Help 2-NDFL: where to get, description of the document

Many citizens need a 2-personal income tax certificate for certain operations. Where to get it? What will be required for this? How long does a document take to produce? All this will be dealt with further. In fact, the 2-personal income tax form is extremely important. Especially if you want to get a loan, mortgage or pension. But why? What is this reference anyway?

Document Description

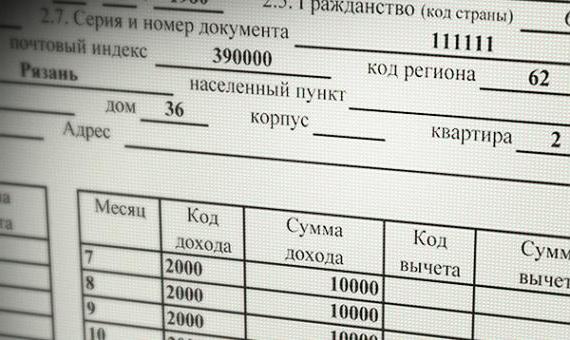

The thing is that the form being studied is a document confirming the income of a citizen. It also contains information about taxes paid and deductions from earnings.

It is a small paper with detailed reporting for a particular period. Every accountant is familiar with this documentation. It is very often necessary to draw up for employees.

Most often, a 2-NDFL certificate (where to get it will be described later) is necessary for:

- registration of the status of the poor;

- loans;

- mortgages;

- loans;

- from a citizen

- visa processing;

- retirement.

It can be said to be a very useful document. As already mentioned, it confirms a person's income for a particular period of time.

Production time

What are the terms for issuing a 2-NDFL certificate? It doesn't matter where it is made out. In Russia, there are certain rules regarding the issuance of documents and certificates. What time limits are there for this form?

On average, after ordering a certificate, you will have to wait 3 days. It is during this period that the organization must issue a certificate of income to a person. In some cases, you have to wait about 5 working days, but such situations are possible only with a high load on the body that draws up the certificate. According to the established laws, the finished form 2-NDFL can be obtained 3 days after the submission of the relevant request. And where to turn in this or that case? Where exactly is a certificate of the established form issued?

For IP

It all depends on the status of the recipient. The thing is that in some cases you have to make a certificate yourself. Typically, a similar alignment is found in individual entrepreneurs who work for themselves, without employees.

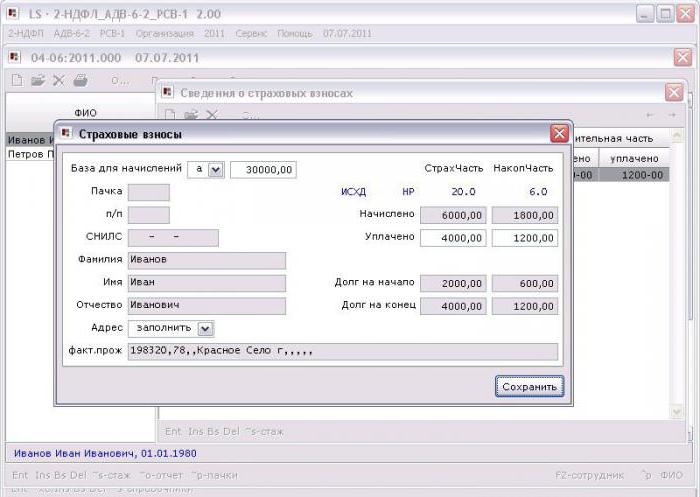

Where can I get a 2-NDFL certificate in this case? It is necessary to draw up the appropriate documentation using a special program. For example, the "Legal Taxpayer" service is suitable. You can also download a ready-made form and fill it out in accordance with the established rules.

But that's not all. Sometimes an individual entrepreneur is employed by a particular company. This is a completely different situation. Do you need a 2-personal income tax certificate? Where to get it? You need to contact your employer. Best for accounting. They must issue the relevant document within the time specified earlier. Nothing difficult or special. Enough verbal request.

For the military

And what about when you are in the military? In this situation, where can I get a 2-personal income tax certificate? There are also several options. It all depends on the military unit in which the citizen works / serves.

![]()

The first way to get it is to contact the accounting department (if any). The process is no different from an IP request. It is advisable to request the studied form in writing.

The second option is a request to the settlement center of the Ministry of Defense of the Russian Federation. This is the most appropriate way to obtain a certificate of the established form. The request is sent to the relevant authority in writing. The only drawback is the long wait for the document. You often have to wait more than 3 days. Especially when it comes to a request sent by mail.

pensioners

Sometimes pensioners need a 2-personal income tax certificate. Where can I get the appropriate form? In this case, there is no single answer. Everything depends on the situation. Why?

If a citizen receives a pension from a non-state pension fund, then a certificate of the established form can be obtained at any branch of the relevant organization. It is proposed to apply in electronic or written form.

When it comes to pensioners receiving a state pension, you should not think about income certificates. Form 2-NDFL for such persons is not provided for in Russia by law. Instead, you can get an extract from the FIU on income received (pensions). But such a document does not replace 2-personal income tax.

Unemployed

These are not all scenarios. Where can I get a 2-personal income tax certificate for the unemployed? This question interests many. In fact, there are no difficulties with the process. Several solutions are proposed for their situation.

The first is an appeal to a former employer. By law, any citizen can request a certificate of income from their former boss. And when he needs it. In practice, upon dismissal (it doesn’t matter, according to the article or of one’s own free will), the accounting department immediately draws up the corresponding document.

The second - in the center of employment. They issue certificates of unemployment benefits. But this is not a studied income statement, not a 2-personal income tax form. Every citizen should remember this.

ordinary hard worker

And where can I order a 2-NDFL certificate for a person who is officially employed? The thing is that this has already been said: you need to contact your employer. Or rather, in the accounting department of the organization in which the employee works.

There are no more options. All certificates of income for working citizens are issued directly by the employer. These are established rules that must be followed.

Do you need a 2-NDFL certificate for tax reporting? Where can I get it if, in addition to official work, there is another source of income? It is best to order the appropriate form from the employer, and also, taking into account the received document, prepare a certificate yourself. As already mentioned, a specialized program will help.

Reality

How long is an income statement valid? At the legislative level, there are no restrictions in this regard. Usually, it is simply necessary to submit certificates for a specific period of time. More precise requests will be made depending on the operation for which the document is needed.

Perhaps these are all the questions that may arise from the population. It is clear what a 2-personal income tax certificate is. Where to get this paper is now also known. A small note - the form for certain operations is presented only in the original.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters