How to fill out an application in the form of UTII-2

An individual entrepreneur who decides to apply in relation to certain types of activity is obliged to register with the tax authority as a single tax payer ():

- at the place of business or;

- at the place of residence.

To do this, an application is submitted within 5 working days from the moment the UTII application begins (). For individual entrepreneurs, there is a form No. ENVD-2, which is approved by the Order of the Federal Tax Service of Russia dated 11.12.2012 No. ММВ-7-6 / [email protected]

The application is quite simple to fill out. And you can do this:

- in a handwritten way;

- on the computer.

If the document is filled in by hand, then a black or blue ink pen is used for this. Text data is written in capital block letters. Fields that are left empty or not completed are crossed out in the middle.

Electronic filling uses a font Courier new 16 - 18 points high. In empty cells (familiarity), dashes can be omitted.

So, you downloaded the application (form No. ENVD-2) on the Internet or printed the form on paper. How to proceed further?

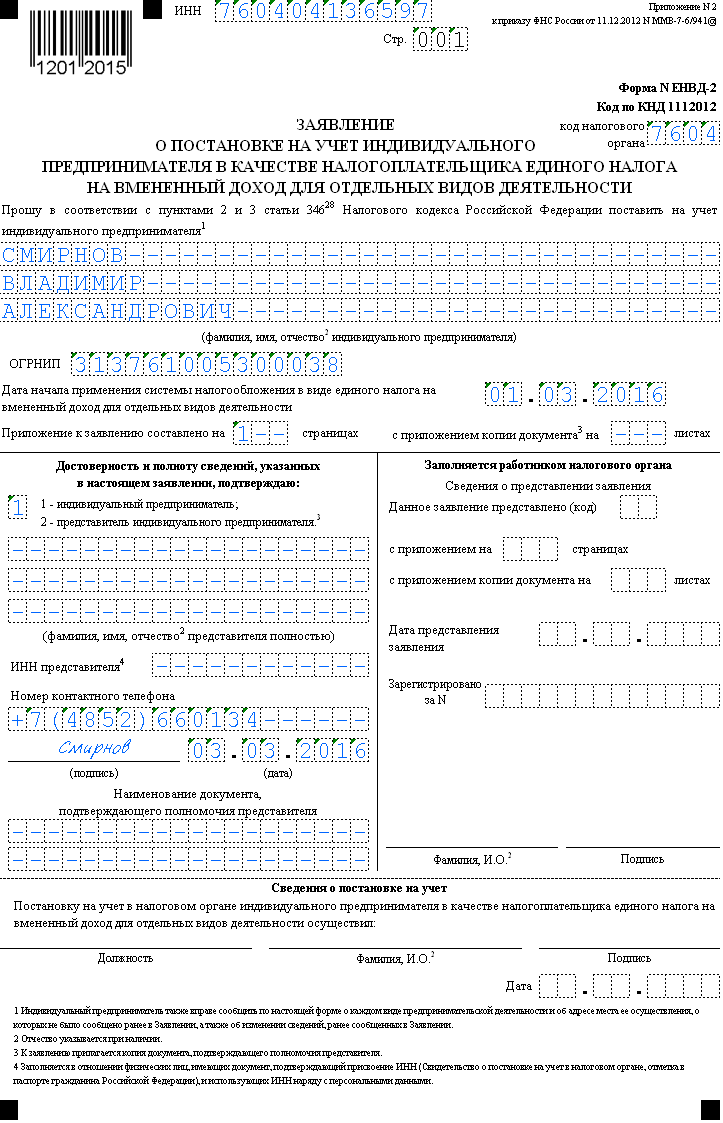

The procedure for filling out page 001 of the application in the form of ENVD-2

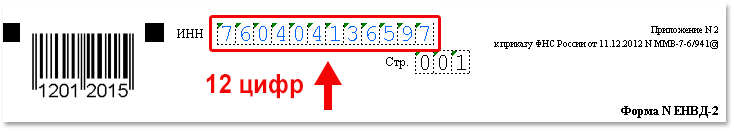

1. In the "INN" field, the taxpayer identification number is indicated. It is assigned to a person from birth, one single time and does not change in his entire life.

You can view the identification number in the certificate of registration of an individual with the tax authority. If you did not receive the certificate or it was lost, you can contact the service or the Federal Tax Service at your place of residence.

Do not forget that an individual's TIN consists of 12 digits, so there should not be empty cells (familiarity).

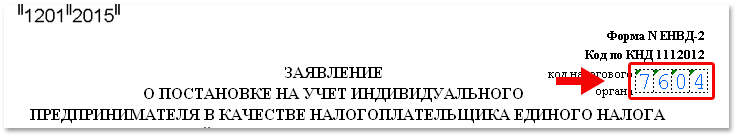

2. In the field “tax authority code” the four-digit code of the tax authority, in the territory of which the individual entrepreneur carries out “imputed” activities (), is indicated. If an entrepreneur is engaged in distribution and delivery retail trade, provides services for the transportation of passengers and goods, or places advertisements on vehicles, then it is necessary to register at the place of residence (). The table below lists the codes of the tax inspectorates of the Yaroslavl region. You can also find out the code of the tax authority where the application is submitted on the website.

Table 1 - Tax inspection codes of the Yaroslavl region

| IFTS code | Name of the IFTS | Serves taxpayers |

| 7600 | Office of the Federal Tax Service for the Yaroslavl Region | |

| 7602 | Inspectorate of the Federal Tax Service for the Dzerzhinsky District of Yaroslavl | Dzerzhinsky district of Yaroslavl |

| 7603 | Inspectorate of the Federal Tax Service for the Zavolzhsky District of Yaroslavl | Zavolzhsky district of Yaroslavl |

| 7604 | Interdistrict Inspectorate of the Federal Tax Service No. 5 for the Yaroslavl Region | Kirovsky, Frunzensky, Krasnoperekopsky districts of Yaroslavl |

| 7606 | Inspectorate of the Federal Tax Service for the Leninsky District of Yaroslavl | Leninsky district of Yaroslavl |

| 7608 | Interdistrict Inspectorate of the Federal Tax Service No. 1 for the Yaroslavl Region | Pereslavl-Zalessky, Pereslavl-Zalessky municipal district |

| 7609 | Interdistrict Inspectorate of the Federal Tax Service No. 2 for the Yaroslavl Region | Rostov, Borisoglebsky, Gavrilov-Yamsky municipal districts |

| 7610 | Interdistrict Inspectorate of the Federal Tax Service No. 3 for the Yaroslavl Region | Rybinsk, Rybinsk, Poshekhonsky municipal districts |

| 7611 | Interdistrict Inspectorate of the Federal Tax Service No. 4 for the Yaroslavl Region | Tutaevsky, Bolsheselsky, Lyubimsky, Pervomaisky, Danilovsky municipal districts |

| 7612 | Interdistrict Inspectorate of the Federal Tax Service No. 8 for the Yaroslavl Region | Uglichsky, Breitovsky, Myshkinsky, Nekouzsky municipal districts |

| 7627 | Interdistrict Inspectorate of the Federal Tax Service No. 7 for the Yaroslavl Region | Yaroslavsky, Nekrasovsky municipal districts |

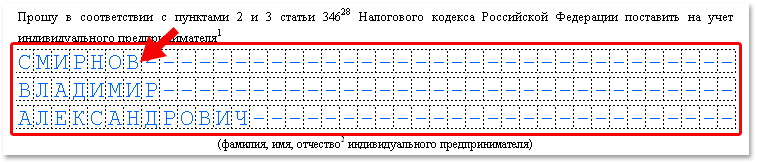

3. The next field "I ask, in accordance with paragraphs 2 and 3 of Article 346.28 of the Tax Code of the Russian Federation, to register an individual entrepreneur" consists of 3 lines. In the first, the surname is indicated, in the second - the name, in the third - the patronymic of the individual entrepreneur without abbreviations.

4. In the "OGRNIP" field, the main state registration number of the individual entrepreneur shall be indicated, consisting of 15 digits. It can be viewed in the certificate of state registration of an individual as an individual entrepreneur.

5. In the field "Date of the beginning of the application of the taxation system in the form of a single tax on imputed income for certain types of activities", the date (day, month and year) of the beginning of the application of the special UTII regime is entered.

6. In the field "Application to the application is drawn up on" indicates the number of pages of the application to the UTII-2 form. There may be several of them: one, two, three, etc., depending on the number of types of entrepreneurial activity and (or) places of their implementation, which the entrepreneur will register in the application.

7. The field "with the attachment of a copy of the document to" is the number of pages of the copy of the document (power of attorney), which confirms the authority of the representative of the individual entrepreneur.

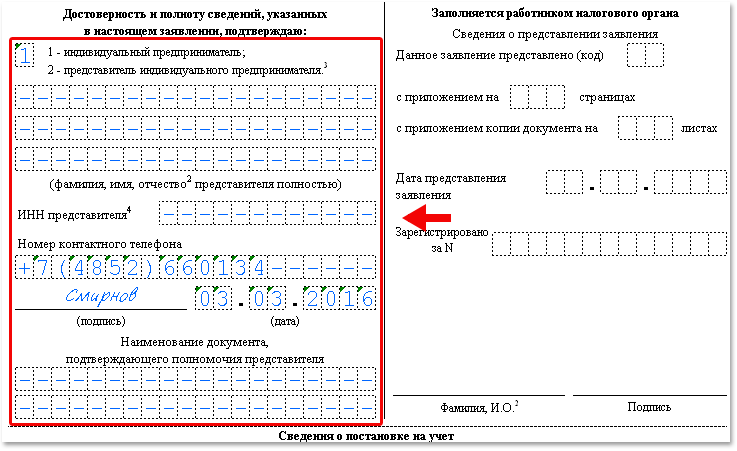

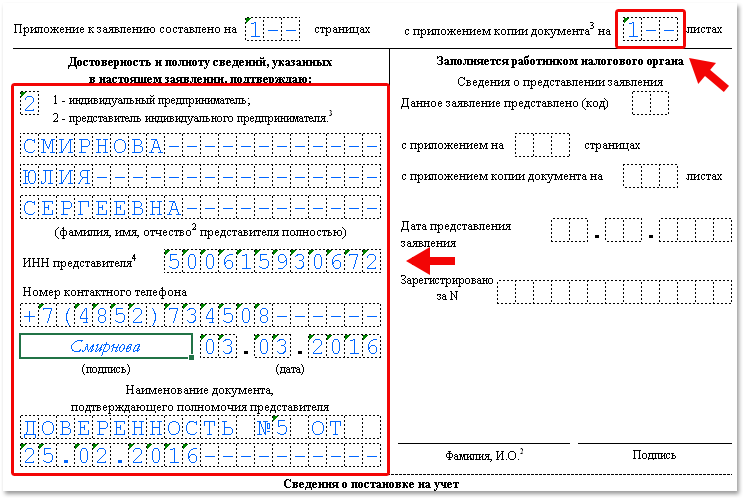

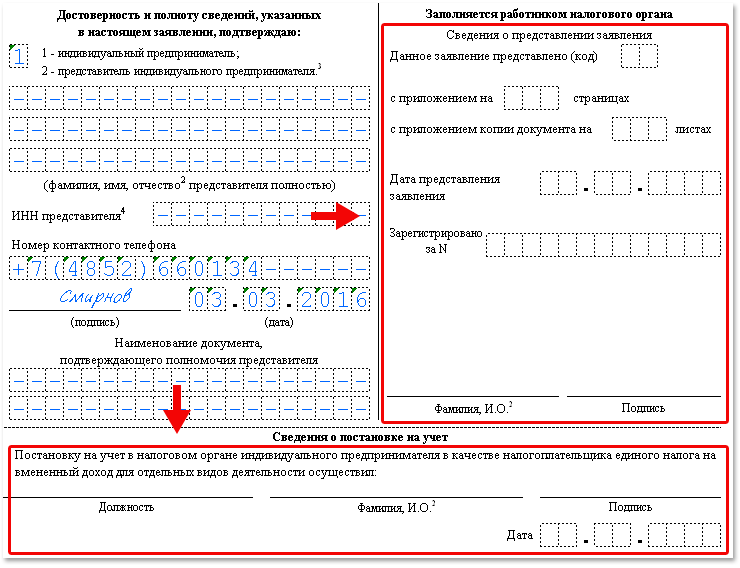

8. In the section “I confirm that the information specified in this application is correct and complete”, several indicators are indicated.

