Preparation of annual reports 2-NDFL in the program 1C Salary and personnel management.

Certificates of annual reporting 2-NDFL must be submitted by April 2, 2012, since April 1 falls on a day off. The date of submission of information on paper or in electronic form is the day the information is provided to the Inspectorate or the date of sending by e-mail.

Let's take a step-by-step look at checking the system's readiness for annual reporting.

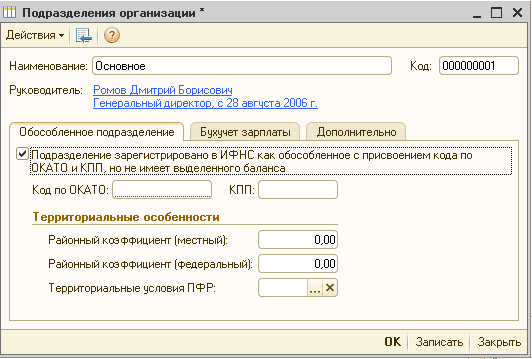

1. If the organization has separate divisions, then it is necessary to check that they contain the completed details of OKATO and KPP

If changes have been made to OKATO and KPP, it is necessary to reconsider all documents related to the calculation of personal income tax.

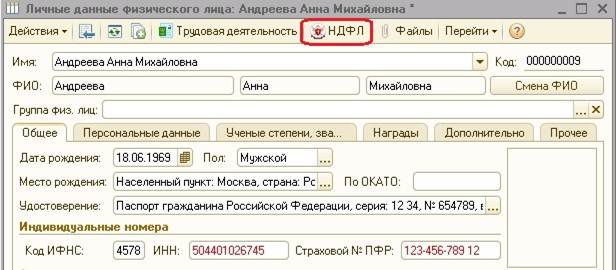

2. It is necessary to double-check all the data of individuals, address, series and passport number. If the address classifier was not installed when entering the address, then it is necessary to install it and select the addresses again.

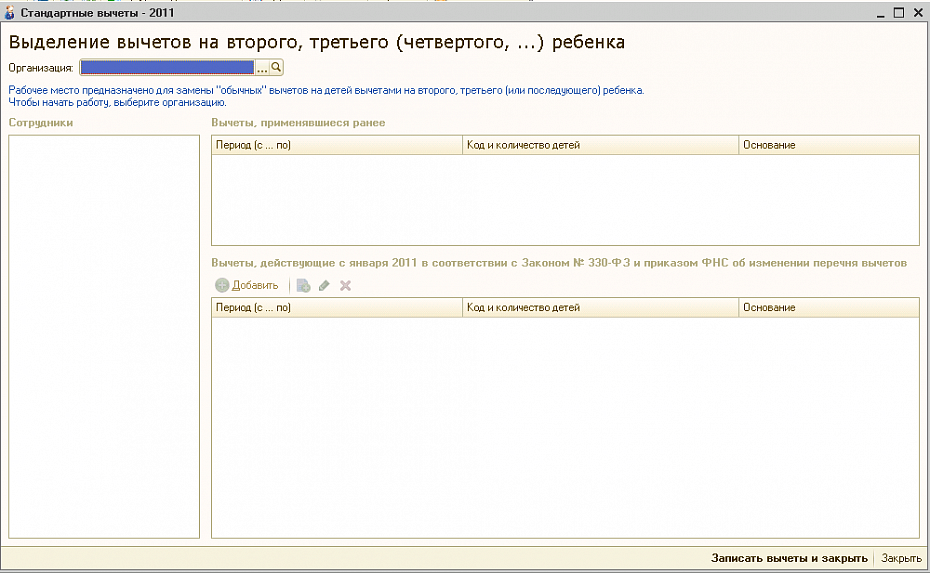

3. We check whether all the deductions to which the employee of the organization is entitled are entered. If an employee with three or more children works in an organization, then we remember that on the basis of the Federal Law of November 21, 2011 No. 330-FZ, a deduction of 3,000 rubles is established. from 01.01.2011

You can change the deduction directly from the directory of individuals by clicking on the button "Individual Income Tax" in the element of the directory "Individuals"

But if there are a lot of such employees, then it is convenient to use the processing “Standard deductions 2011”. Interface "Payroll of organizations", menu "Taxes and contributions" → "Editing deductions for children since 2011".

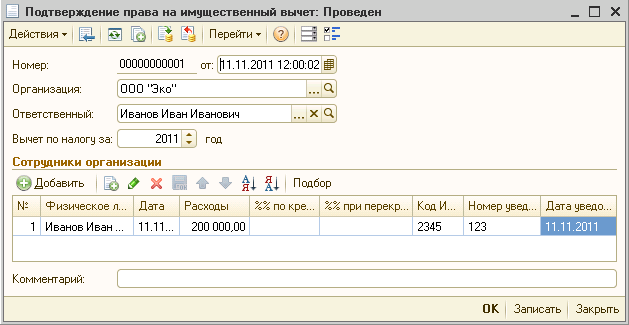

If the organization has an employee entitled to a property deduction, then after receiving from the employee an application for a property tax deduction based on Article 231 of the Tax Code of the Russian Federation, which entered into force on January 1, 2011, it is necessary to return the overpayment to the taxpayer. To do this, you need to create a document “Confirmation of the right to property deduction” Interface “Payroll of organizations”, menu “Taxes and contributions” → “Confirmation of the right to property deduction”.

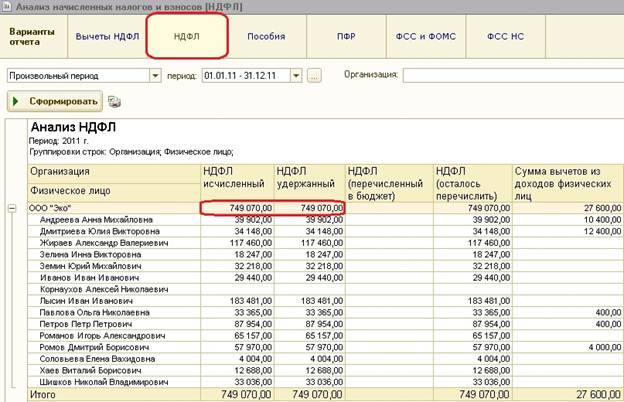

4. It is necessary to check the equality of the calculated and withheld tax.

This can be done using the "Analysis of accrued taxes and contributions" report. Interface "Payroll of organizations", menu "Taxes and contributions" → "Analysis of accrued taxes and contributions".

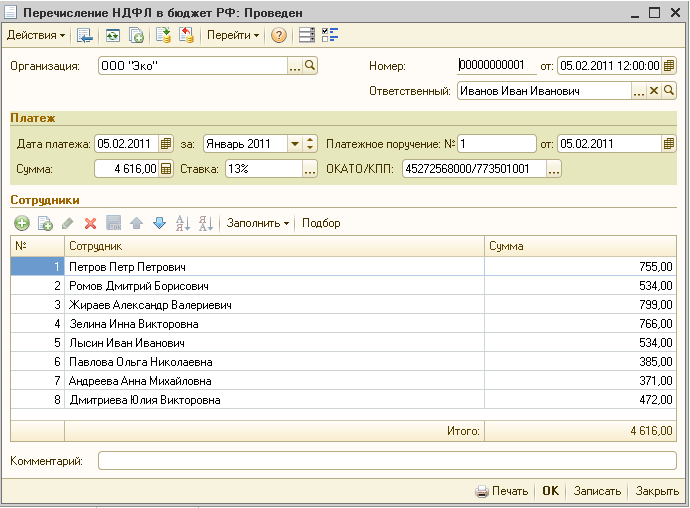

In 2011, in addition to information on the accrued and withheld tax, it is necessary to submit information on the transferred tax. The amount of tax transferred is the amount that was actually transferred to the budget system. This amount in the program 1C "Salary and personnel management" is registered using the document "Transfer of personal income tax to the budget". The amount is distributed in proportion to the amounts to be transferred for each individual. The document "Transfer of personal income tax to the budget" can be found in the menu "Payroll of organizations" → "Taxes and contributions" → "Transfer of personal income tax to the budget".

Fill in the required details in the document. Payment dates must be set no earlier than the first day of the month following the billing period. Before carrying out, it is necessary to set the actual date of payment in this requisite. Also, if this document needs to be entered separately for each OKATO and checkpoint, and in the context of personal income tax rates. So, for example, if there are employees who receive dividends, then a separate document “Personal income tax transfer to the budget” must be entered for them at a rate of 9%.

Automatic filling of the document is possible using the button "Fill" - "Phys. income earners."

If after filling out the document there were any changes with the accruals of employees, then it is necessary to update the data on the amount of tax to be transferred using the "Fill" → "Tax amounts" button.

5. After all the documents "Transfer of personal income tax to the budget" have been created, it is necessary to check the equality of all 3 amounts (accrued, withheld, transferred). You can also check this using the "Analysis of accrued taxes and contributions" report.

After everything is checked, you can generate reports. In the 1C program “Salary and personnel management”, you can use the processing “Preparation of data on personal income tax for transfer to the tax authorities” (Interface “Payroll of organizations”, menu “Taxes and contributions” - “Preparation of data on personal income tax” or simply create a report “Help 2-NDFL for transfer to the IFTS” (Interface “Payroll of organizations”, menu “Taxes and contributions” → “Help 2-NDFL for transfer to the IFTS”).

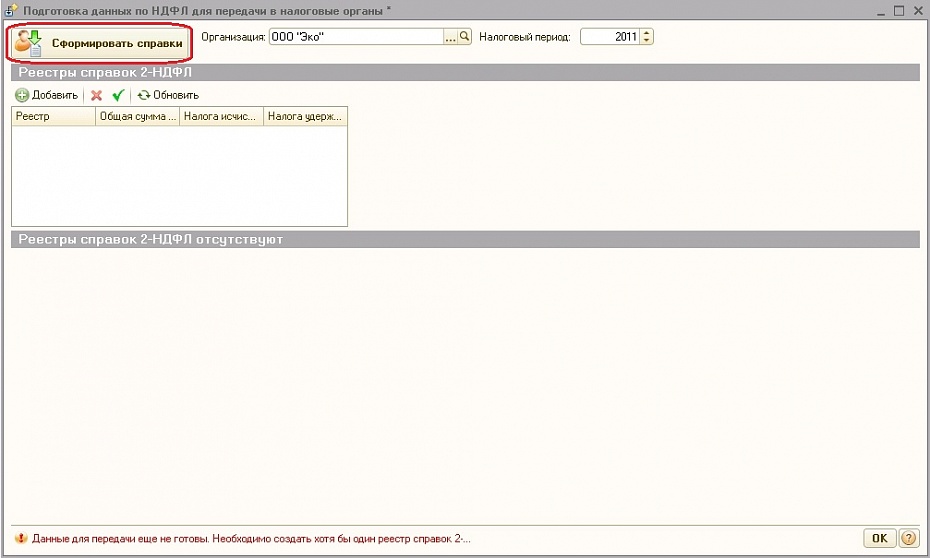

Consider the Preparation of a report using the processing "Preparation of personal income tax data for transfer to the tax authorities."

When you first open the processing, an empty window opens, you must select the organization for which the report will be generated, the reporting period and click on the "Generate references" button.

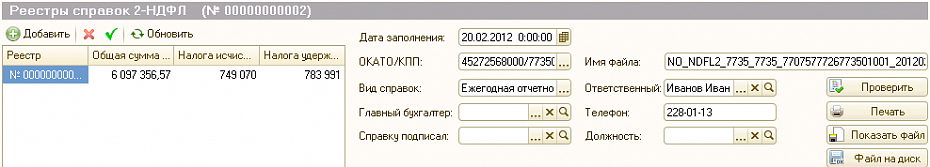

As a result, registers of 2-NDFL certificates for the specified period will be automatically generated for all OKATO codes of departments in which employees received income. In the section registers of 2-NDFL certificates, existing in the information base and / or newly created documents “2-NDFL certificate for transfer to the IFTS” and all the necessary details are shown.

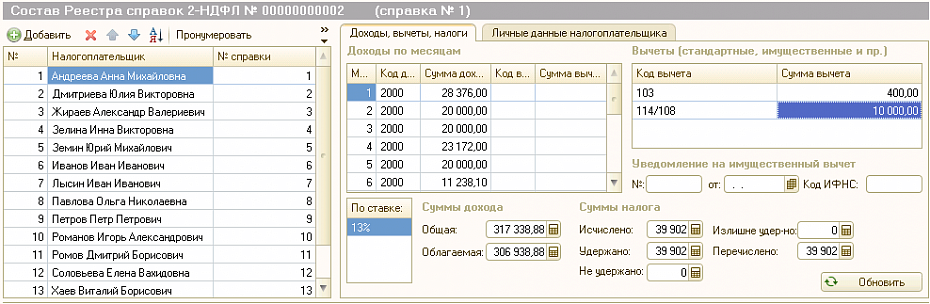

The section "Composition of the Register of 2-NDFL Certificates" shows data on the selected register: a list of employees. On the “Income, deductions, taxes” tab, you can see employee income broken down by months and income codes, deductions provided to the employee, the total amount of income and the taxable amount of income, as well as the calculated, withheld and transferred personal income tax.

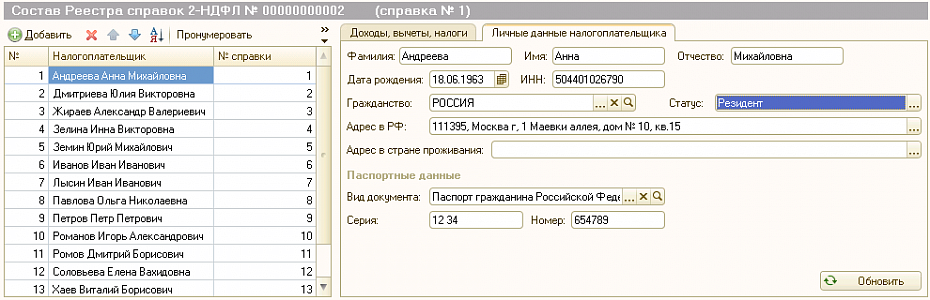

The taxpayer's personal data tab shows data on citizenship, date of birth, status and taxpayer, as well as his address. If in the process of working with the preparation of certificates there were changes with the income or personal data of an individual, then you must click on the "Update" button.

The completeness and correctness of filling in the data can be checked by the commands of the "Check" button. The “Print” button is intended for printing documents, you can view the generated files by registers by clicking the “Show file” button, and the “File to disk” button is intended for generating files and writing to disk.

You can finish processing with the OK button. After all the reporting has been sent and accepted, you can return to the Created certificate, post it and put the "Accepted by the IFTS" flag.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Several Ways to Optimize Windows XP

- How to disable Adobe Flash in your browser Adobe flash player is disabled how to enable

- Screenshot - what is it and how to take a screenshot

- Create a Microsoft account - complete instructions

- Why does pineapple burn your tongue and teeth?

- Which humidifier to choose: a detailed guide

- Wishing you a good day and mood in your own words

- Where does the ostrich live and what does it eat?

- What do chinchillas eat at home - lists of allowed and prohibited foods