How to fill out a new 2-personal income tax certificate

In addition to calculating, withholding and sending tax on personal income to the budget, business entities acting as employers must also submit such a report as a 2-NDFL certificate to their employees. This obligation is assigned to them at the legislative level. Moreover, it applies not only to employees of the company, but also to people for whom the company is a source of income.

Deadline for 2-personal income tax

Despite the fact that tax withholding must be made each time income is paid, the 2-NDFL form is sent by the agent to the IFTS at the end of the year once.

The Tax Code of the Russian Federation establishes two dates for the final submission of reports, therefore they are usually divided into certificates with the code "1" and "2".

Certificate 2-NDFL of the first variety shall be submitted in the general manner until April 1 of the year following the tax year for each recipient of income.

When a company cannot collect personal income tax on the income received by a person to withhold a mandatory payment, then it should send a certificate with the code "2".

An example of such an option is the payment of income to an individual in the form of some property. The deadline for this is March 1 of the next period.

Please note that these dates may fall on weekends. Then the deadline is determined by the next business day.

Important! References with a sign "one" for 2016 must be sent to the IFTS before April 3, 2017, with a sign "2" until March 1, 2017.

Sometimes employees may contact their administration with a request to issue certificates of this sample to them. Basically, they need to be presented to your new employer to receive deductions from him, or to the bank when applying for loans.

The Labor Code of the Russian Federation establishes a three-day period for its release.

Where is the 2-NDFL certificate provided?

The Tax Code of the Russian Federation determines the location of the company and the registration of entrepreneurs as the place for submitting 2-NDFL. However, an economic entity may also include branches, separate representative offices. For them, these reports should be sent to their location, and parent organizations to their address.

There are situations when one employee of the company can carry out his labor functions both in the company itself and in its branch. Then his salary is calculated for each unit and the tax is paid to the address where the income originated.

The legislation singles out such a category of taxpayers, whom it calls "large".

Important! These economic entities may, at their own discretion, decide to which inspection to send 2 personal income tax - all reports to the address of the head enterprise, or to share between the addresses of branches.

This exception became possible due to the interaction of tax inspectorates in the issue of the largest companies.

These reports can be sent to the tax office in several ways. These include:

- Representative on paper - this method is possible only for a limited number of applicants, which can be organizations and individual entrepreneurs with less than 10 employees;

- Representative in electronic form - it can be used by employers who submit information for less than 3,000 people. This method represents the transfer of a file on a medium, for example, on a flash drive;

- Postal service - at the same time, an inventory must be made in the letter;

- Using electronic document management - for this it is necessary that the employer has an EDS and an agreement with a specialized operator.

Help 2-NDFL new form 2016 form sample filling

The new form 2016, filled out by an economic entity, has several sections, the filling of which will be considered in more detail.

header

In addition to the name of the form, this section also includes the time for which the document is drawn up, as well as the sequence number and date of compilation.

The line below indicates the status of the certificate, which determines the submission deadline. Its values can be:

- "one"- for the income of individuals received by them in the usual way;

- "2"- when it is not possible to make personal income tax deductions.

Since 2016, a new column has been introduced in this document - the number of the adjustment. The following types of ciphers are used here:

- 00 - for the initial preparation of a certificate of income of individuals;

- 01-98 - for corrective forms, while this is also the correction number;

- 99 - to cancel previously submitted documents.

Below, the tax agent should write down the tax code - the recipient of the report in the form of a four-digit cipher. 2-NDFL sample shows how best to do it in the best way.

Section No. 1 - Information about the tax agent

This section should include complete information about the company or entrepreneur who is the withholding agent.

The lines with OKTMO, TIN, KPP are sequentially filled in, which can be viewed in the documents issued to the business entity. At the same time, the IP does not have a checkpoint code.

Below is the full name of the company.

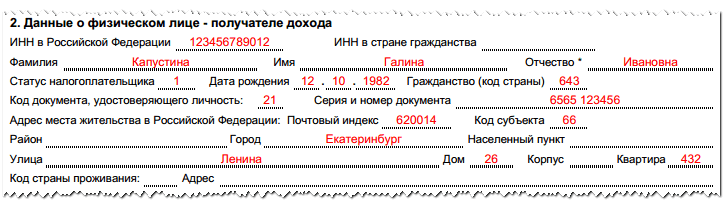

Section No. 2 - Data on the individual - the recipient of income

The first step is to indicate the TIN code of the employee for whom the certificate is issued. A novelty of the document in 2016 is the addition of a field for the TIN of a foreign citizen, issued in his country.

If the certificate is filled out for a foreign citizen, then it is allowed to write down his name and surname in Latin letters.

Also, since 2016, the list of taxpayer statuses has been expanded. Now you can enter here:

- "one"- resident;

- "2"- not a resident;

- "3"- qualified specialist;

- "4"- a voluntary migrant from another country;

- "5"- an alien refugee;

- "6"- a foreigner working under a patent.

The legislation refers to qualified specialists workers who have knowledge in any particular area and receive a salary of more than 2 million rubles per year.

Then personal data for the employee is filled in - date of birth, which country he has citizenship (Russian code 643), data of the document confirming the identity.

The address can be written both Russian and located in another country (for foreigners). Designations in Russia are made on the basis of the KLADR address classifier.

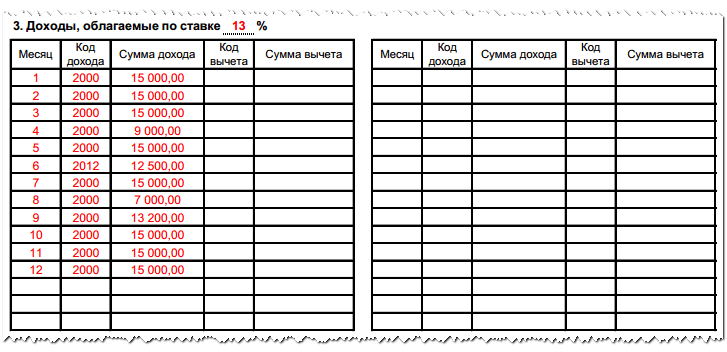

Section 3 - Income

In the heading of this section, you need to put down the tax rate - for Russian citizens - 13%, but for foreigners - 30%.

The section is built in the form of a table in which it is necessary to record line by line information on income and deductions for the reporting period.

You need to fill it out like this. The first column contains the number of the month for which information is entered. The following is the income code and the amount received from it.

Important! If several types of income were received for the same month, then a separate line is allocated for each of them with the same month number and different data on earnings.

In the columns with the code and the amount of the deduction, information is entered on those benefits that are related to professional. Their codes start with 403.

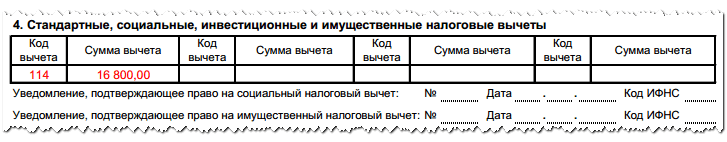

Section 4 - Standard, social, investment and property tax deductions

In this section, it is necessary to put down the designations and amounts of those deductions that the employee used in the reporting period.

In the certificate of the 2016 sample, the concepts of investment deductions were introduced. In addition, a special line was added to the document, in which you need to write down the details of the notification for the use of a social deduction (for treatment or education). The same line for the property deduction was used on the form earlier.

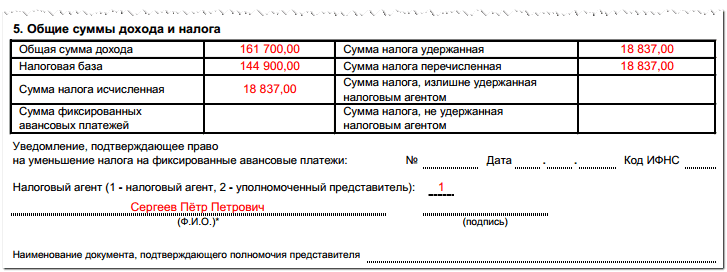

Section 5 - Total Income and Tax

This section summarizes all the data that was entered into the certificate in sections 3 and 4. It is made in the form of a table.

V line "Total amount of income" the total is recorded for all income that was received in the reporting period and indicated in the document above.

Line "Tax base" is the result of subtracting from the total amount of income the amount of deductions provided in this period.

The line "Calculated amount of tax" is obtained as a result of multiplying the tax base from the previous line and the tax rate entered in section 3.

Attention! Line "Amount of fixed payments" filled in only by foreign citizens performing work under a patent. If they have received a notice allowing them to reduce the amount of tax on the amount of advance payments, its details are indicated in the field below.

Then the amounts of income tax that were withheld from the employee and transferred to the tax office are recorded. The following are lines that indicate amounts in excess of tax withheld or not withheld at all.

At the end of the document, the code of the person who signs the certificate is affixed - this can be either the agent himself (code 1) or his authorized person (code 2). In the second case, the details of the document that gave him these powers are written below.

Penalty for delay and failure to submit a certificate 2-NDFL

The tax legislation establishes a penalty for failure to provide 2-personal income tax and a penalty for late delivery of 2-personal income tax. Both in the amount of two hundred rubles for each report not sent or transmitted late. You can consider that this amount is small, but you need to remember that the calculation is made for each certificate. As a result, in large enterprises with hundreds of employees, it can reach a substantial amount.

In 2016, another type of fine was introduced - for filing false information. Its amount was set at five hundred rubles for a certificate with incorrect information. However, if the company itself discovered and corrected its error, then sanctions will not be imposed on it.

Nuances

When the employer was unable to collect tax from the employee, he will have to submit certificates twice - first before March 1, and then with everyone else until April 1.

When entering data into documents, only legally approved codes of income and deductions are used.

In the case when the tax for December is transferred during January of the next year, then in the certificate it is still paid on time. However, if the transfer occurs after February 1, then the line “Tax amount transferred” in the documents will be lower than “Tax amount withheld”.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters