The employee paid with a personal bank card. — rules for a corporate card. Receipt for receipt of advance report

ESSENCE OF DISCUSSION

Non-cash issuance of money on account by transferring it to the employee’s personal bank card account (card issued in his name) certainly has a number of advantages compared to traditional way delivery - through the cash register. And there are fewer expenses (after all, the commission for transferring money is usually lower than for withdrawing cash), and there is little labor costs (since there is no need to draw up cash documents). In addition, the non-cash method allows you to issue money even to an employee located in another city.

But is the “plastic reporting” legal? What could be his tax risks? These are the questions that concern accountants who want to take advantage of all the benefits of non-cash issuance of money on account.

ANALYSIS OF THE SITUATION

Some banks do not allow payment orders to transfer money from the organization's current account to the employee's bank card account because the purpose of the payment contains words about accountable amounts for business, travel or entertainment expenses. In doing so, banks, as a rule, refer to the clarifications of the Central Bank of the Russian Federation that the regulations of the Bank of Russia do not provide for the issuance of money on account by non-cash transfer to the accounts of employees, that is accountable funds Employees should only be given cash.

By the way, there are banks that practice a partial ban: they allow money to pay expenses related to business trips to an employee’s bank card, but accountable amounts, intended for other purposes, are not translated. Exception for money travel expenses banks do this on the basis of another Letter from the Central Bank of the Russian Federation, which specifically discussed the possibility of transferring them to employees’ accounts. According to the logic of this Letter, it turns out that if an organization collective agreement or its local regulatory act (for example, an order, a regulation on business trips) has provided for the possibility of transferring money for travel expenses to employees’ bank cards, then the bank has no reason not to allow such a payment.

ACTIONS

If your bank without question writes off accountable amounts from your current account to the employee’s bank card account, you need to make an entry to the debit of account 71 “Settlements with accountable persons” and the credit of account 51 “Current accounts”. In the future, the employee will have to draw up a regular advance report in Form N AO-1 and attach all supporting documents to it. It does not matter how the employee paid: by card or cash. You can also transfer the amount of overexpenditure according to the advance report to the employee’s account. And the excess amount can be:

- returned by the employee to the company's cash desk (the balance of accountable funds will need to be reflected in the debit of account 50 "Cash" in correspondence with the credit of account 71 "Settlements with accountable persons");

- transferred by the employee to the company's current account (posting in in this case will be as follows: debit of account 51 “Current accounts” - credit of account 71 “Settlements with accountable persons”);

- deducted by decision of the head of the organization from the employee’s salary if there is one written consent(in this case, the return of the balance will need to be reflected in the following entry: debit of account 70 “Settlements with personnel for wages” - credit of account 71 “Settlements with accountable persons”).

Note: despite the fact that the non-cash issuance of accountable funds is not provided for by any regulatory act of the Central Bank of the Russian Federation, sanctions for violation of cash handling and maintenance procedures cash transactions you shouldn't be afraid. After all, an organization can be held liable on this basis only if:

- paid in cash in excess of the established amount;

- revenue is not received in full;

- does not comply with the procedure for storing free money in the cash register;

- accumulates cash in the cash register in excess of the established limit.

The Administrative Code of the Russian Federation does not provide for an administrative fine for the non-cash issuance of accountable funds.

If your bank makes such payments, the main thing is to ensure that the accountable amounts transferred to the employee’s bank card account are not considered by tax authorities as wages with all the ensuing consequences in the form personal income tax accrual, Unified Social Tax and contributions to the Pension Fund. To do this you need:

- provide in local normative act possibility of issuing money on account non-cash by transferring from a current account to an employee’s bank card account;

- indicate in the payment order that the amounts transferred are accountable funds;

- have a correctly completed employee advance report with supporting documents attached.

If these three conditions are met, you will be able to prove that in fact you gave the employee money on account, and not a salary at all.

Compensation of expenses

Return the money to the employee either from the cash register or to a bank card at his request. If the director returns his money spent, let him.

How to make calculations in accounting

Which account to use - 71 "Settlements with accountable persons" or 73 " Settlements with personnel for other operations"? The answer is .

Example

Annual in July costs 8910 rubles. From August 1, the price will increase to 16,104 rubles. The chief accountant did not have time to agree, since the director was on vacation. Therefore, on July 31, I wrote an application for reimbursement of expenses:

"In connection with production necessity accounting department, in order to accurately calculate employee payments, taxes and contributions, I purchased an annual subscription to the practical magazine “Salary” for the period from July 1, 2017 to June 30, 2018, worth 8,910 rubles. (Eight thousand nine hundred ten) rubles 00 kopecks.

I paid for the magazine from own money. Please refund expenses incurred. Please transfer the money to my salary bank card.

I am enclosing a receipt for payment and a statement from my personal bank account."

The director approved the expenses. The subscription and closing documents were issued to the company.

At the same time, Instruction No. 3210-U does not prohibit payments by an accountable person for purchased goods or services of its own by bank card. However, to be on the safe side, we recommend that you write directly in local documents organization such an opportunity, as well as the procedure for providing an employee advance report and supporting documents in such a situation. So, in the case under consideration, part of the amount from the accountable funds, equal to that which was written off from the employee’s personal card, remains with the latter.

7 — rules for a corporate card

A corporate bank card is a good solution if employees need to pay for something themselves. The money in the account belongs to the organization, but the card is issued to specific employee and clause 1.5 of the Regulations, approved. Central Bank December 24, 2004 No. 266-P (hereinafter referred to as Regulation No. 266-P). About the rules of use corporate card and accounting for transactions related to it, we will tell you. A separate bank account is opened for a corporate card, etc.Abroad with a bank card: we pay business trip expenses

At the same time, the procedure and amount of reimbursement of expenses associated with business trips, are determined by a collective agreement or local regulations.That is, the employer must compensate the employee for his actual expenses, namely the amount in rubles that he spent to acquire the spent amount of currency. In accordance with clause 4 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99), the expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into expenses for common types activities and other expenses.

Accountable money: how to prepare an advance report

And when making payments by bank card - original slips, receipts from electronic ATMs and terminals. The amounts spent by the employee according to the report must correspond to the amounts indicated in the payment documents. To take into account the costs of purchasing goods (payment for services), supporting documents are needed. In addition, whether you can deduct input VAT depends on the type primary documents.Which reporting documents will not cause tax authorities to complain?

On September 28, experts from our publishing house held an online conference “Accounting and Cash Expenses.” From questions asked it is clear that accountants are interested in both “evergreen” topics (in particular, the attitude of tax authorities to the issuance of excess revenue for reporting) and specific ones (for example, drawing up advance reports when paying for tickets for business travelers using the director’s personal card).We bring to your attention the answers to the most interesting questions conference participants. It often happens that at the end of the day, when collection has already taken place, the cash register limit is exceeded.

Corporate card

The bank will generate monthly reports on the cards, and in addition, the company will be able to control the movement on the special account using statements. To activate cards you will need to transfer from your current account to a business account the required amount funds. While the money is in a special account, it is not accountable. When paying by card or withdrawing cash, money will be debited from a special account. From this moment on, the money is accounted for, and the employee has the obligation to report on expenses within the deadline set by the company. Some banks offer organizations such banking product, like a corporate credit card.

Accountability

Why accountants make mistakes when writing off accountable amounts. And how to avoid it

P.A Lisitsyna

From this article you will learn:

1.

Under what conditions are “accountable” expenses considered paid?

2.

What information should be in supporting documents so that inspectors have no complaints about them?

3.

What to do if an employee paid for company expenses with someone else’s bank card

After the employee has submitted the expense report, you have checked it, and the manager has approved it with his signature, it is time to reflect the expenses in accounting and tax accounting. In words, everything is simple: paid, received, documented - written off. But, as the questions coming to our editorial office show, annoying mistakes meet often. Due to the fact that expenses were reflected earlier than they should have been, or documents were not drawn up according to the rules, tax authorities assess additional taxes and fines during an audit.

If you are an entrepreneur

This article will be useful if you have wage-earners and you give them money to account for. And it doesn’t matter what object of taxation you have according to the simplified tax system.

We'll talk about the most common mistakes that can be made by both "simplified" people who take into account expenses and those who pay single tax only from income. After all, correct accounting of accountable amounts affects the calculation of both the “simplified” tax and personal income tax and insurance premiums. And our recommendations, we hope, will help you resolve difficult situations correctly.

Error No. 1 The contents of the purchase are not deciphered in the sales receipt

For whom is it relevant? For all the “simplified people”. Having drawn up an advance report, the employee attached to it a cash register receipt for total amount And sales receipt. However, the sales receipt does not indicate the specific names of the purchased goods. But there is only a general name, for example “stationery worth 1000 rubles.” The cash register receipt also indicates only the total cost.

What is the problem. We do not recommend taking into account expenses for documents without titles specific goods. Let's explain why. All expenses must be documented (clause 2 of article 346.16 and clause 1 of article 252 of the Tax Code of the Russian Federation). In this case, documents should be drawn up in accordance with the legislation of the Russian Federation. And the mandatory details of the primary document include the name and quantity of goods, works or services purchased (subclause and clause 2 of Article 9 Federal Law dated December 6, 2011 No. 402-FZ). For a sales receipt with a generic name of goods, this requirement is not met. After all, it does not contain the name, quantity and cost of each specific product.

True, arbitrators sometimes support taxpayers who have taken into account expenses on documents with common names (see, for example, Resolution of the Federal Antimonopoly Service of the Volga District dated February 3, 2006 No. A55-14012/05-32). But I would hardly want to sue over a problem that can be corrected in a timely manner. Moreover, this is relevant not only for “simplified” people who take into account expenses, but also for those who pay tax only on income. After all, if the expenses of the accountable person are not confirmed by correctly executed documents, inspectors may assess additional salary taxes.

Important circumstance

If the accountant brought a sales receipt, which indicates only the total cost of the purchase, it is better to replace such a document by contacting the seller again. Or make a decryption for the check yourself.

Note that the described problem is relevant only for the case when the cash register receipt does not contain a decoding of purchases with their value and quantity - this is when a sales receipt with decoding is required. If the cash register receipt contains the names of all goods, prices, quantities and costs, then a sales receipt will not be required, since all the information necessary for accounting is already in cash receipt. However, not all sellers issue them, but only large supermarkets.

What to do. First, instruct employees that on the sales receipt, the seller must list all items, indicating their quantity, price and total cost. AND accountable person must immediately control it, since it is in his interests. After all, if the tax authorities, during an audit, charge additional personal income tax advance, you will deduct it from the accountant’s salary.

Secondly, if the employee has already brought you documents with a generic name, ask him to go back to the store and change the papers. The seller most likely will not refuse and will rewrite the sales receipt. And the employee who had to go to the store one more time will remember what documents need to be received upon purchase.

If changing a sales receipt is problematic, there is another option. Let the accountant draw up internal document, for example, a transcript to a sales receipt. In it he himself will write the name, quantity, price and total cost of the purchased goods. Since the document is drawn up in accordance with all the rules for a “primary” document, there should be no problems with taking into account expenses. You can see a sample of such a document below.

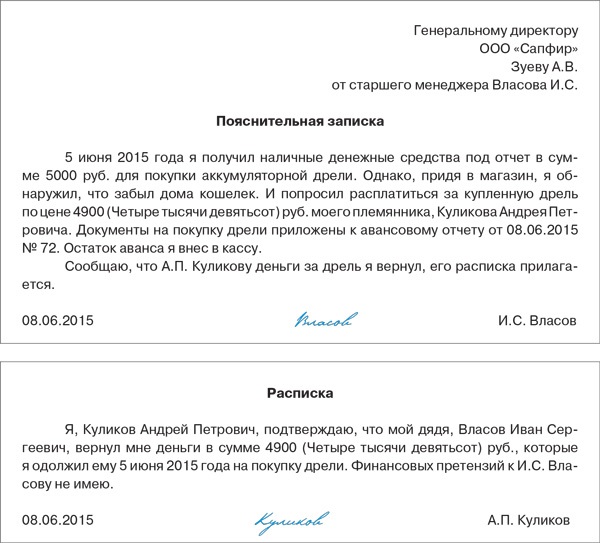

Error No. 2 Expenses of the accountable person were paid with someone else’s bank card

For whom is it relevant? For all the “simplified people”. Everything seemed to be in order, the employee drew up a report, attached documents for purchase and payment. But when detailed consideration You noticed that the cash register check contains the bank card information not of the accountable person himself, but of someone else, for example his relative. Indeed, in this case, the cash register receipt indicates the full name of the person who owns the card.

On a note

If reporting employee paid expenses with someone else's card, ask him to write explanatory note that he returned the money to the cardholder for the purchase.

What is the problem. It would be risky to leave everything as is and accept the report only with the documents attached by the accountant. Suddenly, during an inspection, you will come across particularly attentive inspectors who will consider that the expenses paid by someone unknown have nothing to do with your company. Therefore they should be excluded from tax base. And include this amount in the employee’s income subject to personal income tax, and also accrue from it insurance premiums.

What to do. Ask the employee to write an explanatory note. And indicate that the purchase was made by a relative or friend on his behalf. Additionally, let the accountant attach a receipt from the person whose card he paid with. In the receipt, the friend or relative will confirm that he received his money from the accountable person and has no claims. In this case, you will have evidence that the expenses were actually paid from the funds of your company issued on account. Similar recommendations are given, in particular, by the financial and tax departments (letters from the Ministry of Finance of Russia dated October 11, 2012 No. 03-03-07/46 and the Federal Tax Service of Russia dated June 22, 2011 No. ED-4-3/9876). We have provided samples of documents that will need to be completed below.

Error No. 3 You took into account expenses before you paid off the debt to the accountant

For whom is it relevant? For simplified taxation system payers with an object, income minus expenses. Quite often there is a situation where an employee received money on account, but there was not enough to pay for the purchase. So he added his own. Accordingly, according to the advance report, there was an overexpenditure.

What is the problem. Do not take into account the entire purchase amount in tax costs under the simplified system until you have paid the accountant. Let's explain why. Only paid expenses are reflected in the tax base under the simplified tax system. And they will be paid when the company has no debt (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). If you overspend, you have a debt to the employee. Therefore, it is incorrect to take into account expenses until it is repaid.

What to do. Expenses are considered paid when you issue the overage amount to the employee. This is also confirmed by the Russian Ministry of Finance in letter dated January 17, 2012 No. 03-11-11/4. Therefore, if you have settled with the accountant, fulfilled other conditions and have supporting documents, you can write off the entire amount of expenses.

Example 1. Accounting for expenses paid by an accountable person with personal money

O.I. Grishin, who works at Polet LLC, received 2,000 rubles as a report on June 5. to buy a printer cartridge. On June 8, an employee purchased a cartridge for 2,500 rubles. (without VAT) and brought an advance report to the accounting department of Polet LLC. He attached a sales receipt and a cash register receipt for the purchase of a cartridge to the report. On June 9, the director of Polet LLC approved the report, the company capitalized the cartridge and immediately put it into operation, installing it on the printer. And on June 10, the accountant-cashier issued O.I. Grishin, the amount of overexpenditure according to the advance report is 500 rubles. (2500 rub. – 2000 rub.). When can the cost of a cartridge be included in expenses?

Polet LLC has the right to reflect the cost of a printer cartridge in material costs immediately after posting the property and payment (subclause 5, clause 1, article 346.16 and subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). The cartridge was capitalized on June 9, and paid in full on June 10 - after the debt to the employee was repaid. According to the condition, the employee attached a sales receipt and a cash register receipt to the report. These documents are sufficient to record expenses. Therefore, on June 10, Polet LLC will enter in column 5 of the Accounting Book the cost of the cartridge - 2,500 rubles. Accounting entries will be like this:

DEBIT 71 CREDIT 50

2000 rub. - money was issued against the report of O.I. Grishin;

DEBIT 10 CREDIT 71

2500 rub. - the cartridge purchased by the accountant has been capitalized;

DEBIT 20 CREDIT 10

2500 rub. - the printer cartridge is written off for production;

DEBIT 71 CREDIT 50

500 rub. - issued by O.I. Grishin the amount of overexpenditure according to the advance report.

note

Expenses on the advance report for the employer are considered paid only after you have finally paid the reporting employee (Clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If you reimburse the amount of overexpenditure to the employee in the next quarter, to write off expenses under the simplified tax system, you can not wait for full payment, but proceed as follows. Write off the purchase price minus overruns immediately after the expense report is approved. And the rest - on the day when you pay the amount due to the employee. Of course, to account for expenses, it is necessary to have documents confirming them and to fulfill other the necessary conditions(clause 2 of article 346.16 and clause 2 of article 346.17 of the Tax Code of the Russian Federation).

Mistake No. 4 You wrote off as expenses an item that has not yet arrived

For whom is it relevant? For payers of the simplified tax system with the object of taxation, income minus expenses. The employee went to the counterparty and made an advance payment for a future delivery, spending the money received on account. He must prepare an advance report. However, the accountant does not yet have documents for the purchase, since the goods have not yet been shipped to him. Therefore, he will only be able to attach to the advance report a cash register receipt, a receipt for a cash receipt order or another payment document.

What is the problem. You will make a mistake if in the tax base under the simplified tax system you reflect the money spent as an expense on the date of approval of the advance report. After all, the costs have not yet been fully confirmed; the accountant did not buy or receive anything, but only made an advance payment.

Essence of the question

The amount of advance payment paid by the employee is included in expenses only after goods, work or services have been received.

What to do. Take into account expenses in the tax base under the simplified tax system not on the date of approval of the report, but later. When the material is received, the work or services are performed, and the goods are received and then sold to the buyer (subclause and clause 1 of Article 346.16, subclause and clause 2 of Article 346.17 of the Tax Code of the Russian Federation). And you will have all the necessary documents in your hands.

Tips from the site site

If an employee bought something with his own money, this is not accountable

If the employee did not receive money on account, but purchased property for the company at his own expense, drawing up an advance report would be a mistake. After all, you did not give an advance to the employee. The employee will simply write a statement asking for reimbursement of his expenses. And he will attach documents confirming the purchase.. In the search bar of the “Forms” section, type “application for reimbursement of expenses.” And the document you need will appear in the first search line. By downloading it to your computer, you can make a template for employees.

If the manager approves the employee’s application, give him the required amount. Then reflect the purchase as expenses if all documents are in order and the conditions for accounting are met (Articles 346.16 and 346.17 of the Tax Code of the Russian Federation). And make accounting entries. In this case, to reflect settlements with employees, use accounting account 73 “Settlements with personnel for other transactions.” Account 71 “Settlements with accountable persons” is not suitable here, since this operation does not relate to reporting.

Example 2. Accounting for an advance paid by an accountable

V.P. Sidorov, who works at Vasilek LLC, received cash in the amount of 50,000 rubles as a report on August 10. for the purchase of goods for resale. However necessary goods was not in the supplier's warehouse. Therefore, he did not buy anything, but only ordered these goods to receive them in two weeks. And on August 12, I made an advance payment - 10,000 rubles. What will be included in the accounting of Vasilek LLC?

August 17 V.P. Sidorov drew up an advance report, attaching to it a document for payment of an advance of 10,000 rubles. And the remaining 40,000 rubles. (50,000 rubles - 10,000 rubles) returned to the cashier. Advances issued are not reflected in tax accounting under the simplified tax system. The company will reflect the cost of goods in expenses after they are capitalized, fully paid and sold to the buyer (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

And in the accounting of Vasilek LLC, you need to make the following entries:

DEBIT 71 CREDIT 50

50,000 rub. - money was issued against the report of V.P. Sidorov;

DEBIT 60 subaccount “Advances issued” CREDIT 71

10,000 rub. - prepayment for the goods has been made using accountable funds;

DEBIT 50 CREDIT 71

40,000 rub. - received from V.P. Sidorov balance of the accountable amount.

Nuances requiring special attention

If it is not clear from the documents attached to the advance report what exactly the employee bought, it is better not to accept the report in this form. Ask the accountant to obtain a sales receipt or invoice from the seller, which will list all purchased goods with price and quantity.

Accountable expenses are considered paid by the employer if the employee did not contribute his own money. And if you did, you first need to reimburse him for the overexpenditure and only then take the expenses into account in the tax base under the simplified tax system.

If the reporting party has paid the supplier for a future delivery, expenses cannot be reflected in tax accounting under the simplified tax system as of the date the report is approved. Wait until materials, work or services are received, and goods are also sold.

Star

for the correct answer

Wrong

Right!

An employee of the company, using accountable money, made an advance payment for the future supply of goods. Can a company take into account the amount spent as expenses under the simplified tax system?

The organization can write off the cost purchased goods under the simplified tax system only after the goods have been received, fully paid for and sold to the buyer (subclause 23, clause 1, article 346.16 and subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation)

Yes, as of the date of approval of the advance report

Yes, but only after the goods have been received, fully paid for and sold to the buyer

No, expenses for paying for goods under the simplified tax system are not taken into account

14 min read

Approximate time

Print

and take it with you

Print this article

Download article

Private situations

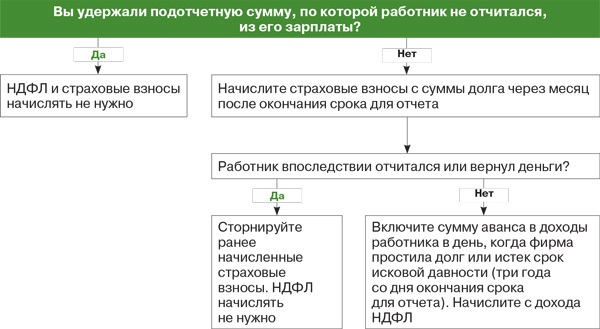

What to do if an employee does not report on accountable amounts on time

Maslennikova L. A., expert of the Simplified magazine, candidate of economic sciences

When an employee wants to receive money on account, he writes a statement indicating the amount and the period during which the money can be used. No later than three working days after the end of this period, the employee must submit an advance report to the accounting department with documents confirming his expenses. Such rules are established by clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. If the money is not spent, it must be returned within the time limit set by the manager. And the employee cannot receive new amount to the report while the debt is registered (paragraph 3, clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

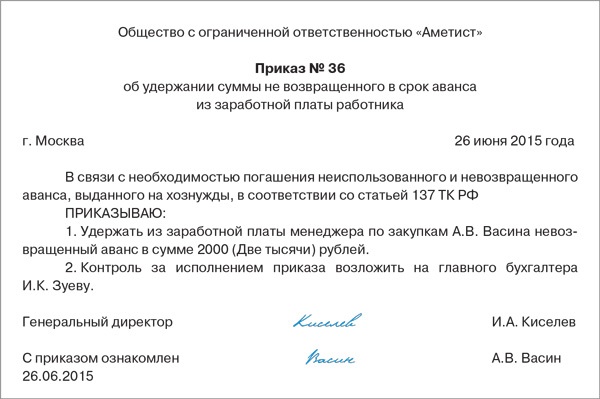

But if all the deadlines have passed, and there is no report or money from the employee, you need to either withhold the debt from the salary, or include a report in the employee’s income and calculate personal income tax and insurance premiums accordingly. Let us consider in detail the procedure.

Situation No. 1 You withhold the amount of debt from the employee’s salary

First of all, inform the employee that he has a debt. Perhaps after a reminder he will still be able to report or return the money. If for some reason he is not going to return them, offer him the following option. Have the employee write a statement asking to withhold the amount of the debt from his wages.

Then, at the next payment, you will withhold from him the required amount and the debt will be repaid. Please note that if there is an employee’s application, no restrictions on the amount or period for deduction apply (letter of Rostrud dated September 26, 2012 No. PG/7156-6-1). After all, an employee has the right to manage his money the way he wants.

Important circumstance

You can deduct from your salary no more than 20% of the amount due to the employee (Article 138 of the Labor Code of the Russian Federation). But if the employee himself writes a statement asking to withhold the debt, this restriction does not apply.

If there is no application, you, as an employer, have the right to forcibly withhold the debt from your salary. True, there will already be restrictions here. Firstly, you can only make a decision to withhold money no later than a month after the deadline for reporting or returning the advance has expired (Part 3 of Article 137 of the Labor Code of the Russian Federation). Secondly, no more than 20% is allowed to be withheld from an employee’s salary for each payment (Article 138 of the Labor Code of the Russian Federation). Note that the 20 percent limit must be calculated from the amount minus personal income tax (letter of the Ministry of Health and Social Development of Russia dated November 16, 2011 No. 22-2-4852).

If the above conditions are met, issue an order to the manager to withhold the unreturned advance. Ask the employee to sign the order indicating that he has read it. Please note that if the employee disputes the amount of the debt, the money can only be withheld from him through the court (Part 3 of Article 137 of the Labor Code of the Russian Federation). A sample order is presented above.

Important circumstance

If you withhold the amount of debt from an employee's salary, he will not have taxable income. Personal income tax and insurance premiums are not charged.

Example. Withholding of accountable amounts from an employee's salary

Purchasing Manager A.V. Vasin, who works at Amethyst LLC, was supposed to report no later than June 15, 2015 on the funds received for the report. But he did not submit the advance report and the money in the amount of 2000 rubles. didn't return it. On June 26, the manager issued an order to withhold the debt from the employee’s salary. Accrued salary for June 2015 - 30,000 rubles. On June 10, an advance was issued - 15,000 rubles. Deductions for personal income tax in June A.V. Vasin is not trusted. We will determine whether Amethyst LLC will be able to withhold the entire amount of debt when paying wages for the second half of June.

Personal income tax from A.V.’s salary Vasina for June amounted to 3900 rubles. (RUB 30,000 × 13%). The amount in hand paid on July 5, minus the previously issued advance, is equal to 11,100 rubles. (30,000 rubles – 3900 rubles – 15,000 rubles). So when paying the salary of A.V. Vasin for June on July 5 you can keep no more than 2220 rubles. (RUB 11,100 × 20%). The amount of debt is less. Therefore, the accountant of Amethyst LLC will be able to retain all 2,000 rubles. A.V. Vasin will receive 9100 rubles. (RUB 11,100 – RUB 2,000).

The accounting entries will be as follows:

DEBIT 94 CREDIT 71

2000 rub. - A.V.’s debt is reflected. Vasin, reporting to the organization;

DEBIT 20 CREDIT 70

30,000 rub. - A.V.’s salary was accrued Vasin for June 2015;

DEBIT 70 CREDIT 68 subaccount “Personal Tax Payments”

3900 rub. - personal income tax accrued;

DEBIT 70 CREDIT 94

2000 rub. - the debt under the report is withheld;

DEBIT 70 CREDIT 50

9100 rub. - salaries were issued for the second half of June 2015.

