How to open an IP in Moscow on your own: step by step instructions

A private person registered with the relevant authorities who is authorized to engage in entrepreneurial activities without establishing, creating an LLC, PJSC or other legal entity. The main difference between an "IP-shnik" and, for example, the sole founder of an LLC (and companies with a similar composition in the Russian Federation is about 75%) is that he is responsible for all his obligations with all his property. Except, of course, for the one on which, according to the law, a penalty cannot be imposed. The same LLC risks only the values and property contained on the company's balance sheet. But if you, having weighed all the risks, nevertheless decided to open an individual entrepreneur in Moscow on your own, then we will try to help you as much as possible by describing in detail your entire plan of action.

Stage 1: choosing a registration option

If you hitherto thought that you could register yourself as an individual entrepreneur only on your own, then you should know that in 2017 this is not the only option. There are two ways to open an IP in Moscow:

- Self-registration. You prepare the documents yourself and go to all instances - the process is simple, but takes a lot of time. In addition, as a bonus, you can get experience in interacting with tax authorities.

- Registration through a specialized company. The main disadvantage: this option is paid. But in return, you will get a lot of saved time and nerves, detailed advice - you will not even need to visit the Federal Tax Service.

To finally decide whether it is worth opening an IP in Moscow on your own, or it is better to turn to specialists, check out this analysis table.

| Self-registration | Registration through intermediaries | |

| Waste | Payment of state duty - 800 rubles (2017) | Payment of state duty - 800 rubles. The price for services in Moscow is 200-5000 rubles. |

| Optional expenses | Making your own print - 500-1000 rubles. Opening a bank account in a bank - 0-2000 rubles. A power of attorney for your representative, certified by a notary, is 1000-1500 rubles. |

|

| Advantages | Obtaining the necessary experience of interaction with bodies that you will encounter more than once in the course of your activities. No additional costs. | Serious time savings. You can register an individual entrepreneur without interrupting your business: the preparation, transfer and acceptance of documentation will take place without your participation. In case of refusal to register, your intermediary assumes responsibility. |

| Minuses | It is possible to receive a refusal due to incorrectly prepared documents (therefore, do not deviate from our step-by-step instructions "How to open an IP in Moscow on your own"). | Additional spending. You will be familiar with the registration procedure in general terms. There is a possibility that the intermediary can use the data you provide to their advantage. |

If you have chosen an independent path, then it's time to move on to the next item.

Stage 2: choosing your name

Of course, the choice of a spectacular, interesting, appropriate name for the activity is the prerogative of legal entities. Individual entrepreneurs who have established their business even in the repair niche, even in the beauty industry, even in creativity, will be referred to in official documents monotonously and dryly - IP V.V. Ivanov, IP G.G. Alekseeva, etc.

There is only one way out - to register a service mark (for services) or a trademark (for goods) with the name that you like. You can also open an individual entrepreneur in Moscow using a commercial designation - the bar "At Boris", the workshop "We'll fix everything", etc. It is not necessary to register it.

Stage 3: choice of registration location

The IP registration address is the place of residence of the future entrepreneur. Therefore, the question is appropriate: "How to open an individual entrepreneur without a residence permit is possible to do if you have a temporary registration stamp in the capital. But only in one case - you do not have a permanent residence permit in another region. And if you are the owner and temporary, and permanent registration, then there is only one way out - to register an individual entrepreneur not in Moscow, but in the home region.

If you are registered in the capital and want to open an individual entrepreneur in Moscow on a turnkey basis (from scratch), but you do not have the opportunity to come to this city, then companies offering to carry out this procedure remotely, through the system of remote online registration of individual entrepreneurs, are at your service. . To do this, you must have a valid digital signature.

Stage 4: selection of OKVED code

Based on what you want to do in your future business, you need to select the appropriate codes from the OKVED classifier, which is freely available on the Web. Although there is no limit on the number of ciphers specified, experienced entrepreneurs do not recommend specifying too many of them. But at the same time, one must also remember that if you engage in a business that is not characterized by OKVED numbers, then it will be considered illegal activity, for which the legislation threatens to punish.

To open an individual entrepreneur in Moscow, you do not need to immediately indicate all the codes based on even the most illusory plans - they can easily be added in the future, just before you are going to do a specific business. One of the ciphers you specified must be selected as the main one. Be careful! Codes consisting of at least 4 characters are entered in the application.

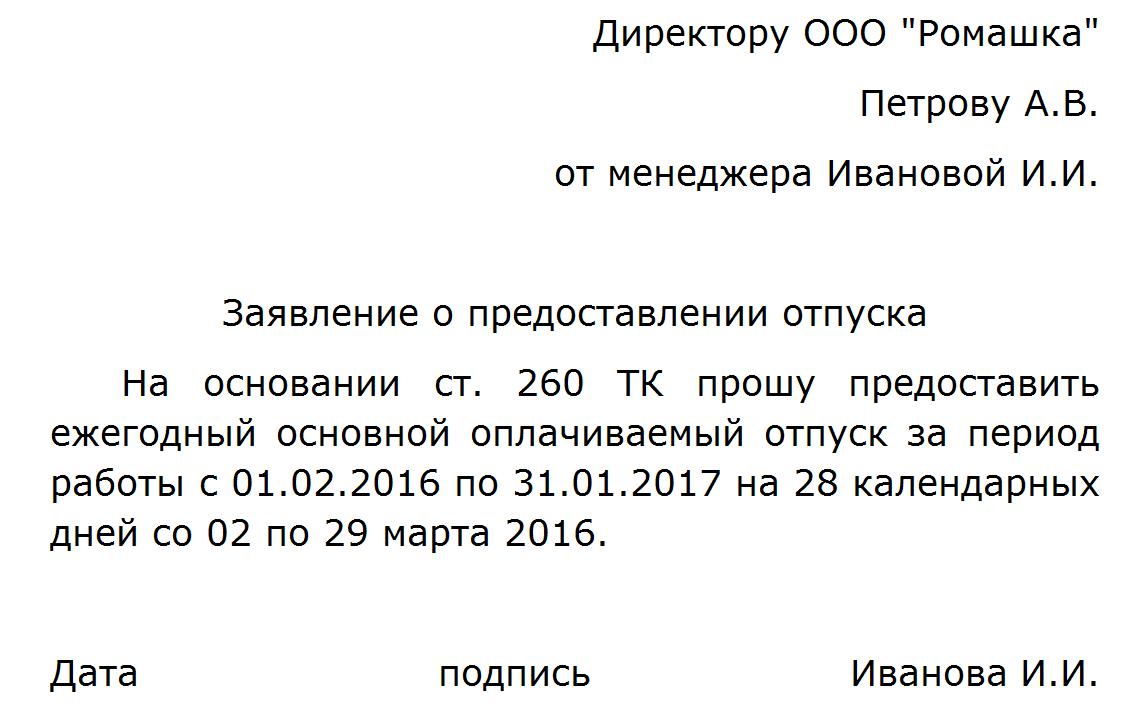

Stage 5: filling out an application for registration of IP

If you want to urgently open an individual entrepreneur in Moscow, then carefully consider this point - most registration refusals occur due to incorrect filling out of the application. You will need to prepare a document of form P21001 - you can freely download its form on the official website of the Federal Tax Service.

You can fill out the application by hand, and on a PC, and using the service of the Federal Tax Service, and with the assistance of third-party organizations that provide the software necessary for this (of course, for a fee). We recommend that you still use the electronic method of entering data - it is much easier to correct errors. In no case do not sign the printed completed document at this stage! This must be done later - in the presence

General filling rules:

- Entries are made in capital letters only. In the electronic version, be sure to set the following settings for entering data: font Courier New, height - point 18.

- Enter all the information from the passport exactly, letter for letter - as written in this document.

- TIN is written only if you have such a number.

- Sheet No. 3 is not filled out for citizens of Russia.

- It is not necessary to fasten, stitch the document.

- Use abbreviations for address objects with caution - only those that are prescribed in the official instructions are allowed (see Appendix to document No. 2).

- Do not write hyphens in the cells - if the word does not fit on the line, just start writing the letters that did not fit on a new line from the first cell.

- For all other words, the entry in the line begins strictly from the second cell!

- If you put a dot in a cell, then be sure to leave the cell following it empty.

In order to open a turnkey IP in Moscow, it is necessary to fill out the P21001 form in accordance with these rules. Let's deal with it in detail.

| Page | Paragraph | Specified data | Notes |

| 1 | 1.1 | FULL NAME. | |

| 1.2 | Citizens of the Russian Federation skip this item | ||

| 2 | TIN (as you remember, if it is not there, you do not write anything in this field) | ||

| 3 | Gender: 1 - male, 2 - female | ||

| 4.1 | Date of your birth | ||

| 4.2 | Place where you were born - copy it from your passport | ||

| 5 | Persons with Russian citizenship put one here | ||

| 5.1 | And again, citizens of the Russian Federation skip this item | ||

| 2 | 6 | Place of registration - transfer data from the passport | |

| 6.1 | Postal code of your place of residence | ||

| 6.2 | Code of your home region (for information see Appendix No. 2 to your application) | Living in Moscow, Sevastopol and St. Petersburg pp. 6.3-6.6 miss! | |

| 6.3 | Area | 6.3-6.6 fill in using the abbreviations from Appendix No. 2: city - city, district - district, etc. | |

| 6.4 | City | ||

| 6.5 | Locality - city dwellers skip this field | ||

| 6.6 | The outside | Pp. 6.6-6.9 fill in without abbreviations - apartment, building, house | |

| 6.7 | House number (if there is a letter, then write together - 45V, not 45V) | ||

| 6.8 | House body | If there is no such data, just leave the fields blank | |

| 6.9 | Your apartment number | ||

| 7.1 | Russian passport code | ||

| 7.2 | Series and passport number - be sure to use two spaces! Sample: 00 00 111111 | ||

| 7.3 | Passport issue date | ||

| 7.4 | The agency that issued your passport - copy the information exactly | ||

| 7.5 | Subdivision code of the above department | ||

| 3 | Citizens of the Russian Federation is not printed, therefore it is not filled out | ||

(be sure to indicate the page number of the application at the top - 003) |

|||

| 1 | Core activity code according to OKVED | Be careful! In 2017, the new OKVED classifier is relevant! | |

| 2 | Enumeration of additional activity ciphers | ||

(at the top write the number - 004) |

|||

| Choose the option to receive your finished documentation | Most choose method "2" - give you personally or a trusted person | ||

| Write down your contact phone numbers without spaces | Mobile example: +7(900)1112233 Homemade example: |

||

| Email address - it is indicated only by those applicants who submit a package of documents via the Internet | |||

| Fields where you need to manually write your full name. and put your signature, as you remember, now you need to ignore | |||

Stage 6: payment of the state fee

We have already figured out where to open an individual entrepreneur in Moscow - in the inspection of the Federal Tax Service at the place of our temporary or permanent registration (we will discuss this in more detail below). As for the payment of state duty, the choice of options will be richer:

- Without leaving home - using the online service on the website of the Federal Tax Service.

- In any branch of Sberbank. To do this, you need to go to the website of the tax service, find and print out the receipt form, fill it out by hand. You can find out the details of your branch of the Federal Tax Service both on this electronic resource and by contacting the tax office directly.

- Through paid assistant services that will generate and prepare both a receipt and a number of other necessary documents.

Stage 7: choice of tax regime

If you decide to open an IP in Moscow, then you need to choose for yourself one of the taxation regimes in force in the Russian Federation:

- general system - OSNO;

- single taxation on imputed income - UTII;

- single agricultural tax - ESHN;

- simplified taxation system - USN;

- patent system - PSN, available only for individual entrepreneurs.

Each of them has its own detailed series of advantages and disadvantages, which varies significantly from a number of individual indicators: the direction of your business, the area occupied by the premises, the number of employees, the level of income. Most beginner "IP-shnikov" traditionally stop at the "simplified" - USN, because it is objectively simpler, more profitable and allows for a wide variety of activities. But still, we recommend that you thoroughly familiarize yourself with all tax regimes before opening a turnkey IP in Moscow.

If you hesitate in choosing, then such an application can be submitted even 30 days after registering yourself as an individual entrepreneur.

Stage 8: TIN problem

We have almost figured out how to open an individual entrepreneur in Moscow on our own. Step-by-step instructions, among other things, assume that you have an individual tax number. If you do not have such a document, you must submit an appropriate application for its creation along with form P21001.

Let us draw your attention to the fact that not all IFTS require the submission of such an application - somewhere you will be automatically started, based on the data indicated in the application for registration of IP.

Step 9: Gathering and Verifying the Documentation Package

So, what you need to open an IP in Moscow:

- application form R21001 - 1 pc.;

- receipt confirming the payment of the fee - 1 piece;

- your passport of a citizen of the Russian Federation or another country;

- a photocopy of an identity document - all pages;

- application for transition to a certain tax regime - 3 pcs.;

- photocopy of TIN (optional item).

For foreigners and stateless persons, a copy of the temporary residence permit in the Russian Federation and a notarized translation of the passport are required. And if you cannot submit the documentation package in person, then at this stage you need to issue a power of attorney for the person who will deal with this matter. Naturally, when visiting the tax office, this citizen must provide a document drawn up for him by a lawyer.

Stage 10: submission of documents

First you need to find the Federal Tax Service agency that deals with the affairs of citizens at your place of permanent or temporary residence. This information is easy to obtain using the same site. But where to open an individual entrepreneur in Moscow on your own? In the capital, this is done by the specialized inspectorate of the Federal Tax Service No. 46, which is located at the address: Pokhodny proezd, 3, building 2.

Action plan for those who submit their documentation package in person:

- Hand over the documents to the inspector.

- Sign with him in your form P21001.

- Take a receipt from the employee, which confirms the transfer of documents by you. In it you will also see the date when you need to return to the office for ready-made documents.

- Ask for one copy of the notice of your transition to a particular tax regime.

You can also submit documentation through the electronic service of the Federal Tax Service (signatures are not required) or by a valuable letter to the address of your tax office. In the latter case, be sure to make an inventory of the enclosed papers and issue a delivery notice. When choosing delivery using the Russian Post or a representative, it is necessary to flash a photocopy of the passport and an application for registration of an individual entrepreneur in a notary's office!

Stage 11, final: receipt of a package of documents

At the time specified in the receipt given to you (as a rule, the tax office will process your documents no more than 3 working days), you will need to return to the office of the Federal Tax Service. Do not forget to bring your passport and receipt with you; your representative must also take a power of attorney. If it is difficult for you to make a visit, then the tax office will send you documents by mail - do not forget to mark this option when filling out P21001.

The Federal Tax Service is obliged to provide you with:

- sheet of the Unified State Register of IP form No. P60009, including the OGRNIP number;

- a document certifying that you are registered with the tax authorities as an individual entrepreneur;

- TIN, if you did not have one before.

Additionally, you may be given a notification from Rosstat about the assignment of a certain statistics code and a notification about registration with a pension fund.

Is it possible to open an IP in Moscow on your own? Of course, this can easily be done the first time by following the instructions above. Another option - all these actions on a commercial basis can be done for you by intermediaries.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

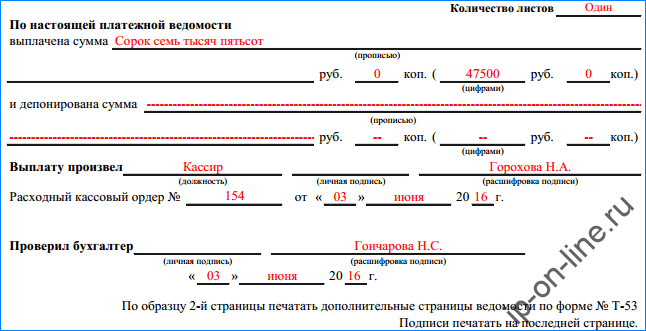

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

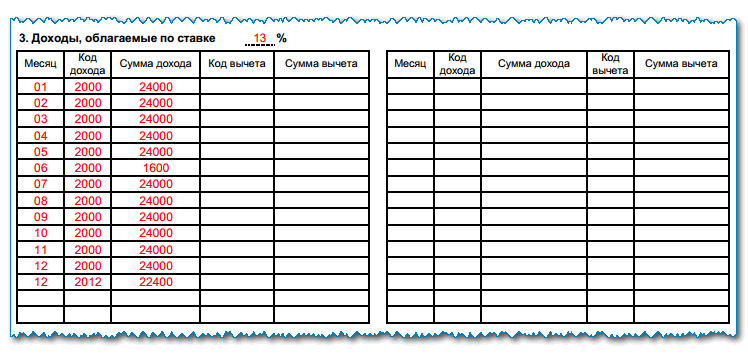

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- What is a crystal drug Harm from smoking crystals

- Dried seaweed: benefits and harms

- Useful properties and contraindications to the use of sunflower oil Natural sunflower oil treatment methods

- What is the most valuable turquoise

- Jewelry Etiquette: Business Woman Jewelry Business Style Jewelry

- Study of synthetic detergents and their influence on biological objects

- The legend of gladiolus plants

- What to do if a man has depression associated with a lack of money?

- The Most Important Sacred Sites on the Planet The Most Holy Christian Sites on Earth