What is a “fixed-term” employment contract - sample

To date, there are many types of different agreements between the employer and the employee, which legally fix their relationship. One of the most sought-after documents of the labor type in recent times is fixed-term contract. The general requirements for compilation, as well as the main characteristics of this document, are spelled out in article 58, 59 of the Labor Code of the Russian Federation.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact through the online consultant on the right or call by phone free consultation:

Fixed-term employment contract - concept

An urgent contract is a document that confirms the existence of a business relationship between the person providing the job and the employee, and also reflects the conditions of the work process and is concluded between the parties for a strictly limited period.

Unlike perpetual contracts, which fix the relationship  business nature for an unlimited period of time, fixed-term contract can be valid for a maximum of 5 years.

business nature for an unlimited period of time, fixed-term contract can be valid for a maximum of 5 years.

Typically, fixed-term contracts are drawn up in case of need for such activities that must be completed within strict time periods. It can be seasonal work, various activities, the relevance of which depends on the season, etc.

You will find a form of a standard fixed-term employment contract.

With whom is it?

Employment contracts that are valid for a specific period, subdivide into the following main types:

- Contracts that take into account the type of activity and working conditions of the future employee, which are valid only for a certain period of time.

- Employment agreements valid for a limited period, which are concluded on the basis of an agreement signed by the employer with an individual who is looking for work.

Article 58 (part 2) of the Labor Code of the Russian Federation allows for the right not to take into account the type of activity the employee is to do, as well as the conditions for working processes, if there are cases recorded in article 59 (part 2).

Article 59 of the Labor Code, contains information about the persons with whom they conclude fixed-term contracts:

- Employees who are going to work outside the territories of the Russian Federation.

- Persons who perform additional types of work that are not related to the main specialization of the employer.

- Employees required for expansion work (no more than 1 year).

- A category of workers recruited to work in enterprises that operate and are established on a temporary basis, as well as with persons performing predetermined types of work.

- Workers who are hired to perform a specific activity characterized by the lack of precise completion dates.

- Individuals performing activities to gain work experience or improve their qualifications in their specialty, as well as those related to practice and some other educational processes.

- Groups of employees of state power, the term of election for which has a specific time frame.

- Employees who stay at the workplace on behalf of the employment service, in order to perform public work, as well as non-permanent activities.

- Individuals who are in the posts of the state civil service.

- Other groups of persons that are not included in the above categories, but are prescribed in the Labor Code or other legislative acts.

A fixed-term contract for individuals who will work abroad is signed no more than 3 years(Article 338 of this Code).

This group includes members of local self-government and political parties, officials, as well as a number of government employees of a different nature.

Pros and cons

Many employers who provide work to a new employee use a fixed-term type of employment agreement.

The positive side of this document is more simplified dismissal procedure, as opposed to a perpetual agreement. When the contract expires, thereby losing its validity, which means the employer can terminate the contract with the employee without stating reasons.

A fixed-term contract is a kind of universal form for embodying the desires of an employer, who can either extend a fixed-term employment document or resort to drawing up an open-ended agreement.

The main plus is the possibility of dismissal of an employee due to the expiration of the contract without indicating grounds.

The negative aspects of a fixed-term contract include the fact that such a document is concluded (in accordance with Article 59 of the Labor Code) only in certain cases.

Also among the minuses is the inability of the employer to terminate a fixed-term contract with an employee who is in a position. This means that it is only legal to fire a pregnant woman in case of complete liquidation of the organization.

Read our article on how to fire a pregnant woman.

Features of the conclusion of the contract

When drawing up an employment contract for a fixed-term type, they are guided by article 57 (second part) of the Labor Code, as well as articles 58 (part three) and 59.

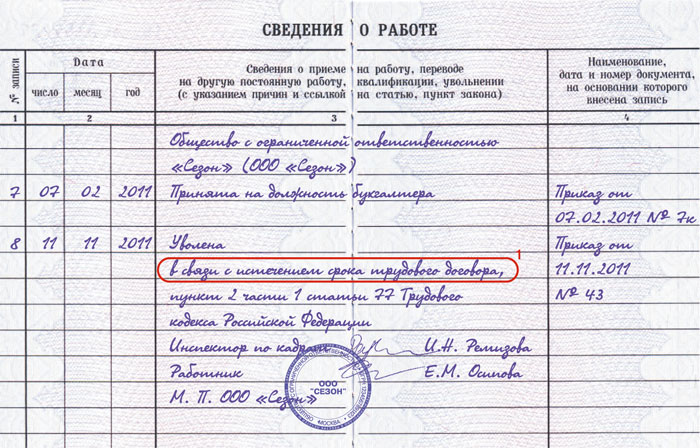

In this type of document, there must be a reason as a result of which the parties entered into a fixed-term contract. It is also necessary to prescribe a clear expiration date for this document. At the end of this period, the employment agreement becomes invalid (paragraph 2 of article 77).

We also strongly recommend that you carefully read with rights and obligations both future employee and employer. The latter is obliged to inform the employee with the requirements of the internal charter of the organization, having received his signature.

The process of registering an employee for employment

In order for an individual to officially start a work process on the basis of a fixed-term contract, it is necessary perform the following steps:

Classification of fixed-term employment contracts

- By agreement of the parties

- At the same time

- With a sole proprietor

A document of this type can be issued with an employee invited to perform the duties of another person working in the organization who is absent from work for some reason, or with employees whose work is possible only in one of the seasons of the year.

Download the form of a fixed-term employment contract by agreement of the parties from us for free.

The Labor Code contains article 44, which details the rights of employees who work multiple jobs.

If the activity fixed in the fixed-term contract is part-time work(performed in a period of time free from other work), then it is necessary to specify in detail in the contract the schedule of the working day and the features of the labor function. The duration of the document is negotiated by both parties.

This fixed-term contract implies the existence of guarantees of a social type for the employee and tax payments from the legal entity. It is possible to draw up an urgent agreement with an individual entrepreneur only if there are cases described in article 59.

Find out everything about the conclusion of a fixed-term contract from the video clip:

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- What is a crystal drug Harm from smoking crystals

- Dried seaweed: benefits and harms

- Useful properties and contraindications to the use of sunflower oil Natural sunflower oil treatment methods

- What is the most valuable turquoise

- Jewelry Etiquette: Business Woman Jewelry Business Style Jewelry

- Study of synthetic detergents and their influence on biological objects

- The legend of gladiolus plants

- What to do if a man has depression associated with a lack of money?

- The Most Important Sacred Sites on the Planet The Most Holy Christian Sites on Earth