IFTS: code in help 2 personal income tax: how to find out the code

Everyone knows about the need to pay tax, which is monthly withheld by the employees of the settlement group during the accrual of earnings and other rewards. The accountant is responsible for the correct calculation of income tax, its transfer to the treasury, and also generates reports in the form of personal income tax 2, thanks to which the IFTS has the ability to control all calculations. Often, when compiling a certificate, questions arise about the correct use of certain ciphers, we will consider this topic in more detail in our review.

Help 2 personal income tax for the IFTS is formed annually after the end of the reporting period. It is handed over to the fiscal authorities no later than April 01, for the report for 2017 this deadline was postponed to April 2 due to the holidays.

In addition, if the legal entity did not withhold personal income tax from the profits of individuals for the reporting period, it is necessary to notify the Federal Tax Service and the employee no later than March 1. Please note that in the second case, 2 personal income tax certificates are submitted for March 1, 2018 and April 2, 2018.

It is important to remember that the personal income tax report 2 includes all types of employee income: earnings, bonuses, valuable gifts, rental of real estate or its sale. In more detail, the entire list of taxable remuneration is listed in Art. 217.

Where can I find out the IFTS code 1 of the help section 2 of personal income tax

In the first part of the report, the accountant finds it difficult to code the IFTS, which means this set of numbers, and also where it can be found. It is a four-digit number, the first two digits are the code of the Russian legal entity, the last two are the code of the inspection to which the company is assigned. There are three ways to refine or verify if necessary.

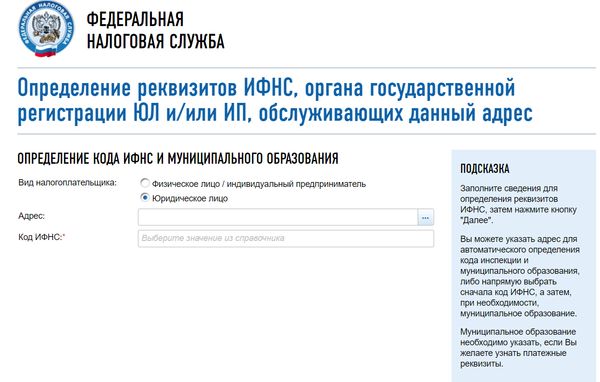

The official website of the Federal Tax Service provides background information, including the IFTS code. To do this, in the electronic services tab, go to the "All services" menu and select the cell with the addresses of inspections.

You don’t need to enter anything in the menu that opens, just follow the “Next” command, enter the city to search for and the street where the fiscal service is located. Information about the tax authority and its details will appear on the screen.

2 way

You can find out the IFTS data by the TIN of the company, which is assigned to any legal entity or individual. The first 4 digits - this will be the cipher of the federal inspection agent. But this option is only suitable for the IFTS code to which the business entity is attached. If you need to find out the code of another tax authority, this method will not work.

You can find out the code of the IFTS service from the directory, for this you need to upload to your computer the SOUN database - a list of designations of tax authorities and other information useful for generating reports. The database contains the codes of all IFTS, their full name, address, contact phone numbers and information about the reorganization.

The easiest and most effective way to find out the IFTS code is to simply call the inspection or the hotline. Consultants will provide detailed information.

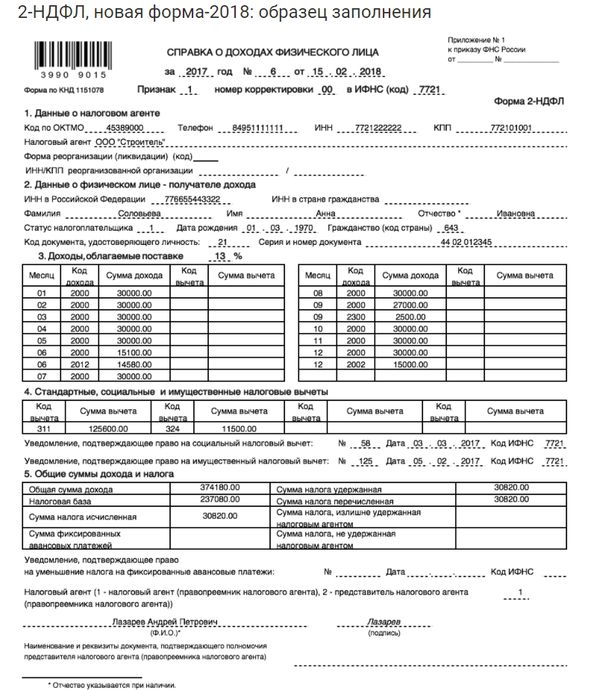

An example of filling out 2 personal income tax since 2017 in a new form:

In the first part of the 2 personal income tax report, it is necessary to correctly reflect the data on the organization. The name is filled in according to the statutory documents, but to form information regarding an individual, his last name, first name and patronymic are indicated in full without abbreviations.

