Filling out an application for registration of an individual entrepreneur in the form p21001

Any citizen can register himself as an individual entrepreneur. To do this, he needs to submit several documents, including an application that is filled in according to the approved form - p21001. How to correctly arrange it in 2019 and what you need to pay attention to - in this article.

The main purpose of the document is to declare your intention to become an individual entrepreneur. The existing form has been in effect since July 2013 and is significantly simplified compared to the previous version. As before, the application consists of 4 pages, the contents of which are described in the table.

| Page 1 |

|

| page 2 |

|

| page 3 |

|

| page 4 | confirmation of the correctness of all the information provided - the application is filled in handwritten, in any font, however, the data in the cells are also written in print and only in lowercase (capital) letters of the same size. |

An example of a correctly completed form р21001 is presented below.

Requirements for filling

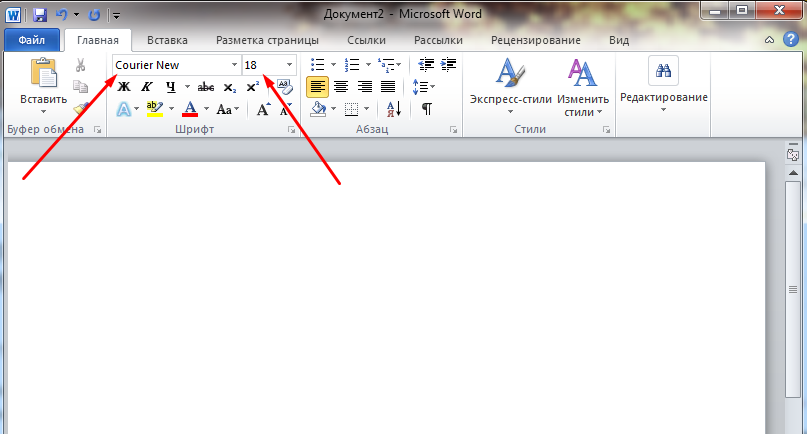

Since the p21001 form is intended for reading in electronic form with subsequent processing of the data by a computer, several requirements are provided for its design at once:

- personally;

- through an attorney acting on the basis of a notarized power of attorney;

- by post.

The application can be downloaded and printed, and then filled in by hand with a black gel pen. It is necessary to send a certified letter to the tax office, and then wait until the notification is received. In the letter itself, you must also attach an inventory of the attachment (indicate the name of the document in the shipment, its type (original) and quantity - 1 piece).

Step-by-step instructions for filling

In general, the instructions for filling out the p21001 form look like this:

- All characters are written in large characters (letters, numbers).

- The principle applies: one field (square) for only one symbol).

- Any dates are filled in numerical format without abbreviating "y." or the word "year". For example, if you need to enter the date February 1, 2012, you should do it like this.

- For simple or decimal fractions, special two fields are filled in, which are separated by appropriate signs - a slash / or a comma ",". In this case, it is necessary to fill in the fields closest to each other, as shown in the figure.

- If a certain characteristic has a monetary expression - for example, the size of the share in the authorized capital, the par value of the share, then the value is prescribed with an accuracy of up to kopecks according to the same principle. If there are no kopecks, then the fields closest to the edge are filled in anyway, but no marks are put in the field for tenths (i.e. you do not need to write zeros).

- For activity codes according to OKVED, three fields must be used at once, each of which is separated by a dot. The designation of the codes must exactly correspond to the generally accepted system, down to the sign.

- All other numerical indicators (for example, date of birth) are written in the usual format, starting with the leftmost square - i.e. exactly the same as in other documents.

- When specifying the series and number of the passport (or other identity document), you must write all the numbers separated by spaces: 2 numbers of the series, a space, 2 numbers of the series, a space and numbers of the series in a row, as shown in the figure.

- When writing a contact number, you should also use each square under its own symbol, and brackets, + and other designations are also filled in a separate field. Landline and mobile numbers are entered in an internationally accepted format as shown below.

