done every day.

The machine is wiped clean of dirt, refilled with tape (for receipts), and the inking mechanism is checked. To thread a receipt tape, you need to open the door of the mechanism, move the handle down and insert the tape.

You need to attach it in such a way that the winding is carried out counterclockwise. Before connecting the machine to the network, be sure to check that the electrical plug and cord are working properly.

Operating rules

Working with autonomous cash registers is not easy. While setting up the equipment, employees explain the operating rules.

These are:

- the equipment must be positioned so that the buyer has the opportunity to see the amount that is being broken;

- Before starting work, the cashier is obliged to check the equipment for serviceability, determine the correctness of the settings - date, time, etc.;

- during the purchase, the cashier/operator tells the buyer the amounts, takes the money and only after that punches the receipt;

- the receipt is given along with the change, the money for the purchase is placed in the box;

- If a paid item is returned, a receipt must be returned. Under the supervision of the administrator, the money is given to the client. Based on the receipt, a return report is drawn up at the end of the shift;

- at the end of the working day, the proceeds are given to the administrator or senior cashier, the data is entered into a special book.

Operation of the device is possible only after it has been placed for maintenance and registered with the tax authorities.

Everyone who works with a cash register has their own responsibilities.

The director of the organization (or deputy) is obliged to:

- turn on the cash register and, in the presence of the cashier, take readings, then compare them with the data recorded in the journal for the past day;

- if the indicators coincide, enter them into the journal for the current day;

- provide the cashier with coins and bills of different denominations;

- consult the employee on the rules of operation of the device.

Cashier responsibilities:

- prepare the cash register for operation - wipe off the dust, insert the tape, set the date and time;

- do not leave the device unattended or leave without notifying your superiors;

- You cannot change programs yourself;

- It is prohibited to store personal finances in a cash register;

- must prepare the proceeds for delivery.

FAQ

Those who use cash register equipment in their activities sometimes have questions. Let's look at them.

| Question - erroneous click on payout from the cash register | Answer - you can do this in the following way - make a contribution in the same amount and write an explanatory note addressed to the manager |

| The parish was opened by the previous shift | Cannot be corrected |

| The device shows error ZPR - 3 | You need to visit the tax office, take their password and enter it |

| The receipt prints blank | You need to make sure that the paper type is used for this cash register model |

| Duplicate check | It won't be possible to do this |

| Bad check | It is necessary to withdraw money from the cash register and deposit it again |

| Will it be possible to withdraw the collection on another day? | Yes |

| Buttons don't respond | It must be taken to a service center for diagnostics. |

| The check went through and after that a question mark pops up | You need to enter the operator password |

Who should use it?

Such machines should be used by any organization that sells goods, provides services and performs work, regardless of legal form.

You will not need a cash register in small trade, at the market, exhibitions, or working in stalls. There is also no need for a machine for trading from tanks, accepting glass containers, selling lottery tickets, newspapers and magazines.

You may not use a cash register in the following cases:

- if an individual entrepreneur or enterprise is located in hard-to-reach places;

- the type of activity is included in the list of those who are allowed not to use the equipment;

- when using strict reporting forms;

- if an individual entrepreneur or organization pays UTII.

The registration card has a date; after the expiration date, the cash register cannot be used.

What you need to know LLC

Society with limited type responsibility is required to maintain accounting records - bank, cash desk, make settlements with product suppliers, submit to the tax office

Online trading must also be carried out using a cash register, since an online store does not fall under the UTII regime.

Operation of the Cashier mode

The “cash register” mode is the main one. In this mode, the cashier punches the money and issues a check to the client.

Thus, the application cash registers Mandatory for both organizations and individual entrepreneurs.

Before you start working, you must familiarize yourself with the operating rules. Cash machine subject to registration with the tax office.

When using CCP, it is important to comply with legal requirements. If the equipment is faulty, it is not allowed to be used. Otherwise, you will face a fine.

In accordance with current legislative norms all individual entrepreneurs, legal entities those conducting commercial activities must use CCP. Devices of this kind have their own characteristics, they must be taken into account. We should not forget about the need to carry out timely...

On legislative level the need to carry out the registration procedure for cash register equipment is established. The use of such equipment is strictly necessary for conducting commercial activities in accordance with the legislation in force in the Russian Federation. All questions related to the use and...

- Fortune telling on paper with a ronglis pen

- Orange peels: uses, features and best recipes

- Homemade caramel syrup

- What is a spelling chart for schoolchildren

- How to soak meat in vinegar

- How to bake a meat pie - step-by-step recipes for preparing dough and filling with photos

- Pike cutlets "Original"

- What color were the insects you saw?

- Delicious snacks with a spicy touch: preparing salads with Korean carrots

- What is binge drinking: symptoms Alcoholic during binge drinking

- Psychosomatic factors of thyroid diseases Psychological causes of thyroiditis

- Recipes for squash preparations for the winter

- Preparing a milkshake with fresh aromatic strawberries in a blender

- Lunar calendar for December dream book

- Marshmallow recipe with sweetener: what to add to homemade dessert

- Puff pastries with cottage cheese, from ready-made puff pastry

- Sterlet recipes

- Why does a woman dream about a baby kangaroo?

- Runic inscription to attract customers for your business

- What do the numbers mean in fortune telling on coffee grounds?