Tax period 6 personal income tax for the 3rd quarter. How to fill out a report when salaries are paid after the end of the reporting quarter. Reorganization and liquidation: what codes to indicate

The period for providing 6-NDFL for the 3rd quarter of 2017 is regulated by Art. 230 Tax Code of the Russian Federation. Read about the nuances of timely preparation and submission of calculations in the article.

General information about reporting 6-NDFL

The obligation to form and provide tax authorities quarterly calculation of personal income tax, transactions for which were carried out within the framework of tax agency, is established by clause 2 of Art. 230 Tax Code of the Russian Federation. The same article also defines the deadlines within which the calculation must be submitted.

The form and procedure for generating the calculation are determined by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450. Tax agents for personal income tax, regardless of whether they are legal entities or individual entrepreneurs, are required to provide calculations to the Federal Tax Service within the established time frame.

About who current legislature defines how tax agent as part of settlements with individuals, read the article .

NOTE! Section 1 of the calculation is compiled on an accrual basis, that is, the 6-NDFL submitted for the 3rd quarter is actually a report for 9 months from the beginning of the year.

Deadlines for submitting payments

Calculations for personal income tax must be submitted to the Federal Tax Service no later than:

- April 30 - for the 1st quarter;

- July 31 - for the 2nd quarter (1st half of the year);

- October 31 - for the 3rd quarter (9 months);

- April 1 of the year following the reporting year - for the year (12 months).

For each of these periods a special code designation, which is placed on the title page of the calculation:

- 1st quarter - 21;

- 2nd quarter (1st half of the year) - 31;

- 3rd quarter (9 months) - 33;

- year (12 months) - 34.

IMPORTANT! For tax agents terminating their activities and reorganizing, their own period codes have been established. This is due to the fact that actual liquidation or reorganization may not occur strictly at the end of the period, but during it. Then a special code is selected for the period in which the last personal income tax payments occurred under the old employer status:

- 51 - if the activity in the previous status was completed in the 1st quarter;

- 52 - in the 2nd quarter;

- 53 - in the 3rd quarter;

- 54 - in the 4th quarter.

Submission of calculations for the 3rd quarter of 2017

We have given the deadlines for submitting 6-NDFL for the 3rd quarter above. Let's look at some of the nuances typical for reporting specifically for this period.

Firstly, it is worth noting that the traditional holiday season continues in the 3rd quarter. Payments of holiday pay lead to special order formation of section 2 of the calculation. Each payment for vacation is entered into section 2 in a separate block. As a result, if there are a lot of vacationers, one sheet with section 2 may not be enough. Then to enter data you need to add calculation sheets. Moreover, in the additional sheets:

- section 1 is left blank;

- in section 2, those data that do not fit on the previous sheet(sheets).

Secondly, in the 2nd and early 3rd quarters, actual payments of dividends calculated for last year. This delay is due to the fact that first annual reports are prepared, then the owners approve them, and only then dividends are distributed. Reflection of dividends in the report also has its own specifics.

For more details, see the article. .

Thirdly, the peculiarities of the formation and submission of 6-NDFL may be associated with the presence of separate divisions of the tax agent. Served separately individual reports 6-NDFL, and in the same order and with the same nuances that we described above for one report.

Some nuances that are useful to know

If it happened that in reporting period there were no transactions with Personal income tax for individuals, you don’t have to submit the calculation. This was explained by the tax office in a letter dated March 23, 2016 No. BS-4-11/4958@. In this case, one should take into account the fact that the calculation should be compiled on an accrual basis. That is, if, for example, in the 1st and 2nd quarters taxable Personal income tax payments were, but not in the 3rd, then the report for 9 months and a year still needs to be submitted (it will contain information). But if, for some reason, the organization accrued income subject to personal income tax, calculated and withheld tax only in the 3rd quarter, then the report for the 1st quarter and half of the year does not need to be submitted. However, if you wish to submit a zero calculation, this is also allowed. And the Federal Tax Service must accept such a report.

If the calculation was submitted with an error and the tax agent himself discovered this, an updated calculation must be submitted.

NOTE! Errors in 6-NDFL are corrected only by clarifications, of which there can be any number. There are no other ways to correct the situation with incorrect data in the calculation.

The correct information must be entered into the clarification and the correction number must be indicated in a special column on the title page. The first adjustment, accordingly, is 001, the second is 002, and so on until there is no need for adjustments.

IMPORTANT! Due to the fact that 6-personal income tax is compiled on an accrual basis, errors can move from more early quarter Next. If this happens, you need to correct all quarters with an error in the adjustment calculations.

Results

Deadline personal income tax report for the 3rd quarter of 2017 is defined in Art. 230 Tax Code of the Russian Federation. The closing date is the last day of October 2017. The content of the report that needs to be generated and submitted will be a report for 9 months of 2017, since section 1 will include data from January to September 2017.

The obligation to submit a 6-NDFL report appeared not so long ago, and filling out the form still raises questions for many accountants. The article discusses different cases accrual of income to employees with examples of filling out 6-NDFL for the 3rd quarter of 2017 for different situations.

The Federal Tax Service returned 6-NDFL and you don’t know what to do? Step-by-step instruction is in the article ""

Rules for filling out the 6-NDFL report for the 3rd quarter

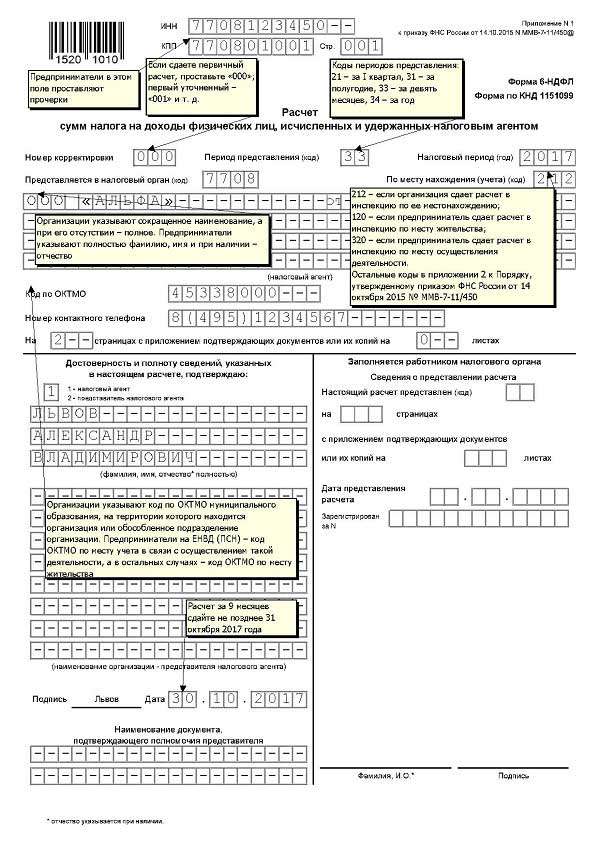

There are no specific features for filling out the title page of the personal income tax form. Just like in many others tax reports, fields are filled in:

- zero is placed in the adjustment number field;

- 33 – in the field of the period for which the report is provided (33 means 3rd quarter);

- 2017 – in the field of the year for which the report is provided;

- code tax office;

- The location code is filled in depending on who submits the report and where (organization at the place of registration, separate division, individual entrepreneur at the place of registration of the individual, etc.);

- OKTMO code is filled in according to municipal entity with which the tax agent is registered;

- contact phone number;

- number of report sheets and attachments;

- section with the details of the person submitting the report, his signature and date.

See below for a sample title page.

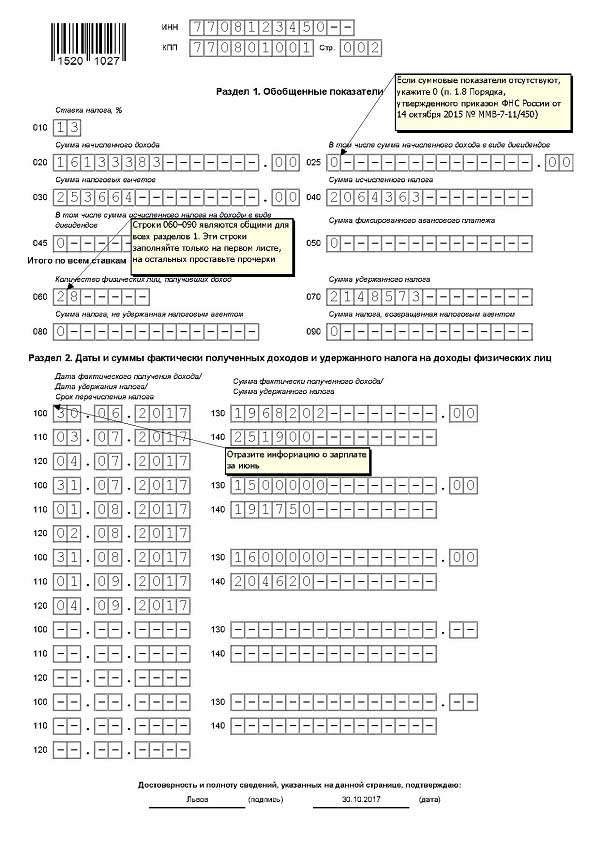

But filling out the sheet, which contains sections 1 and 2, has a number of nuances.

First of all, for each rate at which the tax agent withheld personal income tax from any individual, you must fill out separate sheet. This rate is indicated in field 010.

In this case, fields from 060 to 090 are filled in only on one sheet with generalized indicators for all bets. The same applies to the entire section 2. The legislation does not require it to be divided by rates.

That is, if the tax agent had personal income tax withheld according to different rates, then the following situation will arise:

- on the first page of sections 1 and 2, lines 010, 020, 030, 040, 060, 070 (025, 045, 050, 080, 090 if data is available) and 100, 110, 120, 130, 140 in the second section will be filled in;

- in all subsequent pages of section 1 and 2 with other rates, lines 010, 020, 030, 040 (025, 045, 050 if data is available) will be filled in, and the remaining lines will be zero.

How to fill out 6-NDFL for the 3rd quarter of 2017: sample filling

The personal income tax reporting form was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450. The same document also regulates electronic format submitting the calculation.

Lawmakers established limit value The taxpayer's staff, in which it is possible to report personal income tax on paper, is 24 people. If the number of personnel is 25 people or more, then the report can only be submitted electronically.

The report reflects only those incomes that are subject to taxation. Moreover, if income is taxed at different rates, it is necessary to fill out the relevant sections several times with a breakdown of income according to the rates at which they are taxed.

Below is a sample of filling out sections 1 and 2 if you have income taxed at different rates.

How to fill out a report when salaries are paid after the end of the reporting quarter

Most often, the company pays wages twice a month, as required by Art. 136 Labor Code of the Russian Federation. The advance payment is paid before the end of the month, and the final payment is made in the month following the month paid (but no later than the 15th day).

In this regard, questions arise about how such payments and accruals should be reflected in the 6-NDFL report.

For example:

The Alpha LLC company has set a date for transferring the advance payment - the 28th of each month. And the final payment date is the 15th day of the month following the month being paid. The activities of Alpha LLC began in September 2017, previously wage was not accrued or paid. For September, the amount of remuneration for all employees amounted to 236,570 rubles. None of the employees are entitled to personal income tax deductions. Income tax amounted to RUB 30,754. On September 28, 2017, an advance was paid in the total amount of RUB 100,000. The final payment will be made outside the reporting quarter - October 13, 2017 (the 15th falls on a day off, payment was made the day before). The final payment amount is RUB 105,816.

The advance payment is not yet income, so it is not included in the nine-month 6-NDFL report. This means section 2 will remain blank on the form for the 3rd quarter of 2017. But section 1 will include the amount of accrual of the entire salary and total amount calculated tax. The table below indicates which amounts and dates will be included in which reports:

|

Index |

Amount/date |

Line |

Period for which the report is provided |

|---|---|---|---|

|

Accrued salary |

|||

|

Calculated income tax |

9 months of 2017 and annual report |

||

|

Number of persons to whom income is accrued |

9 months of 2017 and annual report |

||

|

Amount of tax withheld |

Report for 2017 |

||

|

Date of receipt of income |

Report for 2017 |

||

|

Report for 2017 |

|||

|

Deadline for personal income tax transfers |

Report for 2017 |

||

|

Actual income received |

Report for 2017 |

||

|

Amount of personal income tax withheld |

Report for 2017 |

6-NDFL for the 3rd quarter of 2017: example of filling out a report with vacation pay

A special feature of the report for the period in which one of the employees was paid vacation pay is that the law provides for a longer period for paying the withheld personal income tax.

The date of actual receipt of income according to the norms of Article 223 of the Tax Code of the Russian Federation, as well as the letter of the Ministry of Finance dated January 26, 2015 No. 03-04-06/2187, is defined as the actual date of payment of vacation pay (as opposed to salary, when this date is considered last date month for which wages are calculated).

At the same time, the permitted period for payment of withheld personal income tax is postponed to the last day of the month in which vacation pay is paid. This is stated in paragraph. 2 clause 6 art. 226 Tax Code of the Russian Federation.

