Sample explanatory note for 2 personal income tax. What happens if no explanation is provided? Reasons for requesting clarification

From January 1, 2018, amendments to the Tax Code will come into force, according to which it will be necessary to keep separate VAT records for goods (works, services) used both in VATable and tax-free/exempt transactions, even if the rule is observed five percent.

Written explanation to the tax office for personal income tax (sample)

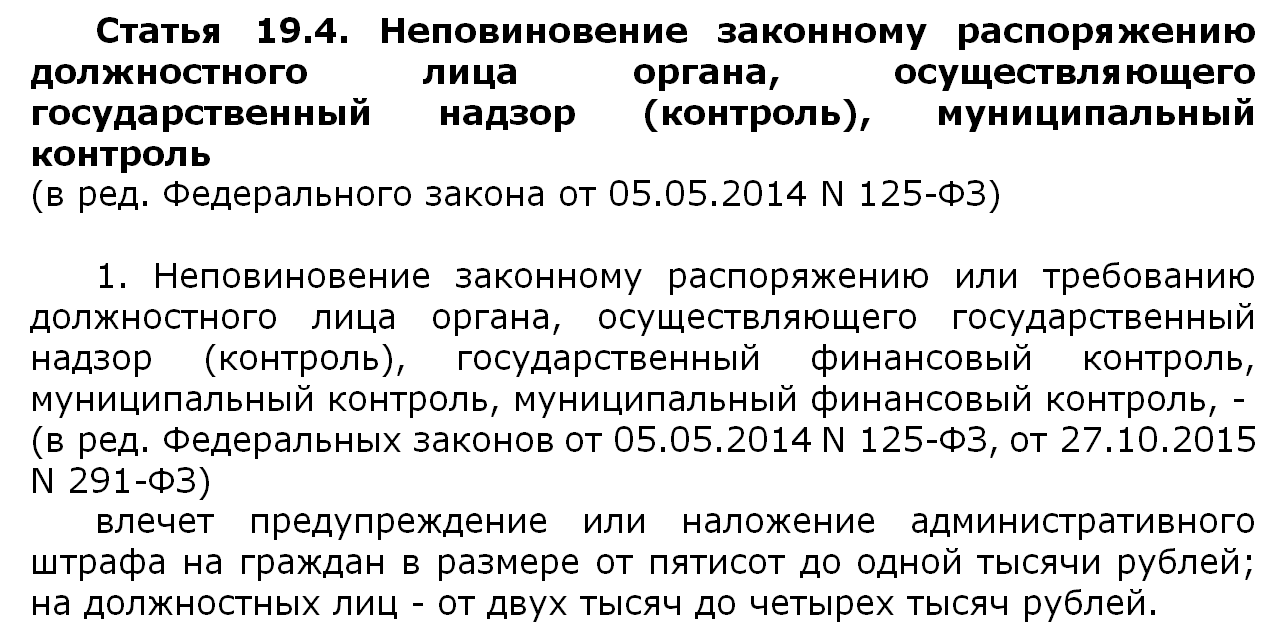

Tax authorities cannot conduct desk audits in relation to the 2-NDFL Certificates submitted by the tax agent, because these references are not tax return or by calculation (Article 80, paragraph 1 of Article 88 of the Tax Code of the Russian Federation). However, this does not mean that the inspectors do not study the Certificates received at all. Moreover, if they find any inaccuracies in them, they will ask tax agent provide written explanations on personal income tax (Article 31 of the Tax Code of the Russian Federation). And it is better not to ignore such requests. Otherwise officials organizations or individual entrepreneurs can be fined in the amount of 2000 rubles. up to 4000 rub. (part 1 of article 19.4 of the Code of Administrative Offenses of the Russian Federation).

Reasons why the IFTS asks for clarifications

In fact, there are many reasons for requesting explanations on personal income tax from a tax agent. For example, an agent may be asked to explain why the amounts of calculated, withheld and paid personal income tax on income differ. specific employee or why deductions are incorrectly applied. Or, for example, inspectors may inquire about the reasons for reducing the amount of personal income tax paid in the current year compared to that transferred last year, if such a decrease exceeds 10% (Letter of the Federal Tax Service of Russia dated July 17, 2013 No. AC-4-2 / 12722).

How to write an explanation to the tax office for personal income tax

In the near future, any company may receive a requirement from the Federal Tax Service on the need to clarify certain data in 2014. Indeed, after companies and individuals report on income subject to personal income tax, tax authorities begin to carefully study the reporting on this tax.

Be careful: carry out desk audit certificates 2-personal income tax inspection is not entitled. After all, such certificates are not declarations. Therefore, the requirements usually refer to Article 31 tax code RF. This rule allows inspectors to request from the company any information related to the payment of taxes.

It is safer for such a requirement, otherwise there is a possibility that the IFTS will fine either the chief accountant in the amount of 2000-4000 rubles. (part 1 of article 19.4 of the Code of Administrative Offenses of the Russian Federation).

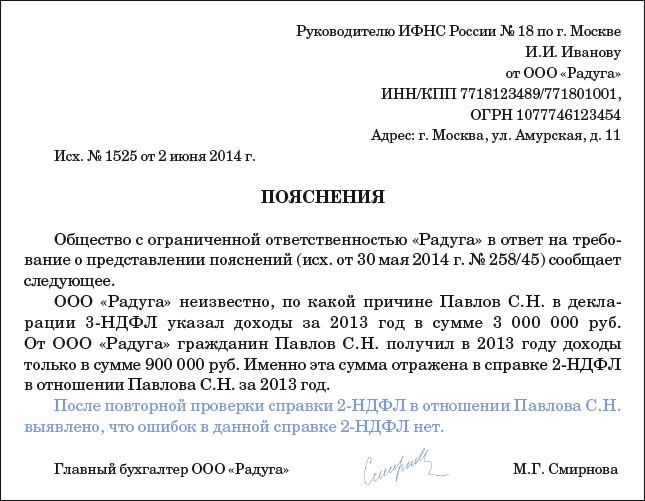

We have prepared four sample explanations for you, by sending them to the Federal Tax Service Inspectorate, you can remove all certificate inspectors and at the same time not harm the company.

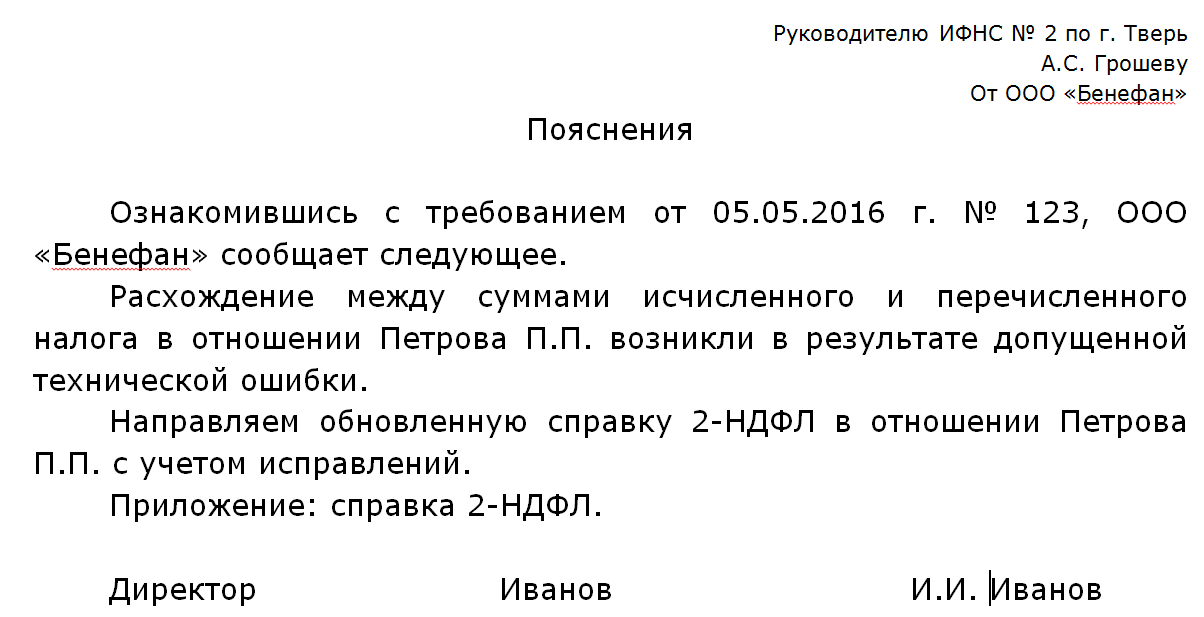

Calculated, withheld and transferred personal income tax differ

The inspectors are sure: the difference in amounts of personal income tax indicates that the company does not fully withhold and transfer tax. Or does it too late.

When you receive a request for clarification on this matter, check the certificates again. To do this, compare the data on account 68 subaccount "NDFL" and in certificates 2-NDFL.

Perhaps the payment was, but lost. Then it is worth conducting a reconciliation with the inspection.

A common reason for discrepancies is that the tax for December 2014 was already transferred in January 2015. It also happens that last year they closed separate subdivision and the organization stopped paying personal income tax to the inspection at the place of its registration.

Technical errors are not excluded. Let's say they didn't fill in the certificates transferred personal income tax. Or they accidentally duplicated the calculated, withheld and remitted tax also in the line "Amount of tax not withheld by the tax agent."

Finally, they could simply forget to transfer the tax. Then pay additional personal income tax and transfer penalties with a separate payment. This will not exempt from a fine of 20 percent of the tax transferred late (Article 123 of the Tax Code of the Russian Federation). But inspectors can fine the organization only during an on-site inspection.

So, if you find an error, describe it in the explanations and resubmit the corrected 2-NDFL certificates. But not for all people who received income in 2015, but only certificates with errors.

Let's say there are no errors according to the company. Then you have full right and write in the explanation.

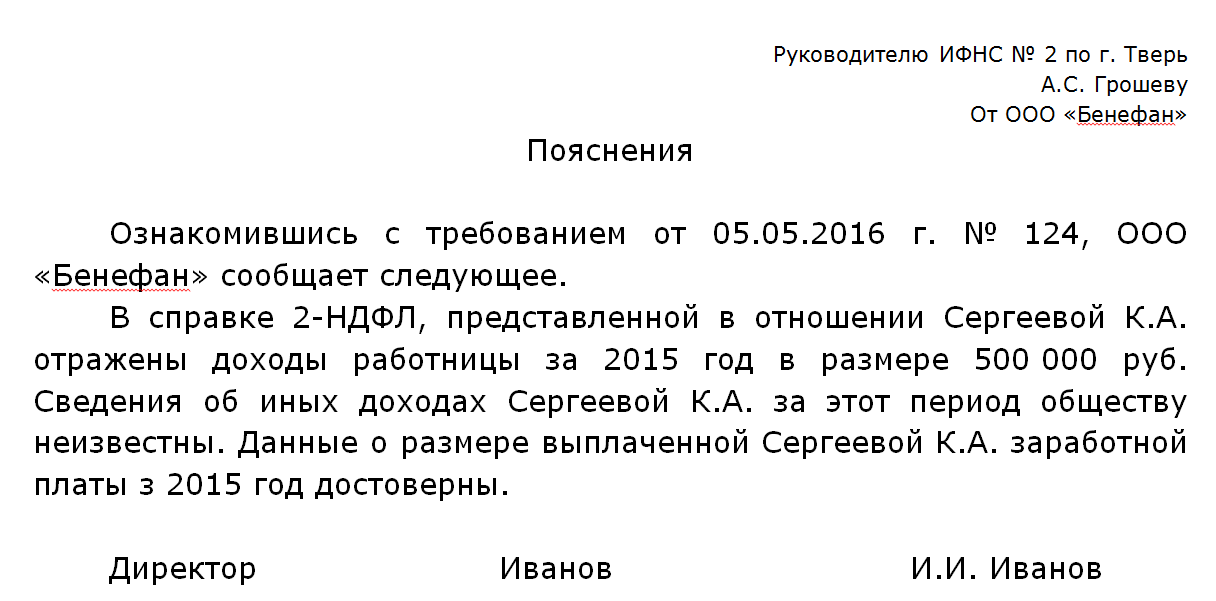

In 2-personal income tax, incomes are less than those declared by employees in 3-personal income tax

Perhaps an employee of your company submitted a 3-NDFL declaration for last year. For example, to declare income from the sale of a car or receive a deduction for the purchase of an apartment, treatment or study.

Inspectors, checking the declaration with the certificate, sometimes find that the income in 2-personal income tax is less than in the declaration. For tax authorities, such inconsistencies are one of the signs that the company is issuing gray salary.

Such discrepancies are not the concern of the company's accountant. Indeed, how can an organization know why a person declared more income than in the 2-NDFL certificate? Maybe it was a typo. Or did the citizen receive additional income from other organizations or from the sale of property, etc.

And if so, the person himself should explain to the inspectors the origin of income in 3-personal income tax. The company may limit itself to reporting that there are no errors in its 2-NDFL certificates.

Of course, before that, you need to check again, all of a sudden there are inaccuracies in the certificates.

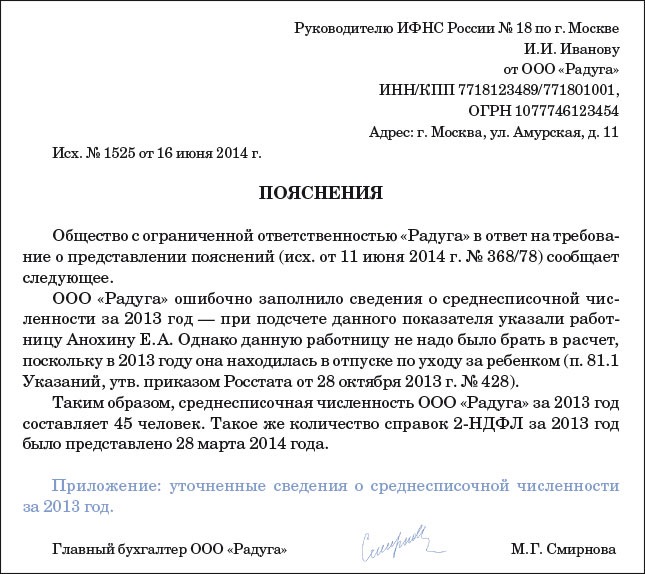

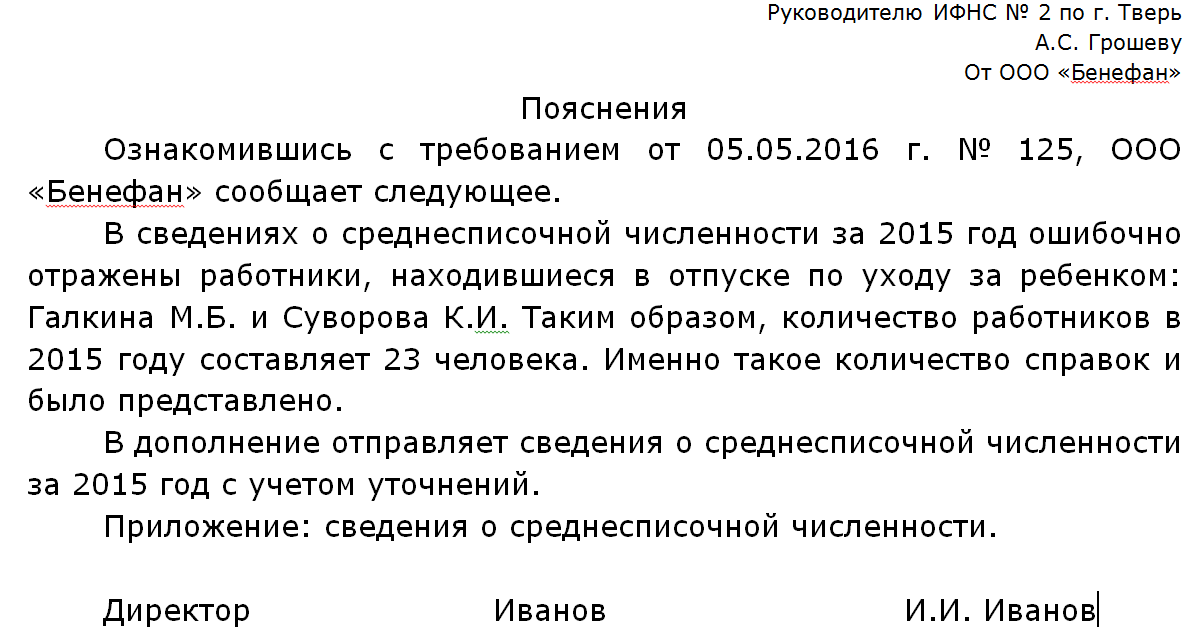

The number of references differs from the average number

Tax authorities always compare information about average headcount and the number of certificates 2-personal income tax. According to the inspectors, if the number of employees in the information on the number of employees is greater than the number of certificates, then the company forgot to hand over one or more pieces of 2-personal income tax.

There may be several reasons for such discrepancies. The most common is that the information overestimates the indicator (for example, they counted an employee on maternity leave, although they should not have).

Another common reason for inconsistencies is that headcount information is considered for the whole company, and some of the certificates were submitted at the place of registration of a separate division.

Write a letter to the inspectors free form explaining the reason for the discrepancy. If necessary, attach corrected numbers to the letter. There is no danger in this - the law does not provide for a penalty for an error in information.

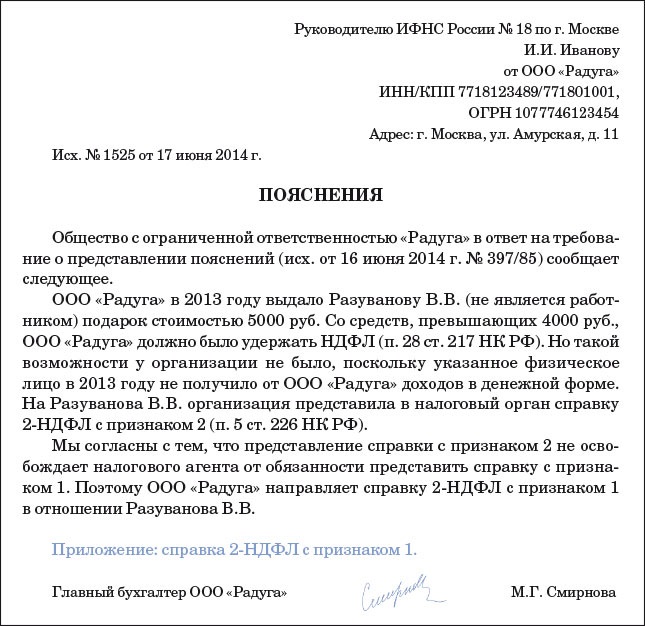

There are no certificates for people who have not had personal income tax withheld

The inspectors believe that even if a 2-NDFL message with feature 2 was submitted, it is mandatory to submit certificates with feature 1. That is, in fact, duplication of reporting is obtained. First you need to inform the tax authorities (not later than a month at the end of the year) that the tax could not be withheld. And then (until April 1 inclusive) submit the same data again in the 2-NDFL certificate.

According to the tax authorities, certificates with attribute 1 must be submitted for all people who have received income from the company. Even for those from whom she could not withhold tax (letter of the Federal Tax Service of Russia for March 7, 2014 No. 20-15 / 021334).

So if a company has submitted only certificates with attribute 2 for some physicists, it is better to send explanations on 2-personal income tax, attaching certificates with attribute 1 to them. Of course, only for these same people, and not for all employees. Be careful: since the certificates were submitted late, the tax authorities have a formal reason to fine the company - 200 rubles each. for each document (clause 1, article 126 of the Tax Code of the Russian Federation).

However, such a fine is illegal. After all, the company has already submitted certificates with sign 2 ahead of time. Judges are on the side of the companies (FAS resolution Ural District dated September 24, 2013 No. Ф09-9209/13).

In conclusion, we add that the FIU can also request clarifications on 2-personal income tax. The fact is that the base for insurance premiums and income tax is similar (although not identical).

The tax authorities carefully monitor the implementation of legislation by taxpayers. In particular, this manifests itself in the fact that if they find any inaccuracies, you will have to provide written explanation to the tax office. For personal income tax, you can see a sample of such a statement in this article.

Situations when it is necessary to provide an explanation of the tax

The tax authorities may request clarification in different cases. So, for example, a situation may arise when the amount of accrued, withheld, and also paid tax will differ. Or, also, there is a possibility that the deductions will be applied in an incorrect way. The amount of tax may also be less than the amount paid in previous year more than ten percent. All this attracts the attention of the tax authorities. Some examples are discussed in more detail below.

A technical error

The difference in the amount of taxes may well not be intentional, it may occur as a result of an error. In this case, you should not worry, just indicate this in the explanation and indicate the correct amount (see example below).

The difference between the information provided in the forms 3-NDFL and 2-NDFL

Another unfortunate case, which may be a reason for requesting clarifications. To receive a deduction, the 3-NDFL form is used, and for income - 2-NDFL. Naturally, there should be no difference between the numbers indicated in them, this may lead to tax authorities the idea that an employee receives informal wages. However, again, there is no need to worry if this was not done on purpose, you just need to indicate it in the explanation.

Average number of employees: discrepancy in numbers

It is necessary that the number of 2-NDFL certificates correspond to the average number of employees. Otherwise, the tax authorities will have doubts that all employees are properly registered.

What happens if no explanation is provided?

Tax authorities often demand clarifications when there is a suspicion of violation tax legislation, identifying errors and inconsistencies in the submitted documents and information. Explanations to the tax office for personal income tax (a sample is given below) are prepared for typical situations, examples of which can also be found below.

In what cases can the tax authorities request clarifications?

According to approved form requirements for sending explanations (the form was adopted by order of the Federal Tax Service No. ММВ-7-2 / [email protected] dated 08.05.2015) cases where clarifications are required are provided for in following articles Code: Art. 88 - holding tax audit(camera), art. 105.29 - conducting tax monitoring, art. 25.14 - with participation in foreign companies.

However, in practice, requirements come about submitting an explanation to the tax office for personal income tax (a sample of such explanations for different cases below) on many other occasions. In such cases, the submission of explanations is not the duty of the taxpayer. However, it is recommended to send them. After all, without receiving satisfactory explanations, the tax authorities will come with.

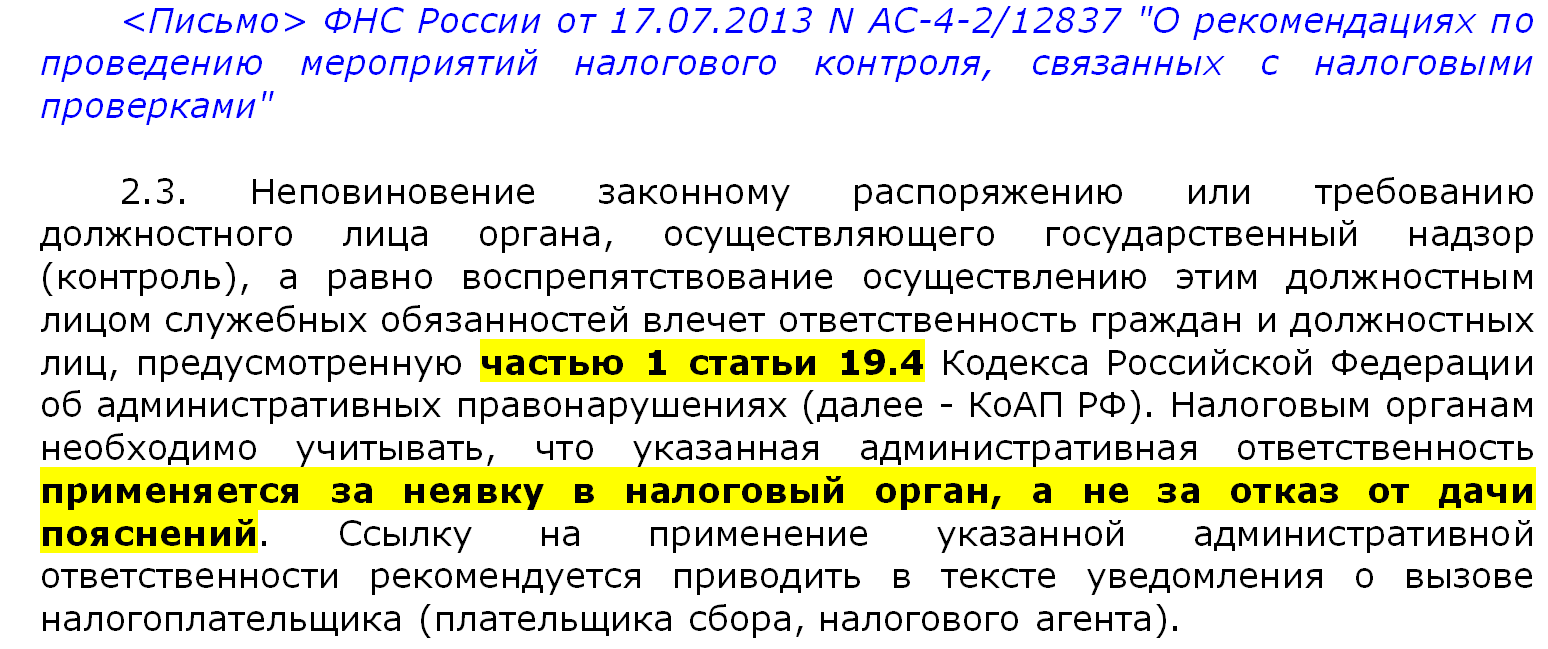

If, nevertheless, no explanations are provided, then it should be borne in mind that the grounds for administrative responsibility in that case no. In confirmation of this, explanations were given by the Federal Tax Service of Russia, according to which they can start a case under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation, but not for refusing to give explanations, but for failure to comply with another requirement - failure to appear to give explanations. That is, it is necessary to appear, but to give explanations is not.

A technical error.

The reasons for such requirements may be the reasons of a very different nature. Often this happens after submission to the tax office, after studying which inspectors establish discrepancies in the amount of income received by employees and income taxes transferred to the treasury.

If such discrepancies result from technical error, the following explanations can be provided.

The discrepancy between the 3-NDFL declaration and the 2-NDFL certificate.

A discrepancy may also arise due to discrepancies between the income statement and the 3-NDFL declaration drawn up and filed by the employee himself. employees apply to take advantage of the deduction. Having received a declaration from an employee with a different amount of income for the same period as in the certificate, the tax authorities will certainly be interested in the reasons for the discrepancies. After all, if a company reports that an employee has such and such an income, this income is deducted income tax, and the employee in the declaration provides information about a different amount of income, then the question arises of where such a discrepancy comes from. Does the employee of the company receive a “gray salary”, taxes on which are not withheld and not paid.

If this is not the reason, and the information provided by the company is true, then it has nothing to worry about. It is enough to prepare explanations and indicate that the information provided is reliable, and the reasons for the employee to indicate other incomes of the organization in the declaration are not known.

Inconsistency of the submitted certificates with the average number of employees.

Companies annually submit SSC information (). If, when checking 2-NDFL certificates from the tax authorities, the number of certificates submitted differs from the number of company personnel according to the SSC, then they will require explanation. Depending on the reason for such a discrepancy, explanations to the tax office may be different.

If there is an error in the SSC, explanations about this should be sent to the tax office, attaching updated information about the SSC.

If information about the SSC was submitted correctly, but certificates about some employees were not sent by mistake, then they must be submitted.

The new procedure for submitting explanations and documents from 06/02/2016.

From 01/01/2017, for not submitting the explanations required under Article 88 of the Tax Code (part 3) for errors identified during, they can be fined 5 thousand rubles, and for repeated violation- for 20 thousand rubles.

- Borjomi with milk is one of the cough treatment methods

- Claim in the arbitration court of the FSS Refusal to compensate Appeal in court of the decision of the FSS

- What circumstances will help reduce the fine in the FSS

- Chip tuning equipment - flashing secrets Difficulties associated with chip tuning

- Chiptuning for beginners

- Appeal, sample appeal against the decision of the arbitration court Sample appeal to the arbitration court

- Characteristics in the military registration and enlistment office for a school student, writing rules

- Ready-made examples (samples) of characteristics for secondary school students

- Characteristics for a student from school to the military registration and enlistment office

- Appointment of an agreement for the repayment of debts and drafting a document Debt Management Agreement

- How to learn to sell a product?

- Recognition of a citizen incompetent

- Legal capacity. Emancipation. Recognition incompetent and limited capacity. What does it mean to limit the legal capacity of citizens? Individual with limited capacity

- Where and how to get a medical book for work: step by step instructions

- Education system in the Netherlands Education in Holland for foreigners

- How to find a job for a fifty-year-old: recommendations

- Compiling a resume: product manager Who is a manager

- How to come up with a name for an LLC that brings good luck?

- Break-Even Point: Calculation Formulas and Control Methods

- Starting a small business from scratch: ideas and rules for doing business