For individual entrepreneurs, information is generated in accordance with the registration documents and with the definition of the abbreviated ownership of the IP. For them, both the indication of the surname with initials and the full decoding of the data are allowed.

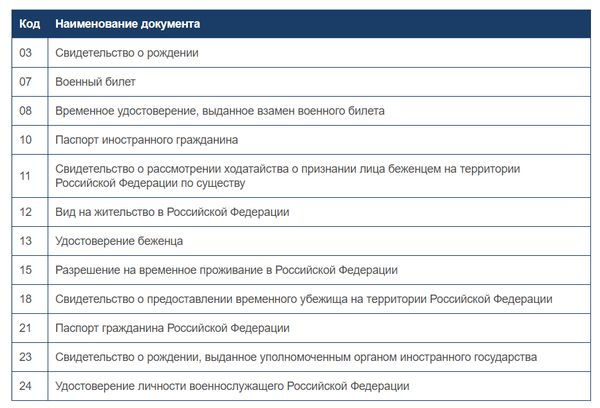

In addition, for physical persons, it is important to correctly indicate the code of the identity document. For Russian citizens, this is the passport of the Russian Federation, in this case, they denote sign 21.

For other documents, you can use the following table:

When filling in the field about the citizenship of the employee, indicate the code of the country of which the employee is a resident. For Russia, this is code 643. You can check all the codes on the IFTS website. If the list does not contain a state of physical person, indicate the data of the country that issued the passport.

Codes for different types of income in the certificate 2 personal income tax

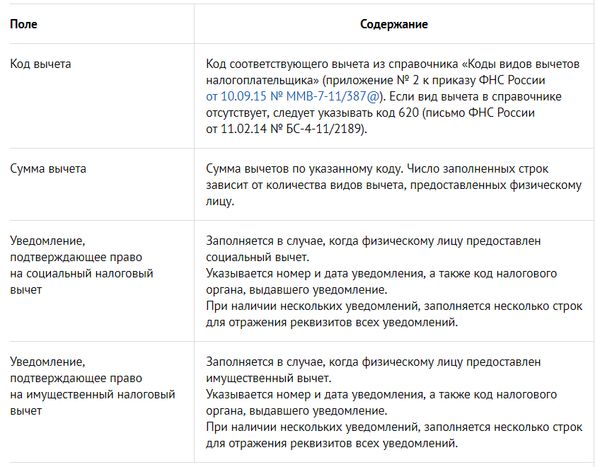

When filling out the third section of the declaration 2 of the personal income tax for the IFTS, it becomes difficult which code to use to reflect information about the income of individuals.

In 2017, the regulatory act MMV 7-11-820 supplemented the general list of codes for different types of remuneration for the following items:

- Cash compensation for unused vacation, now refers to the code 2013;

- code 2014 is used to reflect severance pay, compensation to the director, his deputies and chief accountant, in an amount exceeding 3 times the average monthly salary. For the Far North, this limit is 6 times the size;

- under code 2301, you need to fill in the penalties listed by the decision of the courts for non-compliance with consumer rights;

- written-off debts from the company's balance sheet are reflected under the code 2611;

- 3023 - remuneration in the form of interest on bonds issued after 01/01/2017.

To fill out form 2 regarding earnings and equivalent remuneration in the form of production bonuses, allowances, indicate the code 2000. All payments that come from the company's own funds, for example, surcharges for sick leaves, maternity benefits, business trips in excess of the norms, approved by law, apply code 4800.

When filling out part 4 of the report regarding deductions, physical. the person brings to the accounting department the relevant documents for the right to use them. Most often, they provide a standard benefit in the presence of children; they can also be issued: disability, participation in hostilities, and emergency response.

After the amounts of tax benefits are determined, the amount of income and tax for the reporting period is calculated. In the declaration, all remuneration and deductions are indicated with an accuracy of two decimal places, and the income tax calculated, withheld by the tax agent and transferred to the treasury is rounded to whole numbers according to the rounding rules.

After summing up the deductions, it is important that the calculated amount of tax does not exceed the income of the specified person.

Conclusion

If you use the software to fill out the 2 personal income tax report, there will be no questions about how to find out the IFTS code. For the preparation and verification of data, there are reference systems and programs similar to those established for receiving declarations at the tax office. All information in them is constantly updated on the Internet. When an error occurs, a hint will automatically appear to the user what to look for.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters