Statement of financial results form 2 download form

Financial statements include several forms, one of which is the income statement form 2. However, it is with the help of it that you can track the income received in the course of activity, expenses incurred and the final result - profit or loss. This report must be compiled on the basis of accounting data for government agencies, company owners and other institutions.

The law determines that each economic entity that is a legal entity must carry out accounting in full.

At the same time, no exceptions are provided for the applicable tax calculation system or organizational form.

And a set of financial statements, which includes a report on financial results, must be submitted by the company to the tax service and statistics.

In addition, this report must be compiled by bar associations and non-profit organizations.

The law exempts from the mandatory preparation of this form only those who are engaged in activities as an individual entrepreneur, as well as subdivisions opened in Russia by foreign companies. They can generate these reports themselves and submit them to government agencies in a voluntary form.

Previously, it was not necessary to compile and submit reports for companies that use the simplified tax system as a system for calculating taxes.

Attention! In addition, the firm may have the status of a small business entity. In this case, the reports still need to be drawn up and sent to government agencies, but it is allowed to do this in a simplified form.

Using this benefit, it will be necessary to draw up both the balance sheet form 1 and the income statement form 2 using simplified forms.

Which form to use - simplified or full

If an organization does not meet the established criteria for a small business, then it does not have the right to use simplified forms. In this situation, it is necessary to draw up both the balance sheet and the income statement in their full version.

Companies that can fill out a simplified form are defined in the current law "On Accounting", they include:

- Firms that have received the status of a small business;

- Companies engaged in non-commercial activities;

- Firms involved in development and research in accordance with the provisions of the Skolkovo Center.

Thus, only these entities are entitled to use simplified reporting forms.

However, based on the actual circumstances of the activities and the characteristics of the work of companies, they can choose, including abandoning simple forms and filling out complete ones. At the same time, they must fix their choice in the accounting policy.

Attention! There are exceptions under which it is unacceptable to fill out reports on simplified forms, even if the requirements of the laws are observed.

These include:

- Companies whose reporting, according to applicable laws, is subject to mandatory audit;

- Firms that are housing or housing construction cooperatives;

- consumer credit cooperatives;

- Firms producing microfinance;

- State organizations;

- State parties, as well as their regional offices;

- Law offices, chambers, legal consultations;

- notaries;

- non-profit firms.

Report submission deadlines

The package of financial statements consists of a balance sheet form 1, a statement of financial results form 2 and other forms. All of them must be sent to the tax office and Rosstat no later than March 31 of the year that follows the year the report was compiled. This date is valid only for these government agencies and when submitting an annual report.

For statistics, upon the occurrence of the conditions specified in the law, it may also be required to submit an audit report confirming the correctness of the information in the annual reporting. This must be done within 10 days from the date of publication of this opinion by the audit company, but no later than December 31 of the year following the year in which these reports were compiled.

In addition to the Federal Tax Service and Statistics, reporting can also be provided to other authorities, as well as published in the public domain. This may be due to the nature of the activities carried out by the legal entity. For example, if a company is engaged in tourism activities, then it must, within 3 months from the date of approval of the annual report, also submit it to Rostourism.

If the company registered after October 1, then the current legislation determines for them a different deadline for submitting financial statements for the first time. They may do so for the first time until March 31st of the second following the reporting year.

For example, Gars LLC was registered on October 23, 2017. For the first time, they will submit financial statements until March 31, 2019, and it will reflect the entire period of activity, starting from the opening.

Attention! Firms on a general basis must prepare financial statements annually. However, in some situations, the balance sheet and income statement form 2 can also be issued monthly and quarterly.

Such reporting is called interim. As a rule, it is provided to the owners and managers of companies for assessing the situation and making decisions, to credit institutions when processing the receipt of funds, etc.

Where is provided

The law establishes that the package of financial statements, which also includes the form okud 0710002 income statement, is submitted:

- For the tax authority - at the place of registration of the organization. If the company has separate divisions and branches, then they do not submit financial statements according to their location. Information on them is included in the general summary reporting of the parent organization, which sends it to its location.

- Rosstat authorities - must be sent within the same time frame as to the Federal Tax Service. If this is not done, fines will be applied to the company and responsible persons.

- Founders, owners of the company - they must approve the reporting;

- Other authorities, if it is expressly stated in the current legislation.

If a major contract for the supply or provision of services is being concluded, the parties may ask each other to provide a set of financial statements.

However, this is done only by mutual agreement, and the company administration has the right to refuse this. But such a refusal is currently insignificant, since there are many services that can check the counterparty by TIN or OGRN.

Attention! Very often, reporting is requested by banking institutions when they consider applications for a loan. Especially if an LLC or IP takes.

Delivery methods

Profit and loss statement form 2 can be submitted to government agencies in the following ways:

- Personally come to the government agency, or authorize a trusted person to do this, and submit reports on paper. At the same time, two copies must be provided - one will be marked with acceptance. Sometimes it is also required to provide an electronic file on a flash drive. This submission method is available for companies with up to 100 employees.

- Send by mail or courier service. When sent by the Russian Post, the letter must be valuable, and also contain an inventory of the documents that are enclosed in it.

- Using the Internet through a special communications operator, a reporting program or the website of the Federal Tax Service. This submission method requires .

Statement of financial results form 2 download form

Download in Word format.

Download the form for free (without line codes) in Excel format.

Download (with line codes) in Excel format.

Download in Excel format.

In PDF format.

How to fill out income statement form 2: full version

When filling out a profit and loss statement, the form according to order 0710002, you must follow a certain sequence of actions.

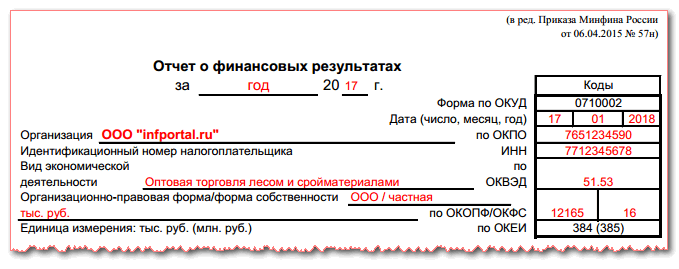

Title part

Under the name of the report, you need to write the period for which it is issued.

Then the date of compilation is indicated in the right table.

Then the date of compilation is indicated in the right table.

The full or short name of the company is written in the column below, and in the table on the right is the code assigned to it according to the OKPO directory. Here, the line below is the TIN code.

In the next column, it is necessary to write in words the main type of activity of the company, and in the right table - its digital designation according to OKVED2.

The next step is to record in what units of measurement the report is compiled - in thousands of rubles, or in millions.

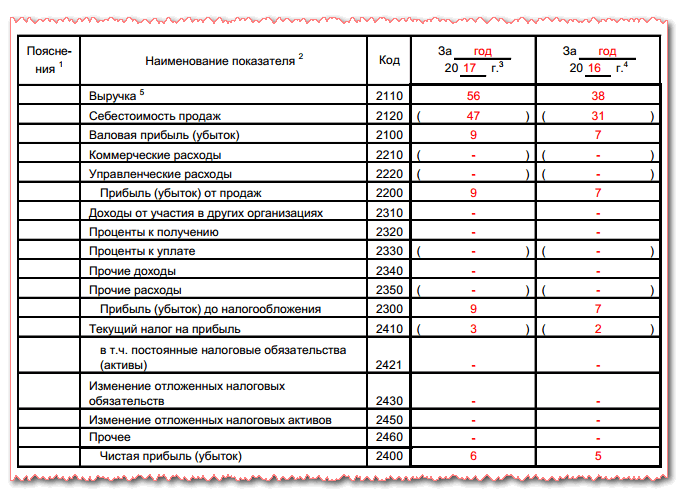

The report is built in the form of a large table, where the rows indicate the necessary indicators of financial activity, and the columns represent the indicators of the reporting period and the previous ones. In this way, data are compared for several periods of activity.

Front page table

Line 2110 represents the income that was received during the reporting period for all activities. This information must be taken from the credit turnover on account 90, sub-account "Income". From this figure it is necessary to remove the amount of VAT received.

Line 2110 represents the income that was received during the reporting period for all activities. This information must be taken from the credit turnover on account 90, sub-account "Income". From this figure it is necessary to remove the amount of VAT received.

Following are the rows in which the total amount of income can be decomposed into individual activities. Small businesses may not produce this transcript.

Line 2120 represents the costs incurred by the enterprise in the manufacture of products or the provision of works, services. For this line, you need to take the turnover on account 90, sub-account "Expenses".

Attention! Depending on the costing method used in accounting, management expenses may also be included in the amount. However, if this is not done, then it is necessary to reflect this indicator further separately on line 2220.

If necessary, then in the following lines you can make a breakdown of all expenses depending on the areas of activity.

Line 2100 represents gross profit or loss. To calculate this indicator, you need to subtract the value from the value of line 2110 lines 2120.

Line 2210 contains the costs that the company has incurred in connection with the sale of its goods, services - advertising, delivery of goods, packaging, etc.

Line 2200 represents the total profit or loss on sales. It is calculated as follows: indicators must be subtracted from line 2100 lines 2210 And 2220 .

Line 2310 contains the organization's income in the form of dividends from participation in other legal entities, as well as other income to the company as a founder.

Line 2320 contains information on the amounts of accrued interest on loans provided by the company.

Line 2330 reflects information about the amount of interest that the organization must pay for the use of borrowed funds.

Line 2340 contains information about revenue from non-core activities - for example, for the sale of materials, fixed assets, etc.

IN line 2350 information on expenses incurred for non-core income should be reflected - for example, the sale or disposal of fixed assets.

IN line 2300 the profit of the company before taxation is recorded. To do this, it is necessary to add up the indicators for lines 2200, 2310 And 2340 , then subtract the data from the result lines 2330 And 2350 .

IN line 2410 the amount of income tax is recorded. It must be indicated on the basis of a completed tax return (for example, on income).

IN line 2421 it is necessary to reflect the value of the permanent tax liability or asset that influenced profit in the reporting year.

IN lines 2430 And 2450 it is necessary to indicate the discrepancies between information on income and expenses in accounting and tax accounting, which are temporary, since their acceptance for accounting will be carried out in different periods.

At the same time, in line 2430 you need to write down the amount of tax that will increase it in the future, and in line 2450- which will reduce it.

IN line 2460 indicators are recorded that have an impact on profit or loss, but are not reflected in the previous columns of the report. For example, this includes fines, sales tax, and so on.

Attention! The amount in this column can be both positive if the turnover on the debit of account 99 is greater than on the loan, and negative - if vice versa.

Line 2400 shows net income. To calculate it, you need to subtract the indicator from line 2300 from line 2410, and then adjust it by lines 2430, 2450 And 2460 .

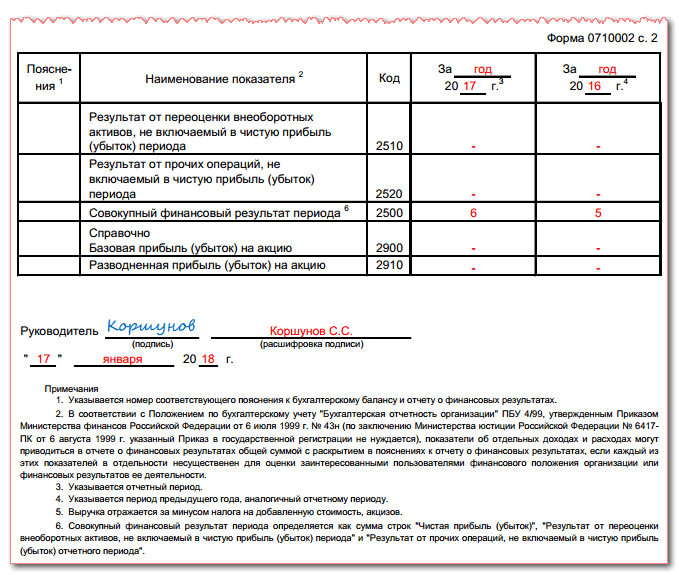

Table on the back

Line 2510 reflects the change in the value of the company's property during the revaluation.

Line 2510 reflects the change in the value of the company's property during the revaluation.

IN line 2520 other results that did not affect the determination of net income should be attributed. These may be, for example, significant errors of the previous year, which were identified only after the approval of the statements for the current reporting year.

Line 2500 shows the cumulative result. You need a result to get it. lines 2400 adjust for row indicators 2510 And 2520 .

Lines 2900 And 2910 are filled in for reference and include information on basic and diluted earnings or loss per share.

At the end, the documents must be signed by the head and the date of its signing is affixed.

How to fill in the income statement in a simplified form line by line

The profit and loss statement, under certain conditions, can be drawn up in a simplified form. Its main difference from the standard type of this report is that it includes much fewer indicators that are typical for most business entities.

This is also due to the fact that enterprises that generate reports on this type do not have specialized indicators reflected in full form, for example, income from participation in the activities of other organizations.

The simplified income statement includes:

- Organization revenue ( page 2000).

- The company's expenses for the main activities.

- Interest paid by the firm for the use of funds from borrowers and creditors (p. 2330).

- Other income.

- Other expenses (line 2350).

- income tax. Here it is reflected already with all deferred and permanent tax assets and liabilities taken into account.

- Net income (line 2400).

Attention! At the same time, the existing algorithm for calculating the values of the income statement lines in the full form is also valid for the simplified one, so it should not cause difficulties for the accountant.

Common mistakes when filling out form 2 of the balance sheet

The main mistakes when filling out form 2 of the balance sheet:

- Most of the inaccuracies and errors in the preparation of the income statement for accountants arise due to arithmetic calculations according to the algorithm established by law. In this regard, when preparing reports, it is recommended to use specialized complexes and services in which, when substituting the necessary values, the remaining lines are calculated automatically.

- Most often, when filling out form No. 2, an error occurs, the essence of which is that the accountant, instead of revenue minus the accrued VAT, substitutes in the appropriate column the entire amount of receipts from buyers and customers.

- Regulations on accounting and tax legislation presuppose the division of the company's income into groups. In this regard, the report shows the company's income in several lines.

- It is quite common for accountants to misidentify the amounts of receipts that are recognized as income, and therefore erroneously report these amounts on the income statement. For example, income from participation in other companies or interest receivable may be included in the "Other income" line when the report structure provides for separate lines for them.

- Many specialists forget to take into account the provisions of the Accounting Regulation “Accounting for income tax”, and omit the reflection in the report of deviations between tax and accounting for determining profit.

- The income statement provides for a reference section in which indicators must be entered to clarify individual articles in Form No. 2. It must be remembered that if you specify in full all the necessary information.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, Form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children