For example:

According to the vacation schedule, the employee is granted vacation from August 10 to August 27, 2017. According to Article 136 of the Labor Code of the Russian Federation deadline for vacation pay – August 7 (3 working days before the start of the vacation). Vacation pay was accrued in the amount of 49,295 rubles, and personal income tax subject to withholding was 6,408 rubles. The accountant met the deadline and paid vacation pay on 08/07/2017. The date of actual receipt of income and the date of tax withholding in cases of vacation pay will always coincide. And for a period personal income tax payment will always be the last day of the same month. In our example, this is 08/31/2017.

Below is an excerpt from a report completed based on this data.

Filling out 6-NDFL for the 3rd quarter of 2017 using the example of a report with payments upon dismissal

Paragraph 2, paragraph 2, art. 223 of the Tax Code of the Russian Federation states that when an employee is dismissed, the date of receipt of his income will be the last day he worked. This date should be included in line 100.

According to Article 140 of the Labor Code of the Russian Federation, the final payment upon dismissal is made on the employee’s last day of work. But the code provides for later payment to former employee, if he did not work on the last day for some reason (sick leave, vacation subsequent dismissal and so on.). In such situations, the employer is obliged to make the final settlement with the individual not later in the day, following the call former employee. The actual date of payment of income, and therefore the withholding of personal income tax, will appear in line 110.

Below is a sample of filling out lines 100 – 140 for the payment paid upon dismissal based on the following data:

- the employee was fired on September 19, 2017;

- payments upon dismissal (salary for part of September, compensation for unused vacation) amounted to 37,250 rubles, and personal income tax on these charges amounted to 4,843 rubles. (the employee had no rights to deductions);

- in compliance with the law, the employer transferred both the amounts to the former employee and the tax on his income on September 19, 2017;

- according to paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the final deadline for payment of withheld personal income tax is the next working day after the actual payment of income, i.e. 09/20/2017.

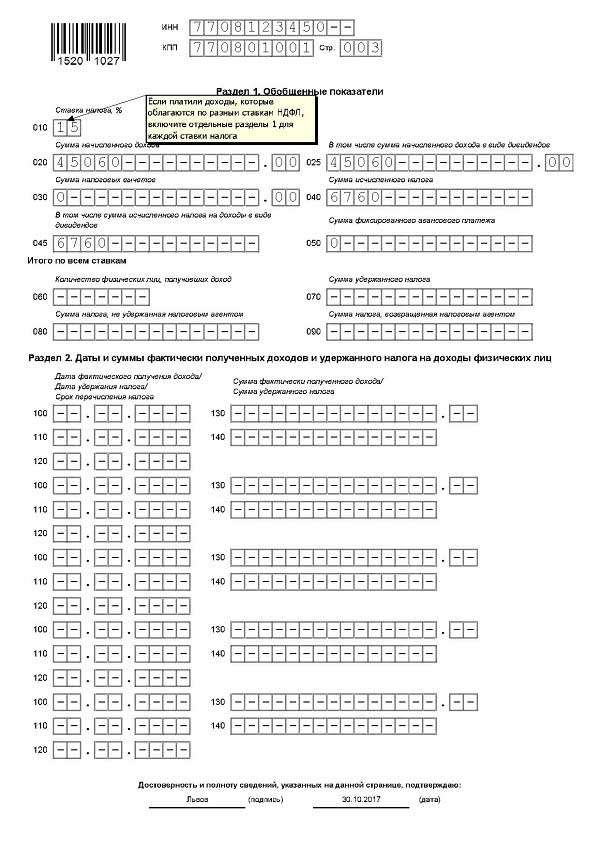

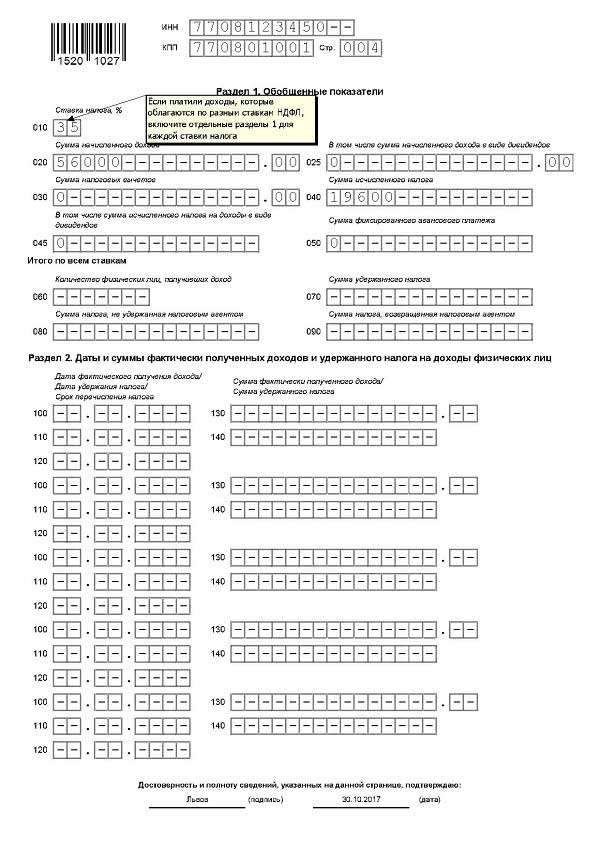

6-NDFL for the 3rd quarter of 2017: sample filling in the presence of accruals for dividends addressed to non-residents

Dividends from participation in Russian organizations, which are received by non-residents, are taxed at a rate of 15% (clause 3 of article 224 of the Tax Code of the Russian Federation). For such a bet, you must fill out sections 1 and 2 separately. Below is a sample of filling out these sections, based on this example:

In April 2017, Alpha LLC distributed profits based on the results of annual meeting for 2016. It was decided to send retained earnings in the amount of 45,060 rubles. the only member of the Society – Petrenko Sergei Alexandrovich, who since 2015 has a residence permit in the UK and spends his time there most of the year.

Let us recall that the criteria for classifying individuals as tax residents and non-residents are described in paragraph 2 of Art. 207 Tax Code of the Russian Federation. If an individual spends more than 182 days in Russia during the year, then this person pays taxes as a resident. IN otherwise this person is subject to special conditions(different rates, no rights to deductions). There are exceptions such as long absence in Russia for treatment or study.

In the above example sole participant Alpha LLC is not tax resident. Therefore, personal income tax on dividends accrued to him amounted to 6,760 rubles. (45,060 * 15%).

Since the accrual and payment occurred in April 2017, in the report for 9 months only section 1 was filled in, and the fields of the second section were left empty, since there were no movements.

An example of filling out 6-NDFL for the 3rd quarter of 2017 in the absence of accruals throughout the year

Some sources, referring to the letter of the Federal Tax Service dated March 23, 2016 No. BS-4-11/4958@, say that zero reports do not need to be submitted. At the same time, the position of the tax authorities is ambiguous. Of course, the fine for failure to submit a report can be repaid in judicial procedure, but it’s better to avoid disputes with the tax authorities.

As an alternative zero report You can submit a letter to the tax office with the following content:

To the Interdistrict Inspectorate of the Federal Tax Service No. 8 for Moscow

from Alpha LLC

TIN 7708123450

Due to the lack of financial and economic activity in the period from January to September 2017, wages were not accrued or paid. The report on Form 6-NDFL for the 3rd quarter is not provided.

General Director (signature) /A.V. Lviv/ 10.10.2017

Form 6-NDFL for the 3rd quarter of 2017: sample completion if there are accruals in the first quarter and no accruals in later periods

Report 6-NDFL is filled out with an accrual total. That is, the report for the 3rd quarter is not such, it is filled out based on the results of activities for 9 months of the year. Therefore, if there are movements in personal income tax in at least one of the previous quarters, it will be necessary to submit a report up to the annual one.

For example, Alfa LLC carried out activities only in the first quarter, after which some of the employees were fired, and the director was given unpaid leave. In 2016, all calculations were made in December, so in 2017 the amount of accrued, withheld and paid personal income tax is the same. The report will only contain title page and section 1, and in section 2, dashes will be placed on the same sheet. Below is an example of such a report.

Who and how often submits a report on Form 6-NDFL?

Report 6-NDFL is submitted quarterly. The obligation to report on this form falls on tax agents who withhold personal income tax from the income of individuals. Tax agents can be employers who pay monthly remuneration employment contracts, and organizations or individual entrepreneurs who paid to an individual its services or goods, even if it happened once.

To fill out the 6-NDFL report form, you can use both popular accounting programs and a special product “Legal Taxpayer”, developed by tax authorities, which can be downloaded on the Federal Tax Service website. It is also possible to fill out the report manually with a staff of up to 25 people.

Urgently from the editorial office!

When filling out the 6-NDFL report, the accountant is required to indicate the tax period code on the title page. For each accounting period, the Federal Tax Service approved a specific code. But what does each tax period code 6-NDFL mean?

How many times a year is 6-NDFL submitted?

The report on Form 6-NDFL must be filled out and submitted every quarter, that is, 4 times a year:

- for the first 3 months of the year;

- within 6 months;

- in 9 months;

- for the entire reporting year.

When filling out the report, do not forget to indicate the year of completion. Reporting year indicated in the line “Tax period”.

What are the period codes?

The list of period codes can be found in the first Appendix of the Filling Procedure. According to the information provided in this Appendix, each period has its own code:

- for reports for 3 months – code 21;

- for reports for 6 months – code 31;

- for reports for 9 months - code 33;

- for reports for 12 months - code 34.

From the above list it follows that the period code in 6-NDFL is indicated by the numbers 34.

Code 6-NDFL for the first reporting quarter

When drawing up a report for the first 3 months, in the “Submission period” line you need to indicate the numbers “21”. must match every value quarterly reporting, since both sections of the document indicate data for the first quarter of the reporting year.

Report codes for the second and third quarters

If the accountant fills out, then the numbers “31” are entered in the provision code column, and for the third quarter – the numbers “33”. Such encodings are used for reports with cumulative totals. It's about on advance payments for property tax or profit declarations.

As you can see, the report in Form 6-NDFL performs the functions of not only quarterly reporting, but also a report that is generated with a cumulative total.

Period code in annual reporting 6-NDFL

IN annual reports taxable period in 6-NDFL it is indicated by the numbers “34”. The first section of such a report contains data for the entire year. But in the second section, attention is focused on the last quarter of the reporting year.

For check indicated indicators in 6-NDFL it is recommended to use data from 2-NDFL certificates, as well as profit declarations for the same period.

Reorganization and liquidation: what codes to indicate

If the company was liquidated or a reorganization procedure took place, then in forms 6-NDFL it is necessary to indicate completely different codes, and not those discussed above. This is due to the fact that the report form is submitted for a period that does not correspond to the quarter. For such organizations, it is necessary to indicate the period from the beginning of the reporting year to the day when the process of reorganization or liquidation was completed. When liquidating or reorganizing, the following period codes should be indicated in Form 6-NDFL:

- for the 1st quarter - code 51;

- for 6 months – code 52;

- for 9 months – code 53;

- for 12 months – code 90.

For example, if the liquidation of the company took place in August 2016, then form 6-NDFL is filled out for the period from January 2016 to August of the same year. In this case, the period code in the document is indicated as “53”. August is the 8th month of the year, which belongs to the 3rd quarter. This is why you should specify the numbers “53” in the presentation code line.

Penalty for incorrectly specified period code

The 6-NDFL report should be drawn up on time. Otherwise, a fine will be imposed on the tax agent. In case of delay by even 10 days, the tax agent may be subject to more severe sanctions. In some cases, even blocking is possible bank account. In addition, a tax agent can be fined for errors in Form 6-NDFL. To avoid problems, it is recommended that you write the code correctly before submitting the report.

- Why do you have nightmares: interpretation of disturbing dreams Causes of disturbing dreams

- Incredible mysteries of nature Mohenjo-Daro, or Mountain of the Dead

- Career zodiac sign Pisces How Pisces can achieve success

- National Emblems in Great Britain

- The meaning of the word cambium in the encyclopedia biology

- Morphological analysis of the verb

- About Great Britain in English

- Is Cyprus still an offshore zone?

- World Development Bank. World BankWorldBank. World Bank in Russia

- Accounts receivable and payable

- Why does a woman dream of an owl: a girl, a married woman, a pregnant woman - interpretation according to different dream books

- What does it mean to go to the panel?

- Pythagoras - Olympic champion What kind of sport did Pythagoras engage in?

- What did a kisser do in Rus'?

- Tselovalnik - a mysterious profession of ancient Rus'

- The creator of geminoid robots, Hiroshi Ishiguro, will give lectures at Skoltech

- Hiroshi Ishiguro - Japanese engineer, creator of humanoid robots

- Measurement of gamma background in places of residence of the population of rural and urban settlements in the southwestern regions of the Bryansk region

- The latest photos from the Hubble telescope

- Blood of Saint Januarius When the blood of Saint Januarius boils in Naples