The net loss of the organization. Enterprise net profit: calculation and analysis

The excess of all expenses over all income during the reporting period. net loss Downsizing equity as a result of the company's operations. Topics… …

Net loss- (net loss) a decrease in the amount of equity capital as a result of the company's operations ... Economic and Mathematical Dictionary

net loss- Syn: pure loss... Thesaurus of Russian business vocabulary

NET LOSS, FINAL- In insurance operations: 1. total amount damages that the insured or any company acting as his insurer, or both of them, are obliged to pay on the basis of legal settlement business or compromise, including but not limited to… …

Pure, pure; clean, clean, clean. 1. Not polluted, not soiled, free from dirt; opposite filthy. Clean linen. Clean tablecloth. Clean dishes. Clean hands. Put on a clean dress. Bring pure water. “How dare you, insolent, impure… … Explanatory Dictionary of Ushakov

Uncovered loss- final financial results obtained as a result of the activities of the organization for reporting year; characterizes the decrease in its capital. Distinguish uncovered loss without taking into account the decision to cover the loss in whole or in part at the expense of the relevant ... ... Encyclopedic dictionary-reference book of the head of the enterprise

net income- AT general meaning: the amount remaining after the payment or deduction of all expenses; a synonym for the terms net income (net earnings), net profit (netprofit), net loss (net loss) (depending on whether this indicator is positive ... ... Financial and investment explanatory dictionary

LOSS, NET- In insurance operations: the amount of loss incurred by the insurer, taking into account all indemnities received by him as a result of reinsurance, salvage and subrogation ... Insurance and risk management. Terminological dictionary

other profit (or loss) Technical Translator's Handbook

Other profit (or loss) (GAIN (OR LOSS))- 1. The net desired (or undesired) effect of minor transactions or events. Increase (or decrease) net assets or shares as a result of minor transactions or events in which the value of the consideration received is higher (or ... ... Glossary of terms for management accounting

When analyzing economic activity enterprises net profit occupies a key place. In all financial statements it is reflected in the last line, and shows the actual state of affairs in the organization. Therefore, in foreign accounting it is sometimes called the "bottom line" - the bottom line.

The answer to the question, what is net income is the profit that remains after deduction from gross income all expenses incurred by the organization in the current calendar period. These expenses include:

- wage fund and expenses for personnel search and advanced training;

- tax deductions;

- contributions to compulsory social insurance funds;

- interest on loans received from banks and repayment of the principal body of the loan.

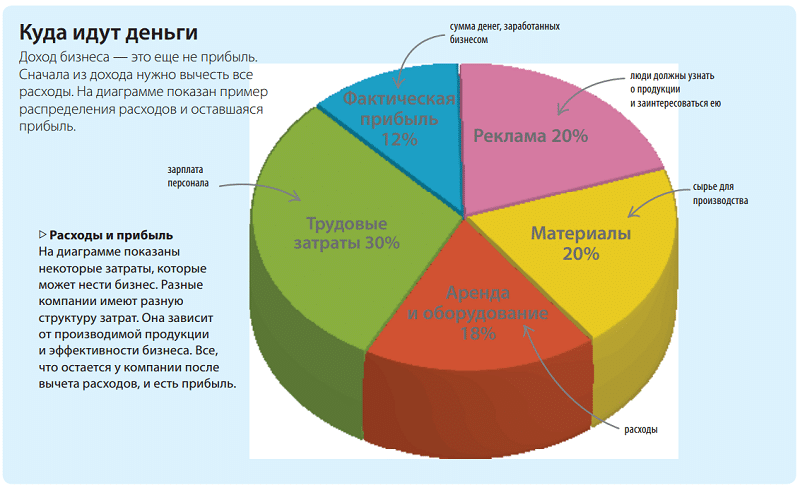

Enterprise expenses

It is sometimes referred to as net earnings or net income. talking plain language, the funds that remained on current account organizations after payment of all mandatory payments, and are its net profit.

Case Study

To understand the concept with an example, let's take the hypothetical company "Cloud". For a month, she was sold from all types of activities of goods and services for 10 thousand rubles. This is gross income.

- Funds in the amount of 3,000 rubles were spent on the production of goods and services. – materials, equipment, space rent and overhead costs.

- She spent 2,000 rubles on the salaries of employees and their training. - payroll fund.

- To the social insurance funds and mandatory pension insurance paid 500 rubles.

- As interest on the loan issued, 500 rubles were paid.

- Tax collections amounted to 3,000 rubles.

Total, 3000 + 2000 + 500 + 500 + 3000 = 9000 rubles. - so many expenses were in the company "Cloud" for the current month. Based on the fact that net profit is the difference between all income and expenses, 10000-9000 \u003d 1000 rubles.

The bottom line "bottom line" = 1000 rubles. "Cloud" can be congratulated, this month it has brought income to its owners.

Suppose that this month she had to pay an additional 3,000 rubles for the repair of a broken car. And now the situation has changed dramatically, instead of a profit of 1000 rubles. the firm "Cloud" brought to the owner lesion in 2000 rub.

Naturally, the smaller the enterprise, the more likely it is that minor accidents will lead him economic indicators to minus. What to do and how to change the situation?

What determines the net profit

In the economic analysis of the company's activities, the net profit indicator indicates whether the enterprise is unprofitable or profitable. If it is positive, the company is called profitable. AT otherwise- unprofitable.

To calculate the net income, you must subtract all costs and taxes of the enterprise from the total profit for certain period. As follows from the calculation formula, to increase profitability, you must either increase gross income or reduce costs. Depending on the market situation, management decides on a strategy further development. If the analysis showed that the net profit is negative, this is due to the excess of expenses over income and requires immediate action to get out of this situation.

Net profit- the main source for the development of production

There are two strategies that allow you to increase the profitability of the enterprise: increase in income or decrease in expenses. Let's consider them below.

Development strategy

Used in a growing market. Economic analysis says that the more the company produces, the lower the cost of one unit of production. However, the more goods and services are produced, the more difficult it is to organize sales due to market saturation. When the forecast signals the growth of the economy, the manufacturer seeks to increase the quantity of goods produced and increase production capacity. This is done in response to an increase in demand. Also, for these purposes, advertising and marketing activities are carried out. They include:

- holding promotions to attract new customers and increase brand awareness;

- search for new niches and increase the range of products and services;

- entering new territorial markets, developing a dealer network.

Saving strategy

AT crisis situation Organizations, on the contrary, strive to reduce costs by all means. Due optimization of production, reduction of development programs and wage fund. There is a reduction in personnel, development programs are frozen. In addition, the following steps are possible:

- transition to a lower or higher price category;

- reduction in production;

- reduction of warehouse stocks;

- refusal to lend to the detriment of modernization and development.

Thus, during the crisis year of 2015 in Russia, enterprises reduced investments in the modernization of their own production by 10%.

Stages of development

In performance analysis, an important role is played by calendar period and the phase in which the entity is located. For a young company, gross margins are often negative.

At this time, the development of production, measures to find new customers and staff training takes an order of magnitude. more funds than received from sales. The start of a young company requires significant investments, which will not return soon.

So, in order to maintain brand awareness, an order of magnitude less funds are required than for its initial appearance on the market. Like a car that has already picked up speed, it consumes less fuel than when accelerating. The law of inertia operates, the net profit of an enterprise is not an indicator that is important at a particular point in time.

The value of the time period for the analysis also has great importance. For getting objective information take a period of at least one year. In a shorter time period, random factors have a very large influence. Thus, the purchase of new equipment, the change of supplier or distributor, and other events of little significance in the global time interval distort the objective picture in a short period of time.

The smaller the enterprise, the more likely it is that small accidents will lead its economic indicators to minus.

Analysis Methods

Two methods are used to evaluate financial position companies - factorial and statistical analysis. They are different in nature. The first examines the factors that influenced the profitability. The second is based on time statistics and tries to predict the development of the situation in dynamics.

Factor analysis

It is used in search of reserves to improve production and financial indicators and considers separately all the factors affecting the operation of the enterprise. For this, four indicators are examined:

- Dynamics of sales volume for the reporting period;

- Influence of assortment on income level;

- Cost dynamics;

- Change in the price of a product or service sold.

As a result analytical work it turns out in which part of the chain there are negative or positive changes, there is a search for ways to reduce costs or increase profitability.

Statistical analysis

To search for factors that affect profitability, the ratio is studied by years, months or other time intervals of the expenditure and income parts of the value chain. Based on the dynamics of each of these indicators, a mathematical model is built.

Profitability

Key performance indicator. It is calculated as the ratio of gross profit to company costs (Profit Margin). This indicator clearly reflects the quality of management work. So, if a huge corporation that employs thousands of people makes a net profit of $ 1,000,000, then this is unlikely to please business owners. At the same time, for a small firm with three workers, a million dollar income would be a significant achievement.

To increase the profitability of the enterprise, it is necessary either to increase gross income or reduce costs.

How profit is distributed

By Russian legislation, no more than once a quarter, the owners can decide where the net profit will be directed. The following options are provided:

- paying dividends to business owners or shareholders;

- increase the authorized capital;

- creation and replenishment of funds.

Funds can be created for the modernization of production, to increase the motivation of employees, reserve fund. Part of the profit in case successful activity is aimed at encouraging and motivating the activities of the company's management. It can be expressed as a straight line cash payment, and in the form of options to purchase shares at an attractive price.

conclusions

Net profit is the main source for the development of production. The stability of this indicator is important for both business owners and employees.

When looking for new investment ideas, investors first of all examine the indicators of net income and profitability. There are few who want to invest in a loss-making company.

Banks take into account net profit when calculating a loan. This depends on the amount interest rate for which the loan is issued.

Partners, analyzing the profitability of colleagues, also put forward certain conditions for the supply of goods or services. A stable company with a large volume of work receives orders for more favorable prices than loss-making enterprises.

You can analyze the result of the company's activities at the expense of its net profit. It shows how profitable or unprofitable production is. So, let's see what it is and how it is calculated.

Definition

Net profit is a certain amount in the budget that remains after paying for the work of employees, tax and other deductions, loans and interest on them. In other words, this is money that remained “on hand” and can be used for various purposes. It is the value of net profit that is final in the balance sheet.

If, after calculations, the net profit of the enterprise turns out to be negative, it is called net loss. It is permissible at the time of the formation of the enterprise, and for future perspective there shouldn't be any cons.

Any organization conducts economic calculations to determine net profit, since it has the following properties:

- Net profit is able to show whether it makes sense to work in the chosen direction, or would it be more profitable to stop or suspend your business.

- Income and savings funds formed from her Money.

- Used to improve expansion and optimization of production.

Compared to foreign enterprises, our net profit is not quite "net". In Russia, it includes both consumer and social fund, while Western organizations work differently.

Bonus payments are subtracted from net income. transport costs, holding events, resting employees in sanatoriums, etc. Only then will the amount received be “net profit”.

Area of use of net profit

When net profit has a positive balance, an enterprise can use it for the purpose of accumulation or consumption:

- reserve fund for keeping money, which is used as insurance for force majeure circumstances;

- production development(purchase modern technology, expansion, launching a new department or adding another area of activity, etc.);

- social needs(holding events for employees, construction and rental of non-production facilities, etc.);

- financial incentives(bonuses to employees, one-time payments, meals, etc.);

- dividend fund(payment to shareholders).

Calculation formula

From the economic side, all formulas carry the same meaning, although they have a different form:

Net profit = Revenue - Cost of sales - Selling and administrative expenses - Other expenses - Taxes.

Net profit = financial profit+ Gross profit (loss) + Operating profit(loss) – Taxes.

Net income = Profit (loss) before tax - Taxes.

For example, let's calculate the net profit for the enterprise LLC "KIP" on the balance sheet. First we need to find gross profit, and then calculate the profit from sales and profit before taxes.

| Name | 2011 | year 2012 | year 2013 | year 2014 |

| Revenue | 952365000 | 9223642000 | 1342325000 | 1673365000 |

| Product cost | 933642000 | 9016650000 | 1363608000 | 1583142000 |

| Gross profit (loss) | 18723000 | 206992000 | -21283000 | 90223000 |

| Selling expenses | 3120000 | 3185000 | 2016000 | 9290000 |

| Management expenses | 0 | 0 | 0 | 0 |

| Profit (loss) from sales | 15603000 | 203807000 | -23299000 | 80933000 |

| Income from participation in other organizations | 0 | 0 | 0 | 0 |

| Interest receivable | 0 | 0 | 98000 | 115000 |

| Percentage to be paid | 53296000 | 864293000 | 63277000 | 316996000 |

| Other income | 100011000 | 173012000 | 320998000 | 2469231000 |

| Other expenses | 186254000 | 153251000 | 190256000 | 2428950000 |

| Profit (loss) before tax | -123936000 | 19761000 | 44264000 | 195667000 |

| income tax | 30907000 | 17432000 | 21599000 | 84870000 |

| Net income (loss) | -93029000 | 2329000 | 22665000 | 110797000 |

Data for the last 4 years show the profitability of the enterprise. For KIP LLC, net profit increases with each period.

What does net profit analysis determine?

The main task of the analysis is to calculate the proportions according to which the distribution of the net profit of the enterprise will take place.

The analysis is:

- factorial(Its goal is to determine what factors influenced the profit).

- Statistical(The analysis is carried out according to the data of past periods (reporting years). Charts are compiled to understand and predict the sources of profit).

Net Profit Functions

Net profit in modern economy performs several functions:

- Regulatory. Net profit governs the distribution of the remaining cash in savings and consumer funds.

- stimulating. Stability in the market, advantage over competitors and regular income - this is what any company strives for. To increase the amount of net profit, it is necessary to improve and develop your business, as well as use modern technologies.

- Controlling. Profitability and production efficiency depend on net profit.

The main goal of the enterprise is the satisfaction of consumers and a stable, and even increasing net profit. In this case, his activity will be both useful and profitable.

Noskova Elena

I have been in the accounting profession for 15 years. She worked as a chief accountant in a group of companies. I have experience in passing inspections, obtaining loans. Familiar with the areas of production, trade, services, construction.

- Congratulations to colleagues in verse

- Download Cheat Engine in Russian Download cheat energy 6 2

- What to do if the guy is busy all the time

- The structure of the Main Intelligence Directorate of the General Staff of the Armed Forces of the Russian Federation

- Smear on the degree of purity: norm, decoding

- Symptoms and causes of infertility in women What could be the causes of infertility in women

- Causes of lower back pain during pregnancy and methods of its treatment Severe pain in the lower back of pregnancy what to do

- When can you get pregnant

- What is the benefit and is there any harm from yogurt?

- What factors can affect the fact that menstruation began early

- How to treat Bechterew's disease?

- Winning dating options How to meet in a club

- How to surpass Casanova: pickup rules for men

- What do girls want from life?

- Philip Bogachev Russian model of effective seduction

- Reduced rate of insurance premiums

- What is a psychological NLP anchor?

- How will the procedure and terms of payment of insurance premiums change?

- How the vehicle tax rate is calculated depending on the region and why Road tax by region table

- The meaning of the Kalanchoe flower What does the Kalanchoe flower mean in the house