2-NDFL: filling

2-NDFL filling applies to all companies and individual entrepreneurs that are tax agents. Let's figure out how the 2-personal income tax certificate should look like in 2018 and give a sample of filling out 2 personal income tax.

Read in the article:

Issuing a certificate of 2 personal income tax with its subsequent submission to the tax authorities confirms the income of an individual paid to him by a company or individual entrepreneur as a tax agent, as well as the amount of tax withheld. Taxable income includes all payments under both employment contracts and GPC agreements.

What should a personal income tax certificate 2 look like?

The form of the certificate 2-NDFL "Information on the income of an individual" was approved by the Federal Tax Service on October 30, 2015 by order No. ММВ-7-11 / [email protected] From February 10, 2018, the updated form is valid. You can report on it starting from the reporting period 2017. In 2018, the old form is still valid. But it's still better to use a new one. This will minimize the risks of claims from tax inspectors.

Actual reference 2 personal income tax looks like this:

2-personal income tax: how to fill it out correctly

To fill out 2-NDFL correctly, you need to be guided by the Procedure established by the Federal Tax Service by Order No. ММВ-7-11/485 dated October 30, 2015 (hereinafter referred to as the Order of the Federal Tax Service).

Companies have data to fill in tax accounting registers in terms of personal income tax.

In the absence of total indicators, the columns are filled with zeros.

The 2-NDFL help header consists of several fields.

In the "Sign" field put:

- "1" if this is an annual certificate;

- "2" when reporting the impossibility of withholding tax;

- "3" when the tax agent's legal successor submits annual reports;

- "4", when the successor informs about the impossibility of withholding tax.

In the field "Adjustment number" indicate:

- "00" when the reference is primary;

- "01", "02", etc., when the certificate corrects the previous one;

- "99" if the certificate is canceling.

In the "in the IFTS" field, a four-digit code of the IFTS is given, which is the place of registration of the company or individual entrepreneur as a tax agent.

In the appropriate fields indicate the reporting year, serial number and date of compilation of 2 personal income tax.

Section 1 contains basic information on the tax agent: his name, TIN, KPP, phone number. The TIN and KPP of the company are taken from the notice of registration. Individual entrepreneurs fill out only the TIN. Put a dash in the checkpoint column. The data is also available in the notice of registration.

In the field "OKTMO code" enter the code of the territory where the tax agent is registered. The code is determined according to the All-Russian classifier (approved by the order of Rosstandart dated June 14, 2013 No. 159-st) or from the comparison table OKATO and OKTMO. Individual entrepreneurs, lawyers, notaries, put OKTMO at their place of residence. At the same time, IP on a patent or on UTII put a code at the place of business.

Note: the document indicates the TIN, KPP and OKTMO at the location of the part of the company that made the payments. This may be, for example, the head office or a separate division. If income was paid in both parts, separate certificates are drawn up.

In the "Tax agent" field, you must specify the abbreviated name of the company in accordance with the constituent documents. In its absence, enter the full name. Individuals in this field indicate their full name in accordance with the passport.

In the fields “Form of reorganization (liquidation) (code)” and “TIN / KPP of the reorganized organization”, only the successor of the legal entity makes the marks when submitting a clarification for the reorganized legal entity. The codes can be found in Appendix 2 to the Order.

Section 2 shows the personal data of an individual.

Section 3 is completed monthly. If there were incomes taxed at different rates, then they must be indicated separately for each rate. To fill out, you will need Appendix 1 "Income Codes" and Appendix 2 "Deduction Codes" to the Order of the Federal Tax Service.

Also in Section 3, professional tax deductions, deductions in accordance with Article 217 of the Tax Code and amounts that reduce the tax base in accordance with Articles 213.1, 214, 214.1 of the Tax Code must be given.

If several deductions are applicable within the same type of income, then they are indicated line by line one by one, and the fields “Month”, “Income code”, “Amount of income” opposite the lower deductions are not filled

Section 4 is provided for standard and social tax deductions, as well as for property deductions for the purchase or construction of housing. To fill in the "Deduction Code" column, use Appendix 2 to the Order of the Federal Tax Service.

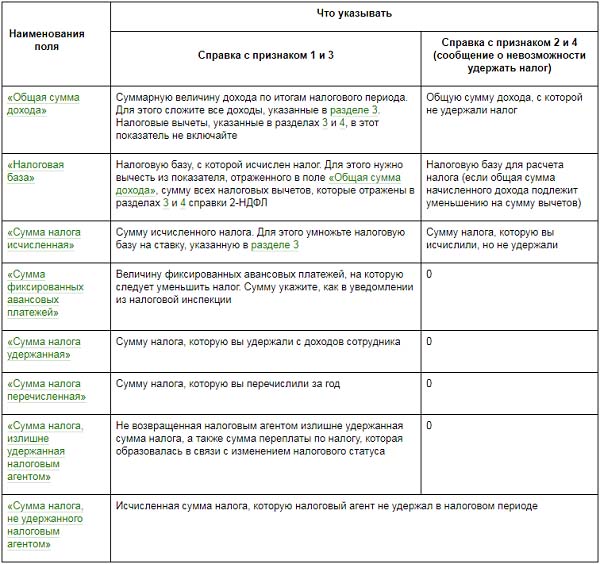

Section 5 is intended to reflect the total amount of income and personal income tax for the year. It is filled out separately in terms of a specific tax rate. See the table below for the order.

Table. The procedure for filling out section 5 2-NDFL

In the absence of a notification confirming the right to reduce personal income tax for fixed advance payments, the corresponding field is not filled out. In the field "Amount of fixed advance payments" put zero.

The amounts in the 2-NDFL certificate must be indicated in rubles and kopecks. But the amount of personal income tax is given in full rubles (values up to 50 kopecks are discarded, and 50 kopecks or more are rounded up to integers).

If there is not enough space and it is necessary to fill out 2 personal income tax on several pages, on the following sheets at the top they put their serial number and a duplicate heading “Certificate of income of an individual for 20__ No. ___ dated ________”.

The field "Tax agent" is filled in on each sheet.

Note: in addition to the annual, certificate 2 personal income tax can also be corrective and canceling. The first is when recalculating tax liabilities for the last year. The second - when the indicators are canceled according to the certificate submitted earlier. At the same time, in the cancellation certificate, the information of the original one is duplicated in sections 1, 2 and sections 3–5 are not filled out.

Sample filling 2 personal income tax

The 2-NDFL certificate for the year is filled out as follows:

An example of filling out 2 personal income tax for a foreign employee looks like this:

Read about the deadlines for submitting 2-personal income tax in 2018 in.

Attached files

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters