Payroll, form T-53

The company, in the course of its business activities, in accordance with labor agreements concluded with employees, must pay monetary remuneration for their work. She can do this in cash and non-cash. Several documents can be used to formalize the issue of salaries, including the payroll.

According to the law, employers under labor contracts must pay wages twice a month. These terms are determined by the internal regulations of the enterprise, and they must be strictly observed.

If the issuance is carried out to a sufficiently large number of employees through the cash desk, it is advisable to use the payroll, for which the State Statistics Service provides for the T-53 form. It is written out by an accountant-calculator after calculating salaries for the past month or within the time frame established in the company as the period for issuing an advance. The basis for filling out this document is the payroll.

In accordance with the accounting policy, the company has the right to use a document such as form 49 payroll instead of these two forms. This is often used in small businesses in order to optimize workflow. The main difference between the payroll and the fact that it is intended only for the payment of money. The calculation of wages and deductions is made in another document ().

The payroll form is provided in all special accounting programs, in which it is filled in automatically. It is also allowed to use typographic forms that are filled in manually. After the creation of the document, it is transferred to the cashier of the company and, within the established time frame, the officials give out cash, and the employees, having received it, sign the statement.

The cashier or accountant subscribes a cash register for the total salary issued. The cashier sums up the salary not received by the employees in time in the document when closing the statement and sends it to the bank with the note “Deposited”. This means that this money is reserved in the current account and cannot be spent by the company for other purposes.

In large enterprises, the payroll may consist of several sheets. Recently, with the development of salary projects in banks, this document becomes irrelevant.

Sample filling out a payroll in the form of T-53

Front side

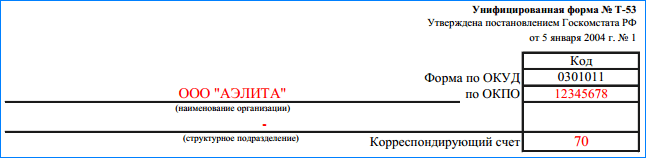

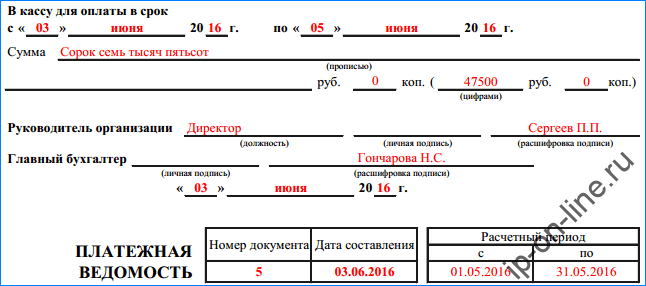

The upper part of the form contains the name of the company, the registration code of OKPO in statistics, as well as the name of the department, if there is a significant organizational structure. The corresponding account must be indicated under the codes.

Next, the established deadlines for the issuance of wages at the enterprise are recorded, during which it will be paid. Basically, these are three consecutive days. The next line indicates the total amount of money to be issued in both words and numbers.

Then the director and chief accountant endorse the payroll with a breakdown of their positions and full name.

Below, next to the name of the form, the number of the document is put down in order and the date of its statement. Then, in the columns, the start and end dates of the period for which the salary is paid are recorded.

Reverse side of the statement

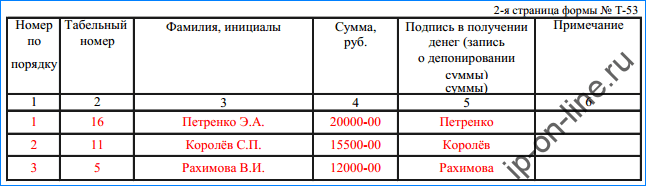

The first column indicates the record number, then the employee's personnel number, and then completely personal data. In the next column, the figures indicate the amount of money that the employee needs to be handed over. The employee reflects the fact of receipt of money by his personal signature in the fifth column. V section "Note" the cashier enters the necessary notes for him, for example, the name and details of the power of attorney when receiving money not personally by the employee.

If the salary was not received on time, the cashier makes a note about the deposit in the "Signature" column.

The last line determines the total amount.

The statement may include several sheets, therefore, their number is indicated below.

The next line contains the details of the issued cash register () - its number and date of issue.

After checking the payroll by the responsible officer, he signs and dates it. Here you need to indicate his personal data.

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- What documents are needed to receive snills for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form of UTII-2

- Sv m by mail

- Child tax deduction

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- Pushkin: reviews, address, faculties, branches