Samples of applications for granting a tax deduction

The appeal to the tax service must be supported by a written statement. If you are going to claim a tax deduction, then you should prepare the documents in advance and write an application with a request to allocate the due compensation.

We will tell you how to write an application for different types of tax payments.

General form and rules for writing an application for a tax deduction

Exists general form for a tax refund claim, which can be

You can use it - or arrange the document in a different way.

Below we consider the possible options for applying, depending on the type of tax compensation.

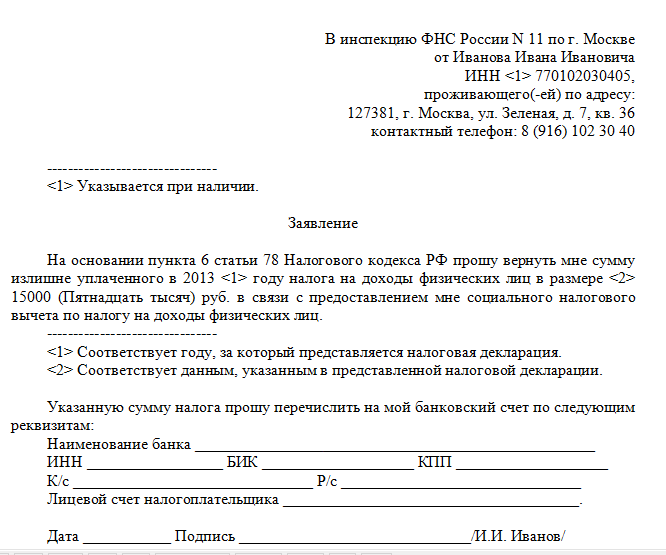

An example of a completed application:

The document requirements are the same.

Let's determine what rules should be followed when writing a statement:

- There must be a “header”, which indicates the name of the body to which you are applying. It is better to ask a tax representative how to enter the name of the department correctly. It also contains information about the applicant - full name, contact details, address of residence.

- Document's name. In the middle of the line, without quotes and a dot at the end, you should write - "Application for a tax deduction" or simply "Application".

- In the content of the document, you should enter your request, indicate what type of compensation you wish to receive, what grounds you have for this.

- It is important to enter the personal account number and all the details of the banking organization where the funds will be transferred.

- Next, do not forget to list the documents confirming the right to receive a tax deduction.

- The date and signature are also required at the end of the document.

For the examples below, the rules are the same.

Sample and examples of application for a standard tax deduction

This type of tax compensation can be issued only for adults, but with different types of compensation:

Personal return

That is, compensation is due to the citizen who applies to the authorities.

An example of an application for a personal tax deduction:

Child return

In this case, the return is due to the child of the citizen who applied for the service. This deduction is obtained by the parents, guardians or legal representatives of the child.

1. An example of an application for a deduction for one child:

2. An example of an application for a deduction for two children:

3. Examples of claims for a tax deduction relating to three or more children:

Standard tax refund is issued once a year.

Of course, with the provision of relevant documents - for example, birth certificates must be submitted for children, and guardians or representatives must have a power of attorney issued by a notary.

Examples of application for property tax deduction

Based on these examples, you will be able to write your personal statement.

Sample 1:

![]()

Sample 2:

Sample 3:

Sample 4:

Do not forget to put the date of submission of the application and your signature at the end of the document.

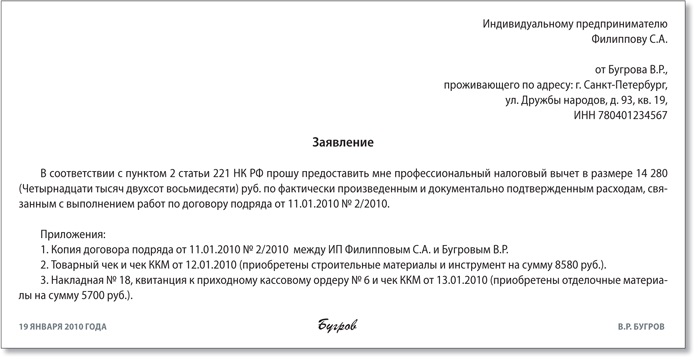

Sample and examples of application for a professional tax deduction

Tax compensation can be returned to a citizen under several conditions, and not just for good work or merit.

Let's give some examples.

Application for a deduction for the creation of scientific works and developments:

Application for a refund for the creation of literary works:

Application for a deduction for the performance of work under a contract:

Application for a refund for the performance of works of literature and art:

Application for deduction in connection with entrepreneurial activity:

Other applications for possible deductions are made in the same way.

Example:

Sample and examples of an application for a social tax deduction

The general application form is as follows:

Sample 1:

Sample 2:

Sample 3:

Now you can write an application yourself and come with it to the tax office.

As a rule, if the application is written without errors, blots and corrections, then it is accepted immediately.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children