SZV-STAGE: who should hand over, in what time frame, sample filling

The innovations that occurred during the transfer of administration for the calculation and payment of insurance premiums from the Pension Fund of the Russian Federation to the tax authorities led to the introduction of SZV-STAZH new reporting for all employers. This form is required to be completed by all entities that have employees and individuals involved under civil contracts, and is used by the PFR as a source of information about their experience.

Previously, the functions of the new report were performed by the RSV-1 form, which included data on the period of work at the employee's enterprise. Since this year, this register has been cancelled.

Since the PFR still has the obligation to record the length of service of employees in order to calculate their pension, the authority introduced a new form of SZV-STAGE, which must be submitted at the end of the reporting year. It includes information about the period of labor activity of a person at the enterprise.

If you look closely at it, you will immediately notice the similarity of this report with SZV-M - a form put into effect last year to record working pensioners.

At the same time, SZV-STAZH has more detailed information, with fixing the dates of the beginning and end of work during the year, as well as indicating and decoding the periods when the employee did not work, but the place for him at the enterprise was preserved.

Attention! In addition, it provides for the obligation of the employer to give SZV-STAZH upon dismissal of an employee in his hands. The accountant must fill out this report only for this employee, print it out, certify it and hand it over.

In addition, the report must contain information on the accrual and payment of contributions. Since this information is currently submitted by employers to the tax office, the FIU remains without this information.

When an employee retires, it is necessary to send the SZV-STAZH form to the FIU so that this body receives all the necessary information to assign a payment.

Who must submit the SZV-STAZH form

The legislation establishes a list of persons who must submit the SZV-STAZH report:

- Organizations of all forms of ownership that have employment contracts, fixed-term employment contracts and civil law contracts (GPC) with individuals, including their branches and representative offices.

- Entrepreneurs, as well as lawyers, notaries, licensed detectives who carry out private practice, when they use outsourced workers.

Attention! Thus, this reporting must be compiled and submitted by all employers for employees and persons in whose favor remuneration is paid, on which insurance premiums must be calculated.

Terms of delivery of SZV-STAZH in 2019

The SZV-STAZH form refers to annual reporting, which, in general, the organization must submit once a year, after its completion. At the same time, at the legislative level, a deadline is set by which date to hand over for the previous year - until March 1 of the next year for the reporting year.

Attention! Thus, for 2018, reporting must be submitted before March 1, 2019. In addition, this form must be issued to employees upon dismissal.

This report is also subject to the rule of postponing the deadline to the next business day if it falls on a weekend or holiday. Therefore, since March 1 falls on a weekend, the deadline is postponed to March 2, 2018.

In addition, the deadlines for issuing a SZV-STAGE are determined for:

- When an employment contract with an employee is terminated - on the final day of the employee's work, along with the rest of the documents required to be handed over.

- When an employee retires, the employer must send the SZV-STAZH to the PFR body within three days from the date of receipt of the request.

Where is the reporting

The rules of law establish the obligation to submit the SZV-STAZH form:

- For individual entrepreneurs - at the place of their registration indicated in the passport;

- For legal entities - at their location;

- For branches, representative offices - at the address of the location of these structural units.

Reporting methods

You can send this report in several ways:

- A paper report can be submitted directly to the representative of the FIU. To do this, you need to fill it in two copies. It is best to draw it up on a computer using specialized programs so that you can generate an electronic file, which in this case also needs to be transferred.

- Through an electronic document management system for entities with more than 25 people involved. For this method, it is necessary to have, as well as draw up an agreement with a special communications operator. The bulk of employers must submit the SZV-STAZH form in this way.

Important! Reporting on paper is possible only if the number of insured persons is not more than 25 people.

Features of filling out the SZV-STAZH form upon dismissal

The current rules of law determine the obligation of the employer to issue the SZV-STAZH form to the employee on the day the agreement is terminated. If it is formed by the enterprise on the basis of the year, all employees of the company are included in it.

