We fill out and submit the form of sv-experience in the PFR

The SZV-STAZH report is a relatively new reporting format for the Pension Fund. Employers must submit this form annually. A new form has been approved for reporting for 2018. Let us consider in more detail the procedure for compiling a report for the FIU, the current sample can be downloaded for free.

The reporting procedure for Russian organizations and individual entrepreneurs that are insurers of their employees in pension, social and medical insurance has changed significantly since 2017. The administration of insurance funds is now handled by the Federal Tax Service of Russia, which accepts a new single calculation from payers of contributions.

However, the funds, which retained a number of their functions, also introduced new reports. In particular, the Pension Fund adopted Resolution No. 3p dated January 11, 2017, which approved four new forms at once. But in 2018, the forms were adjusted. Updates are enshrined in the Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p. Insurers are required to provide:

- "Information on the insurance period of insured persons (SZV-STAZH)";

- “Information on the insured, transferred to the FIU for maintaining individual (personalized) records (ODV-1)”;

- "Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)";

- "Information on earnings (remuneration), income, the amount of payments and other remunerations, accrued and paid insurance premiums, on periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)".

Employers will have to hand over new forms at the end of 2018. The most basic of them is the SZV-1 form (experience), which we will dwell on in more detail.

SZV-STAGE report: due date

The new SZV-STAZH report partially replaces the personalized sections of the abolished RSV-1 form. All employers must fill out this document for each employee separately, therefore, in essence, it is a personalized report.

Pass SZV-STAGE for 2018, deadline - 03/01/2019. Therefore, entrepreneurs still have time to familiarize themselves with the form and the procedure for filling it out. The obligation to submit this document is provided for by paragraph 2 of Article 8 of the Federal Law of 04/01/1996 No. 27-FZ. The form, format and procedure for filling out the new form are approved in the Resolution of the Board of the Pension Fund of the Russian Federation of December 6, 2018 No. 507p.

Who rents

The SZV-STAZH form will have to be filled out for all persons with whom the organization or individual entrepreneur has concluded employment contracts or civil law contracts, copyright agreements. It is noteworthy that the FIU is also waiting for this reporting on those persons who are insured and officially recognized as unemployed. The data will be provided by the employment service.

What information should be included in the new experience report

It is envisaged that on one page of the form the policyholder will reflect the following information for each insured person:

- surname, name, patronymic;

- SNILS;

- period of work in the organization;

- working conditions code;

- code of grounds for early retirement.

Each form is filled out by only one employee and is certified by the person who filled it out. This can be done both by hand in block letters, and using computer technology. The fill color can be anything except green and red. No corrections and blots are traditionally allowed.

The new report can be submitted in electronic format, which the FIU also provides in its Resolution.

In order to correctly fill out the report, the employer will need the following information about the insured person:

- information about salary and other income, payments and other remuneration in favor of the employee;

- information on accrued, additionally accrued and withheld insurance premiums;

- information about the period of work of a citizen, including corrective.

