Application for registration of an individual entrepreneur in the form p21001: instructions for filling out

An individual can decide to carry out his activities without creating an organization as an individual entrepreneur. To do this, he only needs to draw up an application for which the P21001 form is provided, and submit it to the registration authority at the place of his registration. In this case, registration takes place according to a simplified procedure.

You can draw up an application to the tax authority using several methods.

The easiest way is to use specialized software systems or services on sites that allow you to automatically fill out this document, then print it in two copies and take it to the IFTS. The entrepreneur is only required to enter the data provided for by law once, which the program will substitute in the necessary sections.

In addition, the P21001 form can be purchased by an individual in a printing house or in a stationery store. Its future SP can fill in on their own using a pen. But in this case it is necessary to use only the colors of the ink provided by the legislation.

The main requirements for drawing up an application in the form of P21001 are determined by order of the Federal Tax Service, they include:

- Form P21001 should be filled in when drawing up a document by hand only with black pen. You must use uppercase letters written using printable characters. They must be entered each in a separate cell. Fulfillment of this requirement makes it possible to process this form in automatic mode.

- When using computer fill, the Courier New font size 18 must be observed.

- When information is entered into the form, it is necessary to use the rules established by law for abbreviations, word hyphenation, as well as date formats.

- The order of the Federal Tax Service prohibits making any corrections to the document form P21001, if an entrepreneur notices any inaccuracies or errors, he needs to reissue the page on which they were found.

- The application consists of a certain number of sheets that are filled in as needed. However, any sheet should only contain one page. Double-sided filling is not allowed.

- If the sheet remains blank, then it can be excluded from the P21001 form.

Sample and application form for Form P21001 for 2019

Sample of filling out the form Р21001

Let's take a closer look at the form P2100 filling sample.

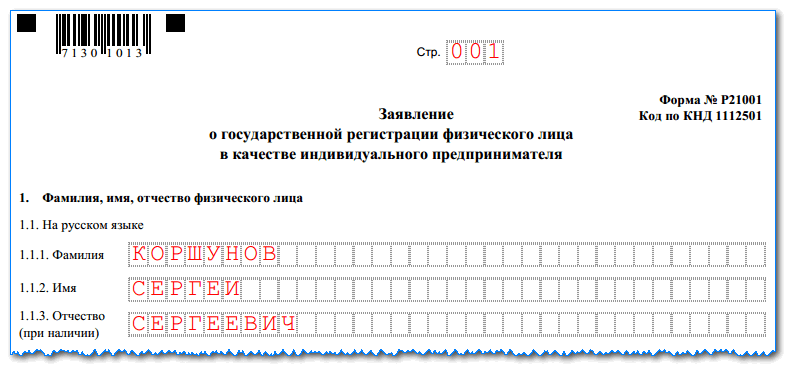

Each page of the application must be numbered, and numbers must be entered from the title page and further in order. The legislation stipulates that the sheet number must consist of three digits. Cover page number "001"

Sheet 1

Section 1.1 reflects information with full name. future entrepreneur. They must be indicated in the same way as in an identity document. A separate box is used for each character, and words are written on a new line.

Section 1.2 is completed in the case when the person who decides to become an individual entrepreneur is a citizen of a foreign state. Here his personal data is filled in with letters of a foreign language. For citizens of our country, this section is not completed.

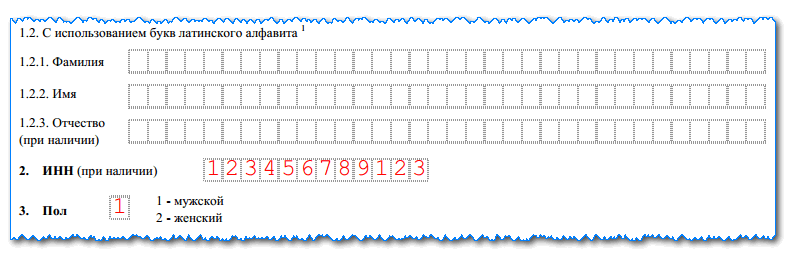

Section 2 includes information about the physical person with TIN number. If the future entrepreneur does not have it, the cells remain empty, and the individual entrepreneur at the time of registration will receive a TIN, which will be indicated in the registration documents issued to him.

Section 3 contains data on the field of the registered IP, which is reflected using a digital code. For men, code 1 is used, for women - 2.

Section 4 must include information about the date of birth of the entrepreneur, which is reflected in the format established by law - DD.MM.YYYY. Here you also need to record information about the place of birth of the individual. a person who formalizes entrepreneurship. The abbreviations provided by the KLADR address directory are used.

Section 5 should reflect information on the citizenship of the registered individual entrepreneur with a digital code:

- "1" - citizen of the Russian Federation;

- "2" - a citizen of a foreign state;

- "3" - stateless person;

Attention! If the code 2 is put down, then next to it it is necessary to indicate the country, the citizen of which is the future entrepreneur. It must contain three digits.

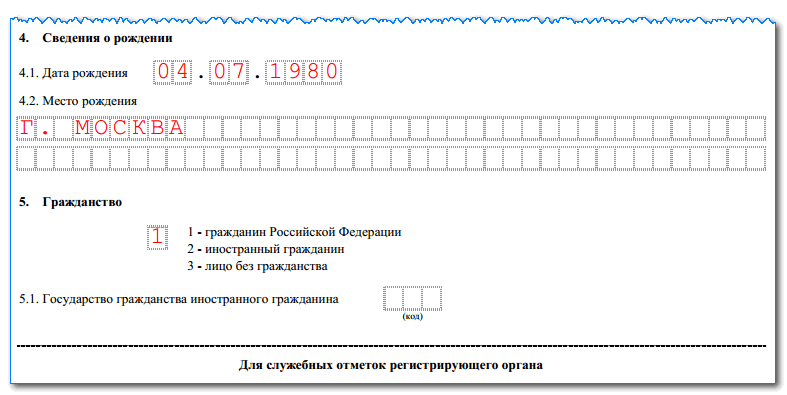

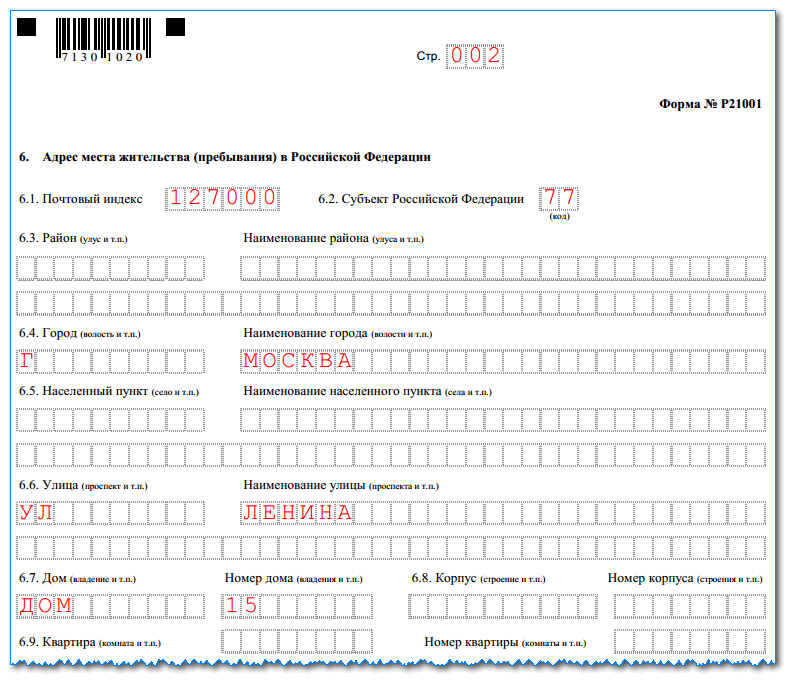

Sheet 2

This sheet is actually a continuation of the previous one, it contains columns starting from 6. This contains the address at which the applicant lives on a permanent basis, or is temporarily located.

The entire address must be divided into components, and a new field is provided for each - from the index to the apartment number. If one of the parts is missing in the address, then the column intended for it remains empty.

Abbreviations in the address must be made as provided by the KLADR address reference book. How to do this without errors is shown by a sample application for an individual entrepreneur.

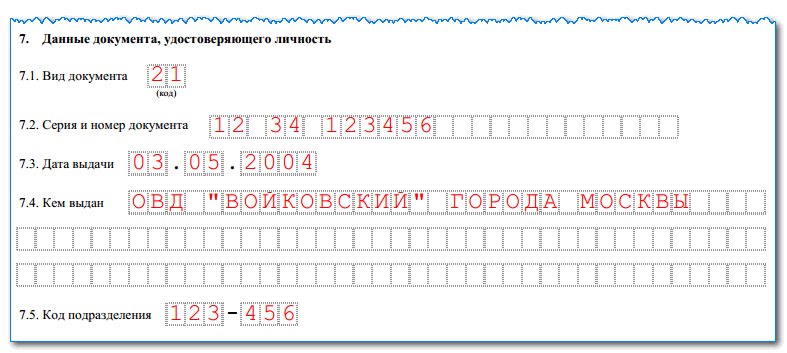

In the next column 7, information about the identity document is entered. The fields contain the name, number and series, date and place of issue, department code. After, where the place of issue is recorded, the information is entered according to the principle “One letter - one cell”.

In addition, one cell must remain empty between words. In the case when the term ends, and the word still has a part, it is carried over to the next line without putting a hyphen.

Sheet 3

Attention! This sheet is filled in if a citizen of a foreign state or a stateless person wants to register as an entrepreneur. In the columns of the sheet, it is necessary to record information about the document that gives the person the right to live in the country, the place of issue and time, as well as the period of validity.

Sheet A

At the first registration of the application for registration, form P21001, you do not need to enter data on this sheet. However, in the future, it will be necessary to go through the procedure for changing the information in the register and enter the activity codes there.

![]()

And all because this sheet indicates the types of activities that the entrepreneur wants to continue to do. In this case, you immediately need to select the main code - it should account for the bulk of the income received.

On the sheet, in addition to the field for the main code, there are also fields for additional ones. If the entrepreneur wants to reserve more codes at once, and one sheet is not enough for him, then another sheet A can be added to the application. However, the main code cannot be put on it.

Attention! There is no need to decrypt the selected codes. The main thing is that these OKVED2 codes contain at least 4 digits.

Depending on the selected codes, the tax office may require additional documents. For example, if an entrepreneur intends to carry out activities with minors, then it will also be necessary to obtain a certificate of no criminal record.

buhprofi

Important! The choice of codes must be approached with all responsibility. If the tax office during the audit reveals that the entrepreneur is carrying out activities under a code that is not indicated in his register, he may be issued a fine.

Sheet B

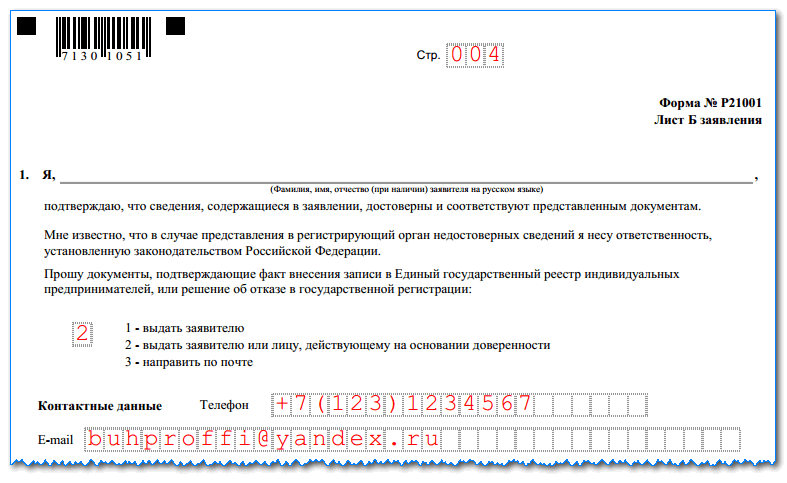

This sheet is always filled in, and the applicant must have two copies of it in his hands. In fact, it is a written confirmation of the applicant that all the information entered in the document is correct and can be documented at any time.

In the upper part of this sheet, the full name of the person is written. Next, a code is put down that indicates how the applicant wants to receive a notification about the registration, or about its refusal.

These include:

- "1" - The submitter will collect the result personally;

- "2" - The result will be taken by the applicant's authorized representative;

- "3" - The result of consideration must be sent by post.

Further in the document, you need to indicate the method of contact - by phone or e-mail. If a telephone is selected, then the number must be recorded in full, including the city or operator code. You do not need to use dashes.

buhprofi

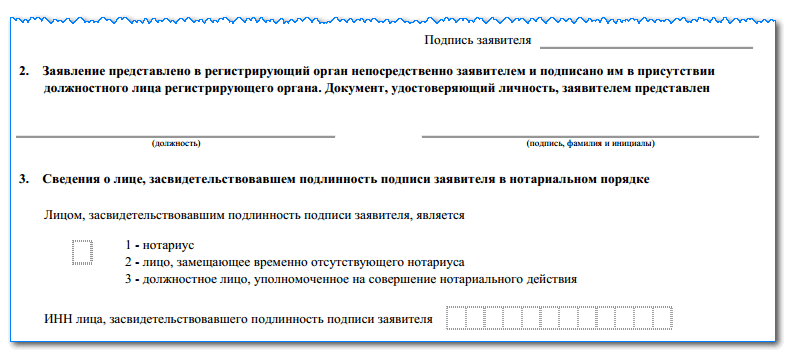

Important! This sheet must be signed at the tax office in the presence of an inspector. If the document is sent to the tax office by mail, or an authorized representative submits it, then the signing must take place at a notary. He himself assures this process by affixing his data.

Do I need to sew an application for registration of an individual entrepreneur

After filling in all the necessary sheets of the application and printing them out, many have a question - whether they need to be stitched together. No, you do not need to do this, despite the fact that the instructions for filling out the document, Form P21001, do not provide for such actions. Nevertheless, so that the sheets do not fall apart and are not lost, it is best to fasten them together with a simple paper clip, or a stapler.

If the future entrepreneur nevertheless decides to sew them, then it is advisable to adhere to the following rules:

- Sheet B is issued in two copies, but it does not need to be reinforced with the general pack - both sheets must be stored separately;

- When the application sheets are stitched, a label is stuck on the tails of the thread on the last sheet with the inscription "Numbered and laced ... sheets." You must put a personal signature next to it;

- One of sheets B is returned back to the applicant with a mark of the Federal Tax Service employee about the receipt of the document for consideration.

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- What documents are needed to receive snills for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form of UTII-2

- Sv m by mail

- Child tax deduction

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- Pushkin: reviews, address, faculties, branches