Sales tax period. Who pays the trading fee

- Who is affected by this requirement?

- Which merchants must pay fees?

- How and when is the fee paid?

- What can size depend on? sales tax?

Since 2015, in some constituent entities of the Russian Federation, a rule has been introduced according to which individual entrepreneurs must pay a sales tax. However, the question of whether an individual entrepreneur pays a trading fee on a patent is of concern to many who have chosen this type of taxation. It is worth noting that we are talking only about representatives of small businesses who are engaged in retail products certain type. This rule approved by federal law.

Who is affected by this requirement?

This type of payment to the state treasury is mandatory for everyone who is included in the certain category individual businessmen. An important condition is a field of activity that brings profit to the IP, since the trading fee should be paid only by those who are engaged in trade, and payments must be made in a timely manner.

It must be paid to the state treasury every quarter. If an individual businessman ignores the rules on payment due contributions, he may be fined by regulatory authorities.

As for the question, if an individual entrepreneur is on a patent, does he pay a trading fee, it is worth noting that the obligation to pay depends not only on the type of activity, but also on the chosen tax regime. Russian tax legislation states that entrepreneurs who have chosen patent system taxation or pay a single agricultural tax, may be exempt from payment of trade. This rule is spelled out in Art. 411 of the Tax Code of the Russian Federation.

Besides, in this section Russian tax legislation it is said that only those who are engaged in specific type activities. First of all, these include Russian entrepreneurs, which conduct commercial activities at the objects of stationary trade without the use of trading floors. This applies to all individual entrepreneurs, except for those that use a patent or receive income from filling station. In addition, sales fees are paid by businessmen who sell products through non-standard outlets. This category includes those businessmen who sell their products through tents, kiosks.

Besides, in this section Russian tax legislation it is said that only those who are engaged in specific type activities. First of all, these include Russian entrepreneurs, which conduct commercial activities at the objects of stationary trade without the use of trading floors. This applies to all individual entrepreneurs, except for those that use a patent or receive income from filling station. In addition, sales fees are paid by businessmen who sell products through non-standard outlets. This category includes those businessmen who sell their products through tents, kiosks.

Businessmen who are engaged in the sale of goods through standard stores and retail space, V without fail must pay fees if they are used by any tax system, except for PSN and ESHN. When selling products from storage facilities sales tax is due. TO trading activities on legislative level equated and market organizations.

Back to index

Which merchants must pay fees?

By law, trade is recognized commercial activity, which is associated with retail, wholesale and small wholesale sales of products. For this, stationary and non-stationary network points for the sale of goods. This also includes storage facilities.

Object for taxation trade tax is the premises, building or structure in which entrepreneurial activities are carried out.

Object for taxation trade tax is the premises, building or structure in which entrepreneurial activities are carried out.

Non-standard objects of trade should also be included here. In addition, this category includes real estate that is used as an office for managing organization owning the retail market.

Back to index

How and when is the fee paid?

For entrepreneurs who are required to pay a trade fee, transferring money to the state treasury will be a quarterly task. Concerning tax rate, it is determined by the municipality. In this case, the type of activity and the size of the trading area are taken into account. All payments in state treasury produced exclusively in Russian rubles.

Local authorities have the right not only to establish interest rate and determine the amount of trading fees for individual businessmen working in the territory of the municipality, but also to cancel given type tax. At the same time, in different settlements or even on various streets of the city there may be a rate. In some places it can be equated to zero.

Separately, it is worth noting those who use the patent system of taxation. IN this case in general, there is no provision for the payment of taxes and fees. If an individual businessman has chosen a PSN for himself, all this is already included in the cost of the document. Instead of the usual payments to the state treasury, he will have to pay for the patent.

The payment period depends on how long the patent will be purchased. If on short term, then you can pay for the PSN in one payment at once. In the case when the document is purchased immediately for the maximum period, that is, for a year, you can pay the state in several installments.

The payment period depends on how long the patent will be purchased. If on short term, then you can pay for the PSN in one payment at once. In the case when the document is purchased immediately for the maximum period, that is, for a year, you can pay the state in several installments.

In any case, the patent system of taxation is much more convenient for an entrepreneur than any other, in which he will have to not only calculate and pay various taxes, but also a sales tax if the company is engaged in sales.

The tax rate for individual entrepreneurs who sell products is directly related to the patent taxation system. The thing is that the size of the trade fee for individual entrepreneurs, by law, should not be more than the estimated cost of a patent for trading activities, issued for 3 months. It is worth noting that each type of commerce has its own rates. A lot of other nuances are also taken into account, for example, the region of doing business.

Back to index

What can affect the size of the sales tax?

The rate that is applied to calculate this type of tax for individual entrepreneurs is calculated taking into account many indicators. As mentioned above, in some cases, fees can be completely abolished, but in general they are mandatory for entrepreneurs who are engaged in retail trade.

The main criteria that are taken to calculate the rate are the patent price at this species entrepreneurial activity and type of trade.

For example, for market sellers, the fee should not be more than 550 rubles per 1 m² of used area.

For big shopping facilities, for example, for stores with an area of more than 50 m², its size should be much smaller than for small points of sale.

From what controversial species Activities need to pay sales tax, and which ones do not? Is it possible to reduce the "simplified" sales tax without the 50% limit? What happens if a sales tax notice is submitted late or not sent at all?

Since July 1, 2015, it has been introduced on the territory of Moscow. And despite the fact that the new collection is dedicated to separate chapter 33 of the Tax Code of the Russian Federation and the Law of Moscow dated December 17, 2014 No. 62 “On the sales tax” (hereinafter referred to as Law No. 62), so far not everything is so smooth with its payment. Capital companies and entrepreneurs constantly have questions related to the obligation to pay sales tax. In order to somehow help traders, specialists from the Russian Ministry of Finance issued several letters at once with their explanations. For your convenience, we have combined the comments of officials in this material.

To begin with, we note that this year the sales tax was introduced only in Moscow (Law No. 62). Therefore, first of all, the article will be interesting. The authorities of St. Petersburg and Sevastopol introduce new fee did not. And other regions of Russia will be able to introduce it only after they adopt a separate federal law (clause 4, article 4 of the Federal Law of November 29, 2014 No. 382-FZ). So far there is no such law. But clarifications may be useful to you in the future. Below we consider questions, the answers to which were not clearly known.

Which disputed activities are subject to sales tax and which are not?

Not all activities immediately allow you to understand whether you need to pay a new fee or not. There are some controversial types of business, carrying out which it is difficult to determine the need to pay a fee. Let's analyze the most common situations.

Situation #1. Entrepreneur sells his own products . Trading is not always reselling before. Some businessmen sell products that they themselves have produced. Do I need to pay sales tax in this case? According to experts from the Russian Ministry of Finance, everything here will depend on where you sell your products (letters dated July 15, 2015 No. 03-11-10/40730 and dated July 27, 2015 No. 03-11-09/43208). So, if you use commercial facility(movable or immovable), then you will have to pay the fee to the budget (Article 413 of the Tax Code of the Russian Federation). For example, the object of trade may be stationary object with a trading floor - a shop, a pavilion, and also without a hall - a kiosk, a tent. Or a non-stationary object - a mobile shop, a trailer. Accordingly, if you, for example, trade in goods own production through the store, you need to pay the sales tax.

Note. Only those entrepreneurs who are engaged in trade through trading facilities are required to pay a sales tax when selling products of their own production. For example, through shops, kiosks, stalls.

If, for the implementation own products you do not use trading facilities, you do not need to pay a trading fee.

Situation #2. The merchant concludes a contract for the sale of goods in the office . Currently, many sellers are saving on retail space. Therefore, the sale of goods is carried out directly in the office. It might look something like this. A person chooses a product on the website and orders it. After that, he comes to pick up the goods at the seller's premises. So, in this case, the need to pay a fee will depend on exactly how your office looks from the inside (letter of the Ministry of Finance of Russia dated July 15, 2015 No. 03-11-10 / 40730). If this is an ordinary office, where there is a table, chair, computer, printer and other office supplies, you will not have to pay sales tax.

It happens that the office is called a rather large room, which has all the signs of a commercial facility. In particular, it has showcases with additional goods, aisles for customers and places of their service - cash desks or terminals for choosing products (Article 2 of the Federal Law of December 28, 2009 No. 381-FZ). When selling goods in such an “office”, a sales tax must be paid.

Situation #3. The sold goods are delivered by courier or post . In this situation, how the delivery is made is important for the purposes of paying the fee. If the goods are delivered from a trading facility, that is, from a room intended for displaying, demonstrating goods, passing and servicing customers, making settlements with them, then the fee should be transferred (letter of the Ministry of Finance of Russia dated July 15, 2015 No. 03-11-10 / 40730) .

If your object does not have these characteristics, such a business will be recognized as a trade by issuing goods from a warehouse. And trading from a warehouse in the territory of Moscow is not subject to sales tax. Since the collection rates for trading from a warehouse in the capital are not set. Therefore, when carrying out trading activities from a warehouse, you do not need to transfer the trading fee (Letter from the Department economic policy and Development of the City of Moscow dated June 26, 2015 No. DPR-20-2/1-161/15).

Note. If the courier delivers the goods to the buyer from a warehouse in Moscow, there is no need to pay a sales tax.

Situation #4. Businessman provides household services and sells related products . Quite often, entrepreneurs, in addition to providing household services, sell related products. For example, beauty salons and hairdressers offer customers to buy various hair care products. And shoe repair shops - creams and brushes for various kinds materials from which these shoes are made. If you have such a business, then you do not need to pay sales tax. This was announced by the Ministry of Finance of Russia in its letter dated July 27, 2015 No. 03-11-09 / 42966.

However, we advise you not to transfer the fee only if your services comply with those named in paragraph 3 of Article 3 of Law No. 62. Since Moscow has established additional terms to exempt businessmen engaged in household services from sales tax. In particular, hairdressers, beauty salons, dry cleaners, shoe and watch repair shops, etc. may not pay the fee. At the same time, they must trade through an object without a hall or with a hall of less than 100 square meters. m. And the area occupied by equipment for displaying and demonstrating goods should not exceed 10% of the area of the object itself. When the marked conditions are not met, it is safer to pay the fee. Or find out the position of your IFTS by this issue by submitting a formal request.

If you only provide domestic services, but you do not sell goods, then you do not need to pay sales tax. Since household services are not trade, they are services. There is no charge for household services. Therefore, it does not need to be paid. Officials from the Department of Economic Policy and Development of Moscow agree with this in a letter dated June 26, 2015 No. DPR-20-2/1-161/15.

Is it possible to reduce the "simplified" tax on the sales tax without a limit of 50%

Merchants on the simplified tax system with an object of income have the right to deduct the trading fee for the single tax on a par with insurance premiums and hospital benefits(clause 8 of article 346.21 of the Tax Code of the Russian Federation). The only difference is this. On contributions paid and benefits paid, you can only reduce the "simplified" tax by half. That is, by 50% (clause 3.1 of article 346.21 of the Tax Code of the Russian Federation).

However, there are no such restrictions on the sales tax. Therefore, you can take into account the amount of the fee paid in the calculation of the "simplified" income tax in addition to insurance premiums and benefits, but without a 50% limit (clause 8 of article 346.21 of the Tax Code of the Russian Federation). It turns out that if the amount of the fee paid is significant, single tax on USN can be reduced down to zero. This was indicated by the Ministry of Finance of Russia in a letter dated July 15, 2015 No. 03-11-10 / 40730.

The only condition that you need to meet in order to reduce the tax on the simplified tax system on the sales fee is to submit a notice to the Federal Tax Service of the Russian Federation on registration as a payer of the fee (more on this below).

If you are working with an object of income minus expenses, then you can put the entire amount of the fee into expenses under the simplified tax system (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

What happens if you submit a sales tax notice late or do not send it at all

By general rule In order to pay a trading fee, you must register with the IFTS as a payer of this fee within five working days after you started trading. To do this, a notification must be submitted to the Federal Tax Service Inspectorate in the form No. TS-1, approved by order of the Federal Tax Service of Russia dated 06.22.2015 No. MMV-7-14 / 249 (clause 2 of article 416 of the Tax Code of the Russian Federation). If you were already trading at the time the fee was introduced (July 1), then you had to submit the appropriate notification before July 7 inclusive (clauses 1 and 2 of article 416 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 06.26.2015 No. GD-4-3 /11229).

So, if such a notification is not submitted, the tax authorities can equate your inaction to doing business without registering with the tax authority (paragraph 2, clause 2, article 416 of the Tax Code of the Russian Federation). And there can be fines for violations. Its size is 10% of the income received for the period while you worked without registration, but not less than 40,000 rubles. (Clause 2, Article 116 of the Tax Code of the Russian Federation). After that, you will be registered as a payer of the fee forcibly and you will still have to pay the fee. But consider transferred amount you will not be entitled to the sales tax when calculating taxes (paragraph 2, clause 8, article 346.21 of the Tax Code of the Russian Federation). Since the fee can be written off only if a notice of registration was submitted to the Federal Tax Service Inspectorate.

But for violation of the deadline for filing a notice of registration, no sanctions are provided. That is, if you did not meet within five working days from the moment you started trading, or if you did not send a notification after July 7, submit it now. This will not deprive you of the opportunity to reduce the single tax on the trade fee paid. This conclusion was made by the employees of the Federal Tax Service of Russia in paragraph 6.2 of the letter dated June 26, 2015 No. GD-4-3 / 11229. The main thing is to have time to file a notice before you are forcibly registered as a sales tax payer.

September 2015

From July 1, entrepreneurs in Moscow (legal entities and individual entrepreneurs) are required, along with other taxes, to pay a fee for conducting trading activities. Payers of the UST, sole proprietors on a patent, entrepreneurs doing business online, as well as those trading from their own warehouse are exempted from its payment. The procedure for payment, rates, tax benefits are established by laws local authorities authorities in the territory where said payment.

The sales tax is a local tax. Since July 1, the specified payment has been introduced in Moscow, since 2016 it is planned to be established in Sevastopol and St. Petersburg. In other regions, the issue of introducing a fee will be decided local authorities.

This fee is a fee and does not replace any taxes. However, some taxes payable to the budget can be reduced by the amount of the fee paid. It should be noted that the fee is paid regardless of income and expenses, unprofitability or profitability of the enterprise and ongoing activities. If in the period of taxation, and this is a quarter according to the code, the object of activity is used, the fee will have to be paid. Recalculation of payment, based on the time of use, is not provided for by law. That is, if the trade in the kiosk was conducted for only 2 weeks, then the fee will have to be paid for the entire quarter.

What will you have to pay for?

Activities for which fees are charged include the following types trade:

- Through objects of the stationary network, both with and without trading floors (with the exception of gas stations);

- Through objects of a non-stationary trading network;

- Retail market organizations

Who pays the trading fee?

New installment must be paid by legal entities and individual entrepreneurs using movable and immovable property in trading activities. Currently, this obligation applies only to Moscow entrepreneurs.

Sole proprietorships on a patent, persons applying the ESHN, as well as entrepreneurs conducting trade on the Internet are exempted from payment of the payment.

With regard to trade from a warehouse, it should be noted that the code specified type of activity is a contribution to the right to use movable and real estate taxable, however, the rate for it in the law of Moscow is not defined, in connection with which the payment said contribution when selling products from the warehouse is not subject.

How much to pay?

The collection rate is established by the regulatory legal acts bodies local government and cities federal significance. In Moscow, it is determined by Law No. 69 of December 17, 2014.

Importance is the location of the property. In relation to objects of the fixed network with and without trading floors and non-stationary network, the legislator has determined differentiated rates depending on the location area.

| Physical indicator | Rate (rub.) |

||

|---|---|---|---|

| Within the Moscow Ring Road (except for the Central Administrative District) | Outside the Moscow Ring Road |

||

| Stationary trade network with an area trading floor: |

|||

| up to 50 sq.m. | (120r per 1 sq.m.) | (600 rubles per 1 sq.m.) | (420 rubles per 1 sq.m.) |

| over 50 sq.m. | 50r for each meter | 50 per meter | 50 per meter |

| Stationary trading network without a trading floor and non-stationary trading network |

|||

| Object of trade | |||

| retail markets |

|||

| For each sq.m. | |||

| Peddling and delivery trade |

|||

| Object of trade | |||

| Physical indicator | Fee per quarter |

|||

|---|---|---|---|---|

| Within the Moscow Ring Road (outside the claims of the Central Administrative District) | Outside the Moscow Ring Road |

|||

| Grocery store area of 40 sq.m. | 60 000 (120r*50sq.m.) | 30 000 (600r*50sq.m.) | (420r. *50sq.m.) |

|

| * The rate is fixed, even if the store has an area of 10 sq.m. you will have to pay for 50 sq.m. |

||||

| Mini market with an area of 200 sq.m. | 60 000+7500 (150sq.*50r) | (150sq.m.*50r) | (150sq.m.*50r.) |

|

| Newsstand | ||||

| * The rate is fixed |

||||

| mobile shop | ||||

| * The rate is fixed |

||||

A complete list of districts included in the Central Administrative District, within the Moscow Ring Road and outside the Moscow Ring Road is given in Law No. 62 of December 17, 2014.

When to pay sales tax in 2015?

This payment must be made to the budget no later than the 25th day of the month following the reporting one. For the 3rd quarter of 2015, the fee must be paid no later than October 26, 2015. (October 25 - falls on a day off), and for the 4th quarter - until 01/25/2016.

Payment of advance payments this payment not provided.

Where to register?

Since the trading tax began to operate on the territory of Moscow on July 1, 2015, all persons already engaged in trade had to register with tax authorities until July 7 (July 4-5 weekend). Those who have just started their activities must submit a relevant notification to the Inspectorate within 5 working days. Trading without notifying the tax authority will be equated by the regulatory authority with conducting activities without registration and will entail a fine and deprivation of the right to tax incentives, which, among other things, are a reduction in income tax, personal income tax and tax on the simplified tax system by the amount of the fee paid.

The tax authority, having revealed the fact of using the property subject to the contribution, has the right to register the taxpayer itself, however, in this case, the latter will also deprived of the right for the said benefits.

Registration and deregistration is carried out:

- Location of the property;

- At the place of residence of the entrepreneur or the location of the legal entity in other cases

If an entrepreneur has several objects of trade in one municipality, but in different districts, then registration new object is placed in the IFTS in which the very first object was delivered.

Example #1

LLC "AstraMed" July 7, 2015 got registered with the Federal Tax Service of Russia No. 13 (SAO) in Moscow at the location of the store (Dmitrovsky proezd, 4). In September, the organization opened another store in the South Administrative District (Bakinskaya Street). She must report information about him to the Federal Tax Service No. 13.

Example #2

LLC "AstroMed" started its activities on August 1, opening three stores at the same time: in the North-East Administrative Okrug, ZAO and SAO. In the notification for registration, the first object is a store in the North-East Administrative District, accordingly, the organization will need to register at the location of the store located in the North-Eastern Administrative District.

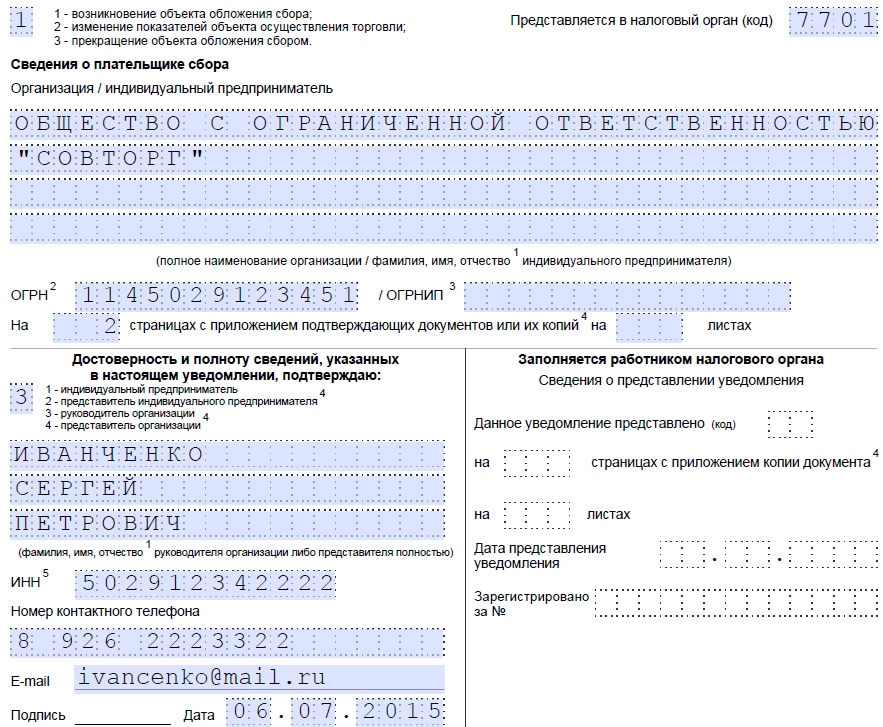

How to fill out notification TS-1 and TS-2?

Federal tax service The following types of notifications have been developed for registration/deregistration of fee payers:

Specified Document consists of 2 pages (if there is one object of trade, if there are several, then sheet 2 is filled in for each object separately).

Page 1 should contain information about the payer (legal entity and individual entrepreneur): the name of the legal entity or full name of the entrepreneur, TIN/KPP and PSRN for legal entities and TIN/OGRNIP for individual entrepreneurs, information about the person who submitted the document, as well as the reason for submitting the notification.

Page 2 should contain information about the property used:

Line 1.1 reflects the date of the event on which the notification is submitted.

Line 1.2 includes the activity code. It must reflect how the trade is conducted.

Line 2.1 - the code of the municipality where the used property is located.

Line 2.2 - code for trading (the list of codes is indicated in Appendix 3 to the Procedure for filling out).

Line 3.5 Benefit code. In this line, it is necessary to reflect the subparagraph and paragraph of the article, which this benefit provided.

For example, the benefit is established in paragraph 1 of paragraph 1 of Art. 3 Laws. The line must be filled in as follows:

Notification may be sent to the Inspectorate, as in paper form, as well as through electronic communication channels with using EDS(electronic digital signature).

Within 5 days from the date of receipt of the notification, the tax authority must register the legal entity or individual entrepreneur and send him a notification in the form TS-1.

Indicated form does not require special order filling out, it is only necessary to indicate the data of the organization or individual entrepreneur, as well as the date of termination of activity.

Filling out the sales tax

Having registered, a reasonable question arises as to where to pay the sales tax? The specified payment is transferred to the address of the Inspectorate in which the organization or individual entrepreneur is registered as the payer of the fee, and the OKTMO code is indicated for the municipality where the object of trade is located. If the objects are located in different districts, then the payment will be according to the number of objects located in these districts.

For example, an organization has 3 stores located in different districts of Moscow. She will need to fill out payment forms for each store. If this organization will own 2 tents on the territory of one municipality, then the payment will be the same for 2 tents.

Sample filling and details for paying the sales tax in Moscow

In the specified p / p, the Beneficiary's Bank and its details (BIC, Account No.), Recipient (UFK for Moscow) always remain unchanged. The CBC of the trading fee in Moscow also does not change. The remaining details are filled in by the taxpayer, depending on:

- to which inspection the payment is sent (TIN / KPP and the name of the tax authority);

- where the object of trade (OKTMO) is located. The education code can be found on the website of the Federal Tax Service of Russia;

- for what period is the fee paid

What are the sales tax incentives?

Tax preferences for this payment are divided into 2 types, represented by the Tax Code of the Russian Federation and legal acts of local governments. In accordance with the code, the payer can reduce the amount of income tax, income tax, and tax on the simplified tax system on the amount of the contribution paid.

Law of the city of Moscow No. 69 removed some types of trade from taxation and exempted a number of organizations, including federal postal service, autonomous, budgetary and state-owned enterprises.

Summarizing the above, we reflect key points, defining the essence of the sales tax, the procedure for its payment and registration:

- The sales tax is local fee and it can be introduced only after the entry into force of the relevant Federal Law;

- This payment is valid only on the territory of Moscow, in 2016 it is planned to introduce a fee in the cities of St. Petersburg and Sevastopol;

- Entrepreneurs with a patent and applying the Unified Agricultural Tax, as well as those trading on the Internet and from a warehouse are exempted from payment;

On July 1, 2015, the law on the rate of sales tax entered into force in the capital. What will happen if you do not submit a notification to the tax office, whether you need to pay a new fee to beauty salons and those who sell goods without a retail outlet.

Trading fee, in fact, is mandatory payment, which must be transferred quarterly for the right to conduct trading activities. Moreover, trade activities are understood as both wholesale and retail trade.

All companies and entrepreneurs are recognized as payers of the fee, regardless of the taxation system (general or simplified), with the exception of entrepreneurs using the patent system of taxation and payers of the unified agricultural tax.

The Moscow authorities have determined the following types of activities that will be subject to sales tax:

- trade through the objects of a stationary trading network that do not have trading floors (exception - gas stations);

- trade through objects of a non-stationary trading network;

- trade through the objects of a stationary trading network with trading floors;

- organization of retail markets.

It is important to note that the Tax Code also classifies trade by issuing goods from a warehouse as trading activity, but the Moscow authorities decided to remove such trade from taxation.

Thus, trade tax included types of entrepreneurial activities generally related to the sale and purchase of goods, carried out through objects of stationary or non-stationary trade. Stationary trade includes, for example, shops, kiosks, tents. Non-stationary trade is a retail delivery or peddling trade.

wholesale companies and entrepreneurs operating in Moscow do not have to worry about paying sales tax. The likelihood that their activities will be subject to taxation is extremely small. And here retailers, including beauty salons engaged in trade, it is worth familiarizing yourself with the procedure for calculating and paying the sales fee.

Trading fee calculation formula starting July 1, 2015

So, organizations and entrepreneurs, as a general rule, will have to calculate the trading fee independently for each object of trade using the following formula:

Trading fee = Fee rate * The actual value of the physical characteristics of the object of trade

Wherein actual value the characteristics of the object are, for example, the area of the object of trade (trading floor) or the object of trading as a whole (in the absence of a trading floor).

Fee rates are established in the Moscow Law.

Sales tax in Moscow

On the territory of Moscow, the sales tax is charged at the rate 200 rubles per year for 1 sq. meter for objects of trade. This rate applies to objects of trade, area exceeding 50 sq. meters.Objects of stationary trade, which have an area of 50 sq. meters or less are subject within the boundaries of Moscow to an annual sales tax:

- on the territory of the Central Administrative District in the amount 240 thousand rubles;

- 120 thousand rubles;

- 84 thousand rubles.

The trading fee will be paid quarterly based on the results previous quarter no later than the 25th day of the month following the quarter. At the same time, the amounts of the trade fee will be counted towards the payment of income tax, tax paid under simplified taxation or personal income tax for entrepreneurs on common system taxation.

Objects of stationary trade, which have over 50 sq. meters, are subject in Moscow to the annual sales tax amounts indicated above, to which are added fees at the rate of 200 rubles for each sq. meter area exceeding 50 sq. meters.

Stationary and non-stationary trade objects that are not equipped with a trading floor are subject to an annual sales tax within Moscow:

- on the territory of the Central Administrative District in the amount 162 thousand rubles;

- on the territory of other districts (within the Moscow Ring Road) in the amount of 120 thousand rubles;

- on the territory of New Moscow (outside the Moscow Ring Road) in the amount of 113.4 thousand rubles.

The procedure for accounting for the fee in the calculation tax liabilities as follows:

| Economic entity, taxation system | The procedure for accounting for sales tax |

|---|---|

| Organization applying DOS | The taxpayer has the right to reduce the amount of tax (advance payment) calculated based on the results of the tax (reporting) period, credited to the budget of the city of Moscow, by the amount of the sales tax actually paid in these cities from the beginning of the tax period to the date of tax payment (advance payment). |

| IP using OSN | If an individual entrepreneur is registered with the Federal Tax Service of Moscow and pays a sales tax, he has the right to reduce the amount of personal income tax for the amount paid in this tax period trade fee. |

| Organization or individual entrepreneur using the simplified tax system with the object "income" | The taxpayer has the right to reduce the amount of tax (advance payment) calculated on the basis of the results of the tax (reporting) period for trading activities, in respect of which the fee has been paid, credited to the budget of Moscow, by the amount of the trade fee paid during this tax (reporting) period. |

| Organization or individual entrepreneur using the simplified tax system with the object "income minus expenses" | The taxpayer has the right to include the amount of the sales tax in expenses. |

In order to register an organization or entrepreneur as a payer of sales tax, it is necessary to submit an appropriate notification to the IFTS. The payer of the fee shall submit a notification not later than five days from the date of occurrence of the object of taxation. That is, if as of July 1, 2015 (the moment the trading tax was introduced in Moscow) you are already trading through one or another object, then you need to notify the tax authorities no later than July 7, 2015. If you started trading, say, on August 25, you need to submit a notification no later than August 31.

An organization or an individual entrepreneur is registered as a payer of the fee with the tax authority at the location of real estate in cases where trading activities are carried out using this object, or, in other cases, at the location of the organization (place of residence of the entrepreneur). If, for example, you have several trading facilities in Moscow in the territories under the jurisdiction of different inspections, you must register with the tax authority at the location of the facility, information about which was received from the fee payer earlier.

Important! The provision of a notification directly affects the possibility of reducing tax liabilities by the amount of the fee. Failure to submit a notification is equated to conducting activities without registration with the tax authority. The penalty for such a violation is 10% of the income received for the period while you worked without registration, but not less than 40,000 rubles.

Thus, all companies and entrepreneurs engaged in the field retail, moreover, both the main activity and the secondary one (this applies to beauty salons, fitness clubs, etc.), must pay a trading fee once a quarter at rates approved by the Moscow authorities.

Consider an example.

The company on the USN has a store with an area of 70 m2, located in the Central Administrative District of Moscow. For example, for 3 sq. 2015, advance tax payments under the simplified tax system amounted to 500,000 rubles.

The size of the sales tax rate per quarter is 60,000 rubles per 50 m2, if the area is exceeded, each subsequent meter is taxed at a rate of 50 rubles. for 1 m2 per quarter.

It turns out, for 3 sq. In 2015, the sales tax for this organization will be:

60 000 + 20 * 50 = 61 000

Trading fees can be deducted under the simplified tax system (if general mode income tax is reduced by the amount of the trading fee).

As a result, the organization must for the 3rd quarter. 2015 to pay tax under the simplified tax system in the amount of:

500,000 - 61,000 \u003d 439,000 rubles.

Companies and entrepreneurs that conduct trading activities in Moscow, but have not yet filed a corresponding notification with the tax office, should hurry up. If you manage to do this before the end of July 2015, the fine for late notification will be only 200 rubles. Such clarifications appeared on the official website of the Moscow Department of Economic Policy and Development.

According to officials, the Department's databases contain information about all objects where trade is carried out (including undeclared ones). This list will be compared with those objects that were declared, and a list of objects where they trade, but no notifications were submitted, will be compiled. After August 1, this list in open access will be posted on the websites of the Federal Tax Service and the Department. Also, all "illegal" traders will be warned through the media. And after another 20 days, they will be checked, an act will be issued and sent to the tax office. And then already a significant fine - at least 40,000 rubles. - cannot be avoided.

Questions and answers on the trading fee

Who should be registered as payers of the sales tax, from which objects the amount of the tax should be calculated, what benefits are provided, etc. Maria Bagreyeva, Deputy Head of the Moscow Department of Economic Policy and Development, answered readers' questions.

The Tax Code of the Russian Federation provides that the sales tax is charged, including when trading from a warehouse ( sub. 4 p. 2 art. 413 Tax Code of the Russian Federation ). HoweverLaw of the City of Moscow dated December 17, 2014 No. 62 the sales tax rate for this type of trading activity is not established. Is an entrepreneur who releases goods from a warehouse obliged to submit a notice of registration as a payer of sales tax by July 7, 2015, and if so, how should paragraph 3 of the notification be filled in in this case (calculation of the amount of the fee)? Volodina S.A.Please note that the answers to the questions are informational character, assignment specific object to the trade, can be established only on the basis of title and inventory documents, taking into account the actual use of the premises.

Organizations and individual entrepreneurs engaged in such trading activities as "trade carried out by issuing goods from a warehouse" in Moscow (for example, online stores) are not payers of the sales tax and do not have to submit a notification of registration with the territorial tax authorities. There is no sales tax for this type of activity in Moscow. At the same time, warehouses, according to the Department of Economic Policy and Development of the City of Moscow, include buildings (structures, structures) or parts thereof intended for storing goods, which do not provide access for buyers and do not have equipment designed for laying out and demonstrating goods and holding cash settlements with customers.

The company carries out wholesale and retail trade ceramic tiles. Tiles are shipped only from a warehouse (both legal entities and individuals), however, there is an office with a showroom in which product samples are presented and in which goods are sold. From what area do you need to pay sales tax? Olga Ch.In this case, the sales tax will need to be calculated and paid only from the area of the office with the showroom. After all, if the office has special equipment, goods are laid out and cash settlements, such an office is a commercial facility and, accordingly, is subject to sales tax. At the same time, when determining the area of the trading floor, it should be taken into account that the area of the trading floor is understood as:

- part of a store or pavilion occupied by equipment intended for displaying, demonstrating goods, making cash payments and serving customers;

- area of cash registers and cash booths;

- work area service personnel;

- aisle area for buyers;

- leased part of the sales area.

The area of the trading floor is determined on the basis of inventory and title documents.

Should a company that provides services for the transportation of lamps and at the same time sells, for example, containers for the transportation and storage of these lamps, have to pay a sales tax, and if so, what will be recognized as the object of trade? Guzal SafinaThe object of taxation of the trade tax is the use of an object of movable or immovable property for trading. Transportation/delivery services are not trading activities and are not subject to sales tax.

With regard to the sale of containers, if the trade is carried out using vehicles specialized or specially equipped for trade, as well as mobile equipment applied only with vehicle, such trade may be classified as a distribution retail trade, in which case the fee must be paid.

The company trades exclusively through the online store. Does she have to pay a sales tax and if so, what rate should she apply? (Danilovsky district). Julia MironovaNo, the company does not have to pay sales tax. The object of taxation of the trade tax is the use of an object of movable or immovable property for trading. If the property is not used (for example, goods from a warehouse are delivered directly to customers, there is no trading floor, which houses equipment designed for displaying, demonstrating goods, conducting cash settlements and serving customers), then tax collection no need to pay.

Special GOST (GOST R 51773-2009 " Trade services. Classification of trade enterprises ") gives definitions of stationary and non-stationary objects. The Tax Code of the Russian Federation also contains such definitions for the purposes application of UTII and PSN. At the same time, the provisions of GOST and the Tax Code of the Russian Federation diverge - for example, GOST classifies vending machines and kiosks as non-stationary objects ( clause 3.14 ), and the Tax Code of the Russian Federation - to stationary ( par. 15 art. 346.27 , sub. 7 p. 3 art. 346.43 of the Tax Code of the Russian Federation ). For the purposes of applying the sales tax, the Tax Code of the Russian Federation does not establish definitions of such objects. What should tax payers be guided by when determining the type of object? Vasily P.Indeed, the concepts of objects of a stationary trade network and a non-stationary trade network in currently not defined in chapter 33 of the Tax Code of the Russian Federation. At the same time, for the purposes of administering the sales tax, the next classification shopping facilities, presented in the Decree of the Government of Moscow No. 401-PP dated June 30, 2015 "On the Procedure for Collecting, Processing and Transferring Information to the Tax Authorities on the Objects of Trade Duty in the City of Moscow".

The objects of a stationary trading network with trading floors include:

- detached non-residential buildings (buildings, structures) used by one organization or individual entrepreneur for the sale of goods and the passage of buyers and equipped with equipment designed for laying out, demonstrating goods, serving customers and making cash payments;

- located in apartment buildings or non-residential buildings(buildings, structures) non-residential premises used by one organization or individual entrepreneur for the sale of goods and the passage of buyers and equipped with equipment designed for laying out, demonstrating goods, serving customers and making cash payments.

The objects of a stationary trading network that do not have trading floors include the following objects:

- retail outlets located in corridors, halls, lobbies of detached non-residential buildings (buildings, structures), as well as non-residential premises in apartment buildings, used by one or more organizations and (or) individual entrepreneurs for the sale of goods and equipped with equipment intended for display, demonstration goods, customer service and cash settlements;

- non-residential premises located in apartment buildings or non-residential buildings (buildings, structures) used by one or more organizations and (or) individual entrepreneurs for the sale of goods and equipped with equipment designed for laying out, demonstrating goods, serving customers and making cash payments, including through a window for the issuance of goods, without access of buyers to the premises;

- non-residential premises located in apartment buildings or non-residential buildings (buildings, structures) used by two or more organizations and (or) individual entrepreneurs for the sale of goods and the passage of buyers and equipped with equipment designed for laying out, demonstrating goods, serving customers and making cash payments.

The objects of the non-stationary trading network include:

- non-stationary retail facilities located in accordance with the Decree of the Government of Moscow dated February 3, 2011 No. 26-PP "On the placement of non-stationary retail facilities located in the city of Moscow on land plots, in buildings, structures and structures that are state-owned" (for example , kiosk, vending machine, car shop, press stand);

- objects of distribution retail trade carried out outside the stationary retail network using vehicles specialized or specially equipped for trade, as well as mobile equipment used only with a vehicle;

- objects of retail retail trade carried out outside the stationary retail network through direct contact between the seller and the buyer in organizations, on transport, at home or on the street.

In accordance with the provisions of Art. 416 of the Tax Code of the Russian Federation, the payer of the sales tax is obliged to send a notification to the tax authorities about registration as a payer of the sales tax within five days from the date of commencement of trading activities. Due to the absence of business in July, August and September, the entity will be required to file a notice for the first time in the fourth quarter, within five days of the resumption of trading activity. At the same time, the payer is not obliged to confirm that trading activities were not carried out at the facility during July-September.

Trading is not the main activity of the organization, and goods are sold only as an addition to the main activity (selling cosmetics in a beauty salon, shampoos in a barbershop). Do I need to file a sales tax registration notice? Ekaterina Zhurkina

Yes need. The organization in this case uses the real estate object for trading activities, is the payer of the fee, and is obliged to submit a notification to the tax authorities. For small objects consumer services(up to 100 sq. meters) at the end of June, amendments were made to the Law of the City of Moscow dated December 17, 2014 No. 62 "On the sales tax" (hereinafter - Law No. 62) providing benefits for organizations and individual entrepreneurs providing personal services. The law applies to legal relations that arose from July 1, 2015, that is, from the beginning of the period of taxation of the sales tax, organizations and individual entrepreneurs will be able to use this benefit.

- the main activity specified in state registration legal entity or IP, refers to the provision of services by hairdressers and beauty salons, laundry services, dry cleaning and dyeing of textiles and fur products, for the repair of clothing and textiles household purpose, repair of shoes and other leather goods, repair of watches and jewelry, for the manufacture and repair of metal haberdashery and keys;

- the area occupied by equipment intended for the display and demonstration of goods shall not exceed 10 percent of the total area of the facility used for the activities referred to above.

The sales tax in the capital was introduced on July 1. It must be paid by entrepreneurs who are engaged in both retail and wholesale trade.

Is there a division into types of goods (bread and bakery products, flowers, products) or does it not matter? And without these taxes it is difficult to live in this difficult time. Maybe hold off on the trade tax?

– Sales tax does not depend on the product specialization of these objects. The sales tax rate is differentiated by type of activity, territory (in the center - more expensive, outside the Moscow Ring Road - cheaper).

We proceed from the fact that taxes should serve to equalize competition between market participants. There should not be situations when one entrepreneur or organization pays a tax, and a nearby retail facility uses "gray" schemes to evade payment, shows zero profit, thereby being more cost-effective in relation to a conscientious taxpayer.

That is, it does not matter, the area of the store is 3 square meters. meters or 50 sq. meters - still pay 60 thousand rubles?

– Collection rates for objects up to 50 sq. meters are not differentiated. At the same time, if your facility is located in the Central Administrative District, then the amount of the fee is 60 thousand rubles per quarter, in the districts between the Central Administrative District and the Moscow Ring Road - 30 thousand rubles. For objects located outside the Moscow Ring Road, the rate is 21 thousand rubles.

It is important to note that the amount of the fee is deducted from income tax, tax on the simplified tax system and personal income tax (for individual entrepreneurs on the general taxation system). Therefore, the owners of all outlets it is important to register to take advantage of the opportunity to reduce your taxes. Detailed information you can find on the website of our department in the section "Trading fee".

We have not yet applied for the sales tax. When deadline? What happens if we don't want to pay?

- main and binding rule for all those involved in trade - to submit a notice of the payer of the trade tax to the Moscow tax authorities. Despite the fact that this had to be done from July 1 to July 7, organizations and individual entrepreneurs can submit a notification later. In this case tax sanctions for untimely filing will be only 200 rubles.

If you decide not to file a notification at all, you will have to pay a fine of 10 percent of the turnover, but not less than 40 thousand rubles, as well as late fees. In addition, you will not be able to deduct sales tax from income tax and other taxes in the specified tax period.

Trading is not the main activity of the organization. And the goods are sold only as an addition to the main activity (we provide services in the field of photography, we additionally sell photo frames). Do I need to pay sales tax?

- Yes need. A sales tax is imposed on movable and immovable property used for trade, in this case, the sale of photo frames. According to the Tax Code of the Russian Federation, trade is a type of entrepreneurial activity associated with retail, small-scale wholesale and wholesale purchase and sale of goods carried out through the objects of a stationary distribution network, a non-stationary distribution network, as well as through warehouses.

The nail service salon rents a room of 17 sq. meters, a showcase is installed on an area of 1 sq. meter with the display of goods for sale to customers. It is necessary to submit a notice for sales tax, which estimated area should be indicated?

– You do not have to pay the sales tax, because the type of activity "beauty salon services" falls under the exemption, but you still need to file a notice with the tax office with the benefit code 000300030000.

I am a jewelry manufacturer, workshop for rent - office in Central District. I sell goods in bulk, put on a commission and with the help of a courier on the Internet. Do I pay sales tax if buyers do not come to my office? Whether trade is realization own goods? IN tax code trade is buying and selling. Tax office insists that the sale of manufactured goods is also trade. Thank you in advance.

- In accordance with the law of the Russian Federation "On the Protection of Consumer Rights", a seller is an organization (regardless of its organizational and legal form) that sells goods to consumers under a sales contract. That is, the sale of products of own production is also trade and, therefore, the trade tax applies to it.

At the same time, persons conducting trade in the territory of Moscow are payers of the trade tax only if they use objects of movable or immovable property located on the territory of the city. In this case, the object of trade is not used (since buyers do not come to the office), and the delivery of goods to customers using mail, couriers or transport companies is not a trade, but a service to which the trade fee does not apply.

LLC rents a pavilion with an area of 18.6 sq. meters on the universal trading market"Gardener". Tell me, should we register as payers of sales tax?

- Yes, they should. In this case, the pavilion has the right to a trade tax exemption, since it carries out trade in the territory retail market. However, in order to receive a benefit, he must register as a trade tax payer, that is, send a notification to the tax authorities.

Is it subject to tax wholesale legal entities, if the goods are released from the seller's warehouses in the presence of a showroom where they accept cash, are issued shipping documents, the product is shown? If yes, what is the base of the tax?

– If the showroom is specially equipped with equipment used for display, demonstration of goods, customer service and cash settlements with customers, then it will be recognized as an object of sales tax. In this case, the person conducting trading activities will be the payer of the sales tax.

In your case, the basis for calculating the sales tax will be the area of the trading floor - a room occupied by equipment designed for displaying, demonstrating goods, conducting cash settlements and servicing customers, the area of cash registers and cash booths, staff workplaces, as well as the area of passages for buyers.

As for trade from a warehouse, organizations and individual entrepreneurs engaged in this type of activity are not payers of the trade tax. At the same time, warehouses, according to the department, include buildings (structures, structures) or parts thereof intended for storing goods, which do not provide access for buyers to it and do not have equipment designed for laying out and demonstrating goods and making cash settlements with buyers.

That is, in your case, you need to pay sales tax from the showroom, but not from the warehouse.

Our organization provides communication services. There is a need to sell property (acquired earlier for the development of the company), is it necessary to pay a sales tax?

- In this case, the sale of property will not be a trading activity and it is not necessary to pay a trading fee.

Should a shop that pays a single tax on imputed income (UTII) pay a sales tax?

- UTII is not valid on the territory of Moscow. Perhaps you are talking about a store located outside of Moscow, therefore, you do not need to pay a sales tax, since it is set for trading in Moscow.

And if the department in the store is small and the profit is small, the tax per month is about 5 thousand. Will I have to pay sales tax and tax?

– The amount of sales tax is deducted from the paid income tax. You calculate the final income tax amount as the difference between the accrued income tax amount and the trade fee paid. That is, in your case, the amount payable for income tax will be equal to zero.

Do I need to pay a sales fee to online stores that do not have retail space, but which, as a rule, have pick-up points where the client can pay for the goods?

– Depends on the characteristics of such a pickup point. If an object is specially equipped with equipment designed and used for displaying, demonstrating goods, serving customers and making cash settlements with buyers, then such an object will be recognized as an object of sales tax, and a person conducting trading activities will be a payer of sales tax.

Thus, if at the pickup point there is cash register equipment, there is a payment for the goods and customer service, then such a room will be a trading facility.

Do I have to pay sales tax to the newsstand?

– Law of the city of Moscow dated 12/17/2014 No. 62 “On the sales tax” establishes a privilege in relation to objects of a non-stationary trading network with a specialization “Print”, placed in accordance with the procedure, approved by the Government Moscow.

Those taxpayers who apply the simplified taxation system (if the object of taxation is income) reduce the amount of tax / advance payments by separate expenses (insurance premiums on compulsory insurance, temporary disability benefits, payments under personal insurance contracts for employees), while the tax cannot be reduced by more than 50% on the amount of such expenses. Does the specified restriction apply when reducing the amount of tax by the value of the sales tax?- No, it does not apply. According to paragraph 8 of Art. 346.21 of the Tax Code of the Russian Federation in the event that the taxpayer carries out trading activities, in addition to the reduction amounts established by clause 3.1 of Art. 346.21, has the right to reduce the amount of tax (advance payment) calculated based on the results of the tax (reporting) period for the object of taxation from specified type entrepreneurial activity credited to consolidated budget subject Russian Federation, which includes the municipality (to the budget of the federal city of Moscow, St. Petersburg or Sevastopol), in which the specified fee is established, in the amount of the sales tax paid during this tax (reporting) period.

Thus, the limitation of the deduction of sales tax amounts from tax amounts under the simplified taxation system (if the object of taxation is income) in the amount of no more than 50% of the tax has not been established.

Often, manufacturers work directly with customers, while they do not have retail space and warehouses, and products go directly from production to the customer. Does the object of taxation of the sales tax arise in this case?- No, it doesn't. Organizations and individual entrepreneurs are payers of the sales tax only in the case of using movable or immovable property (an object of trade) located on the territory of the city of Moscow and when setting the sales tax rate for this type of activity.

Thus, trading activity without the use of an object of movable or immovable property on the territory of the city of Moscow is not subject to the taxation of the sales tax.

Do I need to file a notice of registration as a sales tax payer if there is an exemption?

- Yes need. Individual entrepreneurs and organizations subject to sales tax relief in accordance with the Law of the city of Moscow dated 12/17/2014 No. 62 "On the sales tax", are payers of the sales tax and are obliged to general order send to the tax authorities a notice of registration as a payer of sales tax.

* If you do not register as a trade tax payer, the company or individual entrepreneur will face a fine in the amount of 10% of income, but not less than 40 thousand rubles (clause 2 of article 116 of the Tax Code of the Russian Federation).

Not so long ago, another type of fees appeared in the Tax Code - trade. Effective since 2015, represents a payment in local budgets. However, the obligation to calculate it does not fall on all taxpayers.

Who pays the trading fee

The sales tax is a local payment. It is put into effect not only by the provisions of Chapter 33 of the Tax Code of the Russian Federation, but also by the decision municipalities. It may be mandatory for accrual in cities of federal significance: Moscow, St. Petersburg, Sevastopol. To be able to charge sales tax in other regions of the country, the introduction of a unified federal law which is currently not accepted. Accordingly, potential payers on this moment can only be subjects of the cities listed above.

Payers of the sales tax are organizations and entrepreneurs engaged in trading activities in the territory of the municipality where the specified payment is valid. This requires the fulfillment of several conditions:

- The presence of objects of movable or immovable property, with the help of which the trade takes place. The property can be both owned by the subject and be rented.

- The current taxation regime is general or simplified.

- The effect of the sales tax on the territory of the municipality.

- Certain types of trading activities established by Art. 413 of the Tax Code of the Russian Federation, among which are the following: trade with the help of objects of a stationary network, through objects of non-stationary retail chains with the presence of a trading floor, the release of products from the warehouse.

In the territory where the trade tax is in force, it is impossible to apply the UTII regime. Organizations and individual entrepreneurs that charge agricultural tax, as well as entrepreneurs on PSN, are exempted from paying the fee.

If organizations and individual entrepreneurs who are obliged to transfer the sales tax to the budget do not do this, it is required to immediately submit a notification of the fee to the tax authorities. IN otherwise will have to pay a fine in the amount of 40,000 rubles.

A detailed list of violators is available on the website ]]> of the Department for Economic Policy and Development of the City of Moscow ]]> . The list of non-payers of the sales tax also includes those objects of trade, the notification of which was submitted with errors. In case of disagreement, it is necessary to submit to the department additional clarifications within 20 days after the publication of the list of non-payers.

How the trading fee is calculated

The calculation of the payment for the trade fee depends on the type of object of taxation - movable or immovable property involved in trade. The total amount payable is calculated based on the presence of the object of trade or its area. Physical quantity multiplied by the current rate. This indicator is approved by local authorities in rubles per quarter.

When calculating the sales tax, maximum limits not exceeding the estimated cost of a patent issued for 3 months. Minimum size the fee is not established by law, the municipal authorities are given the right to independently reduce rates.

There is no need to report on the collection. But at the same time, it is required to notify the tax authorities in advance of the upcoming trading activity by providing the TS-1 form with the following information:

- the amount of the fee for the quarter for all objects;

- available benefits;

- calculation of the total payment.

Who pays the sales tax in 2017

As mentioned above, the introduction of a sales tax into action depends not only on federal law, but also from the solution municipal authorities. At the moment, the payment can be made only in the following cities - Moscow, St. Petersburg, Sevastopol.

However, during its existence, the effect of the sales tax is relevant only in Moscow. The situation with those who pay the sales tax did not change in 2017 either. The authorities of St. Petersburg and Sevastopol have not made a decision in favor of paying this payment.

- Where is it better to study the profession of a translator - personal experience Where to enter to work as a translator

- Cancellation of the internship - details of the reform of medical education What is the difference between residency and internship

- Indicators characterizing the failure-free operation Scope of work or service life

- Contract for tailoring a fur product (executor - individual entrepreneur)

- On licensing the activities of private guides in Italy The most profitable regions for guides are

- Trade-in: turning an old home into a new building in one fell swoop

- Construction progress: queues and deadlines for the delivery of buildings

- LCD house by the river - why you should take a closer look at it Residential complex "zilart" from lsr

- Preferential mortgage: conditions for obtaining

- LCD house by the river - why you should take a closer look at it How the "House by the River" became a long-term construction

- The residential building is prominent. The LCD is visible in the visible. LCD "Vidny Gorod": apartments and prices

- The procedure for filling out the calculation of insurance premiums

- Getting acquainted with the new form: calculation of insurance premiums

- Who is exempt from the use of CCP?

- How to inventory the cash register in 1s 8

- Changing the Structure of the Institution's Working Chart of Accounts

- Electronic veterinary certification!

- Primary accounting documents: types, classification, requirements

- Translator - the pros and cons of the profession, what you need to take for a translator Is it worth going to a Chinese translator

- “This is an absolutely thankless profession”: young translators on the pros and cons of their work Is it difficult to study as a linguist translator