All ways to find out the TIN of an individual by passport

The tax authority assigns a taxpayer identification number (TIN) to each individual, which makes it possible to account for income tax, as well as to calculate and control the payment of other taxes.

As a rule, it may be necessary to provide a copy of the TIN certificate when applying for a job and when performing legal actions. Although now employers are everywhere moving away from the practice of requiring this document, since it is not difficult to request a number knowing the last name, first name, patronymic and passport details of the person hired. But there are times when you urgently need to report the indicated numbers, but they are not at hand. Let's figure out how to find out the TIN of an individual from a passport.

Ways to find out TIN

An identification number is automatically assigned to an individual when a citizen applies to the tax authority and consists of 12 digits. It is indicated in the issued certificate and accompanies a person throughout his life. This number collects all information in the Federal Tax Service about his movable and immovable property in order to present tax receipts. It is indicated by employers when transferring personal income tax and by the citizens themselves who submit declarations in cases provided for by tax legislation. If the certificate is lost or not available with you, and you need to find out the TIN number, then there are two main ways to obtain such information:

- when applying in person to the tax office at the place of residence, presenting a passport,

- using online services.

With the development of contactless technologies, direct visits to government bodies are becoming a thing of the past. A more popular and faster way is getting information using various online services that allow you to get information from databases on some details that identify a person. For individuals, the opportunity to find out the TIN by passport in real time is available on the official websites of state bodies:

- Federal Tax Service www.nalog.ru,

- Unified portal of public services www.gosuslugi.ru.

Getting information about the TIN of an individual is quite simple, you just need to fill out a form on the site, indicating a few details. These include:

- surname, name and patronymic,

- Date of Birth,

- Place of Birth,

- details of a passport or other identity document.

Knowing all the above data, you can find someone else's TIN. This may be required, for example, when a person took a job and did not provide a copy of the certificate. An employer can use the service and find out his taxpayer number without forcing a person to look for a certificate in personal documents and provide a copy of it to the accounting department.

Important! Online services of state bodies are free.

Checking the TIN of an individual on the website of the Tax Service

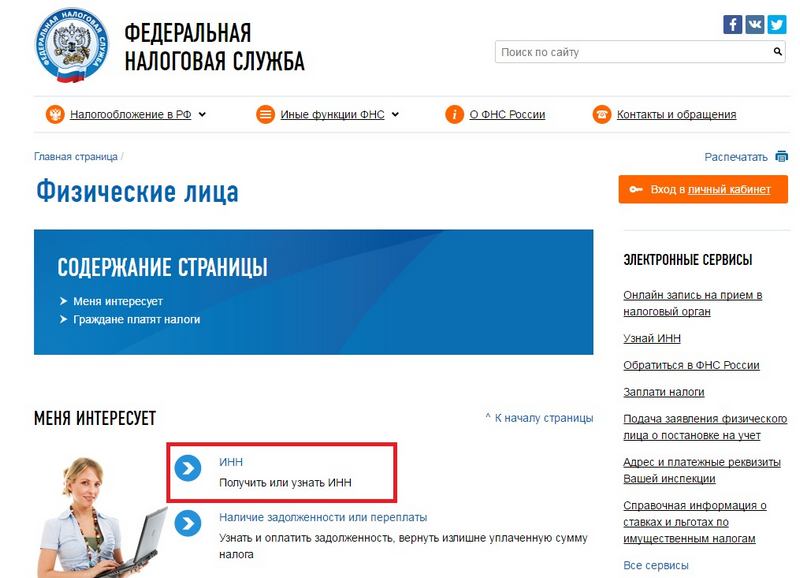

To find the payer identification number in the database of the tax authority, follow the link pointing to the official website nalog.ru and follow a series of steps:

- click on the Individuals section,

- then, according to the list of services, the very first one will be “TIN. Get or find out the TIN.

