What advance payment calculation will suit the tax and labor workers 100%

S.A. Shilkin, head of the expert direction of the magazine "Salary"

Advance - salary for the first half of the month. But there is no such definition in the Labor Code. There is no procedure for calculating the advance, it is established by the company. In this case, the employer must take into account the requirements of the labor and tax inspection. The Trudoviks control the size, and the tax authorities control the payment of personal income tax from salary payments.

An error in the amount of the advance leads to sad consequences. If you pay too little - the labor inspectorate will punish, if too much - there is a risk that the tax inspector will present claims for non-payment of personal income tax. We have found the ideal way to calculate the advance, which takes into account the requirements of both labor and tax laws by 100%.

Failure to pay advance - disqualification

The employer is obliged to pay wages twice a month (part 6 of article 136 of the Labor Code of the Russian Federation). Even the statements of employees with the wording: “ I ask you to pay me a salary once a month» will not save you from trouble when checking. Labor inspectors will impose a fine on the company in the amount of up to 50,000 rubles, on the manager and accountant - up to 20,000 rubles. (part 6 of article 5.27 of the Administrative Code of the Russian Federation), and in case of repeated violation, the director and accountant may be disqualified (part 7 of article 5.27 of the Administrative Code of the Russian Federation). The judges will support them.Andrey Vladimirovich Frolov, lawyer, General Director of ExLege Legal Protection Center LLC:

“Judges support sanctions if the company pays salaries once a month and the manager was previously subject to administrative punishment for this violation. I will give examples of solutions.

The disqualification of the director for one year was upheld by the Supreme Court of the Republic of Tatarstan (decree No. 4a-1390m dated September 28, 2016).

Fines for the company in the amount of 30,000 and 40,000 rubles. upheld:

- The Supreme Court of the Republic of Mari El (decree No. 4A-21/2016 dated February 26, 2016);

- Samara Regional Court (Decision No. 21-1880/2016 dated 08.09.2016).”

Rostrud does not allow everyone to pay a fixed advance

There are three main ways to calculate advance payments:- percentage of salary

- in proportion to hours worked;

- fixed amount in rubles.

How do you calculate salary advance?

The results of a survey of visitors to the site zarp.ru:40% of salary - 35%,

50% of salary - 19%,

43.5% of salary - 3%.

We determine the actual salary for the first half of the month - 34%,

We pay a fixed amount in rubles - 9%.

Ivan Ivanovich Shklovets, Deputy Head of the Federal Service for Labor and Employment, comments:

“The Labor Code does not determine how to determine the size of the advance on wages. The company has the right to set a percentage of the salary, for example 40%, adjusted for the hours actually worked in the first half of the month (ed. note - see example 1).»

An advance in a fixed amount, for example, 5,000 rubles, does not violate the law, but carries risks for the employer. He will be obliged to pay it, even if the employee was sick in the first half of the month, was on vacation, a business trip. At the end of the month, the salary may be less than the advance paid. The accountant will not be able to withhold personal income tax. Let's analyze the problems of other methods of calculating the advance.

Calculation of the advance as a percentage of salary

Labor inspectors are not opposed to an advance payment as a percentage of the salary for the first half of the month. The first half of the month should be understood as the period of time from the 1st to the 15th (letter of the Ministry of Labor of September 21, 2016 No. 14-1 / B-911).Why choose an advance payment of 40% of salary

The salary for each half of the month should be approximately equal in amounts, excluding bonuses (letter of the Ministry of Health and Social Development of Russia dated February 25, 2009 No. 22-2-709). To meet these requirements, companies set an advance payment of 50% of salary. What happens as a result, comments Elena Vyacheslavovna Vorobieva, member of the Scientific and Expert Council of the Chamber of Tax Consultants of the Russian Federation, Ph.D. economy Sciences:“Suppose that the salary is 20,000 rubles. There are 20 working days in a month (10 working days + 10 working days). If the advance is 50% of the salary, then:

- advance payment of 10,000 rubles. (20,000 rubles x 50%);

- to be paid for the second half of 7400 rubles. (20,000 rubles - 2,600 rubles (personal income tax) - 10,000 rubles (advance payment).

If the advance is 40% of the salary, then:

- advance payment 8000 rub. (20,000 rubles x 40%);

- to be paid for the second half of 9400 rubles. (20,000 rubles - 2600 rubles (personal income tax) - 8000 rubles (advance payment)).

The “40% of salary” advance option gives more equal payments than “50% of salary”, more in line with the requirement for approximately equal parts of the salary for the first and second half of the month.”

Note: an advance of 40% of the salary does not exempt the accountant from additional calculations if the employee did not work in full for the first half of the month. The salary, including for the first half of the month, the employee receives for work (part 1 of article 129 of the Labor Code of the Russian Federation). If he didn't work, he didn't get paid. For example, an employee from the 1st to the 15th:

- sick;

- was on vacation;

- went on a business trip;

- truant.

The personnel officer will inform the accountant which employees did not work all the days from the 1st to the 15th. For such employees, the accountant will calculate the advance in proportion to the hours worked. This procedure must be prescribed in the regulation on remuneration or the collective agreement.

Example 1

The employee was on vacation part of the days in the first half of the monthThe company pays salary for the first half of the month on the 17th. The advance payment is 40% of the salary.

Salary A.G. Brusnitsyn - 27,200 rubles. The employee was on vacation from February 1 to February 5 and worked from February 6 to February 15, 2017 for 8 working days. In the first half of February 11 working days.

How much will the employee receive?

Solution

On February 17, Brusnitsyn will receive an advance payment of 7,912.73 rubles. (27,200 rubles × 40%: 11 working days × 8 working days).

So, if you choose the size of the advance between 40% or 50% of the salary, then the first option is more successful. But he is not without flaws.

The problem with personal income tax, if the advance is 40% of the salary

An advance payment of 40% of the salary can lead to the fact that at the end of the month the employee will receive money for unworked time. This is due to the fact that there are fewer non-working days in the first half of January, March, May, June and November than in the second. We will show the calculation in example 2 below.Example 2

The employee received an unearned advance: how to calculate personal income taxThe company pays the advance on the 16th of the current month, and the salary on the 1st of the next month. The advance payment is 40% of the salary.

Salary A.G. Brusnitsyn - 27,200 rubles. The employee worked from 9 to 13 January 2017. From 16 to 31 January was ill.

On January 16, Brusnitsyn received an advance payment of 10,880 rubles. (27,200 rubles × 40%).

How much did Brusnitsyn earn in January? How to reflect the earned amount in 6-personal income tax?

Solution

According to the results of January, Brusnitsyn earned 8,000 rubles. (27,200 rubles: 17 working days × 5 working days). The amount of 2880 rubles. (10,880 rubles - 8,000 rubles) the employee did not receive for work.

Personal income tax from wages amounted to 1040 rubles. (8000 rubles × 13%).

Date of receipt of income in the form of wages in the amount of 8000 rubles. - 31.01.2017.

On February 1, when paying wages for January, it is impossible to withhold personal income tax from Brusnitsyn's income. There were no charges in excess of the advance payment.

The accountant will withhold personal income tax, calculated from the salary for January, from the next payment - from the advance payment for February on February 16. Entries in section 2 of form 6-NDFL, see below (sample 1).

Sample 1. A fragment of section 2 of the 6-NDFL form for the 1st quarter of 2017

Dmitry Alexandrovich Morozov, Deputy Head of the Department of Personal Income Taxation of the Federal Tax Service of Russia, comments:“Date of receipt of income in the form of wages (clause 2 of article 223 of the Tax Code of the Russian Federation):

- last day of the month for which it is accrued;

- the last day of work of the employee in the organization in case of his dismissal before the end of the month.

Until the end of the month, the law does not oblige to pay personal income tax from the advance. The tax should be withheld at the final settlement with the employee at the end of the month. It is necessary to pay to the budget no later than the next day (clause 6 of article 226 of the Tax Code of the Russian Federation).

In the situation from example 2 above, the tax authorities will ask the accountant for clarification. They will be interested in why in section 2 of form 6-NDFL line 100 is the date January 31, 2017, and line 110 is the date February 16, 2017? In section 2 of the 6-NDFL form, the inspector will also see a block of lines related to the payment of salaries for January February 1, 2017. The accountant will have to explain why he did not withhold tax on February 1, 2017. How to write explanations, see below (sample 2).

Sample 2. Explanations to tax authorities about the difference between the dates in lines 100 and 110 of Form 6-NDFL

In this situation, the accountant reflected true information in 6-NDFL, did not violate the rights of the employee. The tax authorities are not entitled to charge a fine for false information (letter of the Federal Tax Service of Russia dated 08/09/2016 No. GD-4-11 / 14515).

