Help 2-NDFL: what is it in simple words

Help 2-NDFL- this is a well-known reduction, which implies the disclosure of the concept of taxes on all income withheld from individuals, that is, all working citizens. Such information must be provided to the tax office of your region within a certain period of time. Information on income taxes also carries certain amounts withheld from an employee for such a period of time.

What is 2-personal income tax in simple words

The official document 2-NDFL contains all the complete information that relates to income and taxes in terms of the monetary equivalent of each working individual. The employer transfers funds to the state for each employee in his organization.

2-personal income tax - what is it? This a document that an individual can only obtain from their own employer. It must contain information indicating the details of the enterprise, as well as its original seal. Only in the accounting department where the employee is registered, it is possible to obtain this official document. The tax code in Russia defines the term for obtaining a certificate by an employee from the enterprise - 3 days, not including holidays and weekends.

For an individual as an employee, it is necessary to know about the effect of this article. It comes into force only after a written application by an individual requesting to issue a 2-NDFL certificate. Otherwise, an oral request for the issuance of information is not supported by an article of the Labor Code and the deadlines for obtaining a document may be delayed.

What is indicated in the certificate 2-NDFL

The correct filling and action of the certificate is possible only if it is correctly filled out, in which all the details and data relating to both the employee and the employer must be indicated:

- Full name of the employer, including an indication of all its details and codes, on the basis of which it was registered in the tax register of companies.

- Passport data from the first two pages of the employee who is on the staff of the organization.

- The total amount of total income, including the amount of all deductions.

- May be indicated information about other deductions in accordance with their codes. Such deductions may include property, standard or social deductions, if the employee has the right to receive them.

Why do you need a 2-NDFL certificate for an individual

In 50% of cases, working citizens apply for such a document at the request of credit organizations, which check how solvent a person is as a potential borrower of funds. The reflected information in the certificate helps bank employees make the right decision in relation to a potential client. 2-NDFL for individuals may also be requested in the following situations:

- a number of situations when it is necessary to issue and receive a tax deduction from the state. Quite often, the provision of a document may be required by some social categories of the population, for example, one of the parent of a student studying at a state higher educational institution on a paid basis;

- if a citizen takes part in court sessions, disputes and proceedings may also require financial information from the current and permanent place of work;

- it is obligatory to confirm your income during the calculation of the future citizen's old-age pension, as well as to confirm your status at the time of confirmation of guardianship or adoption of a child into a family;

- it is better to demand from the previous place of work to provide data on salary and taxes because new employers often need this information. In most cases, the former employer independently draws up such a document, but you can also request it at the time of dismissal;

- in some foreign consulates, when applying for a foreign visa, a citizen has the right to require the provision of this certificate, but in 90% of cases, only a salary card account statement and a certificate from a permanent place of work are enough;

- calculation of benefits for the status of an unemployed person in employment centers directly depends on the information that is reflected in the certificate - more about the amount of wages for the last six months from the previous place of work of a person.

It is necessary to decide in advance where to get and how long to issue a 2-personal income tax document, since most credit organizations impose certain requirements on the deadline for collecting a package of documents from a potential borrower. The bank also needs to clarify the terms for which it is necessary to provide information about your income. Most often, a certificate from the place of work on income is required. over the past six months.

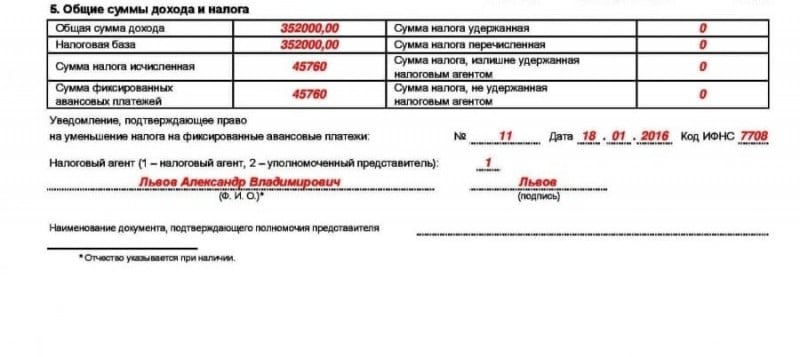

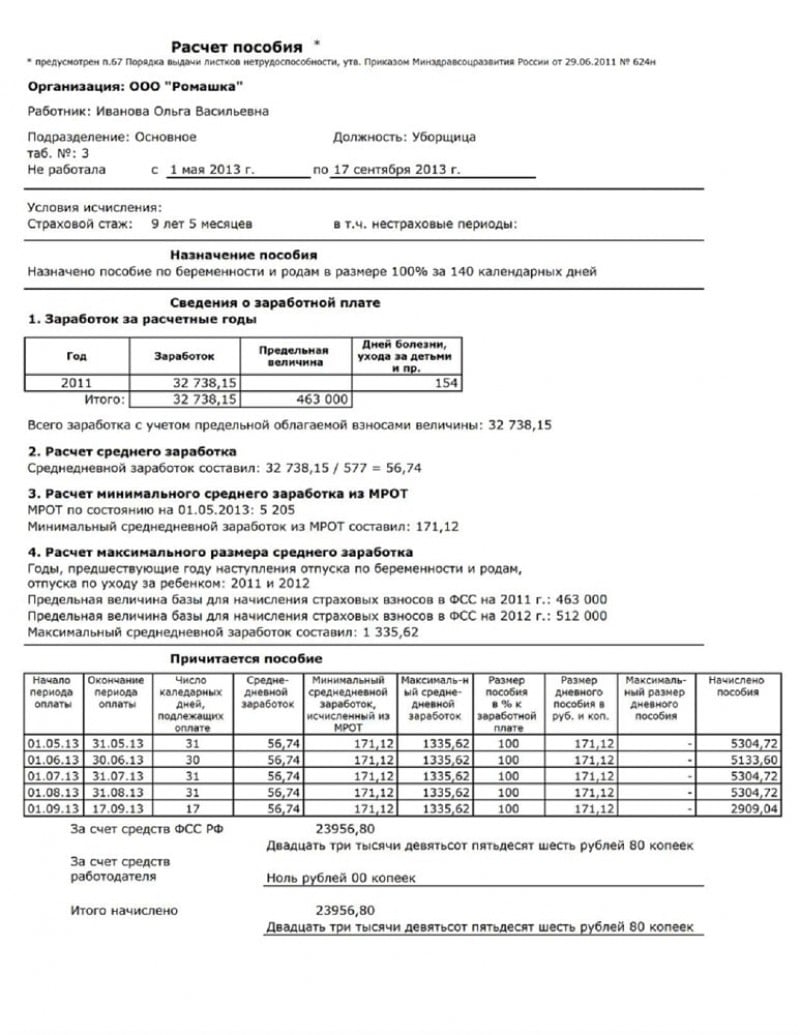

Help 2-NDFL during sick leave and maternity leave

In two situations, it may be necessary to issue a 2-personal income tax for a pregnant woman or a woman on maternity leave:

- When calculating cash benefits in social structures, which is assigned as compensation for child care.

- Upon dismissal the accountant of the enterprise is obliged to calculate payments on the maternity leave based on the last two years of work.

A woman on maternity leave is paid an allowance in the amount of 100% of her average earnings at the place of work. The amount is not affected by the length of service of the employee and other factors that may reduce the amount of the payment. In order for the employer to be able to correctly calculate the cash allowance for the maternity leave, it is necessary to provide 2-personal income tax from the previous place of work, if the woman has been on the staff of the organization for less than two years.

Approximate calculation of the B&D benefit

Since 2010, 2-NDFL has been the main source for calculating the amount of payment to an employee on sick leave. The accountant of the organization is obliged to calculate the average salary of an individual based on the 2-personal income tax of an employee for the last two years of work.

In almost all state departmental structures of the Russian Federation, such a certificate is legally binding, since it is considered a full-fledged official document by order of the Legislative Assembly of the country.

Why do I need a 2-personal income tax certificate at a new place of work

It is more profitable for the employee himself to transfer the 2-NDFL certificate from his previous place of work, since it is on the basis of it that the new accounting employee will calculate the amount of the allowance. Very often in practice it turns out that the benefit comes out more if a certificate was provided and the calculation was not made according to general standards.

A potential or new employer has the right to require 2-personal income tax in order to correctly calculate standard deductions. Citizens who are entitled to receive non-child and child deductions can fall into such categories of employees. in the Russian Federation, it implies a certain amount of the amount that an employee is entitled to count on - a total income of not more than 350 thousand rubles from January 1 of the current year.

