Help 2-NDFL: who should fill out, deadlines, sample filling

If an economic entity enters into contracts with individuals, and he is a source of income for them, then he also acts in these relations as a tax agent for personal income tax. This entails the obligation to transfer to the budget the amounts of tax withheld from individuals, as well as the need to periodically send to the IFTS reports form 2-NDFL and document 6-NDFL.

To answer this question, you need to understand what 2-ndfl is. The 2-NDFL certificate acts as a reporting of tax agents who withhold income tax from individuals and send it to confirm its correctness.

First of all, they are all employers, that is, companies and entrepreneurs who have concluded labor agreements with employees. This group also includes notaries and private lawyers with hired personnel.

In addition, the duties of a tax agent arise in situations when a civil law contract is concluded with an individual, for example, a contract or the provision of services.

If payments are made to the founders-individuals, then the company for these people must also submit to the tax form in the 2-NDFL format.

Attention! It is also necessary to hand over the 2-NDFL form when a company or individual entrepreneur makes rent payments to individuals for the use of their property.

Tax agents are separate representative offices of foreign companies that act as employers.

Individuals who attract other individuals are not tax agents. Therefore, they do not need to send reports in the 2-NDFL format to the Federal Tax Service.

Deadline for 2-NDFL in 2018

Tax legislation provides for the obligation of a tax agent to submit reports in the 2-personal income tax format once a year after it ends. A 2-NDFL form can be submitted with one of two statuses.

Depending on this provision of regulatory enactments, the deadlines for its submission are determined:

- The report has status 1 - it is submitted to the Federal Tax Service Inspectorate no later than April 1 of the year following the year of the report. It is filled in according to the general procedure.

- The report has status 2 - the certificate is submitted to the tax office no later than March 1 of the year following the year of the report. It is made up of tax agents who are not able to make deductions from the income of an individual. Therefore, they in the prescribed form declare to the Federal Tax Service Inspectorate about the occurrence of income of an individual, that the inspectors could take measures to withhold tax.

Subjects should also remember that if these deadlines fall on weekends and holidays, they will be carried over to the next business day.

Therefore, in 2018, a 2-NDFL certificate with a status of "1" must be submitted by April 2, 2018 inclusive, and a report with a "2" status must be sent by March 01, 2018.

Attention! Forms of 2-NDFL can be requested by employees throughout the year, for example, for obtaining loans. In this case, the terms of its registration are determined by the Labor Code of the Russian Federation and are equal to three days.

Where to submit reports

For this report, the general rules apply when determining the body to which you need to take it. Companies must send information in the 2-NDFL format to the Federal Tax Service at the location, that is, to the legal address. If the organization has operating branches and representative offices, then the 2-NDFL forms are sent by the parent company at its location, and the separate divisions at their addresses.

In addition, a situation may arise when an employee receives a salary both at the head office and at its branch. Here, his salary must be divided between departments, and information on the calculated and paid tax must be submitted for its individual parts to different IFTS.

If the company belongs to the category of large taxpayers, then it is given the right to independently determine where to pay and submit reports. It can report as a whole to the address of the parent company, or to the locations of its divisions.

Important! Entrepreneurs are required to report in the 2-NDFL format to the Federal Tax Service at the place of their registration. This must be taken into account by those individual entrepreneurs who work in one subject and are registered in another.

Delivery methods

A tax agent can submit reports in 2-NDFL format in several ways:

- Personally to the representative of the regulatory body in paper form - this opportunity is provided only to firms with a small number of employees - up to 10 people.

- Personally to the inspector of the Inspectorate of the Federal Tax Service in the form of an electronic file - organizations with up to 3000 employees can submit certificates in this way.

- Through post offices - 2-NDFL forms are inserted into an envelope with a list of attachments, and then sent to the IFTS.

- Using an electronic document management system - to use this method, a company or an entrepreneur needs an EDS, an agreement with a special communications operator, as well as the presence of a specialized program or access to the corresponding service.

Sign 1 and 2 in the help - what to choose

There are two signs that can be put on the 2-NDFL form:

- 1- is intended to reflect information about the withheld and transferred amounts of personal income tax from individuals in a general manner.

- 2- is intended to reflect information about the employee's income from which his employer cannot withhold tax, for example, on income received in kind.

Which sign to set is determined by tax legislation. A tax agent cannot put these signs as he pleases if he does not want to be held liable for the inaccuracy of the information provided.

If the organization or individual entrepreneur withheld personal income tax from the income of an individual, then they must indicate the status "1". Otherwise, the sign "2" is indicated in the certificate.

Important! Even if the flag was specified incorrectly or in error, it will still be considered a violation of data presentation. Moreover, these documents have different submission dates.

Download the certificate form 2-NDFL in 2018

Download in Excel format.

Download in PDF format.

Let's see in more detail how to compose a 2-NDFL sample.

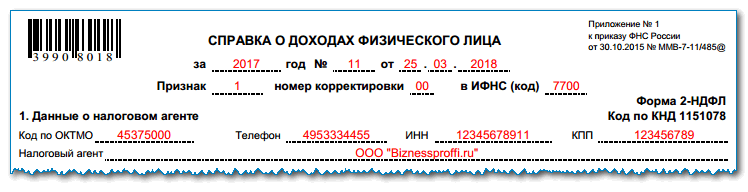

Title and section # 1 (Information about the tax agent)

This contains the title of the report. The person in charge puts down the serial number, the day of the report, the period for which the compilation is performed.

- "1" is affixed upon delivery in a normal situation.

- "2" - when the required tax was not withheld from the employee.

After that, there is a field in which, if necessary, you can put down the number of the correction being submitted.

Here you can specify one of the codes:

- "00" - the certificate is submitted for the first time;

- "01" - "98" is the number of the report with corrective information on this employee.

- "99" - cancellation of submitted information on this employee.

In this section, you need to write down information about the employer. First you need to enter the TIN, KPP, OKTMO codes. It must be remembered that the organization's TIN code includes only 10 digits, and the entrepreneur does not have a checkpoint code.

After that, the contact phone number is indicated. Enter the full name of the company or full name of the company in the field below. entrepreneur.

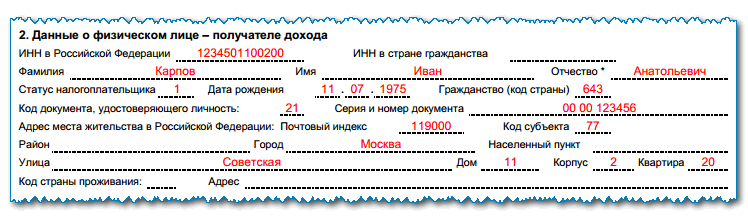

Section No. 2 (Information about an individual - recipient of income)

This section displays information about the person for whom the report is being drawn up. TIN is entered first. In addition, the new form of the form also began to contain a field for the TIN of a foreign state, if the document is issued for a foreign worker.

If the employee's personal data (surname, passport information, etc.) changed in the year for which the certificate is issued, then the new information should be reflected in the document, and copies of the form are attached to the certificate as confirmation.

If 2-NDFL is issued for a foreign worker, then his data on his full name. can be written in Latin letters.

- 1 - For a resident employee;

- 2 - for a non-resident employee;

- 3 - for a qualified specialist;

- 4 - for a person who has moved from abroad;

- 5 - for a foreigner with refugee status;

- 6 - for a foreigner working with a patent.

The address can be entered both on the territory of Russia and in a foreign state (for foreigners). However, in the latter case, you must also record the address at which it is registered in Russia.

Section number 3 (Income)

In the title of the section there is a column in which it is necessary to indicate the applicable tax rate. For example, for Russians it will be 13%, and for foreigners - 30%.

After that, the section contains a table in which it will be necessary to enter the types and amounts of income received for each month line by line.

You need to enter data here according to the following principle:

- the first section contains the number of the month,

- further - the code of the type of income received

- in the next column its sum expression.

The most commonly used codes are:

- 2000 - basic salary.

- 2012 - vacation payment.

- 2300 - sick pay. etc.

Also, new codes have been adopted, which should be used in the preparation of the report starting from 2018. For example, compensation upon dismissal in the 2 personal income tax certificate will now have to be shown with the code 2013.

Attention! If an employee has several incomes in one month, then they are all reflected in different lines. In this case, the number of the month in the lines will be the same, and the code and amount will be different.

The fields for deduction are intended to be reflected in the form of professional benefits. NK provides codes for them from 403 onwards.

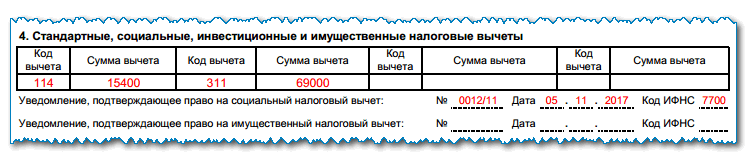

Section number 4 (Standard, social, investment and property tax deductions)

In the specified section, you need to include the codes, as well as the amounts used for benefits that were provided to the employee in the specified period of the report. At this point, you need to show the standard deductions for children.

For example, the following codes apply:

- code 126 - used for the 1st child.

- 127 - for the 2nd.

- 128 - for the 3rd and all further ones.

If the employee was provided with additional deductions, then the right to apply them must be confirmed by notification. For the details of the latter, the corresponding column is assigned. This should be done, in particular, for social and property types of benefits.

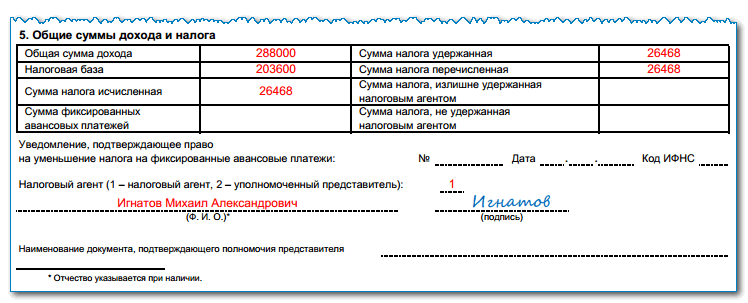

Section No. 5 (Total amounts of income and tax)

This section summarizes the information that was given in the previous sections 3 and 4. It looks like a table.

In the column "Total income" you need to write down the total amount of income received by the employee for the entire year of work in the company.

In the column "Tax base" the amount subject to taxation is recorded. It is obtained by subtracting the total amount of benefits provided for the year from the income received.

In the column "Calculated tax amount" you need to enter the calculated tax amount. This is done by multiplying the base from the previous column in this section and the tax rate from section 3.

In the column "The amount of fixed payments" information is entered only by citizens of foreign countries who are working in Russia under a patent. In the event that they are allowed to reduce the amount of tax by the amount of advance payments previously paid, they must be reflected in this column.

Next, you need to fill in the information in the columns "Amount of tax withheld" and "Amount of tax transferred". Here you need to show the amount that the organization withheld from the employee, as well as the amount that was paid to the budget.

Below it is necessary to reflect the data on the excessively withheld tax, or its arrears from the employee.

Below the tabular section there are columns in which you need to put down the series and the number of the document confirming the right to reduce the tax on advance payments, as well as the inspection code that issued it.

In conclusion, the code of the person who submitted the document is put down:

- 1 - Directly an agent;

- 2 - His representative by proxy.

Basic filling errors

A typical mistake when entering data into 2-NDFL forms is the indication of incorrect personal data about the employee - TIN, SNILS codes, passport information, etc. It is recommended to check the information specified in them with the data from copies of documents when preparing certificates.

The certificate should not contain negative amounts. This can happen if an employee is recalled from vacation, or he brought a sick leave. All recalculations must be made in accounting documents at the enterprise, and the final values are already entered in the certificate.

If a mistake is made in the certificate, then you do not need to cancel it using code 99. In such a situation, you can submit a correction document. Cancellation is made if information needs to be completely removed from the report.

If tax was withheld from the December salary in December, but it is transferred in January, then the entire amount must be paid in the amount of the paid tax, provided that it was transferred before February 1.

Attention! When specifying information, you need to use only codes for income, deductions, etc. determined by law.

Do I need to issue a certificate to an employee upon dismissal

When an employee is dismissed, the responsible persons must hand over a certain package of documents to him. It also includes a 2-NDFL certificate for his last year of work in the company.

This is necessary in order to inform the new employer about his income in the previous place in order to correctly provide benefits for this tax in accordance with the Tax Code. The latter determines that benefits can only be used up to the maximum amount of annual income.

A 2-NDFL form can be used by a citizen to fill out a 3-NDFL declaration. In the latter, it is necessary to summarize all the data from the available certificates, and then attach them as attachments as supporting documents.

The certificate can be issued to the leaving employee on his final day, or he can apply for a document at any time after the dismissal. At the same time, the former employee is entitled not to talk about the purposes for which he needed a certificate, and the former company cannot refuse to issue and issue it.

Attention! A former employee can request 2-NDFL both for his last year of work, and for any other previous one. The year for which the certificate is required must be indicated in the submitted application.

Penalty for delay and failure to submit a 2-NDFL certificate

The law defines the following types of punishments that can be applied for violation of the terms on the 2-NDFL certificate:

- fine for failure to provide 2-NDFL;

- penalty for late delivery of 2-NDFL.

Regardless of the type of offense committed, the organization will need to pay 200 rubles for each employee, in respect of whose certificate the violation was committed.

On the one hand, for an organization with a small number of employees, it does not seem large. But for companies with a large number of employees, the penalties can be significant.

In addition, an additional penalty of 500 rubles was introduced for each certificate in which incorrect information was indicated.

It must be remembered that if a company independently finds errors in its submitted report and corrects them by submitting a correction document, no fines will be charged on it.

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- What documents are needed to receive snills for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form of UTII-2

- Ovarian ultrasound to detect ovulation

- Prayer to the guardian angel for help in business

- Young husband of Ekaterina Klimova Wedding of Ekaterina Klimova and Meskhi

- Fiji spinner games. Fidget spinner games. Fidget spinners are fashionable

- Ancient Slavs in the era of the great migration of peoples

- The story of a peasant who made the world shudder

- Labor to the rear during the war

- Medieval castles: device and siege

- Papa louis cafe bakery papa's games cakes