The field with the code of the person to whom the application is submitted shall indicate:

- number 1 - if the document is submitted directly by an individual entrepreneur;

- number 2 - if the form is submitted to the inspection by an authorized person.

In the second case, it is necessary to fill in the data of the individual entrepreneur line by line in the field “surname, name, patronymic in full”. Also in the "TIN" field, its TIN is indicated (if any).

In the "Contact phone number" field, you must write down the contact phone number with the city code by which you can contact the person who submitted the application. The number is indicated without spaces and dashes.

The application is signed in the place provided for this. The date (day, month and year) when the application was signed is entered in the "Date" field.

In the field "Name of the document confirming the authority of the representative" shall indicate the name and details of the document on the basis of which the representative exercises his powers.

An example of filling in the fields of this section when submitting an application by an authorized person is presented below.

The sections "To be completed by an employee of the tax authority" and "Information on registration" are completed by the tax authority. The entrepreneur should not indicate anything in them.

As a result, we received the first completed page of the application form No. ENVD-2.

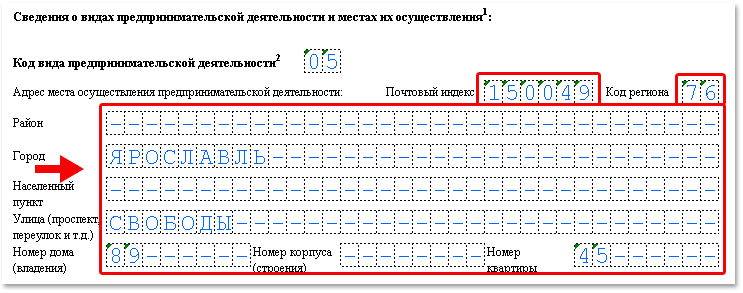

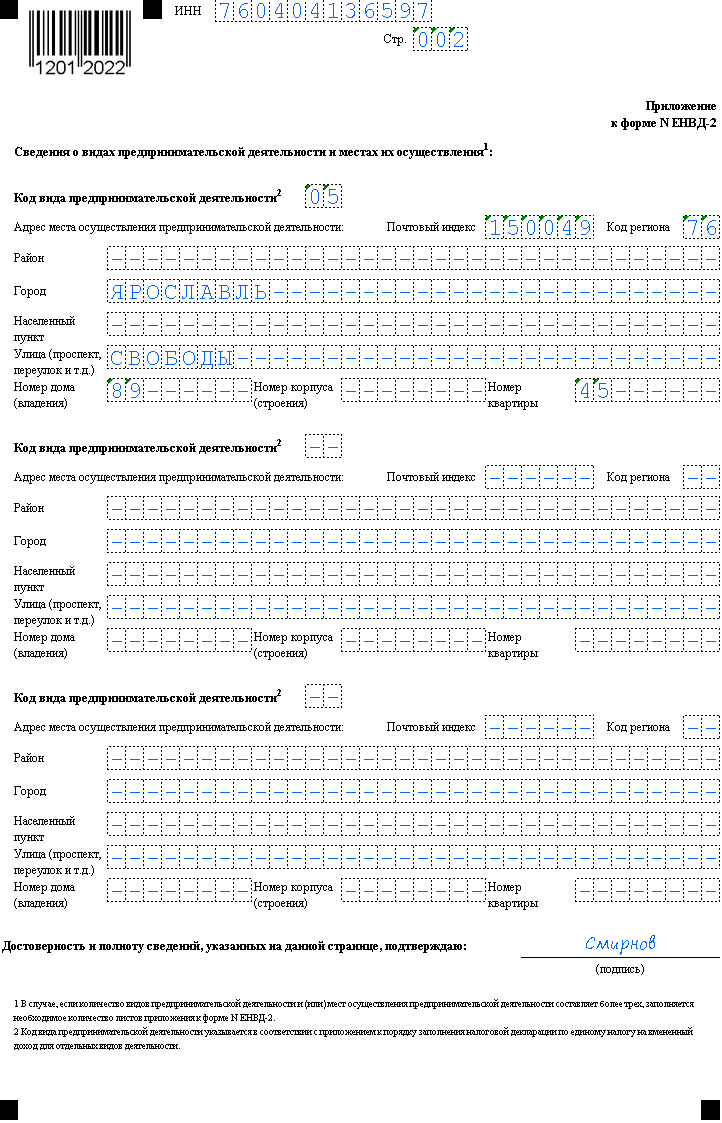

The procedure for filling out the annex to the application according to the form No. ENVD-2

1. As on the first sheet of the application, in the "TIN" field of the application, the TIN of an individual entrepreneur is indicated, consisting of 12 digits.

2. In the "Page" field puts down the page number. If this is the first application, then the ordinal number of the page will be the second and "002" is indicated in the field accordingly.

3. In the field "Code of the type of entrepreneurial activity" the code of the activity is entered, which the individual entrepreneur transfers to a special tax regime. You can find it out from Appendix No. 5 to the Procedure for Completing a Tax Declaration on the Unified Tax on Imputed Income for Certain Types of Activities (approved by Order of the Federal Tax Service of Russia dated 04.07.2014 No. MMV-7-3 / [email protected]) or in the table below.

Table 2 - Business activity codes

4. Specify information about the address of doing business in the specially designated fields:

- postcode;

- region code;

- district;

- town;

- locality;

- street (avenue, lane, etc.);

- house number (ownership);

- building number (building);

- apartment number.

The digital code of the region is taken from the directory "Subjects of the Russian Federation" Appendix No. 2 to Appendix No. 9 (Order of the Federal Tax Service of Russia dated 11.12.2012 No. ММВ-7-6 / [email protected]).

On one sheet of the Appendix to the application form No. UTII-2, you can fill in information only about 3 types of business activities and (or) places of their implementation. If a larger number is required, the required number of sheets of the appendix is taken.

5. In the field "I confirm the accuracy and completeness of the information specified on this page" the applicant (individual entrepreneur or his representative) puts his signature.

As a result, we received the second completed page of the Appendix to the UTII-2 form.

You can download the application form of the ENVD-2 form and samples of its filling below.

Filling out an application in the form of ENVD-2 using the program "Taxpayer LE"

It is also possible to fill out an application form No. ENVD-2 using special programs, one of which is the "Legal entity taxpayer" program. She allows

- automate the process of preparing documents by legal entities and individuals to the tax office;

- to minimize the number of mistakes that taxpayers make when filling out documents.

The program is freely available on the website of the Federal Tax Service. The procedure is as follows:

1. To download, type in the address bar https://www.nalog.ru/rn77/program//5961229/ and follow the link. Download the latest version of the program. At the time of this writing, this is version 4.46.4. However, if you have not previously installed the "Legal entity taxpayer" program, you will need to download version 4.46 and install it first.

2. After successful installation of the program, it is necessary to create a taxpayer and fill in all the necessary details, which will be automatically inserted into the reporting forms and documents in the future.

4. In the window that opens, click the "Add" icon, then select Application f from the list of forms that appears. ENVD-2 (code 1112012);

5. The opened application form already contains all the basic data on the taxpayer (TIN, OGRNIP, tax authority code, applicant's full name). You will not be able to correct them in the document itself. The entrepreneur fills in only the cells that are highlighted in orange and green, if required.

6. The cells with a red line in the middle are filled in automatically after pressing the F5 key. However, they can also be edited manually.

7. The page of the application to the application is filled out very easily with the help of the program directories.

8. After completing the 7th stage on page 001 of the application, in the field "Application to the application is drawn up on", press the F5 key. In this case, the number of pages of completed applications is automatically entered.

9. Check the document using the corresponding icon.

11. Now in the window "List of entered taxpayer accounting documents" there is a saved application form No. UTII-2.

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- What documents are needed to receive snills for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form of UTII-2

- Planting hyacinths in the fall: when and how to carry out the procedure correctly

- Incredible animals of the planet

- Why did they dream of Throwing a Child?

- Old Believers' rumors and accords on the territory of the Nizhny Novgorod region

- What happens at Shrovetide

- How to draw a beautiful fox with a pencil, even if you are not an artist at all

- The two curses of Archpriest Avvakum

- Leo Tolstoy all the best fairy tales and stories Leo Tolstoy fairy tales for children

- How to draw a basket with a pencil step by step