Information about the average number of employees: who should submit it, when, how to fill it out

Business entities of any form of ownership are required to annually send information on the average number of employees to the regulatory authorities. This element plays a crucial role in economic activity - for example, it is on its basis that organizations are classified according to the size of the business. Therefore, the population value is included in a large number of reports that are sent to statistics and the tax service.

The average headcount is a specially calculated element that reflects the average number of employees working in a business entity in a particular time period.

This value must be calculated by each business entity that has hired employees. The time period for calculation, depending on the need, can be chosen by any - month, quarter, half year, year, etc.

But even when calculating different time intervals, the technology for obtaining the indicator does not change from this.

In 2014, an indulgence was made for entrepreneurs - now they can not draw up information on the average number of employees if they do the work on their own, without hiring third-party workers.

Attention: one of the important areas of application of the obtained element is the division of business entities into groups, based on the number of employees involved. And this, in turn, will determine the possibility of using one or another tax preferential regime. Also, payroll is used to determine the average salary for the organization.

The period of storage of the report in the archive of the business entity is 5 years.

Deadlines for submitting the report on the average headcount in 2019

The day by which a business entity is required to submit a report on the average headcount to the regulatory authorities depends on the functioning of the entity itself:

- Individual entrepreneurs and firms that have been operating for a long time are required to submit a report by January 20 of the year that follows the year of the report. If such day falls on a weekend or holiday, the deadline is shifted forward to the first business day. In 2019, January 20 is a Sunday, so the report must be submitted by January 21, 2019.

- The average headcount for newly established organizations must be submitted by the 20th day of the month following the month in which the company was established. The second time you will need to send a report on schedule, at the end of the calendar year. Thus, for the newly created LLC, two dates are determined on which in the first year of its existence it will be necessary to submit a report.

- If an individual entrepreneur or company is closed, then the final report must be submitted on the day the business entity is removed from the state register.

Where is the reporting

The law says that a company must submit a report on the average headcount to the Federal Tax Service, which is located at its location. In the case when the company has branches or separate divisions, all information is summarized in a single report, which is transmitted by the parent company.

Individual entrepreneurs who have employees must send a report to the address of their registration or actual residence.

Attention: if an individual entrepreneur is registered in one subject, and conducts activities in another, he must still submit a report on the number to the Federal Tax Service at the address of his registration.

Ways to submit information

This form is allowed to be submitted both in paper form and in electronic form, there are several ways to submit it:

- You can hand over the completed report on paper personally to the inspector, or through a trustee with a power of attorney. The form must be made in two copies, one will remain with the Federal Tax Service, and the second with a mark of receipt will be returned back to the business entity;

- Sending by mail in an envelope using a registered letter;

- Through the Internet, using the services of EDI. In this case, the file itself must be signed with a qualified signature.

Attention: in some regions, when submitting a report on paper, it is also required to provide a file on a flash drive or other media. Before visiting the government agency, it is recommended to call and clarify this need.

Download the form and a sample of filling out the form UND 1110018

Files:

How to fill out a report in the form of KND 1110018

The form KND 1110018 is not very difficult to fill out. But before doing this, you need to determine the very value of the average number according to the list.

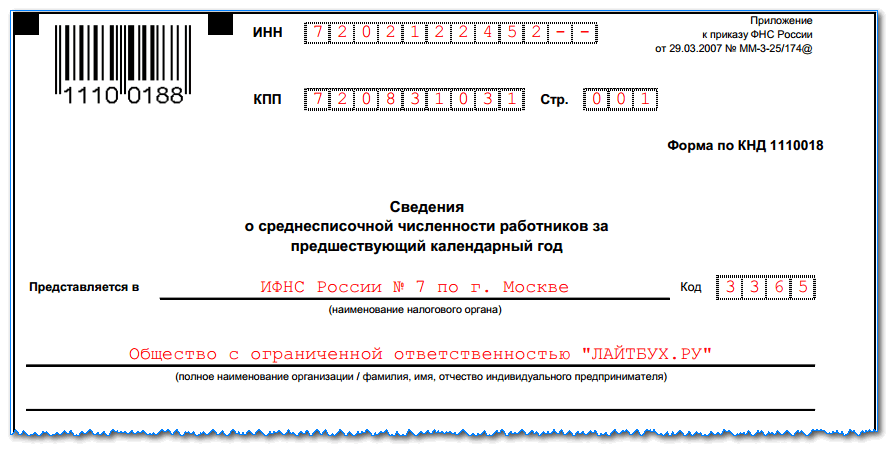

At the top of the form, the TIN and KPP codes are affixed, and next to it is the sheet number. It will always be 001. It must be remembered that if a company fills out the form, it will have two empty cells in the TIN field, which you just need to cross out. If the report is compiled by an individual entrepreneur, then he will not have a checkpoint code, which is also completely crossed out.

At the next stage, the Federal Tax Service enters into the document, where the form is sent - first this must be done in words, and then put down the code in numbers.

At the next stage, the Federal Tax Service enters into the document, where the form is sent - first this must be done in words, and then put down the code in numbers.

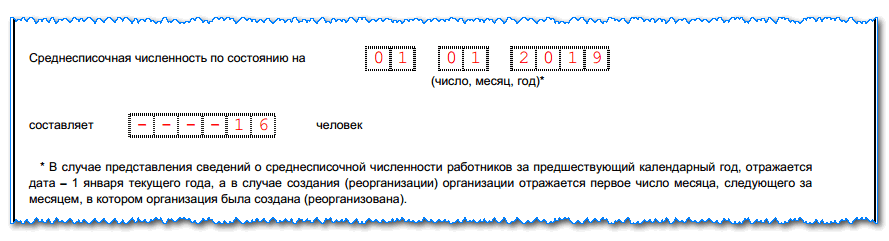

The next step is to enter the date as of which information is provided:

The next step is to enter the date as of which information is provided:

- In the case when a planned annual report is prepared, then January 1 of the current year is entered here.

- If the report is submitted due to the creation of a business entity, or its closure, then here you need to specify the 1st day of the month following the month of this event.

The next line contains the field in which you want to enter the number. It is filled from left to right, if any cells remain empty, they must be crossed out.

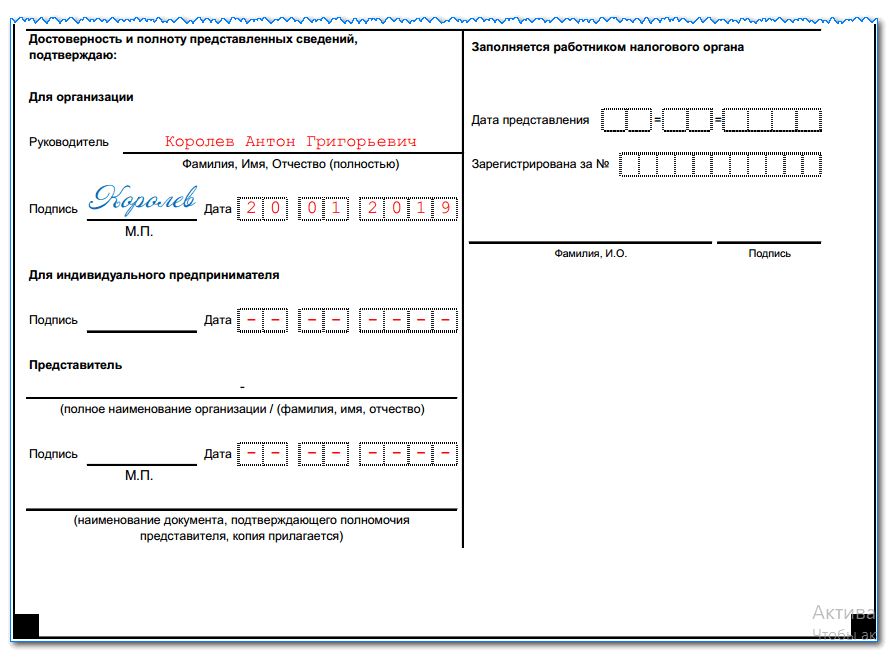

The lower part of the report is divided into two parts, the business entity needs to fill in only the left column.

Filling depends on who provides the completed form:

Filling depends on who provides the completed form:

- The director himself puts down his full name, the date of submission of the document and endorses with a personal signature;

- The entrepreneur must indicate the date of delivery and endorse with a signature;

- In the case when the report is submitted by proxy, it is necessary to indicate the full name of the authorized person or the name of the company. The date of delivery is also indicated and everything is endorsed with a signature. In the lower column, you must put down the data on the executed power of attorney. The power of attorney form itself is attached to the form as an attachment.

How to calculate the average number of employees

The implementation of such a calculation at the enterprise, as a rule, is performed by an accountant or a personnel officer.

Since this indicator is of great importance for the activities of the organization, its calculation must be approached with all responsibility, since the high accuracy of its determination must be observed.

After all, on the basis of the result obtained for the company, the possibility of using a preferential tax regime can be determined. Also, the supervisory authority has the right to double-check the correctness of the calculation at any time.

The data for calculating the indicator are selected from documents on time recording, orders for the admission, dismissal of employees and other similar forms.

Most accounting computer programs calculate the indicator automatically, based on the data entered into them. But even in this case, it is recommended to double-check the calculation, as well as the sources of information.

The employee must understand the process of calculating the indicator in order to check it at any stage.

Step 1. Calculation of the number of employees on each day of the month

At this step, you need to determine the number of employees who on each day of the month had valid labor agreements with the business entity. This number necessarily includes employees who are sick that day, are in, or went on a business trip.

The following people are also excluded from the calculation:

- If they carry out labor activities as part-time workers (they are taken into account at the main place of work);

- Performing work on;

- Employees who are on maternity leave or take care of children under 3 years old;

- Employees who work part time. At the same time, if this condition is established due to legal restrictions, then it is necessary to take them into account.

On weekends and holidays of the month, the number of employees must be taken in the same quantity as they were on the previous working day. Several nuances come out of this - if an employee quit on Friday, then he will still be present on Saturday and Sunday in the headcount calculation.

Attention: if the company does not have a single employee involved, but has an appointed director (even if he is not paid a salary and no deductions are made), the number of 1 person is indicated for each day of the month.

Step 2. Determining the monthly average number of full-time employees

This step determines the number of employees on each day of the month who work the whole working day. Further, this number is divided by the number of calendar days in the month of calculation.

SCHpol=(NUM1+NUM2+…+NUM31)/DAYmonth, where

SSCHpo l is the average number of employees with a full working day per month;

NUM1, NUM2, NUM3- is the number of full-time employees for each calendar day of the month;

DNImonth- the number of days according to the calendar in the month of calculation.

The resulting indicator must be rounded according to mathematical rules to the hundredth decimal place.

Calculation example. July 2017 has 31 calendar days. From the 1st to the 14th, 38 people worked in the company, from the 15th to the 22nd - 37 people, from the 23rd to the 31st - 41 people. Let's define the number.

The average number of full-time employees is:

(14x38 + 8x37 + 9x41) / 31 \u003d 38.61 people.

Step 3. Determining the monthly average number of part-time employees

To calculate this indicator, you need to determine the total number of hours that part-time employees worked per month. If one of them had a period of vacation or illness in the month of calculation, then for these days the number of hours is set according to the previous working day.

After the number of hours is determined, the number is directly calculated. To calculate it, you need to divide the sum of hours worked by the product of the number of working days in a month and the norm of working hours for a full day of work.

SCH hour= HOUR/NORD*NORhour, where

SCH hour- the average number of part-time workers per month,

HOUR- the number of hours that employees worked part-time in total,

NORDn- number of working days in a month

NORhour- fixed standard working hours. If the firm works on a 40-hour week, then its value is 8 hours, with a 32-hour week - 7.2 hours.

The result must also be rounded to the nearest hundredth.

Calculation example. Part-time workers worked a total of 242 hours in July. The company works on a 40-hour working week, the number of working days in July is 22.

Number calculation: 242/(8*22)=1.38 people.

Step 4. Determine the average monthly number of all employees

This indicator is obtained by adding the previously obtained number of full-time and part-time employees.

The following formula is used for the calculation:

SCHmonth\u003d SCHpol + SCHh, where

SCHmonth- total average number per month;

SCHpol- monthly number of full-time workers;

RSCHhour- monthly number of employees working in the partial day mode.

The final result must be rounded to an integer according to the requirements of mathematics. This means that a total less than 0.5 is discarded, and more than this value is rounded up to 1.

Calculation example. Using the values obtained earlier, we find the number for the month:

38,61+1,38=39,99

This value should be rounded up to 40.

Step 5. Calculation of the annual average number of employees

To determine this indicator for the year, you need to take the calculated values of the average number for monthly periods. When calculating this indicator, it is necessary to add up all the monthly values of the average headcount and divide the result by the number of months - by 12.

SSChg\u003d (SCHya + SCHf + ... + SCHd) / 12, where

SSChg- an indicator of the average headcount for the year under review.

SSC, SSChf, etc. - the average number for January, February, March, etc.

The indicator of the average headcount should not include fractional numbers, therefore, according to the rules of mathematics, it must be rounded after calculation.

The legislation provides for the specifics of determining the average headcount for enterprises registered in the current year.

Attention: the peculiarity of this method suggests that for the calculation it is necessary to summarize the indicators of the average headcount only from the moment the company was opened. However, in the denominator of the formula, it is still necessary to put the number of months - 12. This value is not adjusted taking into account the period of the organization's activities.

The indicator of the average headcount is also used in interim reporting, which is submitted for a quarter, half a year, 9 months. The above formula can be used to determine these values.

Only the data is taken for the required number of months, and in the denominator it is necessary to set the figure corresponding to each calculation period. For example, for quarterly numbers - 3, semi-annual - 6, 9 months - 9.

Penalty for not submitting information about the average headcount

The responsibility of an economic entity for the late submission of reports containing information on the average headcount, as well as for failure to submit this form, is established by the Tax Code of the Russian Federation.

The amount of penalties that can be imposed on a business entity for violating the law and failing to submit a report is set at 200 rubles.

The law stipulates that these penalties may apply to a responsible employee who is entrusted with the functions of preparing and sending reports on the average number to the Federal Tax Service Inspectorate. The fine for him can vary from 300 to 500 rubles.

Do not forget that there is also one point - if the subject was held liable for violating the deadlines or not submitting a report on the average number, then the obligation to submit it remains with him anyway.

Important: for repeated violations, the regulations establish a two-fold increase in penalties.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, Form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children