In the case when it is compiled upon dismissal, the information included in this report should relate only to the dismissed employee in order to prevent the disclosure of personal information of other employees, which is considered a violation.

When compiling this report for a dismissed employee, he is assigned the status "Initial", the number of the current year is affixed, which is also the year of dismissal.

The tabular part indicates the date of commencement of work (if the employee has been working since the beginning of the year, then the day of its beginning is indicated), and the date of completion of the employee's labor activity at the enterprise.

If the contract is terminated with an employee on December 31, then the corresponding mark is made in column 14.

When the SZV-STAZH form is drawn up upon dismissal, sections 4 and 5 do not need to be completed.

Report submission form

The SZV-STAZH form combines information about the economic entity itself, as well as information on each employee or individual in whose favor the amounts for which insurance premiums need to be calculated were accrued during the year.

Attention! A mandatory annex to the annual report is an inventory in the EFA-1 format, which is a document that also contains basic information about the insured, as well as general data on the calculated and transferred contributions, as well as the number of insured persons.

Form and sample form SZV-STAZH in 2019

Sample filling SZV-STAZH

Let us consider in more detail how the SZV-STAGE is drawn up.

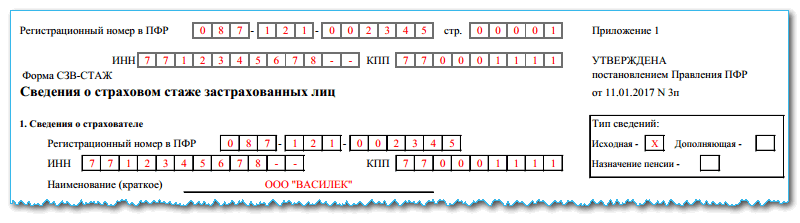

Section No. 1 - Information about the insured

In the line with the registration number, enter the number assigned by the FIU to the employer at the time of its registration with this department.

Further, information about the TIN and KPP of the business entity is reflected. If the employer is an individual entrepreneur, his number should consist of 12 characters, and there should be no checkpoint code. If the policyholder is an organization, its TIN includes 10 digits, and two empty cells are crossed out.

The abbreviated name of the company is reflected below, and for an individual entrepreneur - his full personal data (full name). This information must correspond to the constituent documents of the subject.

In the column "Type of information" should be reflected:

- "Initial" - when the SZV-STAGE is sent by the subject for the first time;

- "Additional" - in the case when the original report is supplemented by a new one.

- “Assignment of a pension” - when the SZV-STAGE is issued for an employee retiring.

Section No. 2 - Reporting period

There is only one column in which you must enter the number of the year of the report.

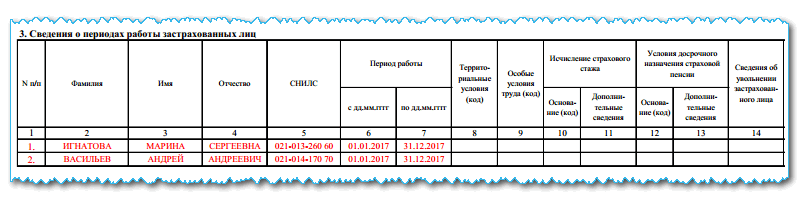

Section No. 3 - Information on the period of work of the insured persons

The specified section has a tabular form, and it is necessary to record line by line information about employees with whom the organization had labor agreements or civil contracts during the reporting period.

In the columns "Last Name", "First Name" and "Patronymic" personal information about the employee is indicated.

Next comes the SNILS column, where the insurance number assigned to the employee in the Pension Fund is recorded.

The column "Work period" includes two separate columns - the start date and end date of the work period. If the employee worked the whole year, then the first and last days of the year are entered here.

If one of the employees needs to show several labor periods (for example, he quit and got a job several times during the year), then they are written in separate lines one under the other. However, the columns with personal data and SNILS are indicated only once - in the first line, and then they are left empty.

When an employee retires, the end date is the estimated date of that event.

If work was performed under a civil contract, then the period of its validity is recorded. If the payment for the work was made in full, then in column 11 the code “AGREEMENT” is recorded, if not, “NEOPLDOG”, “NEOPLAVT” must be entered here.

A code is written in the column "Territorial conditions" if the work was carried out in special environmental conditions. All possible codes can be found in Appendix 1.

A code is entered in the column "Special conditions" if the employee carried out activities in dangerous or harmful conditions that give the right to issue a labor pension ahead of schedule. Possible codes can be seen in Appendix 2.

In the column "Information on the dismissal of the insured person" a mark is made only if the date of dismissal fell on December 31.

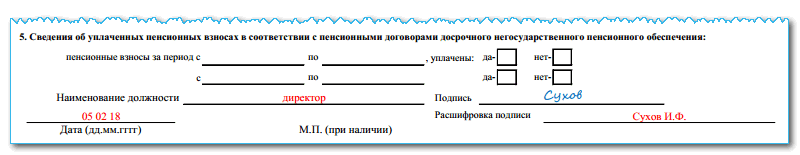

Section No. 4 - Information on accrued (paid) insurance premiums for compulsory pension insurance

This section is filled out only if the report is submitted for persons retiring. It includes two questions, and they must be answered by ticking the box.

Section No. 5 - Information on pension contributions paid in accordance with pension agreements for early non-state pension provision

It is also necessary to enter information in this section only when the employee retires. Here you need to write down the periods for which accruals were made, and also answer the question by putting a mark - whether contributions were transferred for the indicated periods.

Form and sample inventory of EFA-1

Download in Excel format.

Download in Excel format.

Sample filling in the inventory of EFA-1

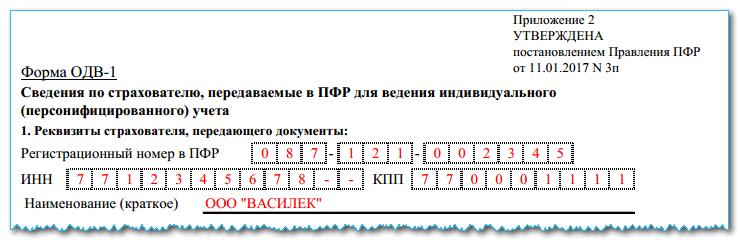

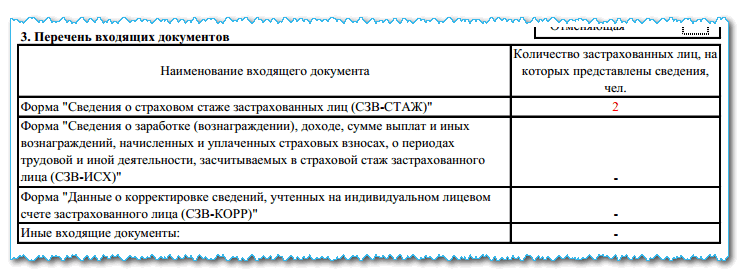

Directly along with the fully completed SZV-STAZH form, the organization is still required to draw up and send an inventory to it in the form of EFA-1. There is a summary of all the proposed information.

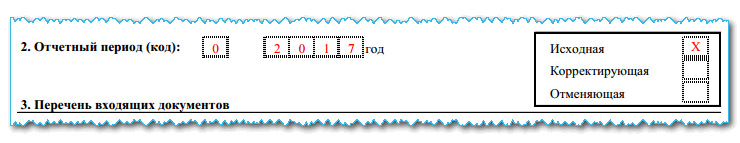

A compiled inventory can be assigned one of three types:

- "original".

- "Corrective".

- "Cancelling".

To do this, you must mark the empty column with an “X” opposite the selected type.

Section 1 - it contains the details of the organization. Filling in is carried out according to the same principle as Section 1 in the SZV-STAGE form itself.

Section 2 - the field "Reporting period" should always contain "0", but in the field "Year" the number of the year of the report of four digits is recorded.

Section 3 - the total number of employees for whom information is transmitted in the SZV-STAGE form is entered here;

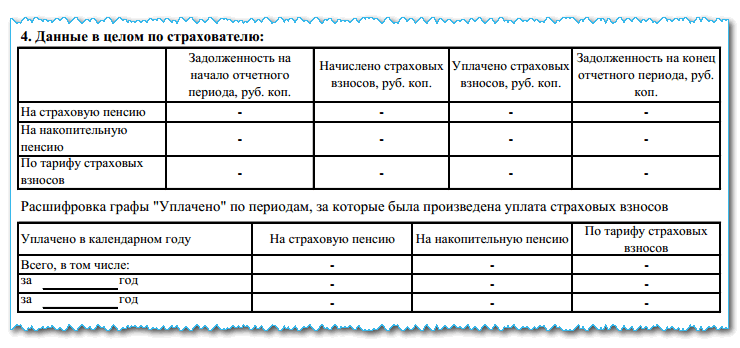

Section-4 - information must be entered here only if information is submitted with the types of SZV-ISKh and SZV-KORR and the mark "Special". The data specified here must contain information for the entire period for which the report is issued.

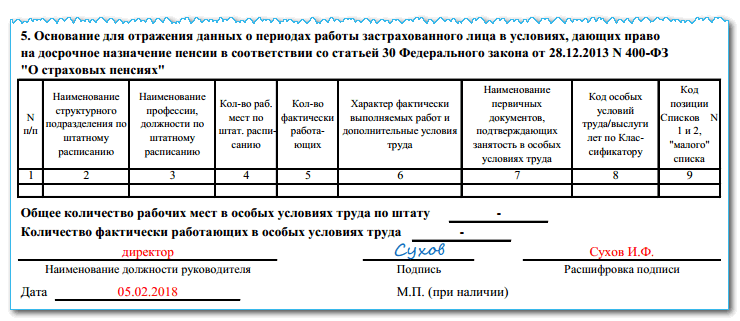

Section 5 - information is entered in this section if data of the SZV-STAZH or SZV-ISH types is transmitted for employees who, due to work in difficult or harmful conditions, have earned the right to receive pension payments ahead of schedule.

At the end of the form, the director must sign in the appropriate field and put the date when this was done.

Zero reporting on the SZV-STAZH form?

According to the approved rules for submitting a report, it must be sent to the PF in the event that an organization or entrepreneur has a valid labor agreement with at least one employee. In the event that a self-employed citizen, entrepreneur, lawyer, notary and other employees do not have employees, then they do not need to draw up and submit a document.

This decision is also supported by the fact that the very structure of the report implies the presence of at least one line with information about the employee, and if there is none, then this form will no longer be able to pass error control.

In relation to companies, this cannot be clearly defined. The thing is that the company initially has one employee - the director, information about which is specified in the Charter. It follows that if the company has not signed a single employment contract, even with the director himself, then it is not necessary to draw up a report and send it, as well as include the head there.

Attention! On the other hand, if there is a signed agreement between the director and the company, but no activity is carried out, a report must be drawn up. In this case, only one person will be indicated there - the head.

Such problems also arose when the SZV-M form was introduced, however, in that situation, the PF quickly issued clarifications on how to act in such a situation. As for the new report, no official comments have yet been made.

Penalties for not submitting a report or for not issuing upon dismissal

The law provides for several types of fines, depending on the circumstances under which the violation was recorded:

- The report was sent in full, but after the due date - 500 rubles each. according to information for each employee, the deadline for which was violated;

- The report was sent on time, but it did not include data on individual employees - 500 rubles each. according to information for each employee, information on which was not submitted;

- The report was sent in full, and within the time limits established by law, but during the check it turned out that for some employees false information was indicated - 500 rubles each. according to the information for each employee whose data is incorrect.

There are also several other penalties associated with this reporting:

- If the report was submitted in paper form, while the organization is obliged to submit it only electronically - 1000 rubles;

- When the employee was dismissed, he was not given a report with his information on deductions, or when the employee retired, the report was not sent to the FIU within 3 days - 50,000 rubles.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children