- When filling in fields with text (letter) data, you must start, as usual, with the leftmost square and provide each character with a separate field. If the text consists of several words, numbers and / or signs at once, then they are written together, without spaces. However, if this contradicts the rules of the Russian language, then the spaces are left. A space is one square.

- If there is not enough space on one line, then it is filled completely, and the next line continues, starting from the nearest square on the left side. In this case, no hyphenation signs "-" are put. For example, you need to write the name of the company, which is officially referred to as the open joint-stock company "RomashkaPlus-7". Then all existing spaces between words are preserved in accordance with the rules of the Russian language. And the name of the company itself is spelled out exactly as it is indicated, for example:

- If the first line ends with a word along with the end of this line, and the next word is written with a space, then it should start from the second square on the second line as well. That is, all spaces are counted as an empty square anyway (regardless of where the space went).

- The form assumes the use of common abbreviations, but no dots. However, initials are abbreviated with periods, as is the case in most cases. For example, if the official street name is written as “street named after V.I. Lenin ", the application should write" UL IM V.I. LENIN ".

- All fields that have not been filled in (for example, fields with codes according to OKVED) simply remain empty - no dashes or other symbols should be put.

The top right corner of the form contains information about the authority that approved the form for this application. You can print a document with or without this information - in any case, the application will be accepted for work, subject to other conditions of registration.

A detailed video instruction on how to fill out is here.

Application procedure

Any citizen of Russia who has already turned 18 years old and who is fully legally capable can register as an individual entrepreneur. The package of documents in this case is small:

- the p21001 application considered earlier;

- original and copy of 2 pages (main and with the registration address) of your passport;

- a receipt confirming the fact of payment of the state duty - at the moment it is 800 rubles.

Having collected this package of documents, you need to do the following:

- Find out which tax office you need to contact. They apply in accordance with the official address for registration (registration). If a citizen is in another region, he should at the place of stay, obtain a certificate and apply to the appropriate tax office. You can find out about the address of your tax office on the official website of the Federal Tax Service.

Fill in the address, indicate their status (individual).

And the IFTS code is selected in accordance with the official code of the region - for example, 17 for the Republic of Tyva, 55 for the Omsk region, etc.

- After that, the documents are sent in person, by mail, through a representative (through the State Services - if technically feasible). At the same time, along with the IFTS, you can also contact the MFC - centers for the provision of public services to citizens.

- The waiting period begins on the working day following the day of the visit to the authority (or notification of delivery of a certified letter). The application is considered within 3 working days, the answer comes to the specified address.

Step-by-step instructions for registration are presented in the video.

Refusal to register: what to do next

Any citizen of Russia, non-resident and even a stateless person has the right to register an individual entrepreneur. Therefore, the refusal can only be associated with formal reasons:

- The documents were not submitted in full.

- The documents were submitted to the wrong authority.

- Form р21001 was completed with errors, clericals, inaccuracies and / or blots.

- If the person is already registered as an individual entrepreneur.

- If the person was already an individual entrepreneur, but by a court decision he was declared bankrupt, and at the same time, 1 year has not yet passed since the date of this decision.

In any case, the Federal Tax Service must send a written response on the adoption of a positive or negative decision, justifying its actions.

Thus, it is quite simple to fill out the p21001 form according to the sample - the main thing is not to miss a single detail and not to make mistakes, corrections and blots.

- How to get TIN via the Internet - step-by-step instructions

- The title page of the work book: all the nuances and a sample of filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line example

- Registration of an incoming cash order: filling out and examples

- What documents are needed to receive snills for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form of UTII-2

- Service "Online application for a mortgage loan to all banks

- About the planets of the solar system for children

- Canon to the Most Holy Theotokos, signs from her icon in novgorod

- The Shepherdess and the Chimney Sweep - Andersen G

- The Shepherdess and the Chimney Sweep - Andersen G

- What are the moral sufferings

- Its history and rulings

- The origin of the cross of the lord

- Valentin Dmitrievich Berestov (short biography)