How to apply for an inn for an individual - a step-by-step description, documents and recommendations

TIN is an important document that every taxpayer should have. Without it, you cannot become an entrepreneur or, for example, get a job. Today we have to figure out how to issue a TIN. All the features and nuances of this process will be presented to our attention. What should every citizen of the Russian Federation know about the procedure?

Description

The first step is to understand what kind of document it is. What is a TIN?

This is how the abbreviation mentioned earlier is deciphered. The document is a sheet of A4 format, on which information about the citizen and his individual number in the tax system are written. It is assigned at birth and does not change throughout life. TIN helps to make a quick search in the existing database. Also, the document is required when registering an individual entrepreneur or as a legal entity.

If a citizen does not have a certificate of registration of a taxpayer number, this does not mean at all that the taxpayer does not have a number. Quite often people just don't know it. How can I get a TIN? What does that require?

Where to draw up

For example, to find out which bodies deal with this issue. Where to apply for a TIN?

Today in Russia it is allowed to apply to the following authorities to receive this public service:

- regional FTS;

- portal of the Federal Tax Service of the Russian Federation.

A duplicate of the certificate of tax registration can be issued through the "Gosuslugi". In practice, most often the document is issued by the tax authorities at the place of registration of the applicant.

Procedure

How can I get a TIN in Russia? It is necessary to follow a certain algorithm of actions. There are not very many steps, they are easier to remember than it seems.

The procedure for issuing a TIN of an individual as a whole is as follows:

- Prepare a certain list of documents. It will be presented below.

- Write an application for the issuance of a number. You can take the completed form from the Federal Tax Service or draw it up yourself.

- Submit a written request for the assignment of a taxpayer number to a particular organization. Mandatory documents must be attached to the application.

- Wait for the paper to be ready and pick it up at the Federal Tax Service or the MFC.

Now it’s clear how to issue a TIN through the appropriate organization. You will have to act somewhat differently if you want to order a document via the Internet. But the process will still remain extremely simple and understandable.

Internet to help

Modern citizens can apply for a TIN via the Internet. The site will help with this. By leaving an electronic application, you can order a document and receive it at the MFC or at the regional tax service.

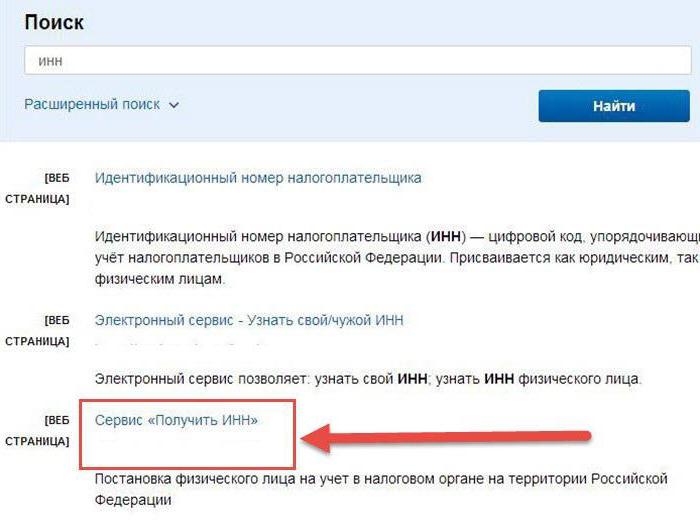

How to proceed when ordering online? This will require:

- Open the website of the tax service. Select your region of residence in the upper right corner of the page.

- Go to the "Individuals" block.

- Select "Filing an application for tax registration" among the services that appear.

- Register in the "Personal Account". To do this, in the fields that appear, you must write an email, a password for authorization, a citizen's full name. You also need to dial the code from the picture.

- Confirm actions.

- Fill out the application form that appears. It is relevant for those who do not have an electronic signature.

- Click on the button "Register application and send it to the Federal Tax Service".

The application number will appear on the screen. After the TIN is ready, it will be possible to pick up the corresponding document at the tax authority at the applicant's registration.

Digital signature

But that's not all! You can issue a TIN in another way for those who have an electronic digital signature. How to act in this case?

Necessary:

- Download and install the "Legal Taxpayer" application. It is important that the program is the latest version.

- Fill out an application form 2-2-Accounting. If you want to receive the TIN in electronic form, you must additionally fill out a 3-Accounting request.

- Form a transport container with an electronic digital signature. There is a separate button for this in the "Legal Taxpayer".

- Submit a request for processing and wait for it to be verified.

After the actions taken, the citizen will receive an electronic TIN. Is it possible to issue a TIN in another way? No, only in the above ways. As a rule, ordering a TIN with a digital signature is almost never found in practice.

Documents for TIN (adult)

You should pay attention to the fact that in order to receive the document under study, you will have to prepare certain papers. TIN is issued to both adults and children. Foreigners can also make this document. In all situations, the list of attached papers will be different.

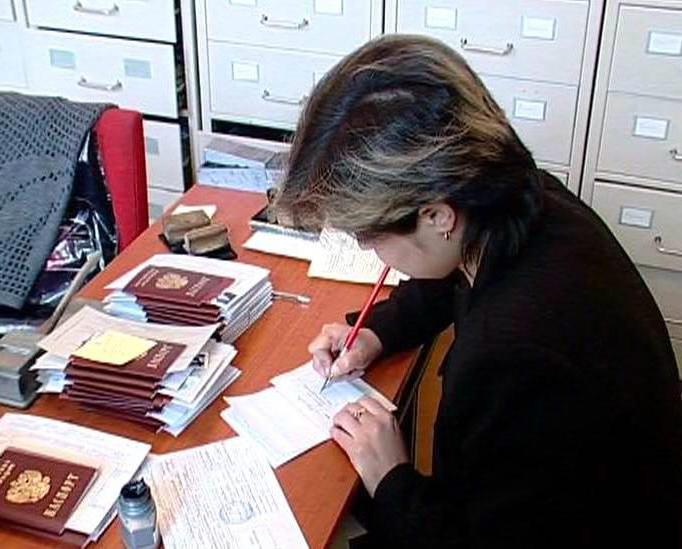

You can issue a TIN for an adult after providing:

- completed application for tax registration;

- passports/identity cards.

Nothing else is needed. What other documents may be useful to the population when ordering a TIN in one case or another?

children

The next situation is ordering a document for children. This operation is not very different from the previously proposed one. The procedure will be exactly the same as when ordering a TIN for adults. The difference lies only in the documents provided.

How to apply for a TIN for a child? For this, the FTS brings:

- application (filled in by one of the parents);

- passport of the parent-applicant;

- birth certificate of a minor;

- registration certificate.

After the age of 14, children must provide a passport along with the listed papers. As a rule, by this time, adolescents have the right to independently obtain a TIN. Until the age of 14, the document must be taken by parents (legal representatives).

For foreigners

How to issue a TIN to an individual who is a foreign citizen? The algorithm of actions is preserved, only the list of documents attached to the request changes.

In the case of foreigners, you need to bring to the Federal Tax Service:

- statement;

- translation of the passport (with notarization);

- migration card;

- certificate of registration in the territory of the Russian Federation (registration).

Nothing difficult, special or incomprehensible. Minimum paperwork!

Production time

Now it’s clear how to issue a TIN. How long will this document be produced?

It usually takes 5 days to produce the appropriate tax registration certificate. After this time, you must come to the Federal Tax Service with a passport and get a TIN.

How to get

Modern citizens can acquire a certificate of tax registration in several ways. And you can get your hands on this document in different ways.

More precisely, the TIN is currently issued:

- personally;

- through a representative

- over the Internet;

- by mail.

If you receive a TIN through representatives, you must write a power of attorney for this operation. When submitting an application, the authorized person presents not only the application and a copy of the applicant's passport, but also his identity card with a power of attorney. Otherwise, the procedure for issuing a TIN remains the same.

Do I need to pay

In Russia, for the production of some documents, you must pay a state fee. How much does it cost a person to obtain a TIN?

Initial registration is free. Each citizen can issue a TIN without paying a state duty.

For secondary registration (in case of damage or loss of the corresponding certificate), it is necessary to pay a state fee. Today it is 300 rubles. Only after that, the Federal Tax Service will accept an application for issuing a duplicate TIN. More precisely, a new document, but with the same taxpayer number.

Results

From now on, it is clear how to issue a TIN through a representative, via the Internet or in person. This operation is not as difficult as it seems. It is carried out quickly, with minimal paperwork.

The instructions offered to attention work in all regions. Instead of contacting the Federal Tax Service, you can submit an application with documents through the MFC. Then the TIN will have to be obtained at the multifunctional center. The studied procedure has no other features.

They cannot refuse to extradite him to a citizen. This is possible if a person submitted fake documents or did not bring them at all.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters