Justified and documented expenses incurred by the taxpayer. The concept of economically justified and documented costs

In accordance with Chapter 25 of the Tax Code of the Russian Federation, profit Russian organizations is defined as income received reduced by the amount of expenses incurred. In this case, only justified expenses are recognized, i.e. economically justified and documented costs. Therefore, in order to correctly calculate corporate income tax, in addition to other conditions, it is necessary to understand what “economically justified costs” are.

Economically justified costs mean the following costs:

v due to the purposes of generating income;

v satisfying the principle of rationality;

v due to business customs;

Income-related expenses are expenses incurred for the purpose of generating income. It should be noted that this feature is directly established in paragraph. 4 paragraphs 1 art. 252 of the Tax Code of the Russian Federation.

The principle of rationality is not defined in current legislation. One can only assume that the principle of rationality presupposes reasonable approach to the implementation of costs, i.e. assessment required size. In fact, we're talking about about expediency.

Cost feasibility relates to economic activity organization and should not be regulated by tax legislation. Tax legislation indicates with what fact of economic activity the tax consequences, but does not regulate the relationships themselves leading to tax consequences.

In accordance with Art. 5 of the Civil Code of the Russian Federation, business customs are recognized as established and widely used in any area entrepreneurial activity rule of conduct, not provided for by law, regardless of whether it is recorded in any document.

When determining the economic justification of costs, it is necessary to proceed from several principles. One of the basic principles is that taxes must have an economic justification and cannot be arbitrary. Economic basis income tax is the profit received by the taxpayer. In order to correctly determine the amount of profit, it is necessary to take into account all the costs incurred by the taxpayer to generate income.

According to para. 4 paragraphs 1 art. 252 of the Tax Code of the Russian Federation, expenses are understood as any expenses incurred by the taxpayer for the purpose of generating income.

In addition, in tax accounting, the organization’s income and expenses must be confirmed with documents.

Until January 1, 2006 Art. 248 of the Tax Code of the Russian Federation, it was determined that income and expenses are recognized on the basis of primary documents. These are considered contracts, invoices and acts that contain all the details listed in Art. 9 Federal Law dated November 21, 1996 No. 129-FZ “On Accounting” (i.e. primary document must contain the name, date of compilation, name of the organization, content of the transaction, its natural and monetary measures, as well as the names and signatures of the responsible persons).

From January 1, 2006, income and expenses can also be recognized on the basis of other documents confirming the income received by the taxpayer (Article 252 of the Tax Code of the Russian Federation provides examples of such documents):

Documents drawn up in accordance with the business customs of the country in whose territory the costs were incurred;

Customs declaration;

Business trip order;

Travel documents;

Report on work performed under the contract.

Often during tax audits, inspectors refuse to recognize the economic justification of expenses and, on this basis, increase the tax base and the amount of income tax payable to the budget. Let us consider the issue of economic feasibility in more detail - when tax authorities Can additional taxes be assessed, but when will it be more difficult to do this?

Who should determine the economic justification of expenses?

The Civil Code of the Russian Federation (Article 2) defines entrepreneurship as an independent activity carried out at one’s own risk, aimed at systematically generating profit. Moreover, due to the principle of freedom economic activity(Article 8, Part 1 of the Constitution of the Russian Federation) the taxpayer has the right to individually assess its effectiveness and expediency.

That is, an entrepreneur (and by this word we mean entity) has the right to determine for himself how much money and what he should spend on in order to make a profit. Moreover, it is established by law (clause 5 of article 10 of the Civil Code of the Russian Federation) that the integrity of the participants civil legal relations and the reasonableness of their actions is assumed. In other words, suspect the entrepreneur that his expenses were made only for the purpose of reducing the tax base and tax burden no one has the right.

Problems of the concept of “economic feasibility of expenses” in Russian legislation

But our legislation is not ready to recognize all costs as reducing the tax base. Article 247 of the Tax Code of the Russian Federation emphasizes that for the purpose of calculating income tax, expenses are determined in accordance with Chapter 25 of the Code, namely (Article 252): justified and documented expenses are recognized as expenses. In this case, justified expenses are understood as economically justified expenses, the assessment of which is expressed in monetary form.

So, our legislation adheres to the second approach, developed by world practice: expenses are what is spent expediently (the first approach is different: expenses are what is spent).

That is, practically one, but fundamental word (“appropriate”) in the approach to taxation has given rise to the possibility of arbitrary interpretation business expenses, since the Tax Code of the Russian Federation does not define the concept of “economic justification”.

Economic feasibility of expenses in the practice of tax audits

As a result, tax authorities were able to broadly interpret the “expediency” of our expenses. Practice tax audits has developed a number of main reasons for recognizing expenses as unreasonable.

The expenses incurred did not result in any income.

For example, an employee was sent on a business trip to conclude a contract. The organization paid for his travel to and from the business trip and hotel accommodation. Paid daily allowance. All documents, including travel certificate with the appropriate notes from the receiving party, the employee provided. But, for a number of reasons, the task was not completed: the receiving party did not sign the agreement. Result: expenses for this business trip cannot reduce the taxable base for income tax.

Expenses do not match income.

For example, an organization purchased on credit a car executive class. Its depreciation and interest on the loan are included in expenses when calculating income taxes. However, the use of this car did not lead to a corresponding increase in income. Or organization management services are used. However, the costs of these services are disproportionate to the financial result obtained. Hence, these costs are economically unjustified and unjustified.

Expenses are not related to the taxpayer's activities.

For example, an organization purchased paintings, flower stands, flowers in pots and other interior items of this kind to decorate the office. Tax authorities often do not consider such expenses to be directly related to income-generating activities. If these costs are taken into account when calculating income tax, there is a high probability that during the audit it will be additionally charged, since, according to the tax authorities, there is no economic justification for the costs.

The expenses incurred resulted in a loss.

For example, the agent’s remuneration under the contract was several times higher than the profit from the sale and purchase transaction of the principal’s goods. As a result, the transaction as a whole (taking into account the amount of the agent’s remuneration) is unprofitable. Hence, attracting an agent under such conditions is unreasonable.

How should the term “economic feasibility” be interpreted? Position of the judicial system

Let's try to figure out how this term should actually be understood - economic feasibility of expenses? And here, first of all, let us turn to the position of the Plenum of the Supreme Arbitration Court RF, set out in Resolution No. 53 of October 12, 2006. In paragraph 9 of the said Resolution, the Plenum of the Supreme Arbitration Court determined that the court’s determination of the existence of reasonable economic or other reasons ( business purpose) in the actions of the taxpayer is carried out taking into account the assessment of circumstances indicating his intentions to receive economic effect as a result of real business or other economic activity.

That is, YOU do not consider it fundamental that expenses should immediately bring real income. The main thing is the organization’s intention now or in the future to make a profit.

Moreover, the very concept of loss is provided for by the Tax Code of the Russian Federation. They can even be (v. 283) transferred to the future. Thus, in accordance with the Tax Code of the Russian Federation even the loss itself can be recognized economically reasonable expense . If this is so, then the costs that the organization incurred in carrying out the activities that led to losses should also be considered economically justified. And such a condition is precisely the organization’s expectation to make a profit from its activities.

Subsequently, the position of the Plenum was confirmed by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 14616/07 of March 18, 2008. It states that hallmark expenses associated with production and sales (Articles 253 - 255, 260 - 264 of the Code) is their focus on developing production and maintaining its profitability. That is, not making a profit, but the intention to get it! Further, the Plenum of the Supreme Arbitration Court directly indicates that the Tax Code of the Russian Federation does not contain provisions allowing the tax authority to evaluate expenses incurred by taxpayers from the standpoint of their economic feasibility, rationality and efficiency, but in terms of legal position Constitutional Court Russian Federation, expressed in Resolution No. 3-P dated February 24, 2004, judicial control It is also not intended to check the economic feasibility of decisions made by business entities, which in the business sphere have independence and broad discretion.

Summary of the issue

Thus, the highest courts directly pointed out the inconsistency with the legislation of the Russian Federation of attempts by tax authorities to assess the economic feasibility of the actions of entrepreneurs.

However, we should not forget that with the right approach, inspectors can try to prove that certain expenses are aimed solely at obtaining an unjustified tax benefit in the form of attribution expenses incurred for costs. But this is much more difficult to do.

Accounting company"Taxcon"

There are still questions about economic justification expenses?.

A significant number of tax disputes are related to company expenses. The inspector’s main task is to prove that certain costs do not reduce the company’s taxable profit. The main task of the accountant is to convince him otherwise. This is not always easy to do. Here the main problem in the vagueness of a number of formulations Tax Code. After all, you will not find a definition of the term “economic feasibility,” as well as “justification” of expenses, in the Code.

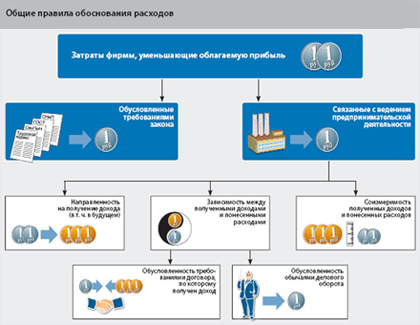

First of all, about the general rules for accounting for expenses. The company's expenses that reduce taxable profit must be related to its direct business activities. That is, one that is aimed at systematically making a profit. Therefore, when deciding on the economic justification of certain expenses, one must proceed from the specifics of the enterprise. For example, rental costs gym trading or manufacturing company are not related to its business activities. Therefore, for such an organization they will not be economically justified.

At the same time, similar costs for a sports, health or fitness center can be specialized and justified. The fact is that without it, the company will not be able to provide its services and, as a result, receive income. A similar situation may arise with other expenses: core expenses for one type commercial activities and non-core for the other.

By the way, there are exceptions to these rules. Certain costs that are not directly related to generating income may be subject to legal requirements. Let's turn to one arbitration case. The tax inspectorate tried to recognize the costs of paying for employee downtime as economically unjustified. Indeed, at first glance, with simple work, it is not possible to talk about the justification of labor costs. However, the company is obligated to pay employees for this time. Labor Code. The company has the right not to do this only in one case - if the employee himself is to blame for the downtime. In all other cases, “damages (losses) associated with payment for downtime do not depend on the will of the organization and cannot be considered as economically unjustified.”

At the same time, some costs, even if required by law, cannot be taken into account when taxing profits. Their list is given in Article 270 of the Tax Code. Such expenses, in particular, include payments for income tax, payments for excess emissions of pollutants, fines transferred to the budget, etc.

Let us add that costs must not only be justified, but also justified. That is, they must be paid according to market prices and be comparable to the amount of income expected or received. If a company pays expenses in obviously inflated amounts that do not correspond to market prices, then the tax inspectorate will have grounds to accuse it of unjustifiably receiving a tax benefit. And in case of unfavorable developments, such costs will be excluded from the company’s tax expenses.

Prepared Andrey Ozariev |

Let's formulate general norms, subject to which the company’s costs can be taken into account when taxing profits:

- there is a direct relationship between expenses and the company’s business activities aimed at generating income;

- costs are associated with the implementation of certain norms that are established by the current civil, labor or tax legislation (unless otherwise provided by the Tax Code);

- expenses are paid at prices that are either less than or equal to market prices.

The results of the company's activities, for example, based on the results of work for the year (i.e., profit or loss), as a rule, do not matter. It also does not matter whether a profit was made on a particular transaction or not. What is important is the purpose of paying certain costs. Simply put, a company must expect to make a profit or minimize its losses. For this reason, it does not matter, for example, that any goods were sold below their cost. In this situation, the costs of purchasing such valuables cannot be considered economically justified.

The results of the company's activities, for example, based on the results of work for the year (i.e., profit or loss), as a rule, do not matter. It also does not matter whether a profit was made on a particular transaction or not. What is important is the purpose of paying certain costs. Simply put, a company must expect to make a profit or minimize its losses. For this reason, it does not matter, for example, that any goods were sold below their cost. In this situation, the costs of purchasing such valuables cannot be considered economically justified.

Thus, the company must only expect to receive economic benefits from the transaction. However, the actual profit may not be made. This can also happen for reasons beyond the organization's control. For example, from unpredictable price fluctuations in the market, changes economic situation and so on.

Legitimate costs

As we have already said, regulations can help a company defend certain costs current legislation. Even if we are talking about those expenses that are traditionally considered controversial. The main thing is to know these norms. Various sanitary and epidemiological rules and regulations (SanPiNs) can provide invaluable assistance in this. The fact is that the employing company is obliged to provide sanitary services for workers. This is the requirement of Article 223 of the Tax Code. In addition, she must comply with the requirements sanitary legislation. In particular, “to carry out... measures to ensure safe working conditions for humans and to comply with the requirements sanitary rules and other regulatory legal acts of the Russian Federation to production processes And technological equipment, organization of workplaces... the regime of work, rest and consumer services workers..."

So, in rooms where computers are located, ventilation should be carried out after every hour of operation. Such a rule allows you to include in tax costs the cost of fans or air conditioning systems necessary for ventilation. Windows in rooms where it is installed Computer Engineering, must be equipped with “adjustable devices such as blinds, curtains, external canopies, etc.” . Accordingly, the cost of purchasing blinds can also be considered necessary for the company. We add that employees who work at a computer more than 50 percent of their working time must undergo regular medical examinations.

In a similar way, you can justify the cost of purchasing a heater or air conditioner for your office. Thus, “copying production premises are equipped with heating, ventilation and air conditioning systems.” Therefore, the cost of a heater (air conditioner) located in the room where the copier is installed should be considered economically justified. Read more about this in "AB" No. 3, 2008, p. 40.

By the way, the courts adhere to a similar position. Thus, the company’s expenses for restoration and restoration of lawns on production area the judges found it justified. The point is that carrying out similar works was due to the requirements of the relevant SanPiN.

In addition, the costs of developing and beautifying territories may be determined by the requirements of legislation on the protection of environment and dangerous production facilities. In this case, the company also has the right to include them in tax expenses.

|

Let us add that inspectors often require that certain expenses that were paid in violation of civil, labor or housing legislation be excluded from tax costs:

- for the rental of premises under an agreement concluded for a period exceeding one year, which has not expired state registration(civil legislation was violated);

- for payment overtime work employee whose duration exceeds 120 hours per year (violated labor legislation);

- to rent premises for an office, which belongs to the housing stock (housing legislation has been violated).

In the vast majority of cases, such demands are unfounded. The Tax Code does not provide that expenses can be taken into account for tax purposes only if all standards are met. tax legislation. Therefore, if a dispute goes to court, the arbitrators tend to side with the company.

In the vast majority of cases, such demands are unfounded. The Tax Code does not provide that expenses can be taken into account for tax purposes only if all standards are met. tax legislation. Therefore, if a dispute goes to court, the arbitrators tend to side with the company.

The contract will help justify the costs

Sometimes a company can justify costs by an agreement that was concluded with the customer and under which it receives income.

First of all, about the basic norms civil legislation that are related to the conclusion of the contract. Thus, it is considered concluded if an agreement is reached between the parties on all essential conditions agreement. In particular, they consider any conditions “regarding which, at the request of one of the parties, an agreement must be reached.”

Thus, if the agreement with a partner (buyer) states that the company is obliged to pay certain costs, then they will be considered economically justified. Indeed, if these conditions are not met (i.e., payment of expenses), the fulfillment of the contract itself and, consequently, the receipt of income become impossible. Thus, the supply agreement must clearly indicate which party bears the costs of delivering the goods to the buyer’s warehouse. If this is the seller's responsibility, then such expenses will reduce his taxable income.

A similar approach can also be applied to those costs that, at first glance, are non-productive in nature. Let's give conditional example. The company rents out premises. According to the contract, the landlord is obliged to ensure that there is a TV and a refrigerator in the premises and to maintain these equipment in good condition. in good condition. IN in this case the costs of purchasing such equipment can be considered economically justified. As well as the cost of repairing it. After all, without paying these expenses, it becomes impossible to conclude a lease agreement under which the company plans to receive taxable income.

