Amount of tax deductions per year. Amounts and provision of standard deductions for personal income tax

Every citizen Russian Federation who receives a salary in the country and any other payments and income must pay personal income tax according to standard rate at 13%. Moreover, everyone who pays income tax, is entitled to standard tax deductions. Why are they needed and what is their importance, what is the amount of deductions in 2017?

Using these benefits, a citizen can reduce tax burden on your income. Standard deductions reduce income when taxed, thereby reducing the personal income tax payable.

Standard benefits apply only to income in the form of wages. Personal income tax rate for such income is 13 percent.

What are standard tax deductions?

Just based on the name, you can easily understand that this is the most common type tax deductions and applies to almost every citizen of the country. Based on this benefit, a person receiving income in the form of wages and taxed according to the standard tax rate at 13%, has the legal right to reduce the overall tax base. Any major changes in terms of the size of deductions in 2017 there were no.

Amounts of deductions in 2017:

- for children - 1400 and 3000 (the first figure for the first and second child, the second for subsequent ones), for disabled children the deduction increases to 12,000 rubles;

- 500 rub. — provided to a number of citizens prescribed in Article 218 of the Tax Code of the Russian Federation;

- 3000 rub. - also put individual categories, various veterans, disabled people, victims, full list specified in Article 218 of the Tax Code of the Russian Federation.

Children's deductions in 2017

“Children’s” deduction is a standard tax benefit provided in connection with the presence of children under 18 years of age, or up to 24 years of age, provided full-time training. This is the most common type of standard deduction, entitled to every parent, guardian, adoptive parent, and trustee of a child.

A personal income tax deduction for a child is an amount that can reduce a citizen’s income when calculating personal income tax. This benefit is approved by this tax code and is provided depending on how many children a citizen has.

For example:

- If a citizen has two children, then 1,400 rubles for each of them;

- For the third and all subsequent ones, 3,000 rubles until they reach adulthood.

In cases where a citizen is the only guardian or parent, he has the right to double the child deduction. This happens in cases where one of the spouses has disappeared or died untimely. In case of marriage this benefit may be lost, and the new spouse of the parent receives the right to a deduction for the child, subject to participation in maintenance. In case of divorce, this benefit is double size can be returned to the parent.

The possibility of receiving a standard deduction for the third and each subsequent child occurs regardless of whether the deduction was given for the first two children. It is possible that the parent or guardian no longer receives benefits for the first and second children (they have become adults), but they rely on the third, if he is under 18 years old. Moreover, the amount of the standard deduction for a child in this case should be 3 thousand rubles.

If a child has disabled status, then each parent has the right to an increased personal income tax deduction - 12,000 rubles.

Deductions for personal income tax for certain categories of citizens (500 and 3000 rubles)

In addition to citizens with children, the government provides individual benefits some other, separate categories of citizens. For example:

- Disabled people from the Second World War, participants in the liquidation of the consequences of the Chernobyl accident, 3,000 rubles each;

- Participants of military operations in the Second World War, as well as disabled people, 500 each.

The entire list of benefits for citizens who are entitled to them can be viewed in Article 218 of the Tax Code of the Russian Federation. Typically, such deductions are taken into account in the process of paying citizens' salaries. In order to qualify for a standard tax benefit, you must provide the employer with a document confirming your right to this deduction. For example, children's birth certificates, disability certificates, etc.

In addition to the standard ones, there are also such deductions as:

How to get a standard deduction

According to the usual procedure, deduction by personal income tax is provided to citizens throughout the year when calculating wages by the employer. If this citizen is employed simultaneously in several jobs, then he has the right to choose one of the places of his employment where he can use this benefit.

He must send his application and attach the accompanying package of documents to the accounting department of the organization in which the employee wants to use his right to a tax deduction. Accordingly, we can say that for part-time work, the use of a deduction is also allowed, but only at one of the jobs.

The step-by-step procedure for obtaining a standard tax benefit can be shown as follows:

- An application is drawn up addressed to the employer to receive a standard personal income tax deduction.

- Documents giving the right to receive benefits are prepared and copies are made if necessary.

- You must contact your employer with your application and all documents.

The tax deduction is valid for one calendar year. In the new year, you will again need to fill out an application and bring documents.

In situations where a citizen for some reason did not receive the deduction due to him at work (for example, did not write an application or did not support it with documents), then at the end of the year he will be able to contact his Federal Tax Service at his place of residence. That's where he'll get personal income tax refund. The statute of limitations for appeals is three years. This means that if you apply at the beginning of the new year 2018, you will be able to receive deductions for 2017, 2016 and 2015, if they were not received on time.

Standard deductions are provided for each month for one year until the citizen’s income exceeds 350 thousand rubles. From the month in which income exceeds this threshold, deductions will not be provided.

What documents are needed

If the standard deduction is provided for children (and not for disability), you will need following documents:

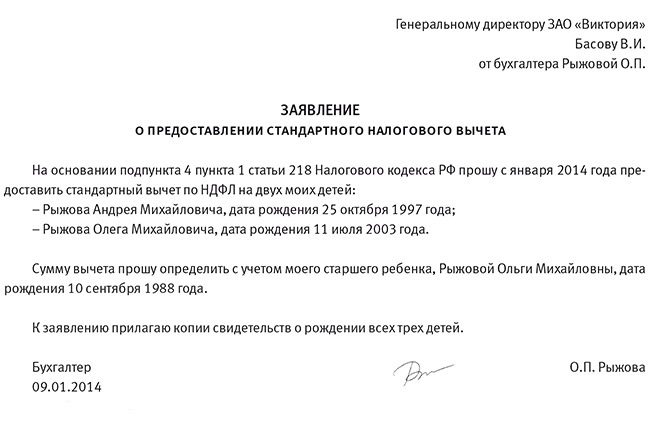

- Statement - ;

- Birth certificate for each child;

- Adoption certificate (if this moment relevant in a specific situation);

- Help from educational institution in cases where the child is studying at full-time department(for students over eighteen and under twenty-four years old);

- Medical opinion on disability (if this point is relevant in a particular situation);

- If an employee has not been working for the company since the beginning of the year, then a certificate in 2-NDFL format with previous place work;

- If one of the parents claims a double deduction, then the second parent’s refusal to receive the right to the benefit must be attached;

- For single mothers, a certificate stating that the data in the paternity column was entered only from her words;

- Certificate from the Housing Office department about cohabitation, a marriage certificate or a document confirming the accrual of alimony (these documents are required if the deduction must be issued by a new wife or husband);

- Document on child support if the parents are divorced.

Absolutely any family that has a child (natural, warded or adopted) can count on a standard personal income tax benefit. After all the documents have been reviewed, the accounting department of the enterprise will deal with the calculation of the deduction. Even if the employee applied at the end of the month on the 30th-31st, the benefit should still be accrued from the current month (outgoing). If the applicant had the right to a deduction earlier (from the beginning of the year, since the benefit is annual), then it can be provided not from the beginning of the month, but from the beginning of the entire year.

From the point of view of this legislation, standard deductions for personal income tax cannot be considered an alternative to the rest tax benefits. It is also possible to register several at once standard benefits. For example, if a citizen applies for a deduction for children and at the same time is a participant in the liquidation of the consequences of the Chernobyl accident.

It is best to submit documents at the beginning of the new year or immediately upon getting a job or upon the birth of a child. It should be understood that benefits are not automatically provided.

Standard personal income tax deductions are available to all employees who have children under the age of 18. And if the child is a full-time student at a university, then up to 24 years of age.

Now the deduction for the first or second child is 1,400 rubles. But for the third and subsequent ones it’s already 3,000 rubles. (see table below). But in practice, questions often arise: which child is counted, when is the parent considered the only one, and how to calculate the amount of deduction if the child’s father and mother are divorced? It is also not always clear at what point an employee loses the right to a deduction?

The amount of children's deductions in 2014

| Who is the deduction for? | Amount of deduction, rub. |

|---|---|

| For the first child* | 1400 |

| For a second child | 1400 |

| For the third and each subsequent child | 3000 |

| For every disabled child under 18 years of age | 3000 |

| For each disabled child of group I or II under the age of 24, if the child is a full-time student (student, graduate student, resident, intern) | 3000 |

| For each child of a single parent (including foster, guardian, trustee, adoptive parent) | The deduction amount doubles |

| * IN general case The deduction is provided for a child under 18 years of age or up to 24 years of age if he is a full-time student. The deduction is due until the end of the year in which your employee’s child turns 18 or 24 years old. If the child completes education before he or she turns 24, the standard deduction is not available starting from the month following the month in which education ceased. | |

First let's look at last letters Ministry of Finance of Russia, in which controversial issues are clarified. And then we’ll figure out how to correctly calculate the amount of the child deduction.

Latest clarifications from officials

A standard deduction can be provided only if the child is supported by the employee. And after marriage, this condition is violated.

Therefore, parents are not entitled to a personal income tax deduction for those children who get married. This conclusion is given in the letter of the Ministry of Finance of Russia dated March 31, 2014 No. 03-04-06/14217. The same can be said about the situation when an employee’s child gets a job. After all, in in this case

he already provides for himself. Another thing is that the company as a tax agent is not obliged to find out Family status children of employees. In addition, the company does not have to find out if they have their own sources of income. For the deduction, an application and a child’s birth certificate are sufficient. And if he is studying, he also needs a certificate from educational institution . Therefore, if the employee has not submitted any documents about marriage or employment of his child, tax agent

(your company) must provide him with a deduction. By general rule the only parent is entitled to a double child deduction. But in Tax Code The concept of “single parent” is not defined. Therefore, in this case, you should be guided by Chapter 10 Family Code

. We can conclude: we are talking about a single parent when the child does not have a second parent.

In particular, due to the death and recognition of the parent as missing.

It turns out that the only parents are not:

– a mother who gave birth to a child out of wedlock, if the father is identified;

– a parent, even the only one, in the event of a new marriage (even if the new spouse does not adopt the child); - divorced spouses. Let's sort it out

the latest situation in details. provides for the child. Her new spouse also receives the right to a deduction from the month in which the marriage is registered. Simply on the grounds that he married the child's mother. This approach is confirmed by subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation. The new spouse just needs to write an application for a child deduction at his work and attach copies of the child’s birth and marriage certificates.

Also, the right to a deduction remains with the former spouse if he takes part in the maintenance of the child. Moreover, in this case, his new wife also has the right to claim a deduction. The logic here is this. A divorced father is entitled to a child deduction because he pays child support. That is, he participates in the maintenance of the child. In addition, property acquired by spouses during marriage is theirs. joint property (Article 256 of the Civil Code of the Russian Federation and Article 34 of the RF IC). That is, including that part of the income that is then transferred in the form of alimony. Means, new wife

the father has the right to receive a personal income tax deduction for this child. The position of the Russian Ministry of Finance on this issue is reflected in letter dated April 15, 2014 No. 03-04-05/17101.

It turns out that in this case, four people can count on a deduction for one child at a time. This is clearly visible in the diagram (see below). PARTICIPANT QUESTION – An unmarried employee has a three-year-old child. The father of this child was deprived of parental rights

. In this case, is the mother entitled to a double child deduction for personal income tax as a single parent?

- Unfortunately no. Even if one parent is deprived of parental rights, this does not mean that the other can be considered the only one. Therefore, in this case there is no reason to receive a standard tax deduction for a child in double amount. This is confirmed by the letter of the Ministry of Finance of Russia dated April 12, 2012 No. 03-04-05/8–501.

Rules for calculating the amount of deduction When determining the amount of deduction, it is necessary to take into account total

children regardless of their age. That is, if your employee has three children, of whom only the youngest has not yet reached the age of 18, the deduction for him will still be 3,000 rubles. After all, he is the third child.

It should be added here: in order for a parent to receive a deduction for a disabled child, he needs to submit accounting documents, confirming the disease. But in the case when the child is also the third in the family, the parent is in any case entitled to a deduction in the amount of 3,000 rubles. This means that the employee may not provide the accountant with documents confirming his disability.

PARTICIPANT QUESTION – The spouses have one common child. The husband also has two children from his first marriage, for whose maintenance he pays alimony. How much is his wife entitled to a deduction for their common child?

– In the amount of 3000 rubles, as for the third child. In this situation, the spouse’s children from his first marriage must also be taken into account. After all, the main condition for the deduction is that the child is supported by the parents or spouse. And in this case this condition is met. Such clarifications are in the letter of the Ministry of Finance of Russia dated April 15, 2014 No. 03-04-05/17101. However, when the husband stops paying alimony for one, and then for both children, the common child will become first the second for his wife, and then the first. That is, the deduction will already be 1,400 rubles. Provided, of course, that there are no more children in the family.

When one parent can transfer their right to a deduction to the second

One parent may waive their right to the standard child deduction. Then the second person, based on the application, will receive the right to a double deduction (paragraph 16, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

However, this rule applies only when the parent who wishes to refuse the deduction receives income taxed at a rate of 13 percent, and such income does not exceed 280,000 rubles from the beginning of the year. If he does not work and does not receive any income, then there is no right to a deduction, which means there is nothing to transfer. This is stated in the letter of the Ministry of Finance of Russia dated February 26, 2013 No. 03-04-05/8–133.

Moreover, the deduction cannot be transferred even if the wife is on the staff of the company, but is currently on maternity leave and does not work (letter of the Ministry of Finance of Russia dated April 3, 2012 No. 03-04-06/8–95 ).

Ryzhova O.P. got a job as an accountant at Victoria CJSC in January 2014.

Ryzhova has three children – 25, 16 and 10 years old. She is no longer entitled to a deduction for her older child, but he is included in the calculation of the number of children. But for others, Ryzhova has the right to claim a standard deduction in the amount of 4,400 rubles. (1400 + 3000).

This means that the tax from January to September inclusive will be calculated not from 30,000 rubles, but from 25,600 rubles. (30,000 – 4400). It will be 3328 rubles. (RUB 25,600 x 13%). And Ryzhov will receive 26,672 rubles.

(30,000 – 3328).

The procedure for providing a child deduction

You can provide children's deductions only if the employee writes an application. The shape is arbitrary (see sample below). At the same time, pay attention to this. The application should not specify the year for which the employee is asking for a standard deduction. And there is no need to specify the amount of the deduction either. After all, in

next year

he may already be different. If you fill out an application this way, you will not have to collect new ones every year (letter of the Ministry of Finance of Russia dated August 8, 2011 No. 03-04-05/1–551).

It happens that an employee submits an application late, say, in the middle of the year, although he has had the right to a child deduction since January.

In this case, it is necessary to provide a deduction for all months from the beginning of the year. At the same time, recalculate the tax for previous months.