What is a 2-NDFL certificate, and what changes have affected it this year

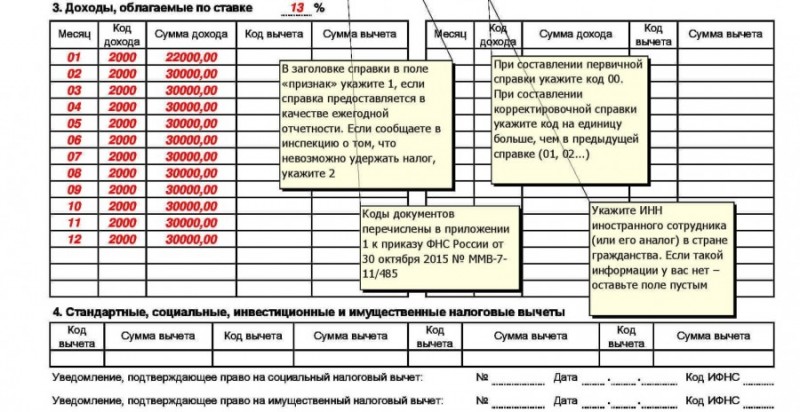

Since 2017, the 2-NDFL certificate has been affected by some changes regarding some sections. In the second section, which provides for filling in data about an individual, a new field has appeared - TIN in the country of citizenship. This field was required for those employees who are considered foreign nationals in the organization. In addition, the list of taxpayer statuses has been expanded in this section, and the following items have been added:

- employees who are voluntary migrants from foreign countries and are compatriots;

- foreign employees with status refugee, as well as foreign persons who have been granted temporary asylum on the territory of the Russian Federation;

- foreign employees working in an organization on the basis of a patent.

Very often, the agent responsible for the taxation of an employee calculates the income of a citizen at different rates, which is not prohibited by law.

What common errors are found in the 2-NDFL certificate

The form can easily be declared invalid or erroneous if it contains errors, strikethroughs or omitted fields for mandatory filling by a citizen. If such errors are made, it is most reasonable to fill out a new form, following the standard pattern.

When filling out the certificate form, many individuals make the following mistakes, in which the certificate will be erroneous:

- Pay special attention when filling in the date field of the document. According to the standards, a person must indicate the date only in numbers without the use of words, for example, 02.01.2019.

- The seal can only be affixed in the appropriate place on the form, i.e. at the bottom of the page in the left corner, next to the inscription " M.P.”, Must be clear and bright, without scuffs or washouts.

- The accountant must carefully fill out their fields, since any error or inaccuracy in the numbers may subsequently affect not in a positive direction for a person. Be sure to check the signature of the accountant, which by standards can only be done with a blue ballpoint pen, as well as the brightness, clarity and correctness of the organization's printing.