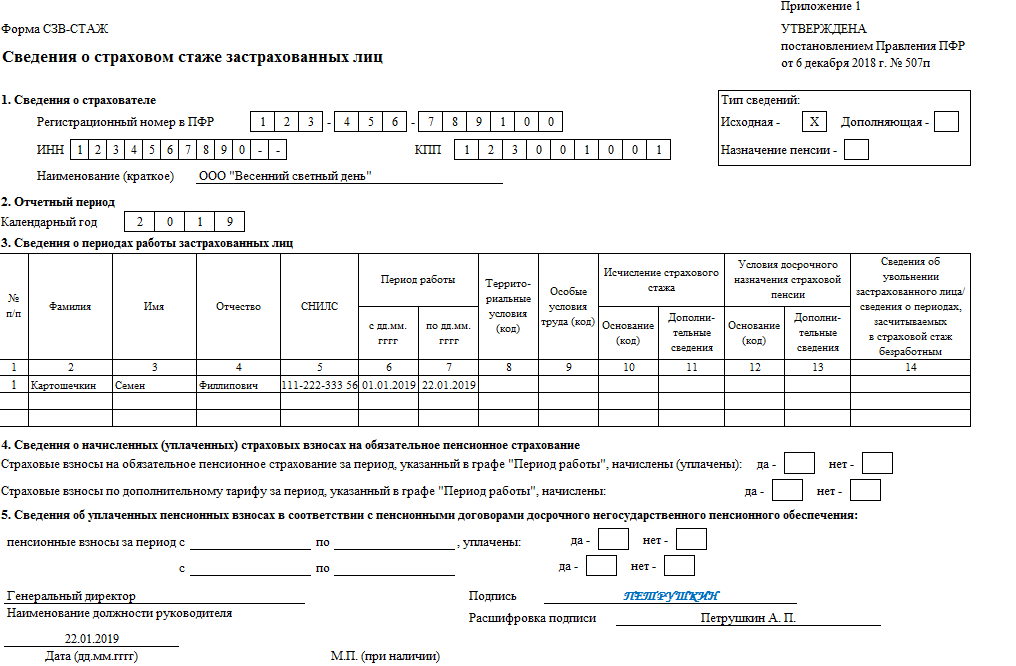

Important changes for 2019

As we noted above, officials have developed and approved a new SVZ-STAZH form. Let's determine what exactly has changed in the structure of the reporting document sample, what to pay close attention to when filling out the form.

So, important changes in the SZV-STAGE form (2019) in terms of the form:

- Props "p." completely excluded from the structure of the reporting sample. Now you no longer need to specify the page number of the report.

- Previously, details such as TIN, KPP and registration number of the insured were duplicated in the form of a sample. Now the inaccuracy has been eliminated, there is no need to duplicate the data on the insured.

Changes in terms of drafting rules:

- Column 8 of the reporting sample is now not filled in if the code "DETIPRL" is indicated in the 11th column of the report. That is, if leave to care for a child under the age of three was granted to a grandmother, grandfather or other close relative or even a guardian.

- The circle of persons for whom a reporting sample should be prepared in the FIU has been expanded. Additions are made to paragraph 1.5 of the Filling Rules. So, the heads of organizations that are the sole founders and (or) participants are included in the number of persons for whom the form should be filled out. Let us recall that earlier this situation provoked quite a large number of controversies.

- The procedure for filling out the report by the Employment Center in relation to unemployed citizens who have registered and received the official status of unemployed has also been adjusted. Now, in column 14 of the reporting sample, opposite the name of the citizen, “BEZR” should be indicated.

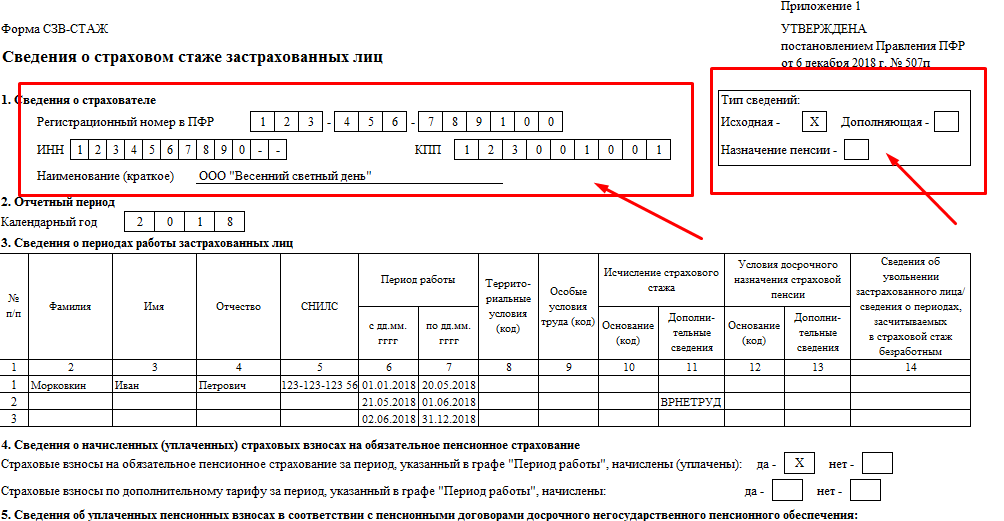

Form and procedure for filling out the SZV-STAZH report

The new SZV-STAZH report has only five sections:

- Section 1. "Information about the insured".

- Section 2. "Reporting period".

- Section 3. "Information on the period of work of the insured persons".

- Section 4. "Information on the accrued (paid) insurance premiums for compulsory pension insurance."

- Section 5. "Information on paid pension contributions in accordance with pension agreements for early non-state pension provision."

Form SZV-STAZH

The report is called "SZV-STAZH", but in fact it contains data on the accrued and paid insurance premiums for the employee. Therefore, its formation will, in some respects, duplicate the data of the “Unified Calculation”, which insurers must submit to the Federal Tax Service.

It's not hard to fill it out. There are only a few features that you should pay attention to.

So, when filling out the field “Registration number in the PFR”, you need to indicate the registration number of the insured from 12 characters, and in the field “TIN” - the individual number of the organization or individual entrepreneur, which can consist of 10 or 12 characters. If there are fewer characters than cells, dashes should be put in the last two. In the column "Type of information" the type of report should be marked with an "X". There are three such types:

- initial;

- complementary;

- assignment of a pension.

If the latter type is indicated, then the form is submitted without taking into account the reporting deadlines only for those persons who need to take into account the length of service for the current calendar year to establish a pension. A supplementary report to the FIU is expected for insured persons who were not taken into account for one reason or another in the main report.

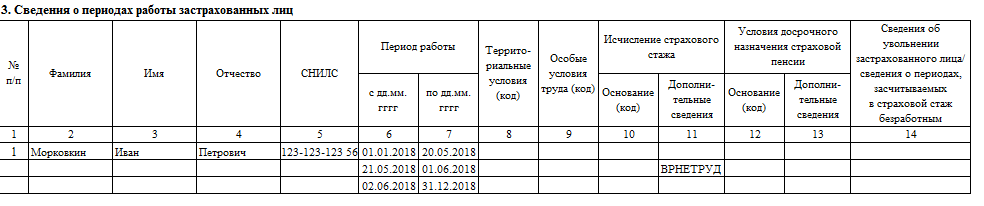

When filling out Section 3, please note that it provides continuous numbering. This means that a serial number must be assigned to the records for each insured person. Even if several lines need to be filled in about the period of work, the number is assigned only to the first of them. It is important to remember that all numbers are put down in ascending order without gaps and repetitions.

In the column "Period of work" dates should be indicated only within the reporting period, which was entered in Section 2 of the report. In the event of a break in work, you need to start a new line, without duplicating the data of the employee and SNILS.

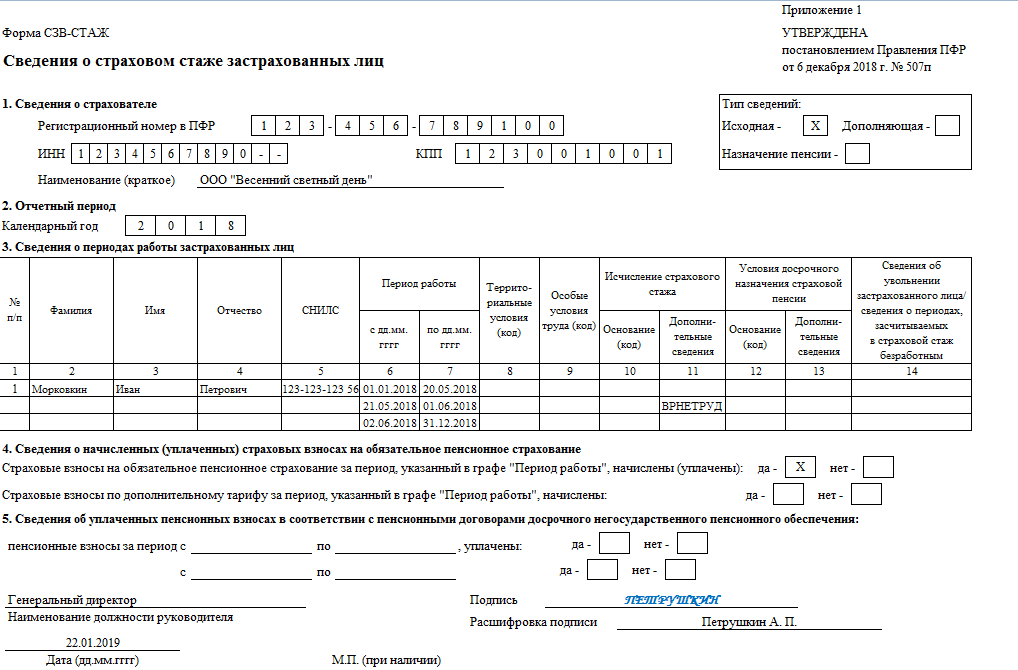

After filling out the form, the responsible person must indicate the name of the position of the head, and certify the report with his signature. The stamp is placed if available.

To send the completed SZV-STAZH forms to the PFR authority, you need to collect and draw up an additional inventory for them in the OVD-1 form. They will only be accepted as such.

Sample filling SZV-STAZH 2019

Extract from the SZV-STAZH form upon dismissal of employees

The obligation to submit a new report to the FIU came in 2018 (previously it was only during the liquidation of the organization), but employers were previously required to issue extracts from the SZV-STAZH to all employees upon their dismissal or upon separate request.

At the same time, the data in the form must be given exactly to the employee to whom the document should be issued, since personalized accounting information refers by law to personal data that cannot be disclosed by virtue of Article 7 of Federal Law No. 152 of July 27, 2006.

In addition to full-time employees, contractors under civil law contracts at the end of the contract have the right to receive an extract. At the same time, no written application for issuing an extract is needed, since, by virtue of Article 11 of the Federal Law of 04/01/1996 No. 27, this is the responsibility of the employer. The document must be issued on the day of dismissal along with all other documents.

This is what a completed statement for one employee looks like:

If several employees quit on the same day, then an SZV-STAZH statement is issued to each of them, filled out individually. Also, any employee can request this statement from the employer, being employed. Then it is prepared within 5 days from the date of receipt of the relevant application. The document is always drawn up in two copies: one is handed out, and on the second, the employee signs for receipt.

Punishments, fines, liability

Now it has become expensive to violate the deadlines and the rules for filling out the SZV-STAZH. So, for each employee for whom the report was submitted to the FIU late, or if there are significant errors in the information provided, a fine of 500 rubles is threatened.

If you submit a report on paper with the obligation to submit electronic reports, companies will issue a fine for such a violation in the amount of 1,000 rubles. Recall that a company or individual entrepreneur with more than 25 employees is required to submit an electronic report.

If you do not issue a sample of SZV-STAZH to an employee upon dismissal, then the company will be fined 30,000-50,000 rubles. The head of the organization or individual entrepreneur will be fined in the amount of 1000-5000 rubles.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Pros and cons of ooo and ip

- Filling out the certificate 2 personal income tax - step by step instructions

- Help 2-NDFL new sample: latest changes and instructions for filling out the form

- How to write an application for another paid vacation?

- Payroll, Form T-53

- Help 2-NDFL: who should fill out, deadlines, sample filling

- How much tax does an employer pay for an employee?

- Szv m by mail

- tax deduction for children