We get the Inn through the public service portal

The Government of the Russian Federation is interested in ensuring that all its citizens register with the tax office and receive their Taxpayer Identification Number. The realities of modern life are such that almost no document can be issued without this number. Therefore, in this article we will try to cover how to get it through the portal with a verified account.

Procedure for issuing a TIN for an individual (including a child)

Everything is quite prosaic, to get it, you need to visit the site of the tax office, and log in using the registered account of the State Services portal. You can do this at the link: https://service.nalog.ru/zpufl. You will be on a page like this:

Now, in order to enter the personal account of the website of the tax inspectorate, you just need to select the entrance using the account of the "Gosuslugi" portal, instead of tedious registrations on tax.ru, visiting the tax office and changing your password within 1 month. Just press the "login" button, and enter the login and password with which you visit the website of the State Services.

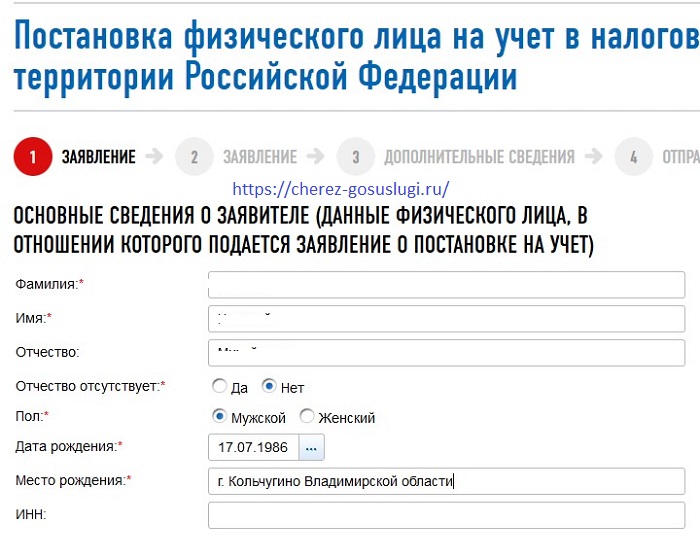

After that, an individual must enter information about himself in the fields of the same name: indicate your full name, gender, date and place of birth. Indicate your citizenship and residence permit (temporary or permanent). You will be required to enter this data from the passport, with an excerpt of the exact dates and wording. After that, choose where you would like to register, it is there that you will receive a certificate. After completing these steps, click next.

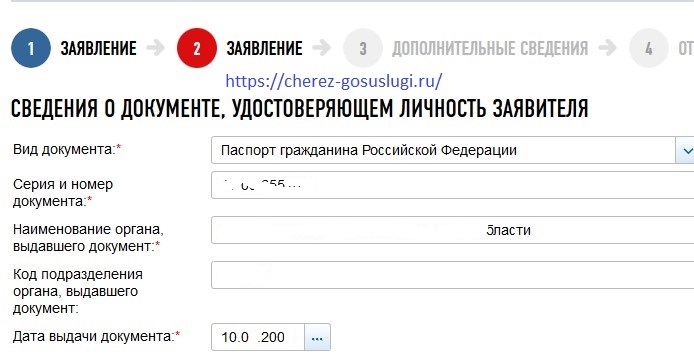

On the second page of the application, the passport will again be required - all you need to do is enter the series and number and data on its issuance. If you changed your first name, last name or patronymic, you will additionally need this information.

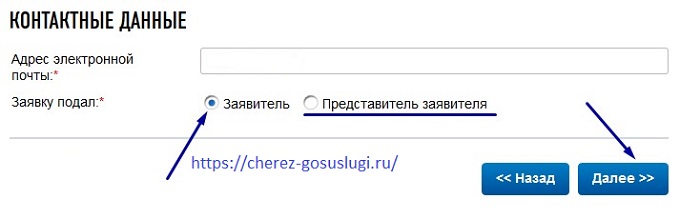

Below we write your contact details and select the person from whom you make the application. If an individual is the "applicant", then you can get a TIN for yourself. And if you select the item "representative of the applicant" - you can issue child's certificate(in this case, in the previous two steps information must be about the child)

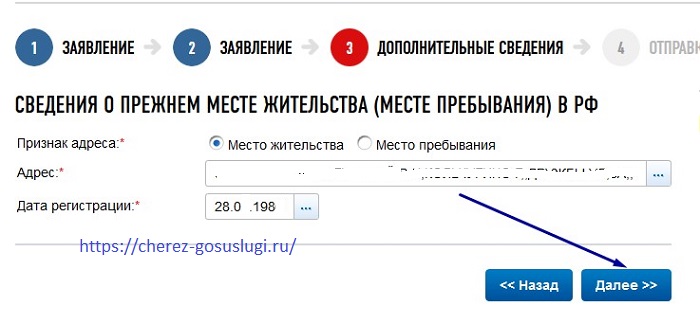

At this stage, you will have to enter data on the former place of residence or stay. You will also find them in the passport on the "place of residence" page, or fill in information about who you are to the child if the registration is not for yourself.

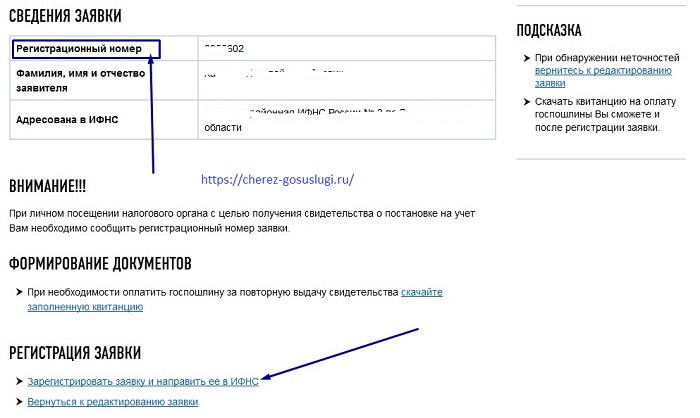

The final step in obtaining a TIN and registering with the tax office as an individual will be sending your application to the IFTS. Please note that you need to remember the registration number of your application. It must be reported when visiting the selected tax office.

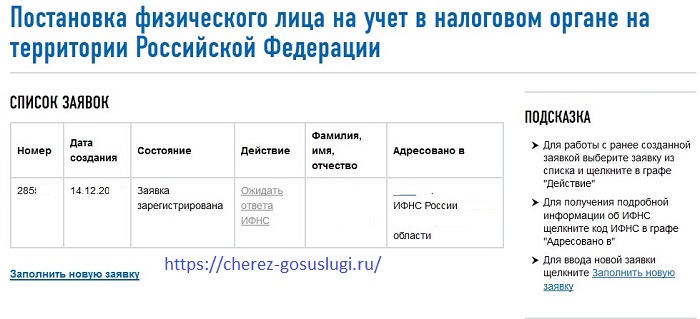

On the next page you will see your application in a structured and compact form, where the status of the application is displayed, in our case it is registered. All that remains for us to do is to wait for the response of the IFTS. This should not take more than 24 hours.

Obtaining a TIN at the tax office after sending the application and paying the state fee (if you receive it again)

Your application will be reviewed within 24 hours. After this time, a notification of the result of the consideration will be sent to your e-mail specified in the application. You can also find out the result on the nalog.ru website by clicking on the same link that was indicated at the beginning of the article: you will only need the application number and the applicant's full name.

The service for the initial receipt of TIN and setting an individual as a taxpayer is free. If the certificate has become unusable, you have lost it and you receive it again, you will have to pay state duty for replacement in the amount of 300 rubles.

You can download a receipt for payment on the page of the list of applications by clicking on the link "wait for a response from the IFTS" - at the bottom there will be a download link. All information about you will be filled in - you just have to print and pay for it.

How long does it take to make

A new form of the certificate of registration of an individual with the tax authority must be produced within 5 working days after the registration of the application. But as a rule, production takes much less time. When everything is ready, you can go to the tax office, taking your passport with you (if you get a TIN for yourself), or again your passport and, in addition, a child's birth certificate (if you issued a certificate for a child).

During a visit to your chosen tax office, you must give the number of your application to the IFTS officer and provide him with documents. After verification, he will issue you a new certificate. So, through the State Services, or rather, using the data of the State Services account, you can get a TIN via the Internet.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters