Help 2-NDFL sample filling

All business entities that attract labor resources into their economic activities by entering into contracts with people, in accordance with the law, act as tax agents. This means that enterprises and individual entrepreneurs need to calculate, withhold and send to the budget the amount of personal income tax from payments, as well as submit 2 personal income tax.

Help 2-NDFL is a report that an employer generates for each of its employees, as well as another individual who has income from this subject, and submits it to the IFTS to confirm the tax calculation.

The legislation establishes that the company draws up this report on the basis of the year and sends it to the Federal Tax Service. This must be done once, after the year is over.

This certificate is used not only as reporting to the tax authority, but also as a source of information on the total income, which is issued in the form of a certificate to an employee upon his dismissal or in cases when he requests it for personal needs.

In the certificate, the employee's income is grouped by codes. , sick leave, vacation pay, compensation upon dismissal in the certificate 2- personal income tax are shown monthly in different lines.

Do I need to issue a certificate to an employee upon dismissal?

It is necessary to draw up 2-NDFL certificates upon dismissal in order to inform future employers about the income achieved by this employee in connection with the use of the benefits provided for by the Tax Code of the Russian Federation. This is due to the fact that they are provided subject to certain conditions, among which an important place is occupied by the maximum amount of income that gives the right to deductions.

In addition, upon dismissal, the employee is issued. This document, unlike the certificate in question, is necessary for calculating sick leave at a new place of work.

The 2-NDFL document is also used by the employee when filling out the 3-NDFL report, in which he summarizes the information contained in them. When submitting a 3-NDFL report, individuals must attach reference data to confirm.

Currently, many banks, when applying for a loan, ask employees to provide certificates in the form of 2-NDFL.

Attention! Individuals can receive a 2-NDFL document on the final day of their work, or, if necessary, apply to their former employer with a statement, and after this date. The employee has the right not to inform the former employer about the purpose of obtaining this document, and the company does not have the right to refuse to issue it.

At the same time, the report can be drawn up both for the current year in which the employee leaves, and for all previous years of work in the company. In the latter case, this must be reflected in the written request.

Deadline for 2-personal income tax

The obligation of a business entity to send Form 2-NDFL to tax reports is provided for by the Tax Code of the Russian Federation. He must do this once a year.

The 2-NDFL report can have two statuses:

- 1 - used when submitting reports in a general manner. It should be sent to the IFTS before April 1 of the following year.

- 2 - this type of certificate is filled out when the tax agent cannot withhold personal income tax from the employee's income (for example, the salary was paid in kind). Companies must submit this type of report before March 1 of the following year.

If this period falls on a non-working day, then it is shifted to the next working day.

This means that for 2017, reports of 2 personal income tax with status 1 must be submitted before April 2, 2018, and with status 2 - before March 1, 2018.

Attention! If an employee applies to the employer with a request to draw up a certificate in the form of 2-NDFL, then this document must be issued to him by the accounting department of the enterprise within three days.

In addition to the 2-NDFL reporting, which is submitted once a year, there is a duplicate 6-NDFL reporting, which is submitted by the tax agent quarterly.

Where to provide

The Tax Code of the Russian Federation establishes the obligation of the organization to send reports to the IFTS at its location, and for persons who have registered entrepreneurship, at the place of their registration.

The legislation provides for the possibility for an economic entity to open branches, representative offices. He can do this in places other than the main location address. In these cases, the parent company and each separate division must report to the regulatory authorities each at their location.

Sometimes, employees of the enterprise can work in the parent organization and in the branch, then their personal income tax from the salary on them must be paid at each address in accordance with the income received by the employee.

Attention! In addition, there are organizations that are large taxpayers. These firms are given the right to independently choose to which IFTS they will make tax payments.

Reporting methods

A business entity can submit reports in several ways:

- Directly on paper to the inspector of the Federal Tax Service - it is possible to use this method only for small companies that have a small number of employees (less than 10 people).

- In electronic form, the report is directly submitted to the tax inspector. It can only be used if the number of employees in the enterprise is less than 3000 people.

- Through electronic document management via telecommunication channels - the report is submitted to the IFTS through a special operator, an electronic digital signature (EDS) is required.

- Through post offices - 2-NDFL reports are sent to the tax office in a valuable letter with the described attachment.

Download form and sample certificate

Download in Excel format.

Download in Excel format.

A sample of filling out a certificate 2-NDFL

Let us consider in more detail the 2-personal income tax new form 2016 form sample filling.

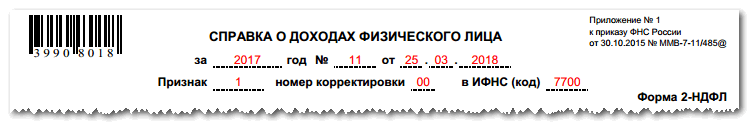

header

Here, in addition to the name of the report itself, its number, the date of registration and the reporting period for which the compilation is made are recorded.

The status of the document is shown below. "1" is assigned to the one that is rented in the usual way, and "2" - if it is impossible to withhold personal income tax from the employee.

The status of the document is shown below. "1" is assigned to the one that is rented in the usual way, and "2" - if it is impossible to withhold personal income tax from the employee.

In 2016, a column with an adjustment number was introduced into the report. The following cipher can be entered here:

- 00 - for the report submitted for the first time;

- 01-98 - the number of the corrective report, at the same time it also acts as the number of the correction;

- 99 - cancel all previously sent documents.

Below is the tax inspection code of 4 digits.

How to start filling out the report correctly shows a 2-personal income tax sample.

Section No. 1 - Information about the tax agent

This section contains information about the company or entrepreneur.

First, the OKTMO, TIN and KPP codes are indicated. They can be found in the founding documents. It must be remembered that the entrepreneur does not have a KPP code, and the TIN code contains 12 digits, unlike companies with a TIN of 10 digits. Next, in a separate column you need to write down the contact phone number.

The last step is to enter the full name of the legal entity, or full name. entrepreneur.

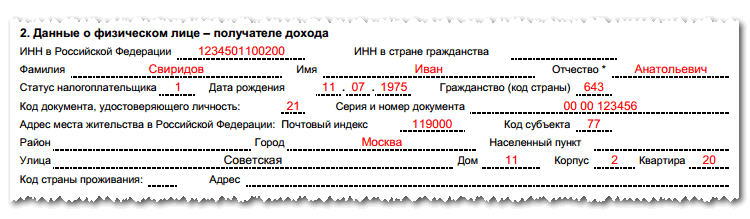

Section No. 2 - Data on the individual - the recipient of income

This section contains detailed information about the person for whom the report is issued. First, his TIN number is recorded. The novelty of this document format is the addition of a field to indicate the TIN of a foreigner issued in his home country.

Then the full name is recorded, the patronymic is affixed if available.

Then the full name is recorded, the patronymic is affixed if available.

In the event that during the reporting year there was a change in one of the components (for example, a surname), then new information is already entered in the certificate, and a document confirming the correctness of filling is attached.

If the report is generated for a foreigner, then it is allowed to put down his surname and first name in Latin.

In 2016, there was an expansion in the number of statuses of persons, now you can specify here:

- "1" - for a resident.

- "2" - for a non-resident.

- "3" - for a qualified specialist.

- "4" - for a migrant from another country.

- “5” is a foreign refugee and “6” is a foreigner with a patent.

Qualified specialists are employees who have knowledge in any area and receive a salary of at least 2 million rubles. in a year.

The next step is to record the date of birth of the employee, information about citizenship (Russian code - 643), information about the identity document.

The address can be entered both Russian and from another country - for foreign workers. The Russian address is compiled on the basis of KLADR. For a foreigner, it is also necessary to enter the address at which he is registered.

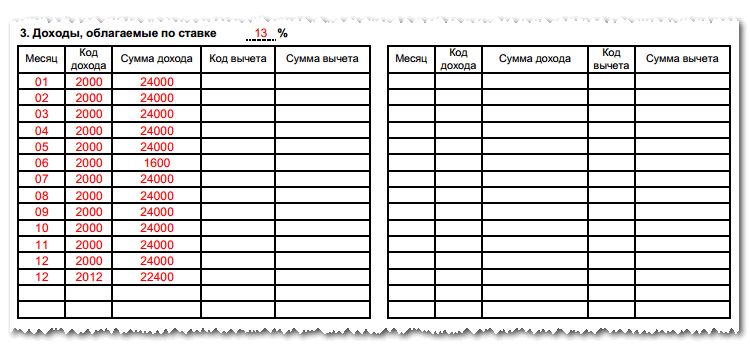

Section 3 - Income

There is a field in the name of the section in which you need to enter the applicable tax rate - it can be 13% for Russian citizens or 30% for foreigners.

The section itself looks like a table where you need to enter line by line information about the income received and the deductions used.

The section itself looks like a table where you need to enter line by line information about the income received and the deductions used.

The table is filled in according to the following principle. The number of the month for which information is indicated is entered in the first column, after which the income code and the amount related to it are recorded. For example, code 2000 indicates salary, 2012 - vacation pay, 2300 - sick leave, etc.

If in one month the employee had several sources of income reflected by different codes, then each one is entered in a separate line, in which the month number will be the same, but the code and amount will be different.

The columns for the code and deduction amount indicate information on professional benefits. Such codes are counted from the number 403.

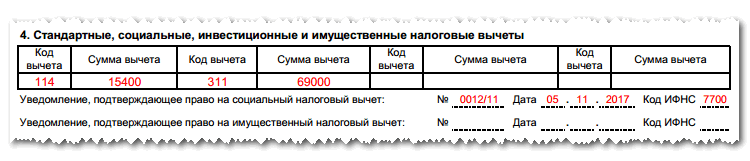

Section 4 - Standard, social, investment and property tax deductions

The specified section records the deduction codes used by the employee in the reporting period, and their amount. For example, the standard deduction for the first child is 126, for the second - 127, for the third and further - 128.

Since 2016, the concept of investment deductions has appeared in the certificate. In addition, a field has been added in which it is necessary to enter the details of the notification for the assignment of a social deduction (for study, treatment, etc.). A similar line is also present for the property deduction, which was present in the document before that.

Since 2016, the concept of investment deductions has appeared in the certificate. In addition, a field has been added in which it is necessary to enter the details of the notification for the assignment of a social deduction (for study, treatment, etc.). A similar line is also present for the property deduction, which was present in the document before that.

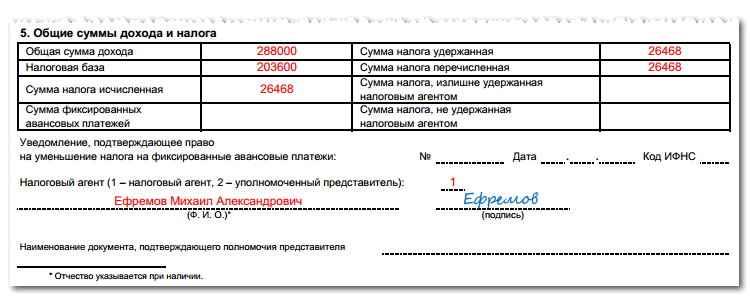

Section 5 - Total Income and Tax Amounts

This section summarizes the information that was reflected in sections 3 and 4. It has the form of a table.

The column "Total amount of income" reflects the income received for the reporting period, indicated earlier in the report.

The column "Total amount of income" reflects the income received for the reporting period, indicated earlier in the report.

The column "Tax base" is obtained as a result of subtracting the amount of deductions provided for the reporting period from the total amount of income.

The column "Calculated tax amount" is the result of multiplying the tax base calculated in the previous column and the tax rate from section 3.

The column "Amount of fixed payments" can only be filled in by foreigners who work in Russia under a patent. If they have received a document authorizing them to reduce the tax on the amount of advance payments, such data are entered further.

After that, the amounts of tax that were withheld from the employee and transferred to the IFTS are affixed. Then there are two columns where you can enter the amount of tax withheld in excess, or not withheld from the employee at all.

The final stage is the code of the person who signs the certificate - the tax agent himself (code 1 is indicated), or his legal representative (code 2). If this is done by a representative, then below you need to put down information about the document that granted him the rights.

Penalty for delay and failure to submit a certificate 2-NDFL

The tax legislation of the country provides for two types of penalties: a penalty for failure to provide 2-NDFL and a penalty for late delivery of 2-NDFL. In each situation, it will be necessary to transfer 200 rubles for information not submitted or submitted at the wrong time.

On the one hand, this is a very small amount, but if an organization employs a large number of people, and it is late in submitting a report, the amount of penalties can reach a serious amount.

Attention! In 2016, an additional penalty was added - for submitting incorrect information. If the taxpayer submitted a report, then the information in it is deliberately false, he will have to pay 500 rubles for each certificate with incorrect data. At the same time, if after the delivery the company itself discovered errors and made an adjustment, sanctions will not be applied to it.

The nuances of filling out the form

If the organization was unable to withhold tax from the employee, then the certificate will need to be submitted twice - for the first time before March 1, and after that with the rest of the employees until April 1.

When reflecting information on income and deductions in the certificate, you can use only the codes established for this.

If the tax was withheld from the employee in December, but transferred during January of the next year, then it is still noted in the certificate as paid on time. At the same time, if the transfer took place after February 1, then the “Tax amount transferred” position will contain a lower value than the “Tax amount withheld” position.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- What is a crystal drug Harm from smoking crystals

- Dried seaweed: benefits and harms

- Useful properties and contraindications to the use of sunflower oil Natural sunflower oil treatment methods

- What is the most valuable turquoise

- Jewelry Etiquette: Business Woman Jewelry Business Style Jewelry

- Study of synthetic detergents and their influence on biological objects

- The legend of gladiolus plants

- What to do if a man has depression associated with a lack of money?

- The Most Important Sacred Sites on the Planet The Most Holy Christian Sites on Earth