Help 2 ndfl for the labor exchange. Certificate of average salary (form and sample filling)

Employment centers (labor exchanges) operate in each of the districts of Moscow and in the regions. Their task is to provide intermediary public services between the employer and the applicant. In order to register at the labor exchange, it is necessary to recognize a citizen as unemployed legally. Only then does a citizen have the right to receive unemployment benefits from the state. For registration at the Employment Center, you must provide a set of documents. Among them: passport, diploma, TIN, insurance certificate and income statement from the last job for the previous three months.

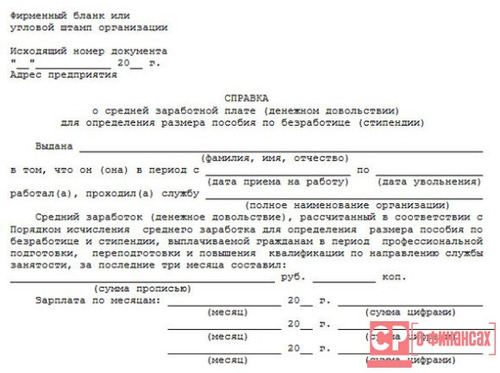

Certificate from the place of work: form and content

The reference form can be filled out in a standardized or free form. In any case, it must carry the information necessary for registration. The content of this document must contain the following details:

- Legal address of the company. It can be inscribed or stamped with an angle stamp.

- Round stamp. It must also be present on the document.

- TIN of the company as a sign that identifies a legal entity.

- Signatures of the chief accountant of the enterprise, head. Signatures must be decrypted.

- Surname, name, patronymic of the employee (in full).

- Date of employment, dismissal.

- Number of working days per week, type of employment.

To eliminate errors in filling out the certificate, it is better to take the appropriate form at the Employment Center. If the certificate is filled in incorrectly, you will have to return to work again, until the shortcomings in the document are eliminated.

One of the important points in the payment of sums of money to a former employee is the duration of the employment contract concluded with him. Salary for 3 months is calculated taking into account various factors, including work schedule, absenteeism (if any), etc. For employees of the Employment Center, the salary for the last 3 months is associated with the accrual of unemployment benefits.

Unemployed citizens recognized in this capacity in accordance with the established procedure receive benefits from the state. And the starting point in the amount of benefits is the salary that a citizen received at his former place of work.

Amount of benefits

In 2018, as in previous years, the amount of the benefit depended on the citizen's salary. In the first quarter, the unemployed receives 75% of the former salary, after 3 months the amount is reduced to 60%. For the remaining time, until the end of the prescribed 12 months, the amount of unemployment benefits is 45% of the citizen's salary.

The maximum unlimited amount of money will not be paid to the citizen. You shouldn't count on it. If the salary at the previous place of work was high, the citizen can count on the maximum amount of the benefit.

Download

You can download a sample certificate of the average salary for the Employment Center in .doc format

Average earnings are calculated on the basis of the Decree of the Ministry of Labor and Social Development of the Russian Federation of August 12, 2003 No. 62 "On approval of the Procedure for calculating average earnings for determining the amount of unemployment benefits and scholarships paid to citizens during vocational training, retraining and advanced training in the direction of the authorities employment services ", registered with the Ministry of Justice of the Russian Federation on October 23, 2003 (registration No. 5196).The certificate must be issued by the employer in accordance with the requirements "GOST R 7.0.97-2016. National standard of the Russian Federation. System of standards for information, librarianship and publishing. Organizational and administrative documentation. Requirements for paperwork" (approved by the Order of Rosstandart dated 08.12.2016 No. 2004-st) and contain the following details: corner stamp, round seal, certifying certificate, signatures of the head and chief accountant with a decryption, taxpayer identification number (TIN). If a legal entity does not have a corner stamp, the certificate should contain the following information in the upper left corner: the name of the legal entity, the name of the higher authority, if any, legal address, telephone. In the absence of the position of chief accountant in the employer's staff, the certificate can only be signed by the head.

In accordance with clause 3 of the Procedure, the settlement period is three calendar months (from the 1st to the 1st day) preceding the dismissal.

The time is excluded from the calculation period for calculating the average earnings, as well as the amounts accrued during this time, in accordance with clause 4 of the Procedure. If the employee for the billing period did not have actually accrued wages or actually worked days, or this period consisted of the time excluded from the billing period in accordance with paragraph 4 of this Procedure, the average earnings are determined based on the amount of wages actually accrued for the previous period of time, equal to the calculated one.

The average earnings of an employee is determined by multiplying the average daily earnings by the average monthly number of working days in the billing period (depending on the established duration of the working week in the organization).

Average daily earnings are calculated by dividing the amount of wages actually accrued for the billing period by the number of days actually worked during this period.

Awards and rewards, actually accrued for the billing period, are taken into account when calculating the average earnings in the following order:

- monthly for the same indicators - no more than one for each month of the billing period;

- for a period of work exceeding one month, for the same indicators - no more than one payment in the amount of a monthly part for each month of the billing period;

- remuneration based on the results of work for the year, one-time remuneration for length of service, other remuneration based on the results of work for the year, accrued for the previous calendar year, - in the amount of 1/12 for each month of the billing period, regardless of the time of accrual. At the same time, if the time falling for the billing period is not fully worked out, bonuses and remunerations are taken into account when calculating the average earnings in proportion to the hours worked in the billing period (except for monthly bonuses paid together with wages for a given month).

.

| Month | Wage. Amount accrued, (rub.) | Bonuses and other incentive payments. Amount accrued (rub.) | Completed. days (hours) actually | Number of days / hour. to be worked out (according to the schedule) | Periods from__ to__ during which the employee did not work, indicating the reasons | ||

| month. prem. | quart. prem. |

year. prem. | |||||

| january 2018 | 38 000 | 10 500 | - | 36 000 | 12 | 17 | from 15 to 19.01 b / sheet |

| february 2018 | 34 000 | 9 500 | - | - | 16 | 19 | from 26 to 28.02 business trip |

| march 2018 | 36 000 | 10 000 | 25 000 | - | 15 | 20 | from 12 to 16.03 vacation |

| Total | 108 000 | 30 000 | 25 000 | 36 000 | 43 | 56 | |

.

Calculation of the average earnings 25,000+ (36,000: 12) х3 \u003d 34,000 - the sum of the quarterly bonus and 3/12 of the annual remuneration.

34,000: 56x43 \u003d 26,107.14 rubles. - estimated value of the part of the quarterly bonus and annual remuneration, which is taken into account when calculating the average earnings in proportion to the hours worked.

(108,000 + 30,000 + 26 107.14): 43x18.667 \u003d 71,241.58 rubles. - average monthly earnings, where 18.667 is the average number of working days in the calendar of a 5-day working week for January, February, March 2018.

New form "Certificate of average earnings to determine the amount of unemployment benefits (scholarships)" officially approved by the document Letter of the Ministry of Labor dated August 15, 2016 N 16-5 / B-421 ..

More about applying the form:

- The procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of vocational training, retraining and advanced training in the direction of the employment service

... “On the approval of the procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the professional period ... to the organization with a request to provide a certificate of average earnings for the employment service. His official salary ... to the organization with a request to provide a certificate of average earnings for the employment service. Billing period (June ... to the organization with a request to provide a certificate of average earnings for the employment service. Billing period (June ...

- The procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of vocational training, retraining and advanced training in the direction of the employment service

...; “On the approval of the procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the professional period ... to the organization with a request to provide a certificate of average earnings for the employment service. His official salary ... to the organization with a request to provide a certificate of average earnings for the employment service. Billing period (June ... to the organization with a request to provide a certificate of average earnings for the employment service. Billing period (June ...

- Employment certificates: types and terms of issue

Labor, he will need a certificate of average earnings for the last three months at the last place of work ... information on the employee's average earnings for the specified period. We will give an example of filling out the recommended certificate form ... certificates should be recorded in the register of certificates issued to employees. A sample of filling out a certificate of average earnings to determine the amount of unemployment benefits (scholarships ...

- Calculation of average earnings to fill out a certificate for the employment service

The calculation of average earnings must be made in accordance with the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid ... increase. * * * In conclusion, we note that a certificate of average earnings for the employment service can be drawn up ... official salaries or allowances. The completed certificate of average earnings for the employment service must be provided to the employee ...

