Do I need to take zero sv-m

All employers are required to submit a monthly report on insured persons to the Pension Fund. But some organizations have only a single employee - the director, or have suspended their functioning. And sometimes the company has no staff at all. Are zero SZV-M submitted in 2018 in such situations? Our consultation will help you sort out these issues.

What does “zero” SZV-M mean in the FIU

SZV-M is a form of personalized accounting. It is designed to reflect data on insured employees of an organization or individual entrepreneur. Approximately, this designation is deciphered as follows: Information about the Insured Incoming for the Month. This report is prepared by a responsible person appointed by the head.

As a general rule, if there are no employees at the enterprise and at the same time an employment agreement has not been signed between the head and the organization itself, then we are talking about zero forms of SZV-M. Anyway, that's what accountants call these monthly reports.

Under what conditions and who delivers

Legal entities and individual entrepreneurs who have entered into an employment or civil law contract with individuals are required to submit the report in question to the FIU. In this case, it is important to observe 2 conditions:

- The agreement/contract has not expired.

- There is an obligation for insurance premiums (even if there is nothing to charge contributions for, and employees walk at their own expense).

SZV-M is handed over monthly to the territorial FIU at the place of registration of the enterprise as an insurer.

What is the zero report SZV-M in 2018

It is impossible to take an empty sample of zero SZV-M and hand it over to the Pension Fund, and it does not make sense. The fact is that at the legislative level the concept of “zero reporting of SZV-M” in 2018 is not spelled out, as before.

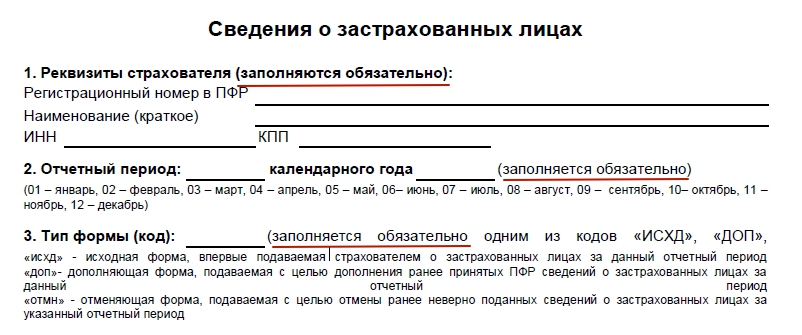

If you familiarize yourself with the contents of this form, among the required details you can see:

- registration number in the Pension Fund;

- name of the organization / individual entrepreneur;

- identification tax number;

- the period for which the report was submitted;

- form type.

Of course, the first 3 sections cannot be left blank:

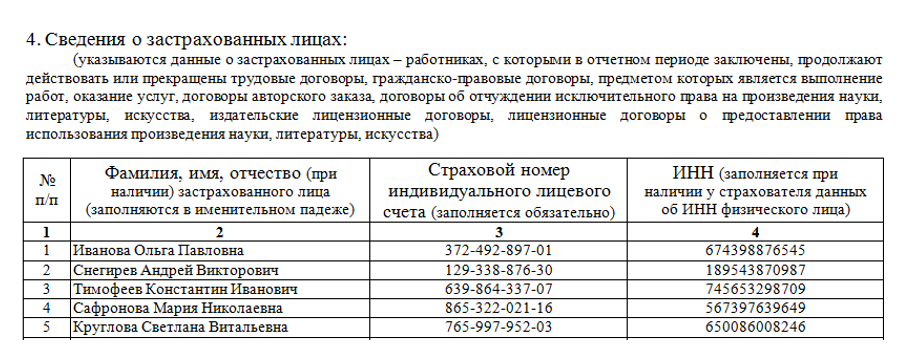

The 4th section of the SZV-M form provides a list of insured individuals with whom an employment or civil law contract has been concluded and is in effect. And also - personal information for each: SNILS and TIN. An example is shown below:

It is logical to believe that in fact the organization cannot exist without employees. Therefore, it should reflect information at least about its CEO.

Zero Form and Suspension

Let's say right away that the question of whether it is necessary to pass zero SZV-M in 2018, in practice, has not yet found a clear answer. And the point is the following.

Economic entities may face a situation where it is necessary to suspend activities. In this case:

- the staff is;

- he does not perform labor functions;

- accounting does not charge insurance premiums.

As a result, it is not clear whether it is necessary to submit a zero SZV-M in 2018, in which the “Information about the insured persons” block should be left empty.

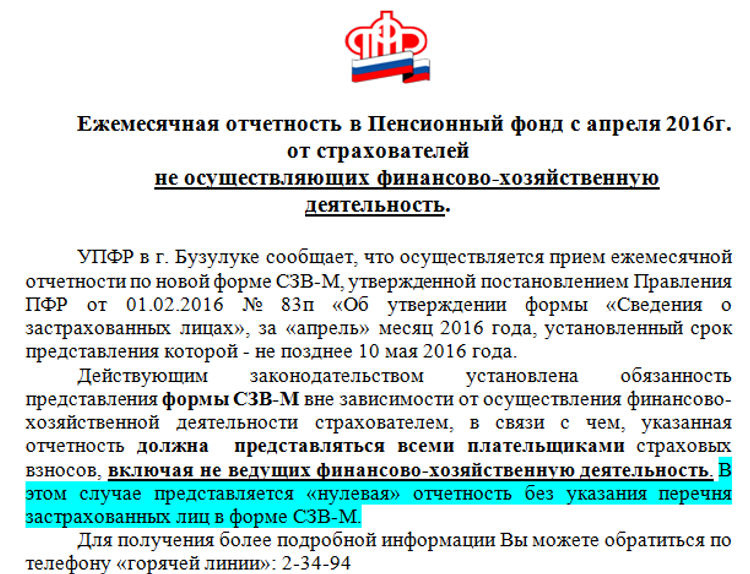

An unequivocal answer to the question of whether zero SZV-Ms are surrendered was absent for a long time, since the opinion of the Pension Fund and its territorial bodies often contradicted each other. So, initially in 2016, it was permissible to send a report to the fund without a block of information about the insured persons. That is, in fact, the delivery of zero SZV-M:

However, according to another, more common opinion, it is necessary to submit a report if there are insured persons. Namely:

1. Working under an employment or civil law contract.

2. Receiving income from the enterprise.

If the company's activities for 2018 are temporarily suspended, employees still continue to be insured. Submission of the SZV-M form with their listing in this case is mandatory.

Do IPs pass the zero form

A separate question is whether or not to hand over zero SZV-M to entrepreneurs. So: businessmen submit the report in question to the Pension Fund only when they act as insurers. Such a requirement follows from paragraph 2.2 of Art. 11 of Law No. 27-FZ<О персучёте в системе ОПС˃. А это возможно только при использовании наемного труда.

When all employees are dismissed or absent at all, and the entrepreneur independently conducts his activities, the report in question is not submitted. In this case, filling in the zero SZV-M does not make sense.

Zero report on the sole founder - gender

For an organization, the founder of which is the CEO in a single person, it does not matter the presence / absence of an agreement with him. According to clarifications No. 08-22 / 6356, the submission of SZV-M with him to the Pension Fund is mandatory.

But there is still a controversial situation: after all, when specifying the founding director in SZV-M, at the same time, information about his length of service must be reflected in the calculation of insurance premiums.

In July 2016, additional clarifications from the FIU appeared on whether SZV-M zero reporting is submitted for the general director. According to them, if the company, for certain reasons, does not conduct financial and economic activities, it is not necessary to submit a zero SZV-M to the general director without an agreement.

As mentioned, the question of whether it is possible to leave the section "Information about the insured persons" empty for a long time did not have a clear answer. Companies still submitted zero SZV-M, where they reflected information only about the general director.

According to the letter of the Ministry of Labor dated July 7, 2016 No. 21-3 / 10 / V-4587, which was signed by Deputy Minister A.N. Prudov, officials considered the situation when the general director does not conclude an employment contract with the organization and does not receive income.

Based on these clarifications, we can conclude: when the general director - who is also the founder and only employee - did not sign an employment contract with the enterprise and did not receive cash payments, the organization does not submit reports on insured persons.

The Central Office of the Pension Fund reacted to the position of the Ministry of Labor and changed its mind. According to the letter of the Pension Fund of the Russian Federation of July 13, 2016 No. LCh-08-26/9856, in such situations, the SZV-M report is not required.

In connection with the change in position, the FIU sent relevant recommendations to its territorial divisions. Some of the branches notified legal entities and individual entrepreneurs of the change in the position of the PFR.

On the basis of the latest clarifications, the insurers are exempted from the delivery of precisely "nulls". This follows from the letter of the PFR dated July 13, 2016 No. LCh-08-26/9856. However, many accountants prefer to play it safe and submit this SZV-M form.

How to act

Today, it is impossible to unequivocally state that policyholders are finally exempted from the fine for zero SZV-M - failure to submit such a form.

We discussed above that the zero report without a list of insured persons has been cancelled. Insurers must submit only SZV-M with information about employees.

Letters from the Ministry of Labor and the Pension Fund of the Russian Federation do not yet give unequivocal answers to controversial questions about reporting in the SZV-M form. Therefore, we recommend that policyholders, in the event of their occurrence, apply for written answers to the divisions of the Pension Fund. This way you minimize the risk of being prosecuted for an offense.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, Form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children