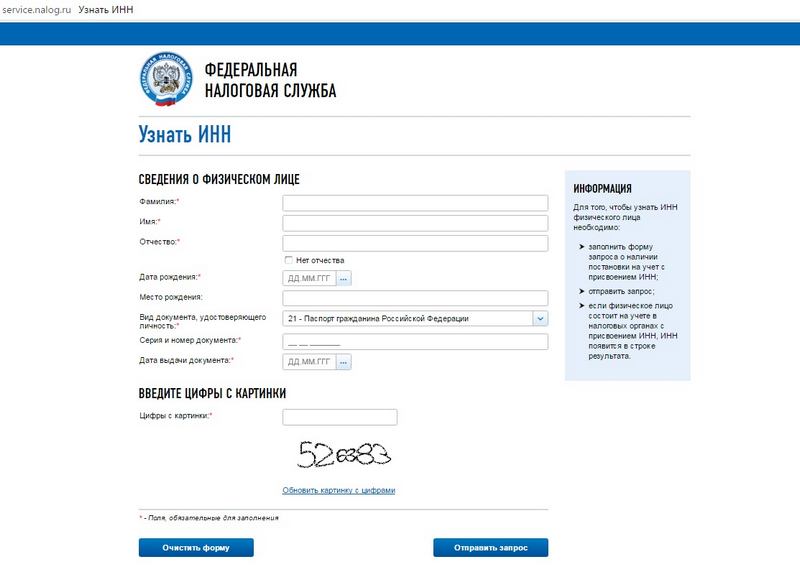

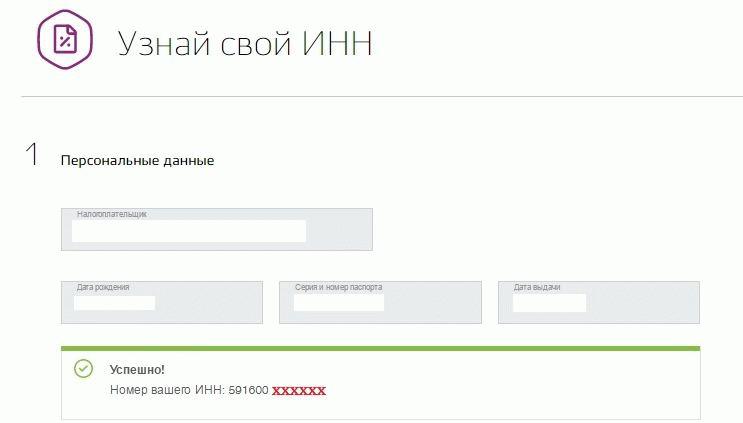

- it remains to fill out the form that opens, enter the numbers from the picture and click Send request.

Note that mandatory details are marked with a red asterisk. Place of birth can be left blank. In addition to the passport of a citizen of the Russian Federation, it is permissible to indicate the following identity documents: passport of a foreign citizen, birth certificate, residence permit, temporary residence permit.

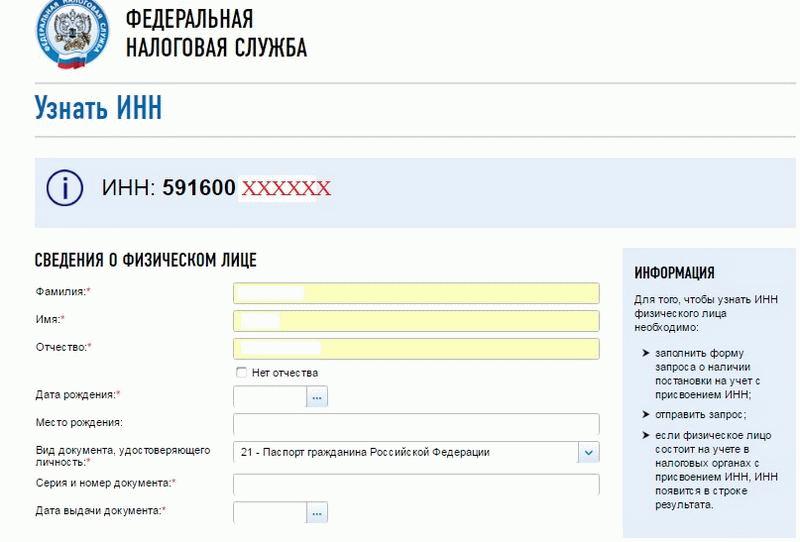

- after entering the numbers from the picture, click on Send a request and almost instantly we get the taxpayer number at the top of the form.

If any details do not match the data contained in the database of the tax authority, then the TIN will not be found. Therefore, when changing a passport in the near future, when the Federal Tax Service has not yet received new information, you need to enter the data of the old document.

It should be noted the intuitive interface of the site, which is easy to navigate for a user of any level of knowledge of the Internet. In addition to the service itself, the site contains all the necessary information about what a TIN number is for and what it consists of. There are also a number of useful links and answers to frequently asked questions.

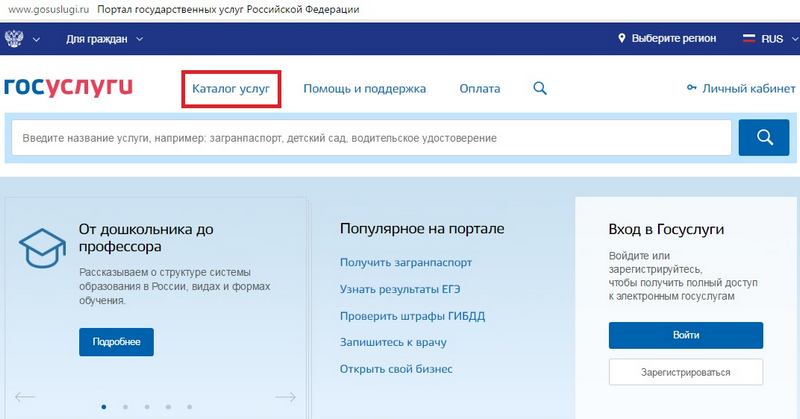

Checking the TIN of an individual on the State Services portal

If a citizen is registered on the Public Services portal, then it is much easier to get information about the TIN here. The procedure for registering and confirming an ESIA account to gain access to all services provided by public services is quite complicated. But, having received a verified account and full access to the site once, you have the opportunity to receive all services without contacting officials and without visiting government agencies.

The ESIA account is also used to access your personal account on the official websites of such bodies as the Federal Tax Service, Rosreestr, and the Pension Fund of Russia. It contains all the information about the immovable and movable property of a citizen, about the calculation and payment of taxes, accumulated pension rights. Therefore, having an ESIA account is quite useful.

You can find out the TIN of an individual from a passport on the State Services portal according to the following scheme:

Information in the database is almost instantly. This is convenient because you do not need to go to the inspection, write a statement and wait for a response. Such online services are designed to improve the quality of life of service users and minimize corruption risks. It also makes it possible for people of any age and health condition to receive full public services without leaving their homes.

Is it possible to find out the TIN only by last name without a passport?

Note that in order to fill out the request form for obtaining information about the TIN, there must be a field for an identity document. Therefore, without entering these details, it is not possible to find out the payer number. The principle of operation of the services is as close as possible to the personal appeal of a citizen to the structure providing the service. In case of a personal appearance at the tax authority without a passport, the inspector will not give any information related to an individual. TIN refers to personal data on a par with others that identify his personality, for example, passport and SNILS number.

There is only one way to find out the TIN of a foreign citizen, knowing only his last name, first name and patronymic - if he is registered with the tax authority as an individual entrepreneur. To do this, the website of the Federal Tax Service has a service "Business risks: check yourself and the counterparty" egrul.nalog.ru. Here it is enough to fill in the full name and the region where the taxpayer is registered. As a result, you will see the registration data that was submitted to the Federal Tax Service and reflected in the Unified Register of Legal Entities and an identification number.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters