Filling in the balance sheet: an example with decoding

is a form of reporting on the financial and economic activities of a modern enterprise. BB is a table that reflects the financial performance of the enterprise. These indicators are reflected for the year of the current report and for the two previous years. In this article, we will consider the basic rules and step-by-step instructions for filling out the balance sheet using an example.

Download form Balance sheet (form 0710001) possible by .

Simplified form of Balance available at .

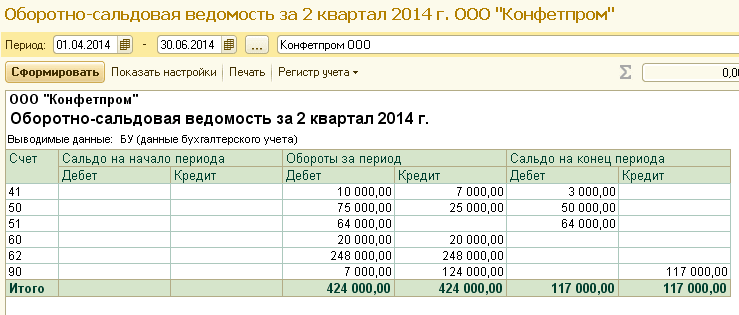

The easiest way to fill in the balance sheet is to fill in the balance sheet of the organization. The formation of WWS is based on the use of the double entry method, which allows you to track the correctness of business accounting. The turnover on the debit of the OSV is always equal to the turnover on the loan. OSV is the most visual set of turnovers and balances of an enterprise for a certain period.

An example of a balance sheet in the popular 1C program:

Before the formation of the balance sheet, all operations are performed to close the reporting period.

The chart of accounts was approved by law in 2000. Until that time, the old PS, which had already ceased to meet the requirements of life, was used to account for the economic activities of organizations.

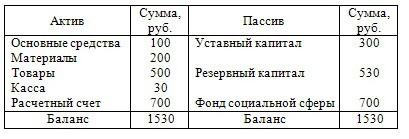

The balance sheet asset contains data on the assets of the enterprise, that is, on property and intangible assets that are capable of bringing economic benefits to the enterprise in the future.

Assets

Assets are divided into current and non-current.

Current assets are assets used in the course of economic activity and reflected in the financial result for the period in full.

Non-current assets - property that the company uses for a long time; its cost is transferred to the financial result in parts during the period of use.

Accounts receivable, that is, the debt of counterparties to the organization, is also included in the assets section.

Passive

The liabilities side of the balance reflects the sources of funds at the expense of which its asset is formed. This:

- own funds of the organization (capital and reserves);

- short-term and long-term liabilities.

These liabilities show the legal status of the enterprise.

Balance currency

The totals of the asset and liability (balance sheet currency) must be equal.

Balance example

For a static type of balance, articles are filled in according to accounting data as of the date of this report. That is, the usual static balance sheet is a slice of the company's financial indicators at a selected point in time - the end of the reporting period. The static balance is of interest to the regulatory authorities.

To conduct an internal assessment of the state of the enterprise, a dynamic balance can be used. It can be formed on any desired date, and the difference between an asset and a liability shows the state of the organization.

An asset less than a liability means that the company would not have enough money to pay off its current liabilities. This amount will be reflected in the liabilities side of the balance sheet with a minus.

The excess of an asset over a liability means that if the enterprise were liquidated at that moment, there would be profit left that would have to be transferred to the owner. Therefore, this amount will be reflected in the liabilities side of the balance sheet.

Balance sheet items

BB articles are a detail of asset and liability indicators. The option of detailing, approved by the Ministry of Finance of the Russian Federation in 2015, is recommended, but not mandatory. An enterprise may develop its own clarifying breakdown if it believes that it will more reliably reflect information about its activities.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, Form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children