2 personal income tax differ in the values \u200b\u200bof tax withheld more. Listed personal income tax and how to deal with it

Tax agents submit to the IFTS Form 2-NDFL in two cases: general order - no later than April 1 of the year following the tax period, and if it is impossible to withhold tax. In addition, a certificate in the form 2-NDFL must be submitted by a tax agent to a taxpayer - an individual at his request. At the end of last year, following changes in legislation, tax office updated the reporting forms for personal income tax, including changing the usual form 2-personal income tax. Our recommendations will help tax agents not only check and, if necessary, clarify the reports already submitted, but also correctly draw up certificates in the future.

Filling procedure new help spelled out in sufficient detail. But life constantly presents such "surprises" to accountants that it turns out to be difficult to reflect in the reporting.

Filling out the certificate: transitional moments

Let's start with the questions of filling out the certificate. After all, incorrect information in this document threatens the organization with a fine of 500 rubles. for each incorrect certificate (Article 126.1 of the Tax Code of the Russian Federation).

The so-called "transitional" payments cause a lot of difficulties. Although they occur only once a year, they are the cause of a constant headache for an accountant. How to correctly fill out a certificate on payments accrued in 2015, but actually paid in 2016?

Everything is clear with the current salary. That december salary it was necessary to include in the certificate for 2015, even if it was actually paid in January 2016, the tax authorities decided long ago (see, for example, letters of the Federal Tax Service of Russia dated 03.02.2012 No. ED-4-3 / [email protected] and No. ED-4-3 / [email protected]).

However, there is also a nuance here: this provision does not apply to wages paid in violation of the terms established labor legislation (letter of the Federal Tax Service of Russia dated 07.10.2013 No. BS-4-11 / [email protected]). And if, for example, in January, salaries were paid not for December 2015, but for earlier periods, it is considered income in 2016. This means that it will be included in the certificate for 2016. Although in practice the tax authorities do not object to the inclusion of such payments (in terms of wages for 2015) in the certificate for 2015, if the actual payment occurred before the submission of the relevant reporting.

With regard to payments for civil contracts the transitional rules do not apply at all. By general rule date of actual receipt of income in monetary form the day of its payment or transfer to the taxpayer's bank accounts (accounts of third parties on behalf of the taxpayer) is recognized. This is stated in sub. 1 p. 1 of Art. 223 of the Tax Code of the Russian Federation. And if, for example, the rent for December 2015 was paid in January or February 2016, this is income in 2016. Therefore, in the Information on Form 2-NDFL provided for 2015, data on accrued but not paid in this year rent there was no need to turn it on.

Salary nuances

Let's move on to standard charges. Here, difficulties with reflecting information in the help may arise in different situations... For example, if, at the end of the year, excessively withheld amounts were found.

Refund of personal income tax to full-time employees: general procedure

Let us illustrate this situation with an example.

Suppose an employee worked in the organization from February to May - a mother of three children. Accordingly, she could receive a monthly deduction in the amount of 5800 rubles. (1400 rubles for the first and second child and 3000 rubles for the third). In February, she received an income of 800 rubles, in March - 12,000 rubles, in April and May - 2,000 rubles each. As a result, at the date of dismissal, the amount of deductions was greater than the income received. But due to the uneven distribution of income by months, personal income tax was withheld in March. And this amount, accordingly, became unnecessarily withheld. Let's see how all this should be reflected in the help.

Let's say right away that the order of reflection depends on when the overly withheld amount will be returned.

The fact is that in accordance with the Procedure for filling out Section 5 of the Certificate 2-NDFL (approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected]) in the field “Tax amount unduly withheld by the withholding agent” shall be indicated the excessively withheld tax amount not returned by the tax agent. That is, this field is filled in when, at the time of filing the certificate, the indicator in the field “Tax amount calculated” is less than in the field “Tax amount withheld”.

Of systemic interpretation of the said Order filling in Section 5 of the Certificate 2-NDFL, it follows that if during the year adjustments were made to the withheld amounts, including the refund of the excessively withheld tax to the taxpayer, in the certificate drawn up on the basis of this tax period, already adjusted amounts are included. This means that if the amount of personal income tax that was excessively withheld in March was returned to the taxpayer in 2015, the already adjusted data should have been included in the 2-personal income tax certificate.

In this case, the certificate had to be completed as follows. In Section 4, in the field "Deduction amount" for the corresponding codes (114, 115, 116), it was necessary to indicate the amount of the standard tax deductionprovided for the first, second and third child in February - May. total amount deduction by virtue of paragraph 3 of Art. 210 of the Tax Code of the Russian Federation cannot exceed the amount of income, therefore, it was necessary to indicate 16 800 in the certificate. Further, in Section 5, in the "Total amount of income" field, it was necessary to indicate the total amount of accrued and actually received income, excluding the deductions specified in Sections 3 and 4 That is, in the case under consideration - 16 800.

The “Tax base” field indicates the tax base from which the tax is calculated. The indicator specified in this field corresponds to the amount of income shown in the "Total amount of income" field, reduced by the amount of deductions reflected in sections 3 and 4. In this case, it is equal to zero. The fields “Tax amount calculated”, “Tax amount withheld”, “Tax amount transferred” and “Tax amount unduly withheld by the withholding agent” should also have been zero.

Similarly, a certificate is filled out if the return of overly withheld personal income tax was made in 2016, but before the organization submitted certificates for 2015 to the IFTS.

If the return of the excessively withheld tax will take place in 2016 after the submission of the 2-NDFL certificate, then the accountant will have to enter the actual data in the certificate, that is, indicate the excessively withheld tax. Therefore, Section 5 will be filled in differently: in the “Total amount of income” field, it will also indicate 16 800. In the “Tax base” field, there will be zero. The field “Tax amount calculated” will reflect the amount of personal income tax for the March salary, it will also appear in the fields “Tax amount withheld”, “Tax amount transferred” and “Tax amount unnecessarily withheld by the tax agent”.

And most importantly: after the tax refund, you will need to submit to the IFTS a new (correcting) certificate 2-NDFL, in which there will no longer be unnecessarily withheld tax, and the amounts of personal income tax calculated, withheld and transferred will be zero (see. General requirements to the procedure for filling out the certificate form, approved. by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected], and letter of the Federal Tax Service of Russia dated 13.09.2012 No. AS-4-3 / 15317).

We refund the tax to employees on the patent

Excessively withheld amounts may arise not only due to deductions, but also due to the fact that the organization employs employees on a patent. Moreover, the amount of overpayments here can be significant due to the fact that the notification of the possibility of offset was received from the Federal Tax Service Inspectorate with a delay.

Let us remind you that the Tax Code of the Russian Federation says that the tax that is excessively withheld from an individual is returned at the expense of the "common boiler", that is, personal income tax withheld from other employees of the organization (clause 1 of Article 231 of the Tax Code of the Russian Federation). In this regard, the question arises: how will such a return be reflected in the certificates of those employees, at the expense of whose personal income tax the overpayment was reimbursed? What to write in the "Amount of tax transferred" field if personal income tax did not go to the budget, but actually went to the account of a foreign employee?

Actually, current Procedure filling out the 2-NDFL certificate does not distinguish between the amounts transferred by the tax agent to the budget and the amounts listed in the order of Art. 231 of the Tax Code of the Russian Federation to the bank account specified in the application for the return of excessively withheld tax. Both amounts refer to those listed. At the same time, neither in the certificate itself, nor in the Procedure for filling it out, there is no clarification that it comes it is about transferring to the budget.

Thus, it can be stated that for the purposes of reporting on personal income tax, the amounts of personal income tax returned from the "common boiler" are also recognized as listed and are reflected in Section 5 of the certificate in a general manner. Simply put, there will be no distortions in the certificates of those employees whose personal income tax was actually transferred not to the budget, but to the account of another individual against the excessively withheld tax amount.

There is another problem associated with workers who work on the basis of a patent. For them, the certificate provides a separate status - 6. But at the same time, many of them are also tax residents RF, since they have worked in Russia for more than six months. And for residents, as you know, a different status is established - 1. How to combine these two statuses in the certificate?

For an answer, let us refer to the Procedure for filling out Section 2 "Data on an individual - recipient of income" of the 2-NDFL certificate. It states that if during the tax period the taxpayer is a tax resident Russian Federation, then the number 1 is indicated. And then - in brackets - a note is given: except for taxpayers carrying out labor activity for hire in the Russian Federation on the basis of a patent.

It turns out that "patent" employees are a kind of exception: regardless of whether they have a residence permit, they always appear under code 6. This rule is also applicable in a situation when an employee got a job while already a resident, and what At that time he worked without a patent (for example, on a work permit issued earlier), and later received a patent within a year. After all, the status of a taxpayer is determined at the end of the year, for which tax agent submits a certificate 2-NDFL (letter of the Ministry of Finance of Russia dated 15.11.2012 No. 03-04-05 / 6-1305). When an employee is dismissed before the end of the year, his status is determined on the date of dismissal.

Remote workers from other countries: what benefits are assessed

Finally, another situation that accountants sometimes have to face is the registration of employees from other countries for remote work.

Wage such personal income tax employees not taxed, since remuneration for the performance of work for russian company from the territory of another state refers to income received from sources outside the Russian Federation (subparagraph 6 of paragraph 3 of article 208 of the Tax Code of the Russian Federation).

At the same time, vacation pay is not such a remuneration, because it is not a payment for labor, but a saved average earnings... Consequently, such payments received from a Russian organization relate to income from sources in the Russian Federation and on the basis of Art. 209 of the Tax Code of the Russian Federation are subject to taxation in the Russian Federation (letter of the Ministry of Finance of Russia dated 02.04.2015 No. 03-04-06 / 18203).

Accordingly, upon payment of this amount russian organization recognized as a tax agent (clause 1 of article 226 of the Tax Code of the Russian Federation), is obliged to calculate, withhold and transfer the amount of personal income tax to the budget. And as a result, it is obliged to keep records of the income paid and submit it to tax authority information about him (clauses 1 and 2 of article 230 of the Tax Code of the Russian Federation).

It turns out that by remote foreign employees the organization must also submit information to the tax authorities in the form 2-NDFL (with sign 1). At the same time, only the amounts of paid vacation pay are indicated in the certificate. The amounts of wages, as not taxable with personal income tax, are not indicated in the 2-personal income tax form; a separate certificate with attribute 2 for them is also not submitted.

We reflect dividends

Separately, it should be said about dividends.

Let's start with the fact that only companies with limited liability. Joint Stock Companies reflect personal income tax on dividends paid to individuals in the income tax declaration (clauses 2, 4 of article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 02.02.2015 No. BS-4-11 / [email protected]).

LLC the amount of paid dividends is reflected in section 3 of the certificate indicating the tax rate - 13%. Income in the form of a paid dividend is always reflected in the 2-NDFL certificate for the year in which the actual payment of dividends was made. The amount of dividends is indicated in full, without deduction by the amount of withheld tax. The income code for dividends is 1010. Moreover, if during the calculation Personal income tax organization took into account dividends received from other organizations (clause 2 of article 210, clause 5 of article 275 of the Tax Code of the Russian Federation), in the same line in Section 3 of the certificate, where the amount of dividends is indicated, the amount of deduction with the code 601 must be indicated. dividend deductions are also reflected in Section 3. Pay attention to this!

There is one more problem momentrelated to dividends.

In accordance with paragraph 1 of Art. 224 of the Tax Code of the Russian Federation income from equity participation in the activities of organizations received by tax residents in the form of dividends are subject to taxation of personal income tax at a rate of 13%. But at the same time, according to paragraph 3 of Art. 226 of the Tax Code of the Russian Federation, the tax base for them is considered separately and is not included in the tax base, which is determined on an accrual basis for other income taxed at the rate provided for in paragraph 1 of Art. 224 of the Tax Code of the Russian Federation.

As a result, if the recipient of dividends is at the same time an employee of this organization, then the personal income tax for dividends must be counted separately, and for wages - separately. However, the Procedure for filling out the 2-NDFL certificate does not regulate this situation in any way: it is not clear whether it is necessary to fill out separate Sections 3 and 5 for dividends, or whether these incomes are indicated in conjunction with others taxed at a rate of 13%.

We believe that in this situation, the taxpayer can independently decide how to fill out a 2-NDFL certificate. You can specify all the amounts in one Section 3 and Section 5. And you can fill out two different Sections 3 and 5 in relation to income in the form of salaries and in relation to income in the form of dividends, because the Procedure for filling out the 2-NDFL form does not contain outright ban for registration separate Sections 3 and 5 for income taxed at the same rate, but for which the calculation procedure is different tax base (on an accrual basis or separately for each amount).

Note that the second option is also preferable because it eliminates the possible discrepancy in the sums arising from the summation due to rounding. The fact is that by virtue of paragraph 6 of Art. 52 of the Tax Code of the Russian Federation, the tax amount is always determined in full rubles, by rounding, in which the tax amount less than 50 kopecks is discarded, and the tax amount of 50 kopecks or more is rounded to the full ruble. As a result of this rounding, the amount of personal income tax calculated separately from dividends and from wages may not converge with the amount of personal income tax calculated from total income.

Example

The salary of an employee of the LLC for the year amounted to 257,942 rubles, personal income tax calculated, withheld and transferred - 33,532 rubles.

Dividends paid to an employee who is also a member of the LLC amounted to 35,593 rubles. Personal income tax calculated, withheld and transferred - 4,627 rubles.

As a result, we find that in Section 5 the total amount of income is 293,535 rubles, and personal income tax is 38,159 rubles. But this amount obviously does not coincide with the one that we will get if we take 13% of the total amount of income specified in Section 5. Due to rounding into the budget, 1 ruble is “underpaid”.

However, in our opinion, the mechanism for calculating personal income tax laid down in the Tax Code directly suggests the possibility of a discrepancy between the rounding result of tax amounts calculated from each individual amount and the tax amount calculated from gross income for the tax period. Therefore, in this case the tax agent does not have the amount of unused tax, that is, in the corresponding field “The amount of tax not withheld by the tax agent” of Section 5, it is necessary to put 0. Moreover, neither the Tax Code of the Russian Federation, nor the Procedure for filling out the 2-NDFL form contain a requirement that the amount in the Calculated Tax Amount field in Section 5 was the product of the amount specified in the Tax Base field in Section 5 and the tax rate.

Choosing an inspection

Next block difficult situations, which arise in practice, is associated with the fact to which tax authority it is necessary to submit information on the 2-NDFL form. And it should be noted that here some of the problems are directly related to the incorrect work of the legislator.

Features for the largest

So, legislators, changing and specifying the Procedure for submitting information, established in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, apparently, allowed technical error, as a result of which a part of the text that does not belong to this category of tax agents at all was included in the norm on the procedure for submitting certificates by the largest taxpayers. As a result, it is not at all clear where this category tax agents must submit a certificate.

In our opinion, the meaning of the rule is that this category of tax agents has the right to choose where to file reports regarding the income of employees of separate divisions, as well as individuals under civil contracts concluded with separate subdivisions: at the place of registration as the largest taxpayer either at the location a separate subdivision.

This conclusion is confirmed by the letter of the Federal Tax Service of Russia dated 01.02.2016 No. BS-4-11 / [email protected] However, it makes a significant adjustment.

According to the Federal Tax Service, the right to choose the procedure for submitting 2-NDFL certificates given to a tax agent classified as the largest taxpayer does not provide for the possibility of simultaneously submitting such documents to the tax authority at the place of registration as the largest taxpayer and to the tax authority at the place of registration of the organization for the corresponding separate subdivision, regardless of whether these payments are made by an organization or a separate subdivision.

That is, the "largest" must, for all incomes paid to employees by both the organization and its separate subdivision, submit 2-NDFL certificates either to the tax authority at the place of registration as the largest taxpayer, or to the tax authority at the place of registration of such a taxpayer for the corresponding separate division.

Rules for individual entrepreneurs in special modes

Another flaw of the legislator is the procedure for submitting reports by entrepreneurs working for special modes taxation. Here the problem is as follows.

In accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, tax agents submit a 2-NDFL certificate to the tax authority at the place of their registration. But further in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation contains norms that actually specify the concept of "place of registration" for different categories taxpayers.

So, according to par. 6 p. 2 art. 230 of the Tax Code of the Russian Federation for tax agents - individual entrepreneurswho are registered with the tax authority at the place of business in connection with the application of the taxation system in the form of a single tax on imputed income for certain types activities and (or) patent system taxation, it is indicated that they provide information regarding their employees to the tax authority at the place of its registration in connection with the implementation of such activities.

At the same time, there is no stipulation in the Tax Code of the Russian Federation that we are talking only about personal income tax withheld from the income of persons engaged in activities transferred to UTII.

It turns out that an entrepreneur who combines UTII (or PSN) with other taxation regimes must submit reports in relation to all employees (employed both in activities taxed within the framework of general regime taxation, or USN, and taxed under UTII / PSN) exclusively to the tax authority at the place of registration as a payer of UTII.

If the organization has moved

And in conclusion of this block, we will consider the procedure for submitting certificates of 2-NDFL by organizations that during the year "moved" from one IFTS to another. They need to pay attention to how in the Procedure for filling out the 2-NDFL certificate, the rules for filling in the "OKTMO Code", "TIN" and "KPP" fields of Section 1 of the certificate are fixed.

So, in the part of the OKTMO code, the Order requires specifying the code municipality, on the territory of which the organization or a separate division of the organization is located. And in the fields "INN" and "KPP" for tax agents - organizations indicate an identification number tax agent (TIN) and the registration reason code (KPP) at the location of the organization according to the Tax Registration Certificate. If the Certificate form is filled in by an organization that has separate subdivisions, in this field, after the TIN, the checkpoint at the location of the organization at the location of its separate subdivision is indicated.

From the above provisions, it becomes obvious that when changing the "registration" of the organization, submit several certificates (to the old and new IFTS) not required. After all, the presentation of two certificates of income for one individual with different check points and OKTMO codes is possible only if he works in several separate divisions of the organization or in the organization and in its separate division during the tax period. Accordingly, when changing the location of the organization, information on the income of individuals must be submitted to the tax authority only at the place of new registration. Information is submitted for the entire past tax period as a whole. At the same time, the organization - the tax agent indicates the new (valid at the time of delivery of the certificate) checkpoints in accordance with the Certificate of registration with the tax authority and OKTMO (letter of the Ministry of Finance of Russia dated November 19, 2015 No. 03-04-06 / 66956).

Is feature 2 self-sufficient?

As before, the 2-NDFL certificate is intended not only to inform the tax authorities about the amounts of income calculated and withheld by the tax agent for personal income tax. This document also has a second hypostasis: informing about the impossibility withholding personal income tax... In this case, a certificate is submitted to the tax authorities with attribute 2.

In 2015, there were changes in the Tax Code of the Russian Federation - lawmakers changed the deadlines for submitting such certificates.

Now in paragraph 5 of Art. 226 of the Tax Code of the Russian Federation states that if it is impossible to withhold the calculated amount of tax from the taxpayer during the tax period, the tax agent must, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose, notify the taxpayer and the tax authority in writing at the place of his accounting for the impossibility of withholding tax, on the amounts of income from which tax has not been withheld, and the amount of unreserved tax.

However, as is, unfortunately, often the case, having changed one article, the legislators forgot about a similar provision contained in another article of the Code.

So, the changes did not affect sub. 2 p. 3 art. 24 of the Tax Code of the Russian Federation, which contains a rule obliging the agent to notify the tax authority at the place of his registration in writing about the impossibility of withholding tax and the amount of the taxpayer's debt within one month from the day the tax agent became aware of such circumstances. That is, it still remains here month term to the message (which was previously synchronized with Art. 226 of the Tax Code of the Russian Federation), however, the wording of the norm, albeit insignificantly, differs from that contained in Art. 226 of the Tax Code of the Russian Federation. It turns out that Art. 24 and 226 of the Tax Code of the Russian Federation formally establish different duties of a tax agent. And now the tax agent must assess the situation in each specific case in order to determine the deadline for submitting a message about the impossibility of withholding personal income tax.

So, if with the person to whom the income was paid, there are no contractual relationshipproviding for the payment in the current year money in his favor, the message is submitted within the time period specified in Art. 24 of the Tax Code of the Russian Federation, or rather, within a month from the date of income payment. If there is a documented probability of payment cash income (eg, framework agreement), the deadline for notification of the tax authority is postponed to March next year, as provided for in paragraph 5 of Art. 226 of the Tax Code of the Russian Federation.

But this is not the only trap that awaits the accountant when providing certificates with attribute 2.

So, many believe that such certificates are self-sufficient and, having submitted them, it is no longer necessary to re-submit information in the 2-NDFL form within the generally established time frame (before April 1). However, it is not. No later than April 1, the tax authority at the place of registration must submit information in the form 2-NDFL with attribute 1, including information on payments for which personal income tax was not withheld due to the impossibility of withholding and for which certificates with attribute 2 were previously submitted (letters of the Ministry of Finance of Russia dated December 29, 2011 No. 03-04-06 / 6-363 and dated October 27, 2011 No. 03-04-06 / 8-290).

The employee asked for a certificate

In addition to reporting to the IFTS, a 2-NDFL certificate can be issued to employees at their request. And here, too, oddly enough, difficult situations can arise. For example, how many certificates should be issued to an employee who has worked in several divisions of an organization (or in an organization and a separate division) during the year?

Here we must proceed from the following. The obligation of tax agents to issue to individuals, upon their applications, certificates of income received by individuals and withholding tax amounts is provided for in paragraph 3 of Art. 230 of the Tax Code of the Russian Federation. Certificates are issued in the form approved by federal body executive power, authorized to control and supervise taxes and fees. By order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] for these purposes, the 2-NDFL form was approved. Accordingly, if a certificate is issued to an individual at his request, it must still be drawn up in accordance with the Procedure approved by the Federal Tax Service of Russia, that is, the certificate must be prepared in the same manner as when submitted to the tax office.

According to section III Order in the "OKTMO Code" field of Section 1 of the 2-NDFL certificate, the code of the municipality on the territory of which the organization or a separate subdivision of the organization is located. If the certificate form is filled in by an organization that has separate subdivisions, in the "TIN and KPP" field of Section 1 of the certificate after the TIN, the KPP at the location of the organization at the location of its separate subdivision is indicated.

Thus, the Procedure for filling out a certificate provides for a separate indication of information about income paid by different separate divisions of the organization. Possibilities to "mix" this information in one certificate issued on behalf of the head office of the organization, the Procedure does not contain.

The supervisory authorities also indicate that if during the year an employee worked both in a separate subdivision and in the head office of the organization, information on the income of such an employee should be submitted, respectively, at the place of registration of the separate subdivision and at the location of the head office of the organization (letters of the Ministry of Finance of Russia dated March 29 .2010 No. 03-04-06 / 55, Federal Tax Service of Russia dated October 14, 2010 No. ShS-37-3 / 13344). That is, two separate certificates are issued. A similar approach, in our opinion, is applicable in a situation where an employee has worked in several separate divisions for a year.

So an employee who has worked in several divisions (parent organization and division) for a year needs to issue and issue several certificates.

How to issue a certificate in case of reorganization

Difficulties also arise in organizations that have undergone a reorganization or renaming, if employees ask for help for the period before the reorganization (renaming).

When drawing up a certificate in this case, it must be borne in mind that the document is always drawn up by the tax agent to which the taxpayer applies, and in the form that is valid at the time of the application (see letter of the Federal Tax Service of Russia dated June 14, 2006 No. 04-1-04 / 317 ). Accordingly, since the legal succession of organizations occurs during the reorganization, the successor organization on its own behalf has the right to issue a certificate to the employee, including for the period before the reorganization.

Issuance of a certificate when changing the name of the company

The issue is solved in a similar way when changing the name of the organization. In this case, the TIN of the organization - the tax agent remains the same. This means that there is no change of the tax agent in this case. Therefore, in the situation under consideration, upon receipt of an application by an individual to provide information about the income received and the withheld tax amounts, the tax agent draws up a certificate of current form 2-NDFL, indicating in Section 1 data on the tax agent as of the date of circulation. In this case, the TIN and KPP are indicated according to the certificate of registration with the tax authority, the abbreviated name (in the absence - the full name) of the organization - according to its constituent documents (see the Procedure for filling out Section 1 "Information about the tax agent" of the 2-NDFL form, approved by order of the Federal Tax Service of Russia No. ММВ-7-11 / dated 30.10.2015 [email protected]).Decision:

What is this report?The FSS of the Russian Federation, by order of September 26, 2016, No. 381, approved a new form 4-FSS (calculation of contributions for injuries), which is applied from the reporting for the first quarter of 2017.

The new calculation will replace the part old form 4-FSS on insurance premiums for employees in the FSS for injuries, which was used to report contributions to the FSS before the report for the 4th quarter of 2016 (inclusive).

The rest of the report (on contributions for temporary disability) goes into the RSV report.

Full name new form 4-FSS "Calculation of accrued and paid insurance premiums for compulsory social insurance from industrial accidents and occupational diseases, as well as the costs of paying insurance coverage. "

When to take?A new calculation must be submitted once a quarter.

On hard copy no later than the 20th day of the month following the reporting period;

In the shape of electronic document no later than the 25th day of the month following the reporting period.

Organizations and entrepreneurs with average headcount more than 25 people must submit a new calculation at electronic form by TCS.

This rule is enshrined in paragraph 1 of Article 24 of Federal Law 125 (as amended from 01.01.2017).

Thus, in 2017, the deadline for the submission of a new calculation for TCS

Where to send the report?As before, the 4-FSS form was submitted to the territorial body of the FSS.

Features of filling out the report.There are no changes in the procedure for filling out the report (relative to the 4-FSS form until the first quarter of 2017).

The report indicates both the assessment of contributions and their payment.

Specifics of adjusting the report.The obligation to file an adjustment report in the event of past adjustments is determined by whether the error resulted in an understatement of contributions.

If it did, then the policyholder, regardless of his desire, needs to submit an updated calculation;

If not, then the submission of clarifications is the right, but not the obligation of the policyholder.

Reporting for previous years (up to Q1 2017).For periods related to 2016 and more early years, you need to report on the "old" forms and formats.

In particular,

Contributions for temporary disability for December 2016 will not be reflected in the new calculation of 4-FSS and RSV, even if they are listed in January 2017 (they are reflected in RSV-1 for 2016).

Contributions for injuries will be reflected in the report for the 1st quarter of 2017 (Table 2, page 1 "Indebtedness to the insured" / page 12 "Indebtedness for territorial body Fund "at the beginning of the billing period).

We can offer you two bonuses -

- 3 months as a gift (to receive it, you just need to enter the promotional code 1358 at and make the first payment). This bonus is not always provided and depends on the current promotions.

- 10% of payment on the phone (about him below).

In 2017, there are also promotions under the promo code 1358

- 15% discount when purchasing 2-year rates If you pay for a 2-year work in Kontur. Accounting, the discount on the entire purchase amount will be 15%. The offer is valid for any payment.

- Gift for New LLC An organization registered more than 3 months ago gets 3 months of work in Kontur. Accounting department. Its first reporting organization.

- Easy relocation Users of 1C or other accounting programs who were thinking of changing the accounting service or supplementing it with a salary module can get a 50% discount when paying for any annual payment.

- Confident start All clients who, upon registration, indicate the promo code SC 1358, receive 3 months as a gift free service at the first payment for the service.

- 25% per recommendation The BC subscriber, on the recommendation of which another organization, will receive 25% of the amount paid by the recommended invoice.

- Cuba Free video courses in directions: My first organization on the simplified taxation system; Payroll accountant. Based on the results of training, a certificate is issued. Registration on the portal http://kuba.kontur.ru/.

The 10% bonus on the phone can be combined with any of the promotions. To get 10% of the payment on any phone, you need to specify the promotional code - 1358.

You will need to email (e-mail):

- Phone number. Telecommunications operator.

- The name of the LLC.

- The amount in rubles that you paid.

We will reply to the letter and transfer the remuneration within 24 hours (in case of confirmation of payment).

Please apply for a bonus only by e-mail:. Others service centers and support does not provide such a discount.

Description of a simple technique for getting rid of hanging balances for personal income tax listed

To begin with, a small excursion into the methodology (a quote from the ITS article "Accounting for the tax transferred to the budget by individuals"):

Accounting listed in personal income tax budget in the context of individuals in the program must be conducted in order to automatic formation report "Register tax accounting on personal income tax "and filling out the documents" Certificate 2-personal income tax "(both for the employee and for transfer to the IFTS) in terms of amounts the listed tax... Keeping such records in a special register is required by Article 230 Tax Code RF (hereinafter referred to as the RF Tax Code), the need to indicate such amounts in the 2-NDFL certificates is stated in the Order of the Federal Tax Service of November 17, 2010 N ММВ-7-3 / [email protected]

The amount of tax transferred to the budget in general case may not be the same as withholding tax. In addition, clause 1 of Art. 230 of the Tax Code of the Russian Federation obliges to indicate in the tax accounting registers the details of the payment documents with which the tax was paid to the budget of the Russian Federation. Such information is not contained in the payroll subsystem. Therefore, such amounts are registered in the program separate document "Personal income tax transfer to the budget of the Russian Federation ".

Registration in the accounting of the amounts of the transferred tax is complicated by the fact that the Tax Code of the Russian Federation obliges to keep such accounting separately for each individual, however, the tax is transferred to the budget in total, without indicating to which person what amount is transferred. IN currently there are no explanations of the regulatory authorities on how to distribute the amounts of tax transferred to the budget between individuals in order to maintain a tax accounting register in accordance with paragraph 1 of Art. 230 NC. Therefore, the methodologists of the 1C company proposed the following approach to the automated distribution of the amounts of the listed tax.

At the time of registration of withheld personal income tax in the accounting (this point is described above), the need (obligation) to transfer to the budget the amount of tax withheld for each individual is also registered in the accounting, and this need is recorded exactly the same date as the date with which the tax was withheld. Because the need to transfer tax is directly related to the fact of tax withholding, and withheld tax, like calculated, is recorded in the accounting in the context of tax rates (13%, 30%, 9%, etc.), months of the tax period (i.e. months , for which the income and tax is registered) and territorial affiliation (OKATO and KPP codes), then the amounts required for transfer are registered in the context of these signs in order to ensure maximum accuracy in the distribution of tax and the reflection of information about the transferred tax in the tax register.

The next date in the accounting records the fact of transfer of tax to the budget, i.e. the document "Transfer of personal income tax to the budget of the Russian Federation" is introduced, which indicates the total amount of the transferred tax, the date of its transfer, the month of the tax period, the tax rate, OKATO / KPP codes, as well as the details of the payment document. The total amount of the transferred tax, manually indicated in the document, is automatically distributed to individuals in proportion to the amounts that were previously (at the time of tax withholding) registered as required for transfer.

If the total amount transferred coincides with the total amount of tax withheld (i.e. the tax withheld is transferred in full), then as a result of such distribution transferred amount for each individual will coincide with the amount withheld, registered as required for transfer.

End of quote.

IN real life very often situations arise when the amount of personal income tax transferred is greater or, on the contrary, less than the amount of personal income tax withheld.

In these cases, the program behaves as follows:

1. Amount Personal income tax listed less than Personal income tax withheld: the remainder of the unallocated amount of personal income tax "hangs" in the accumulation register "Calculations of tax agents with the budget for personal income tax" and "hangs" until another document "Transfer of personal income tax to the budget" is entered. In this document, it will be necessary to indicate the month for which personal income tax was not fully listed and fill it in by individuals who have this balance.

2. Amount Personal income tax listed more than Personal income tax withheld: the amount of overpaid tax is recorded with a minus in the accumulation register "Calculations of tax agents with the budget for personal income tax". Such debt is not carried over to subsequent months of the tax period and cannot be offset in other months. According to the 1C methodologists, this approach is based on the provisions of the Tax Code of the Russian Federation and is confirmed by the letter of the Federal Tax Service dated October 19, 2011 N ED-3-3 / [email protected], which says: "... a monthly transfer to the budget of an amount in excess of the amount actually withheld from personal income tax on personal income is not a tax. In this case, the tax agent should apply to the tax authority with an application to return the amount to the organization's current account , which is not a tax on personal income and is mistakenly listed in budget system Russian Federation."

If the accounting of personal income tax listed at your enterprise is kept in accordance with the above recommendations, you do not admit the presence of "positive" or, God forbid, negative balances, then further reading of the article will be useless for you!

On this moment There are 2 methods known to me to get rid of the "hanging" balances for personal income tax listed:

1. Writing a processing that will analyze the "hanging balances" and itself create documents "Transfer of personal income tax to the budget";

2. Modification of the document "Transfer of personal income tax to the budget" to close the "hanging" balances in one document.

I propose for consideration the second option, namely, adding one procedure and one function to the module of the document "Transferring personal income tax to the budget", which will save you from the "hanging" balances in the accumulation register "Calculations of tax agents with the budget for personal income tax".

But, first, let's see how the typical mechanism for closing balances for the listed personal income tax works.

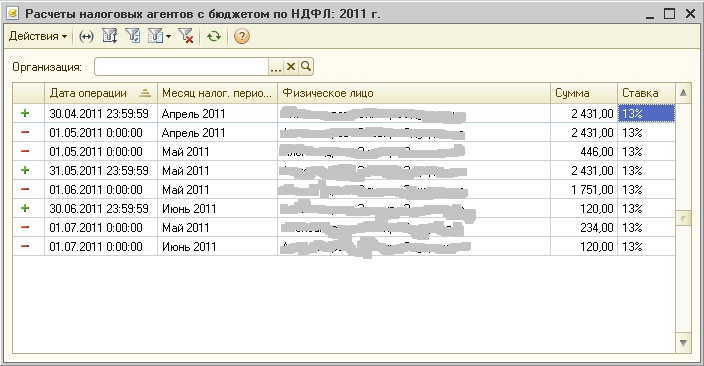

Records with "+" were formed when two documents "Payroll" were posted (for April and May 2011).

Records with "-" movement standard documents "Transfer of personal income tax to the budget" (for April and May 2011).

Overpayment for April \u003d -446 = 2431 - 2877 ;

Debt formed in May \u003d 680 = 2431 - 1751 .

As a result, we have a debt on the listed personal income tax \u003d 234 = 680 - 446 .

The question arises as to how to close the debt and why the overpayment for April was not studied in May. It's that simple! according to the letter of the Federal Tax Service dated October 19, 2011 N ED-3-3 / [email protected] overpayment for April is not taxable and will not be automatically credited in the standard configuration. Further, in order to offset the debt for May, it is necessary to enter another document "Transfer of personal income tax to the budget", in which May will be indicated as the month for which they are paid. Moreover, it is may,since for example, when transferring tax for June, the unlisted personal income tax for May will not be automatically credited either. In this situation, the number of man-hours of work of the accounting department with a well-branched structure of the company and the number of employees exceeding 2000 people increases to frightening values.

Now let's compare with the movements of the amended document "Transfer of personal income tax to the budget".

Records with "+" were formed during the three "Payroll" documents (for April, May and June 2011).

Records with "-", formed by the amended documents "Transfer of personal income tax to the budget" (for April, May and June 2011).

Let's calculate the balance of the unallocated amount of personal income tax (by months of the tax period):

April: overpayment \u003d -446 = 2431 - 2877. Please note that the overpayment amount, unlike the typical mechanism, is recorded separately (in May 2011).

May: debt \u003d 234 = 2431 - 1751 - 446 ... The document "Transfer of personal income tax to the budget" for May 2011 counted the overpayment for April in the amount of 446 rubles, after which the amount of payment in the amount of 1,751 rubles was planted entirely in May. Because the amount of payment is not enough to fully pay off the debt, therefore, a debt arises \u003d 234 rubles.

June: debt is repaid \u003d 0 = 234 + 120 - 354. The document "Transfer of personal income tax to the budget" for June 2011 extinguishes the debt for May in the amount of 234 rubles, and also extinguishes the debt for June in the amount of 120 rubles.

The result of the work of the changed document was full repayment indebtedness on personal income tax without input additional documents "Transfer of personal income tax to the budget" and register adjustments.

What needs to be done to make this mechanism work?

The first thing that is necessary is to get the balances of personal income tax by months of the tax period. This is the responsibility of the function "GetDistributionTableByOdiscount":

Function GetDistributionTableBy Individual (Individual) Export

Request \u003d New request; Query.Text \u003d "SELECT ALLOWED VARIOUS

| Calculations of tax agents with a budget

| BEGINNING OF THE PERIOD (Calculations of Tax Agents With Budget PONDFL Balance.Month of Tax Period, MONTH) AS Month of Tax Period,

| AMOUNT (Calculations of Tax Agents WITH PONDFL Budget Balance Amount) AS Debt

| FROM

| Accumulation Register.Tax Agent SettlementsWith BudgetPONDFL.Balances (

| &Period,

| Individual \u003d & Individual

| And Rate \u003d & Rate

| AND OKATO_KPP \u003d & OKATO_KPP) AS Tax Agents Calculations With Budget

| WHERE

| Calculations of Tax Agents with Budget PONDFL Balances.Amount Balance<> 0

| LOAD BY

| Calculations of tax agents with a budget

| BEGINNING OF THE PERIOD (Calculations of Tax Agents with Budget PONDFL Balance.Month of Tax Period, MONTH)

| ORDER BY

| PhysicalPerson,

| Month of Tax Period

| AUTO ORDERING ";

Request.SetParameter ("Period", New Boundary (End of Day (Date), Boundary View. Including));

Request.SetParameter ("OKATO_KPP", OKATO_KPP);

Request.SetParameter ("Rate", Rate);

Request.SetParameter ("Individual", Individual);

Result \u003d Query.Run ();

TableResult \u003d Result.Upload ();

Return TableResult;

EndFunction

Now the procedure for generating movements in the accumulation register "Calculations of tax agents with the budget for personal income tax":

Procedure Generate Movements By Individual (Individual, Value Amount Enumerated)

Allocation Table \u003d Get AllocationTable by Individual (Individual);

NegativeSums \u003d NewValuesTable;

NegativeSum.Columns.Add ("TaxPeriod Month", New TypeDescription ("Date", New Date Qualifiers (PartDate.Date)));

NegativeSum.Columns.Add ("Sum", New TypeDescription ("Number", New QualifiersNumber (15,2)));

PositiveSums \u003d NewValuesTable;

PositiveSums.Columns.Add ("TaxPeriod Month", New TypeDescription ("Date", New Date Qualifiers (PartDate.Date)));

PositiveSum.Columns.Add ("Sum", New Description of Types ("Number", New QualifiersNumber (15,2)));

For Each RowTableDistribution from TableDistribution Cycle

If RowDistributionTable.Debt\u003e 0 Then

TableRow \u003d PositiveSums.Add ();

TableString.Sum \u003d AllocationTableString.Debt;

Otherwise

TableRow \u003d NegativeSums.Add ();

TableRow.TaxPeriodMonth \u003d AllocationTableRow.TaxPeriodMonth;

TableString.Sum \u003d -DistributionTableString.Debt;

EndIf;

End of Cycle;

// Close negative amounts

For Each Line Negative Sums Of Negative Sums Loop

RemainingDistribute \u003d StringNegativeSum.Sum;

Distributed \u003d 0;

If StringPositiveSum.Sum\u003e RemainingDistribute Then

Movement.PhysFace \u003d Physical person;

Movement.Bet \u003d Bid;

Movement.Sum \u003d RemainingDistribute;

StringPositiveSum.Sum \u003d StringPositiveSum.Sum - Allocated;

Distributed \u003d Distributed + Remaining Distributed;

Remaining Distribute \u003d 0;

Otherwise

Movement \u003d Movement.Calculations of Tax AgentsWith BudgetPoNDFL.Add ();

Movement.Period \u003d Payment Date;

Movement.PhysFace \u003d Physical person;

Movement.Movement type \u003d Movement typeAccumulation.Expense;

Movement. Organization \u003d Organization;

Movement.TaxPeriodMonth \u003d StringPositiveSum.TaxPeriodMonth;

Movement.OKATO_KPP \u003d OKATO_KPP;

Movement.Bet \u003d Bid;

Movement.Sum \u003d StringPositiveSum.Sum;

Allocated \u003d Allocated + StringPositiveSum.Amount;

RemainingDistribute \u003d RemainingDistribute - StringPositiveSum.Sum;

StringPositiveSum.Sum \u003d 0;

EndIf;

If Remaining to Distribute \u003d 0 Then

Abort;

EndIf;

End of Cycle;

If Allocated\u003e 0 Then

Movement \u003d Movement.Calculations of Tax AgentsWith BudgetPoNDFL.Add ();

Movement.Period \u003d Payment Date;

Movement.PhysFace \u003d Physical person;

Movement.Movement type \u003d Movement typeAccumulation.Expense;

Movement. Organization \u003d Organization;

Movement.TaxPeriodMonth \u003d StringNegativeSum.TaxPeriodMonth;

Movement.OKATO_KPP \u003d OKATO_KPP;

Movement.Bet \u003d Bid;

Movement.Sum \u003d -Distributed;

StringNegativeSum.Sum \u003d Remaining to Distribute - Distributed;

EndIf;

End of Cycle;

// Form records for the remaining positive amounts

For Each LinePositiveSums Of PositiveSums Loop

If StringPositiveSum.Sum \u003d 0 Then

Proceed;

EndIf;

Movement \u003d Movement.Calculations of Tax AgentsWith BudgetPoNDFL.Add ();

Movement.Period \u003d Payment Date;

Movement.PhysFace \u003d Physical person;

Movement.Movement type \u003d Movement typeAccumulation.Expense;

Movement. Organization \u003d Organization;

Movement.TaxPeriodMonth \u003d StringPositiveSum.TaxPeriodMonth;

Movement.OKATO_KPP \u003d OKATO_KPP;

Movement.Bet \u003d Bid;

Movement.Sum \u003d Min (StringPositiveSums.Sum, AmountListed);

Amount Enumerated \u003d Amount Enumerated - Movement.Amount;

If SumListed \u003d 0 Then

Abort;

EndIf;

End of Cycle;

// The remaining overpayment needs to be planted in the month of the tax period from the document form

If SumListed\u003e 0 Then

TaxPeriod Month \u003d StartMonth (TaxPeriod Month);

Movement \u003d Movement.Calculations of Tax AgentsWith BudgetPoNDFL.Add ();

Movement.Period \u003d Payment Date;

Movement.PhysFace \u003d Physical person;

Movement.Movement type \u003d Movement typeAccumulation.Expense;

Movement. Organization \u003d Organization;

Movement.TaxPeriod Month \u003d TaxPeriod Month;

Movement.OKATO_KPP \u003d OKATO_KPP;

Movement.Bet \u003d Bid;

Movement.Sum \u003d AmountListed;

EndIf;

End of Procedure

And finally, commenting out the lines typical procedure "ProcessingPerformance ()" and add a call to the "GenerateMotionsByOwnIndividual ()" procedure:

If Not Refusal Then

// Movement \u003d Movement.Calculations of TaxAgenciesWithBudgetPoNDFL.AddExpense ();

// Fill inProperty Values \u200b\u200b(Movement, ThisObject, "Organization, TaxPeriod Month, Rate, OKATO_KPP");

// Movement.Period \u003d Payment Date;

// FillValues \u200b\u200bofProperties (Motion, LinePT, "Individual, Amount");

GenerateMotions by Physical Entity (LinePT.PhysFace, LinePM.Total);

EndIf;

I hope that this article will help you in your future work.

The rule that allows the application of VAT deduction not only in the period in which the right to it arose, but in subsequent periods, does not apply to all types of deductions.

Getting property tax benefits made easier

Getting property tax benefits made easier

From the next year, citizens eligible for property tax relief, transport and / or land tax, you do not have to submit documents confirming the right to the benefit to the Federal Tax Service Inspectorate.

We fill out section 5 of the 2-NDFL certificate

Section 5 of the 2-NDFL certificate reflects the total amounts of income paid and the amount of personal income tax accrued, withheld and transferred to the budget.

| Section 5 field of the reference 2-NDFL | What is indicated when submitting certificates 2-NDFL with sign 1 |

|---|---|

| Total income | The total amount of accrued and actually paid income from section 3, excluding deductions reflected in sections 3 and 4 |

| The tax base | Difference between total income and total deductions in section 3 and 4 |

| Calculated tax amount | The amount obtained by multiplying the tax base by the corresponding personal income tax rate |

| The amount of fixed advance payments | The amount of fixed advances by which the tax paid on income is reduced foreign workerlaborer on the basis of a patent |

| Tax amount withheld | The total amount of personal income tax withheld from the income of an individual |

| Tax amount transferred | The total amount of personal income tax actually transferred to the budget. By the way, if you paid the salary for December 2015 to employees already in January 2016, then when submitting certificates of 2-NDFL for 2015, you need to take into account the personal income tax withheld and transferred to the budget in January 2016. you have fully fulfilled personal income tax obligations for 2015 |

| Tax amount unduly withheld by the withholding agent | The amount unduly withheld by the tax agent and not returned to the individual, as well as the amount of personal income tax overpayment that arose due to a change during the year tax status natural persons |

| Tax amount not withheld by the withholding agent | Personal income tax amount, which for some reason the tax agent could not withhold from the income of an individual |

| Notice confirming the right to reduce tax on fixed advance payments | Details of the corresponding tax notice, as well as the code of the Inspectorate of the Federal Tax Service that issued this notification |

Completing Section 5 for References

- How to correctly draw up a vehicle sales contract form (sample) and download it in different formats

- Registration of coursework according to GOST

- How to staple documents correctly

- Examples of general form design

- Orders in the organization: types and design features

- How to draw up an act correctly: registration, samples Act of an event

- The procedure for the preparation and execution of acts

- Layout of requisites on documents Rules for placing requisites in documents

- Organizational and administrative documents: Types, Functions, Drafting

- Sighting a document How to properly endorse documents sample

- Criminal Prosecutor

- My Arbitrator: Arbitration Cases File

- Success fee in legal practice review of controversial litigation by bulls a

- Features of drawing up a testamentary assignment Non-property testamentary assignment

- Form of the certificate of completion - sample

- Waybills for a rented vehicle without a crew

- We fill in the employee's personal card

- Employee's personal card

- Features of the annual power of attorney for obtaining goods and materials and a sample document for download

- What if the employer does not accept the letter of resignation?