What to do with the unearned amount of 2880 rubles. in example 2 above? We offer two options. The first is to take it into account when issuing an advance for the next month (part 2 of article 137 of the Labor Code of the Russian Federation).

Example 3

Set-off of a part of the advance paid to the employee, but not earned, against the salary for the next monthAccording to the results of January, it became clear that on January 16, the employee received 8,000 rubles in advance. for work, and 2880 rubles. not for work. What to do? What documents to issue?

Solution

The accountant prepared the accounting statement (see sample 3 below).

Sample 3. Accounting certificate

The accountant will set off the advance payment that was not worked out in January in the amount of 2880 rubles. in advance for February 2017. The basis is part 2 of article 137 of the Labor Code. The accountant will calculate the advance payment for February minus personal income tax from the salary for January and the amount overpaid in January (based on the accounting statement). The advance payment for February to issue will be 6960 rubles. (27,200 rubles × 40% - 2880 rubles - 1040 rubles).2880 rub. the accountant will show in 6-personal income tax as part of income in the form of wages for February. Date of receipt of income - 02/28/2017. The accountant will calculate personal income tax at the end of February, and withhold when paying wages for February on March 1, 2017.

The second option is to withhold personal income tax from 2880 rubles. on the date of advance payment for February. Then on this day you will withhold tax from the entire amount of the advance payment of 10,880 rubles, which the employee received in January.

Advance payment in proportion to hours worked

Labor inspectors do not mind if you calculate the advance in proportion to the hours worked (formula below). For them, it is important that you take into account the requirement of the Decree of the Council of Ministers of the USSR dated 05.23.57 No. 566. The document establishes a rule: the advance payment for the first half of the month must not be lower than the wage rate of the worker for hours worked. This position is cited:- Ministry of Labor in a letter dated 05.08.2013 No. 14-4-1702;

- The Supreme Court in its decision of 06/06/2016 No. 29-AD16-10.

Formula. Advance payment based on hours worked

Example 4

Calculation of the advance in proportion to the hours workedSalary S.N. Erofeev - 20,000 rubles. In February 2017, 18 working days. The first half of the month from February 1 to February 15 - 11 working days Erofeev worked completely. The company pays an advance on the 17th based on the salary in proportion to the hours worked.

How much will the employee receive?

Solution

On February 17, the employee will receive an advance payment of 12,222.22 rubles. (20,000 rubles: 18 working days × 11 working days).

Personal income tax when calculating the advance in proportion to hours worked

The method of calculating the advance payment in example 4 above fully complies with the official recommendations of the Trudoviks. However, from the point of view of accountants and tax specialists, it is not good enough.First, by the time the advance payment is calculated, the accountant must have complete information about the time worked in the first half of the month by each employee. But most employers do not want to close the report card twice a month.

Secondly, there may be difficulties with the calculation of personal income tax. For example, an employee will go on sick leave on the 16th and fall ill until the end of the month. At the end of the month, there is no amount to be issued. It turns out that the advance is the salary for the month. But there is nothing to keep personal income tax. Let's consider this situation with an example.

Example 5

In the second half of the month, the employee was sickLet's use the conditions of example 4 above. February 17 S.N. Erofeev received an advance payment for February in proportion to the hours worked in the amount of 12,222.22 rubles.

From February 16 to March 15, 2017, the employee was on sick leave. Erofeev has no right to deductions.

How to withhold personal income tax from salaries for February?

Solution

On the day the advance was transferred - February 17, 2017, the accountant did not withhold personal income tax, since the Tax Code does not require this. After all, the date of receipt of income has not yet arrived.

The employee does not have hours worked in the second half of February. The salary for the time worked in February is 12,222.22 rubles. The amount of personal income tax - 1589 rubles. (12,222.22 rubles × 13%).

According to the results of February, the accountant will not pay additional salary to Erofeev.

On March 2, there is no amount to be issued. In this regard, the accountant does not have the opportunity to withhold personal income tax on this day.

The accountant will withhold tax at the next payment of money - March 17, 2017 (Friday) from the advance payment for March, transfer the tax no later than March 20, 2017 (Monday).

How to explain to the tax authorities the difference between the dates of receipt of income and withholding of personal income tax

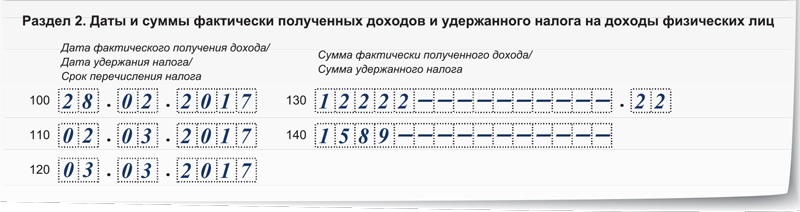

In example 5 above, there was a significant time gap between the day of receipt of income and the date of withholding personal income tax. The inspectors will see this difference in the form 6-NDFL (see example 6 below).Example 6

Entries in 6-NDFLLet's continue the previous example. February 17 S.N. Erofeev received an advance payment of 12,222.22 rubles. This amount turned out to be his final salary for February (the date of receipt of income is 02/28/2017). The accountant withheld the tax of 1589 rubles. only March 17th.

How to fill in a block of lines 100-140 in section 2 of form 6-NDFL?

Solution

Entries in section 2 of form 6-NDFL, see below (sample 4)

Sample 4. Fragment 6-NDFL for the I quarter of 2017

In the situation from example 6, the tax authorities, just as in example 2 at the beginning of the article, will be asked to explain why in section 2 of the 6-NDFL form for the first quarter of 2017, line 100 contains the date - February 28, 2017, and line 110 is the date - March 17, 2017. After all, between these dates there was a payment of money to employees - March 2, 2017.

The accountant must write explanations. See sample explanations above (sample 2).

The tax authorities will not charge a fine for false information in the form of 6-personal income tax. The accountant reflected true information in the report, did not violate the tax rights of the employee (letter of the Federal Tax Service of 08/09/2016 No. GD-4-11 / 14515).

Ideal advance - in proportion to salary adjusted for a reduction factor of 0.87

In examples 4-6, the accountant calculated the advance in proportion to the hours worked. But even compliance with these rules led to the fact that personal income tax has to be withheld from charges for the next month.Is there a hassle-free way to calculate the advance? Yes, I have. It is enough to calculate the advance in a proportional way using a reduction factor of 0.87.

Example 7

Advance payment adjusted by a factor of 0.87Let's use the conditions of examples 4-6 and supplement them. The local regulatory act of the company establishes that the advance is calculated in proportion to the time worked in the first half of the month, adjusted by a factor of 0.87.

What amount of advance will S.N. Erofeev, if:

- the salary of an employee is 20,000 rubles;

- did the employee work 11 working days in the first half of February?

What entries in 6-personal income tax will the accountant make?

Solution

The formula for calculating the advance in this option looks like this:

The accountant applied the formula to calculate the advance for February.

On February 17, the employee will receive an advance payment of 10,633.33 rubles. (20,000 rubles: 18 days × 11 days × 0.87). On February 28, the accountant will calculate the employee's salary of 12,222.22 rubles, personal income tax - 1,589 rubles. (12,222.22 rubles × 13%).

On March 2, the accountant will deduct the advance payment and personal income tax from the employee's salary. To be paid to the employee for the month - -0.11 rubles. (12,222.22 rubles - 1,589 rubles - 10,633.33 rubles). This is the error from rounding off personal income tax (clause 6, article 52 of the Tax Code of the Russian Federation).

Entries in section 2 of form 6-NDFL for the first quarter of 2017, see below (sample 5).

Sample 5. A fragment of section 2 of the 6-NDFL form for the 1st quarter of 2017

Neither the labor nor the tax inspector will fine the company if you write in the internal local regulation that you consider the advance based on salary in proportion to the hours worked and include a reduction factor of 0.87 in the calculation.

Since 1997, we have been helping our clients in the field of labor protection and HR administration. We provide services throughout Russia. Remotely, in a short time, our specialists will help to solve any issue.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- The meaning of the word neutron The role of the neutron in the fission of the uranium nucleus

- Puppet state of Manchukuo

- Creation of the puppet state of Manchukuo

- the origin of the ancient Russian people

- What is physical space?

- Dyatlov Pass: what really happened?

- What did Stanley Miller's experiment prove?

- Paleolithic Paleolithic Swan Lake

- Scale lichens: description, structure, meaning in nature