Why do I need a 2-personal income tax certificate from a previous place of work

The obligation to draw up and submit to the tax authorities and, if necessary, an employee of the enterprise, a certificate of 2-NDFL falls on tax agents (NA). In this article, we will consider why a 2-NDFL certificate is needed and in what situations its registration is not required.

Help functions 2-NDFL

2-NDFL includes data on the individual whose salary was taxed, his NA, the amount of income of the employee and the tax withheld from them.

2-NDFL contains sections:

- information about NA;

- information about the employee-taxpayer;

- data on earnings and personal income tax rate;

- summarizing the amounts of income and taxes;

- tax deductions:

- standard;

- social;

- property;

- investment.

Registration of a certificate in the form of 2-NDFL is necessary for:

- presentation to the IFTS;

- issuance to the taxpayer if he applies.

How to fill out a 2-NDFL certificate

Making a 2-NDFL certificate raises many questions and difficulties, because it consists of a large number of fields, and there are strict requirements for filling it out. Let's skip the obvious points of filling out the document and move on to the controversial sections.

- sign

- We put the value “1” if the tax is paid according to the standard scheme;

- We put “2” when there are legal grounds for which personal income tax was not withheld.

- Correction number

- We write “00” if this is the initial filling of the document;

- We write “01”, “02” and so on, depending on how many times the certificate is issued;

- We write “99” if 2-NDFL is canceling.

- Taxpayer status

- "1" - resident of Russia,

- “2” – non-resident of Russia,

- "3" - a highly qualified worker,

- "4" - a citizen participating in the program of voluntary resettlement of compatriots,

- “5” – refugee worker,

- “6” - a foreign worker on a patent

- Taxable income

- The personal income tax rate for a resident employee is 13%,

- The personal income tax rate for a non-resident employee is 30%.

All columns with codes must be filled in very carefully, the IFTS website has guides for all codes and their updates, you should check the relevance of the data at least once per tax period.

Why do I need a 2-NDFL certificate and where is it provided

If an employee of an enterprise has asked for a certificate in the form of 2-NDFL, the responsible employee of the accounting department is not entitled to refuse (despite the absence in the Tax Code of the Russian Federation of any penalties for failure to provide a document). Within 3 working days from the date of application, 2-NDFL must be in the hands of the employee. In the event that a request for the issuance of 2-NDFL is received in the middle of the year, the NA draws up a document according to the data that it has to date.

| In IFTS | To the taxpayer |

| 1. NA paid the employee, and is now obliged to withhold personal income tax from this salary and deduct it to the budget. 2. The employee had cash receipts from which the NA, for legal reasons, will not be able to withhold personal income tax. A 2-NDFL certificate is sent to the tax office, including explanations of the reasons why tax transfer is impossible. | 1. To be presented to the accounting department at a new job in order to receive standard tax deductions (when assigning deductions, all cash receipts from the beginning of the year, including salaries from previous bosses, will be taken into account). 2. To fill out a declaration in the form 3-NDFL (data from 2-NDFL are required). 3. For other purposes, such as applying for a loan or loan. |

In what situations is it not required to issue 2-NDFL

In the event that an enterprise or individual entrepreneur does not take into account and does not calculate personal income tax from the salaries of the main taxpayers, having legal grounds for doing so, such companies do not perform the functions of NA and do not send 2-personal income tax certificates to the IFTS.

This is possible in the following cases:

- Earnings are transferred to employees who are required to calculate and pay income tax on their own;

- Monetary incentives take the form of payments, the tax on which is transferred by the individual himself;

- The taxpayer receives income that is not subject to personal income tax.

Help 2-NDFL for an employee

There are many situations when an employee of an enterprise may need a certificate in the form of 2-NDFL, and he is not obliged to explain to the company's accountant the reason why he needed it:

- job change,

- registration of 3-personal income tax,

- applying for a loan,

- payment of personal income tax not withheld by the employer,

- receiving standard tax deductions,

- pension registration,

- getting a visa,

- participation in litigation,

- proof of solvency in disputes,

- adoption of a child

Let's analyze the most common reasons for issuing 2-personal income tax for employees:

- Standard tax deduction. When there is a change of place of work, and the start of the work process does not fall at the beginning of the tax period, deductions are provided based on the received data on salaries from the previous place of work. Deductions for children cannot be issued without proof of previous earnings, and the only legal confirmation is a certificate in the form 2-NDFL. Control over tax deductions is also needed in order not to go beyond the amounts set by law. Deductions for children will occur until the total salary since the beginning of the year reaches 350 thousand rubles.

- Non-payment of personal income tax from a one-time assistance at the birth of a child. When an employee receives a lump-sum payment at the place of work (for example, assistance with the birth of a child). The amount of such payments should not exceed 50 thousand rubles and is transferred to the employee's account in the first year after the birth of the baby. If both parents work in the same organization, assistance is paid either to one of them based on the application of the second parent, or to both at the rate of not more than 50 thousand total payments. Upon receipt of funds, one parent must prove with a 2-NDFL certificate that the spouse did not receive (or received in a certain amount) a similar payment.

- Obtaining a visa. Embassies may request income statements for the past 5 years. When a person worked in one place, there are no difficulties. Another thing is if he has changed several employers, and now he cannot find some of them. For such cases, it is provided to obtain a 2-NDFL certificate from the tax office at the place of registration.

- Making a loan or loan. Banking institutions usually insure themselves by asking the applicant for a certificate of income. Thus, they can make sure that their client is solvent. Depending on what lending conditions a particular bank imposes, 2-personal income tax may be required for a period of six months to several years. Usually, a bank employee immediately warns that the certificate is valid for only a few days, after which you need to ask the employer for a new document, but such requirements are contrary to the law.

- Confirmation of earnings by a foreign worker. In order for the employee’s income not to be taxed in Russia and in the homeland of a foreigner, it is necessary to confirm the amount of income and withhold personal income tax from them. There is no special procedure for providing such evidence to a foreign state by Russian enterprises, the duty lies with the employee himself. He must make a request for confirmation of the document at the tax office at the place of registration, the IFTS will compare the NA data with the information contained in them themselves, and if the information matches, confirm the certificate issued by the NA with a seal. It is also the responsibility of the IFTS in this case to decipher the code of income received by a foreigner.

Help 2-NDFL for tax

Purposes of requesting a 2-NDFL certificate by tax authorities:

- To conduct personal income tax administration;

- To monitor enterprises to detect violations:

- non-payment of the full amount of taxes,

- calculation of personal income tax at incorrect tax rates,

- withholding personal income tax from the salaries of employees without deductions to the budget,

- provision of incomplete data on the cash receipts of employees.

- In order to find reasons for organizing an on-site inspection,

- As proof that it is legal not to withhold personal income tax from some employees.

Help 2-NDFL upon dismissal

Usually, upon dismissal, an employee automatically receives a certificate in the form of 2-NDFL. If it has not been issued, the employee has the right to demand that it be prepared within three days or, if necessary, at a new job. And the document will certainly come in handy, since without it it is impossible to correctly calculate personal income tax at a new place of work and determine the standard tax deductions that are rightfully due to the employee.

The document must contain data on all monetary receipts of the employee, starting from January of the current year and ending with the date of termination of the employment contract. There is no need to mention payments from which personal income tax deduction is not allowed:

- severance pay within 3 salaries,

- benefits for mothers and expectant mothers,

- compensation for harm, etc.

Sending certificates to the IFTS is carried out no later than:

- April 1 next year, when indicating all the earnings of an employee;

- March 1 next year, when specifying only the amounts from which personal income tax was not withheld.

An example of filling out a certificate in the form 2-NDFL

An example of filling is presented as follows:

Regulations on the topic

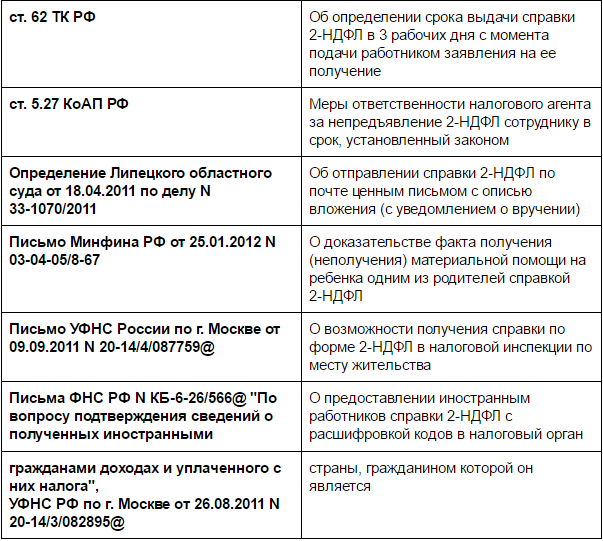

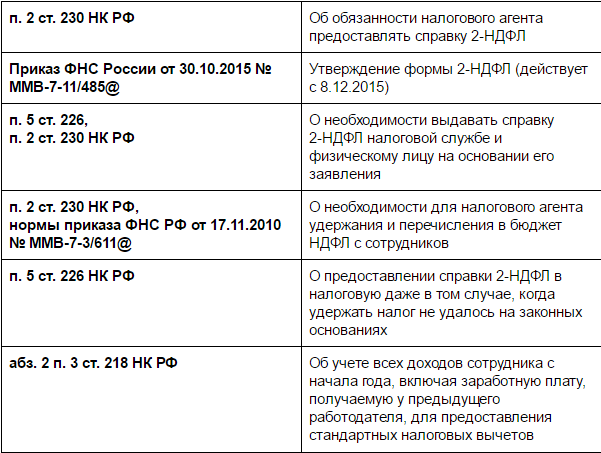

Normative acts are represented by the following documents:

Typical mistakes when filling out 2-personal income tax

Mistake #1: Indication in the 2-NDFL certificate of abbreviated forms of the last name, first name, patronymic of employees.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- How to close an IP yourself - step by step instructions

- How to close an IP yourself - step by step instructions

- Job description of the head of the personnel department

- Mollusk type. Class Gastropoda. Bivalve class. Class Cephalopoda. Mollusks are invertebrates

- Ballad genre in Russian literature Ballads read short in Russian

- Story. What is history? What is history scientific definition

- Ballad genre in Russian literature Famous ballads

- Revolts in France The course of the uprising in England and France

- Ostrovsky, "Dowry": analysis and characterization of the characters