- The procedure for calculating benefits for temporary disability and benefits for pregnancy and childbirth

Copies of employment contracts. At the same time, certificates from a previous place of work are not ... with this, when determining the average earnings for calculating temporary disability benefits and maternity benefits ... receives unemployment benefits, scholarships, takes part in public works, the time required for moving in the direction of ... average earnings calculated in accordance with the legislation of the Russian Federation on benefits for temporary disability. " The maximum allowance for ...

- Social Security Benefits

The size of the average earnings at the place of work. The allowance is paid at the expense of the FSS of the Russian Federation. The basis for granting the grant is ... the amount of the scholarship established by the educational institution, but not the amount of the scholarship established by the legislation of the Russian Federation. The allowance is paid ...; a certificate from the state employment service that they do not receive unemployment benefits ... of Law No. 8-FZ, which determines the amount of social benefits for burial in areas where ...

- Other social insurance benefits

The size of the average earnings at the place of work. The allowance is paid at the expense of the FSS of the Russian Federation. The basis for granting the grant ... is in the amount of the scholarship established by the educational institution, but not the amount of the scholarship established by the legislation of the Russian Federation. The allowance is paid ...; a certificate from the state employment service that they do not receive unemployment benefits ... the provision of leave for the adoption of a child is determined by the Decree of the Government of the Russian Federation of 11 ...

- Maternity and childcare leave. Documenting

Scholarships - for women studying full-time in educational institutions of primary vocational, secondary ... limits the amount of maternity allowance for insured women, whose average earnings are ... 6,000 rubles. When determining the amount of monthly allowance for caring for a second child ... - a certificate from the state employment service that they do not receive unemployment benefits ..., as well as the procedure for calculating average earnings to pay for vacations, in general ...

- Reduce according to the law!

Earnings (child benefit, old-age pension or survivor's pension, scholarship, unemployment benefit and other earnings ... the decision to terminate employment with certain employees has been made ... the employee is paid severance pay in the amount of the average monthly earnings, as well. .. to find a job, then, according to the employment center, the employer is obliged ... to pay unemployment benefits, provide temporary disability benefits, consider opportunities for retraining ...

- Rostrud sent out a letter "On the form of a certificate of average earnings for the last three months at the last place of work"

About the form of a certificate of average earnings for the last three months at the last place of work "Failure to submit a certificate of average earnings ... for the last three months in the form approved ... and the calculation of unemployment benefits. Rostrud notes that the form of a certificate of average earnings for recent ... federal level reference form containing the necessary information to determine the amount of unemployment benefits and scholarships paid to citizens ...

- The Ministry of Labor recommends a new form of certificate issued to the dismissed for the employment service

I sent for use in work the recommended form of certificate of average earnings for the last three months at ... the last place of work. The certificate is used ... 62, which approved the procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period ...

This article will focus on help for the labor exchange. We will find out in what cases it is issued, how it is issued and by whom. Also, at the end of the article, you can download a sample certificate for the labor exchange, which is relevant for 2015. So, let's start with the situation in which a certificate is issued.

Help for the labor exchange

In what cases is a certificate issued and issued? Let's imagine a situation: your organization was downsized and many employees were “on the street”. Or, let's say they quit of their own free will. Naturally, due to the rapidly changing environment, employees were unable to prepare a “exit plan” in advance, that is, they could not find a new job. Therefore, it would be logical to assume that former employees will join the labor exchange to get at least some money before finding a new job. But how much money can an unemployed person receive on benefits? Good question. In general, the total amount of unemployment benefits is calculated by the employee's average earnings for the last 3 months that he worked in the organization. Of course, if your organization was the last place of work of this employee. Based on the above, we can conclude that an employee has every right, upon dismissal, to ask his organization for a certificate for the labor exchange, that is, a certificate of average earnings. To do this, ask him to write a statement and issue a certificate. Remember that the organization cannot refuse to provide this document, because the financial and life well-being of the former employee depends on it. If you are interested in reading about these processes in official sources, then open the Labor Code of the Russian Federation on article 62 and number 3 of the 91st year “On employment of the population of the Russian Federation. Let's make a reservation right away in order to save you from annoying oversights: the document for the employment service does not indicate the average salary, which turned out as a monetary compensation for unused vacation time and for severance pay. The average monthly earnings are calculated differently, we will tell you what to do.

How to draw up a certificate for the labor exchange?

Let's now look at how a certificate is issued for a labor exchange. We will warn you right away that there are no standards for this document. You have the right to issue such a certificate arbitrarily, relying only on some mandatory points. By the way, we recommend that you download a sample of filling out the certificate for the labor exchange, which you can find at the end of the article. An illustrative example will greatly facilitate your task. The main and most important item that is present in the help for the labor exchange is the details of your organization. This fact is confirmed by representatives of Rostrud in a published appeal dated November 8, 2010. The certificate for the labor exchange must indicate the organization's data, information about the employee, as well as the time period that he worked in the organization. Well, as we have already said, you should write the figure of the employee's average earnings for the last three months. Do not forget to write down exactly which three months were included in your calculations, because this information is also required by the employment service due to the fact that there are often cases when this period does not coincide with the last three months. If you issue a certificate for the labor exchange, you can safely forget about the 2ndfl format - it will not be useful to you, since the Employment Law implies other formats. Let's now step by step draw up instructions for filling out a certificate for a labor exchange. What we need for this: the Labor Code of the Russian Federation, a calculator, company details, employee documents, personnel certificates and papers, company seal, blank form issued by the employment service, the employee's accountants for the last year of work.

How to issue a certificate for the labor exchange?

Your organization probably has a corporate seal, so you can affix one at the top left corner. On the right side, we enter the individual tax number of the company, which is indicated in the certificate. We do this so that there are no contradictions with the tax service, because during the audit, it will find out that the amounts of the employee's benefits do not converge. Next, fill in the column "Issued by gr." There we enter information about the employee who was listed in your organization. Do not forget to write down the time period that the employee worked in your organization, based on the dates of admission and dismissal prescribed in the work book. After that, let's start calculating the average monthly salary of an employee. We add up all the money that was transferred to the employee in the last year. We exclude the time when the employee took administrative leave, that is, unpaid. Next, divide the total amount of money by the total number of working days for the last year. To make the calculations easier, use the calendar of working days.

So, we got the amount that the employee received on average per day. Next, we multiply the resulting number by the number of days that the employee worked in the month we need. We enter the final figure in the reference column for the labor exchange. All periods when an employee took administrative leave, skipped, took unpaid study leave, we enter in the required column and prescribe specific reasons. After all of the above, we collect the signatures of the glabukh and the head of the organization for reference. In doing so, do not forget to indicate their full names and positions held. We put the seal of the organization. Remember that in case of fraud or false information provided to the labor exchange, the persons indicated in the certificate will be responsible.

So, we figured out how to draw up a certificate for the labor exchange. We have established in what cases it is issued and by whom. Remember that writing this document is very important for your former employee. To see how it is filled in, download the sample from the link below.

Salary certificate - a document that contains information about the amounts of accrued wages to an employee of an enterprise (organization), as well as deductions for a certain period of time. The issuance of a certificate is not mandatory and is carried out exclusively at the request of an employee, which must be confirmed by his written statement. In the application, the employee must indicate the purpose of obtaining the certificate, and the organization, in turn, must provide it within three working days from the date of application.

Also, the information provided in the certificate will be useful to the social security authorities. Even upon dismissal or retirement, citizens need officially certified data regarding income for a certain period.

A certificate of income is needed in such cases: when applying for a loan, to receive assistance from the protection authority, in the process of dismissal, going abroad. And in each excluded case, there may be their own not mentioned nuances and design features. Many people need to have an idea of \u200b\u200bhow to fill out and receive such a certificate: an entrepreneur, an employee, a civil servant. And in each case there will be a different type of filling.

An organization (state enterprise, institution, individual entrepreneur, etc.) issues a certificate to confirm the place of work, position, length of service and salary of a person.

Such a document will be needed for registration:

- maternity;

- pensions;

- visas for travel abroad;

- subsidies;

- a bank loan;

- unemployed status (Employment Center);

- documents to the court and other institutions.

Each organization has an established form of the document, but a free one is also allowed.

Under the new legislation, in order to receive a document, an employee does not have to wait and ask.

At the very first written request within three days (Article 62 of the Labor Code of the Russian Federation), the management of the organization must submit the document to the applicant.

This information is confidential, protected by the Law "On Personal Data", therefore the certificate is handed over to the employee personally. Taking it away, you need to write a receipt, and the responsible officer writes it down in a special journal.

The outgoing number on the certificate, the date of issue must correspond to the number and date recorded in the journal.

An employee who leaves the company must issue a document on the day of dismissal. A former employee also has the right to apply for such a certificate by submitting an application.

In calculating average earnings, remuneration and bonuses are taken into account.

Example of a statement:

Help should contain

Each document has its own details. Salary certificate is no exception.

It should contain the following information:

- main state registration number (OGRN);

- taxpayer identification number (TIN);

- full details of the enterprise;

- the address;

- contact phone numbers;

- surname, name, patronymic of the employee;

- the document is certified with the seal of the organization.

Nuances: information is indicated only for one calendar year.

The head and chief accountant are required to sign the document.

The certificate is valid for up to 30 days.

The appearance of the salary certificate

There is no single clear form for drawing up a salary certificate. It is drawn up in any form by employees of the personnel department.

The main thing is that the correct amount of salary received by the employee is indicated:

- for all the years of work in the organization;

- per year;

- a few months.

Each organization sets the form of the document independently, taking as a basis the existing form - for example, a bank or another organization.

Only the head of the enterprise, the head of the personnel department, the chief accountant has the right to certify the document. The document must be stamped with the company.

Salary certificate (sample):

Samples download:

When is this certificate needed?

The salary document will be required to be submitted to the Pension Fund for calculating the pension.

It should contain complete information on annual payments, and not averaged over several months.

When calculating, all official payments are taken into account:

- for work on weekends;

- for part-time job;

- overtime.

For the calculation, they do not take payments issued upon dismissal, payment for unused vacation.

To apply for a pension, you need to present other documents:

- the passport;

- certificate of average earnings;

- original work book;

- if there is a disability, then a certificate.

When the organization (firm) is liquidated

The document can be issued by a higher organization or one that has become a legal successor after reorganization or renaming, indicating orders to change the details.

No assignees? All documentation must be archived. Its employees will issue a certificate by making an extract from the accounting documents.

If it is not possible to issue a document in the approved form, they have the right to draw up it on their own, based on the information that the archive has.

Inquiry to the embassy

Have you decided to go abroad on vacation or on business? The embassy of the country where you are going will also require a certificate confirming your income, in Russian and English.

In addition to the certificate, you need to provide other evidence of your solvency:

- bank statement;

- a document for an expensive car;

- document for a cottage, a prestigious apartment.

Advice: you will draw up a document for submission to the consulate, ask about its form there, because there may be nuances in the requirements for registration.

There is no way to contact the consulate - they will help you in a travel agency. After all, incorrectly designed paper can jeopardize the trip itself abroad.

For maternity leave

According to Russian legislation, every woman expecting the birth of a baby is guaranteed a state-paid vacation for 140 days.

After giving birth, she has the right to extend it until the child is one and a half or three years old. He will also receive state aid. To get it, you also need a salary document.

To receive financial assistance up to one and a half years of age, a child must submit:

- statement;

- baby's birth certificate;

- certificate of wages.

The allowance is calculated as follows:

- The average salary for the last two years is divided by calendar days for the same period (minus maternity leave, childcare, release time with pay, sick leave).

- Average daily earnings are equal to the limit divided by 730. Multiply by 30.4 and 40 percent. It turns out a monthly allowance.

Subtleties of design

Until 2013, there was no clearly established form of salary certificate, which is submitted to apply for assistance in caring for children under three years of age. It was compiled in free form.

Now, when filling out, you need to use the established form. Since the formats were not approved in a timely manner, pay attention to the periods of their validity.

The document is filled in by hand with a ballpoint pen. The ink is blue or black. You cannot clean up, fix. You can change the font, add lines.

Example:

A woman, while on maternity leave, worked part-time - this period is considered parental leave. When calculating monthly allowances, parental leave is excluded. The amounts earned during this time are taken into account in the average earnings.

A snippet of help:

For the Employment Center

The unemployment benefit to dismissed citizens during vocational training or retraining, if they were sent there by the employment service, depends on the salary at the last place of work. And you can't do without a salary certificate.

For example, a dismissed employee needed a salary certificate to be presented to the Employment Center.

Calculation scheme:

- 01.03.2015-31.10.2015 - worked period;

- working days - 63 (19 + 21 + 23);

- during this period, salaries were increased; salary: 35,200 rubles. (10,000 rubles + 12,600 rubles + 12,600 rubles).

- ratio \u003d 12600/10000 \u003d 1.26

- salary in the billing period \u003d 10000 * 1.26 + 12600 + 12600 \u003d 37800 rubles.

- average daily earnings \u003d 37800/63 \u003d 600 rubles.

- average monthly number of working days in the billing period \u003d 63 days / 3 months \u003d 21 days

- average earnings \u003d 600 rubles * 21 days \u003d 12600 rubles.

For social protection for a subsidy

Subsidies for housing and communal services and other social benefits are relevant for many.

The following are eligible for the subsidy:

- owners of apartments and houses;

- tenants of apartments;

- relatives who live with the tenant.

To receive a subsidy, you need to submit a salary certificate.

Example:

For submission to court

In court, where you will defend property and other rights, you will also need a salary document. It can be drawn up according to the sample established by the court or in free form.

Sample:

For what purposes a salary certificate is required for 3 months and for 6 months

In order to acquire the official status of a citizen who does not have a job and who is looking for it, it is necessary to submit a list of papers to the employment center, one of which must be certificate of average earnings for the 3 months preceding dismissal... This thesis is enshrined in clause 2 of Art. 3 of the Law of 19.04.1991 No. 1032-1.

Employment authorities, as a rule, do not have special requirements for the data format, therefore, the certificate can be created in any form. But it also happens that regional authorities approve a sample certificate of the average salary in their region, and if you do not follow it, the citizen may be denied acceptance of documents. Although, according to the letter of the Federal Labor Service of 08.11.2010 No. 3281-6-2, the submission of a certificate in an unidentified form should not be a reason for refusing to grant benefits due to loss of work.

The procedure for calculating the average earnings is carried out on the basis of the decree of the Ministry of Labor of the Russian Federation of 12.08.2003 No. 62.

In order to assess future risks and determine the threshold for disbursing funds, credit institutions require data on wages for 6 months preceding the date of the borrower's application. Although there is no fixed form for this document either, there is an established list of details that must be included in it:

- name and location of the company, contact details;

- seniority of the employee and the name of the rate occupied by him;

- the amount of accrued earnings for each month.

A certificate of average monthly earnings for six months will also be needed when applying to the social security, for example, to receive "children's" benefits or to register a subsidy for paying utility bills. In addition, applying for a visa to enter some countries will also require the submission of a certificate six months in advance (although other periods may be indicated).

In both latter cases, the details for drawing up the certificate will be similar to those required in the "bank statement".

The time period that should be taken into account when drawing up a certificate of average earnings depends on the purpose of its use. The most common in practice are the following intervals:

- 6 months - to obtain permission to enter a foreign country (information may be required 12 months in advance);

- 3 months - for employment agencies;

- 2 years - for the purpose of calculating sick leave, to confirm the amount of earnings;

- 5 years - for calculating pension payments.

2-NDFL and others

The most common form of a salary certificate, a sample form was approved by the Federal Tax Service (FTS) in 2015.

It indicates:

- Date of completion.

- Full name, INN, OKTMO code of the employer.

- Information about the employee. Surname, name, patronymic, passport and contact information, TIN, registration address.

- Income for the past period, with a monthly list.

- Deductions that have been received.

- Paid taxes.

but 2-NDFL form is not always needed, departments and companies come up with their own forms, and then a sample of a certificate of wages is issued at the place of demand, the employer is only required to fill in and certify it.

In some cases, a free-form document is sufficient.

In this case, the sample looks like this:

- Document header. Template form, indicating the full details of the organization.

- Document name: "Help".

- To whom it was issued. The surname, name, patronymic of the recipient is written.

- Text. It describes when and in what position the citizen worked, what salary he received.

- Signature and seal. Signed by the director and chief accountant, certified by the round seal of the enterprise.

Samples of writing references

Modern office work considers the form of writing "help is given" to be outdated. Now it is customary to describe the situation immediately after the word "help". It is easier to understand this with an example.

Example 1

Ivan Petrovich Sidorov worked at Open Your Business LLC for three years as a furniture purchasing manager. After his dismissal, he needed a certificate for a new place of work in order to accrue sick leave. If you write it in free form, then a sample free-form certificate of salary from the place of work for 6 months will look like this:

Limited Liability Company

"Open your business"

Address: Commercial, st. Entrepreneurs house 86 445047

Tel. 898-54-33, 344-54-32

OKPO 859548990, TIN 68065980,

KPP 48808677, OGRN 489687686

Ref. No. 433 dated May 32, 2017

Ivan Petrovich Sidorov worked at Open Your Business LLC since May 1, 2014 as a furniture purchasing manager. Over the past 6 (six) months, the salary was:

- __month__ 2016 - 10,000 rubles.

- __________ 2017 - 10,000 rubles.

- __________ 2017 - 10,000 rubles.

- __________ 2017 - 10,000 rubles.

- __________ 2017 - 10,000 rubles.

- __________ 2017 - 10,000 rubles.

Total income for 6 months amounted to 60,000 rubles.

The certificate was issued for submission to Close Your Business LLC. Director of Open Your Business LLC ___________ Sidorenko E.L. Chief Accountant _________ Petrenko N.D.

Sidorov I.P.

Since Ivan Petrovich worked in a Limited Liability Company, the document must be certified with a round seal and the outgoing number must be affixed to the certificate.

Example 2

Maria Sergeevna Commercial works for an individual entrepreneur Sidor Yegorovich Prikhodko as an air seller. She needed a certificate from the social security authorities. Here is a sample of how to write a certificate of salary for an individual entrepreneur.

Since Sidor Yegorovich does not follow the latest trends in office work, he draws up the document in the classic form:

IP Prikhodko I.S.

INN 45646537

It was given to Maria Sergeevna Commercial that she was actually hired by an individual entrepreneur Prikhodko Sidor Yegorovich as an air seller on January 15, 2016 with a salary of 50,000 rubles.

Prikhodko I.S. Date.

In this case, the document is certified only by the signature of the entrepreneur. The position of a chief accountant for an entrepreneur is optional.

Example 3

This example shows another sample of an LLC's average monthly wage statement. Nikolay Pavlovich Enterprising, works as a commercial director at LLC "Secret of Success".

Limited liability company

"Secret of success"

INN 5536566 KPP 00087666 PSRN 4655777777

445639, Russia, Samara region, Chapaevsk, st. Chapaeva, 6

No. 64 dated 07.12.2017.

Certificate This certificate was issued to Enterprising Nikolai Petrovich, passport 45 54 345345 issued on 12.12.2012. OUFMS of Russia in the Samara region of the Chapaevsky district. Registered at Russia, Samara region, Chapayevsk, st. Good luck, d.45, tax number 353555455, in that he really works as a commercial director at LLC "Success Secret" since 09/31/2012. and his salary is:

- __month _ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

- _________ 2016 - 100,000.

Total for 9 months of 2016 received income in the amount of 900,000 rubles.

General Director ___________________ Udachny P.E.

Chief Accountant ____________________ Unsuccessful M.N.

M.P. _____________ The date

Any of the three examples of the reference has full legal force, the style of the presentation of the information does not matter. In the event that documents of a certain form are required, a form is provided. Otherwise, the solution of the issue is completely shifted to the shoulders of the employer, and the requesting organization is ready to accept a document drawn up in free form.

Save, otherwise you will forget:

- How to correctly draw up a vehicle sales contract form (sample) and download it in different formats

- Registration of coursework according to GOST

- How to staple documents correctly

- Examples of general form design

- Orders in the organization: types and design features

- How to draw up an act correctly: registration, samples Act of an event

- The procedure for the preparation and execution of acts

- Layout of requisites on documents Rules for placing requisites in documents

- Organizational and administrative documents: Types, Functions, Drafting

- Sighting a document How to properly endorse documents sample

- Criminal Prosecutor

- My Arbitrator: Arbitration Cases File

- Success fee in legal practice review of controversial litigation by bulls a

- Features of drawing up a testamentary assignment Non-property testamentary assignment

- Form of the certificate of completion - sample

- Waybills for a rented vehicle without a crew

- We fill in the employee's personal card

- Employee's personal card

- Features of the annual power of attorney for obtaining goods and materials and a sample document for download

- What if the employer does not accept the letter of resignation?