An ideal card for keeping track of contributions. Sample card for individual accounting of accrued payments and contributions

Significant change legislation, such as replacing the unified social tax with insurance premiums, led to the need to change the usual documents to new ones. In particular, the Pension Fund together with the Social Insurance Fund have developed a new card for recording accrued payments and the amounts of accrued insurance contributions. The basis new form the well-known individual card for recording payments to individuals and accrued unified social tax for “simplified people” and organizations on common system, the indicators of which have been changed and brought into compliance with the legislation on insurance premiums.

As before, employing organizations are required to keep records of income paid to individuals. This follows from paragraph 6 of Art. 15 Federal Law dated July 24, 2009 N 212-FZ "On insurance contributions to the Pension Fund Russian Federation, Social Insurance Fund of the Russian Federation, Federal Fund compulsory health insurance and territorial compulsory health insurance funds" (hereinafter referred to as Federal Law No. 212-FZ).

Previously, taxpayers used cards for this purpose individual accounting according to the Unified Social Tax, the form and procedure for filling which were approved by Order of the Ministry of Taxes and Taxes of Russia dated July 27, 2004 N SAE-3-05/443. With the abolition of the unified social tax, the old cards lost their relevance, and the Pension Fund and the Social Insurance Fund at the beginning of the year published a new form of card for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance contributions (Letter of the Pension Fund of the Russian Federation dated January 26, 2010 N AD-30-24/ 691, FSS of the Russian Federation dated January 14, 2010 N 02-03-08/08-56P).

The new one, as before, provides for monthly reflection of payments throughout the entire billing period (calendar year) (clauses 3, 4, article 15 of Federal Law N 212-FZ). Based on them, organizations and entrepreneurs calculate monthly insurance payments.

The individual accounting card records all payments, reflects non-taxable amounts, and also calculates the base of insurance premiums and the amounts of contributions themselves to all funds: to the Pension Fund of the Russian Federation, to the Federal Compulsory Medical Insurance Fund (FFOMS) and territorial fund compulsory medical insurance (TFIF), to the Social Insurance Fund (FSS).

For your information. The Letter from the Pension Fund and the Social Insurance Fund provides the recommended form of the card. Organizations have the right to make their own adjustments to the proposed form, add, combine or highlight individual columns based on practical expediency. In addition, it is allowed to develop own form cards.

Let's take a closer look at the sections of the new document and the nuances of filling them out.

A cap

In the title of the card you must indicate for what year it was compiled, as well as put down the page numbers. The pages are numbered through, that is, in a continuous manner.

The first line of the header reflects information about the payer of insurance premiums, his TIN and KPP.

It is necessary, as before, to indicate the insurance number, citizenship and date of birth of the employee. At the same time, an indicator such as an individual’s Taxpayer Identification Number (TIN) has been added to the new card. However, it may not be filled out if information about identification number The organization does not have a taxpayer.

The recommended card does not require indicating the number and series of the employee’s passport, his gender, place of residence, position, type and number of the contract, as well as the date of appointment to the position. These indicators were considered insignificant and excluded from the new form of the document.

But information about disability remains mandatory. If the employee is disabled, then it is enough to indicate the validity period of the certificate (date of issue and expiration date), but there is no need to indicate the certificate number.

For your information. The form of the card can be found on the official website of the FSS of the Russian Federation (www.fss.ru) in the section “Enterprises and organizations”.

About tariffs

A small table on the right side of the card displays information about the insurance premium rate applied by the organization.

Tariff code

The first line of this plate indicates the tariff code, which can be found in the Directory of tariff codes for insurance premium payers.

In 2010, institutions paying insurance premiums according to the basic tariff indicate code 01.

Agricultural producers, organizations of folk arts and crafts, family communities of indigenous peoples of the North engaged in traditional industries households indicate tariff code 02.

Tariff code 03 indicates:

Organizations and individual entrepreneurs, having the status of resident of a technical innovation special economic zone(TVOEZ) and making payments to individuals working in the territory of TVOEZ;

Public organizations of disabled people (including those created as unions public organizations disabled people), among whose members disabled people and their legal representatives make up at least 80 percent;

Organizations, authorized capital which consists entirely of contributions from public organizations of people with disabilities and in which average number disabled people make up at least 50 percent, and the share of disabled people's wages in the wage fund is at least 25 percent;

Institutions created to achieve educational, cultural, medical and recreational, physical culture, sports, scientific, information and other social goals, as well as to provide legal and other assistance to people with disabilities, disabled children and their parents (other legal representatives), the only owners of property of which are public organizations of disabled people, with the exception of insurance premium payers engaged in production and (or) sale excisable goods, mineral raw materials, other minerals, as well as other goods in accordance with the list approved by the Government of the Russian Federation on the proposal of all-Russian public organizations of disabled people.

Organizations and individual entrepreneurs paying the Unified Agricultural Tax use tariff code 04.

Organizations and individual entrepreneurs using the simplified tax system, as well as organizations and individual entrepreneurs paying only UTII, use tariff code 05 (but since 2011 they have been paying insurance premiums at the basic tariff).

Tariff size

The "%" column indicates the size of the insurance premium rate. Basic tariff of insurance premiums in 2010:

Pension fund - 20 percent;

Social Insurance Fund - 2.9 percent;

Federal Compulsory Health Insurance Fund - 1.1 percent;

Territorial compulsory health insurance funds - 2 percent.

For compulsory pension insurance (OPI), the tariff for insurance part, on savings part and additional deductions. Pension insurance is carried out taking into account the employee’s year of birth. The main insurance rate for compulsory insurance in 2010:

To finance the insurance part labor pension for persons born in 1966 and older - 20 percent, for persons born in 1967 and younger - 14 percent;

To finance the funded part of the labor pension for persons born in 1967 and younger - 6 percent.

For mandatory health insurance(Compulsory Medical Insurance) tariffs are also indicated with a breakdown into federal and territorial funds - 1.1 and 2 percent, respectively.

Card body

Due to the fact that the names of the rows and indicators of the main table contain many references to clauses, parts and articles of Federal Law N 212-FZ, you have to constantly refer to the text of the Law, which does not add convenience to the work of an accountant.

Let's consider in order all the indicators to be filled out.

Each indicator in the card has two lines: the first line indicates the amount for the month, the second - from the beginning of the year with an accrual total.

"Payments in accordance with Parts 1 - 2 of Article 7 212-FZ"

This line records payments and other remuneration under employment contracts and civil contracts, the subject of which is the performance of work, provision of services, as well as under contracts author's order, alienation agreements exclusive right for works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art. It also indicates payments and other remuneration in favor of individuals subject to mandatory social insurance in accordance with federal laws on specific types compulsory social insurance.

"Amounts not subject to taxation in accordance with 212-FZ"

- “Part 7, Article 8” - this line records the amounts (actually incurred and documented expenses) that reduce income received under an author’s order agreement, an agreement on the alienation of the exclusive right to works of science, literature, art, publishing license agreement, a license agreement granting the right to use a work of science, literature, or art. If expenses cannot be documented, they are accepted for deduction in accordance with Art. 8 of Federal Law N 212-FZ sizes;

- “Parts 1, 2 of Article 9” - non-taxable income is reflected. It's about O state benefits; compensation payments; amounts of one-time financial assistance; income of members of family communities of indigenous peoples of the North; amounts of insurance payments under voluntary personal insurance contracts, non-state pension provision; additional insurance premiums paid by the employer no more than 12,000 rubles. in year; the cost of travel for employees and members of their families to the vacation destination and back, etc. This line also reflects travel expenses;

- “Clause 1, Part 3, Article 9” - amounts are not included in the base for calculating insurance premiums in terms of compulsory insurance monetary allowance and other payments received by prosecutors and investigators, as well as judges federal courts and justices of the peace;

- “clause 2, part 3, article 9” - these lines reflect payments that are not subject to insurance contributions to the Social Insurance Fund: remuneration paid to individuals under civil law contracts, including under an author’s order agreement, an agreement on the alienation of exclusive rights to works of science, literature, art, publishing license agreement, license agreement granting the right to use works of science, literature, art.

"Amounts of payments exceeding those established by Part 4 of Article 8 212-FZ"

The basis for calculating insurance premiums for each individual is established in an amount not exceeding RUB 415,000. cumulatively from the beginning of the billing period. From amounts of payments and other remuneration in favor of an individual exceeding given limit, insurance premiums are not charged. These excesses should be reflected in this line.

“Base for calculating insurance premiums for compulsory health insurance”, “...for compulsory medical insurance” and “...for the Social Insurance Fund”

The base for calculating insurance premiums is determined as the amount of payments and other remunerations accrued for billing period in favor of individuals, with the exception of payments not subject to contributions, and payments exceeding the limit established by Part 4 of Art. 8 of Federal Law N 212-FZ (RUB 415,000).

“Insurance premiums accrued for compulsory health insurance”, “...for compulsory medical insurance” and “...for the Social Insurance Fund”

As the name suggests, the section reflects information on accrued contributions to the Pension Fund, Federal and territorial medical funds and the Social Security Fund.

Insurance contributions to the Pension Fund should be reflected broken down into the insurance part, the funded part and additional tariff.

Contributions to compulsory medical insurance are also divided in the card into insurance premiums to the Federal and territorial medical funds.

IN next line The accountant shows the amounts of contributions accrued to the Social Insurance Fund.

"Benefits accrued from the Social Insurance Fund"

The last line of the card records what was received from social insurance. cash in the form of benefits in case of temporary disability, in connection with maternity, social benefits for burial, etc. (Clause 2, Article 8 of the Federal Law of July 16, 1999 N 165-FZ “On the Basics of Compulsory Social Insurance”, Part 1 of Article 1.4 of the Federal Law of December 29, 2006 N 255-FZ “On Compulsory Social Insurance” in case of temporary disability and in connection with maternity").

To bring greater clarity to the rules for filling out a new accounting card, we will analyze most of the indicators using an example.

Example. S.A. works at Muzyka LLC. Petrov (b. 1980) as a sales consultant. An employment contract with a salary of 20,000 rubles was concluded with Petrov. Also, Muzyka LLC lists additional pension contributions for employees in accordance with Federal Law of April 30, 2008 N 56-FZ in the amount of 1000 rubles. per month.

In January 2010, Petrov received a bonus of 1,500 rubles.

In February 2010, Muzyka LLC paid Petrov financial assistance in the amount of 2000 rubles.

In March 2010, an agreement was concluded with Petrov civil contract for the provision of services for tuning musical instruments with a remuneration of 5,000 rubles.

In April 2010, Petrov was accrued wage in the amount of 16,300 rubles. and temporary disability benefits in the amount of 2850 rubles. (including 1,710 rubles from the Social Insurance Fund).

We fill in the data in the first section - the line "Payments in accordance with Parts 1 - 2 of Article 7 212-FZ":

January: 22,500 rub. (20,000 + 1500 + 1000);

February: 23,000 rub. (20,000 + 2000 + 1000);

March: 26,000 rub. (20,000 + 5000 + 1000);

April: RUB 20,150 (16,300 + 2850 + 1000).

We fill in the data in the second section - the line “Of which amounts are not subject to taxation in accordance with 212-FZ”:

According to the line “Part 7, Article 8”: no payments were made.

According to the line “part 1, 2 of article 9”:

January: 1000 rub. (Clause 6, Part 1, Article 9 of Federal Law No. 212-FZ);

February: 3000 rub. (1000 + 2000) (clause 6, part 1, article 9, clause 11, part 1, article 9 of Federal Law N 212-FZ);

March: 1000 rub. (Clause 6, Part 1, Article 9 of Federal Law No. 212-FZ);

April: 3850 rub. (1000 + 2850) (clause 1, part 1, article 9, clause 6, part 1, article 9 of Federal Law N 212-FZ).

According to the line “clause 1, part 3, article 9”: no payments were made.

According to the line “Clause 2, Part 3, Article 9”:

March: 5000 rub. (Clause 2, Part 3, Article 9 of Federal Law No. 212-FZ).

The lines of the section “Amount of payments exceeding the established part 4 of Article 8 212-FZ” are not filled in, since the cumulative total base for calculating insurance premiums did not exceed 415,000 rubles.

We fill in the data in the section - the lines "Base for calculating insurance premiums for compulsory health insurance":

January: 21,500 rub. (22,500 - 1000);

February: 20,000 rub. (23,000 - 3000);

March: 25,000 rub. (26,000 - 1000);

April: 16,300 rub. (20 150 - 3850).

We fill in the data in the section - the lines "Base for calculating insurance premiums for compulsory medical insurance."

Strings this section are filled in similarly to the previous one, since the base for calculating contributions is pension insurance in our case, equal to the base for calculating health insurance premiums.

We fill in the data in the section - the lines “Base for calculating insurance contributions to the Social Insurance Fund”.

Remunerations paid to individuals under civil contracts are not subject to insurance contributions to the Social Insurance Fund. This means that in March 2010 the base for calculating contributions to the Social Insurance Fund will differ from the base for pension and health insurance. In other months, the bases for calculating contributions for all funds are the same.

March: 20,000 rub. (26,000 - 1000 - 5000).

We fill in the data in the section - the line “Insurance premiums accrued for compulsory health insurance” according to insurance tariffs.

Insurance part:

January: 3010 rub. (RUB 21,500 x 14%);

February: 2800 rub. (RUB 20,000 x 14%);

March: 3500 rub. (RUB 25,000 x 14%);

April: 2282 rub. (RUB 16,300 x 14%).

Storage part:

January: 1290 rub. (RUB 21,500 x 6%);

February: 1200 rub. (RUB 20,000 x 6%);

March: 1500 rub. (RUB 25,000 x 6%);

April: 978 rub. (RUB 16,300 x 6%).

We fill in the data in the section - the line “Accrued insurance premiums for compulsory medical insurance” according to insurance tariffs.

January: 236.5 rub. (RUB 21,500 x 1.1%);

February: 220 rub. (RUB 20,000 x 1.1%);

March: 275 rub. (RUB 25,000 x 1.1%);

April: 179.3 rub. (RUB 16,300 x 1.1%).

January: 430 rub. (RUB 21,500 x 2%);

February: 400 rub. (RUB 20,000 x 2%);

March: 500 rub. (RUB 25,000 x 2%);

April: 326 rub. (RUB 16,300 x 2%).

We fill in the data in the section - the line “Insurance contributions accrued to the Social Insurance Fund” according to insurance tariffs:

January: 623.5 rub. (RUB 21,500 x 2.9%);

February: 580 rub. (RUB 20,000 x 2.9%);

March: 725 rub. (RUB 25,000 x 2.9%);

April: 472.7 rub. (RUB 16,300 x 2.9%).

Finally

It is not necessary to affix the organization’s seal, since special place(“M.P.”) is not provided on the card. It is enough to certify the accounting card with the signature of the chief accountant.

A kopeck saves the ruble

The algorithm for rounding certain amounts when calculating insurance premiums is similar to rounding when calculating the unified social tax.

The amount of insurance premiums to be transferred to the relevant government off-budget funds, is determined in full rubles (clause 7 of article 15 of Federal Law N 212-FZ). However, in an individual card monthly amounts accrued payments and insurance premiums must be reflected in rubles and kopecks. IN otherwise in the final calculation, this may lead to a distortion of the amounts of contributions for the entire organization as a whole. Thus, the individual card is filled out taking into account kopecks, and the indicators are subject to rounding only after summing up the individual accounting data for the taxpayer as a whole.

Contributions for "injuries"

Please note that contributions from accidents and occupational diseases are not included in this card. This is due to the fact that the base for accrual for them differs from the base for insurance contributions to extra-budgetary funds.

In this case, accountants have the right to independently supplement the accounting card with lines for calculating contributions “for injuries”.

A new form has been developed to record employee accruals and payments. individual card accounting for insurance premiums. The form of the document is contained in the joint letter of the Pension Fund and the Social Insurance Fund No. 17-03-10/08/47380 and No. AD-30-26/16030 dated December 9, 2014.

In accordance with the law, insurers must keep records of remuneration, payments, as well as insurance premiums to personnel for each employee separately. This requirement defined by paragraph 6 of Article 15 of Federal Law No. 212 of July 24, 2009. Previously, the card form was used for accounting, which is provided by a joint letter of the Federal Social Insurance Fund of the Russian Federation No. 02-03-08/08-56P dated January 14, 2010 and the Pension Fund No. AD-30-24/691 dated January 26, 2010. Due to the change in The legislation required updating the form.

The form proposed for individual accounting of payments and insurance premiums is advisory in nature and is not mandatory for use. In this regard, based on a letter from the Ministry of Health and Social Services. Development of the Russian Federation No. 286-19 dated February 11, 2010, payers, at their own discretion, can make any changes to it, as well as carry out accounting using a self-created form.

Individual insurance premium card

As before, the card must contain the individual’s full name, citizenship, insurance number, TIN, and information regarding disability. The date of birth is no longer indicated on the form. In addition, the form is supplemented with such indicators as the number and type of contract concluded with the employee.

On the right at the top of the document there is a table of tariff codes for calculating insurance. contributions. In the line “Compulsory medical insurance” (CHI), the breakdown of tariffs for FFOMS and TFOMS has been eliminated. It should be noted that currently contributions are fully transferred to the FFOMS.

The “body” of the document must indicate all payments to an individual and amounts that are not subject to contributions. Single lines are devoted to calculating the base of insurance premiums, as well as the amounts of contributions for compulsory medical insurance, social insurance and pension insurance.

The form is also supplemented with a column in which it is necessary to reflect contributions for insurance against occupational diseases and accidents.

If you fill out the card foreign worker, the status of the person is indicated:

- 1 - permanent residence;

- 2 - temporary;

- 3 - temporary stay, in accordance with an employment contract concluded for a period of 6 months or more;

- 4 - temporary stay, in accordance with an employment contract concluded for a period of up to six months;

- 5 - specialist with high level qualifications - permanent residence;

- 6 - specialist with a high level of qualifications - temporary residence.

The new form excludes information about contributions accrued to the funded and insurance parts of the pension. There is no such division due to the fact that since 2014, policyholders in individual information Only the amount of contributions based on the general tariff is indicated.

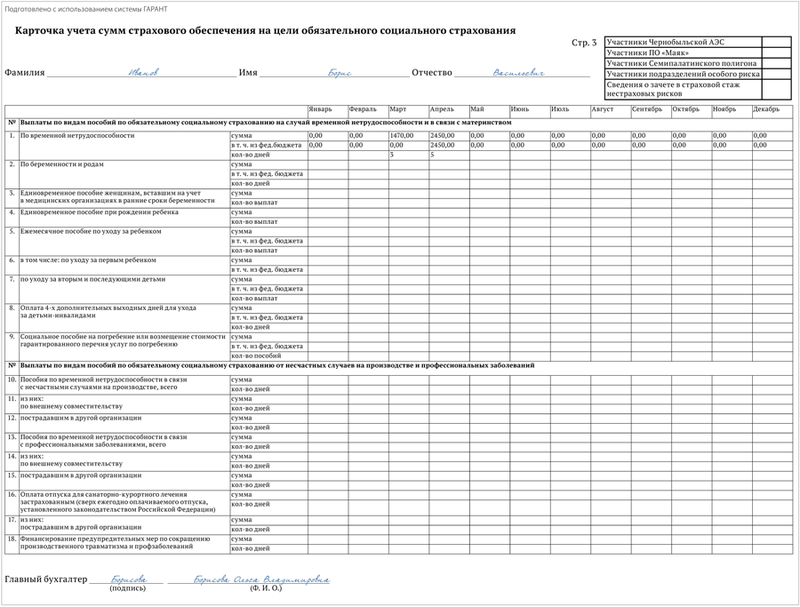

Additional sheets

The form has been updated with new pages. On page 2 you should reflect information regarding depending on the special class. assessments working conditions. On page 3, the “Card for recording the amounts of insurance coverage for compulsory social insurance” must be filled out. It contains data on the payment of benefits in the event of temporary loss of ability to work, in connection with maternity, from occupational diseases and accidents occurring at work.

Accountable amounts, incl. for the purchase of gasoline, you can give the employee not only in cash, but also transfer it by bank transfer to his “salary” card.

Insurance payment card

Current as of: October 4, 2016

All insurers are required to keep records of accrued payments and rewards, as well as contributions from them separately for each individual in whose favor such payments were made (Part 6, Article 15, Clause 2, Part 2, Article 28 of the Law of July 24, 2009 No. 212-FZ). The Pension Fund of the Russian Federation and the Social Insurance Fund recommend using for this purpose a card for individual accounting of the amounts of accrued payments and insurance premiums according to the form they developed (Appendix to the Letter of the Pension Fund of the Russian Federation No. AD-30-26/16030, FSS of the Russian Federation No. 17-03-10/08/47380 dated 09.12. 2014). The card reflects data for calendar year.

The card indicates following information:

- name of the insured organization, its tax identification number and checkpoint;

- Full name of the insured person, citizenship, disability, type of contract concluded with him, as well as its number and date of conclusion (or date of appointment of the person to the position), status of the person. Status is indicated only if the person is foreign citizen or has no citizenship;

- the amount of payments in favor of the person. Moreover, payments subject to and not subject to insurance contributions are shown separately;

- bases for calculating contributions separately for compulsory health insurance, compulsory medical insurance and social insurance;

- the amount of accrued premiums for each type of insurance. In this case, pension contributions are reflected separately from amounts not exceeding limit value base, and amounts exceeding it;

- expenses for the purposes of compulsory social insurance - benefits paid in case of temporary disability and in connection with maternity, as well as in connection with industrial accidents and occupational diseases (of course, if there were any). Detailed information about benefits is shown on page 3 of the card.

Please note that all total indicators in the card must be indicated both for the corresponding month and as a cumulative total.

In addition, if among your insured persons there are flight crew members, coal industry workers, and those who work in hazardous (hazardous) working conditions, then on the card you will also have to reflect the “additional” contributions accrued from their payments. For this purpose, page 2 of the card is provided.

Sample card for individual accounting of accrued payments and contributions

Most policyholders will probably have to fill out the first page of the entire card. An example of filling it out is given below.

The card shows accruals (and contributions from them) in favor of the head of the sales department, A.M. Sviridov, who in February 2016, in addition to his salary, received financial assistance in the amount of 30 thousand rubles. in connection with the birth of his son.

Card for individual accounting of accrued payments (sample)

An individual accounting card for the amounts of accrued payments and insurance premiums was developed by the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia. Direct duty to apply this form no, but departments recommend that employers use it in their work. Let's consider the procedure for filling out an individual accounting card for payments and insurance premiums.

The employer is obliged to keep records of the amounts of accrued payments and other remuneration to employees, as well as the amounts of insurance premiums related to them, in relation to each individual in whose favor the payments were made (Part 6 of Article 15, Clause 2 of Part 2 of Article 28 Federal Law of July 24, 2009 No. 212-FZ).

The form of an individual accounting card for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums has been developed Pension Fund Russia and the Social Insurance Fund of Russia. There is no direct obligation to use the Card, but departments recommend it for keeping records of taxable objects and charging insurance premiums (letter from the Pension Fund of the Russian Federation and the Federal Insurance Service of Russia dated December 9, 2014 No. AD-30-26/16030, 17-03-10/08/47380).

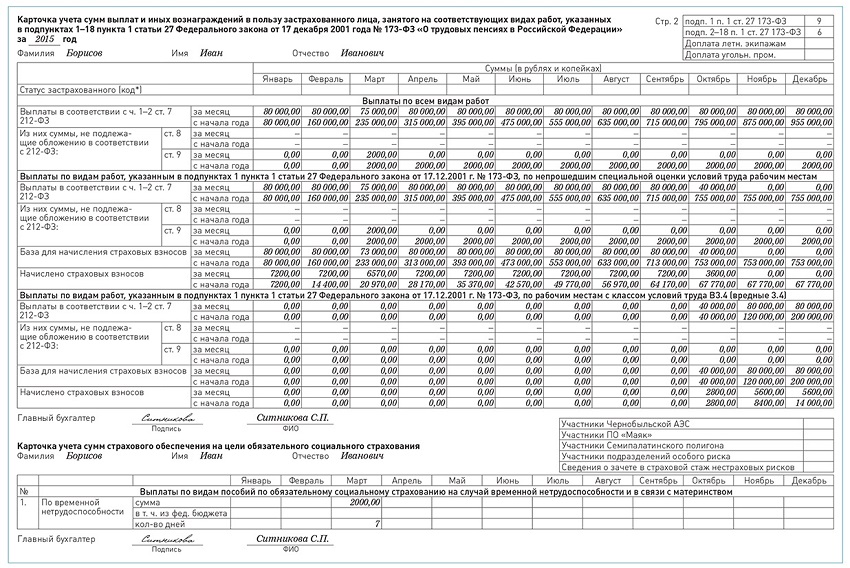

The new form, in comparison with the old (no longer valid) (approved by letter of the FSS of Russia and the Pension Fund of Russia dated January 14, 26, 2010 No. 02-03-08/08-56P, AD-30-24/691) is significantly expanded and consists of three pages . To account for payments to persons working in hazardous and harmful conditions(subparagraph 1-18, paragraph 1, article 27 of the Federal Law of December 17, 2001 No. 173-FZ), is intended separate page 2. Also, now information on benefits paid is indicated by their types (if there are expenses, page 3 is filled out).

The procedure for filling out an individual accounting card for payments and insurance premiums

The individual registration card allows you to reflect information about contributions for foreigners and stateless persons: for this category of workers, the column “insured status” is filled in with one of the following codes: 1 - permanent residence, 2 - temporary residence, 3 - temporary stay, under concluded employment contracts for a period of 6 months or more, 4 - temporary stay, under concluded employment contracts for a period of less than 6 months, 5 - highly qualified specialist - permanent residence, 6 - highly qualified specialist - temporary residence.

EXAMPLE

The Aktiv company makes monthly payments to the employee according to employment contract and charges contributions on them. In March and April 2015, the employee was sick for 3 and 5 days, respectively. Card individual contributions in relation to the employee is filled out as follows.

Sample of filling out a card for individual accounting of payments and insurance premiums

The funds have developed a new card for companies to track salaries and accrued contributions. Its form is recommended, so you can use your own form. But it’s easier and more convenient to fill out the card according to the sample.

* Individual registration card... is shown in the joint letter to the Pension Fund of Russia and FSS of Russia dated December 9, 2014 No. AD-30-26/16030, No. 17-03-10/08/47380.

Why did we develop a new form?

For each employee, it is necessary to keep records of payments and contributions (clause 6 of Article 15, subclause 2 of clause 2 of Article 28 of the Federal Law of July 24, 2009 No. 212-FZ). Mandatory accounting of contributions and expenses for insurance for temporary disability and maternity is also provided for in paragraph 1 of Article 4.8 of the Federal Law of December 29, 2006 No. 255-FZ. To do this, use an individual registration card. Its previous form was recommended in the joint letter of the Pension Fund of January 26, 2010 No. AD-30-24/691, FSS of Russia dated January 14, 2010 No. 02-03-08/08-56P. But now it is not relevant, since it only has one line for limit base on contributions, and since 2015, funds have different limits. In addition, many construction organizations pay contributions at additional rates depending on the classes of working conditions determined during the special assessment, and in old uniform they are not provided.

There are other adjustments that take into account, in particular:

- abolition of the employer's division of pension contributions into insurance and funded parts;

- elimination of the breakdown of contributions for health insurance by fund: to the FFOMS (Federal Compulsory Health Insurance Fund) and TFOMS (Territorial Compulsory Health Insurance Fund), since contributions are transferred only to the FFOMS;

- the need to indicate the status of a foreign worker (in connection with the obligation to pay contributions from the salaries of foreign workers).

Therefore, instead of one page there are now three (three sections) in the card. The first page must be completed for all employees. The second - only for those who are employed in harmful or hazardous work. And the third - for employees receiving benefits from social insurance funds.

How to fill out the form

Let's take a closer look at filling out each page of the card.

Calculation of contributions based on the general tariff

At the beginning of the form you must indicate general information for the employee: full name, insurance number, type and number of the concluded contract (labor, civil law, etc.).

The plate on the right shows the tariff code (if general, then 01), as well as the percentage of tariffs by type of contribution: for compulsory pension insurance (MPI) - 22 percent; for compulsory health insurance (CHI) - 5.1 percent; for compulsory social insurance (FSS) - 2.9 percent.

In FFOMS. Since 2015, employers have paid contributions to compulsory health insurance on all payments that are subject to contributions (no limit has been set). Therefore, the card does not provide lines for above-limit payments in terms of compulsory medical insurance. You only need to show the base and the amount of accrued contributions.

In the Pension Fund. For pension contributions, the base limit is 711 thousand rubles. For all payments above this amount, contributions are paid at a rate of 10 percent. Payments in excess of the limit must be reflected on the card in a special line “Amount of payments exceeding the established…”. They are not included in the database; they are indicated on the card before the line “Base for calculating insurance premiums for compulsory health insurance”.

Therefore, the line where pension contributions are reflected is divided into two parts: for contributions accrued for payments within the base, and for over-limit contributions.

Please note: if construction company applies a simplification, then payments in excess of the maximum base are not subject to contributions (subclause 8, clause 1, article 58 of law No. 212-FZ, letter of the Ministry of Labor of Russia dated January 30, 2015 No. 17-3 / B-37).

In the FSS of Russia. The limit for contributions to the social insurance fund is 670 thousand rubles, this amount differs from the base limit for pension contributions (Resolution of the Government of the Russian Federation of December 4, 2014 No. 1316). That's why cards appeared on page 1 different lines for payments exceeding the limit on pension contributions, and for payments exceeding the limit on contributions to the social insurance fund.

Please note that there is no limit set for contributions for injuries (they are accrued from all payments).

There is a special line on page 1 for benefits expenses, but at the same time payments need to be deciphered on page 3.

Calculation of additional contributions

For employees who work in hazardous or hazardous conditions, you need to fill out page 2 of the card.

This sheet reflects the amounts of payments subject to contributions at additional fixed (6 or 9%) or differentiated (from 2 to 8%) tariffs.

During the year, the additional tariff may change if the company conducts special assessment working conditions. Until the day the assessment report is approved, contributions must be calculated at rates of 9 and 6 percent (for lists No. 1 and No. 2, respectively).

And from the date of approval of the report - at differentiated tariffs: from 2 to 8 percent (letter of the Ministry of Labor of Russia dated March 13, 2014 No. 17-3/B113). Contributions at different rates are indicated in different subsections of the card.

Reflection of social security expenses

Page 3 of the card is intended for recording the amounts of benefits (sick leave, maternity leave, children's benefits, as well as benefits for insurance against industrial accidents) and other payments at the expense of the Federal Social Insurance Fund of Russia. In addition to the amounts, you must enter the number of payments or sick days.

When reflected monthly benefits for the care of a child (children) they separately indicate what amount is for the first child and what amount is for other children.