Important circumstance

If you withhold the amount of debt from an employee's salary, he will not have taxable income. Personal income tax and insurance premiums are not charged.

So, if you have withheld from the employee’s salary the entire debt under the report, personal income tax and insurance premiums do not need to be charged. After all, the debt has been repaid, which means the individual has no income.

Situation No. 2 During the month, no action was taken to repay, but later the employee repaid the debt

As we have already said, you can forcibly deduct a debt from an employee’s salary only for a month (Article 137 of the Labor Code of the Russian Federation). If time has passed, and the employee has not reported and has not returned the money, a sufficient unpleasant situation. Since specialists from the Ministry of Labor and the Social Insurance Fund of the Russian Federation say that one month after the end of the reporting period, insurance premiums must be calculated on the amount of the debt off-budget funds(clause 5). The arguments are as follows. An advance not returned on time is considered employee remuneration according to employment contract. Therefore, the amount of debt is subject to insurance contributions to extra-budgetary funds (Part 1, Article 7 and Article 8 of Federal Law No. 212-FZ of July 24, 2009, hereinafter referred to as Law No. 212-FZ).

If the employee subsequently submits a report or returns the money, then the previously accrued contributions should be adjusted.

Essence of the question

For the amount of the advance not returned on time, officials demand that insurance contributions be charged to extra-budgetary funds. If the employee subsequently returns the money or submits an advance report, the contributions will have to be adjusted.

Please note that there is no need to accrue personal income tax one month after the end of the reporting period. And that's why. Insurance premiums are determined on the date of accrual of benefits (clause 1 of Article 11 of Law No. 212-FZ), and personal income tax - on the date of payment of income (Article and Tax Code of the Russian Federation). Until the reporting debt is forgiven or written off, the money is not the employee’s property. Therefore taxable Personal income tax Not yet ().

But let's get back to insurance premiums. Due to the fact that the employee is more than a month late with the report, the organization will have to pay excess amounts to extra-budgetary funds. Of course, when the employee pays off the debt, you will offset the overpayment, but the company could use this money for other purposes. Therefore, to avoid additional waste of money and time, our recommendations are as follows.

Don't wait until all the deadlines are over. Remind your employees that they will need to report soon, e.g. e-mail. If the deadline has passed and there is no report, without delay, discuss this situation with your manager. It is better to immediately ask the employee to write a statement of voluntary withholding or quickly make a decision to forcibly withhold money. And besides, if your employees often delay documents, it makes sense to increase the period for reporting business expenses. After all, it is installed at the discretion of the company.

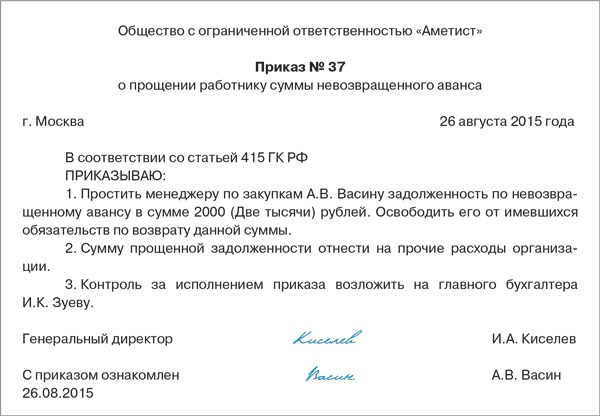

Situation No. 3 They decided to forgive the debt

The following situation is that the employee never reported and did not return the money. And for some reason you decided to forgive the debt. To do this, issue an order from the manager or another internal document. The main thing is to indicate in it the amount of debt that will be written off and the date. A sample of such a document is shown on the right. Notify the employee about the debt forgiveness. After this, the debt is considered repaid (clause 2 of Article 415 of the Civil Code of the Russian Federation).

For the amount of forgiven debt, pay insurance premiums to extra-budgetary funds. In general, this should have been done a month after the expiration of the reporting period (clause 5 of the appendix to the letter of the Federal Social Insurance Fund of the Russian Federation dated April 14, 2015 No. 02-09-11/06-5250 and the letter of the Ministry of Labor of Russia dated December 12, 2014 No. 17-3/B- 609). And in this situation you won’t have to recalculate anything. Since the employee did not return anything and did not report, the contributions were calculated correctly.

Accrue personal income tax on the date of debt forgiveness. Income subject to personal income tax arises on the date of receipt Money(Article 223 of the Tax Code of the Russian Federation). And when the debt is forgiven, the amount of the unreturned advance becomes the property of the employee and is subject to personal income tax (letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610).

Withhold tax on your next paycheck. And transfer personal income tax to the budget on the same day or the next if the salary was paid from cash proceeds (clause 6 of Article 226 of the Tax Code of the Russian Federation).

If the employee has already quit and it is impossible to withhold tax, then no later than January 31, 2016, submit a certificate for him in Form 2-NDFL for 2015 with sign 2 (clause 5 of Article 226 of the Tax Code of the Russian Federation). Send the same certificate yourself former employee. In the certificate with attribute 2, indicate not all income received for the year, but only those from which tax was not withheld. And, accordingly, the amount of tax accrued but not withheld.

Please note that the amount of the employee’s forgiven debt is not taken into account in expenses under the simplified tax system. Since there is no suitable item in the list from paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. In accounting, the amount of forgiven debt is included in other expenses of the organization (clause 11 of PBU 10/99 “Expenses of the organization”). The postings will be like this:

DEBIT 94 CREDIT 71

The employee's reporting debt is reflected;

DEBIT 91 subaccount “Other expenses” CREDIT 94

The amount of the employee’s forgiven debt is written off as other expenses;

DEBIT 20 (26, 44) CREDIT 69

Insurance premiums have been accrued to extra-budgetary funds.

If the employee is still working in the organization and personal income tax can be withheld, then make the following entry:

DEBIT 70 CREDIT 68 “Calculations for personal income tax”

Personal income tax is assessed on the amount of the forgiven debt.

If the employee has already been fired, the last posting is not needed, since he will pay personal income tax himself.

Situation No. 4 You did not forgive the debt, but the statute of limitations for debt collection has passed

It happens that, while taking an inventory of payments, you discovered that an employee has an old accountable debt. If the deadline has already passed limitation period, the amount can be written off. Let us recall that total term The limitation period is three years (Article 196 of the Civil Code of the Russian Federation). Count it from the day when the employee was supposed to submit an advance report or return the money. For example, if the last day of the report was June 20, 2012, then the statute of limitations for collecting the debt will end on June 20, 2015 - unless, of course, you made documented attempts to return the money during this period of time - then the period is extended.

On the date the debt is written off, accrue personal income tax, since on this day the outstanding amount becomes the property of the employee (letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610).

But with insurance premiums it’s more complicated. After all, they should have been accrued a long time ago - a month after the reporting period expired. If this was not done and you pay them only after three years, you will also need to transfer penalties (Article 25 of Law No. 212-FZ). Let us remind you that penalties are calculated as a percentage of the unpaid amount for each day of delay at a rate equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force on those days. Reflect the additional accrued amounts of insurance premiums in the reports for the current period (letter of the Pension Fund of the Russian Federation dated June 25, 2014 No. NP-30-26/7951).

On a note

To calculate the amount of penalties, you can use special service on the website of the magazine “Simplified” 26-2.ru. The penalty calculator is available only to subscribers.

In tax accounting simplified taxation system amount The employee's written-off debt is not reflected (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). In accounting, include bad debt as part of other expenses (clause 11 of PBU 10/99). The accounting entries will be the same as when the debt is forgiven, that is, similar to the previous situation.

Star

for the correct answer

Wrong

Right!

The organization forgave the employee's reporting debt. When should personal income tax be calculated on the amount of forgiven debt?

The employee has income subject to personal income tax on the date the debt is forgiven. Accordingly, it is on this day that the tax itself should be calculated (letter of the Ministry of Finance of Russia dated September 24, 2009 No. 03-03-06/1/610). In fact, keep Personal income tax employer will be able to with the next payment of wages to the employee

One month after the deadline for

On the date of debt forgiveness

12 min read

Approximate time

Print

and take it with you

Print this article

Download article

Comment on the document

How “simplistic” people can apply new changes to the Civil Code of the Russian Federation in practice

Ya.A. Dianova, Director of the Department of Corporate and commercial law law firm GRATA

On June 1, 2015, the next block of changes to Civil Code RF (Federal Law dated 03/08/2015 No. 42-FZ). They mainly affect the procedure for concluding, executing and terminating transactions. So, now in my contract work can be used as a guarantee of fulfillment of obligations security deposit. Interest in case of late payment should be calculated according to the new rules. Should “simplified people” be guided by these changes? We turned to a legal practitioner with these questions.

An employee who has received money on account is required to submit an advance report along with documents confirming payment for goods and services. This is stated in paragraph 6.3 of the Procedure approved by the Bank of Russia Directive No. 3210-U dated March 11, 2014 (hereinafter referred to as Directive No. 3210-U).

The unified form of advance report No. AO-1 was approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

Limitations of the unified form

The use of corporate cards expands the list of transactions available to the accountable person. In addition to direct payment for services and goods purchased in the interests of the company in a non-cash manner, an employee can withdraw money from the corporate card to pay in cash. In addition, the use of a corporate card makes it possible to replenish the balance of accountable amounts by non-cash transfer of funds to the card.

The unified form of the advance report does not provide lines for reflecting transactions on the company’s corporate card. Let's figure out how to get around these restrictions.

Add unified form . The company may make changes to unified forms. In particular, add lines. This is stated in the Procedure for the Application of Unified Forms of Primary accounting documentation, approved by resolution Goskomstat of Russia dated March 24, 1999 No. 20.

Develop the form yourself. Since January 1, 2013, unified forms are not mandatory for use by companies (clause 4 of article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, hereinafter referred to as Law No. 402-FZ).

The obligation to apply unified forms remains only in relation to cash documents, which are directly listed by Directive No. 3210-U. These include incoming and outgoing cash orders, settlement- payment statement and payroll and bank documents. The advance report is not listed among them, so the company can develop its form independently. The main thing is that it contains everything required details. Their list is given in paragraph 2 of Article 9 of Law No. 402-FZ.

Let's figure out what additional lines are needed in the expense report to reflect all transactions using the company's corporate cards.

Cashless replenishment of the balance on a corporate card

Let's say an employee has been tasked with buying expensive equipment for the company. The balance on the corporate card he received is not enough for the purchase. The accountant transfers the missing amount to the card (to the corporate card account) from the company account. Let's look at what lines will be needed in the expense report using an example.

Example

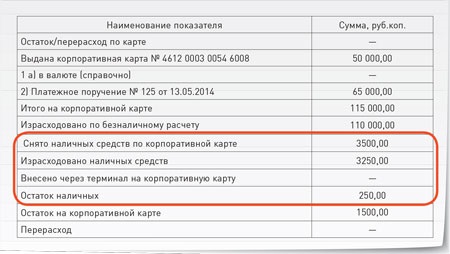

IN. Lunokhodov received a corporate card. Available funds on the card - 50,000 rubles.

An employee was instructed to purchase a multifunctional device (MFC) for the company at a cost of 110,000 rubles. By order to the corporate card of V.O. Lunokhodov payment order No. 125 dated March 24, 2014 transferred 65,000 rubles. After purchasing the MFC, 5,000 rubles remained on the card. How to prepare an advance report?

The company's accountant added new lines to the unified advance report form, taking into account transactions on the company's corporate card.

Balance of funds and card issuance. In the advance report form developed by the accountant, there are two lines that show the amount of funds on the date the card was used:

— “Card balance (if the card has not been previously handed over by the employee)”;

— “Card No. issued”, filled in if the card was issued before completing the task.

The balance on the card in our case is zero, since O.V. Lunokhodov received the map immediately before completing the mission. In the line “Card No. issued” we indicate the card number and the amount available on it.

Topping up funds on the card. The line “ Payment order" In this line we indicate the number and date of the payment order. In our case, the entry will look like this: “Payment order No. 125 dated March 24, 2014.”

Final balance. In the line “Total on corporate card” you need to indicate either the balance on the card or the amount of the balance on the issued card and additional transfer. On the map of V.O. Lunokhodov accumulated the amount of 115,000 rubles. (50,000 rub. + 65,000 rub.).

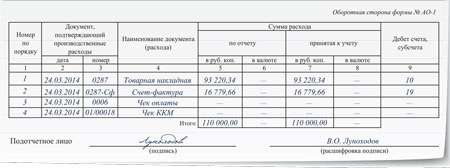

Reverse side of the expense report. On back side In the advance report, the employee will list documents confirming the intended use of funds on the card, indicate their date and number, and the amount of expenditure.

Please note: when paying for goods (work, services) using corporate cards, you do not need to comply with the settlement limit (100,000 rubles), according to paragraph 6 of the Bank of Russia Directive dated 10/07/2013. No. 3073-U for cash payments under one agreement.

Withdrawing cash from a corporate card

The accountable person does not always have the opportunity to pay for goods (work, services) by non-cash method. But an employee can withdraw money from the company’s corporate card and pay in cash. This situation must be taken into account when developing the expense report form. It is enough to add four lines:

- “Cash withdrawn using a corporate card”;

- “Cash spent”;

- “Deposited through the terminal onto a corporate card”;

- "Cash balance."

The employee must deposit the remaining cash after withdrawing it from the corporate card to the company cash desk or through the terminal to the corporate card. The accountant will reflect all cash transactions with entries on front side advance report.

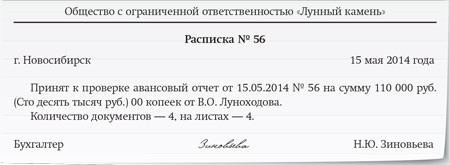

Receipt for receipt of advance report

The reporting employee submits an advance report to the authorized accounting employee, and in his absence, to the manager. This rule is established in paragraph 6.3 of Instructions No. 3210-U. The verified expense report is approved by the head of the company. After this, the goods (work, services) purchased by the accountable are accepted for accounting. The employee is given a receipt for receipt of the advance report. This is the cut-off bottom part of the report of a unified form.

If this part is not provided in the form of the advance report developed independently, the receipt must be drawn up in any form.

Approval of the advance report form

The form of the advance report must be approved by the manager (clause 4 of article 9 of Law No. 402-FZ). This requirement is not waived if the company plans to use a unified form. As a rule, the forms of primary documents are provided in the appendix to the order for registration

I. Dmitrieva,

auditor

- Lipotropic products: our helpers that break down fats Lipotropic substances in which products

- Anatomy - what kind of science is it?

- The main layers in the solar atmosphere What is the visible layer of the solar atmosphere called?

- Sanitary treatment of the patient 1 sanitary treatment of the patient

- Modern dictionary of the Russian language stress pronunciation orthoepic

- The magic of numbers. Why do you dream about the Face? Dream Interpretation dirty face in the mirror

- Personal eastern horoscope

- The great mantra of Shiva - Om Namah Shivaya Shivaya namah nama om meaning

- Dream Interpretation: why you dream of walking through a cemetery, interpretation of the meaning of sleep for men and women

- Lego Secret Figure Minifigures Series 17

- Real benefits and mythical harm of dates for the human body

- Daniel Defoe "The Life and Extraordinary Adventures of Robinson Crusoe" - Document How many years did Robinson stay on the island

- What is the difference between Sunnis and Shiites

- Closing the month in accounting

- Main current account in 1s 8

- Schemes for correcting old errors

- Biography of Irina Saltykova: personal life, creativity

- Dysphoria - what is it and how is it treated?

- How to attract a Taurus man

- Gems for scales. Stones for scales. Where to wear a talisman stone for Libra women