When to take 2 personal income tax per year

13494

- Topics:

- Personal income tax

- 2-NDFL

The deadlines for the delivery of 2-NDFL in 2017 depend on the sign of the certificate - 2 or 1. At the same time, all tax agents are obliged to report for employees on time, otherwise a fine is imminent. Read on for the deadlines for submitting certificates for organizations.

General term reporting income individuals according to the 2-NDFL form - no later than April 1 of the year following the reporting period (year) (clause 2 of article 230 of the Tax Code of the Russian Federation). However, one must also take into account with what sign. Let's consider in more detail when to take 2-NDFL.

Deadlines for the delivery of 2-NDFL in 2017

2-NDFL certificates are classified according to the criterion depending on whether the employer withheld tax on income paid to employees or not. There are two types of certificates - with attribute 1 and with attribute 2. The deadline for them is different.

In the event that the employer withholds the amounts paid in favor of the employees income tax, 2-NDFL certificates with the sign "1" are handed over to the inspection. This value is indicated in the "Attribute" field of the form itself.

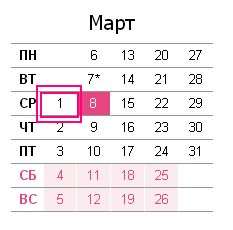

Deadline for 2-NDFLin 2017with sign 1 - no later than April 3, since this year the last day of the deadline for submitting certificates (April 1) falls on a day off. Therefore, the day of the end of the term is the next working day following it (clause 7 of article 6.1 of the Tax Code of the Russian Federation). April 1 this year falls on a day off.

If, for some reason, the organization was unable to withhold income tax from payments in favor of its employees, tax certificate 2-NDFL with sign 1 is not needed. This happens, for example, when paying income in in kind and the emergence of income in the form material benefits... Or, say, when an organization gives gifts to third parties. In such situations, it is necessary to inform the individual in writing and tax office at the place of registration of the organization about the impossibility of withholding personal income tax and the amount of tax.

If before the end tax period the organization pays any income to the same natural person, it is obliged to withhold tax from them, taking into account the previously not withheld amounts. After reporting the impossibility of withholding tax, the individual must transfer personal income tax on his own and submit a declaration.

If, during the entire tax period, the organization was unable to withhold the calculated amount of tax from the individual, it, as a tax agent, presents 2-NDFL with attribute 2.

If, during the entire tax period, the organization was unable to withhold the calculated amount of tax from the individual, it, as a tax agent, presents 2-NDFL with attribute 2.

FROMrock of delivery of certificates 2-NDFL in 2017 with sign 2 - no later than March 1(Clause 5 of Article 226 of the Tax Code of the Russian Federation).

Thus, for 2017, following dates submission of certificates 2-NDFL:

- March 1 - for references with sign 2,

- April 3 - for references with attribute 1.

If the deadlines for the delivery of 2-NDFL in 2017 are violated

We have already told when to take 2-NDFL in 2017. Now let's clarify what responsibility all organizations bear - tax agents for the delay of 2-NDFL and the mistakes made in them.

If the terms of 2-NDFL are violated, liability is regulated by article 15.6 of the Administrative Code of the Russian Federation. Untimely submission reporting threatens the tax agent with a fine of 200 rubles for each certificate.

Responsibility for the submission by tax agents of false information about the income of individuals is established by Article 126.1 of the Tax Code of the Russian Federation. According to this rule, errors and inaccuracies in the 2-NDFL certificate will result in a fine of 500 rubles for the organization. Specified penalty imposed for each document submitted containing false information.

As practice shows, they can even be fined for a mistake made in the TIN, although the TIN in the certificates may not be indicated at all.

To avoid fines, pay attention to the new income and deduction codes in the 2-NDFL certificates. The new codes are valid from December 26th. The Federal Tax Service updated them by order of November 22, 2016 No. ММВ-7-11 / [email protected]

In 2017, all organizations must submit a 2-NDFL certificate for new form... We will analyze what determines the deadline for submitting 2-NDFL for the 3rd quarter of 2017, to which department to take 2-NDFL. Let's also consider an example of filling 2-NDFL. You can download the help form free of charge from our website.

What determines the deadline for the delivery of 2-NDFL for the 3rd quarter of 2017

Accountants often ask the question, what is the deadline for the delivery of 2-NDFL for the 3rd quarter of 2017? We answer - the 2-NDFL certificate is not submitted every quarter or month. This is an annual report, and the accountant prepares a certificate for the results of 2016, and not for the 3rd quarter of 2017.

The deadline for the delivery of 2-NDFL depends on whether the tax on those employees to whom cash payments were made was withheld until the end. Depending on this, you need to choose one of two options:

- We fill out and submit a report on the 2-NDFL form to all employees who are officially on the staff of your organization. We also take into account in the 2-NDFL report employees who are not officially on the staff, but who received officially cash from your organization. The deadline for the delivery of 2-NDFL for this option is April 3, 2017. And formally, you might think that the certificate is submitted for the 3rd quarter of 2017, but this is not the case. The certificate is prepared immediately for the whole of 2016.

- We fill out the 2-NDFL report and submit it to those employees sums of money income which was paid during the year, but the tax was not withheld until the end of the reporting year. FROMrock surrender 2-NDFL in 2017 for this option until March 1, 2017. Here, again, we can say that the certificate is submitted in the 3rd quarter of 2017, apparently from here comes this confusion with the timing.

It is important in a timely manner and in specified period submit a report in the form 2-NDFL to the tax office. IN otherwise, according to article 126 of the Tax Code of the Russian Federation, an organization is subject to a fine. Also, if the provided report contains errors and inaccurate information, in this case, the organization will also pay a fine.

Which departments to submit a 2-NDFL report for the 3rd quarter of 2017

According to paragraph 2 of Art. 230 of the Tax Code of the Russian Federation in 2017, it remained necessary to submit a report in the form of 2-NDFL to the tax office at the place of registration of the organization. Namely, to the tax office where your organization is registered. You do not need to submit a certificate to a bank, Rosstat or funds.

How will tax authorities check your 2-NDFL certificate? The inspectorate will compare the data from 2-NDFL with annual form 6-NDFL, will automatically find any inconsistencies and require an explanation. If the inspectors are not satisfied with the explanations of the company, this will be a reason to include the company in the candidates for in-depth verification. Prepare reports together with expert advice from the Russian Tax Courier magazine. This will avoid unnecessary inspection attention. today and get additional bonuses,

Check control ratios 6-NDFL and 2-NDFL according to the methodology of the Federal Tax Service

We have developed a unique program. She will check for inconsistencies and tell you if you need to retry reports. This is a complete analogue of the system by which the FTS checks personal income tax reports!

How to fill out a 2-NDFL report for the 3rd quarter of 2017

We have already found out that the question about the deadline for the delivery of 2-NDFL for the 3rd quarter of 2017 is a mistake. You are handing over a certificate for 2016. And for the accountant, two deadlines have been set: for employees from whom it was possible to withhold tax, and for those from whose personal income tax has not been withheld for a year. But not only the deadline is different, but also the procedure for filling out the 2-NDFL certificate.

The report form was approved by order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11 / 485.

The deadline for the delivery of 2-NDFL for the 3rd quarter of 2017 depends on whether the tax on those employees who carried out cash payment... The filling of 2-NDFL depends on this.

Consider the algorithm for filling out a 2-NDFL report for the first option, where employees are officially on the staff of your organization, which you submit before April 3.

- We indicate in the title reporting year, then we prescribe the sign -1.

- Next, we indicate the details of the organization, then physical data. the person who received the income.

- In section 3 of the report, we indicate the month, code and amount of accrued income, as well as the code and amount of deduction.

- In section 4 of the report, we indicate the month, code and amount of the deduction.

- In section 5 of the report, we indicate the amount of taxes.

Now let's move on to the algorithm for filling out the 2-NDFL report for the second option, which you submit in the 1st quarter of 2017. That is, we take into account those employees whose income was paid during the year, but the tax was not withheld until the end of the reporting year.

2-NDFL reflects the amount of income received by the employee for reporting period, and personal income tax amountpaid from these proceeds. In addition, the report contains information on the deductions applied to the employee. Submission deadlines, filling rules, and appearance Forms 2-NDFL are regulated by order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11 / 485.2-NDFL: due date 2017

According to the above order, the deadline for submitting the 2-NDFL report in 2017 is April 1. Accordingly, all tax agents will have to submit a report for 2016 no later than April 1, 2017. Taking into account the fact that April 1 falls on a day off, the deadline is postponed to April 3.If the tax agent during the reporting period was unable to withhold taxes from the funds paid to individuals, then the report must be submitted by March 1, 2017. This rule applies to those cases when persons who are not employees of the company received gifts in the amount of more than 4,000 rubles. It is believed that it is not possible to withhold personal income tax from the income received, but inform about it tax office it is still necessary.

A 2-NDFL report can be submitted:

- On paper - if the number of employees does not exceed 25 people;

- IN in electronic format - if the number of employees exceeds 25 people.

Penalties for errors and late filing of reports

tax code provides for liability for errors made in the reporting of 2-NDFL, as well as for its untimely submission. In particular, a fine for tax agents who did not provide in time tax authority this form is 200 rubles for each certificate. Therefore, if certificates for 10 employees were not provided, the fine will be 2,000 rubles. If the reporting contains inaccurate information, then the fine will be 500 rubles. Note that if a tax agent discovers an error earlier than the tax authorities do and sends corrective reports before deadline filing a report, the fine can be avoided. Tax agents it is necessary to exercise extreme care when filling out the reporting form, since the legislation does not specify for which errors a fine can be imposed. By and large, sanctions can be applied even if mistakes are made in the address of the employee's residence. In addition, according to the letters of the Federal Tax Service, an error in indicating the TIN also leads to a fine.- How to correctly draw up a vehicle sales contract form (sample) and download it in different formats

- Registration of coursework according to GOST

- How to staple documents correctly

- Examples of general form design

- Orders in the organization: types and design features

- How to draw up an act correctly: registration, samples Act of an event

- The procedure for the preparation and execution of acts

- Layout of requisites on documents Rules for placement of requisites in documents

- Organizational and administrative documents: Types, Functions, Drafting

- Sighting a document How to properly endorse documents sample

- Criminal Prosecutor

- My Arbitrator: Arbitration Cases File

- Success fee in legal practice review of controversial litigation by bulls a

- Features of drawing up a testamentary assignment Non-property testamentary assignment

- Form of the certificate of completion - sample

- Waybills for a rented vehicle without a crew

- We fill in the employee's personal card

- Employee's personal card

- Features of the annual power of attorney for obtaining goods and materials and a sample document for download

- What if the employer does not accept the letter of resignation?