If there are relevant categories of employees, it is necessary to clarify how much money was issued from the funds federal budget(for example, regarding payments to Chernobyl victims). Since in in some cases financial support expenses for social insurance are made at the expense of interbudgetary transfers from the federal budget provided by the FSS of Russia (clause 5 of article 3 of law No. 255-FZ, article 5 of Federal Law of December 1, 2014 No. 386-FZ).

The card also contains a line for events that were financed by the social insurance fund. These include: special assessment of jobs, mandatory medical examinations, purchasing first aid kits, etc.

But these are expenses not for a specific employee, but for the company as a whole. Therefore, they may not be indicated on the card.

Based on the data on page 3 of the card, it will be easy to fill out Table 2 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity” and Table 8 “Expenses for compulsory social insurance against industrial accidents and occupational diseases” of Form-4 of the Federal Social Insurance Fund of the Russian Federation .

Example

Borisov I.I. Works at Stroika LLC. Salary - 80,000 rubles. per month. In March, he was sick for seven days, his salary this month was 73,000 rubles, and his disability benefit was 2,000 rubles.

Above-limit payments to compulsory pension insurance and the Social Insurance Fund must be reflected on the card starting from September 2015.

Let's assume that Borisov's profession is included in list No. 1 hazardous work. In October 2015, the company plans to conduct a special assessment of working conditions. Based on its results, class 3.4 (harmful) will be established for this employee’s workplace. Consequently, before the special assessment, the company calculates additional pension contributions at a rate of 9 percent, and after - at a rate of 7 percent (Clause 2.1, Article 58.3 of Law No. 212-FZ).

The special assessment report was approved on October 16, 2015. The employee's salary this month was 40,000 rubles. before assessment and 40,000 rubles. after it (11 working days from October 1 to 15 and from October 16 to 31).

According to the author, based on the legislation and the explanations provided by the Russian Ministry of Labor, salaries and contributions are divided in proportion to the days of the month: before the date of approval of the special assessment report and after it. Conditions that the tariff needs to be changed from next month, not in the legislation. A sample of filling out a card for an employee is given on page 77.

According to the author, based on the legislation and the explanations provided by the Russian Ministry of Labor, salaries and contributions are divided in proportion to the days of the month: before the date of approval of the special assessment report and after it. There are no conditions in the legislation that the tariff needs to be changed from next month. Sample of filling out a card for an employee:

What are the dangers of errors in the card?

When checking the correctness of the calculation of contributions, controllers from funds may require Required documents. These include accounting cards or other forms in which the organization keeps records of payments to employees and accrued contributions.

And if errors are found in the cards, can the organization be punished for this?

The company should not be held liable just for the fact of incorrect accounting of objects subject to insurance premiums. After all, the procedure for maintaining such records is not regulated by the legislation of the Russian Federation. And in Law No. 212-FZ responsibility for mismanagement individual accounting of accrued payments and amounts of accrued contributions has not been established.

The main thing is that in the reporting itself, which is submitted to the fund, the taxable base and contributions are calculated correctly.

If, due to errors in the card, contributions are underestimated, then the organization may be fined for incomplete payment of contributions as a result of a distortion of the base. The amount of the fine is 20 percent of the amount of unpaid contributions. And 40 percent - with deliberate distortion of data in reporting.

- Why do you dream about fire? Dream interpretation fire. Why do you dream of fire - interpretation of the dream I dreamed of a stove and fire in the stove

- Princess Diana and Prince Charles: a royal love story

- Direct proportionality and its graph

- Why do you dream that they want to kill you in a dream?

- How to get rid of your mother-in-law using magic?

- Making a lapel at home How to make a lapel at home the easiest way

- Strong lapel: methods for all occasions How to make a strong lapel

- Daniel Defoe "The Life and Extraordinary Adventures of Robinson Crusoe" - Document How many years did Robinson stay on the island

- What is the difference between Sunnis and Shiites

- Closing the month in accounting

- Main current account in 1s 8

- What are the reviews from residents about the residential complex?

- Interview: flight attendant about English for work English words needed for flight attendants

- Yegoryevsk Aviation Technical College of Civil Aviation named after V

- Allesandro Volta and the first electrochemical generator (Volta's column) Galvani and Volta discovered the existence of electric current

- Almanac "Day by Day": Science

- Common amoeba: description, reproduction, habitat Reproduction of common amoeba

- Prophecies of Abel during the monarchy of Catherine II and Paul I

- Teaching materials on the Russian language The world-famous gallery is presented

- Greater and Lesser Keys of Solomon