| But you will no longer be able to provide deductions for the previous year. To recalculate the tax, the employee should contact his Federal Tax Service at his place of residence. Let him write an application and attach all supporting documents to it. The tax authorities will do the recalculation themselves. You don't have to adjust anything. This is stated in paragraph 4 of Article 218 of the Tax Code of the Russian Federation. | Remained at the level established in 2012. According to adopted regulatory documents, tax deductions for personal income tax are calculated based on the number of children an employee of an enterprise, institution or organization has. Deduction of 400 rubles. "On Yourself" has been filmed since 2012. | So, below is a table of standard tax deductions (in thousand rubles) for the period from 2011 to 2014: | Name of deduction |

| 2011 | 0,4 | - | 40 |

| 2012-2014 | 0,5 | 0,5 | Limit for deduction |

| To “yourself”, i.e. on the employee himself | 3 | 3 | Limit for deduction |

| Per employee for certain categories of citizens (clause 2, clause 1, article 218 of the Tax Code of the Russian Federation) | 1 | 1,4 | 280 |

| No restrictions | 3 | 3 | 280 |

| Per employee (categories of citizens are listed in clause 1, clause 1, article 218 of the Tax Code of the Russian Federation) | 3 | 3 | 280 |

For 1st and 2nd children

Clause 3, clause 1, Article 218 of the Tax Code of the Russian Federation, the amount of the deduction directly to the employee was previously approved in the amount of 400 rubles. This deduction has now been cancelled. It should be noted that this deduction was provided monthly to any tax payer as long as the income portion of his budget, calculated from the beginning of the year, was no more than 40 thousand rubles.

At the same time, the remaining tax deductions for the taxpayer have been preserved. For example, disabled people from the Great Patriotic War and Chernobyl survivors are entitled to a deduction in the amount of 3 thousand rubles (a full list of beneficiaries can be found in clause 1, clause 1, article 218 of the Tax Code of the Russian Federation). Heroes of the USSR and the Russian Federation, disabled children, disabled people of the first two groups, as well as other categories of persons listed in clause 2, clause 1, Article 218 of the Tax Code of the Russian Federation, are subject to a deduction of 500 rubles. If a company, institution or organization employs persons from specified categories, and they previously submitted applications, deductions are still provided to them.

Child deductions increased

Law No. 330-FZ amounts standard deductions for children were promoted. Taxpayers entitled to receive a child deduction include parents (as well as adopted) of the child, their spouses, as well as guardians/trustees (spouses of these categories will not be able to use the right to deduction).

Children's deductions are divided into subcategories. For example, the deduction for the first 2 children in the current edition is 1,400 rubles each. For the 3rd and subsequent children - 3 thousand rubles. Moreover, this norm was put into effect backdating. As a result, parents of many children at the end of 2011, there was an overpayment of personal income tax, since before the introduction of amendments to regulations The deduction for each child was calculated in the amount of 1 thousand rubles. regardless of the number of children an employee of the enterprise has.

In addition, an employee who has a disabled minor child, starting in 2011. has the right to deduction. The specified deduction is maintained until the child reaches the age of 24, provided he is studying full-time and has been diagnosed with a disability of 1 or 2 groups. Before Law No. 330-FZ came into force, the deduction amount was 2.0 thousand rubles.

It should be noted that the income threshold, while child deductions remain in force, remained unchanged at the level of 280 thousand rubles.

The accountant of the enterprise, in connection with the increase in the amount of deductions, will need to collect new statements from employees with children, because only the tax agent has the right to reduce the base for personal income tax, based on such a statement (clause 3 of Article 218 of the Tax Code). And it will be better if new amount the deduction will be directly written on the statements.

Providing a deduction for the 3rd child if the eldest child has become an adult

Article 218 of the Tax Code of the Russian Federation states that a deduction must be provided for each child, without exception, supported by parents until he turns 18 years old or 24 years old if he is a resident, graduate student, intern, cadet or full-time student. establishments.

The question arises: what to do when a company employee has 3 children, 2 of whom are minors, and one child over 18 years old? More detailed explanations given in a letter dated December 8, 2011 by officials of the Ministry of Finance of the Russian Federation. Representatives of the ministry remind that the 1st child is the oldest child, regardless of whether the standard deduction applies to him or not. That is, for the 3rd child the employee will be given a deduction of 3,000 rubles, and for the second – 1,400 rubles.

Example.

An employee of Snezhok LLC has three children aged 9, 14 and 20 years. He has the right to deduction only for the 2 youngest children, and no deductions are provided for the eldest. The employee's salary is set at 25,000 rubles.

The accountant calculated the salary for January 2014 taking into account a deduction for the 2nd child in the amount of 1.4 thousand rubles. and on the third – 3 thousand rubles. This means that personal income tax will be equal to 2678 rubles: (25,000 – (1400 + 3000))*13%.

And the employee will be paid 22,322 rubles.

If there is an overpayment for the past year

Let's say your organization has employees with many children. They received the right to increased deductions, but retroactively from 2011. If the accounting department of this organization did not manage to recalculate and return the tax before the end of 2011, then in 2012, as in any other year, there is no need to offset the overpaid tax or return it, because any transactions for overpayment for the past year can be carried out by only tax authority. To do this, the employee submits a 3rd personal income tax declaration to the tax office at his place of residence, to which he attaches a 2nd personal income tax certificate, as well as documents that confirm his right to deductions.

If the deduction amount is greater than wages, tax will not be withheld

In some cases, the amount of new deductions may exceed the employee's wages. For example, mother of many children does the job part-time and her salary is low. In addition, single parents, as before, can take advantage of the double child deduction.

So what should you do if the personal income tax base goes to zero or more than your salary? A description of this situation is given in paragraph 3 of Article 210 of the Tax Code of the Russian Federation. It says that if the amount of deductions is higher than the employee’s earnings, tax base for personal income tax should be taken equal to zero. In other words, no tax will be deducted from the employee’s salary in this case.

The difference that arises between the amount of deductions and income for one month can be attributed to another month, but within the boundaries of one year.

Example

An employee of Romashka LLC works part-time and is raising three children alone: one is 7 years old, the second is 13 years old, and the third is 22 years old, and he is studying at the university for full-time department. As a single mother, she is entitled to double child deductions. Based on the work schedule, the employee is entitled to a salary of 11,000 rubles. There are no allowances or bonuses.

She is provided with the following deductions: for the first 2 children the deductions will be 1,400 rubles, for the third – 3,000 rubles. Therefore, deductions for children ultimately amount to 11,600 rubles: (1400x2+3000) x 2.

It turned out that the amount of monthly deductions exceeds the employee’s salary. In this case, the tax base for personal income tax is assumed to be zero and there is no need to withhold payroll tax. The employee will be paid a salary of 11,000 rubles without withholding personal income tax.

All parents of a child are entitled to receive a monthly child tax deduction. This deduction is called the standard personal income tax deduction for children.

How does the child tax credit benefit us? Starting from the month the child is born, part of your salary will not be subject to personal income tax. This means that less tax will be withheld from your salary at a rate of 13%, and you will receive a larger salary in your hands. The right to take advantage of the deduction arises in the event of receiving income taxed at a rate of 13% (salary).

How to get a personal income tax deduction for children? Who is entitled to a personal income tax deduction for children?

Both parents can take advantage of the tax deduction at once (i.e. at the same time). Adoptive parents, guardians, trustees also have the right to receive a deduction for a child. adoptive parents, if the child is in their care (this is established by clause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

Even if the child’s parents are divorced but pay alimony, they are not deprived of the right to use the deduction.

Restrictions related to the provision of deductions

1. Limitations on the parent’s income

Every month a parent can be given a tax deduction, but before certain limit- 280,000 rub. (total from the first month). The deduction is not provided from the month in which the excess is established the specified amount(this is stated in paragraphs 17, 18, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

2. Restrictions on the child’s age

A parent can receive a deduction until the child reaches the age of 18 inclusive - this is according to general order. IN exceptional cases The deduction can be provided until the child reaches 24 years of age. Such cases include:

- teaching the child full-time form of education,

- if the child is a student, graduate student, resident or intern (this is stated in paragraph 12, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

How much is the deduction available?

The tax deduction depends on the number of children:

- for the first child 1400 rubles;

- for the second child 1400 rubles;

- for the third and each subsequent child - 3000 rubles.

A deduction of 3,000 rubles. is due to parents for a disabled child, regardless of the birth date (paragraph 11, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

Who is entitled to a double deduction?

A double deduction for a child can be provided:

- to the only parent (adoptive parent, guardian, trustee) at his request, but up to and including the month of his marriage (paragraph 13, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

Note. A single parent is considered to be the only parent in cases where the child does not have a second parent due to the death of the second parent, or due to his unknown absence, or if only one parent is indicated on the child’s birth certificate. The case where there is no registered marriage between the parents does not fit the concept of a single parent;

If one of the parents refuses to receive a tax deduction (you need to write an application), then the second parent will be able to receive a double deduction (paragraph 16, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation). This child deduction rule also applies to 2014.

How to get a child benefit?

There are two ways to receive a deduction.

1. Receiving a deduction from the employer

You need to contact your employer with an application and documents confirming your right to a deduction (clause 3 of Article 218 of the Tax Code of the Russian Federation).

To receive a deduction from an employer, the following documents are required:

- child’s birth or adoption certificate (in case of adoption of a child);

- marriage registration certificate;

- certificate of disability (if the child is disabled);

- a certificate from the educational institution where the child is studying (if the child is over 18 years old);

- agreement to pay alimony or performance list(court order) on the transfer of child support (if the parent pays child support);

- a parent’s receipt stating that the second parent applying for a deduction is involved in providing for the child. This is necessary if the parents are not married, but the other parent provides for the child, although does not pay child support.

2. The second way is to obtain a tax deduction from the tax office

In accordance with paragraph 4 of Art. 218 of the Tax Code of the Russian Federation, you can contact your tax office to receive a tax deduction, but only if your employer did not provide you with a deduction for a child, or provided it, but in a smaller amount.

To receive a deduction, you must submit the following documents to the tax office:

- tax return in form 3-NDFL for the year in which you were not provided with a child deduction or it was provided in a smaller amount;

- copies of documents confirming the right to deduction;

- a statement about the need to transfer (refund) overpaid tax to your bank account;

- a certificate of income in form 2-NDFL for the year for which you plan to return the overpaid tax.

Three months tax office will conduct desk tax audit your submitted declaration in form 3-NDFL, check your documents, the right to deduction, and may also request other documents and explanations from you (clause 2 of article 88 of the Tax Code of the Russian Federation). Tax return for personal income tax, in order to receive a deduction for a child, you must submit it in 2014 (at any time, not necessarily before April 30, 2014)

When desk audit ends, the refund must be made to the bank account within one month. That is, in order to receive a refund of overpaid tax, sometimes you have to wait 4 months, but most often, inspection inspectors do not postpone the return of personal income tax to such a late date.

- Main current account in 1s 8

- Schemes for correcting old errors

- Biography of Irina Saltykova: personal life, creativity

- Dysphoria - what is it and how is it treated?

- How to attract a Taurus man

- Gems for scales. Stones for scales. Where to wear a talisman stone for Libra women

- Lipotropic products: our helpers that break down fats Lipotropic substances in which products

- Anatomy - what kind of science is it?

- The main layers in the solar atmosphere What is the visible layer of the solar atmosphere called?

- Sanitary treatment of the patient 1 sanitary treatment of the patient

- Modern dictionary of the Russian language stress pronunciation orthoepic

- Princess Diana and Prince Charles: a royal love story

- Direct proportionality and its graph

- Why do you dream that they want to kill you in a dream?

- How to get rid of your mother-in-law using magic?

- Making a lapel at home How to make a lapel at home the easiest way

- Strong lapel: methods for all occasions How to make a strong lapel

- Daniel Defoe "The Life and Extraordinary Adventures of Robinson Crusoe" - Document How many years did Robinson stay on the island

- What is the difference between Sunnis and Shiites

- Closing the month in accounting