Business customs

In some cases, a concept such as business custom helps justify costs. Its definition is given in Article 5 Civil Code. According to this document, “a business custom is a rule of behavior that has been established and widely applied in any area of business activity, not provided for by law, regardless of whether it is recorded in any document.”

True, in the Tax Code such a concept is used only in one case. Namely when documentation costs. By general rule expenses are confirmed by documents drawn up in accordance with the legislation of the Russian Federation. But if the costs were incurred in the territory foreign country, then the papers are drawn up in accordance with the business customs of the corresponding country.

However, the term is sometimes used by courts to justify a firm's costs. For example, according to the tax inspectorate, the company unlawfully reduced profits for the costs of asphalting the area adjacent to the building, which was leased. The court did not agree with this opinion.

However, the term is sometimes used by courts to justify a firm's costs. For example, according to the tax inspectorate, the company unlawfully reduced profits for the costs of asphalting the area adjacent to the building, which was leased. The court did not agree with this opinion.

There is a reference to business customs in a number of other court decisions. For example, according to the judges, “economically justified expenses should be understood as expenses determined by the goals of generating income, satisfying the principle of rationality and determined by business customs.”

In conclusion, we note that this term was also used in methodological guidelines on the application of Chapter 25 of the Tax Code on income tax. However, this document has now been cancelled. Therefore, this argument must be used extremely carefully when justifying costs.

|

|

- Banana-nut sponge cake in a slow cooker, photo recipe Chocolate sponge cake with banana in a slow cooker

- Whole chicken baked with garlic and pepper

- Cod liver salads for every taste Cod liver salad with green peas

- Recipes for squash preparations for the winter

- Preparing a milkshake with fresh aromatic strawberries in a blender

- Lunar calendar for December dream book

- Marshmallow recipe with sweetener: what to add to homemade dessert

- Puff pastries with cottage cheese, from ready-made puff pastry

- Sterlet recipes

- Why does a woman dream about a baby kangaroo?

- Runic inscription to attract customers for your business

- Real benefits and mythical harm of dates for the human body

- Curry with chicken and rice - exclusive recipe with step-by-step photos Rice with curry seasoning recipe

- Time delay prefix pvl Structure of the symbol

- Was Nicholas II a good ruler and emperor?

- An educational resource for thinking and curious people

- Saint Venerable Barnabas of Gethsemane (1906), founder of the Iversky Vyksa Monastery

- How do prayers in front of the Old Russian Icon of the Mother of God help? The Old Russian Icon of the Mother of God is located

- Chernigov Gethsemane icon of the Mother of God Prayer to the Ilyin Chernigov icon

- Coconut panna cotta recipe with photo and banana Recipe Vegan panna cotta made from coconut milk

Swedish nightclub dancer Lia Damen had plastic surgery in 1999. When it came time to pay taxes, she entered the amount of money spent on this procedure in the declaration section "

Swedish nightclub dancer Lia Damen had plastic surgery in 1999. When it came time to pay taxes, she entered the amount of money spent on this procedure in the declaration section "  Let's consider this situation. The company invites a famous artist to film a commercial. At the same time, at the request of the artist, which is reflected in the contract with him, he is provided with personal security. Is it possible to reduce taxable profit for such security expenses?

Let's consider this situation. The company invites a famous artist to film a commercial. At the same time, at the request of the artist, which is reflected in the contract with him, he is provided with personal security. Is it possible to reduce taxable profit for such security expenses?  In accordance with Article 252 of the Tax Code, expenses of an organization are any expenses aimed at generating income. They must be economically justified and documented. Then they can be taken into account for the purpose of calculating income tax. An important factor in this case is the commensurability of the organization’s expenses with the subsequently received

In accordance with Article 252 of the Tax Code, expenses of an organization are any expenses aimed at generating income. They must be economically justified and documented. Then they can be taken into account for the purpose of calculating income tax. An important factor in this case is the commensurability of the organization’s expenses with the subsequently received  Costs associated with compliance with business customs can be taken into account for the purpose of calculating income tax. This follows from Article 252 of the Tax Code.

Costs associated with compliance with business customs can be taken into account for the purpose of calculating income tax. This follows from Article 252 of the Tax Code.