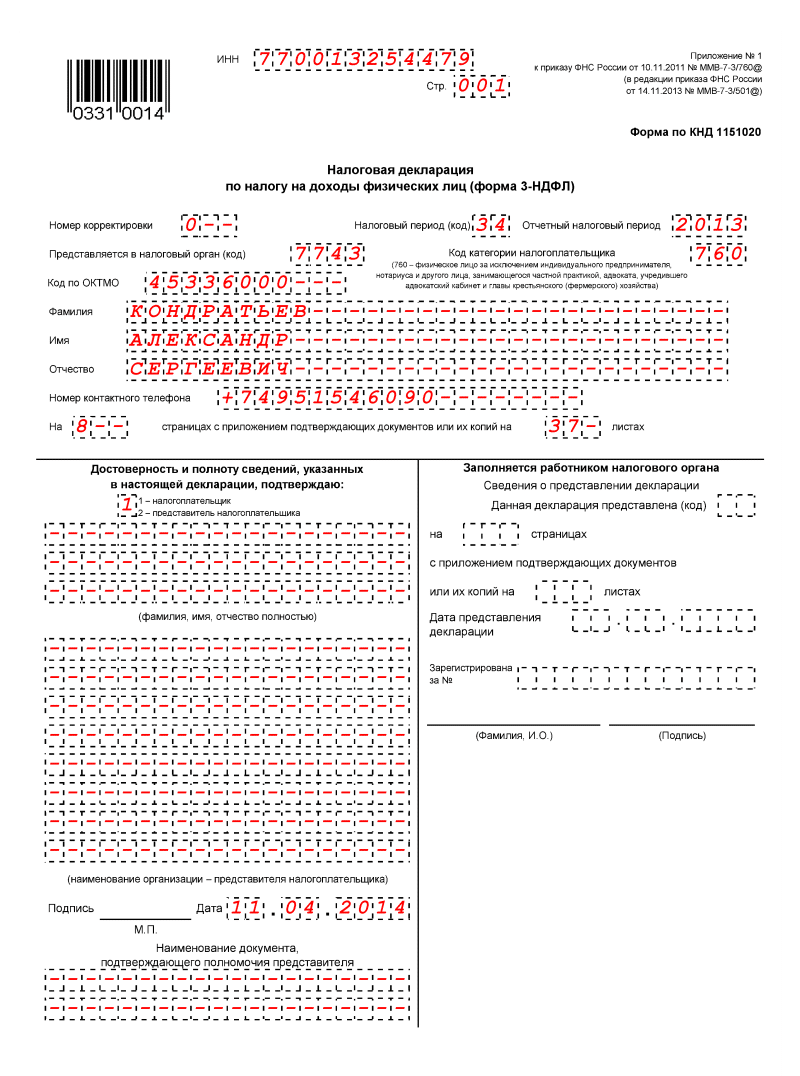

What is the difference between 2-personal income tax and 3-personal income tax

The taxpayer is obliged to fill out the 3-NDFL certificate himself and submit it to the appropriate tax office in the region. The essence of 3-personal income tax is that it is a declaration that takes into account the third-party cash income of a citizen, in addition to his employment.

For example, a 3-NDFL certificate may be required by an individual after the sale of an apartment that has been owned by him for less than three years. In this case, the state has the right to withhold a tax deduction from it.

3-NDFL must be submitted if an individual has additional cash income. In addition, along with filling out this certificate, a person is obliged to provide a 2-personal income tax certificate from a permanent place of work to the tax and certificate. The latter in this case is necessary to prove to an individual about his status as an income tax payer.

Validity period of the 2-NDFL certificate

The Code of the Russian Federation, namely the 23rd tax article, does not limit the validity of the income tax certificate for all individuals. But in practice, there are cases when the organizations to which this document is submitted set their own time frame for the validity of 2-NDFL. This is due to the fact that the enterprise has a certain period of validity according to the procedure for internal document management.

To confirm solvency, the organization must have a certificate that will meet the following criteria:

- the relevance of the data provided by the taxpayer. In most situations, a certificate is required that takes into account all the amounts of money received by a person and given to the state for a six-month period;

- the host should not have any questions and doubts, which are associated with the lack of data adjustment.

Credit institutions themselves at the time of approval of the application for short-term and medium-term payments of funds may establish a certain period during which the certificate will be valid. Most often, the validity of the document 2-NDFL fits only in the period from 10 to 30 days. As part of each package of documents for processing loan applications, the mandatory content of the information that relates to the income of a potential borrower is required. In addition, all information must be provided with the current date.

In accordance with the individual requirements and rules of credit institutions, the duration of the certificate may vary significantly, in many respects it all depends on the status of the bank - commercial or state-owned under an individual form of ownership. In the first types of banks, they may require a new 2-personal income tax from the borrower, which will be drawn up according to the standards of a credit institution, that is, its form may differ greatly from the declared standard.

- How to get a TIN via the Internet - step by step instructions

- Title page of the work book: all the nuances and sample filling

- SNILS for a newborn: instructions on how to get

- Help 3 personal income tax - what is it?

- How to fill out a cash flow statement: line by line example

- Making a cash receipt order: filling in and examples

- What documents are needed to obtain SNILS for a child

- Form AO-1. Advance report

- Rules and procedure for filling out an advance report by an accountant and accountable persons

- Help 2-NDFL sample filling

- How to fill out an application in the form No. UTII-2

- Recognition of a citizen incompetent

- Legal capacity. Emancipation. Recognition incompetent and limited capacity. What does it mean to limit the legal capacity of citizens? Individual with limited capacity

- Where and how to get a medical book for work: step by step instructions

- Education system in the Netherlands Education in Holland for foreigners

- How to find a job for a fifty-year-old: recommendations

- Compiling a resume: product manager Who is a manager

- How to come up with a name for an LLC that brings good luck?

- Break-Even Point: Calculation Formulas and Control Methods

- Starting a small business from scratch: ideas and rules for doing business